0001776932

false

0001776932

2023-07-05

2023-07-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 5, 2023

MEDMEN ENTERPRISES INC.

(Exact

name of registrant as specified in its charter)

| A1British Columbia |

|

000-56199 |

|

98-1431779 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

8740 S Sepulveda Blvd, Suite 105, Los Angeles, California 90045

(Address,

including zip code, of principal executive offices)

Registrant’s

telephone number, including area code (424) 330-2082

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act: None.

| Title of Each Class | |

Trading Symbol | |

Name of Each Exchange on Which Registered |

| | |

| |

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 5.02 | Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers |

Appointment

of Ellen Beth Harrison as Chief Executive Officer and Director

On

July 5, 2023, MedMen Enterprises Inc. (the “Company”) announced the appointment of Ellen Beth Harrison (a.k.a. Ellen

Deutsch) to serve as the Company’s Chief Executive Officer, effective immediately. Ms. Harrison replaced Edward Record, who stepped

down from the role of Interim Chief Executive Officer but will continue as a non-executive member of the board of directors of the Company

(the “Board”). Concurrently, Ms. Harrison was appointed to the Board, which increased the size of the Board to six directors.

Ellen

Beth Harrison, 62, served as Senior Vice President of Market Development and Shared Services at Acreage Holdings, Inc., a vertically

integrated, multi-state operator of cannabis cultivation and retailing facilities in the U.S., from February 2022 to July 2023.

Prior to that, from October 2019 to November 2021, Ms. Harrison was Executive Vice President and Chief Operating Officer at

Stem Holdings, Inc, a vertically integrated cannabis branded products and technology company. Before joining Stem Holdings, Ms. Harrison

worked in various executive C-suite roles with the Hain Celestial Group, Inc., a leading organic and natural products company with operations

in North America, Europe and the Middle East, from April 1996 to July 2019. Ms. Harrison received a Bachelor of Business Administration,

Marketing and a Master of Business Administration, Marketing from Hofstra University.

In

connection with Ms. Harrison’s appointment as Chief Executive Officer, Ms. Harrison and the Company entered into an employment

letter, dated July 1, 2023 (the “Harrison Employment Letter”), pursuant to which Ms. Harrison will receive (i) an initial

annual base salary of $416,000, (ii) a grant of $4,000 in Class B Subordinate Voting Shares of the Company (the “Shares”)

in compensation for each week she is employed as Chief Executive Officer during the prior fiscal year, to be granted at the end of each

fiscal year, and (iii) options valued at $6,000 to acquire Shares for each week she is employed as Chief Executive Officer, to be granted

at the beginning of each fiscal quarter, vesting effective as of the end of each such fiscal quarter-end based upon the achievement of

performance metrics mutually agreed upon by Ms. Harrison and the Board.

The

initial term of Ms. Harrison’s employment is one year with automatic renewal for successive one-year periods subject to the mutual

consent of the Company and Ms. Harrison. In the event that the Company terminates or does not renew Ms. Harrison’s employment,

or she terminates or elects to not renew her employment due to material breach by the Company or any reduction in her title, duties,

authorities or responsibilities, she will be entitled to the Severance Benefits (as defined below) on the date of termination, in addition

to pro-rated compensation and benefits, including equity incentives, under the Harrison Employment Letter for the period through the

termination date. “Severance Benefits” is defined as all amounts that would be due for an additional period of 120 days (pro-rated

for all partial periods) following the termination date, including (a) all compensation and benefits under Harrison Employment Letter

for such period, including payment by the Company of the premiums due for Ms. Harrison’s medical insurance, (b) no less than the

guaranteed amount of Shares for such period, and (c) the options with respect to such period, with all performance metrics deemed satisfied

(and once granted shall be immediately vested).

Other

than as described herein, there are no arrangements or understandings between Ms. Harrison and any other person pursuant to which she

was appointed to serve as Chief Executive Officer and Ms. Harrison does not have a direct or indirect material interest in any “related

party” transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K. There are no family relationships between

Ms. Harrison and any director or executive officer of the Company.

Appointment

of Amit Pandey as Chief Financial Officer

On

July 5, 2023, the Company also announced the appointment of Amit Pandey as the Company’s Chief Financial Officer, effective

July 24, 2023. In the interim, Ed Record will act as principal financial officer. Amit Pandey, 41, will join the Company from Clever

Leaves International, Inc., a global medical cannabis company with one of the world’s largest cultivation and extraction capacities,

where he has served as Executive Vice President of Finance since March 2021, as Senior Vice President & Interim Chief Financial

Officer from April 2020 to February 2021, and as Vice President of Finance from May 2019 to December 2020. Prior

to that, Mr. Pandey worked at PayCommerce, LLC, a private-equity-backed B2B global cross-border platform fintech SAAS firm, as Chief

Financial Officer from February 2018 to February 2019, and as Vice President and Corporate Controller from April 2017

to January 2018. Mr. Pandey holds a Bachelor’s Degree in Accounting from Rutgers University and a Master’s Degree in

Data Science with a concentration in Business Analytics from Saint Peter’s University.

In

connection with Mr. Pandey’s appointment as Chief Financial Officer, Mr. Pandey and the Company have entered into an employment

letter, dated July 1, 2023 (the “Pandey Employment Letter”), pursuant to which Mr. Pandey will receive (i) an annual

base salary of $300,000, (ii) a sign-on equity bonus in an amount equal to $300,000 worth of Restricted Stock Units based on the average

of the trailing ten days closing price of the Shares as of the start date of his employment, and (iii) options valued at $3,000 to acquire

Shares for each week he is employed as Chief Financial Officer, to be granted at the beginning of each fiscal quarter, vesting effective

as of the end of each such fiscal quarter-end based on the achievement of performance metrics mutually agreed upon by Mr. Pandey and

the Board. In addition, Mr. Pandey will be eligible to participate in the Company’s 2021 Employee Equity Bonus Program starting

in 2024. In the event of a Change in Control, as defined in the Pandey Employment Letter, any unvested stock awards outstanding on the

date of the Change of Control will immediately vest.

Under

the Pandey Employment Letter, Mr. Pandey’s employment can be terminated with or without cause by the Company after the first year

of employment. However, if his employment is terminated within the first nine months without cause or if he resigns for good reason,

he will be paid for the remainder of that one year period, plus the reimbursement for COBRA premiums for the duration of the one year

period. After nine months of employment, if he is terminated without cause or if he resigns for good reason, he will receive three months

of paid severance, plus the reimbursement for COBRA premiums for the duration of the three month period.

Other

than as described herein, there are no arrangements or understandings between Mr. Pandey and any other person pursuant to which he was

appointed to serve as Chief Financial Officer and Mr. Pandey does not have a direct or indirect material interest in any “related

party” transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K. There are no family relationships between

Mr. Pandey and any director or executive officer of the Company.

The

foregoing descriptions of the Harrison Employment Letter and Pandey Employment Letter are not complete and are qualified by reference

to the full text and terms of such documents, which are filed as Exhibits 10.1 and 10.2, respectively, to this report and incorporated

herein by reference.

| Item

7.01 | Regulation

FD Disclosure. |

On

July 5, 2023, the Company issued a press release announcing the events described in Item 5.02 above. A copy of the press release

is attached hereto as Exhibit 99.1.

| Item

9.01 | Financial

Statements and Exhibits. |

(d)

Exhibits

| * | Certain portions of this exhibit have been redacted pursuant

to Item 601(a)(6) of Regulation S-K and marked by brackets and asterisks. The Company hereby undertakes to furnish supplementally an

unredacted copy of the exhibit upon request by the Securities and Exchange Commission. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Dated:

July 11, 2023 |

MEDMEN

ENTERPRISES INC. |

| |

|

| |

|

/s/ Ellen Beth Harrison |

| |

By: |

Ellen Beth Harrison |

| |

Its: |

Chief Executive Officer |

Exhibit 10.1

MM Enterprises USA, LLC

10115 Jefferson Blvd

Culver City, CA 90232

June 29, 2023

Ellen Deutsch

[ * ]

Dear Ellen,

MM Enterprises USA, LLC and MedMen Enterprises, Inc. (collectively “The Company”), is pleased to extend an offer of Full-Time employment to you for the position of Chief Executive Officer. This is a remote location position with travel as needed. This is an exempt position. In your capacity as Chief Executive Officer, you will perform duties and responsibilities that are reasonable and consistent with your position as may be assigned to you from time to time. You will be on the Board of Directors but will receive no associated compensation/fees for sitting on the Board of the Company.

Your estimated start date will be July 5, 2023, with this offer of a one-year contract of employment being conditional upon successful completion of certain requirements, as explained in this letter. Your employment is subject to the terms and conditions set forth in this letter, which override anything communicated to you during your interview or as part of any other communication about your employment with the Company.

The term of your employment shall be for one year from your start date. Your employment term shall automatically renew for successive one-year periods subject to the mutual consent of each party, with a Year 2 base salary increase of 10%.

Compensation

As compensation for your services, you will be paid US$416,000 per annum which you will receive in the amount of US$16,000 per pay period, subject to all withholdings and deductions as required by law and paid on a bi-weekly basis. In addition to your compensation, the Company will also provide the following:

Short Term Equity Incentive

|

● |

Guarantee of US$4,000 in Class B Subordinate Voting Stock (“Shares”) of the Company in compensation for each week you are employed as Chief Executive Officer during the prior fiscal year, to be granted at the end of each fiscal year at the discretion of the Board as a bonus based on an annual review of your performance but no less than such guaranteed amount. |

Long Term Equity Incentive

|

● |

Options valued at US$6,000 to acquire Shares (“Options”) for each week you are employed as Chief Executive Officer, to be granted at the beginning of each fiscal quarter, vesting effective as of the end of each such fiscal quarter-end based upon the Company achieving performance metrics that are aligned with the interests of shareholders but no less than such guaranteed amount, and which metrics are to be mutually agreed upon by you and the Board as soon as practical after your date of hire |

The number of Shares granted by the Board shall be calculated based upon the dollar value of the award dividend by the trailing 10-day volume weighted average price of the Company’s share trading on the Canadian Securities Exchange (or if traded on any National Securities Exchange, such National Securities Exchange) prior to the date of grant (the “Price”). The number of the Options shall be determined based on the Option value determined using the Black Scholes option pricing model using mutually agreed customary assumptions which shall be consistent with those used for financial reporting purposes, including that the strike price per share of the Options shall be the Price and the Options shall expire ten (10) years from the date of grant. An illustration of such valuation as of the date hereof has been separately provided by the Company prior to the date hereof and separately agreed.

At your election you shall be entitled to exercise your Options on a net basis, such that you will receive a net number of Shares that is equal to (i) the number of Shares as to which the Option is being exercised minus (ii) the quotient (rounded down to the nearest whole number) of the aggregate exercise price of the Shares being exercised divided by the Price of a Share on the Option exercise date. At your election you shall be entitled to use the same method as set forth in the preceding sentence to satisfy applicable tax withholding obligations with respect to Shares granted under the Short Term Equity Incentive provisions above and in connection with the exercise of Options.

Benefits

You will have unlimited vacation days and are to use your own discretion in this regard. In addition, MedMen provides 6 paid sick days, 11 paid holidays, medical, dental, and vision insurance through Anthem Blue Cross Blue Shield, including an employee/patient discount. Details on these benefits, including eligibility, use, and accrual can be found in the Employee Handbook.

The Company and each of its subsidiaries hereby fully indemnifies you and holds you harmless and agrees to provide you with prompt expense advancement to the fullest extent permitted by applicable law with respect to any costs, expenses (including legal expenses), proceedings, judgements, awards, taxes, or other liabilities of any nature associated with or otherwise related to (x) the Company and its affiliates, including its creditors, debt holders, equity holders and other relationships, and including any liabilities related to or in respect of Section 280E of the Internal Revenue Code or rules and regulations thereunder and any personal liability related thereto, and (y) all officer, director, employee and other positions and capacities you have with respect to the Company and its affiliates or which you accept at their request or suggestion, including any liabilities related to Section 280E of the Internal Revenue Code or rules and regulations thereunder. Without limiting the generality of the foregoing, in addition you will receive a separate customary indemnification agreement relating to your capacity as a member of the Board of the Company. The Company shall procure and maintain (and keep you informed regarding) customary director and officer liability insurance. Each of the shareholders of the Company identified as guarantors on the signature pages hereto hereby irrevocably guarantee the immediate payment when due of all obligations and liabilities of the Company and its subsidiaries under this paragraph and otherwise under this letter, on a joint and several basis, without any presentment or other process requirements or conditions. For the avoidance of doubt, this paragraph shall survive termination of this letter for any reason whatsoever, and shall inure to the benefit of your heirs, successors and assigns.

Adherence to Company Policies. You agree to abide by and will be subject to all applicable employment and other policies of the Company as outlined in the Employee Handbook and elsewhere. This includes our Alcohol & Drug Policy.

Separation of Employment Relationship. You and the Company agree that the company may not end the employment relationship prior to the first anniversary of the start date, provided that you may terminate your employment relationship at any time. Except as provided in the immediately preceding sentence, nothing in this letter or in the Company’s policies or procedures is intended to change the at-will nature of our relationship.

Upon any termination or non-renewal of your employment for any reason, you shall be entitled to the following: (a) all compensation and benefits referred to above for the period through the termination date (pro-rated for all partial periods), (b) no less than the guaranteed amount of Shares for the period through the termination date (pro-rated for all partial periods), and (c) the Options with respect to for the period through the termination date (pro-rated for all partial periods), with all performance metrics deemed satisfied. In the event that the Company terminates your employment or this letter is not renewed, or you terminate or fail to renew your employment due to material breach by the Company or any reduction in your title, duties, authorities or responsibilities, then in addition in each case you shall immediately be provided the Severance Benefits on the date of termination. “Severance Benefits” means all amounts that would be due for an additional period of 120 days (pro-rated for all partial periods) following the termination date, including (a) all compensation and benefits referred to above for such period, including payment by the Company of the premiums due for your medical insurance, (b) no less than the guaranteed amount of Shares for such period, and (c) the Options with respect to such period, with all performance metrics deemed satisfied (and once granted shall be immediately vested).

By accepting this offer, you confirm that you are able to accept this job and carry out the work involved without breaching any legal restrictions on your activities, such as restrictions imposed by a current or former employer. You also confirm that you will inform the Company about any such restrictions and provide the Company with as much information as possible, including copies of any agreements between you and your current or former employer describing any restrictions on your activities.

You further confirm that you will not remove or copy any documents or proprietary data or materials of any kind, electronic or otherwise, with you from your current or former employer to the Company without written authorization from your current or former employer, nor will you use or disclose any such confidential information during the course and scope of your employment with the Company. If you have any questions about the ownership of particular documents or other information, discuss those questions with your current or former employer before removing or copying any documents or information.

We are excited about the prospect of you joining our team. If you wish to accept this offer, please sign below, and return this letter within three (3) days. This offer is open for you to accept for three (3) days from the date of this letter, at which time it will be deemed to be withdrawn.

The Company will pay or immediately reimburse you for all legal fees in connection with the preparation and negotiation of this letter and any matters related to the Shares or Options.

We look forward to you joining MedMen!

Sincerely

| COMPANY: |

|

ACCEPTED: |

| |

|

|

| /s/ Michael Serruya |

|

/s/ Ellen (Deutsch) Harrison |

| Michael Serruya |

|

Ellen (Deutsch) Harrison |

| Chairman of the Board |

|

July 1, 2023 |

| MedMen Enterprises, Inc. |

|

|

| |

|

|

| GUARANTORS: |

|

|

| |

|

|

| /s/ Michael Serruya |

|

|

| Michael Serruya |

|

|

| Chairman of the Board |

|

|

| MedMen Enterprises, Inc. |

|

|

Exhibit 10.2

MM Enterprises USA, LLC

July 1, 2023

Dear Amit,

MM Enterprises USA, LLC and MedMen Enterprises, Inc. (collectively “The Company”), is pleased to extend an offer of Full-Time employment to you for the position of Chief Financial Officer. This is a remote location position with travel as needed. This is an exempt position. In your capacity as Chief Financial Officer, you will perform duties and responsibilities that are reasonable and consistent with your position as may be assigned to you from time to time.

Your estimated start date will be July 24, 2023, with your offer of a one-year contract of employment being conditional upon successful completion of certain requirements, as explained in this letter. Your employment is subject to the terms and conditions set forth in this letter, which override anything communicated to you during your interview or as part of any other communication about your employment with the Company.

Compensation

As compensation for your services, you will be paid US$300,000 per annum which you will receive in the amount of US$11,538.46 per pay period, subject to all withholdings and deductions as required by law and paid on a bi-weekly basis. In addition to your compensation, the Company will also provide the following:

Sign on Equity Bonus

You will receive the fiscal year 2024 equity grant at the start of your employment in an amount equal to US$300,000 worth of RSUs based on the average of the trailing 10 day closing price of Class B Subordinate Voting Shares (“Shares”) as of your start date of employment. This grant will vest annually from your start date in equal installments over 3 years. If your employment is terminated without Cause between 182 and 365 days after your start date, then 1/3 of the RSUs granted to you will vest upon the termination. Starting in 2024, you will receive your grant as part of the Company’s Employee Equity Bonus Program.

All Share prices are as quoted on the Canadian Securities Exchange (“CSE”) as converted to U.S. dollars applying the Canadian/U.S. Dollar exchange rate quoted on the foreign exchange (forex) market.

Equity Bonus Program

You will be eligible to participate in the Company’s equity bonus program as set forth in the MedMen Enterprises, Inc. 2021 Employee Equity Bonus Program starting in 2024. In addition, you will be eligible for:

Long Term Equity Incentive

|

● |

Options valued at US$3,000 to acquire Shares (“Options”) for each week you are employed as Chief Financial Officer, to be granted at the beginning of each fiscal quarter, vesting effective as of the end of each such fiscal quarter-end based upon the Company achieving performance metrics that are aligned with the interests of shareholders which metrics are to be mutually agreed upon by you and the Board as soon as practical after your date of hire. |

The number of Shares granted by the Board shall be calculated based upon the dollar value of the award dividend by the trailing 10-day volume weighted average price of the Company’s Shares trading on the Canadian Securities Exchange (or if traded on any National Securities Exchange, such National Securities Exchange) prior to the date of grant (the “Price”).

The number of Options shall be determined based on the Option value determined using the Black Scholes option pricing model using mutually agreed customary assumptions which shall be consistent with those used for financial reporting purposes, including that the strike price per share of the Options shall be the Price and the Options shall expire five (5) years from the date of grant.

In the event a Change in Control of the Company any unvested stock awards outstanding on the date of the change of control will immediately vest. For purposes hereof, the term “Change in Control” shall mean the occurrence of any of the following events (each, a “Business Combination”) followed within 12 months of such Business Combination by your termination without Cause or resignation for Good Reason: (a) the sale of more than 50% of the outstanding equity securities of the Company in a single transaction or in a series of transactions occurring during a period of not more than twelve months; (b) the Company is merged, amalgamated or consolidated with another corporation; or (c) a sale of substantially all of the assets of the Company to another entity, unless, following any of the foregoing Business Combinations in (a) through (c) above, all or substantially all of the individuals and entities that were the beneficial owners of the Company’s outstanding voting securities immediately prior to such Business Combination beneficially own immediately after the transaction or transactions, directly or indirectly, 50% or more of the combined voting power of the then outstanding voting securities (or comparable interests) of the entity resulting from such Business Combination (including an entity that, as a result of such transaction, owns the Company or all or substantially all of the Company’s assets either directly or through one or more affiliates) in substantially the same proportions as their ownership of the Company’s voting securities immediately prior to such Business Combination.

Benefits

You will have unlimited vacation days and are to use your own discretion in this regard. In addition, MedMen provides 6 paid sick days, 11 paid holidays, medical, dental, and vision insurance through Anthem Blue Cross Blue Shield, including an employee/patient discount. Details on these benefits, including eligibility, use, and accrual can be found in the Employee Handbook.

Adherence to Company Policies. You agree to abide by and will be subject to all applicable employment and other policies of the Company as outlined in the Employee Handbook and elsewhere. This includes our Alcohol & Drug Policy.

Separation of Employment Relationship. You and the Company agree that either you or the Company may end the employment relationship, after the 1st year, with or without Cause. If your employment is terminated within the first 9 months of employment without Cause or if you resign for Good Reason, you will be paid for the remainder of that 1 year period, plus the reimbursement for COBRA premiums for the duration of the 1 year period. After 9 months of employment, if you are terminated without Cause or if you resign for Good Reason, you will receive 3 months of paid severance, plus the reimbursement for COBRA premiums for the duration of the 3 month period. Nothing in this letter or in the Company’s policies or procedures is intended to change the at-will nature of our relationship.

For purposes hereof. “Cause” shall mean a (i) repeated failure to competently and diligently perform duties of your position with the Company (other than due to physical or mental illness); (ii) conviction of guilty or nolo contendere plea to, a misdemeanor which is materially and demonstrably injurious to the Company or any of its subsidiaries or any felony; (iii) commission of an act, or a failure to act, that constitutes fraud, gross negligence or willful misconduct (including without limitation, embezzlement, misappropriation or breach of fiduciary duty resulting or intending to result in personal gain at the expense of the Company or any of its subsidiaries); and (iv) violation of any applicable laws, rules or regulations (excluding federal laws, rules or regulations pertaining to the regulation of commercial cannabis in states that have legalized cannabis for medical and/or adult use) or failure to comply with applicable confidentiality, non-solicitation and non-competition obligations to the Company or any of its subsidiaries, corporate code of business conduct or other material policies of the Company or any of its subsidiaries in connection with or during performance of your duties to the Company or any of its subsidiaries that could, in the Board’s opinion, cause material injury to the Company or any of its subsidiaries. In the case of a violation or failure under (i) or (iv), if such violation or failure is curable, such violation or failure shall only constitute “Cause” if it is not cured within thirty (30) days after notice thereof to you.

For purposes hereof, “Good Reason” shall mean any one of the following: (i) the reduction of your base salary or failure of the Company to pay your base salary and benefits when due, (ii) requiring that your position cease to be remote, or (iii) the assignment to you of any duties materially and negatively inconsistent in any respect of your position (including status, offices, titles and reporting requirements), authority, duties or responsibilities, or any other action by the Company which results in a material diminution in such position, authority, duties or responsibilities (including without limitation a requirement to report to any person or entity other than the CEO); provided, that, in each case, you will not be deemed to have Good Reason unless (1) you first provide the Company with written notice of the condition giving rise to Good Reason within 30 days of its initial occurrence, (2) the Company or the successor company fails to cure such condition within 30 days after receiving such written notice (the “Cure Period”), and (3) your resignation based on such Good Reason is effective within 30 days after the expiration of the Cure Period.

By accepting this offer, you confirm that you are able to accept this job and carry out the work involved without breaching any legal restrictions on your activities, such as restrictions imposed by a current or former employer. You also confirm that you will inform the Company about any such restrictions and provide the Company with as much information as possible, including copies of any agreements between you and your current or former employer describing any restrictions on your activities.

You further confirm that you will not remove or copy any documents or proprietary data or materials of any kind, electronic or otherwise, with you from your current or former employer to the Company without written authorization from your current or former employer, nor will you use or disclose any such confidential information during the course and scope of your employment with the Company. If you have any questions about the ownership of particular documents or other information, discuss those questions with your current or former employer before removing or copying any documents or information.

We are excited about the prospect of you joining our team. If you wish to accept this offer, please sign below, and return this letter within three (3) days. This offer is open for you to accept for three (3) days from the date of this letter, at which time it will be deemed to be withdrawn.

We look forward to you joining MedMen!

Sincerely

| /s/ Ed Record |

|

| Ed Record |

|

| CEO |

|

| MedMen Enterprises, Inc. |

|

Accepted, as of July 1, 2023

| /s/ Amit Pandey |

|

| Amit Pandey |

|

Exhibit 99.1

MedMen

Announces Ellen Deutsch as Chief Executive Officer and Amit Pandey as Chief Financial Officer

7/5/2023

Edward

Record Transitioning to Non-Executive Board Director

LOS

ANGELES--(BUSINESS WIRE)-- MedMen Enterprises Inc. (“MedMen” or the “Company”) (CSE: MMEN) (OTCQX: MMNFF), a

premier cannabis company with operations across the United States, today announced the appointments of Ellen Deutsch as Chief Executive

Officer, effective immediately, and Amit Pandey as Chief Financial Officer, effective July 24th. Deutsch succeeds Interim CEO Edward

Record, who will now continue as a non-executive member of MedMen’s Board of Directors. Deutsch has also been appointed to the

Company’s Board of Directors, increasing the size of the Board of Directors to six.

“We

thank Ed for his tenure as Interim CEO and success initiating MedMen’s turnaround and returning the Company to positive Adjusted

EBITDA. We look forward to his continued presence as a member of our Board of Directors,” said Michael Serruya, MedMen’s

Chairman. “Ellen’s leadership and strong operational experience in the public cannabis sector will prove invaluable as we

complete our restructuring plan and transition into a new phase of growth for the Company.”

Deutsch

brings deep operational, marketing, and financial experience and expertise in the cannabis and CPG industries, having most recently served

as Senior Vice President of Market Development and Shared Services at Acreage Holdings (OTC: ACRHF), a vertically integrated, multi-state

operator of cannabis cultivation and retailing facilities in the U.S. Before joining Acreage, Deutsch served as Executive Vice President/Chief

Operating Officer at Stem Holdings, Inc (OTC: STMH), a vertically integrated cannabis branded products and technology company, following

two decades in the C-suite of Hain Celestial (Nasdaq: Hain), predominantly as its Senior Vice President/Chief Growth Officer among other

leadership roles.

“MedMen

is one of the most recognizable brand names in cannabis and has a loyal base of consumers who trust it to deliver excellence in product

and customer experience,” said Deutsch. “It is an exciting challenge to lead its team of dedicated professionals to deliver

value for all stakeholders as we enter a new phase of the Company’s strategic vision and implement plans to strengthen our core.”

Pandey

joins MedMen with a lengthy financial background in private and public markets spanning cannabis, consumer packaged goods (CPG), and

fintech. He previously served as Executive Vice President and Interim Chief Financial Officer of Finance at Clever Leaves International,

Inc (NASDAQ: CLVR), a global medical cannabis company with one of the world’s largest cultivation and extraction capacities, which

he joined in its early stages and led to the public listing on NASDAQ. Prior to Clever Leaves International, Pandey served as the Chief

Financial Officer of PayCommerce, LLC, a private-equity-backed B2B global cross-border platform fintech SAAS firm.

“Amit’s

considerable background and experience in both the public and private capital markets in cannabis and CPG sectors will be critical to

MedMen’s short-term restructuring and long-term growth,” said Serruya. “With the addition of Ellen and Amit, MedMen

has completed the buildout of its go-forward management team.”

ABOUT

MEDMEN:

MedMen

is a premier American cannabis company with operations across the United States, in California, Nevada, Illinois, Arizona, Massachusetts,

and New York. Known for its leading MedMen and LuxLyte brands, MedMen curates the best products for its retail operations and drives

consumer loyalty with reward programs and convenience including home-delivery and curbside pickup. MedMen believes that a world where

cannabis is legal and regulated is safer, healthier and happier.

Lisa

Weser

Trailblaze

MedMen@Trailblaze.co

Source:

MedMen Enterprises Inc.

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

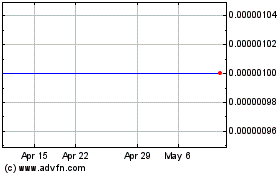

Medmen Enterprises (CE) (USOTC:MMNFF)

Historical Stock Chart

From Apr 2024 to May 2024

Medmen Enterprises (CE) (USOTC:MMNFF)

Historical Stock Chart

From May 2023 to May 2024