Patriot Energy Receives New Stock Purchase Agreement at $0.57 Per Share From Marmara Motorlu of Dubai

May 15 2009 - 1:37PM

Marketwired

Patriot Energy Corporation (PINKSHEETS: PGYC) announced today that

it has received a revised and final all cash stock purchase offer

at $0.57 per share from Dubai based Marmara Motorlu, a subsidiary

of Marmara Parts headquartered in Istanbul, Turkey.

According to the stock purchase agreement signed and mutually

announced today, Marmara will acquire all of the outstanding shares

of Patriot Energy Corp. at a price of $0.57 per share in an all

cash transaction, however, the previously announced royalty shares

are eliminated from the offer to allow for a larger upfront price.

The shareholders will vote on the purchase offer on June 9, 2009 at

9:00 further to the notice of a special meeting of shareholders.

The company plans to make available the proxy documentation as well

as the accompanying information circular by no later than end of

day May 15, 2009.

About Patriot Energy Corporation

Patriot Energy Corp. is a management holding corporation, which

owns a wholly owned subsidiary named TelTeck Solutions and owns a

99 year exclusive leased license agreement with Tectane

Technologies Corporation for the Dual H2O Engine Oxygenator and New

Tri-Brid Engine (Electric/Flex-Fuels/H2O) Technologies. Patriot

Energy specializes in the development and marketing of energy

efficient technologies with a focus on reducing America's

dependence on Foreign Oil.

All statements in this news release that are other than

statements of historical facts are forward-looking statements,

which contain our current expectations about our future results.

Forward-looking statements involve numerous risks and

uncertainties. We have attempted to identify any forward-looking

statements by using words such as "anticipates," "believes,"

"could," "expects," "intends," "may," "should" and other similar

expressions. Although we believe that the expectations reflected in

all of our forward-looking statements are reasonable, we can give

no assurance that such expectations will prove to be correct.

A number of factors may affect our future results and may cause

those results to differ materially from those indicated in any

forward-looking statements made by us or on our behalf. Such

factors include our limited operating history; our need for

significant capital to finance internal growth as well as strategic

acquisitions; our ability to attract and retain key employees and

strategic partners; our ability to achieve and maintain

profitability; fluctuations in the trading price and volume of our

stock; competition from other providers of similar products and

services; and other unanticipated future events and conditions.

Contacts: Momentum IR Max Gagne 514-913-0351 877-253-7001

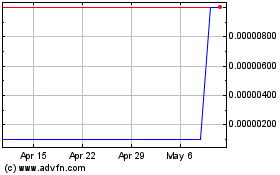

Patriot Energy Corporati... (CE) (USOTC:PGYC)

Historical Stock Chart

From Apr 2024 to May 2024

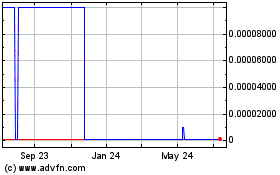

Patriot Energy Corporati... (CE) (USOTC:PGYC)

Historical Stock Chart

From May 2023 to May 2024