FALSE000145151200014515122023-09-122023-09-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 12, 2023 (September 7, 2023)

| | | | | | | | |

| UNRIVALED BRANDS, INC. | |

| (Exact name of registrant as specified in its charter) | |

| | | | | | | | | | | | | | | | | | | | |

| Nevada | | 000-54258 | | 26-3062661 | |

| (State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) | |

| | | | | | | | |

3242 S. Halladay St., Suite 202 Santa Ana, California | | 92705 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (888) 909-5564

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol | | Name of each exchange on which registered |

| Common Stock, par value $0.001 | | UNRV | | OTCQB |

Indicate by check mark whether the registrant is an emerging growth company as defined in in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 7.01. Regulation FD Disclosure.

As previously disclosed in the Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2023, (the “Quarterly Report”) of Unrivaled Brands, Inc. (the “Company”), on May 11, 2022, the Company and its wholly-owned subsidiary, Medifarm I, LLC (“Plaintiffs”) initiated an action in the Second Judicial District of the State of Nevada, County of Washoe, against Mystic Holdings, Inc. (“Mystic”) and Picksy Reno LLC (collectively with Mystic, “Defendants”) in connection with Defendants’ failure to honor Plaintiffs’ exercise of a put option entitling Plaintiffs to the repurchase of approximately 8,332,096 shares of Mystic at a price of $1.00 per share.

On September 7, 2023, the Company entered into a binding term sheet to terminate the pending litigation matters with Mystic. Upon execution of the binding term sheet, the parties agreed to inform the court of the settlement and request a stay of all pending litigation. The settlement remains subject to final documentation; the terms will be disclosed to the extent required by law.

On September 12, 2023, Company issued a press release announcing the term sheet described above. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information contained in this Item 7.01, and in Exhibit 99.1, referenced herein is being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any registration statement or other filing under the Securities Act of 1933, as amended, unless the Company expressly so incorporates such information by reference.

Certain information in this Current Report on Form 8-K is forward-looking, including our projections as to the timing of final court approval of the settlement, the amount and timing of the charge relating to the proposed settlement and the timing of payments under the proposed settlement. Forward-looking information is based on management's estimates, assumptions and projections, and is subject to significant uncertainties and other factors, many of which are beyond the Company's control. Important risk factors could cause actual future results and other future events to differ materially from those currently estimated by management, including, but not limited to: obtaining court approval of the proposed settlement, the amount and timing of the proposed settlement, and whether the proposed settlement is appealed.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL Document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| UNRIVALED BRANDS, INC. | |

| | |

Date: September 12, 2023 | By: | /s/ Sabas Carrillo | |

| | Sabas Carrillo | |

| | Chief Executive Officer | |

Unrivaled Brands and Mystic Holdings Reach Settlement; Agree to Explore Collaborative Opportunities

SANTA ANA, Calif., Sept. 12, 2023 (GLOBE NEWSWIRE) – Unrivaled Brands, Inc. (OTCQB: UNRV) (“Unrivaled,” “Unrivaled Brands,” or the “Company”), a cannabis company with operations throughout California, is pleased to announce the resolution of outstanding litigation with Mystic Holdings, Inc. (OTCQX: MSTH) (“Mystic”), subject to final documentation.

On the heels of the Department of Health and Human Services’ recommendation to reschedule marijuana from Schedule 1 to Schedule 3, both companies have designed to effect a strategic vision anchored on the idea that working on building a long-term partnership is better than resources spent on litigation. The settlement grants Unrivaled up to two seats on the board of directors of Mystic in addition to its 5.5% of shares of Mystic common stock and 9.7% of Series A Preferred shares of Mystic which grant 1,100 to 1 voting rights and which convert on a 1-to-1 basis to Mystic common stock. The parties have agreed to explore opportunities for mutual collaboration and growth. The collaboration could empower the two companies to leverage Mystic’s supply chain and cultivation facility in Nevada along with its retail footprint, enhancing operational efficiency and cost-effectiveness across California and Nevada. The partnership could also unlock cross-selling opportunities and access to new capital, supporting expansion, innovation, and strategic investments. Upon execution of the binding term sheet, the parties agreed to inform the court of the settlement and request a stay of all pending litigation. The settlement marks another milestone in Unrivaled’s turnaround efforts over the last twelve months.

Sabas Carrillo, Unrivaled’s Chief Executive Officer stated, “The synergistic potential is immediately apparent between Unrivaled and Mystic and their respective leadership teams. I am excited about working closely with the Mystic team. Their roots in the hospitality industry offer a fresh perspective, and I’m eager to explore how we can integrate this expertise to bring new, innovative products and experiences to our customers. Unrivaled’s equity stake in Mystic not only reinforces this compatibility but also makes it imperative for both companies to harness each other’s unique strengths in navigating these trying times for the cannabis industry. Mystic’s vertical integration lays the primer for Unrivaled to enter a Nevada market structured to only reward large players. By introducing our top-tier California genetics and brands into Nevada, we position ourselves for the opportunity to disrupt the market in a significant way.”

Mystic’s President, Michael Cristalli, also weighed in stating, “We're excited about partnering with Unrivaled, a seasoned operator in California, the most mature cannabis market in the Country. Their entrance into Nevada’s more favorable regulatory climate will be a strategic benefit to both companies. Unrivaled brings with them deep relationships and experience which will benefit the consumer with greater product choices.”

Robert Baca, Unrivaled’s Chief Legal Officer, expressed a note of optimism, stating, “The resolution of this litigation underscores our commitment to turning challenges into opportunities. Unrivaled and Mystic are best served capitalizing on the talent, knowledge, brands, operational and manufacturing expertise, and marketing experience that each brings to bear. The companies are united in a common cause of setting a new standard in cannabis.”

About Unrivaled Brands

Unrivaled Brands is a company focused on the cannabis sector with operations in California. Unrivaled Brands operates four dispensaries and direct-to-consumer delivery, a cultivation facility, and several leading company-owned brands. Unrivaled Brands is home to Korova, known for its high potency products across multiple product categories.

For more info, please visit: https://unrivaledbrands.com.

About Mystic Holdings

Mystic Holdings, Inc., through its subsidiaries, engages in the cultivation, production, and wholesale of medical and recreational cannabis in Nevada, the United States. It offers cannabis flowers; edibles, such as gummies, brownie bites, cookies, caramels, rice crispies, and chocolate chip bars; concentrates and oils; pre-rolls and small bud batches; and cannabis vape products under the Qualcan, Lush, and Cosmic brands. The company also operates three recreational/medical retail dispensaries; and provides branding consulting services for third-party cannabis products. It serves state-licensed dispensaries. The company was founded in 2014 and is based in Las Vegas, Nevada.

For more info, please visit: https://www.qualcan.com.

Cautionary Language Concerning Forward-Looking Statements

Certain statements contained in this communication regarding matters that are not historical facts, are forward-looking statements within the meaning of Section 21E of the Securities and Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, known as the PSLRA. These include statements regarding management's intentions, plans, beliefs, expectations, or forecasts for the future, and, therefore, you are cautioned not to place undue reliance on them. No forward-looking statement can be guaranteed, and actual results may differ materially from those projected. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise, except to the extent required by law. The Company uses words such as “anticipates,” “believes,” “plans,” “expects,” “projects,” “future,” “intends,” “may,” “will,” “should,” “could,” “estimates,” “predicts,” “potential,” “continue,” “guidance,” and similar expressions to identify these forward-looking statements that are intended to be covered by the safe-harbor provisions of the PSLRA. Such forward-looking statements are based on the Company’s expectations and involve risks and uncertainties; consequently, actual results may differ materially from those expressed or implied in the statements due to a number of factors.

New factors emerge from time-to-time and it is not possible for the Company to predict all such factors, nor can the Company assess the impact of each such factor on the business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. These risks will be more fully discussed in the Company’s reports with the SEC. Additional risks and uncertainties are identified and discussed in the “Risk Factors” section of the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other documents filed from time to time with the SEC. Forward-looking statements included in this release are based on information available to the Company as of the date of this release. The Company undertakes no obligation to update such forward-looking statements to reflect events or circumstances after the date of this release.

Contact:

Jason Assad

LR Advisors LLC.

jassad@unrivaledbrands.com

678-570-6791

v3.23.2

Cover

|

Sep. 12, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 12, 2023

|

| Entity Registrant Name |

UNRIVALED BRANDS, INC.

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity File Number |

000-54258

|

| Entity Tax Identification Number |

26-3062661

|

| Entity Address, Address Line One |

3242 S. Halladay St.

|

| Entity Address, Address Line Two |

Suite 202

|

| Entity Address, City or Town |

Santa Ana

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92705

|

| City Area Code |

888

|

| Local Phone Number |

909-5564

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001

|

| Trading Symbol |

UNRV

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001451512

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

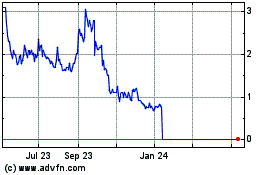

Unrivaled Brands (QB) (USOTC:UNRV)

Historical Stock Chart

From Apr 2024 to May 2024

Unrivaled Brands (QB) (USOTC:UNRV)

Historical Stock Chart

From May 2023 to May 2024