Patriot Energy Confirms Receipt of an All Cash Purchase Offer

March 30 2009 - 9:45AM

Marketwired

Patriot Energy Corporation (PINKSHEETS: PGYC) today confirmed that

the board of directors has received a formal purchase offer from a

Fortune 500 Corporation.

According to the company, the initial offer, which was

structured as an all cash transaction, was short of the discounted

cash valuation of the carbon credit trading revenue, which is

estimated at $113,715,000 or approximately $0.57 per share. The

company is continuing its negotiation and believes that an all cash

purchase offer could be concluded shortly and is expected to be

somewhere between the initial offer of $65,000,000 or 0.33 per

share and the net discounted cash value of $113,715,000 or $0.57

per share. However, it should be noted that upon receipt of a new

offer, several milestones will need to be met including a legal and

technical due-diligence, and a shareholders meeting to seek

acceptance of the offer. Management is very confident that the

due-diligence both the legal and technical will be concluded

without any issues. The Fortune 500 Company has requested that its

name be kept confidential until such time as the offer is accepted

by the board of directors and presented to shareholders for

approval.

"We had been in discussions for sometime, but this sudden formal

all cash offer did catch us a little by surprise" said Tony

Bisante, President of Patriot Energy Corp. "We have a strong

product, a sound business model and the green shift has forced the

hands of many multi-nationals to action. Carbon credits and the

reduction of America's dependence on foreign oil are strong

advantages in the present and the future economy" further added Mr.

Bisante.

About Patriot Energy Corporation

Patriot Energy Corp. is a management holding corporation, which

owns a wholly owned subsidiary named TelTeck Solutions and owns a

99 year exclusive leased license agreement with Tectane

Technologies Corporation for the Dual H2O Engine Oxygenator and New

Tri-Brid Engine (Electric/Flex-Fuels/H2O) Technologies. Patriot

Energy specializes in the development and marketing of energy

efficient technologies with a focus on reducing America's

dependence on Foreign Oil.

Total Shares Outstanding (fully diluted): 199,500,000

www.patriotenergycorporation.com

All statements in this news release that are other than

statements of historical facts are forward-looking statements,

which contain our current expectations about our future results.

Forward-looking statements involve numerous risks and

uncertainties. We have attempted to identify any forward-looking

statements by using words such as "anticipates," "believes,"

"could," "expects," "intends," "may," "should" and other similar

expressions. Although we believe that the expectations reflected in

all of our forward-looking statements are reasonable, we can give

no assurance that such expectations will prove to be correct.

A number of factors may affect our future results and may cause

those results to differ materially from those indicated in any

forward-looking statements made by us or on our behalf. Such

factors include our limited operating history; our need for

significant capital to finance internal growth as well as strategic

acquisitions; our ability to attract and retain key employees and

strategic partners; our ability to achieve and maintain

profitability; fluctuations in the trading price and volume of our

stock; competition from other providers of similar products and

services; and other unanticipated future events and conditions.

Contacts: Momentum IR Max Gagne 514-913-0351 877-253-7001

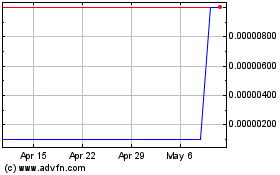

Patriot Energy Corporati... (CE) (USOTC:PGYC)

Historical Stock Chart

From Apr 2024 to May 2024

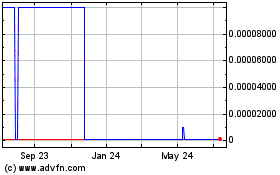

Patriot Energy Corporati... (CE) (USOTC:PGYC)

Historical Stock Chart

From May 2023 to May 2024