Weather Buffets Bayer Crops Unit -- WSJ

July 31 2019 - 3:02AM

Dow Jones News

By Sara Germano and Ruth Bender

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 31, 2019).

BERLIN -- Bayer AG warned that severe weather affecting its

crop-science division could put its 2019 sales target out of reach,

adding to concerns about the fallout from last year's acquisition

of Monsanto.

The German chemical and pharmaceutical giant is grappling with

the effects of what analysts say has been one of the worst

crop-planting seasons in the U.S. on record.

On Tuesday, it reported a 49% drop in profit for the quarter

ended in June, as extreme weather across the U.S., Canada and

Europe hurt the crop-science division, Bayer's largest unit by

sales. Chief Financial Officer Wolfgang Nickl said that impact

makes the company's full-year goals seem "increasingly

ambitious."

Bayer has targeted a 4% rise in group sales to EUR46 billion

($51.3 billion) for 2019.

The company said the number of plaintiffs suing over the

herbicide Roundup acquired in the Monsanto deal rose by another

5,000 over the past three months, highlighting the difficulty in

putting to rest a damaging legal battle over the world's most

widely used weedkiller.

Overall sales grew 21% from last year's second quarter to

EUR11.5 billion ($12.8 billion), boosted by its acquisition of

Monsanto. Profit fell by nearly half to EUR404 million, crimped by

restructuring costs and write-downs, as well as the challenges in

the crop division.

A wet planting season in the U.S. Midwest delayed farmers from

getting their corn crop into the ground, while dry weather across

Europe and Canada hit demand for herbicides and fungicides. Despite

that challenge, Bayer said it is optimistic that its agricultural

business can rebound as planting begins in the Southern

Hemisphere.

Shares of Bayer fell nearly 4% to EUR57.16 on Tuesday.

The Leverkusen, Germany-based inventor of Aspirin has lost

almost 40% of its market value since acquiring Monsanto, due to

fears that the lawsuits will cost the company several billions of

dollars and jeopardize plans to boost profits by expanding in the

agriculture sector.

Bayer has been entangled in a protracted legal battle that pits

it against thousands of cancer patients claiming Monsanto-invented

Roundup weedkillers cause cancer. The number of plaintiffs rose to

18,400 as of July 11, from 13,400 in April, Bayer said.

"While this is an increase since our last reporting, it is by no

means a reflection of the merits of the litigation," Bayer Chief

Executive Werner Baumann told analysts, adding that the company

will "only consider a settlement if financially reasonable."

Bayer lost the three first jury verdicts in the U.S. with the

biggest award topping $2 billion, though last week a California

judge reduced that penalty to $86.7 million. Bayer, which argues

that Roundup and its active ingredient glyphosate are safe, is

appealing the verdicts.

In recent weeks, Bayer has stepped up efforts to reassure

investors that it is doing what it can to get the legal woes under

control after shareholders staged a dramatic revolt at the group's

last annual meeting. In June, Bayer bowed to shareholder pressure

by announcing it would review its approach to defending itself

against the claims and hiring a high-profile lawyer to advise on

legal strategy.

Write to Sara Germano at sara.germano@wsj.com and Ruth Bender at

Ruth.Bender@wsj.com

(END) Dow Jones Newswires

July 31, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

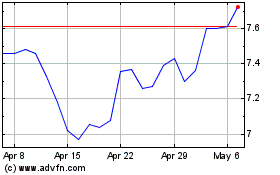

Bayer Aktiengesellschaft (PK) (USOTC:BAYRY)

Historical Stock Chart

From Mar 2024 to Apr 2024

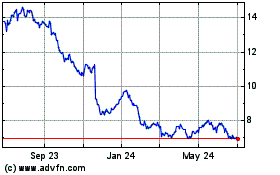

Bayer Aktiengesellschaft (PK) (USOTC:BAYRY)

Historical Stock Chart

From Apr 2023 to Apr 2024