0001670592FALSE00016705922023-08-102023-08-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): August 10, 2023

YETI Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware |

| 001-38713 |

| 45-5297111 |

| (State or other jurisdiction |

| (Commission |

| (IRS Employer |

| of incorporation) |

| File Number) |

| Identification No.) |

7601 Southwest Parkway

Austin, Texas 78735

(Address of principal executive offices, including zip code)

(Registrant's telephone number, including area code): (512) 394-9384

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common stock, par value $0.01 | YETI | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On August 10, 2023, YETI Holdings, Inc. (the “Company”) issued a press release announcing its 2023 fiscal second quarter financial results. The press release is being furnished with this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits. | | | | | | | | |

| Exhibit | | |

| No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File, formatted in Inline Extensible Business Reporting Language (iXBRL) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| YETI Holdings, Inc. |

|

|

Date: August 10, 2023 | By: | /s/ Michael J. McMullen |

| |

| Michael J. McMullen |

| | | Senior Vice President, Chief Financial Officer and Treasurer |

Exhibit 99.1

YETI Reports Second Quarter 2023 Results

Net Sales Decreased 4%; Adjusted Net Sales Increased 2%

Gross Margin Continues to Expand

Raises Low End of Full Year 2023 Adjusted Net Sales Outlook Range

Increases Full Year 2023 Adjusted EPS Outlook

Austin, Texas, August 10, 2023 – YETI Holdings, Inc. (“YETI”) (NYSE: YETI) today announced its financial results for the second quarter ended July 1, 2023.

With one full quarter of product recall activity, YETI is providing an update on its product recalls and their impacts on its financial performance. The results below should be read in conjunction with the “Product Recall Updates” section of this press release.

YETI reports its financial performance in accordance with accounting principles generally accepted in the United States of America (“GAAP”) and as adjusted on a non-GAAP basis. YETI’s non-GAAP measures exclude the impact of the voluntary recalls, as well as certain other items. Please see “Non-GAAP Financial Measures,” and “Reconciliation of GAAP to Non-GAAP Financial Information” below for additional information and reconciliations of the non-GAAP financial measures to the most comparable GAAP financial measures.

Matt Reintjes, President and Chief Executive Officer, commented, “YETI continued to execute at a high level in the second quarter, driven by brand strength, consideration and purchase in a dynamic demand environment. We continue to see attractive trends in the market with growing consumer demand for hydration solutions from coolers to drinkware, broadening colorways and an increasing focus on durable, reusable product. Our innovation continues to successfully address these trends, and we are excited about the pipeline of product we have in development across our product families. In drinkware, we are seeing positive results from the expansion of our bottle portfolio, our straw lid tumblers, the growing range of our Yonder water bottles, and the successful launch of our beverage bucket. In hard coolers, we saw strong demand for our wheeled cooler offerings. On the soft cooler front, we remain firmly on-track to not only bring our full lineup of soft coolers and dry gear bags back to the market, but also expand some of these offerings to new sizes as we move into the fourth quarter.”

Mr. Reintjes continued, “As we look at our second quarter performance, adjusted sales growth was above our expectations. Importantly, our gross margin performance continues to strengthen as we are now seeing greater benefit from lower container costs. We continue to thoughtfully invest in the business to drive growth and brand expansion, while maintaining a healthy level of profitability. Finally, we have further strengthened our balance sheet with a growing cash balance and an expanded credit facility, providing increased flexibility across our capital allocation priorities.”

Second Quarter 2023 Results

Sales decreased 4% to $402.6 million, compared to $420.0 million during the same period last year. Sales were unfavorably impacted by $24.5 million due to a recall reserve adjustment. See “Product Recall Updates” below for additional information on the impact of the recalls referenced throughout this press release.

Adjusted sales, which exclude the unfavorable impact of the recall reserve adjustment, increased 2% to $427.1 million.

Sales and adjusted sales for the second quarter of 2023 include $12.5 million of sales related to gift card redemptions in connection with recall remedies. Our 2023 results have also been materially adversely impacted by the stop sale of the soft coolers included in the recalls initiated during the first quarter of 2023.

•Direct-to-consumer (“DTC”) channel sales increased 1% to $226.4 million, compared to $224.8 million in the prior year quarter, mainly due to growth in Drinkware, partially offset by an $8.1 million unfavorable impact related to the recall reserve adjustment. Excluding the impact of the recall reserve adjustment, DTC channel adjusted sales increased 4% to $234.5 million.

•Wholesale channel sales decreased 10% to $176.2 million, compared to $195.2 million in the same period last year, and include a $16.4 million unfavorable impact related to the recall reserve adjustment. Excluding the unfavorable impact of the recall reserve adjustment, wholesale channel adjusted sales decreased 1% to $192.5 million. This decrease was primarily driven by a decline in Coolers & Equipment due to the stop sale of the products affected by the recalls, partially offset by Drinkware growth.

•Drinkware sales increased 8% to $233.4 million, compared to $216.1 million in the prior year quarter, reflecting strong demand for Rambler bottles, the introductions of our new Yonder bottles, Rambler straw lid mugs, our new beverage bucket, and new seasonal colorways.

•Coolers & Equipment sales decreased 19% to $156.6 million, compared to $193.4 million in the same period last year, and include a $24.5 million unfavorable impact related to the recall reserve adjustment. Excluding the unfavorable impact of the recall reserve adjustment, Coolers & Equipment adjusted sales decreased 6% to $181.1 million. This decrease was primarily due to the stop sale of the products affected by the recalls. These impacts were partially offset by strong performance in hard coolers, our soft coolers that were not impacted by the recalls, and cargo.

Gross profit decreased 2% to $214.8 million, or 53.4% of sales, compared to $219.1 million, or 52.2% of sales, in the second quarter of 2022. Gross profit included a $19.4 million, or 150 basis points, unfavorable impact related to the recall reserve adjustment. Gross profit was positively impacted by lower inbound freight and lower product costs, partially offset by other costs, including higher customization costs and the unfavorable impact of foreign currency exchange rates.

Adjusted gross profit, which excludes the unfavorable impact related to the recall reserve adjustment, increased $15.2 million to $234.3 million, or 54.9% of adjusted sales, compared to $219.1 million, or 52.2% of adjusted sales, in the second quarter of 2022.

Selling, general, and administrative (“SG&A”) expenses increased 9% to $164.5 million, compared to $150.8 million in the second quarter of 2022. SG&A expenses included a $10.7 million favorable impact related to the recall reserve adjustment. As a percentage of sales, SG&A expenses increased 500 basis points to 40.9% from 35.9% in the prior year period. This increase was primarily due to higher non-variable expenses driven by higher employee costs, including incentive compensation and investments in headcount to support future growth, marketing expenses, and warehousing costs. Variable expenses increased primarily due to the increased mix of our growing Amazon Marketplace business.

Adjusted SG&A expenses, which exclude certain items including the unfavorable impact related to the recall reserve adjustment, increased 15% to $167.2 million, compared to $145.3 million in the second quarter of 2022. As a percentage of adjusted sales, adjusted SG&A expenses increased 450 basis points to 39.1% from 34.6% in the prior year period.

Operating income decreased 26% to $50.3 million, or 12.5% of sales, compared to $68.3 million, or 16.3% of sales during the prior year quarter, and includes an $8.7 million unfavorable impact primarily from the recall reserve adjustment.

Adjusted operating income decreased 9% to $67.1 million, or 15.7% of adjusted sales, compared to $73.8 million, or 17.6% of adjusted sales during the same period last year.

Net income, which includes the unfavorable impact from the recall reserve adjustment, decreased 18% to $38.1 million, or 9.5% of sales, compared to $46.3 million, or 11.0% of sales in the prior year quarter; Net income per diluted share decreased 17% to $0.44, compared to $0.53 in the prior year quarter.

Adjusted net income decreased 9% to $49.8 million, or 11.7% of adjusted sales, compared to $54.8 million, or 13.0% of adjusted sales in the prior year quarter; Adjusted net income per diluted share decreased 10% to $0.57, compared to $0.63 per diluted share in the prior year quarter.

Six Months Results

Sales decreased 1% to $705.4 million, compared to $713.7 million in the prior year. Sales were unfavorably impacted by $24.5 million due to a recall reserve adjustment. See “Product Recall Updates” below for additional information on the impact of the recalls referenced throughout this press release.

Adjusted sales, which exclude the unfavorable impact of the recall reserve adjustment, increased 2% to $729.9 million.

Sales and adjusted net sales for the first half of 2023 include $12.5 million of sales related to gift card redemptions in connection with recall remedies. Our 2023 sales have also been materially adversely impacted by the stop sale of the soft coolers included in the recalls initiated during the first quarter of 2023.

•DTC channel sales increased 3% to $393.4 million, compared to $380.8 million in the prior year period, due to growth in both Drinkware and Coolers & Equipment, partially offset by an $8.1 million unfavorable impact related to the recall reserve adjustment. Excluding the impact of the recall reserve adjustment, DTC channel adjusted sales increased 5% to $401.5 million.

•Wholesale channel sales decreased 6% to $312.0 million, compared to $332.9 million in the same period last year, and include a $16.4 million unfavorable impact related to the recall reserve adjustment. Excluding the unfavorable impact of the recall reserve adjustment, wholesale channel adjusted sales decreased 1% to $328.4 million. This decrease was primarily driven by a decline in Coolers & Equipment due to the stop sale of the products affected by the recalls, partially offset by Drinkware growth.

•Drinkware sales increased 6% to $423.7 million, compared to $400.1 million in the prior year period, reflecting strong demand for Rambler bottles, the introductions of our new Yonder bottles, Rambler straw lid mugs, our new beverage bucket, and new seasonal colorways.

•Coolers & Equipment sales decreased 12% to $261.0 million, compared to $296.4 million in the same period last year, and include a $24.5 million unfavorable impact related to the recall reserve adjustment. Excluding the unfavorable impact of the recall reserve adjustment, Coolers & Equipment adjusted sales decreased 4% to $285.5 million. This decrease was primarily due to the stop sale of the products affected by the recalls. These impacts were partially offset by strong performance in hard coolers, our soft coolers that were not impacted by the recalls, cargo, and bags.

Gross profit increased 1% to $376.7 million, or 53.4% of sales, compared to $374.0 million, or 52.4% of sales in the prior year. Gross profit included an $18.2 million, or 70 basis points, unfavorable impact primarily related to the recall reserve adjustment. Gross profit was positively impacted by lower inbound freight and lower product costs, partially offset by other costs, including higher customization costs and the unfavorable impact of foreign currency exchange rates.

Adjusted gross profit, which excludes the unfavorable impact primarily related to the recall reserve adjustment, increased $21.0 million to $394.9 million, or 54.1% of adjusted sales, compared to $374.0 million, or 52.4% of adjusted sales, in the prior year.

SG&A expenses increased 14% to $311.3 million, compared to $272.3 million in the prior year. SG&A expenses included a $10.5 million favorable impact primarily related to the recall reserve adjustment. As a percentage of sales, SG&A expenses increased 590 basis points to 44.1% from 38.2% in the prior year period. This increase was primarily due to higher non-variable expenses driven by higher employee costs, including incentive compensation and investments in headcount to support future growth, warehousing costs, and marketing expenses. Variable expenses increased primarily due to the increased mix of our growing Amazon Marketplace business.

Adjusted SG&A expenses, which exclude certain items including the unfavorable impact related to the recall reserve adjustment, increased 17% to $306.1 million, compared to $262.1 million in the prior year. As a percentage of adjusted sales, adjusted SG&A expenses increased 520 basis points to 41.9% from 36.7% in the prior year period.

Operating income decreased 36% to $65.4 million, or 9.3% of sales, compared to $101.6 million, or 14.2% of sales during the prior year, and includes a $7.7 million unfavorable impact primarily from the recall reserve adjustment.

Adjusted operating income decreased 21% to $88.8 million, or 12.2% of adjusted sales, compared to $111.9 million, or 15.7% of adjusted sales during the same period last year.

Net income, which includes the unfavorable impact from the recall reserve adjustment, decreased 32% to $48.6 million, or 6.9% of sales, compared to $71.9 million, or 10.1% of sales in the prior year; Net income per diluted share decreased 32% to $0.56, compared to $0.82 per diluted share in the prior year.

Adjusted net income decreased 22% to $65.3 million, or 8.9% of adjusted sales, compared to $83.3 million, or 11.7% of adjusted sales in the prior year period; Adjusted net income per diluted share decreased 21% to $0.75, compared to $0.95 per diluted share in the same period last year.

Balance Sheet and Other Highlights

Cash increased to $223.1 million, compared to $92.0 million at the end of the second quarter of 2022.

Inventory decreased 34% to $322.0 million, compared to $490.0 million at the end of the prior year quarter. On a sequential basis, inventory decreased $25.0 million, making this the fourth consecutive quarter with a sequential decline in our inventory balance.

Total debt, excluding finance leases and unamortized deferred financing fees, was $84.4 million, compared to $101.3 million at the end of the second quarter of 2022. During the first quarter of 2023, we made mandatory debt payments of $5.6 million. During the second quarter of 2023, we amended our credit facility to, among other matters, extend its maturity to June 2028, increase the revolving credit facility from $150.0 million to $300.0 million and refinance the term loan.

Product Recall Updates

As previously disclosed, in February 2023 we proposed a voluntary recall of our Hopper® M30 Soft Cooler, Hopper® M20 Soft Backpack Cooler, and SideKick Dry gear case (the “affected products”). As a result, we established reserves for unsalable inventory on-hand and estimated product recall expenses as of December 31, 2022.

In March 2023, we initiated voluntary recalls of the affected products. During the second quarter of 2023, we began processing recall returns and claims, and based on such experience and trends, we reevaluated our assumptions and adjusted our estimated recall expense reserve. These trends included higher than anticipated elections to receive gift cards in lieu of product replacement remedies, variations in individual product participation rates, and lower logistics costs than previously estimated. As a result, we updated our prior recall reserve assumptions, which increased the estimated recall expense reserve by $8.5 million. However, the overall consumer recall participation rate has remained consistent with our expectations.

During the first half of 2023, we recorded the following impacts as a result of the recall reserve adjustment and other incurred costs. These impacts are excluded from our non-GAAP results:

•Sales - a reduction to sales for higher estimated future recall remedies (i.e., estimated gift card elections) of $24.5 million for the three and six months ended July 1, 2023, of which $8.1 million and $16.4 million was allocated to our DTC and wholesale channels, respectively. These amounts were allocated based on the historical channel sell-in basis of the affected products;

•Cost of goods sold - a benefit of $5.1 million and $5.0 million primarily related to lower estimated costs of future product replacement remedy elections and logistics costs for the three and six months ended July 1, 2023, respectively, and a $1.3 million favorable impact from an inventory reserve adjustment for the six months ended July 1, 2023; and

•SG&A - a benefit of $10.7 million and $10.5 million primarily related to lower estimated other recall-related costs, including logistics costs, for the three and six months ended July 1, 2023, respectively.

In addition, our sales have also been materially adversely impacted by the stop sale of the affected products initiated during the first quarter of 2023. We have developed solutions to address the potential safety concern of the affected products and intend to re-introduce and sell the redesigned products to consumers in the fourth quarter of 2023.

Updated 2023 Outlook

Mr. Reintjes concluded, “We have narrowed our full year sales outlook to the higher end of our prior range inclusive of the favorable impact of recall-related gift card redemptions during the second quarter. This outlook includes an expected return to double-digit growth in the fourth quarter supported by the reintroduction and expansion of the products impacted by the recall and our continued success driving demand in newer product families and line extensions. We have also increased our gross margin outlook for the year driven by our first half performance, supporting an increase in our bottom-line outlook. And finally, we remain disciplined in our capital allocation approach as our cash generation continues to strengthen our balance sheet.”

For 2023, YETI expects:

•Adjusted sales to increase between 4% and 5% (versus the previous outlook of between 3% and 5%) with adjusted sales growth weighted to the second half of the year. Expected adjusted sales are inclusive of an approximate 500 basis points unfavorable impact on our growth rate from the stop sale of the products affected by the recalls. Expected adjusted sales also include $12.5 million of sales from recall-related gift card redemptions in the second quarter of 2023;

•Adjusted operating income as a percentage of adjusted sales between 15.5% and 16.0% (versus the previous outlook of between 15.0% and 15.5%). The benefit from the adjusted gross margin expansion is expected to be more than offset by the deleverage from increases in adjusted SG&A expenses due to strategic investments and the unfavorable topline impact from the stop sale of the products affected by the recalls;

•An effective tax rate of approximately 25.1% (versus the previous outlook of 24.9%; compared to 22.8% in the prior year period);

•Adjusted net income per diluted share between $2.23 and $2.32 (versus the previous outlook of between $2.12 and $2.23), reflecting a 2% to 6% decrease, with earnings growth beginning in the fourth quarter of the year;

•Diluted weighted average shares outstanding of approximately 87.3 million (versus the previous outlook of 87.2 million); and

•Capital expenditures of approximately $60 million primarily to support investments in technology and new product innovation and launches.

Conference Call Details

A conference call to discuss the second quarter of 2023 financial results is scheduled for today, August 10, 2023, at 8:00 a.m. Eastern Time. Investors and analysts interested in participating in the call are invited to dial 833-816-1399 (international callers, please dial 412-317-0492) approximately 10 minutes prior to the start of the call. A live audio webcast of the conference call will be available online at http://investors.yeti.com. A replay will be available through August 24, 2023 by dialing 844-512-2921 (international callers, 412-317-6671). The accompanying access code for this call is 10180639.

About YETI Holdings, Inc.

Headquartered in Austin, Texas, YETI is a global designer, retailer, and distributor of innovative outdoor products. From coolers and drinkware to bags and apparel, YETI products are built to meet the unique and varying needs of diverse outdoor pursuits, whether in the remote wilderness, at the beach, or anywhere life takes you. By consistently delivering high-performing, exceptional products, we have built a strong following of brand loyalists throughout the world, ranging from serious outdoor enthusiasts to individuals who simply value products of uncompromising quality and design. We have an unwavering commitment to outdoor and recreation communities, and we are relentless in our pursuit of building superior products for people to confidently enjoy life outdoors and beyond. For more information, please visit www.YETI.com.

Non-GAAP Financial Measures

In addition to our results determined in accordance with GAAP, we supplement our results with non-GAAP financial measures, including adjusted net sales, adjusted gross profit, adjusted SG&A expenses, adjusted operating income, adjusted net income, adjusted net income per diluted share as well as adjusted gross profit and adjusted SG&A expenses, adjusted operating income and adjusted net income as a percentage of adjusted net sales. Our management uses these non-GAAP financial measures in conjunction with GAAP financial measures to measure our profitability and to evaluate our financial performance. We believe that these non-GAAP financial measures provide meaningful supplemental information regarding the underlying operating performance of our business and are appropriate to enhance an overall understanding of our financial performance. These non-GAAP financial measures have limitations as analytical tools in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP. Because of these limitations, these non-GAAP financial measures should be considered along with GAAP financial performance measures. The presentation of these non-GAAP financial measures is not intended to be considered in isolation or as a substitute for, or superior to, financial information prepared and presented in accordance with GAAP. Investors are encouraged to review the reconciliation of these non-GAAP financial measures to their most directly comparable GAAP financial measures. A reconciliation of the non-GAAP financial measures to such GAAP measures can be found below.

YETI does not provide a reconciliation of forward-looking non-GAAP to GAAP financial measures because such reconciliations are not available without unreasonable efforts. This is due to the inherent difficulty in forecasting with reasonable certainty certain amounts that are necessary for such reconciliation, including in particular the impact of the voluntary recalls and realized and unrealized foreign currency gains and losses reported within other expense. For the same reasons, we are unable to forecast with reasonable certainty all deductions and additions needed in order to provide a forward-looking GAAP financial measures at this time. The amount of these deductions and additions may be material and, therefore, could result in forward-looking GAAP financial measures being materially different or less than forward-looking non-GAAP financial measures. See “Forward-looking statements” below.

Forward-looking statements

This press release contains ‘‘forward-looking statements’’ within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical or current fact included in this press release are forward-looking statements. Forward-looking statements include statements containing words such as “anticipate,” “assume,” “believe,” “can have,” “contemplate,” “continue,” “could,” “design,” “due,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “likely,” “may,” “might,” “objective,” “plan,” “predict,” “project,” “potential,” “seek,” “should,” “target,” “will,” “would,” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operational performance or other events. For example, all statements made relating to our future expectations relating to our voluntary recalls, demand and market conditions, pricing conditions, expected sales, gross margin, operating expense and cash flow levels, and our expectations for opportunity, growth, and new products, including those set forth in the quotes from YETI’s President and CEO, and the 2023 financial outlook provided herein, constitute forward-looking statements. All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that are expected and, therefore, you should not unduly rely on such statements. The risks and uncertainties that could cause actual results to differ materially from those expressed or implied by these forward-looking statements include but are not limited to: (i) economic conditions or consumer confidence in future economic conditions, including the ongoing conflict in Ukraine, and inflationary conditions resulting in rising prices; (ii) our ability to maintain and strengthen our brand and generate and maintain ongoing demand for our products; (iii) our ability to successfully design, develop and market new products; (iv) our ability to effectively manage our growth; (v) our ability to expand into additional consumer markets, and our success in doing so; (vi) the success of our international expansion plans; (vii) our ability to compete effectively in the outdoor and recreation market and protect our brand; (viii) the level of customer spending for our products, which is sensitive to general economic conditions and other factors; (ix) problems with, or loss of, our third-party contract manufacturers and suppliers, or an inability to obtain raw materials; (x) fluctuations in the cost and availability of raw materials, equipment, labor, and transportation and subsequent manufacturing delays or increased costs; (xi) our ability to accurately forecast demand for our products and our results of operations; (xii) our relationships with our national, regional, and independent retail partners, who account for a significant portion of our sales; (xiii) the impact of natural disasters and failures of our information technology on our operations and the operations of our manufacturing partners; (xiv) our ability to attract and retain skilled personnel and senior management, and to maintain the continued efforts of our management and key employees; and (xv) the impact of our indebtedness on our ability to invest in the ongoing needs of our business. For a more extensive list of factors that could materially affect our results, you should read our filings with the United States Securities and Exchange Commission (the “SEC”), including our Quarterly Report on Form 10-Q for the three months ended April 1, 2023, as such filings may be amended, supplemented or superseded from time to time by other reports YETI files with the SEC.

These forward-looking statements are made based upon detailed assumptions and reflect management’s current expectations and beliefs. While YETI believes that these assumptions underlying the forward-looking statements are reasonable, YETI cautions that it is very difficult to predict the impact of known factors, and it is impossible for YETI to anticipate all factors that could affect actual results.

The forward-looking statements included here are made only as of the date hereof. YETI undertakes no obligation to publicly update or revise any forward-looking statement as a result of new information, future events, or otherwise, except as required by law. Many of the foregoing risks and uncertainties may be exacerbated by the global business and economic environment, including the ongoing conflict in Ukraine.

Investor Relations Contact:

Tom Shaw, 512-271-6332

Investor.relations@yeti.com

Media Contact:

YETI Holdings, Inc. Media Hotline

Media@yeti.com

* * * * *

YETI HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(In thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| July 1,

2023 | | July 2,

2022 | | July 1,

2023 | | July 2,

2022 |

| Net sales | $ | 402,563 | | | $ | 420,042 | | | $ | 705,359 | | | $ | 713,670 | |

| Cost of goods sold | 187,725 | | | 200,943 | | | 328,651 | | | 339,711 | |

| Gross profit | 214,838 | | | 219,099 | | | 376,708 | | | 373,959 | |

| Selling, general, and administrative expenses | 164,507 | | | 150,753 | | | 311,279 | | | 272,323 | |

| Operating income | 50,331 | | | 68,346 | | | 65,429 | | | 101,636 | |

| Interest expense, net | (731) | | | (960) | | | (1,325) | | | (1,726) | |

| Other income (expense) | 1,244 | | | (5,823) | | | 1,250 | | | (4,921) | |

| Income before income taxes | 50,844 | | | 61,563 | | | 65,354 | | | 94,989 | |

| Income tax expense | (12,773) | | | (15,311) | | | (16,719) | | | (23,078) | |

| Net income | $ | 38,071 | | | $ | 46,252 | | | $ | 48,635 | | | $ | 71,911 | |

| | | | | | | |

| Net income per share | | | | | | | |

| Basic | $ | 0.44 | | | $ | 0.54 | | | $ | 0.56 | | | $ | 0.83 | |

| Diluted | $ | 0.44 | | | $ | 0.53 | | | $ | 0.56 | | | $ | 0.82 | |

| | | | | | | |

| Weighted-average common shares outstanding | | | | | | | |

| Basic | 86,677 | | | 86,165 | | | 86,603 | | | 86,766 | |

| Diluted | 87,196 | | | 86,860 | | | 87,141 | | | 87,542 | |

YETI HOLDINGS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In thousands, except per share amounts)

| | | | | | | | | | | | | | | | | |

| July 1,

2023 | | December 31,

2022 | | July 2,

2022 |

| ASSETS | | | | | |

| Current assets | | | | | |

| Cash | $ | 223,136 | | | $ | 234,741 | | | $ | 91,994 | |

| Accounts receivable, net | 131,599 | | | 79,446 | | | 94,251 | |

| Inventory | 321,955 | | | 371,412 | | | 490,013 | |

| Prepaid expenses and other current assets | 45,234 | | | 33,321 | | | 40,767 | |

| Total current assets | 721,924 | | | 718,920 | | | 717,025 | |

| | | | | |

| Property and equipment, net | 131,809 | | | 124,587 | | | 127,309 | |

| Operating lease right-of-use assets | 57,659 | | | 55,406 | | | 56,460 | |

| Goodwill | 54,293 | | | 54,293 | | | 54,293 | |

| Intangible assets, net | 110,929 | | | 99,429 | | | 97,757 | |

| | | | | |

| Other assets | 8,825 | | | 24,130 | | | 2,514 | |

| Total assets | $ | 1,085,439 | | | $ | 1,076,765 | | | $ | 1,055,358 | |

| | | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | | |

| Current liabilities | | | | | |

| Accounts payable | $ | 143,435 | | | $ | 140,818 | | | $ | 204,091 | |

| Accrued expenses and other current liabilities | 162,170 | | | 211,399 | | | 129,923 | |

| Taxes payable | 6,199 | | | 15,289 | | | 17,038 | |

| Accrued payroll and related costs | 15,170 | | | 4,847 | | | 4,275 | |

| Operating lease liabilities | 11,775 | | | 12,076 | | | 11,494 | |

| Current maturities of long-term debt | 6,167 | | | 24,611 | | | 24,587 | |

| Total current liabilities | 344,916 | | | 409,040 | | | 391,408 | |

| | | | | |

| Long-term debt, net of current portion | 81,106 | | | 71,741 | | | 83,575 | |

| Operating lease liabilities, non-current | 57,269 | | | 55,649 | | | 56,269 | |

| Other liabilities | 14,942 | | | 13,858 | | | 24,245 | |

| Total liabilities | 498,233 | | | 550,288 | | | 555,497 | |

| | | | | |

| Commitments and contingencies | | | | | |

| | | | | |

| Stockholders’ Equity | | | | | |

| Common stock | 884 | | | 881 | | | 878 | |

| Treasury stock, at cost | (100,025) | | | (100,025) | | | (100,025) | |

| | | | | |

| Additional paid-in capital | 371,348 | | | 357,490 | | | 346,675 | |

| Retained earnings | 317,186 | | | 268,551 | | | 250,769 | |

| Accumulated other comprehensive (loss) income | (2,187) | | | (420) | | | 1,564 | |

| Total stockholders’ equity | 587,206 | | | 526,477 | | | 499,861 | |

| Total liabilities and stockholders’ equity | $ | 1,085,439 | | | $ | 1,076,765 | | | $ | 1,055,358 | |

YETI HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands, except per share amounts)

| | | | | | | | | | | |

| Six Months Ended |

| July 1,

2023 | | July 2,

2022 |

| Cash Flows from Operating Activities: | | | |

| Net income | $ | 48,635 | | | $ | 71,911 | |

| Adjustments to reconcile net income to cash provided by (used in) operating activities: | | | |

| Depreciation and amortization | 23,197 | | | 18,489 | |

| Amortization of deferred financing fees | 276 | | | 310 | |

| Stock-based compensation | 14,113 | | | 10,221 | |

| Deferred income taxes | 15,309 | | | 344 | |

| | | |

| Loss on modification and extinguishment of debt | 330 | | | — | |

| Product recalls | 8,538 | | | — | |

| Other | (2,792) | | | 3,723 | |

| | | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | (51,941) | | | 15,542 | |

| Inventory | 48,830 | | | (174,289) | |

| Other current assets | (11,468) | | | (10,260) | |

| Accounts payable and accrued expenses | (54,109) | | | (13,100) | |

| Taxes payable | (9,112) | | | 2,544 | |

| Other | (1,025) | | | 1 | |

| Net cash provided by (used in) operating activities | 28,781 | | | (74,564) | |

| Cash Flows from Investing Activities: | | | |

| Purchases of property and equipment | (25,068) | | | (26,022) | |

| Additions of intangibles, net | (6,849) | | | (5,803) | |

| | | |

| Net cash used in investing activities | (31,917) | | | (31,825) | |

| Cash Flows from Financing Activities: | | | |

| Repayments of long-term debt | (5,625) | | | (11,250) | |

| | | |

| Payments of deferred financing fees | (2,824) | | | — | |

| Taxes paid in connection with employee stock transactions | (1,825) | | | (1,280) | |

| Proceeds from employee stock transactions | 1,573 | | | — | |

| Finance lease principal payment | (1,236) | | | (1,212) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Repurchase of common stock | — | | | (100,025) | |

| | | |

| | | |

| Net cash used in financing activities | (9,937) | | | (113,767) | |

| Effect of exchange rate changes on cash | 1,468 | | | (39) | |

| Net decrease in cash | (11,605) | | | (220,195) | |

| Cash, beginning of period | 234,741 | | | 312,189 | |

| Cash, end of period | $ | 223,136 | | | $ | 91,994 | |

YETI HOLDINGS, INC.

Supplemental Financial Information

Reconciliation of GAAP to Non-GAAP Financial Information

(Unaudited) (In thousands except per share amounts) | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| July 1,

2023 | | July 2,

2022 | | July 1,

2023 | | July 2,

2022 |

| Net sales | $ | 402,563 | | $ | 420,042 | | $ | 705,359 | | $ | 713,670 |

Product recall(1) | 24,490 | | — | | | 24,506 | | — |

| Adjusted net sales | $ | 427,053 | | $ | 420,042 | | $ | 729,865 | | $ | 713,670 |

| | | | | | | |

| Gross profit | $ | 214,838 | | $ | 219,099 | | $ | 376,708 | | $ | 373,959 |

Product recall(1) | 19,438 | | — | | | 18,201 | | — | |

| Adjusted gross profit | $ | 234,276 | | $ | 219,099 | | $ | 394,909 | | $ | 373,959 |

| | | | | | | |

| Selling, general, and administrative expenses | $ | 164,507 | | $ | 150,753 | | $ | 311,279 | | $ | 272,323 |

Non-cash stock-based compensation expense(2) | (7,338) | | (5,467) | | (14,113) | | (10,221) |

| | | | | | | |

| | | | | | | |

Product recall(1) | 10,716 | | — | | 10,549 | | — |

Organizational realignment costs(3) | (702) | | — | | (1,582) | | — |

| Adjusted selling, general, and administrative expenses | $ | 167,183 | | $ | 145,286 | | $ | 306,133 | | $ | 262,102 |

| | | | | | | |

| Gross margin | 53.4 | % | | 52.2 | % | | 53.4 | % | | 52.4 | % |

| Adjusted gross margin | 54.9 | % | | 52.2 | % | | 54.1 | % | | 52.4 | % |

| SG&A expenses as a % of net sales | 40.9 | % | | 35.9 | % | | 44.1 | % | | 38.2 | % |

| Adjusted SG&A expenses as a % of adjusted net sales | 39.1 | % | | 34.6 | % | | 41.9 | % | | 36.7 | % |

_________________________

(1)Represents adjustments and charges associated with recalls. These include a reduction to sales for higher estimated future recall remedies (i.e., estimated gift card elections) of $24.5 million for the three and six months ended July 1, 2023; a benefit of $5.1 million and $5.0 million primarily related to lower estimated costs of future product replacement remedy elections and logistics costs for the three and six months ended July 1, 2023, respectively, and a $1.3 million favorable impact from an inventory reserve adjustment for the six months ended July 1, 2023; and a benefit of $10.7 million and $10.5 million primarily related to lower estimated other recall-related costs, including logistics costs, for the three and six months ended July 1, 2023, respectively.

(2)These costs are reported in SG&A expenses.

(3)Represents employee severance costs in connection with strategic organizational realignments.

YETI HOLDINGS, INC.

Supplemental Financial Information

Reconciliation of GAAP to Non-GAAP Financial Information

(Unaudited) (In thousands except per share amounts) | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| July 1,

2023 | | July 2,

2022 | | July 1,

2023 | | July 2,

2022 |

| Operating income | $ | 50,331 | | $ | 68,346 | | $ | 65,429 | | $ | 101,636 |

| Adjustments: | | | | | | | |

Non-cash stock-based compensation expense(1) | 7,338 | | 5,467 | | 14,113 | | 10,221 |

| | | | | | | |

Product recalls(2) | 8,722 | | — | | | 7,652 | | — | |

Organizational realignment costs(3) | 702 | | | — | | | 1,582 | | | — | |

| | | | | | | |

| Adjusted operating income | $ | 67,093 | | $ | 73,813 | | $ | 88,776 | | $ | 111,857 |

| | | | | | | |

| Net income | $ | 38,071 | | $ | 46,252 | | $ | 48,635 | | $ | 71,911 |

| Adjustments: | | | | | | | |

Non-cash stock-based compensation expense(1) | 7,338 | | 5,467 | | 14,113 | | 10,221 |

| | | | | | | |

Product recalls(2) | 8,722 | | — | | 7,652 | | — |

Organizational realignment costs(3) | 702 | | — | | 1,582 | | — |

| | | | | | | |

Other income(4) | (1,245) | | 5,823 | | (1,251) | | 4,921 |

Tax impact of adjusting items(5) | (3,802) | | (2,766) | | (5,414) | | (3,710) |

| Adjusted net income | $ | 49,786 | | $ | 54,776 | | $ | 65,317 | | $ | 83,343 |

| | | | | | | |

| Net sales | $ | 402,563 | | $ | 420,042 | | $ | 705,359 | | $ | 713,670 |

| Adjusted net sales | $ | 427,053 | | $ | 420,042 | | $ | 729,865 | | $ | 713,670 |

| | | | | | | |

| Operating income as a % of net sales | 12.5 | % | | 16.3 | % | | 9.3 | % | | 14.2 | % |

| Adjusted operating income as a % of net sales | 15.7 | % | | 17.6 | % | | 12.2 | % | | 15.7 | % |

| | | | | | | |

| Net income as a % of net sales | 9.5 | % | | 11.0 | % | | 6.9 | % | | 10.1 | % |

| Adjusted net income as a % of net sales | 11.7 | % | | 13.0 | % | | 8.9 | % | | 11.7 | % |

| | | | | | | |

| Net income per diluted share | $ | 0.44 | | $ | 0.53 | | $ | 0.56 | | $ | 0.82 |

| Adjusted net income per diluted share | $ | 0.57 | | $ | 0.63 | | $ | 0.75 | | $ | 0.95 |

| | | | | | | |

| Weighted average common shares outstanding - diluted | 87,196 | | 86,860 | | 87,141 | | 87,542 |

_________________________

(1)These costs are reported in SG&A expenses.

(2)Represents adjustments and charges associated with recalls. These include a reduction to sales for higher estimated future recall remedies (i.e., estimated gift card elections) of $24.5 million for the three and six months ended July 1, 2023; a benefit of $5.1 million and $5.0 million primarily related to lower estimated costs of future product replacement remedy elections and logistics costs for the three and six months ended July 1, 2023, respectively, and a $1.3 million favorable impact from an inventory reserve adjustment for the six months ended July 1, 2023; and a benefit of $10.7 million and $10.5 million primarily related to lower estimated other recall-related costs, including logistics costs, for the three and six months ended July 1, 2023, respectively.

(3)Represents employee severance costs in connection with strategic organizational realignments.

(4)Other income substantially consists of realized and unrealized foreign currency gains and losses on intercompany balances that arise in the ordinary course of business. For the three and six months ended July 1, 2023, other income includes the loss on modification and extinguishment of debt of $0.3 million related to the amendment of our credit facility in the second quarter of 2023.

(5)Represents the tax impact of adjustments calculated at an expected statutory tax rate of 24.5% for each of the three and six months ended July 1, 2023 and July 2, 2022.

YETI HOLDINGS, INC.

Supplemental Financial Information

Reconciliation of GAAP to Non-GAAP Financial Measures

(Unaudited) (In thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended July 1, 2023 | | Three Months Ended July 2, 2022 | |

| Net Sales | | Product Recalls(1) | | Adjusted Net Sales | | Net Sales | | Product Recalls(1) | | Adjusted Net Sales | |

| Channel | | | | | | | | | | | | |

| Wholesale | $ | 176,175 | | | $ | 16,358 | | | $ | 192,533 | | | $ | 195,195 | | | $ | — | | | $ | 195,195 | | |

| Direct-to-consumer | 226,388 | | | 8,132 | | | 234,520 | | | 224,847 | | | — | | | 224,847 | | |

| Total | $ | 402,563 | | | $ | 24,490 | | | $ | 427,053 | | | $ | 420,042 | | | $ | — | | | $ | 420,042 | | |

| | | | | | | | | | | | |

| Category | | | | | | | | | | | | |

| Coolers & Equipment | $ | 156,610 | | | $ | 24,490 | | | $ | 181,100 | | | $ | 193,415 | | | $ | — | | | $ | 193,415 | | |

| Drinkware | 233,417 | | | — | | | 233,417 | | | 216,070 | | | — | | | 216,070 | | |

| Other | 12,536 | | | — | | | 12,536 | | | 10,557 | | | — | | | 10,557 | | |

| Total | $ | 402,563 | | | $ | 24,490 | | | $ | 427,053 | | | $ | 420,042 | | | $ | — | | | $ | 420,042 | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Six Months Ended July 1, 2023 | | Six Months Ended July 2, 2022 | |

| Net Sales | | Product Recalls(1) | | Adjusted Net Sales | | Net Sales | | Product Recalls(1) | | Adjusted Net Sales | |

| Channel | | | | | | | | | | | | |

| Wholesale | $ | 312,004 | | | $ | 16,374 | | | $ | 328,378 | | | $ | 332,861 | | | $ | — | | | $ | 332,861 | | |

| Direct-to-consumer | 393,355 | | | 8,132 | | | 401,487 | | | 380,809 | | | — | | | 380,809 | | |

| Total | $ | 705,359 | | | $ | 24,506 | | | $ | 729,865 | | | $ | 713,670 | | | $ | — | | | $ | 713,670 | | |

| | | | | | | | | | | | |

| Category | | | | | | | | | | | | |

| Coolers & Equipment | $ | 260,964 | | | $ | 24,506 | | | $ | 285,470 | | | $ | 296,373 | | | $ | — | | | $ | 296,373 | | |

| Drinkware | 423,704 | | | — | | | 423,704 | | | 400,068 | | | — | | | 400,068 | | |

| Other | 20,691 | | | — | | | 20,691 | | | 17,229 | | | — | | | 17,229 | | |

| Total | $ | 705,359 | | | $ | 24,506 | | | $ | 729,865 | | | $ | 713,670 | | | $ | — | | | $ | 713,670 | | |

_________________________

(1)Represents adjustments and charges associated with recalls. These include a reduction to sales for higher estimated future recall remedies (i.e., estimated gift card elections) of $24.5 million for the three and six months ended July 1, 2023, of which $8.1 million and $16.4 million was allocated to our DTC and wholesale channels, respectively. These amounts were allocated based on the historical channel sell-in basis of the products affected by the recalls

YETI HOLDINGS, INC.

2023 Outlook

(Unaudited) (In thousands except per share amounts)

| | | | | | | | | | | | | | | | | |

| | | | | |

| 2022 | | Updated 2023 Outlook |

| | | Low | | High |

| Adjusted net sales | $ | 1,633,637 | | $ | 1,698,983 | | $ | 1,715,319 |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Adjusted operating income | $ | 274,297 | | $ | 263,342 | | $ | 274,451 |

| Adjusted operating income as a % of net sales | 16.8 | % | | 15.5 | % | | 16.0 | % |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Adjusted net income | $ | 205,702 | | $ | 194,472 | | $ | 202,793 |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Adjusted net income as a % of net sales | 12.6 | % | | 11.4 | % | | 11.8 | % |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Adjusted net income per diluted share | $ | 2.36 | | | $ | 2.23 | | | $ | 2.32 | |

| Weighted average common shares outstanding - diluted | 87,195 | | | 87,337 | | | 87,337 | |

YETI HOLDINGS, INC.

Supplemental Financial Information

Reconciliation of GAAP to Non-GAAP Financial Information

(Unaudited) (In thousands)

| | | | | |

| Twelve Months Ended |

| December 31,

2022 |

| Net sales | $ | 1,595,222 |

Product recall(1) | 38,415 |

| Adjusted net sales | $ | 1,633,637 |

| |

| Operating income | $ | 126,361 |

| Adjustments: | |

Non-cash stock-based compensation expense(2) | 17,799 |

Long-lived asset impairment(2) | 1,229 |

| |

| |

| |

Product recalls(1) | 128,908 |

| |

| |

| Adjusted operating income | $ | 274,297 |

| |

| Net income | $ | 89,693 |

| Adjustments: | |

Non-cash stock-based compensation expense(2) | 17,799 |

| |

Long-lived asset impairment(2) | 1,229 |

Product recalls(1) | 128,908 |

| |

Other expense(3) | 5,718 |

| |

| |

| |

Tax impact of adjusting items(4) | (37,645) |

| Adjusted net income | $ | 205,702 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | |

| |

| |

| |

| Operating income as a % of net sales | 7.9 | % |

| Adjusted operating income as a % of net sales | 16.8 | % |

| | |

| Net income as a % of net sales | 5.6 | % |

| Adjusted net income as a % of net sales | 12.6 | % |

| |

| | |

| Net income per diluted share | $ | 1.03 |

| Adjusted net income per diluted share | $ | 2.36 |

| | |

| Weighted average common shares outstanding - diluted | 87,195 |

_________________________

(1)Represents adjustments and charges associated with the proposed voluntary recalls. These include a reduction to net sales for estimated future product returns and recall remedies of $38.4 million; recorded costs in cost of goods sold primarily related to inventory write-offs for unsalable inventory on-hand and estimated costs of future product replacement remedies and logistics costs of $58.6 million; and operating expenses of $31.9 million associated with estimated other recall-related costs.

(2)These costs are reported in SG&A expenses.

(3)Other (income) expense substantially consists of realized and unrealized foreign currency gains and losses on intercompany balances that arise in the ordinary course of business.

(4)Represents the tax impact of adjustments calculated at an expected statutory tax rate of 24.5%.

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

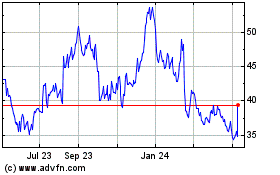

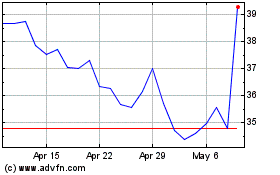

YETI (NYSE:YETI)

Historical Stock Chart

From Apr 2024 to May 2024

YETI (NYSE:YETI)

Historical Stock Chart

From May 2023 to May 2024