0001576873

false

--06-30

0001576873

2023-09-08

2023-09-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): September 8, 2023

| AMERICAN

BATTERY TECHNOLOGY COMPANY |

| (Exact

name of registrant as specified in its charter) |

| Nevada

|

|

000-55088

|

|

33-1227980 |

| (State

or other jurisdiction of |

|

(Commission

|

|

(IRS

Employer |

| incorporation

or organization) |

|

File

No.) |

|

Identification

Number) |

100

Washington Street, Suite 100

Reno, NV |

|

89503

|

| (Address

of principal executive offices) |

|

(Zip

Code) |

(775)

473-4744

(Registrant’s

telephone number including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act: None

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| |

|

|

|

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

3.03 Material Modification to the Rights of Security Holders.

The

information set forth in Item 5.03 of this Current Report on Form 8-K is hereby incorporated by reference into this Item 3.03.

Item

5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On

August 31, 2023, American Battery Technology Company (the “Company”) filed a Certificate of Change to the Company’s

Articles of Incorporation, as amended, with the Secretary of State of the State of Nevada (the “Certificate of Change”),

which unless earlier modified or terminated, shall effect, at 6:00 a.m. Pacific Time on September 11, 2023, a one-for-fifteen (1:15)

reverse stock split (the “Reverse Stock Split”) of both the Company’s issued and outstanding shares of common stock,

$0.001 par value per share (the “Common Stock”), and the authorized shares of preferred stock, $0.001 par value per share

(the “Preferred Stock”) (collectively, the Common Stock and Preferred Stock are the “Securities”).

The

new CUSIP number for the Common Stock following the Reverse Stock Split will be 02451V309. The Common Stock will begin trading

on a split-adjusted basis on the OTCQX under the symbol “ABML” when the market opens on September 11, 2023. The Reverse Stock

Split is intended to fulfill the stock price requirements by the Company in connection with its application to uplist the Common Stock

to a national exchange.

As

a result of the Reverse Stock Split, every fifteen (15) shares of Common Stock issued and outstanding will be combined into one (1) share

of Common Stock, with a proportionate 1:15 reduction in the Company’s authorized Common Stock. There are no shares of Preferred

Stock issued and outstanding. The Reverse Stock Split will affect all stockholders uniformly and will not alter any stockholder’s

percentage interest in the Company’s equity, except to the extent that the Reverse Stock Split would have resulted in some stockholders

owning a fractional share. No fractional shares will be issued in connection with the Reverse Stock Split. Any fractional shares of Common

Stock resulting from the Reverse Stock Split will be rounded up to the nearest whole post-Reverse Stock Split share and no stockholders

will receive cash in lieu of fractional shares. Immediately after the Reverse Stock Split, each stockholder’s percentage

ownership interest in the Company and proportional voting power will remain virtually unchanged, except for minor changes and adjustments

that will result from rounding fractional shares into whole shares. The rights and privileges of the holders of shares of Common Stock

will be substantially unaffected by the Reverse Split.

As

of September 5, 2023, the Company had 692,068,218 shares of Common Stock issued and outstanding, and after the Reverse Stock Split,

the Company will have approximately 46,137,882 shares of Common Stock issued and outstanding.

The

Reverse Stock Split will not change the par value of the Common Stock or Preferred Stock. All outstanding securities entitling their

holders to purchase shares of Common Stock or acquire shares of Common Stock, including restricted stock units and warrants, will be

adjusted as a result of the Reverse Stock Split, as required by the terms of those securities. Pursuant to NRS 78.207, no consent or

approval of the stockholders is required for the Reverse Stock Split.

The

foregoing description of the Certificate of Change is a summary of the material terms thereof, do not purport to be complete, and are

qualified in their entirety by reference to the full text of the Certificate of Change, filed with this report as Exhibit 3.1, and are

incorporated herein by reference.

Item

7.01 Regulation FD Disclosure.

On

September 11, 2023, the Company issued a letter to shareholders (the “September 2023 Shareholder Letter”), the full text

of which is attached hereto as Exhibit 99.1.

Item

8.01 Other Events.

On

September 11, 2023, the Company issued a press release regarding the Reverse Stock Split, the full text of which is attached hereto as

Exhibit 99.2.

The

information furnished with Item 7.01 and Item 8.01 to this Current Report on Form 8-K, including Exhibits 99.1 and 99.2 attached hereto,

shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other

filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such

a filing.

Item

9.01 Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its

behalf by the undersigned hereunto duly authorized.

| |

AMERICAN

BATTERY TECHNOLOGY COMPANY |

| |

|

| Date:

September 11, 2023 |

By:

|

/s/

Ryan Melsert |

| |

|

Ryan

Melsert |

| |

|

Chief

Executive Officer |

Exhibit

3.1

Exhibit

99.1

American

Battery Technology Company Announces Share Consolidation in Preparation for Listing on Major National Exchange

Highlights

| |

● |

Share

consolidation is part of the company’s uplisting process for The Nasdaq Capital Market listing requirements. It further simplifies

ABTC’s capital structure and is intended to enable the company to meet Nasdaq’s rigorous listing requirements. |

| |

|

|

| |

● |

The

consolidation is an important step in the company’s next phase of growth with the potential to provide greater exposure and

increased access to global capital markets and institutional investors to help support future growth at more favorable terms. |

| |

|

|

| |

● |

The

company is uniquely positioned with its first-of-kind technologies for both lithium-ion battery recycling and primary lithium manufacturing

operations to address the immense imbalance of supply and demand for battery metals, particularly sustainably- and domestically-sourced

battery metals. |

Reno,

Nev., September 11, 2023 — American Battery Technology Company (ABTC) (OTCQX: ABML), an integrated critical battery

materials company that is commercializing both its primary minerals manufacturing and secondary minerals lithium-ion battery recycling

technologies, today announced that the ABTC board of directors approved a 1-for-15 reverse split of its common stock effective at 9:00

a.m. Eastern Time on Monday, September 11, 2023. ABTC’s common stock will continue to trade on OTCQX Markets (“OTC”)

under the symbol “ABML” and will begin trading on a split-adjusted basis when the market opens on Monday, September 11, 2023.

The

company’s board of directors approved the reverse stock split with the objective of uplisting the company’s shares to The

Nasdaq Capital Market (Nasdaq). As a result of the reverse stock split, every 15 shares of common stock issued and outstanding as of

the effective date will be automatically combined into one share of common stock. The reverse stock split will not change the terms of

the common stock.

No

fractional shares will be issued in connection with the reverse stock split. Any fractional shares of common stock resulting from the

reverse stock split will be rounded up to the nearest whole post-split share, and no shareholders will receive cash in lieu of fractional

shares.

About

American Battery Technology Company

American

Battery Technology Company is uniquely positioned to supply low-cost, low-environmental impact, and domestically sourced battery metals

through its three divisions: lithium-ion battery recycling, primary battery metal extraction technologies, and primary resources development.

American

Battery Technology Company has built a clean technology platform that is used to provide a key source of domestically manufactured critical

and strategic battery metals to help meet the near insatiable demand from the electric vehicle, electrical grid storage, and consumer

electronics industries. This ESG-principled platform works to create a closed-loop circular economy for battery metals that champions

ethical and environmentally sustainable sourcing of critical and strategic materials.

Forward-Looking

Statements

This

press release contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, are “forward-looking statements.”

Although the American Battery Technology Company’s (the “Company”) management believes that such forward-looking statements

are reasonable, it cannot guarantee that such expectations are, or will be, correct. These forward-looking statements involve a number

of risks and uncertainties, which could cause the Company’s future results to differ materially from those anticipated. Potential

risks and uncertainties include, among others, interpretations or reinterpretations of geologic information, unfavorable exploration

results, inability to obtain permits required for future exploration, development or production, general economic conditions and conditions

affecting the industries in which the Company operates; the uncertainty of regulatory requirements and approvals; fluctuating mineral

and commodity prices, final investment approval and the ability to obtain necessary financing on acceptable terms or at all. Additional

information regarding the factors that may cause actual results to differ materially from these forward-looking statements is available

in the Company’s filings with the Securities and Exchange Commission, including the Annual Report on Form 10-K for the year ended

June 30, 2022. The Company assumes no obligation to update any of the information contained or referenced in this press release.

###

American

Battery Technology Company

Media

and Company Contact:

Tiffiany

Moehring

tmoehring@batterymetals.com

720-254-1556

Investor

Relations Contact:

Georg

Venturatos / Jared Gornay

Gateway

Group

ABML@Gateway-grp.com

(949)

574-3860

Exhibit

99.2

September

11, 2023

Dear

Valued Shareholders,

On

behalf of the team at American Battery Technology Company, we are excited to have closed out another fiscal year this summer and to provide

an update to you all about our progress over the past year and about our critical steps ahead. We continue to drive forward with each

of our three business units in order to bring an integrated set of technologies to commercialization to address our domestic critical

battery mineral challenges.

Lithium-Ion

Battery Recycling

Earlier

this year we purchased a move-in ready facility in McCarran, Nevada for the first implementation of our internally-developed, first-of-kind

battery recycling processes. The use of this existing facility and utility infrastructure dramatically reduced our time to production.

Over the past several weeks, we have commissioned the initial set of processes in the plant, successfully feeding test material. We are

on pace to be feeding high-throughput quantities of battery materials in the coming weeks. The transition to commercial-scale, revenue-generating

operations is a critical milestone, and we are excited about the steps ahead as we ramp the operations of this novel facility.

Primary

Lithium Resource Development

We

have been exploring and developing our Tonopah Flats Lithium Project for the past two years, and earlier this year we published our third-party

audited SK-1300 compliant Inferred* Resource Report, which concluded that this deposit is one of the largest known lithium resources

in the US. In order to further expand and improve the classification of this resource, we began a third drill program this summer and

are now concluding operations for this eight-hole program. We will be publishing the results of this program shortly, with the intent

of evolving portions of this resource to measured and indicated classifications.

Primary

Lithium Hydroxide Refinery

While

having a lithium-bearing sedimentary claystone resource that is identified as one of the largest overall lithium deposits in the US is

important, it is only beneficial if a technology can be commercialized that can access the constituent lithium and manufacture a battery

grade lithium product that is economically competitive. We are proud to have developed an in-house set of technologies specifically designed

for use with this unique central Nevada-based sedimentary claystone resource, and to have proven out these unit operations at the bench

scale over the past two years. With the support of a grant from the US DOE, we have further scaled these technologies and designed a

pilot-scale integrated system that can intake up to 5 metric tonnes per day of claystone material, process this material through each

of our unit operations, and generate a battery-grade lithium hydroxide product. The majority of the components for this pilot-scale system

have already been delivered, and we are looking forward to commissioning this system and commencing operations over the coming months.

| ABTC Shareholder Letter, September 2023 | 1 |

With

support from an additional US DOE grant, we are also undergoing the construction design of a commercial-scale refinery that employs these

internally-developed processes to produce commercial quantities of battery-grade lithium hydroxide. We have engaged the global EPC firm

Black & Veatch and are proceeding through the design, engineering, procurement, construction, and commissioning operations. As the

identified quantity and quality of our lithium resource continues to grow, and as the demand for domestically manufactured lithium hydroxide

grows, the ultimate size of this commercial-scale refinery continues to grow as well.

Our

Team: Who we are

ABTC

is one of the only companies in the world that is commercializing technologies to manufacture battery metals through both lithium-ion

battery recycling and primary metal refining operations. This creates a very impactful value proposition; however, designing, constructing,

and operating this wide range of processes is only possible because of the breadth and caliber of individuals we have been able to bring

onboard as members of the team. We had a strong base team in place last year, and now over the past year we have nearly tripled the size

of our team with substantial increases in our R&D, Engineering, and Operations organizations.

There

is a significant difference between an employee, who focuses on performing individual tasks, and a team member, who takes on responsibility

and ownership of key company efforts. Recruiting someone who will act as a team member is not something that can be accomplished through

magnitude of compensation, seniority of title, or number of direct reports, but instead can only be realized by truly believing in the

company mission and being empowered to execute towards those efforts.

Last

summer, as we were working late preparing designs for a critical project one night, I noticed it was past midnight, and told everyone

in the office it was time to head home and that we would pick it up in the morning. We all packed up and walked outside, but as there

was significant work left before a deadline the end of the next day, once everyone else had walked away from the building, I went back

inside to keep working on a few remaining items. I didn’t expect everyone else to notice I had gone back inside, or to feel the

responsibility to continue working that late, but one –by one everyone else came back into the office as well and kept working

on the key items.

We

ordered food and ended up working through most of the night and were able to complete all of the requirements. The next day I expected

to hear individuals upset about working through the night; however, it was the opposite. They each said it was one of their proudest

moments in the company to be able to directly contribute to a key company effort like that. They didn’t come back inside because

they were required to, or because they thought it would reflect badly if they didn’t. Instead they said they each came back because

they felt ownership of the project and responsibility for its success and the success of the company. While that overnight effort was

for a key deliverable that ultimately led to us being awarded a US DOE grant for a $115M project, that level of dedication and personal

ownership from our team members is far more valuable.

As

we have been moving through the installation and commissioning of processes in our first commercial-scale battery recycling facility,

I see the same level of personal ownership and sense of responsibility for the success of these operations from each and every one of

our team members. It is this sense of ownership of project and company success that will drive us forward as we undergo the design, construction,

and operations of each of our commercial-scale recycling and primary refining efforts.

| ABTC Shareholder Letter, September 2023 | 2 |

Our

Partnerships: How we succeed

While

there was strong demand for domestic critical battery minerals last year, the quantity of battery cell gigafactories announced and under

construction in the US since then has grown dramatically. This, combined with the passage of the Inflation Reduction Act (IRA) last year

that includes significant subsidies for products that contain domestically sourced critical battery minerals, have worked together to

result in near insatiable demand for these products from both our battery recycling and primary lithium hydroxide refining operations.

As

a result of these dynamics, the market is demanding a substantial increase in the scale of these planned commercial domestic battery

critical mineral operations. We have been in discussions with nearly all of the automotive OEMs, cell manufacturers, and battery material

refiners, and the demand for these critical battery minerals from facilities already under construction is far more than can be provided

from current domestic operations.

As

we commercialize our first lithium-ion battery recycling facility and demonstrate the benefits of our internally-developed systems to

these prospective partners, the next steps are to formalize these partnerships to build additional commercial-scale implementations of

these recycling facilities directly at the sites of these partners. This co-located strategy allows for the collection of production

waste and end-of-life materials directly at the facility, the recycling of these materials in an on-site fashion, and the sale of the

recycled products directly back into the associated supply chain to enable closed-loop operations.

Correspondingly,

the current planned capacity of our primary lithium hydroxide refinery is 30,000 MT LiOH/yr. There are very few projects planned in the

US that can produce a battery grade lithium hydroxide product, and as such there has been extreme demand for the offtake of this material.

As we move forward with discussions with prospective partners, there are opportunities to substantially increase the throughput of this

refinery.

Our

Future: How we scale and grow

We

are in a very fortunate position, whereas we have manufacturing facilities under development and construction to produce critical battery

minerals that are highly desired by some of the largest corporations in the world. The expansion of these facilities to meet demand will

be a multi-billion dollar effort, and we are excited to continue to scale and grow our operations.

We

are grateful to have been traded on the over-the-counter exchange for the past several years; however, we have recently been trading

at many –times over the average monthly dollar trading volume of average OTC-listed companies, and many of our prospective investors

and partners necessitate us to be traded on a national exchange in order to finalize our agreements. We have had an application pending

to move our listing to the Nasdaq exchange for quite some time, and we have set three milestones that we have wanted achieved before

finalizing this process:

| |

1) |

To

have a world class board of directors in place, establishing our governance and oversight processes |

| |

2) |

To

be transitioning into revenue-generating operations with the commissioning of our first battery recycling facility |

| |

3) |

To

have identified partnerships for the commercial-scale supply of feed materials and for the offtake of our products |

| ABTC Shareholder Letter, September 2023 | 3 |

As

we have now achieved these critical milestones, we are excited to be taking the last steps to finalize our listing on the Nasdaq exchange

to enable our future growth and partnership development.

Thank

you for your support as we continue our path forward together,

Ryan

Melsert

CEO

/ CTO / Chairman

American

Battery Technology Company

*Inferred

Resource

Inferred

mineral resource is that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological

evidence and sampling. The level of geological uncertainty associated with an inferred mineral resource is too high to apply relevant

technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic

viability. Because an inferred mineral resource has the lowest level of geological confidence of all mineral resources, which prevents

the application of the modifying factors in a manner useful for evaluation of economic viability, an inferred mineral resource may not

be considered when assessing the economic viability of a mining project and may not be converted to a mineral reserve.

Forward-Looking

Statements

This

letter contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities

Litigation Reform Act of 1995. All statements, other than statements of historical fact, are “forward-looking statements.”

Although the company’s management believes that such forward-looking statements are reasonable, it cannot guarantee that such expectations

are, or will be, correct. These forward-looking statements involve a number of risks and uncertainties, which could cause the company’s

future results to differ materially from those anticipated. Potential risks and uncertainties include, among others, interpretations

or reinterpretations of geologic information, unfavorable exploration results, inability to obtain permits required for future exploration,

development or production, general economic conditions and conditions affecting the industries in which the company operates; the uncertainty

of regulatory requirements and approvals; fluctuating mineral and commodity prices, final investment approval and the ability to obtain

necessary financing on acceptable terms or at all. Additional information regarding the factors that may cause actual results to differ

materially from these forward-looking statements is available in the company’s filings with the Securities and Exchange Commission,

including the Annual Report on Form 10-K for the year ended June 30, 2022. The company assumes no obligation to update any of the information

contained or referenced in this letter.

| ABTC Shareholder Letter, September 2023 | 4 |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

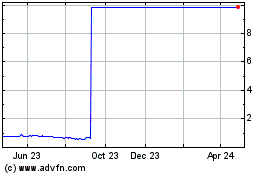

American Battery Technol... (QX) (USOTC:ABML)

Historical Stock Chart

From Apr 2024 to May 2024

American Battery Technol... (QX) (USOTC:ABML)

Historical Stock Chart

From May 2023 to May 2024