AXcess News: Green Silver Maker Expands Refining Capacity Ten-Fold

October 15 2009 - 3:57PM

Marketwired

Itronics Inc. (PINKSHEETS: ITRO) said it obtained the funding

needed to expand its silver refining capacity ten-fold, which gave

the Reno-based green silver maker the ability to increase silver

sales from $360,000 per year to over $3.6 million.

Itronics operates the only EPA approved plant in the nation to

manufacture environmentally friendly fertilizers that are sold

under the Company's GOLD n'GRO brand, recovering the heavy metals

which it then manufactures into numismatic quality five-ounce

silver bars from the silver recovered through its patented

process.

Plant capacity and process limitations have kept Itronics from

recovering more silver from spent photochemical liquids while

identifying more sources of raw material for recycling by the

introduction of new silver-bearing sources, namely, steel wool

recovery cartridges used in the photographic industry which

Itronics estimates can greatly expand its silver-bearing raw

materials.

On Thursday, Itronics announced that its first phase silver

refining expansion would become a reality having obtained the

financing needed. But in the process of building out its phase one

expansion, Itronics is now able to introduce those new sources of

raw materials that in turn will expand its GOLD n'GRO line of

liquid fertilizers through the recovery of materials that will

replace fertilizer ingredients which are presently purchased from

outside suppliers.

Investors showed their support, pushing Itronics shares up more

than 40% in record trading volume when the market learned that

Itronics would increase silver production 10 fold, which could make

Itronics one of the largest green silver manufacturers in the

nation in the process.

While Itronics estimates $3.6 million in silver sales capacity,

weakness in the dollar has fueled a buying frenzy for gold and

silver which could push average silver prices up into the $18 to

$20 per ounce range going into the holiday jewelry buying period

due to gold's record-setting levels. India's jewelry buying period

just began and demand for the precious metal is lower than normal,

though the global economic downturn is most likely why. Metals

pundits see a shift to the 'poor man's gold' with higher silver

jewelry demand as a result. Prices are likely to remain above $17

well into 2010. What that could mean for Itronics is strong,

on-going demand for its green silver to make the Company's phase 2

silver refining expansion a near-term reality.

Note to Editors: "News Features" are stories provided to

publishers copyright-free for print or online display at no charge.

All we ask is that publishers include our byline (AXcess News) as

the source, or if online, link to our Web site:

http://www.axcessnews.com. If you are interested in displaying our

news on a regular basis, please contact our editorial department

at: 775-546-3377 or by email at: editor@axcessnews.com.

Add to Digg Bookmark with del.icio.us Add to Newsvine

Contact: AXcess News 775-546-3377 Email Contact

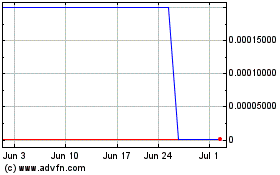

Itronics (CE) (USOTC:ITRO)

Historical Stock Chart

From May 2024 to Jun 2024

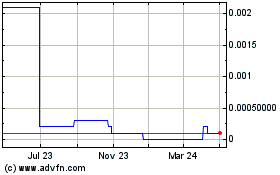

Itronics (CE) (USOTC:ITRO)

Historical Stock Chart

From Jun 2023 to Jun 2024