Amended Tender Offer Statement by Issuer (sc To-i/a)

August 02 2019 - 8:44AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO/A

(Amendment No. 4)

(Rule

14d-100)

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

CYTODYN INC.

(Name of Subject Company (Issuer))

CYTODYN INC.

(Name of

Filing Persons (Issuer))

WARRANTS TO PURCHASE COMMON STOCK

(Title of Class of Securities)

23283M101

(CUSIP Number

of Common Stock Underlying Warrants)

Nader Z. Pourhassan, Ph.D.

President and Chief Executive Officer

CytoDyn Inc.

1111 Main

Street, Suite 660

Vancouver, Washington 98660

Phone:

(360) 980-8524

(Name, address, and telephone numbers of person authorized to receive notices and communications on behalf of filing persons)

With copies to:

Michael J. Lerner, Esq.

Steven M. Skolnick, Esq.

James O’Grady, Esq.

Lowenstein Sandler LLP

1251 Avenue of the Americas

New York, New York 10020

Phone:

(212) 262-6700

CALCULATION OF FILING FEE

|

|

|

|

|

Transaction Valuation(1)

|

|

Amount of Filing Fee (1)(2)

|

|

$64,890,736.28

|

|

$7,864.75

|

|

|

|

(1)

|

Estimated for purposes of calculating the amount of the filing fee only. An offer to amend and exercise

warrants to purchase an aggregate of 141,066,818 shares of common stock (the “Exercise Offer”). The transaction value is calculated pursuant to

Rule 0-11 using

$0.46 per share of common

stock, which represents the average of the high and low sales price of the common stock on June 17, 2019.

|

|

(2)

|

Calculated by multiplying the transaction value by 0.0001212.

|

|

☒

|

Check the box if any part of the fee is offset as provided by Rule

0-11(a)(2)

and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

Amount Previously Paid: $7,864.75

|

|

Filing Party: CytoDyn Inc.

|

|

Form or Registration No.: Schedule TO

|

|

Date Filed: June 24, 2019

|

|

☐

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a

tender offer.

|

Check the appropriate boxes below to designate any transactions to which the statement relates:

|

|

☐

|

third-party tender offer subject to Rule

14d-1.

|

|

|

☒

|

issuer tender offer subject to Rule

13e-4.

|

|

|

☐

|

going-private transaction subject to Rule

13e-3.

|

|

|

☐

|

amendment to Schedule 13D under Rule

13d-2.

|

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☒

EXPLANATORY NOTE

This Amendment No. 4 (this “Amendment”) amends and supplements the Tender Offer Statement on Schedule TO previously filed by CytoDyn Inc. (the

“Company”) on June 24, 2019, as amended on July 19, 2019, July 25, 2019 and July 26, 2019 (collectively, the “Tender Offer Statement”). This Amendment is the final amendment to the Tender Offer Statement, in

accordance with Rule

13e-4(c)(4)

under the Securities Exchange Act of 1934, as amended.

The Tender Offer

Statement related to the Company’s tender offer (the “Warrant Tender Offer”) for certain outstanding series of eligible warrants, offering the holders of such warrants the opportunity to amend and exercise their warrants at a reduced

price equal to the lower of (i) their respective existing exercise price (the “Original Exercise Price”) or (ii) $0.40 per share of common stock. As an inducement to holders to participate in the Warrant Tender Offer, the Company

offered to issue to participating holders shares of common stock equal to an additional 50% of the number of shares issuable upon exercise of the eligible warrants (collectively, the “Additional Shares”). The Warrant Tender Offer was made

upon the terms and subject to the conditions set forth in the Offer to Amend and Exercise Warrants to Purchase Common Stock of CytoDyn Inc., as amended, previously mailed to the holders of eligible warrants on June 24, 2019, and which was

included in the Company’s Schedule

TO-I

initially filed with the Securities and Exchange Commission (the “SEC”) on June 24, 2019.

At 5:00 P.M. (Eastern time) on July 31, 2019, the offering period and withdrawal rights for the Warrant Tender Offer expired. Upon completion of the

Warrant Tender Offer, 175 Original Warrants to purchase up to 7,307,490 shares of common stock had been validly tendered and not withdrawn in the Warrant Tender Offer, for gross cash proceeds to the Company of approximately $2.8 million.

Accordingly, the Company is instructing its transfer agent to issue an aggregate of 10,961,213 shares of Common Stock, which includes 3,653,723 Additional Shares, to participants in the Warrant Tender Offer.

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

|

|

|

|

|

|

|

Date: August 2, 2019

|

|

|

|

CytoDyn Inc.

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Michael D. Mulholland

|

|

|

|

|

|

Name:

|

|

Michael D. Mulholland

|

|

|

|

|

|

Title:

|

|

Chief Financial Officer

|

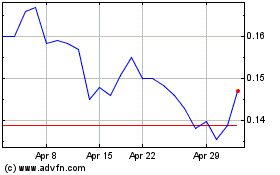

CytoDyn (QB) (USOTC:CYDY)

Historical Stock Chart

From Mar 2024 to Apr 2024

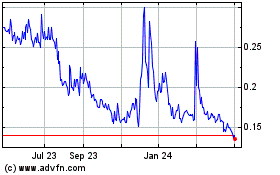

CytoDyn (QB) (USOTC:CYDY)

Historical Stock Chart

From Apr 2023 to Apr 2024