BlackRock Latin Am Portfolio Update

June 20 2023 - 4:11AM

UK Regulatory

TIDMBRLA

The information contained in this release was correct as at 31 May 2023.

Information on the Company's up to date net asset values can be found on the

London Stock Exchange Website at

https://www.londonstockexchange.com/exchange/news/market-news/

market-news-home.html.

BLACKROCK LATIN AMERICAN INVESTMENT TRUST PLC (LEI - UK9OG5Q0CYUDFGRX4151)

All information is at 31May2023 and unaudited.

Performance at month end with net income reinvested

One Three One Three Five

month months year years years

% % % % %

Sterling:

Net asset value^ 6.5 6.9 4.4 52.1 18.3

Share price 6.6 2.7 -7.3 45.9 22.8

MSCI EM Latin America 0.5 0.3 -2.2 48.0 17.4

(Net Return)^^

US Dollars:

Net asset value^ 5.0 9.4 2.8 52.6 10.2

Share price 5.1 5.2 -8.8 46.4 14.5

MSCI EM Latin America -0.9 2.7 -3.8 48.4 9.3

(Net Return)^^

^cum income

^^The Company's performance benchmark (the MSCI EM Latin America Index) may be

calculated on either a Gross or a Net return basis. Net return (NR) indices

calculate the reinvestment of dividends net of withholding taxes using the tax

rates applicable to non-resident institutional investors, and hence give a

lower total return than indices where calculations are on a Gross basis (which

assumes that no withholding tax is suffered). As the Company is subject to

withholding tax rates for the majority of countries in which it invests, the NR

basis is felt to be the most accurate, appropriate, consistent and fair

comparison for the Company.

Sources: BlackRock, Standard & Poor's Micropal

At month end

Net asset value - capital only: 426.42p

Net asset value - including income: 431.49p

Share price: 371.00p

Total assets#: £127.5m

Discount (share price to cum income NAV): 14.0%

Average discount* over the month - cum income: 14.0%

Net gearing at month end**: 0.3%

Gearing range (as a % of net assets): 0-25%

Net yield##: 8.3%

Ordinary shares in issue(excluding 2,181,662 shares held in treasury): 29,448,641

Ongoing charges***: 1.1%

#Total assets include current year revenue.

##The yield of 8.3% is calculated based on total dividends declared in the last

12 months as at the date of this announcement as set out below (totalling 37.32

cents per share) and using a share price of 459.82 US cents per share

(equivalent to the sterling price of 371.00 pence per share translated in to US

cents at the rate prevailing at 31 May 2023 of $1.2395 dollars to £1.00).

2022 Q2 Interim dividend of 5.74 cents per share (paid on 12 August 2022).

2022 Q3 Interim dividend of 6.08 cents per share (paid on 9 November 2022).

2023 Q4 Interim dividend of 6.29 cents per share plus a Special Dividend of

13.00 cents per share (paid on 12 January 2023).

2023 Q1 Interim dividend of 6.21 cents per share (Paid on 16 May 2023)

*The discount is calculated using the cum income NAV (expressed in sterling

terms).

**Net cash/net gearing is calculated using debt at par, less cash and cash

equivalents and fixed interest investments as a percentage of net assets.

*** The Company's ongoing charges are calculated as a percentage of average

daily net assets and using the management fee and all other operating expenses

excluding finance costs, direct transaction costs, custody transaction charges,

VAT recovered, taxation and certain non-recurring items for the year ended 31

December 2022.

Geographic % of % of Equity MSCI EM Latin

Exposure Total Assets Portfolio * America Index

Brazil 60.5 60.6 59.0

Mexico 25.8 25.7 31.0

Chile 5.6 5.6 6.1

Argentina 4.1 4.1 0.0

Colombia 2.4 2.4 1.0

Panama 1.6 1.6 0.0

Peru 0.0 0.0 2.9

Net current Assets(inc. 0.0 0.0 0.0

fixed interest)

----- ----- -----

Total 100.0 100.0 100.0

===== ===== =====

^Total assets for the purposes of these calculations exclude bank overdrafts,

and the net current assets figure shown in the table above therefore excludes

bank overdrafts equivalent to 0.4% of the Company's net asset value.

Sector % of Equity Portfolio % of Benchmark*

*

Financials 26.2 25.3

Materials 17.5 19.8

Consumer Staples 14.1 16.8

Energy 12.3 10.6

Industrials 11.7 8.9

Consumer Discretionary 5.3 2.0

Health Care 4.1 1.9

Real Estate 3.7 0.8

Communication Services 2.7 7.0

Information Technology 2.4 0.5

Utilites 0.0 6.4

----- -----

Total 100.0 100.0

===== =====

*excluding net current assets & fixed interest

Country % of % of

Company of Risk Equity Benchmark

Portfolio

Petrobrás - ADR: Brazil

Equity 7.8 3.9

Preference Shares 1.5 4.4

Banco Bradesco - ADR: Brazil

Equity 4.9 0.7

Preference Shares 1.7 2.9

Grupo Financiero Banorte Mexico 6.2 3.7

Vale - ADS Brazil 5.6 8.6

FEMSA - ADR Mexico 5.4 3.5

B3 Brazil 4.8 2.9

AmBev - ADR Brazil 3.5 2.4

Itaú Unibanco - ADR Brazil 3.4 4.5

Gerdau - Preference shares Brazil 3.2 1.0

Grupo Aeroportuario del Pacifico - ADS Mexico 3.1 1.0

Commenting on the markets, Sam Vecht and Christoph Brinkmann, representing the

Investment Manager noted;

The Company's NAV was up 6.5% in May, outperforming the benchmark, MSCI EM

Latin America Index which returned 0.5% on a net basis over the same period.

All performance figures are in sterling terms with dividends reinvested.1

In Latin America, Argentina and Brazil outperformed in May (USD +3.8%m/m and

+0.6% m/m respectively), while the rest of the region was down, Colombia (USD

-6.7%m/m), Mexico (USD -2.6%m/m and Chile (USD -3.3%m/m).

From a country perspective, Brazil has been the key contributor to performance.

We have been overweight domestic, interest-rate sensitive stocks in Brazil

since the start of the year and this position has finally paid off in May.

There has been a material shift in sentiment in the Brazilian market after the

fiscal outlook improved and inflation undershot expectations for several

months. This has led investors to move forward their expectations for the start

of the easing cycle in Brazil, which shifted the yield curve down and supported

asset prices.

Separately, our underweight and stock positioning in Mexico and Peru also

helped relative returns. There were no detractors from country positioning, we

saw positive relative returns in all country positions.

From a single name perspective, Hapvida, a Brazilian health care service

provider, has been the best performer. The stock sold off sharply in March as

the market focused on 4Q23 results, but since then the balance sheet has been

recapitalized and the company decided to raise prices more significantly, which

should improve margins going forward. We had added to this position during the

sell-off in March. Low-income homebuilder MRV and investment management

platform XP also performed very well as their earnings outlook is sensitive to

lower interest rates (as lower rates make housing more affordable in the case

of MRV and lead to flows from fixed income to equities in the case of XP). Our

underweight position in Vale, a Brazilian iron ore miner, continued to help

relative returns, as iron ore prices declined on the back of disappointing

commodity demand in China. Globant, a software company based in Argentina,

performed strongly after reporting stronger revenue growth than most global

peers.

On the other side, our overweight in Brazilian supermarket chain, Assai, has

continued to underperform as food retail sales were below expectations in April

/May. Tenaris, the off-benchmark steel pipe manufacturer in Argentina,

underperformed as it's been trading down together with the weakness in the oil

price. Banorte, a leading Mexican bank, detracted as the market is anticipating

an end to the rate hiking cycle in Mexico. Chilean brewer CCU, weighed on

returns post weak Q1 earnings results reported in May.

Considering the very strong performance of domestic Brazilian assets during

May, we have started to trim our positions in Brazil, as a result our exposure

to Brazil has been reduced. We added to our position in Globant, taking

advantage of the underperformance as an opportunity to add to our position. We

reduced our position in Braskem after the stock spiked on the back of a buyout

offer and we trimmed our position in Cemex, a cement supplier in Mexico, to

reduce our exposure to US cyclicality. We also initiated positions in two names

in May, Mag Silver, a silver miner operating in Mexico, which is ramping up its

key asset this year and recently reached commercial production. In addition, we

initiated a position in Ecopetrol, an oil and gas company in Colombia, where

the government has committed to pay outstanding receivables that the government

owes the company.

Our largest overweight is in Argentina as we hold two off-benchmark names.

While we have reduced the weight in Brazil, by taking profit in several names,

it remains the second largest overweight. We are most underweight Mexico and

Peru.

Outlook

In Brazil, domestic activity has slowed down materially as monetary policy is

very restrictive. Inflation has already declined significantly to 3.94% in May,

which means that the policy rate can likely be lowered from the current high

level of 13.75% over the next six months. The government's fiscal framework is

more orthodox versus market expectations, which helps to reduce uncertainty

regarding the fiscal outlook and is key for the central bank to start reducing

rates. A reduction in interest rates is the most important support for both the

economy and the equity market.

Mexico remains defensive as both fiscal and the current account are in order

however, concerns remain on how the market will behave if the US goes into a

recession. Banxico has raised their interest rates to 11% and with inflation

receding to 6%, they can stay on hold there before reducing rates later in the

year. High interest rates have attracted financial flows in the form of carry

trades and the Mexican peso has appreciated strongly year-to-date. Our lower

allocation in Mexico is largely a result of locking in strong performance.

In Peru, political uncertainty and social unrest will continue to weigh on

market performance. The lack of support for the government and increased

fragmentation in congress represent a difficult environment to form an

effective government.

The recent constitutional election in Chile has resulted in a very strong

outcome for the conservative, right-wing parties, in a sign that the population

has lost confidence in the policies of leftist President Boric. We believe this

is positive from a market perspective, as it should result in stronger checks

and balances on the government and removes the risk of a radical new

constitution. However, we have not yet increased our exposure because economic

activity continues to be weak due to the hangover from past years' pension

withdrawals.

There have been some negative developments in Colombia in recent months.

President Pero removed the majority of his cabinet including the orthodox

Finance Minister, who had been the last point of trust and stability from a

market perspective. We believe this is a sign that Petro will act in a more

radical way going forward.

We continue to have a negative view on the Argentinian economy as the

government's policies of increasing the monetary base while being unwilling to

devalue the currency creates large imbalances and inflation. Our off-benchmark

positions in Argentina are not exposed to the domestic economy as they generate

revenues from exports globally.

1Source: BlackRock, as of 31 May 2023.

20 June 2023

ENDS

Latest information is available by typing www.blackrock.com/uk/brla on the

internet, "BLRKINDEX" on Reuters, "BLRK" on Bloomberg or "8800" on Topic 3 (ICV

terminal). Neither the contents of the Manager's website nor the contents of

any website accessible from hyperlinks on the Manager's website (or any other

website) is incorporated into, or forms part of, this announcement.

END

(END) Dow Jones Newswires

June 20, 2023 04:11 ET (08:11 GMT)

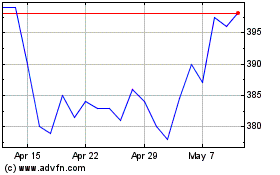

Blackrock Latin American... (LSE:BRLA)

Historical Stock Chart

From Jun 2024 to Jul 2024

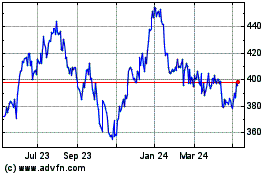

Blackrock Latin American... (LSE:BRLA)

Historical Stock Chart

From Jul 2023 to Jul 2024