Zurich Insurance to Sell Legacy Traditional Life-Insurance Back Book in Germany

June 24 2022 - 3:20AM

Dow Jones News

By Mauro Orru

Zurich Insurance Group AG on Friday said it had agreed to sell

its legacy traditional life-insurance back book in Germany to

specialist insurer Viridium Holding AG, in a move to shield its

business from rising interest rates as central banks move to curb

inflation.

The Swiss insurance giant said the deal, which includes the

transfer of $20 billion in net reserves, would add 8 percentage

points to its Swiss solvency test ratio--a measure to assess the

capitalization of insurance companies.

"This is, perhaps, the most important step in our efforts to

reduce the capital intensity of Zurich's legacy life portfolios and

to lower our exposure to interest rates," Chief Financial Officer

George Quinn said.

"As indicated at last year's investor day, the priorities for

capital released by disposals are the elimination of earnings

dilution as well as supporting growth," Mr. Quinn added.

Zurich Insurance said it would continue to invest in Germany,

one of its most important markets, despite the move it said was

needed to protect against volatility.

Write to Mauro Orru at mauro.orru@wsj.com; @MauroOrru94

(END) Dow Jones Newswires

June 24, 2022 03:05 ET (07:05 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

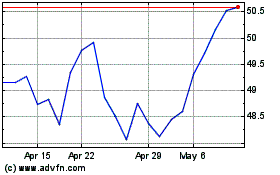

Zurich Insurance (QX) (USOTC:ZURVY)

Historical Stock Chart

From Sep 2024 to Oct 2024

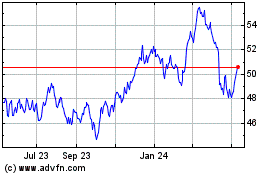

Zurich Insurance (QX) (USOTC:ZURVY)

Historical Stock Chart

From Oct 2023 to Oct 2024