As filed with the Securities and Exchange

Commission on September 10, 2014

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14F-1

INFORMATION

STATEMENT PURSUANT TO SECTION 14(f)

OF

THE SECURITIES EXCHANGE ACT OF 1934 AND

RULE

14F-1 THEREUNDER

BRAZIL

INTERACTIVE MEDIA, INC.

(Exact name of Registrant as specified in its

charter)

| Delaware |

|

|

|

94-2901715 |

| (State or other jurisdiction of incorporation or organization) |

|

|

|

(IRS Employer Identification No.) |

3457 Ringsby Court, Unit 111

Denver, Colorado 80216-4900

(Address of Principal Executive Offices, including

Zip Code)

(720) 466-3789

(Registrant’s telephone number, including

area code)

Approximate Date of Mailing: September 10, 2014

BRAZIL INTERACTIVE MEDIA, INC.

3457 Ringsby Court, Unit 111, Denver, Colorado

80216-4900

Tel: (720) 466-3789

INFORMATION

STATEMENT PURSUANT TO SECTION 14(f)

OF THE

SECURITIES EXCHANGE ACT OF 1934 AND

RULE

14F-1 THEREUNDER

SCHEDULE 14F-1

REPORT OF CHANGE IN MAJORITY

OF DIRECTORS

September 10, 2014

This Information

Statement is being mailed to holders of record of shares of common stock, par value $0.00001 per share, of Brazil Interactive Media,

Inc., a Delaware corporation, in accordance with the requirements of Section 14(f) of the Securities Exchange Act of 1934, as amended,

and Rule 14f-1 promulgated thereunder.

THIS INFORMATION STATEMENT

IS BEING PROVIDED SOLELY FOR INFORMATIONAL PURPOSES AND NOT IN CONNECTION WITH ANY VOTE OF THE STOCKHOLDERS OF BRAZIL INTERACTIVE

MEDIA, INC. NO PROXIES ARE BEING SOLICITED, AND YOU ARE NOT REQUESTED TO SEND A PROXY.

If you have questions

about, or would like additional copies of, this Information Statement, you should contact Mr. Corey Hollister, Chief Executive

Officer, Brazil Interactive Media, Inc. by mail at 3457 Ringsby Court, Unit 111, Denver, Colorado 80216-4900, or by telephone

at (720) 466-3789.

By Order of the Board of Directors,

/s/ Corey Hollister

Corey Hollister, Chief Executive

Officer

Denver, Colorado

September 10, 2014

INTRODUCTION

Summary of the Change in the Majority

of Directors

This Information Statement is being

mailed to holders of record as of April 30, 2014 (the “record date”) of shares of common stock of Brazil Interactive

Media, Inc., a Delaware corporation (the “Company”), in accordance with the requirements of Section 14f-1 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), and Rule 14f-1 promulgated thereunder. This Information Statement

relates to a change in the composition of our Board of Directors (our “Board”) that is expected to occur in connection

with, and pursuant to the terms of, an Agreement and Plan of Merger, dated as of May 15, 2014 (the “Merger Agreement”),

between the Company, Cannamerica, Inc., a Delaware corporation and a wholly owned subsidiary of the Company (“Merger Sub”),

and Hollister & Blacksmith, Inc. d/b/a American Cannabis Consulting, Inc., a Colorado corporation (“ACC”).

On May 15, 2014, the

Company entered into the Merger Agreement, pursuant to which Merger Sub will be merged with and into ACC through a reverse triangular

merger transaction upon the terms and subject to the conditions of the Merger Agreement, and in accordance with the Delaware

General Corporation Law (“DGCL”). Pursuant to the transactions contemplated by the Merger Agreement (i) each

share of common stock of ACC will be exchanged for shares of the Company based on a ratio of 3,171.0628 to one, (ii) ACC shall

continue as the surviving corporation after the transactions contemplated by the Merger Agreement, (iii) each share of common stock

of Merger Sub will be converted into and exchanged for one share of common stock of ACC and (iv) the Company shall change its name

to “American Cannabis Company, Inc.” Upon the consummation

of the of the transactions contemplated by the Merger Agreement, ACC’s current shareholders will receive 31,710,628 shares

of our common stock, representing approximately 70% of our common stock with a corresponding dilution to our current stockholders.

In addition, pursuant

to the terms of the Merger Agreement and upon the effectiveness of the transactions contemplated by the Merger Agreement, Themistocles

Psomiadis and Michael Novielli will resign from our Board, and Mr. Corey Hollister will appoint new members to our Board to fill

the vacancies created by the resignations of Messrs. Psomiadis and Novielli.

The foregoing description of the Merger

Agreement does not purport to be complete and is qualified in its entirety by the terms of the Merger Agreement, which is filed

as an exhibit to the Form 8-K filed by the Company with the Securities and Exchange Commission (“SEC”) on May 15, 2014,

and as an exhibit to the Schedule 14C Information Statement filed by the Company with the SEC on September 9, 2014.

On

May 16, 2014, the Company entered into a Separation and Exchange Agreement (the “Separation Agreement”), between the

Company, BIMI, Inc. (“BIMI”), a Delaware corporation and wholly-owned subsidiary of the Company, and Brazil Investment

Holding, LLC (“Holdings”), a Delaware limited liability company and the majority stockholder of the Company, pursuant

to which the Company agreed to distribute all shares of common stock of BIMI held by the Company in exchange for all of our common

stock held by Holdings. Pursuant to the Separation Agreement, the Company and BIMI each shall retain all assets and liabilities

in its respective name, and shall take any and all actions necessary so that (i) the Company will own or be liable for all existing

Company assets and liabilities and (ii) BIMI will own or be liable for all existing BIMI assets and liabilities, including

all assets and liabilities of BIMI’s subsidiaries. Further, all intercompany agreements by and between the Company, or any

of its subsidiaries, and BIMI, or any of its subsidiaries, are terminated except for confidentiality, non-disclosure or release

of liability agreements.

The foregoing description

of the Separation Agreement does not purport to be complete and is qualified in its entirety by the terms of the Separation Agreement,

which is filed as an exhibit to the Form 8-K filed by the Company with the SEC on May 20, 2014, and

as an exhibit to the Schedule 14C Information Statement filed by the Company with the SEC on September 9, 2014.

Effective Date

The consummation of all of the transactions

contemplated by the Merger Agreement is expected to occur no less than ten (10) and within forty-five (45) business days after

mailing of this Information Statement to the Company's stockholders of record as of the record date.

Voting and Vote Required

No action is required by our stockholders

in connection with this Information Statement. However, Section 14(f) of the Exchange Act and Rule 14f-1 promulgated thereunder

require the mailing to our stockholders of record the information set forth in this Information Statement at least 10 days prior

to the date a change in a majority of our directors occurs, otherwise then at a meeting of our stockholders. The transactions contemplated

by the Merger Agreement and the resulting change in a majority of our directors will not occur until at least 10 days following

the mailing of this Information Statement. This Information Statement is being mailed on or about September 10, 2014 to all holders

of record on April 30, 2014.

Notice Pursuant to the Delaware General

Corporation Law

Pursuant to Section 228(e) of the DGCL,

the Company is required to provide prompt notice of the taking of a corporate action by written consent to the Company’s

stockholders who have not consented in writing to such action. This Information Statement serves as the notice required by Section

228(e) of the DGCL.

VOTING SECURITIES

Voting Securities of the Company

Our authorized capital

stock consists of 100,000,000 shares of common stock, $0.00001 par value per share, and 5,000,000 shares of blank check preferred

stock, par value $0.01 per share. As of the record date, there were 45,279,114 shares of our common stock issued and outstanding.

We anticipate that there will be 40,300,000

shares of our common stock issued and outstanding as of the date that all transactions contemplated by the Merger Agreement and

Separation Agreement have been consummated (such date being hereinafter referred to as, the “Post-Transaction Date”).

Security Ownership of Certain Beneficial Owners of More

than Five Percent of our Common Stock

The following table sets forth information

regarding each stockholder who will beneficially own more than five percent of our common stock as of the Post-Transaction Date.

Except as otherwise indicated, we believe, based on information furnished by such persons, that each person listed below has sole

voting and investment power over the voting securities shown as beneficially owned, subject to community property laws, where applicable.

Beneficial ownership is determined under the rules of the SEC and includes any shares which the person has the right to acquire

within 60 days after the Post-Transaction Date through the exercise of any stock option, warrant or other right.

| Name of Beneficial Owner | |

Amount and Nature of Beneficial Ownership | |

Percentage of Class (1) |

Corey Hollister

5316 Rustic Ave.

Firestone, CO 80504 | |

12,684,251 (2) | |

| 31.47 | % |

Ellis Smith

5163 Raleigh St.

Denver, CO 80212 | |

12,684,251 (3) | |

| 31.47 | % |

Anthony Baroud

2225 East Oakton Street

Arlington Heights, IL 60005 | |

4,756,594 (4) | |

| 11.80 | % |

Dutchess Opportunity Fund II LP

50 Commonwealth Ave., Suite 2

Boston, MA 02116 | |

4,668,837 (5) | |

| 11.33% (6) | |

____________________________

| (1) | The percentages are based on 40,300,000 shares of our common stock outstanding as of the Post-Transaction

Date, plus shares of common stock that may be acquired by the beneficial owner within 60 days after the Post-Transaction Date,

by exercise of stock conversions and/or warrants. |

| (2) | Shares beneficially owned by Mr. Corey Hollister consist of issued common stock (12,684,251 shares)

held in his name. |

| (3) | Shares beneficially owned by Mr. Ellis Smith consist of issued common stock (12,684,251 shares)

held in his name. |

| (4) | Shares beneficially owned by Mr. Anthony Baroud consist of issued common stock (4,756,594 shares)

held in his name. |

| (5) | Shares beneficially owned are aggregated without regard to the 4.99% Blocker (defined below), and

consist of (i) issued common stock (3,775,087 shares) and (ii) shares of common stock issuable upon the conversion of that certain

Debenture, dated April 24, 2014 (the “Dutchess Debenture”), issued by the Company (893,750 shares), all held in the

name of Dutchess Opportunity Fund II LP, of which Michael Novielli is a managing director and has shared voting and dispositive

power over the securities. Certain debentures issued by the Company, including the Dutchess Debenture, contain a provision which

prevents the Company from effecting the conversion or exercise of the debenture, to the extent that, as a result of such conversion

or exercise, the holder beneficially owns more than 4.99%, in the aggregate, of the issued and outstanding shares of the Company's

common stock calculated immediately after giving effect to the issuance of shares of common stock upon the conversion or exercise

(the “4.99% Blocker”). |

| (6) | Dutchess Opportunity Fund II LP would beneficially own 11.33% of our issued and outstanding common

stock upon exercise of the Dutchess Debenture, which contains the 4.99% Blocker. We anticipate that Dutchess Opportunity Fund II

LP will beneficially own 9.37% of our issued and outstanding common stock as of the Post-Transaction Date. |

Security

Ownership of Management

The following table sets forth

the number of shares of our common stock beneficially owned as of the Post-Transaction Date by our directors, executive officers

and our directors and executive officers as a group. Beneficial ownership is determined under the rules of the SEC and includes

any shares which the person has the right to acquire within 60 days after the Post-Transaction Date through the exercise of any

stock option, warrant or other right.

| Name of Beneficial Owner | |

Amount and Nature of Beneficial Ownership | |

Percentage of Class (1) |

| Corey Hollister | |

| 12,684,251 (2) | | |

| 31.47 | % |

| Themistocles Psomiadis | |

| 1,514,900 (3) | | |

| 3.76 | % |

| Michael Novielli | |

| 5,014,863 (4) | | |

| 12.17% (5) | |

| Officers and Directors as a group | |

| 19,214,014 | | |

| 46.64% (6) | |

_____________________________

| (1) | The percentages are based on 40,300,000 shares of our common stock outstanding as of the Post-Transaction

Date, plus shares of common stock that may be acquired by the beneficial owner within 60 days after the Post-Transaction Date,

by exercise of stock conversions and/or warrants. |

| (2) | Mr. Corey Hollister is our Chief Executive Officer, and is a director. Shares beneficially owned

by Mr. Hollister consist of issued common stock (12,684,251 shares) held in his name. |

| (3) | Mr. Themistocles Psomiadis is a director. Shares beneficially owned by Mr. Psomiadis consist of

issued common stock (1,514,900 shares) held in his name. |

| | (4) | Mr. Michael Novielli is a director. Shares beneficially owned by Mr. Novielli are aggregated without regard to the 4.99% Blocker,

and consist of (i) issued common stock (3,824,835 shares) of which Michael Novielli has shared dispositive power over due to his

ownership in Dutchess Opportunity Fund II LP, Dutchess Advisors LLC, Dutchess Private Equities Fund II LP and Dutchess Private

Equities Fund, Ltd.; (ii) previously-issued common stock (296,278 shares) held by Dutchess Global Strategies Fund LLC of which

Michael Novielli has sole voting and dispositive power over; and (iii) shares of common stock issuable upon the conversion of the

Dutchess Debenture (893,750 shares), which is subject to the 4.99% Blocker, held in the name of Dutchess Opportunity Fund II LP,

of which Michael Novielli has shared voting and dispositive power over. |

| (5) | Mr. Novielli would beneficially own 12.17% of our issued and outstanding common stock upon exercise

of the Dutchess Debenture, which contains the 4.99% Blocker. We anticipate that Mr. Novielli will beneficially own 10.23% of our

issued and outstanding common stock as of the Post-Transaction Date. |

| (6) | All of our officers and directors as a group would beneficially own 46.64% of our issued and outstanding

common stock upon exercise of the Dutchess Debenture, which contains the 4.99% Blocker. We anticipate that all of our officers

and directors as a group will beneficially own 45.46% of our issued and outstanding common stock as of the Post-Transaction Date. |

Change of Control

Pursuant to the terms of the

Merger Agreement, and upon the effectiveness of the transactions contemplated thereby, ACC will become our wholly-owned subsidiary.

In exchange for 100% of the common stock of ACC, ACC’s former shareholders will collectively own approximately 70% of our

common stock on a fully-diluted basis. Among ACC’s former shareholders, Corey Hollister and Ellis Smith will each beneficially

own approximately 31.47% of our common stock, and Anthony Baroud will beneficially own approximately 11.80% of our common stock.

Pursuant to the terms

of the Merger Agreement, and upon the effectiveness of the transactions contemplated thereby, including the effectiveness of this

Schedule 14f-1, Themistocles Psomiadis and Michael Novielli will resign from our Board, and Mr. Corey Hollister will appoint new

members to our Board to fill the vacancies created by the resignations of Messrs. Psomiadis and Novielli. In addition, because

of the change in composition of our Board and the issuance of securities pursuant by the Merger Agreement, there will be a change

of control of the Company upon the effectiveness of the transactions contemplated by the Merger Agreement.

Consummation of the transactions contemplated

by the Merger Agreement is also conditioned upon, among other things, preparation, filing and distribution to our stockholders

of this Information Statement. There can be no assurance that the transactions contemplated by the Merger Agreement will be completed.

DIRECTORS AND EXECUTIVE OFFICERS

Legal Proceedings

The Company is not aware of any material

proceedings in which any director, executive officer or affiliate of the Company, any owner of record or beneficially of more than

5% of our common stock, or any associate of any such director, officer, affiliate or security holder is a party adverse to the

Company or any of its subsidiaries or has a material interest adverse to the Company or any of its subsidiaries.

Current Executive Officers and Directors

The following table sets forth

certain information regarding our current directors and executive officers:

| Name |

|

Age |

|

Position |

| Corey Hollister |

|

39 |

|

Chief Executive Officer, Director |

| Jesus Quintero |

|

52 |

|

Chief Financial Officer |

| Michael Novielli |

|

49 |

|

Director |

| Themistocles Psomiadis |

|

68 |

|

Director |

The business experience of each

such person is set forth below.

Corey Hollister. Since May

2014 to the present, Corey Hollister has served as our Chief Executive Officer and as a director. In March 2013, Mr. Hollister

co-founded ACC, the Surviving Corporation, and from March 2013 to May 2014, Mr. Hollister served as a Managing Director of ACC.

From September 2009 to July 2013, Mr. Hollister co-owned and was director of Colorado Kind Care LLC d/b/a The Village Green Society,

a Colorado-based Medical Marijuana Center. From September 2009 to June 2010, Mr. Hollister served as the Director of Operations

of Colorado Kind Care LLC, where he oversaw all aspects of operations, including legal, accounting, regulatory compliance, seed-to-sale

tracking, security, staff management and production. From October 2007 to September 2009, Mr. Hollister owned and operated Built-to-Last

Fitness, a private health and wellness company focused on exercise and nutritional guidance for individuals, companies and schools.

Prior to this Mr. Hollister was based in Boston, MA and worked in Marketing and Advertising. Our Board believes Mr. Hollister’s

qualifications to serve as an executive of the Company and as a member of our Board include his past success in founding and operating

businesses, his leadership and corporate management experience, and his unique experience in Colorado and across the country advising

clients in emerging medical cannabis markets.

Jesus Quintero, CPA - From

January, 2013 to the present, Jesus Quintero has served as our Chief Financial Officer. From 2011 to the present, Mr. Quintero

has served as a financial consultant to several multi-million dollar businesses in South Florida. He has extensive experience in

public company reporting and SEC/SOX compliance, and held senior finance positions with Avnet, Inc. (NYSE:AVT), Latin Node, Inc.,

Globetel Communications Corp. (AMEX:GTE) and Telefonica of Spain. His prior experience also includes tenure with PriceWaterhouse

and Deloitte & Touche. Mr. Quintero earned a B.S. in Accounting from St. John’s University and is a certified public

accountant. He is fluent in English and Spanish, and conversant in Brazilian Portuguese.

Michael Novielli. Since 1996

to the present, Mr. Novielli has served as a Managing Partner of Dutchess Capital, where he co-managed an investment portfolio

of $125 million in assets and has made over $250 million in principal investments in emerging growth companies, within the U.S.

domestic as well as global markets. Mr. Novielli co-manages risk assessment, oversees investment opportunities and deal origination

in Asia and Latin America, as well as the firm’s legal and compliance matters. He is also a member of Dutchess’s investment

committee and has 22 years of experience in securities, investment banking and asset management. Prior to founding Dutchess, Mr.

Novielli began his investment career with PaineWebber and Co., where he served from 1992 to 1995. He received a Bachelor of Science

degree in Business from the University of South Florida.

Themistocles Psomiadis. From

December 2012 to the present, Mr. Psomiadis has served as the Company’s Chief Executive Officer. From June 2011 to September

2012, Mr. Psomiadis was a consultant to the Company’s Brazilian subsidiary EsoTV with Brazilian Investment Group, LLC. From

1970 to 2010, Mr. Psomiadis worked in the financial sector, serving as CFO of County Trust Company from 1970 to 1980 and from 2005

to 2010 with New York Life, where he was a partner. Also during that time, he started and developed several financial businesses.

From 2009 to the present, he has served as executive director of Brazilian Investment Group, LLC. Mr. Psomiadis attended New York

University, and is fluent in English, Brazilian Portuguese, Spanish and Greek.

All members of our Board are elected

to serve until their respective successors for each class of directors have been elected and qualified or until their earlier death,

resignation or removal in the manner specified in the Company's by-laws. The Board is divided into three classes, with the term

of office of the first class to expire at the first annual meeting of stockholders following such classification (“Class

1 Directors”) and the term of office of the second class to expire at the second annual meeting following such classification

(“Class 2 Directors”) and the term of office of the third class to expire at the third annual meeting following such

classification (“Class 3 Directors”). The three classes of directors shall be as nearly equal in number as possible.

At each annual meeting of stockholders following such initial classification, directors elected to succeed those directors whose

terms expire shall be elected for a term of office to expire at the third succeeding annual meeting of stockholders after their

election. Mr. Novielli is a Class I Director, Mr. Psomiadis is a Class 2 Director, and Mr. Hollister is a Class III director.

Executive Officers and Directors Following the Transactions

Contemplated by the Merger Agreement

Following the transactions contemplated by the Merger

Agreement, the following individuals will be our executive officers and members of our Board:

| Name |

|

Age |

|

Position |

| Corey Hollister |

|

39 |

|

Chief Executive Officer, Director |

| Ellis Smith |

|

37 |

|

Chief Development Officer, Director |

| Anthony Baroud |

|

51 |

|

Chief Technology Officer, Director |

| Jesus Quintero |

|

52 |

|

Chief Financial Officer |

The business experience of each

such person is set forth below.

Corey Hollister. Since May

2014 to the present, Corey Hollister has served as our Chief Executive Officer and as a director. In March 2013, Mr. Hollister

co-founded ACC, the Surviving Corporation, and from March 2013 to May 2014, Mr. Hollister served as a Managing Director of ACC.

From September 2009 to July 2013, Mr. Hollister co-owned and was director of Colorado Kind Care LLC d/b/a The Village Green Society,

a Colorado-based Medical Marijuana Center. From September 2009 to June 2010, Mr. Hollister served as the Director of Operations

of Colorado Kind Care LLC, where he oversaw all aspects of operations, including legal, accounting, regulatory compliance, seed-to-sale

tracking, security, staff management and production. From October 2007 to September 2009, Mr. Hollister owned and operated Built-to-Last

Fitness, a private health and wellness company focused on exercise and nutritional guidance for individuals, companies and schools.

Prior to this Mr. Hollister was based in Boston, MA and worked in Marketing and Advertising. Our Board believes Mr. Hollister’s

qualifications to serve as an executive of the Company and as a member of our Board include his past success in founding and operating

businesses, his leadership and corporate management experience, and his unique experience in Colorado and across the country advising

clients in emerging medical cannabis markets.

Ellis Smith. Upon the effectiveness

of the transactions contemplated by the Merger Agreement, Ellis Smith will serve as our Chief Development Officer and as a director.

In March 2013, Mr. Smith co-founded ACC, the Surviving Corporation, and from March 2013 to May 2014, Mr. Smith served as a Managing

Director of ACC. From September 2010 to July 2013, Mr. Smith co-owned Colorado Kind Care LLC d/b/a The Village Green Society, a

Colorado-based Medical Marijuana Center, where he was responsible for managing the operations and protocols supporting the growth

and production of medical marijuana. From 2008 to 2010, Mr. Smith founded and operated The Happy Camper Organics Inc., a medical

marijuana company focused on the growth of wholesale cannabis for sale to medical marijuana businesses. From 2005 to 2010, Mr.

Smith founded and operated Bluebird Productions, a video production company. Mr. Smith has been published and recognized for his

horticultural experience and organic gardening in the cannabis industry, and he is known for assisting in identifying the Hemp

Russet Mite and working with SKUNK magazine to educate the industry. Our Board believes Mr. Smith’s qualifications to serve

as an executive of the Company and as a member of our Board include his past success in founding and operating businesses, his

unique experience in horticultural and organic gardening, and his recognized qualifications in the emerging medical cannabis markets.

Anthony Baroud. Upon the

effectiveness of the transactions contemplated by the Merger Agreement, Anthony Baroud will serve as our Chief Technology Officer

and as a director. In August 2005, Mr. Baroud founded Baroud Development Group, LLC, an umbrella organization of construction and

real estate development companies serving the Illinois market, where he directed the operations of all its companies. Mr. Baroud

has also founded and served as an equity partner of several businesses focused on the provision of renewable energy solutions,

and is a member of the Chicago Sustainable Business Alliance. Our Board believes Mr. Baroud’s qualifications to serve as

a member of our Board include his past success as an entrepreneur, and in the areas of product development, applied technology

and operations.

Jesus Quintero, CPA - From

January, 2013 to the present, Jesus Quintero has served as our Chief Financial Officer. From 2011 to the present, Mr. Quintero

has served as a financial consultant to several multi-million dollar businesses in South Florida. He has extensive experience in

public company reporting and SEC/SOX compliance, and held senior finance positions with Avnet, Inc. (NYSE:AVT), Latin Node, Inc.,

Globetel Communications Corp. (AMEX:GTE) and Telefonica of Spain. His prior experience also includes tenure with PriceWaterhouse

and Deloitte & Touche. Mr. Quintero earned a B.S. in Accounting from St. John’s University and is a certified public

accountant. He is fluent in English and Spanish, and conversant in Brazilian Portuguese. Our Board believes Mr. Quintero’s

qualifications to continue to serve as an executive of the Company include his extensive experience as a financial consultant and

with public company reporting.

If any proposed director listed

in the tables above should become unavailable for any reason, a substitute nominee or nominees will be designated by ACC prior

to the date the new directors take office.

Legal Proceedings Affecting Directors or Executive

Officers

None of our executive officers

or directors have (i) been involved in any bankruptcy proceedings within the last ten years, (ii) been convicted in or has pending

any criminal proceedings, (iii) been subject to any order, judgment or decree enjoining, barring, suspending or otherwise limiting

involvement in any type of business, securities or banking activity or (iv) been found to have violated any federal, state or provincial

securities or commodities law and such finding has not been reversed, suspended or vacated.

Transactions with Related Persons

The Company received

$101,000 in loans from our directors and officers in 2013. The proceeds from these loans were used to make a $100,000 payment towards

another loan, which had a maturity date of October 1, 2013 and paid interest at a rate of 5% per annum. All such loans have either

been paid off, or were exchanged for shares in the Company pursuant to the transactions contemplated by the Merger Agreement.

| Loans from Directors and Officers |

Amount |

| 2013 |

$101,000 |

| Total |

$101,000 |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act

requires our directors, executive officers, and persons beneficially owning more than 10% of a registered class of our equity securities

to file with the SEC and to provide us with initial reports of ownership, reports of changes in ownership, and annual reports of

ownership of our common stock and other equity securities. Based solely upon a review of such reports furnished to us by our directors,

executive officers and 10% beneficial owners, we believe that all Section 16(a) reporting requirements were timely fulfilled during

the year ended December 31, 2013.

Board Structure

Our Chief Executive Officer is

also a member of our Board. We believe that this Board leadership structure is the most appropriate for the Company

given our Chief Executive Officer’s qualifications and the early

stage of our management and business development.

Committees of the Board

We presently do not have an audit

committee, nominating committee, compensation committee, or other committee or committees performing similar functions, as our

management believes that, at the early state of our existence, it would be premature to form an audit, compensation or other committee,

as we may not face similar issues confronted by companies who have established such committees. The functions traditionally performed

by any such committees are being undertaken by our Board as a whole.

None of the members of our Board

are an “audit committee financial expert” within the meaning of Item 401(e) of Regulation S-K, except for Messrs. Novielli

and Psomiadis. We are not currently otherwise subject to any law, rule or regulation requiring that all or any portion of our Board

include “independent” directors, nor are we required to establish or maintain an audit committee or other committee

of our Board.

Board Meetings; Annual Meeting Attendance

During the fiscal year

ended December 31, 2013, the Board did not meet, and the Company did not hold an annual meeting. The members of the Board maintain

regular informal contact throughout the year and act, when necessary, upon unanimous written consent.

Director Independence

Our common stock is currently

quoted on the OTCQB quotation system, which currently does not have director independence requirements. On an annual basis, each

director and executive officer will be obligated to disclose any transactions with the Company in which a director or executive

officer, or any member of his or her immediate family, have a direct or indirect material interest in accordance with Item 407(a)

of Regulation S-K. Following completion of these disclosures, the Board will make an annual determination as to the independence

of each director using the current standards for “independence” that satisfy the criteria for the NASDAQ Marketplace

Rules. The Board has determined that there are no members that are independent under such standards.

Family Relationships

There are no family relationships

among the directors and executive officers.

EXECUTIVE COMPENSATION

Summary of Cash and Certain Other Compensation

The following table shows, for the most

recent three fiscal years, the cash compensation paid by the Company, as well as all other compensation paid or accrued for those

years to the Chief Executive Officer and the Company's other executive officers as of December 31, 2013.

| Annual Compensation | |

| | | |

| Annual Compensation | | |

| Annual Compensation | |

| Name and Principal Position | |

| Fiscal Year | | |

| Salary | | |

| Bonus | | |

| Other | | |

| Stock Awards | | |

| Warrants | |

Themistocles Psomiadis

Chief Executive Officer | |

| 2013 | | |

| — | | |

| — | | |

| — | | |

| 336,000 | (1) | |

| — | |

| | |

| 2012 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| 2011 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

Jesus Quintero

Chief Financial Officer | |

| 2013 | | |

| — | | |

| — | | |

| 25,000 | (2) | |

| 25,000 | (3) | |

| — | |

| | |

| 2012 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| 2011 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| (1) | Mr. Psomiadis received 600,000 shares of common stock on September 12, 2013

for his services, these shares were valued at $0.56 per share. |

| (2) | Mr. Quintero received 50,000 shares of common stock on September 12, 2013

for his services, these shares were valued at $0.56 per share. |

| (3) | Mr. Quintero received 25,000 in cash compensation through his consulting

business, JDE Development, LLC. |

Option Grants in Last Fiscal Year

There were no options granted to the

named executive officers during the year ending December 31, 2013 or subsequent to year-end.

Fiscal Year-End Option Values

There were no options being held

by the named executive officers for the fiscal year ending December 31, 2013.

Compensation of Directors

Currently, none of the Company's

directors receives compensation for serving on the Board.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

The Company is subject to the informational

requirements of the Exchange Act and files reports and other information with the SEC. Such reports and other information filed

by the Company may be inspected and copied at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C.

20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the SEC’s public reference rooms.

The SEC also maintains an Internet site that contains reports, proxy statements and other information about issuers, like us, who

file electronically with the SEC. The address of the SEC’s web site is http://www.sec.gov.

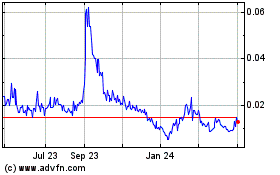

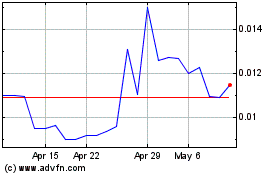

American Cannabis (QB) (USOTC:AMMJ)

Historical Stock Chart

From Jun 2024 to Jul 2024

American Cannabis (QB) (USOTC:AMMJ)

Historical Stock Chart

From Jul 2023 to Jul 2024