BioSyent Releases Q4 and Full Year 2013 Results: Full Year Sales Increase 55%, Net Income Up 25%, 3 Year CAGR 67%, Q4 Sales I...

March 12 2014 - 8:00AM

Marketwired Canada

BioSyent Inc. ("BioSyent") (TSX VENTURE:RX) released today a summary of its

Fiscal 2013 and Fourth Quarter (Q4 2013) financial results. Key highlights

include:

-- Full year 2013 Sales of $7,799,426 increased by 55% versus 2012

-- Revenue has grown at a compound annual growth rate (CAGR) of 67% over

the last three years

-- Full year 2013 Pharmaceutical Sales of $6,969,031 increased by 63%

versus 2012

-- Seventeen consecutive quarters of continued pharmaceutical sales growth

-- 2013 Net Income Before Tax of $2,452,840 increased year over year by 75%

-- 2013 Tax Expense (net of deferred tax credit) was $524,812 versus

($142,195) in 2012

-- Net Income After Tax of $1,928,028 increased by 25% versus 2012

-- 2013 Basic EPS of $0.14; Fully Diluted EPS of $0.13

-- Cash Generation in 2013 of $2,065,082 was 64% higher than 2012

-- The company ended 2013 with $4,405,910 in working capital of which cash

was $4,381,137

-- The company remains debt-free and has an unutilized operating line of

credit with Royal Bank of Canada

-- Selected as a TSX Venture 50 Top Performer for three consecutive years -

2012, 2013 and 2014

-- Named as one of Canada's fastest growing companies in the Profit 500

rankings for 2013

-- 2 New Products submitted to Health Canada awaiting marketing approval

-- Pre-launch activity for a new Women's Health product - launch planned

for second quarter of 2014

-- Pre-launch activity for a new Gastrointestinal Health product - launch

planned for fourth quarter of 2014

Total sales for Q4 2013 of $2,142,835, were 61% higher compared to $1,327,953 in

the corresponding prior year period. On a full year basis, sales in 2013 of

$7,799,426 were 55% higher than the previous year sales $5,024,154.

Income Before Tax for Q4 2013 was $619,124, which was 71% higher than $361,237

in Q4 2012. Net Income Before Tax for full year 2013 was $2,452,840, an increase

of 75% over the corresponding prior year period.

The Company recognized a deferred tax credit of $232,199 in the fourth quarter

of 2012. The Company further recognized a deferred tax credit of $123,332 in the

fourth quarter of 2013. These deferred tax credits pertain to the full year of

2012 and 2013. The increase of Net Income After Tax in the fourth quarter of

2013 is 59% over the fourth quarter of 2012 reckoned without these deferred tax

credits.

The Company has provided for tax of $524,812 (net of deferred tax credit) in

2013 versus ($142,195) in 2012. Inspite of this difference in tax expense, Net

Income After Tax increased by 25% from $1,541,317 in 2012 to $1,928,028 in 2013.

Working capital, which is the difference between current assets and current

liabilities, increased by 76% from $2,509,278 as at December 31, 2012 to

$4,405,910 as at December 31, 2013. Total Cash included in working capital on

December 31, 2013 was $4,381,137. Total Shareholder's Equity increased by 71%

from $2,839,409 at December 31, 2012 to $4,854,630 at December 31, 2013. This is

mainly due to an increase in retained earnings in 2013.

On October 1, 2013 the Company signed an exclusive Canadian Licence and

Distribution Agreement with a new European Partner for a Women's Health product

that has prior approval from Health Canada. The Company plans to launch the

product in the second quarter of 2014.

Subsequent to year-end, BioSyent in-licensed a new Gastrointestinal Health

product from an existing European partner. This product is approved by Health

Canada and is being prepared for launch in Q4 2014.

The Company's Consolidated Financial Statements and Management's Discussion &

Analysis will be posted on www.sedar.com on March 12, 2013.

For a direct market quote (15 minutes delay) for the TSX Venture Exchange and

other Company financial information please visit www.tmxmoney.com.

BioSyent will also release a CEO presentation on the Fourth Quarter and Full

Year 2013 Financial Results at the following link: www.biosyent.com/q4/.

About BioSyent Inc.

Listed on the Toronto Venture Exchange under the trading symbol "RX", BioSyent

is a profitable growth oriented specialty pharmaceutical company which searches

the globe to in-license or acquire innovative pharmaceutical products that have

been successfully developed, are safe and effective, and have a proven track

record of improving the lives of patients and supporting the healthcare

professionals that treat them.

Once a product of interest has been found, BioSyent then acquires the exclusive

rights to the product and manages it through the Canadian governmental

regulatory approval process. Once approved, BioSyent markets the product

throughout Canada.

At the date of this press release the Company had 13,626,195 shares issued and

outstanding.

BioSyent Inc.

Consolidated Statement of Comprehensive Income

----------------------------------------------------------------------------

In Canadian Q4 Q4 % Full Year Full Year %

Dollars 2013 2012 Change 2013 2012 Change

----------------------------------------------------------------------------

Revenues 2,142,835 1,327,953 61% 7,799,426 5,024,154 55%

Cost Of Goods

Sold 448,614 251,401 78% 1,644,266 1,040,136 58%

Total Operating

Expense 1,075,097 715,315 50% 3,702,320 2,584,896 43%

Net Income

Before Tax 619,124 361,237 71% 2,452,840 1,399,122 75%

Tax (including

Deferred Tax) 63,580 (142,195) NA 524,812 (142,195) NA

Net Income After

Tax 555,544 503,432 10% 1,928,028 1,541,317 25%

Net Income After

Tax % to Sales 26% 38% 25% 31%

----------------------------------------------------------------------------

BIOSYENT INC.

ANNUAL CONSOLIDATED STATEMENT OF FINANCIAL POSITION

-------------------------------------

December 31, December 31, %

AS AT 2013 2012 Change

-------------------------------------

ASSETS

Receivables 585,519 589,697 -1%

Inventory 522,787 345,630 51%

Prepaid expenses & deposits 136,511 71,257 92%

Cash & Cash Equivalents 4,381,137 2,316,055 89%

-------------------------------------

-------------------------------------

Current Assets 5,625,954 3,322,639 69%

Equipment 141,025 97,932 44%

Intangible Assets 52,994 -

Deferred Tax 271,559 232,199 17%

-------------------------------------

TOTAL ASSETS 6,091,532 3,652,770 67%

-------------------------------------

-------------------------------------

LIABILITIES AND SHAREHOLDERS' EQUITY

Current Liabilities 1,220,044 813,361 50%

Deferred Tax Liability 16,858 -

Total Equity 4,854,630 2,839,409 71%

-------------------------------------

TOTAL LIABILITIES AND SHAREHOLDERS'

EQUITY 6,091,532 3,652,770 67%

-------------------------------------

This press release may contain information or statements that are

forward-looking. The contents herein represent our judgment, as at the release

date, and are subject to risks and uncertainties that may cause actual results

or outcomes to be materially different from the forward-looking information or

statements. Potential risks may include, but are not limited to, those

associated with clinical trials, product development, future revenue,

operations, profitability and obtaining regulatory approvals.

The TSX Venture Exchange assumes no responsibility for the accuracy of this

release and neither approves nor disapproves of the same.

FOR FURTHER INFORMATION PLEASE CONTACT:

BioSyent Inc.

Mr. Rene C. Goehrum

President and CEO

(905) 206-0013

investors@biosyent.com

www.biosyent.com

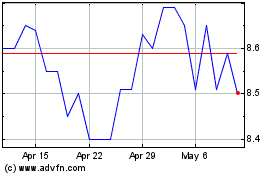

Biosyent (TSXV:RX)

Historical Stock Chart

From Apr 2024 to May 2024

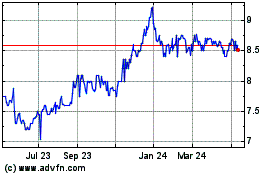

Biosyent (TSXV:RX)

Historical Stock Chart

From May 2023 to May 2024