Amerigo Resources Ltd. (TSX:ARG) ("Amerigo" or the "Company")

reported today results for the quarter ended September 30, 2012

("Q3-2012").

Dr. Klaus Zeitler, Amerigo's President and CEO, stated:

"Production results were strong in Q3-2012, with copper and

molybdenum production 15% and 73% higher, respectively, than the

comparable quarter in 2011. For the full year we expect to meet or

exceed forecast production of 50 million pounds of copper and 1

million pounds of molybdenum. Although Q3-2012 financial results

were adversely affected by one-time charges for a $4.6 million

bonus payment to our Chilean workers on the signing of a new four

year union agreement and a $2.3 million deferred (future) income

tax non-cash accounting charge following an increase in Chile's

corporate tax rate to 20%, cash flow remained positive at $2.7

million and we ended the quarter with an improved cash

balance."

Dr. Zeitler added: "The price of energy from the grid remains

high, but as previously announced the Company's contract with its

power provider changes on January 1, 2013 from a variable to a much

lower fixed rate. This change will result in savings over current

levels of more than $20 million annually for the next five years

significantly improving MVC's operating cash flow. Accordingly, the

board has declared a dividend of $0.02 per share, payable on

November 29, 2012 to shareholders of record as of November 19,

2012."

Comparative Quarterly Overview

--------------------------------------------------------------------------

Quarters ended September 30,

2012 2011 Change

%

--------------------------------------------------------------------------

Copper produced, million

pounds 12.70 11.01 1.69 15%

Copper sold, million

pounds 13.02 10.80 2.22 21%

Molybdenum produced,

pounds 321,788 186,297 135,491 73%

Molybdenum sold, pounds 337,818 148,940 188,878 127%

Percentage of copper

production from old

tailings 47% 45% 2%

Revenue ($) 44,230,998 41,958,747 2,272,251 5%

Cost of sales (1) ($) 46,284,812 38,815,312 7,469,500 19%

El Teniente royalty

costs ($) 10,178,780 10,817,627 (638,847) (6%)

Gross (loss) profit ($) (2,053,814) 3,143,435 (5,197,249) (165%)

Net (loss) profit ($) (4,188,947) (1,194,499) (2,994,448) 251%

Operating cash flow ($) 2,707,456 4,563,713 (1,856,257) (41%)

Cash flow paid for plant

expansion ($) (4,605,712) (4,503,714) (101,998) 2%

Cash and cash

equivalents ($) 35,648,835 34,260,808 1,388,027 4%

Bank debt ($) 2,500,590 6,469,421 (3,968,831) (61%)

Average realized copper

price per pound 3.52 3.93 (0.41) (10%)

Cash cost per pound 2.64 2.39 0.25 10%

Total cost per pound 3.76 3.69 0.07 2%

--------------------------------------------------------------------------

(1) Includes El Teniente royalty costs

Financial results

-- Revenue was $44,230,998 compared to $41,958,747 in Q3-2011, an increase

of 5% as a result of higher copper (3%) and molybdenum (60%) revenue.

-- Cost of sales was $46,284,812, 19% higher than Q3-2011. Bonuses totaling

$4,559,327 payable to MVC workers on the signing of a four-year union

agreement constituted more than 60% of this increase.

-- Gross loss was $2,053,814, compared to gross profit of $3,143,435 in Q3-

2011. Excluding the signing bonuses, normalized gross profit was

$2,505,513 in Q3-2012.

-- Net loss was $4,188,947, compared to a loss of $1,194,499 in Q3-2011. In

addition to the impact of the signing bonuses, financial results were

affected by a $2,577,526 deferred (future) income tax expense, following

an increase in Chile's corporate tax rate to 20%. Excluding these items,

normalized net profit was $2,947,906 in Q3-2012.

Production

-- The Company produced 12.70 million pounds of copper, 15% higher than the

11.01 million pounds produced in Q3-2011.

-- Molybdenum production was 321,788 pounds, 73% higher than the 186,297

pounds produced in Q3-2011.

Revenue

-- Revenue increased to $44,230,998 compared to $41,958,747 in Q3-2011.

Copper and molybdenum sales volume increased 21% and 127% respectively

over Q3-2011, but the Company's copper selling price of $3.52/lb and

molybdenum selling price of $11.64/lb were 10% and 26% lower,

respectively, than in Q3-2011.

Costs

-- Cash cost (the aggregate of smelting, refining and other charges,

production costs net of molybdenum-related net benefits, administration

and transportation costs) before El Teniente royalty was $2.64/lb,

compared to $2.39/lb in Q3-2011. Normalized Q3-2012 cash cost excluding

the labour signing bonuses was $2.28/lb.

-- Total cost (the aggregate of cash cost, El Teniente royalty and

depreciation) was $3.76/lb compared to $3.69/lb in Q3-2011. Normalized

Q3-2012 total cost excluding signing bonuses was $3.40/lb.

-- Power costs in Q3-2012 were $11,456,788 ($0.1659/kwh) compared to

$10,594,425 ($0.1790/kwh) in Q3-2011.

-- Total El Teniente royalties were $10,178,780, compared to $10,817,627 in

Q3-2011.

-- The Company recorded a $4,559,327 ($0.36/lb) expense for bonuses payable

on the signing of a four-year union labour agreement. Signing bonuses

are customary in Chile and in recent years the mining industry has paid

historically high bonuses due to a shortage of skilled workers. Most of

the cost of the signing bonuses was allocated to direct labour costs,

with a smaller amount allocated to administration costs.

Cash and Financing Activities

-- Cash balance at $35,648,835 on September 30, 2012 (December 31, 2011:

$20,819,467) was higher than expected due to increased royalties

outstanding to El Teniente, deferral of accounts payable due to month-

end timing and the deferral of payment of a portion of the signing

bonuses to October in order to optimize associated employee payroll

taxes.

Investments

-- Cash payments for capital expenditures ("Capex") were $4,605,712,

compared to $4,503,714 in Q3-2011 and year to date cash payments for

Capex were $20,870,233 (YTD-2011: $13,096,219). Capex payments have been

funded from operating cash flow.

-- Year to date Capex totalled $19,225,722 (YTD-2011: $13,267,825) and

included process plant investments in anticipation of the Company

obtaining the rights to process tailings from an additional tailings

pond. Q3-2012 Capex totalled $3,427,625 (Q3-2011: $4,227,408).

-- The Company's investments in Candente Copper Corp. ("Candente Copper)",

Candente Gold Corp. ("Candente Gold"), Cobriza Metals Corp. ("Cobriza")

and Los Andes Copper Ltd. ("Los Andes") had aggregate fair values of

$5,900,708 at September 30, 2012 (December 31, 2011: $8,722,744).

Dividend Declared

-- On November 5, 2012, Amerigo declared a semi-annual dividend of Cdn$0.02

per share, payable on November 29, 2012 to shareholders of record as of

November 19, 2012.

Outlook

-- Management expects 2012 production to meet or exceed fifty million

pounds of copper and one million pounds of molybdenum. Negotiations are

ongoing for the rights to process old tailings from an additional

tailings pond owned by El Teniente which will enable the Company to

significantly increase production from current levels. The majority of

the Company's Capex budget has been incurred to September 30, 2012 and

it is estimated that Capex incurred in the remainder of the year will be

approximately $1,900,000.

The information in this news release and the Selected Financial

Information contained in the following page should be read in

conjunction with the Unaudited Condensed Consolidated Interim

Financial Statements and Management's Discussion and Analysis for

the quarter ended September 30, 2012 and the Audited Consolidated

Financial Statements and Management's Discussion and Analysis for

the year ended December 31, 2011, which will be available at the

Company's website at www.amerigoresources.com and at

www.sedar.com.

Amerigo Resources Ltd. is a Canadian junior company producing

copper and molybdenum from its MVC operations near Santiago, Chile.

Tel: (604) 681-2802; Fax: (604) 682-2802; Web:

www.amerigoresources.com; Listing: ARG:TSX

Statements contained in this news release that are not

historical facts are forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. Such

forward-looking statements are subject to risks and uncertainties

which could cause actual results to differ materially from

estimated results. Such risks and uncertainties are detailed in the

Company's filings with the TSX and on SEDAR. Forward-looking

statements are based on the beliefs, estimates and opinions of the

Company's management on the date the statements are made. The

Company undertakes no obligation to update these forward-looking

statements if management's beliefs, estimates or opinions, or other

factors, should change.

AMERIGO RESOURCES LTD.

SELECTED FINANCIAL INFORMATION

QUARTERS ENDED SEPTEMBER 30, 2012 AND 2011

All figures expressed in US Dollars and presented under IFRS

Consolidated Statements of Financial Position

September 30, December 31,

2012 2011

$ $

---------------------------------

Cash and cash equivalents 35,648,835 20,819,467

Property, plant and equipment 159,368,328 138,638,900

Other assets 41,768,510 45,871,252

---------------------------------

Total assets 236,785,673 205,329,619

---------------------------------

---------------------------------

Total liabilities 93,248,493 66,348,005

Shareholders' equity 143,537,180 138,981,614

---------------------------------

Total liabilities and shareholders'

equity 236,785,673 205,329,619

---------------------------------

---------------------------------

Consolidated Statements of Comprehensive (Loss) Income

Quarter ended Quarter ended

September 30, September 30,

2012 2011

$ $

---------------------------------

Total revenue, net of smelter and

refinery charges 44,230,998 41,958,747

Cost of sales (46,284,812) (38,815,312)

Other expenses 405,915 (3,982,223)

Non operating gain (loss) (125,794) (184,535)

Income tax recovery (expense) (2,415,254) (171,176)

---------------------------------

(Loss) profit for the period (4,188,947) (1,194,499)

Other comprehensive (loss) income 7,377,299 (16,408,204)

---------------- ----------------

Comprehensive (loss) income 3,188,352 (17,602,703)

---------------------------------

---------------------------------

(LPS) EPS- Basic and Diluted (0.02) (0.01)

Consolidated Statements of Cash Flows

Quarter ended Quarter ended

September 30, September 30,

2012 2011

$ $

---------------------------------

Net cash provided by operating

activities 33,350,184 7,316,946

Net cash used in investing activities (4,605,712) (4,503,714)

Net cash used in financing activities (1,150,647) (2,023,795)

---------------------------------

Net cash outflow during the period 27,593,825 789,437

---------------------------------

---------------------------------

The Toronto Stock Exchange has not reviewed nor accepted

responsibility for the adequacy or accuracy of the contents of this

news release, which has been prepared by management.

Contacts: Amerigo Resources Ltd. Dr. Klaus Zeitler President and

CEO (604) 218-7013 Amerigo Resources Ltd. (604) 697-6201

www.amerigoresources.com

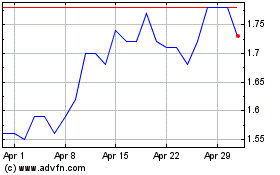

Amerigo Resources (TSX:ARG)

Historical Stock Chart

From Jul 2024 to Aug 2024

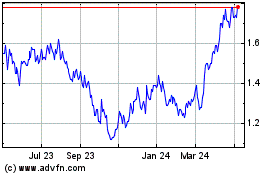

Amerigo Resources (TSX:ARG)

Historical Stock Chart

From Aug 2023 to Aug 2024