Freeport-McMoron Isn't Looking for Strategic Deals in Coming Years, CEO Says

January 13 2020 - 2:26PM

Dow Jones News

By Alistair MacDonald

U.S. mining company Freeport-McMoRan Inc. has no interest in

major strategic deals over the next three years, its chief

executive said Monday, potentially stymieing informal overtures

from Barrick Gold Corp. to merge.

Barrick Gold Chief Executive Officer Mark Bristow has told

reporters that there is logic in merging with Freeport. That has

stoked expectations among some investors and bankers that the two

sides could get together. Alongside copper, Freeport's massive

Indonesian mine, Grasberg, is also one of the world's largest gold

producers.

But Freeport is too focused on the engineering challenge of

turning Grasberg from open pit mining into an underground operation

to think about mergers and acquisition deals, said the company's

veteran CEO Richard Adkerson.

In addition, market challenges related to the U.S.-China trade

war mean this isn't the best time for major strategic moves, Mr.

Adkerson said.

"Our company is laser-focused on completing that [Grasberg

transition], so we are focused on that and not M&A

opportunities," he told The Wall Street Journal. "After that is

complete, we would be in a position to look at a number of

alternatives that could be attractive to our shareholders," he

said.

That could be a problem for Barrick. Mr. Bristow recently told

Bloomberg News that if Barrick was to attempt a merger with

Freeport, it would have to be a friendly rather than a hostile

approach. The South African executive has talked generally about

adding more copper to its current reserves of the metal. That makes

sense because the industrial metal is often found with gold, and

because copper is an important component in the increasing

electrification of energy, he has said.

Mr. Adkerson declined to comment on whether Barrick Gold has

approached his company. Barrick also declined to comment.

The two executives know each other through their work at the

International Council on Mining and Metals, a trade group that

represents the world's largest mining and metals companies.

At current copper prices, Freeport's cash flows will double in

two years, Mr. Adkerson said, but investors have yet to price in

the expected growth. Meanwhile, the company faces lower revenue and

higher capital costs during the transition at Grasberg. The change

represents a significant technical challenge analysts say.

"It is a real challenging time for us to think about strategic

opportunities, because of the cash flow situation as we move" from

open pit to underground, Mr. Adkerson said.

When Freeport does come to look at strategic opportunities, this

could be about pouring capital into the company's own projects,

rather than M&A, he said. There are several new projects

Freeport is developing, including a new project in eastern

Arizona.

Mr. Adkerson, who joined Freeport in 1989, said he is feeling

bullish about the copper market, given that the scarcity of new

projects in the metal should boost its price. Analysts mainly share

that view. The scarcity has also triggered speculation about deals

as miners look to increase their exposure to the metal, with

Freeport frequently talked of as an acquisition target.

In 2018, Indonesia took a 51% stake in Grasberg, paying $3.65

billion to Freeport and Australian miner Rio Tinto PLC. The

agreement has ended a standoff with Indonesia. The country's

government refused export permits and threatened new taxes.

Relations between the sides remain positive and the mine is

progressing well, Mr. Adkerson said.

Jacquie McNish contributed to this article.

Write to Alistair MacDonald at alistair.macdonald@wsj.com

(END) Dow Jones Newswires

January 13, 2020 14:11 ET (19:11 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

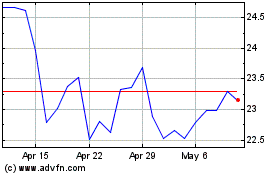

Barrick Gold (TSX:ABX)

Historical Stock Chart

From Aug 2024 to Sep 2024

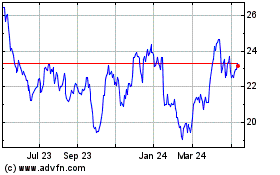

Barrick Gold (TSX:ABX)

Historical Stock Chart

From Sep 2023 to Sep 2024