|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549 |

| |

|

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933 |

| |

| US Lighting Group, Inc. |

| (Exact name of registrant as specified in its corporate charter) |

| |

| Florida |

| (State or other jurisdiction of incorporation or organization) |

| |

| 3792 |

| (Primary Standard Industrial Classification Code Number) |

| |

| 46-35556776 |

| (I.R.S. Employer Identification Number) |

| |

|

1148 East 222nd Street

Euclid, Ohio 44117

216-896-7000 |

|

(Address, including zip code, and telephone number,

including area code, of registrant’s principal

executive offices) |

| |

|

Registered Agents Inc.

7901 4th St. Ste 300

St Petersburg, Florida 33702

302-241-0613 |

|

(Name, address, including zip code, and telephone

number,

including area code, of agent for service) |

| |

| Copies to: |

|

Christopher J. Hubbert, Esq.

Kohrman Jackson & Krantz LLP

1375 East 9th Street, 29th Floor

Cleveland, Ohio 44114

216-696-8700 |

Anthony Corpora

US Lighting Group, Inc.

1148 East 222nd Street

Euclid, Ohio 44117

216-896-7000 |

| |

|

From time to time after this registration statement

becomes effective,

as determined by the selling shareholder |

| (Approximate date of commencement of proposed sale to the public) |

| |

| If any of the securities

being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933

check the following box: ☒ |

| |

| If this Form is

filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following

box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

☐ |

| |

| If this Form is

a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ☐ |

| |

| If this Form is

a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ☐ |

| |

| Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. |

| |

Large accelerated

filer ☐

Non-accelerated

filer ☐ |

Accelerated

filer ¨

Smaller

reporting company ☒

Emerging

growth company ☐ |

| If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐ |

| |

| The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission acting pursuant to said section 8(a), may determine. |

The information in this preliminary prospectus

is not complete and may be changed. The selling shareholder may not sell these securities until the registration statement filed with

the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not

soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion,

Dated September 1, 2023

PROSPECTUS

Up to 22,900,433 Shares of Common Stock

US Lighting Group, Inc.

This prospectus relates to the offer and sale of up to 22,900,433 shares

of common stock, $0.0001 par value, of US Lighting Group, Inc., a Florida corporation, by the selling shareholder, Alumni Capital LP.

Alumni may acquire shares of our stock pursuant to a stock purchase agreement that we entered into with Alumni and upon the exercise of

a warrant that we issued to Alumni. The stock purchase agreement with Alumni establishes an equity line pursuant to which we can elect

to sell shares to Alumni for up to $1.0 million. In addition, Alumni Capital may acquire up to 6,666,667 shares of our stock upon

exercise of the warrant. Alumni Capital does not currently own any shares of our stock. Please see Selling Shareholder beginning

on page 20 for more information about how Alumni Capital may acquire the shares being registered pursuant to this prospectus.

We are not selling any securities under this prospectus and will not

receive any of the proceeds from the sale of shares by Alumni Capital. However, we may receive up to $1.0 million in proceeds from the

sale of our common stock to Alumni if we draw on the equity line and an indeterminant amount from the exercise of the warrant. We will

use any funds we receive from Alumni for general corporate purposes and working capital requirements. We have not yet drawn on the Alumni

equity line.

Alumni Capital may sell the shares described in this prospectus in

a number of different ways and at varying prices. Please see Plan of Distribution beginning on page 23 for more information about

how Alumni may sell the shares being registered pursuant to this prospectus.

Alumni Capital may sell any, all or none of the shares offered by this

prospectus, and we do not know when or in what amounts Alumni may sell its shares following the effective date of the registration statement.

Alumni will pay all brokerage fees and commissions and similar expenses. We will pay the expenses incurred in registering the shares,

including legal and accounting fees.

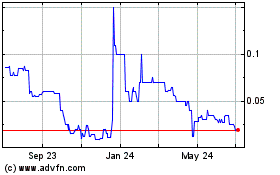

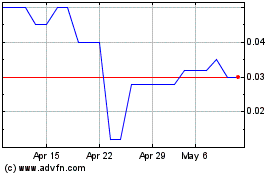

Our shares of common stock are traded on the OTC Pink Market under

the symbol “USLG.” On August 28, 2023, the last reported sale price of our stock on the OTC Pink Market was $0.057 per share.

Investing in our stock involves a high degree of risk. Please see

Risk Factors beginning on page 4 and in the documents incorporated by reference in this prospectus. You should carefully consider

these risk factors, as well as the other information contained in this prospectus, before you invest.

Neither the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation

to the contrary is a criminal offense.

The date of this Prospectus is , 2023

Table of Contents

About This Prospectus

This prospectus forms part of a registration statement that we filed

with the Securities and Exchange Commission (the “SEC”) and that includes exhibits that provide more detail of the matters

discussed in this prospectus. You should read this prospectus and the related exhibits filed with the SEC, together with the additional

information described under the headings Where You Can Find More Information and Incorporation by Reference before making

your investment decision.

You should rely only on the information provided in this prospectus

or in a prospectus supplement or any free writing prospectuses or any amendments. Neither we, nor the selling shareholder, have authorized

anyone else to provide you with different information. If anyone provides you with different or inconsistent information, you should not

rely on it. You should assume that the information in this prospectus is accurate only as of the date on the cover. Our business, financial

condition, results of operations and prospects may have changed since that date. Other than our filings with the SEC, information found

on our website, or that may be accessed by links on our website, is not part of this prospectus.

Neither we, nor the selling shareholder, are offering to sell or seeking

offers to purchase stock in any jurisdiction where the offer or sale is not permitted. We have not done anything that would permit this

offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in

the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe

any restrictions relating to, the offering of the shares as to distribution of the prospectus outside of the United States.

Unless the context otherwise requires, references in this prospectus

to “USLG,” the “company,” “we,” “us” and “our” refer to US Lighting Group,

Inc. and its wholly-owned subsidiaries.

Summary

This summary highlights, and is qualified in its entirety by, the

more detailed information included elsewhere or incorporated by reference in this prospectus. This summary does not contain all of the

information that may be important to you. You should read and carefully consider the entire prospectus, especially the matters described

in Risk Factors beginning on page 4, before making an investment decision. You should be able to bear a complete loss of your

investment.

Business Overview

We are an innovative composite manufacturer utilizing advanced fiberglass

technologies in growth sectors such as high-end recreational vehicles (RVs), prefabricated off-grid houses, and high-performance powerboats.

We derive expertise and inspiration from the marine industry, where the harshest conditions are expected and met with superior engineering

and the latest in composite technology. Molded fiberglass products are exceptionally strong, lightweight and durable. Composite materials

are also corrosion resistant and provide efficient insulation, making them attractive for both outdoor enthusiasts and residential housing

needs. Molded construction allows for the creation of irregular, unusual or circular objects, which permits the innovative shapes and

features of our products. As of June 30, 2023, our revenue was driven by shipments of fiberglass campers marketed under Cortes Campers

brand.

Cortes Campers designs and manufactures high-end molded fiberglass

RV travel trailers and campers designed for comfort, style and durability. We utilize superior quality materials and fiberglass construction

resulting in significantly stronger, more durable and lighter weight products. Cortes Campers’ first product is the Cortes 17, a

17-foot long single axle tow-behind molded fiberglass camper. In the second quarter of 2023, we introduced a new floorplan, Cortes 16,

which has expanded sleeping capacity with a king size bed. We are currently developing additional models, including a larger, family-oriented

all composite 22-foot travel trailer. Cortes Campers has established a network of professional RV dealerships to market and distribute

its products. As of June 30, 2023, Cortes Campers are available through 37 dealer locations in US and Canada.

Recognizing that we could utilize many of the same technologies and

manufacturing processes we have perfected for the Cortes Campers line of RVs to make small, prefabricated homes, we began exploring the

market in early 2022. The international tiny-house movement has gained new relevance in the recent years as the quest for off-grid, rugged,

prefabricated homes has entered the mainstream and was further fueled by the COVID-19 pandemic. We named our modular housing line Futuro

Houses after the Futuro Pod, the iconic “UFO house” designed by Finnish architect Matti Suuronen, of which fewer than one

hundred were built during the late 1960s and early 1970s. Our first home design is an update of the original Futuro utilizing modular

construction and fiberglass for structural integrity and energy efficiency and designed to address modern residential requirements in

a 600-square-foot living space. The Futuro can also serve as a commercial structure as it is currently available as a “shell kit”

to be outfitted by consumers to meet their needs. We exhibited the Futuro house at the Cleveland Home & Remodeling Expo in March 2023,

signed our first distributor in New York, and sold our first home in May 2023.

In early 2021, we formed Fusion X Marine to design, manufacture and

distribute high-performance speed boats utilizing advanced fiberglass composites. Our first boat model is the X-15, a miniature speed

boat designed for rental sites and excursions, as well as to serve as an entry-level boat for first time buyers. Tooling and molds have

been developed for this model and the X-15 is expected to go into production in the fourth quarter of 2023. The similarly styled X-27

is a 27-foot fiberglass V-hull speedboat and is designed for speed and superior maneuverability. The tooling and molds for the X-27 are

currently under development and the model is not yet available for pre-orders. As of June 30, 2023, Fusion X Marine has not generated

revenue for us.

We plan to expand our manufacturing footprint, enhance production techniques,

and develop more products in the RV, marine and composite housing sectors. Our current R&D efforts are focused on future tow-behind

camper models under Cortes Campers brand as well as prefabricated housing segment.

Our headquarters, manufacturing and research and development facilities

are located at 1148 East 222nd Street, Euclid, Ohio, 44117. Our phone number is 216-896-7000 and our website is www.USLightingGroup.com.

Corporate Information

US Lighting Group, Inc. is a holding company with four operating subsidiaries:

Cortes Campers, LLC, a brand of high-end molded fiberglass campers; Futuro Houses, LLC, focused on design and sales of molded fiberglass

homes; Fusion X Marine, LLC, a high-performance boat designer; and MIGMarine Corporation, a composite manufacturing company that produces

proprietary molded fiberglass products for our three business lines.

The company was originally incorporated in the State of Florida on

October 17, 2003, under the name Luxurious Travel Corp. Initially the company developed hotel booking software, but subsequently exited

that business. On July 13, 2016, we acquired a company named US Lighting Group, Inc. (founded in 2013) and changed our corporate name

to US Lighting Group, Inc. on August 9, 2016. At the time, the company designed and manufactured commercial LED lighting. Ultimate we

decided to exit the LED lighting market, which was being negatively impacted by inexpensive import products, and enter new business lines

focused on recreational products manufactured from advanced composite materials.

Implications of Being a Smaller Reporting Company

We are a “smaller reporting company” as defined in Rule

12b-2 of the Exchange Act because the market value of our stock held by non-affiliates is less than $250 million and our annual revenue

was less than $100 million during our most recently completed fiscal year. We may continue to be a smaller reporting company if either

the market value of our stock held by non-affiliates is less than $250 million, or our annual revenue was less than $100 million during

the most recently completed fiscal year and the market value of our stock held by non-affiliates is less than $700 million. We may continue

to rely on exemptions from certain disclosure requirements that are available to smaller reporting companies. For so long as we remain

a smaller reporting company, we are permitted and intend to rely on exemptions from certain disclosure and other requirements that are

applicable to public companies that are not smaller reporting companies.

The Offering

| Selling shareholders |

|

We are registering shares of our common stock for resale by Alumni Capital LP. |

| Share of common stock currently outstanding |

|

101,786,188 as of August 8, 2023 |

| Shares of common stock registered for resale |

|

We are registering shares of our common stock to be issued to Alumni

Capital LP as follows:

Shares that we sell to Alumni pursuant to a common stock purchase agreement

we entered into with Alumni on July 14, 2023. The stock purchase agreement establishes an equity line pursuant to which we can elect to

sell shares to Alumni for up to $1.0 million, subject to the terms and conditions of the purchase agreement. We have not yet sold any

stock to Alumni pursuant to the purchase agreement.

Shares that Alumni acquires upon exercise of a common stock purchase

warrant that we issued to Alumni when we entered into the purchase agreement. Alumni may purchase up to 6,666,667 of our shares pursuant

to the warrant. |

| Plan of Distribution |

|

Alumni may sell all or a portion of its shares from time to time directly to purchasers or through one or more underwriters, broker-dealers or agents, by a variety of methods. Alumni may sell the shares it purchases pursuant to the purchase agreement in its discretion for market prices prevailing at the time of sale, prices related to market prices, a fixed price or prices subject to change, or privately negotiated prices. Alumni may only sell the warrant shares for $0.05 per share until our common stock is listed on a national securities exchange or quoted on the OTCQX or OTCQB Market, at which time Alumni may also sell these shares for market or privately negotiated prices. |

| Use of proceeds |

|

We will not receive any proceeds from the sale of our shares by Alumni pursuant to this prospectus. However, we may receive up to an aggregate of $1.0 million in proceeds from the sale of our stock to Alumni pursuant to the stock purchase agreement and an indeterminant amount from the exercise of a warrant. |

| Risk factors |

|

Investing in our shares involves a high degree of risk. Please carefully consider the risks described in Risk Factors below before making an investment decision. |

Risk Factors

Risks Related to our Business and Operations

We have incurred substantial losses and only recently began

generating significant revenue.

We incurred losses as we developed our Cortes Camper products and repositioned

the company as an innovative composite technology provider. Although we have begun generating revenue, if we are not successful in expanding

our sales network and controlling costs, among many other factors, we may not be able to achieve or sustain profitability as planned.

We may need to raise substantial funds for operations and to

fund expansion.

We may need substantial additional funding, on an ongoing basis, in

order to continue execution of our business plan, to develop new products and increase production of existing products, to develop and

optimize our manufacturing and distribution arrangements, and for other corporate purposes. Any financing, if available, may include restrictive

covenants and provisions that could limit our ability to take certain actions, preference provisions for the investors, and/or discounts,

warrants, conversion rights, anti-dilution rights, the provision of collateral, or other incentives. Any financing will involve issuance

of equity and/or debt, and these issuances will be dilutive to existing shareholders. For example, the shares we are issuing to Alumni

Capital are being priced at a discount to the current market price and in that sense are dilutive to our current shareholders. There can

be no assurance that we will be able to complete any financing or that the terms will be acceptable. If we are unable to obtain additional

funds on a timely basis or on acceptable terms, we may be required to curtail our plans.

Our sales may be negatively impacted by numerous macroeconomic

events.

Sales of recreational vehicles could decline for many reasons outside

our control, such as a financial crisis, recession, inflation, higher interest rates, higher fuel costs, or significant geopolitical events.

In times of economic uncertainty, consumers may have less discretionary income and may defer spending on high-cost, discretionary products

such as RVs which may in turn adversely affect our financial performance. Although the RV industry has experienced increased sales and

operating results as a result of the unique consumer demand for recreational vehicles since the start of the COVID-19 pandemic, demand

for RVs could decrease amid high inflation and rising interest rates.

Our business is affected by the availability and terms of financing

to independent dealers and retail purchasers.

Generally, independent recreational vehicle dealers finance their purchases

of inventory with financing provided by lending institutions. A decrease in the availability of this type of wholesale financing, more

restrictive lending practices or an increase in the cost of such wholesale financing could limit or prevent independent dealers from carrying

adequate levels of inventory, which may limit product offerings and could lead to reduced demand for our products. Further, a decrease

in availability of consumer credit resulting from unfavorable economic conditions, or an increase in the cost of consumer credit, may

cause consumers to reduce discretionary spending which could, in turn, reduce demand for our products and negatively affect our sales

and profitability.

Our ability to attract and retain talented and highly skilled

employees is critical to our future success and competitiveness.

Our success depends on the existence of an available, qualified workforce

to manufacture our products, including skilled composite technicians, and on our ability to continue to recruit and retain our workforce.

Competition for skilled employees is intense and could require us to pay higher wages to attract and retain a sufficient number of qualified

employees. We may be unable to recruit and retain highly skilled employees we depend on. Further, if we lose existing employees with needed

skills or are unable to train and develop existing employees, it could have an adverse effect on our business.

We also rely upon the knowledge, experience and skills of our executive

management team. Our future success depends on, among other factors, our ability to attract and retain executive management and key leadership

level personnel. The loss of our executive management or other key employees could have a material adverse effect on the company.

We may outgrow our current manufacturing facility.

While our manufacturing facilities in Euclid, Ohio currently meet our

needs, future growth may require a larger manufacturing footprint. If we are unable to expand our manufacturing to meet demand, we may

not realize the full potential of new product lines and our operations and profitability may be harmed.

Our success will depend on the results of our R&D investments

and acceptance of new products.

Our business plan involves introducing several new product lines, such

as our Futuro homes, and we continue to invest heavily in research and development. Our future success will depend on whether our investment

yields new products that are accepted by the public.

Significant product repair and/or replacement costs due to product

warranty claims could adversely impact the company.

We receive warranty claims from our dealers in the ordinary course

of our business. Warranty expense levels may not remain at current levels. A significant increase in warranty claims exceeding our current

warranty expense levels could have a material adverse effect on our results of operations, financial condition, and cash flows.

Increased costs associated with environmental compliance could

negatively impact our financial results.

Both federal and state authorities also have various environmental

control standards relating to air, water, noise pollution, and hazardous waste generation and disposal that affect us and our operations.

Our failure to comply with present or future laws and regulations could result in fines being imposed on us, potential civil and criminal

liability, suspension of production or operations, alterations to the manufacturing process, or costly cleanup or capital expenditures,

any or all of which could have a material adverse effect on our results of operations. In addition, various governmental bodies have proposed

further regulatory measures relating to climate change, greenhouse gas emissions, and energy policies. Additional regulation could increase

our energy, environmental, and other costs and capital expenditures for compliance. We cannot currently determine how future regulation

might impact us.

Our diversification plans could distract us from Cortes Campers.

Currently we are growing our Cortes Campers business and have achieved

material revenues from RV sales. We also in the process of developing our Futuro Houses and Fusion X Marine product lines, which have

not yet generated significant revenue. By diverting limited resources to these unproven product lines, we may unintentionally impede the

growth of Cortes Campers.

Risks Related to Our Company and Stock

You may experience dilution of your ownership interests because

of the future issuance of additional shares of our common stock for general corporate purposes.

In the future, we may issue additional equity securities for capital

raising purposes, in connection with hiring or retaining employees, to fund acquisitions, or for other business purposes. The future issuance

of any additional shares of common stock will dilute our current shareholders and may create downward pressure on the value of our shares.

Our former CEO currently has the ability to determine the election

of our directors and the outcome of matters submitted to our shareholders.

As of August 8, 2023, our former chief executive officer Paul Spivak

owns 49.4% of our outstanding shares of common stock and his wife, Olga Smirnova, owns 1.0% of our outstanding shares. As a result, together

they control a majority of our stock and have the ability to determine the outcome of all matters submitted to our shareholders, including

the election of directors. As a consequence, it may be difficult for the other shareholders to remove our board members. Mr. Spivak’s

voting control could also deter unsolicited takeovers, including transactions in which our shareholders might otherwise receive a premium

for their shares over then current market prices.

Our auditors have issued a “going concern” audit

opinion.

Management has determined and our independent auditors have indicated

in their report on our December 31, 2022 financial statements that there is substantial doubt about our ability to continue as a going

concern. A “going concern” opinion indicates that the financial statements have been prepared assuming we will continue as

a going concern and do not include any adjustments to reflect the possible future effects on the recoverability and classification of

assets, or the amounts and classification of liabilities that may result if we do not continue as a going concern. Therefore, you should

not rely on our consolidated balance sheet as an indication of the amount of proceeds that would be available to satisfy claims of creditors,

and potentially be available for distribution to shareholders, in the event of liquidation.

Our management and our independent auditors previously identified

certain internal control deficiencies which, while now considered remediated, had been considered by our management and our independent

auditor as material weaknesses.

In connection with the preparation of our financial statements for

the year ended December 31, 2021, our management and our independent auditor identified internal control deficiencies that, in the aggregate,

represent material weaknesses, as described more fully in our 2022 Form 10-K. As of December 31, 2022, our management team concluded that

the material weakness had been addressed and that our internal controls were effective. If we do not successfully maintain a strong controlled

environment this could lead to heightened risk for financial reporting mistakes and irregularities, and/or lead to a loss of public confidence

in our internal controls that could have a negative effect on the market price of our common stock.

Our articles of incorporation allow for our board to create

a new series of preferred stock without further approval by our shareholders, which could adversely affect the rights of the holders of

our common stock.

We are authorized to issue ten million shares of preferred stock that

has not been previously designated or issued, and our board has the authority to define the relative rights and preferences of these shares

of preferred stock without further shareholder approval. As a result, our board could authorize the issuance of a series of preferred

stock that would grant to holders the preferred right to our assets upon liquidation, the right to receive dividend payments before dividends

are distributed to the holders of common stock and the right to the redemption of the shares, together with a premium, prior to the redemption

of our common stock. In addition, our board could authorize the issuance of a new series of preferred stock that has greater voting power

than our common stock or that is convertible into our common stock, which could decrease the relative voting power of our common stock

or result in dilution to our existing shareholders. The issuance of additional shares of preferred stock could materially adversely affect

the rights of the holders of our common stock, and therefore, reduce the value of our common stock. Although we have no present intention

to issue any additional shares of preferred stock or to create any additional series of preferred stock, we may issue such shares in the

future.

Our articles of incorporation and bylaws have provisions that

could discourage, delay or prevent a change in control.

Our articles of incorporation and bylaws contain provisions which could

make it more difficult for a third party to acquire us, even if closing such a transaction would be beneficial to our shareholders. We

are authorized to issue more than ten million shares of preferred stock that has not been previously designated or issued. This preferred

stock may be issued in one or more series, the terms of which may be determined at the time of issuance by our board without shareholder

approval. Specific rights granted to future holders of preferred stock could be used to restrict our ability to merge with, or sell our

assets to, a third party and, as a result, preserve control by the present management.

We have nearly 400 million shares of authorized but unissued common

stock. Our authorized but unissued shares of common stock are available for future issuance without shareholder approval. These additional

shares may be used for a variety of corporate finance transactions, acquisitions, and employee benefit plans. The existence of authorized

but unissued and unreserved common stock could make it more difficult or discourage an attempt to obtain control of us by means of a proxy

contest, tender offer, merger or otherwise.

Provisions of our articles of incorporation and bylaws also could have

the effect of discouraging potential acquisition proposals or tender offers or delaying or preventing a change in control, including changes

a shareholder might consider favorable. These provisions may also prevent or frustrate attempts by our shareholders to replace or remove

our management. In particular, the articles of incorporation and bylaws, among other things: provide our board with the ability to alter

the bylaws without shareholder approval; place limitations on the removal of our directors; and provide that vacancies on our board may

be filled by a majority of directors in office, although less than a quorum.

The market price of our common stock is volatile and can be

adversely affected by numerous factors.

The share prices of publicly traded microcap and emerging companies,

particularly companies without consistent product revenues and earnings, can be highly volatile and are likely to remain highly volatile

in the future. The price which investors may realize in sales of their shares of our stock may be materially different than the price

at which our stock is quoted, and will be influenced by a large number of factors, some specific to us and our operations, and some unrelated

to our operations. These factors may cause the price of our stock to fluctuate frequently and substantially. Relevant factors may include

large purchases or sales of our common stock, shorting of our stock, positive or negative events, commentaries or publicity relating to

our company, management or products, positive or negative events relating to recreational vehicle companies generally, the publication

of research by securities analysts and changes in recommendations of securities analysts, legislative or regulatory changes, and/or general

economic conditions. In the past, shareholder litigation, including class action litigation, has been brought against other companies

that experienced volatility in the market price of their shares or unexpected or adverse developments in their business. Whether or not

meritorious, litigation can result in substantial costs, divert management’s attention and resources, and harm the company’s

financial condition and results of operations.

Our common stock is considered a “penny stock” and

may be difficult to sell.

The SEC has adopted regulations which generally define “penny

stock” to be an equity security that has a market price of less than $5.00 per share or an exercise price of less than $5.00 per

share, subject to specific exemptions. Historically, the price of our stock has fluctuated greatly. As of the date of this filing, the

market price of our common stock is less than $5.00 per share, and therefore is a “penny stock” according to SEC rules. The

“penny stock” rules impose additional sales practice requirements on broker-dealers who sell securities to persons other than

established customers and accredited investors (generally those with assets in excess of $1.0 million or annual income exceeding $200,000

or $300,000 together with their spouse). For transactions covered by these rules, the broker-dealer must make a special suitability determination

for the purchase of securities and have received the purchaser’s written consent to the transaction before the purchase. Additionally,

for any transaction involving a penny stock, unless exempt, the broker-dealer must deliver, before the transaction, a disclosure schedule

prescribed by the SEC relating to the penny stock market. The broker-dealer also must disclose the commissions payable to both the broker-dealer

and the registered representative and current quotations for the securities. Finally, monthly statements must be sent disclosing recent

price information on the limited market in penny stocks. These additional burdens imposed on broker-dealers may restrict the ability or

decrease the willingness of broker-dealers to sell our stock and may result in decreased liquidity for our stock and increased transaction

costs for sales and purchases of our stock as compared to other securities.

FINRA sales practice requirements may also limit your ability

to buy and sell our stock.

In addition to the “penny stock” rules described above,

the Financial Industry Regulatory Authority (FINRA) has adopted rules that require that in recommending an investment to a customer, a

broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative

low-priced securities to their customers, broker-dealers must make reasonable efforts to obtain information about the customer’s

financial status, tax status, investment objectives and other information. Under interpretations of these rules, FINRA believes that there

is a high probability that speculative low-priced securities will not be suitable for at least some customers. FINRA requirements make

it more difficult for broker-dealers to recommend that their customers buy our stock, which may limit your ability to buy and sell our

stock and have an adverse effect on the market for our shares.

Our former CEO and one of our directors have been indicted for

securities fraud.

An indictment was filed on September 16, 2021 and unsealed on October

8, 2021 against Paul Spivak, our former chief executive officer and a major shareholder of the company, Mr. Spivak’s wife,

Olga Smirnova, our vice president of finance and administration and a member of our board of directors, and others, alleging fraudulent

sales of stock of USLG by Mr. Spivak and others (United States of America v. P. Spivak, O. Smirnova, et al., Case No. L21CR491,

United States District Court for the Northern District of Ohio, Eastern Division). The events outlined in the indictment allegedly occurred

between June 2016 and June 2021. The alleged acts include issuing favorable press releases to artificially inflate the price of USLG’s

stock, selling shares that benefited Mr. Spivak and others while the price was artificially inflated, and paying illegal commissions

to unlicensed brokers to sell USLG’s shares. On June 29, 2023, a second superseding indictment was filed in the case naming additional

defendants not affiliated with USLG and making additional allegations against Mr. Spivak, including engaging in a conspiracy to obstruct

justice and making false declarations before the court. We have been advised that Mr. Spivak and Ms. Smirnova have pled not

guilty, vehemently deny the charges, and are defending themselves aggressively. Although USLG is not a party to this case, the ongoing

matter has impacted the willingness of some parties to invest in or work with the company and has impaired the company’s ability

to have its shares traded on an exchange other than the OTC Pink Market. In addition, if the case is decided against Mr. Spivak or

Ms. Smirnova, the company will be unable to utilize certain exemptions for private securities sales, which could negatively impact

the ability of the company to raise capital.

The requirements of the Sarbanes-Oxley Act of 2002 and other

U.S. securities laws impose substantial costs, and may drain our resources and distract our management.

We are subject to certain of the requirements of the Sarbanes-Oxley

Act of 2002, as well as the reporting requirements under the Exchange Act of 1934 (the “Exchange Act”). The Sarbanes-Oxley

Act requires, among other things, that we maintain effective disclosure controls and procedures and internal controls over financial reporting.

We have previously identified material weaknesses in our internal controls. Substantial efforts and resources must be expended to maintain

a controlled environment, which is difficult for a small company like ours. Continued additional investments and management time to meet

these requirements will be necessary since control weaknesses raise the risk of future material errors in our financial statements. We

may not be able to maintain effective controls over time. If we have material weaknesses in the future, this may subject us to an SEC

enforcement action, which could include monetary fines or other equitable remedies that could be detrimental to our ongoing business.

We do not intend to pay any cash dividends in the foreseeable

future and, therefore, any return on your investment in our stock must come from increases in the market price of our stock.

We have not paid any cash dividends on our stock to date in our history,

and we do not intend to pay cash dividends on our stock in the foreseeable future. We intend to retain future earnings, if any, for reinvestment

in the development and expansion of our business. Also, any credit agreements which we may enter into with institutional lenders may restrict

our ability to pay dividends. Therefore, any return on your investment in our stock must come from increases in the fair market value

and trading price of our stock, which may not occur.

Risks Related to the Offering

Alumni Capital will pay less than the then-prevailing market

price of our stock, which could cause the price to decline.

Pursuant to our purchase agreement with Alumni Capital, they will purchase

our shares at 80% of the lowest traded price of our stock over the six business days before closing the sale. Alumni Capital has a financial

incentive to sell our shares immediately upon receiving them to realize the profit between the discounted price and the market price.

If Alumni Capital sells a large number of our shares, the price of our stock may decrease. If our stock price decreases, Alumni Capital

may have further incentive to sell their shares, creating downward pressure on the stock price. Accordingly, the discounted sales price

in the Alumni Capital purchase agreement may cause the price of our stock to decline.

Our existing stockholders may experience significant dilution

from our sale of shares to Alumni Capital.

Our sale of a significant number of shares to Alumni Capital at a discount

to the market price could have a significant dilutive effect upon our existing shareholders. If our stock price decreases, we will have

to issue a greater number of shares to Alumni Capital to obtain the same amount of funds. As a result, if our stock price decreases, then

our existing shareholders would experience greater dilution for any given dollar amount raised through the offering.

The risk of dilution could cause the market price of our stock

to decline.

The perceived risk of dilution may cause our shareholders to sell their

shares, which may cause a decline in the price of our stock. In addition, the perceived risk of dilution and the resulting downward pressure

on our stock price could encourage investors to engage in short sales of our stock. By increasing the number of shares offered for sale,

material amounts of short selling could further contribute to progressive price declines in our stock.

We may not have access to the full $1.0 million investment

from Alumni Capital.

Our agreement with Alumni Capital provides that we may sell them up

to $1.0 million of our stock. However, under the agreement Alumni Capital is also limited to owning less than 5% of our outstanding

stock. On August 8, 2023, 5% of our stock equaled 5,089,309 shares. On that date the lowest traded price of our stock during the six previous

business days was $0.077. At that price, after the 20% discount, we would be able to sell shares to Alumni Capital for $0.062 a share.

At that discounted price, we would only be able to raise $313,501 while remaining below the 5% limit. After that, Alumni Capital would

have to sell some of our shares before we could sell more shares to them. Alumni Capital’s sales could negatively impact the market

price of our stock and further reduce the amount of funds we could raise from Alumni Capital.

The exercise of Alumni Capital’s warrant could dilute

our existing stockholders.

When we entered into the stock purchase agreement with Alumni Capital

we issued to Alumni a warrant to acquire up to 6,666,667 shares of our stock for a five-year term. The per share warrant exercise price

is not fixed, but is instead determined at the time of exercise by dividing $15.0 million by the number of shares of our common stock

then outstanding. On August 8, 2023, the per share exercise price is $0.147. However, in the future, we may issue additional stock for

capital raising purposes, in connection with hiring or retaining employees, to fund acquisitions, or for other business purposes, in which

case the warrant purchase price will decrease even if the market price of our stock has increased. Alumni Capital’s purchase of

shares under the warrant could have a significant dilutive effect on our existing shareholders. In addition, Alumni Capital might be willing

to sell the warrant shares for less than the current market price, creating downward pressure on the value of our stock. Just the potential

for the issuance of a significant amount of our common stock pursuant to the warrant could create a circumstance commonly referred to

as an “overhang” and in anticipation of which the market price of our stock could fall. The existence of an overhang, whether

or not sales have occurred or are occurring, could also hinder our ability to raise additional equity capital at a time and price that

we deem reasonable or appropriate.

Forward-Looking Statements

This prospectus contains statements that are forward-looking within

the meaning of Section 21E of the Exchange Act. Forward-looking statements are statements other than historical facts, including,

without limitation, statements that are identified by words like “may,” “could,” “would,” “should,”

“will,” “believe,” “expect,” “anticipate,” “plan,” “predict,”

“estimate,” “target,” “project,” “intend,” or similar expressions. These statements include,

among others, statements regarding our current expectations, estimates and projections about future events and financial trends affecting

the financial condition and operations of our business. These statements are inherently subject to a variety of risks and uncertainties

that could cause actual results to differ materially from those expressed. You should not rely solely on these forward-looking statements

and should consider all uncertainties and risks discussed throughout this prospectus. Forward-looking statements are only predictions

and not guarantees of performance and speak only as of the date they are made. We do not undertake to update any forward-looking statement

in light of new information or future events.

Although we believe that the expectations, estimates and projections

reflected in the forward-looking statements in this prospectus are based on reasonable assumptions when they were made, we cannot assure

you that these expectations, estimates and projections will be achieved. We believe the forward-looking statements in this report are

reasonable; however, you should not place undue reliance on any forward-looking statement, as they are based on current expectations.

Future events and actual results may differ materially from those discussed in the forward-looking statements. Factors that could cause

actual results to differ materially from our expectations include, but are not limited to:

| ● | RVs are discretionary purchases, and our sales may be impacted by macroeconomic conditions that reduce discretionary spending, such

as rising inflation and interest rates. |

| ● | RV dealers rely on floor plan financing to restock inventory, and our sales may be impacted if we are unable to provide additional

floor plan financing options to our dealers. |

Additional risks and uncertainties not presently known to us or that

we currently deem immaterial also may impair our business operations and also could cause actual results to differ materially from those

included, contemplated or implied by the forward-looking statements made in this prospectus, and you should not consider the factors listed

above to be a complete set of all potential risks or uncertainties. All subsequent written or oral forward-looking statements concerning

USLG or other matters addressed in this prospectus and attributable to us or any person acting on our behalf are expressly qualified in

their entirety by the cautionary statements contained or referred to in this section of this prospectus, the other information contained

or incorporated by reference in this prospectus, especially in the “Risk Factors” and “Management’s Discussion

and Analysis of Financial Condition and Results of Operations” sections of our Annual Report on Form 10-K and quarterly reports

on Form 10-Q, which are available on the SEC’s website at SEC.gov.

The Company

In this prospectus we refer to US Lighting Group, Inc. and its subsidiaries

as USLG, the company, we and our, unless the context requires otherwise.

Overview

We are an innovative composite manufacturer utilizing advanced fiberglass

technologies in growth sectors such as high-end recreational vehicles (RVs), prefabricated off-grid houses, and high-performance powerboats.

We derive expertise and inspiration from the marine industry, where the harshest conditions are expected and met with superior engineering

and the latest in composite technology. Molded fiberglass products are exceptionally strong, lightweight and durable. Composite materials

are also corrosion resistant and provide efficient insulation, making them attractive for both outdoor enthusiasts and residential housing

needs. Molded construction allows for the creation of irregular, unusual or circular objects, which permits the innovative shapes and

features of our products. As of June 30, 2023, our revenue was driven by shipments of fiberglass campers marketed under Cortes Campers

brand.

We plan to expand our manufacturing footprint, enhance production techniques,

and develop more products in the RV, marine and composite housing sectors. Our current R&D efforts are focused on future tow-behind

camper models under Cortes Campers brand as well as prefabricated housing segment.

Our headquarters, manufacturing and research and development facilities

are located at 1148 East 222nd Street, Euclid, Ohio, 44117. Our website is www.USLightingGroup.com.

Cortes Campers

Cortes Campers is our brand of high-end molded fiberglass RV travel

trailers and campers designed for comfort, style and durability. We utilize superior quality materials and fiberglass construction resulting

in significantly stronger, more durable and lighter weight products.

Cortes Campers will exhibit at the largest RV industry consumer and

trade shows in the fall of 2023, the Hershey RV show in Pennsylvania and the Elkhart RV Dealer Open House in Indiana.

RV Industry Overview

According to Recreational Vehicle Industry Association research, the

RV industry has demonstrated growth over the last several years with an unprecedented surge in 2021. Results for the RV Industry Association’s

December 2022 survey of manufacturers determined the total shipments for 2022 ended with 493,268 shipments, the third best year on record.

According to a Facts & Factors research report, the global RV market was estimated at US $51 billion in 2019 and is expected

to reach US $77 billion by 2026. The new forecast projects 2023 RV shipments to range between 307,000 to 287,200 units with a median of

297,100 units. In 2024, wholesale shipments are inspected to increase to a range of 354,400 to 342,500 units, with a median of 348,400

units.

Reasons for growth include a general increase in popularity, rising

household incomes and new demographics entering the market. The COVID-19 pandemic further fueled interest in RV recreation as more people

were able to work remotely. RV trips also became a preferred mode of tourism for many Americans as the pandemic impacted traditional travel.

While wholesale shipments of towable RVs declined after lifting of COVID-related restrictions, interest in RVing remains high with campgrounds

reporting full utilization over summer 2023 and a third of leisure travelers indicating that they would like to buy an RV.

A recent survey has found that 37% of American leisure travelers, representing

67 million, plan on taking an RV trip this year. Among leisure travelers, who are defined as any US resident who has taken some type of

leisure trip in the past year, the top reasons for RV travel are exploring the outdoors and having additional flexibility through remote

work or school. While spending time outdoors has consistently remained a top reason for RVing, the number of respondents who cited flexibility

in work have increased by 12% in the past year. The survey also showed that finances are a driving reason for people’s plans to

take an upcoming RV trip. On average, RV vacations cost 50% less than comparable hotel and plane travel trips and a third less than hotel

and car travel trips, making RVing an attractive option for people looking for the freedom to travel while also controlling their travel

expenses. The industry continues to experience both private and public sector investments in its infrastructure, particularly installations

of pull-through electric vehicle charging stations to meet the needs of RVers today and well into the future.

The most popular RV trip destinations include state and national parks,

with the latter remaining the most popular destination among all age groups. However, the highest interest in RVing overall comes from

the younger age groups. Surveys indicate that 49% of Generation Z and 48% of Millennials plan to take an RV trip in the next year. Their

purchase intent is also higher, with 41% of Generation Z and 35% of Millennials planning to buy an RV in the next year. Among RVers, defined

as people who have taken a trip in an RV they rent, own, or borrow in the past twelve months, 50% plan to buy an RV in the next year.

This is up 14% from last year.

The increased demand for RV units also fuels innovation as manufacturers

seek to satisfy the needs of a new, younger demographic, most of whom are first time buyers. Cortes Campers saw these market trends as

an opportunity to introduce lightweight, towable, composite-built campers that feature luxury amenities in a small footprint.

Principal RV Products

Traditional RVs are built using wooden structures and corrugated aluminum

shells, also referred to in the industry as “stick and tin” construction, or with aluminum skeleton and fiberglass wall panels

also known as “laminated” RVs. While these methods dominate the manufacturing landscape of the industry, traditional RVs are

known for frequent structural damage, mold and rot, rapid deterioration, and lack the ability to perform in harsher, colder environments.

Additionally, both manufacturing techniques require highly skilled manual labor in such fields as carpentry, wood-working and interior

finish.

Molded composite manufacturing, including fiberglass, has been the

primary construction process for many high-tech industries such as aerospace, the wind power industry and marine. Composite materials

offer unparalleled structural integrity, while being lightweight and resistant to the elements, allowing us to provide an industry-leading

seven-year fiberglass warranty. In addition, molded construction utilizes a master mold which consistently yields production units with

minimal variances.

Cortes Campers’ first product is the Cortes 17, a 17-foot long

single axle tow-behind molded fiberglass camper. The innovative design challenges construction techniques currently used by the RV industry.

Drawing from expertise in the marine industry, our unique “no-wood” construction replaces all wood with composite alternatives

or corrosion resistant materials, producing a truly durable camper designed to last a lifetime. Other innovations include plug-and-play

wiring harnesses, all stainless-steel fasteners, axle-less independent suspension, corrosion resistant chassis, and four-season insulation.

Amenities include a gas oven, three-burner cooktop, microwave oven, 8.0 cubic-foot refrigerator, kitchen workstation, bathroom and shower,

air conditioner, and LED television, as well as ample storage and many large windows. The Cortes 17 camper sleeps two and is rated at

3,500 pounds maximum towable weight. These amenities are not typically available in competitor campers of this size.

In the second quarter of 2023, Cortes Campers introduced a new floorplan,

Cortes 16, which has expanded sleeping capacity with a king size bed. We are currently developing additional models, including a larger,

family-oriented all composite 22-foot travel trailer.

We are also developing partnerships with other industry players and

offer design and manufacturing services for camper models to be private-labeled and sold under other established industry brands. This

will also help bring awareness to the benefits of molded fiberglass construction and its advantages to the end consumer.

Futuro Houses

Recognizing that we could utilize many of the same technologies and

manufacturing processes we have perfected for the Cortes Campers line of RVs to make small, prefabricated homes, we began exploring the

market in early 2022. The international tiny-house movement has gained new relevance in the recent years as the quest for off-grid, rugged,

prefabricated homes has entered the mainstream and was further fueled by the COVID-19 pandemic. The tiny homes market is expected to grow

by US $3.3 billion from 2021 to 2025.

We named our modular housing line after the Futuro Pod, the iconic

“UFO house” designed by Finnish architect Matti Suuronen, of which fewer than one hundred were built during the late 1960s

and early 1970s. The shape, reminiscent of a flying saucer, and the structure’s airplane hatch entrance, has made the houses sought

after by collectors and by Airbnb renters.

Our first home design is an update of the original Futuro utilizing

modular construction and fiberglass for structural integrity and energy efficiency and designed to address modern residential requirements

in a 600-square-foot living space. The Futuro can also be used as a rental property or for commercial use. We are developing a distribution

model and plan to make our homes available for sale through a network of exclusive distributors. We exhibited the Futuro house at the

Cleveland Home & Remodeling Expo in March 2023, signed our first distributor in New York, and sold our first home in May 2023.

Futuro houses are currently available as fiberglass shell kits, to

be outfitted by the end purchaser based on their needs. In the future, we plan to introduce factory-installed interior lay-outs, which

will feature built-in furniture and appliances. Our vision for the future also includes energy independent and off-grid living amenities,

such as rainwater collection, and wind and solar power options.

Since launching Futuro Houses we have added two additional tiny house

designs ranging from more traditional to futuristic and from 200 to 300 square feet.

Fusion X Marine

In early 2021, we formed Fusion X Marine to design, manufacture and

distribute high-performance speed boats utilizing advanced fiberglass composites. Our first boat model is the X-15, a miniature speed

boat designed for rental sites and excursions, as well as to serve as an entry-level boat for first time buyers. At just 15 feet long,

an ocean-capable X-15 can be stored in a standard garage space, towed with virtually any vehicle and provides a powerful and exciting

experience on the water. The X-15 features a traditional V-hull design, is suitable for three people, and takes an outboard motor of up

to 50 HP. Tooling and molds have been developed for this model and the X-15 is expected to go into production in the fourth quarter of

2023. We intend to develop a chain of rental locations that would rent and sell the X-15 directly to the consumer.

The similarly styled X-27 is a 27-foot fiberglass V-hull speedboat

and is designed for speed and superior maneuverability. While offering all the thrill and power on the water, this model is expected to

be affordable compared to other boats in its class. The X-27 is designed for up to five people and features an interior cabin that sleeps

two. The X-27 can be equipped with either inboard or outboard motors with a minimum of 300 HP rating. The tooling and molds for the X-27

are currently under development and the model is not yet available for pre-orders.

Our speedboat division is still in the development phase as we have

focused on expanding our Cortes Campers line and launching Futuro Houses. As of June 30, 2023, Fusion X Marine has not generated revenue

for us. More information about these products can be found at FusionXMarine.com.

Manufacturing Process

The manufacturing of molded fiberglass products involves constant cycling

of master molds that require curing time before the finished parts can be freed form the mold. Currently Cortes campers and Futuro houses

are built out of a single mold for each body component, however, more molds can be created to increase the number of units that can be

produced. Each mold can be cycled once a day. The fabrication schedule includes processes such as gel coat spray application, fiberglass

lamination, reinforcement, curing time, cutting and final assembly. Manufacturing is performed in-house in our 26,000 square-foot industrial

facility located just outside of Cleveland, Ohio.

Distribution and Current Market

Cortes Campers has established a network of professional RV dealerships

to market and distribute its products. Throughout 2022, Cortes Campers added several multi-location dealers who represent the brand and

serve markets in Florida, Texas, New England, Tennessee and others. Cortes Campers also has three established dealers in Canada. We continue

to focus on nurturing our already well-established dealer network for Cortes Campers and adding distribution partners in North America

and beyond. As of June 30, 2023, Cortes Campers are available through 37 dealer locations in US and Canada. A full list of our current

dealers can be viewed on our Cortes Campers website at www.CortesCampers.com.

In 2022, we secured several floor planning arrangements for banks to

finance dealer purchases through their floor planning programs. This has allowed Cortes Campers to attract additional dealer interest

and made inventory purchases more attractive for dealers. As we grow, we expect to build and strengthen our relationships with leading

industry lenders to provide floor plan arrangements and fuel dealers’ ability to keep campers on their lots available for immediate

sale.

We are in the process of developing a distribution network for Futuro

Houses.

Patents

We are in the process of obtaining access to intellectual property

that we believe will enable meaningful product innovation and significant cost reductions in the current and future Cortes Campers models.

Some of the issued patents that we have access to or are pursuing exclusive

access to are listed below.

|

Document/Patent

number |

|

Title |

|

Inventor Name |

|

Publication

Date |

| US-20220379796-A1 |

|

Integrally Molded Recreational Vehicle Body |

|

Paul Spivak |

|

2022-12-01 |

| US-20220274649-A1 |

|

Chassis for Recreational Vehicle |

|

Paul Spivak |

|

2022-09-01 |

| US-20220131379-A1 |

|

Energy Management System for a Recreational Vehicle |

|

Paul Spivak |

|

2022-04-28 |

| US-20210053626-A1 |

|

Heat-Reflective Recreational Vehicle Body |

|

Paul Spivak |

|

2021-02-25 |

| EU- 015011617-0001 |

|

European Union Design Patent for “House” |

|

Paul Spivak |

|

2023-02-16 |

In addition, Mr. Spivak has filed a pending U.S. Design Patent

Application for “House” Serial No.: 29/866,039.

Suppliers — International and Domestic

Raw materials utilized in composite manufacturing include fiberglass,

gelcoats and resins. We manufacture the fiberglass shells of our products, as well as certain interior components. However, we purchase

other components for our products from third party suppliers, including custom fabricated chassis, water tanks, wheels and tires, appliances,

electrical, plumbing and other interior components. Currently Cortes Campers and Futuro Houses’ specifications call for materials

that can be sourced domestically from United States or Canadian based manufacturers and suppliers. However, many of those components have

origins in Asia, and recent supply chain disruptions, driven by the COVID-19 pandemic as well as increased demand for RV components, might

dramatically alter the supplier base of the company and its vendors. Although we have developed alternative sources for critical components,

we cannot guarantee that there will be no supply chain disruptions.

Competition

Cortes Campers directly competes with several molded fiberglass camper

manufacturers such as Casita, Oliver Travel Trailers, and Scamp. Another notable competitor is Airstream. As of June 30, 2023, Cortes

Campers is the only fiberglass RV manufacture with a dealer network, which we believe provides us with a competitive advantage. Indirect

competition includes traditionally built tow-behind campers in the same length from large established RV manufacturers such as Thor, Forest

River and Jayco.

Futuro Houses operates in a highly fragmented competitive space with

numerous small builders of tiny homes. However, some of our larger competitors are Cavco Industries Inc., CMH Services Inc., Handcrafted

Movement and Heirloom Inc. To our knowledge, there are currently no other factory-built all-fiberglass residential homes on the market.

Competition for the Fusion X Marine X-15 model includes jet-ski and

other small watercraft. The X-27 model’s competition would include powerboat manufacturers such as SeaRay, Checkmate Boats, Mastercraft,

Pantera and others who offer watercraft models in the same size and price range. However, the style and performance of the X-27 is intended

to compare with industry leading high-performance manufacturers, such as Cigarette Racing.

Seasonality

Historically, because RVs are used primarily by vacationers and campers,

RV sales tend to be seasonal, with lower sales during the winter months than in other periods. However, we have experienced continuous

sales growth the last few quarters after the release of our Cortes Campers line. We currently expect that our RV sales will vary based

on historical seasonal patterns in the future.

Product Safety and Environment Regulation

In the countries where our products are sold, we are subject to various

vehicle safety and compliance standards. Within the United States, we are a member of the RVIA, a voluntary association of recreational

vehicle manufacturers which promulgates recreational vehicle safety standards in the US. We place a RVIA seal on each of our North American

recreational vehicles to certify that the RVIA’s standards have been met. We also comply with the National Highway Traffic Safety

Administration (NHTSA) in the US and with similar standards in Canada relating to the safety of our products.

Various environmental regulations relating to air, water and noise

pollution affect our business and operations. For example, these standards, which are generally applicable to all companies, control our

choice of paints, our air compressor discharge, the handling of our wastewater and the noise emitted by our facility. We believe that

our products and plant comply in all material respects with applicable vehicle safety (including those promulgated by NHTSA), environmental,

industry, health, safety and other required regulations.

We do not believe that ongoing compliance with existing regulations

will have a material effect in the foreseeable future on our capital expenditures, earnings or competitive position. However, future developments

could impose additional costs on our business operations, particularly as we increase our fiberglass manufacturing operations.

Human Capital

As of June 30, 2023, we had 22 full-time employees and one part time

employee. We rely on a skilled workforce, particularly fiberglass laminators, to manufacture our products. We believe that we offer competitive

compensation packages and that we have good working relationships with our employees. Our employees are not members of a union.

Corporate Structure and History

US Lighting Group, Inc. is a holding company with four operating subsidiaries:

Cortes Campers, LLC, a brand of high-end molded fiberglass campers; Futuro Houses, LLC, focused on design and sales of molded fiberglass

homes; Fusion X Marine, LLC, a high-performance boat designer; and MIGMarine Corporation, a composite manufacturing company that produces

proprietary molded fiberglass products for our three business lines.

The company was originally incorporated in the State of Florida on

October 17, 2003, under the name Luxurious Travel Corp. Initially the company developed hotel booking software, but subsequently exited

that business. On July 13, 2016, we acquired a company named US Lighting Group, Inc. (founded in 2013) and changed our corporate name

to US Lighting Group, Inc. on August 9, 2016. At the time, the company designed and manufactured commercial LED lighting, both for retrofits

and new construction. Applications included commercial spaces such as board rooms, offices, factories, stores, gymnasiums, schools, hospitals,

warehouses, and greenhouses, as well as some residential applications such as garages. Distribution channels included Home Depot and a

chain of regional dealers.

On December 1, 2016, we acquired Intellitronix Corp., an automotive

electronics manufacturer, serving a niche market of aftermarket electronics for customer installations as well as several emerging original

equipment manufacturer (OEM) applications. At the time of acquisition, Intellitronix had access to the automotive electronics market and

an established distributor and consumer base.

Through supplying OEMS with electronic components, we were introduced

to the RV industry. Management identified a fast growing and underserved niche of small, tow-behind fully molded fiberglass travel trailers.

We started developing a new business plan to create a luxury 17-foot travel camper to appeal to young professionals working remotely as

well as retirees and other consumers intrigued by the travelling lifestyle. Ultimately, we decided to exit the LED lighting market, which

was being negatively impacted by inexpensive import products, and enter new business lines focused on recreational products manufactured

from advanced composite materials.

On January 11, 2021, we formed Cortes Campers, LLC to design, manufacture

and distribute innovative fiberglass composite travel trailers. We developed the product, created a dealer network and started supplying

campers in the second part of 2022. Financial results for the year ending December 31, 2022 reflect revenue of $1.1 million generated

by Cortes Campers.

On April 12, 2021, we formed Fusion X Marine, LLC to design, manufacture

and distribute high-performance speed boats utilizing advanced fiberglass composites. Our speedboat division is still in the development

phase.

On May 14, 2021, we sold selected assets of Intellitronix to Ohio INTX

Cooperative, a Northeast Ohio based non-profit organization, to focus on pursuing our new business in the RV industry.

On January 12, 2022, we formed Futuro Houses, LLC to design, manufacture

and distribute molded fiberglass homes. Throughout 2022, Futuro Houses engaged in engineering and development of our first “UFO”

themed home model inspired by the original Futuro house designed by Finnish architect Matti Suuronen. We sold our first Futuro house in

May 2023.

On August 5, 2022, we acquired MIGMarine Corporation, a fiberglass

manufacturing company founded in 2003. With the acquisition of Mig Marine, we were able to streamline our manufacturing processes, improve

production cycles and scale to meet the demand of Cortes Campers generated order back-log.

Our Management Team

The following table provides summary information about our board members

and executive officers. All directors serve until the next annual meeting of shareholders or until their successors are elected and qualified.

Officers are appointed by our board of directors and their terms of office are at the discretion of our board.

|

Name |

|

Age |

|

Title |

|

Joined USLG |

| Anthony R. Corpora |

|

47 |

|

Chief Executive Officer, President and Director |

|

08-09-2021 |

| Donald O. Retreage, Jr. |

|

69 |

|

Chief Financial Officer |

|

09-06-2022 |

| Michael A. Coates |

|

47 |

|

Corporate Controller and Treasurer |

|

02-13-2023 |

| Patricia A. Salaciak |

|

76 |

|

Director of Marketing and Director |

|

02-02-2022 |

| Olga Smirnova |

|

40 |

|

Vice President of Finance and Administration, Corporate Secretary and Director |

|

08-09-2021 |

Biographical information about our board members and executive

officers is summarized below.

Anthony R. Corpora, Chief Executive Officer, President and Director

Mr. Corpora joined USLG as the CEO, president and a director in

2021. Mr. Corpora continues to be responsible for USLG and its subsidiaries collectively. Mr. Corpora has a strong dynamic leadership

background that is strategic, democratic, transformational and motivational. These leadership traits intrinsically develop a holistic

growth-mindset within the company to develop the team that will continue driving and executing the vision of USLG. Prior to joining USLG,

Mr. Corpora worked for Mayfield City Schools and he utilizes his 21 years of intense public-school background and experience to drive

the same leadership and management principles at USLG. Mr. Corpora holds a master’s degree in educational leadership from Ursuline

College. Notable milestones under Mr. Corpora’s leadership were driving revenues to over $1.0 million for the second half of

2022 and over $1.2 million for the first quarter of 2023, USLG’s best quarter ever. Mr. Corpora continues to drive the day-to-day

operations of USLG and leads planning and preparation with his team for the long-term growth and success of the company.

Donald O. Retreage, Jr., Chief Financial Officer

Mr. Retreage most recently served as senior vice president and

chief financial officer of Lightpath Technologies, Inc. from 2018 through 2021 where he drove finance and accounting strategies for domestic

and international (China and Latvia) operations. Prior to that, he served as senior vice president of Houser Logistics, where he was responsible

for aligning strategic initiatives with corporate targets for customer service, revenue, and cost control. In 2017, Mr. Retreage

was a financial specialist at Robert Half/Accountemps, and from 2016 to 2017 he served as a senior business consultant for International

Services Inc., where he worked with business owners to develop management processes, practices, and policies to drive profitability and

grow businesses. He received a Bachelor of Science in Business Administration, Accounting and Finance from University of Louisiana at

Lafayette. Mr. Retreage is experienced in directing international business operations and aligning strategic initiatives with corporate

targets for revenue, cost control, and employee development and engagement.

Michael A. Coates, Corporate Controller and Treasurer

Mr. Coates is responsible for directing and coordinating our accounting

functions, managing the consolidation of financial data for accurate reporting and analysis, and preparing internal and external financial

statements. Prior to joining USLG, Mr. Coates was a senior tax analyst at PNC Private Bank Hawthorn, a business dedicated to serving