Factory Shutdowns, Demand Slump Hammer European Auto Earnings

April 29 2020 - 4:34AM

Dow Jones News

By William Boston

BERLIN -- Two of Germany's largest auto makers reported sharp

falls in earnings, revenue and new-car sales for the first three

months of the year. Volkswagen AG and Daimler AG's results are a

measure of the impact on manufacturers of the auto industry

shutdown that was part of the drive to contain the coronavirus

pandemic.

German auto makers suspended swaths of production in Europe, the

U.S. and China for weeks after Covid-19, the disease caused by the

new coronavirus, spread world-wide. Both Volkswagen and Daimler,

two of Europe's largest manufacturers, saw pretax earnings slide

more than 80% in the quarter as a result.

European auto makers and their suppliers have furloughed more

than a million auto workers across the continent. Even as factories

begin to reopen, most are operating at a fraction of their previous

output levels, making it difficult to forecast for the rest of the

year.

"We have taken numerous measures to lower costs and secure

liquidity," Frank Witter, Volkswagen's chief finance officer, said

in a statement.

Net profit at Daimler, which makes Mercedes-Benz cars fell to

EUR94 million in the first quarter from EUR2.1 billion the year

before.

Volkswagen, the world's largest auto maker by sales, reported

EUR405 million in net earnings after a 25% drop in production to

just under two million vehicles in the first three months of

2020.

As the virus spread in Europe and the U.S. in February and

March, it was beginning to recede in China, the world's biggest car

market by sales. Auto makers, including Daimler and Volkswagen,

have reopened their plants in China and are gradually reviving

output, but demand for new cars and production remain well below

levels at the same time last year.

Volkswagen said in its first-quarter report that "positive

impulses came from the developing economic recovery in China."

Still, the damage to the auto industry from slumping demand and

efforts to contain the virus by locking down large parts of the

global economy is widespread and could be long-lasting.

Ford Motor Co. this week reported a $2 billion pretax loss in

the first quarter, which it attributed to the impact of the

pandemic on its global business. Nissan Motor Co., Japan's

second-largest auto maker after Toyota Motor Corp., said Tuesday

that it expected to report a net loss, its first in more than a

decade, of up to $885 million in its fiscal year that ended on

March 30.

As global auto sales slump, auto makers are cutting expenses and

securing loans to ensure that they have sufficient cash to weather

the coming months should demand fail to return to precrisis levels

and the economic slump worsen.

Daimler, which has been bleeding cash as a result of big

investments in new technology, said the outflow of capital worsened

in the first quarter, as negative cash flow in its industrial

businesses widened to EUR2.3 billion in the first quarter.

Volkswagen reported negative cash flow of EUR2.5 billion in the

first quarter, but said net liquidity had risen 11% in the same

period to EUR17.8 billion.

U.S. auto maker Ford said it has about $35 billion in cash,

which it described as sufficient to weather the storm for

months.

Write to William Boston at william.boston@wsj.com

(END) Dow Jones Newswires

April 29, 2020 04:19 ET (08:19 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

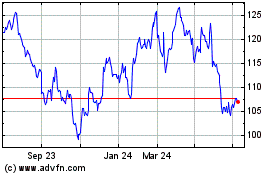

Volkswagen (TG:VOW3)

Historical Stock Chart

From Mar 2024 to Apr 2024

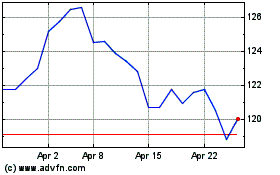

Volkswagen (TG:VOW3)

Historical Stock Chart

From Apr 2023 to Apr 2024