false000087952600008795262023-07-262023-07-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) July 26, 2023

WABASH NATIONAL CORPORATION

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | |

| Delaware | 001-10883 | 52-1375208 |

(State or other jurisdiction

of Incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

| | | | | | | | | | | |

| 3900 McCarty Lane | | |

| Lafayette | Indiana | | 47905 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (765) 771-5310

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock, $0.01 par value | | WNC | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On July 26, 2023, Wabash National Corporation (the “Company”) issued a press release announcing its financial results for the quarter ended June 30, 2023. A copy of the Company’s press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference. The press release and a teleconference visual presentation are also available on the Company's Investor Relations website at ir.wabashnational.com.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits.

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | | Description |

| | | |

| | |

| 104 | | Cover Page Interactive Data File (the Cover Page Interactive Data File is embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | WABASH NATIONAL CORPORATION |

| | | |

| Date: July 26, 2023 | By: | /s/ Michael N. Pettit |

| | | Michael N. Pettit |

| | | Senior Vice President and Chief Financial Officer |

Media Contact:

Dana Stelsel

Director, Communications

(765) 771-5766

dana.stelsel@onewabash.com

Investor Relations:

Ryan Reed

Sr Director, Corporate Development & Investor Relations

(765) 490-5664

ryan.reed@onewabash.com

Wabash Announces Second Quarter 2023 Results

▪Quarterly revenue of $686.6 million

▪Record operating income of $103 million with operating margin of 15.0% on strong material margin and favorable product mix

▪Record quarterly earnings per share of $1.54

▪Strong total backlog of $2.4B, sequential contraction in-line with normal seasonality

▪2023 EPS outlook increased to $4.45 midpoint

LAFAYETTE, Ind. – July 26, 2023 – Wabash (NYSE: WNC), the innovation leader of connected solutions for the transportation, logistics and distribution industries, today reported results for the quarter ended June 30, 2023.

The Company's net sales for the second quarter of 2023 reached $686.6 million, reflecting a 6.8% increase compared to the same quarter of the previous year. This growth was a function of the Company's continued execution to fulfill customer demand. The Company achieved consolidated gross profit of $151 million, equivalent to 22.0% of sales. Operating income amounted to $103 million, representing 15.0% of sales for the quarter. These results exceeded prior expectations, primarily due to the Company's strong material margin, favorable product mix, and strong results from parts and services, tanks, and truck bodies. Second quarter diluted earnings per share was $1.54, surpassing the Company's previous quarterly outlook range.

As of June 30, 2023, total Company backlog stood at approximately $2.4 billion, an increase of 5% compared to the second quarter of 2022. Backlog expected to be shipped within the following 12-months amounted to approximately $2.1 billion as of June 30, 2023.

“During the second quarter, Wabash accomplished another significant milestone with record quarterly EPS of $1.54," said Brent Yeagy, president and chief executive officer. “These financial results further reinforce our belief that Wabash's earnings power is structurally higher than previously anticipated. We have transformed the way our Company is perceived by customers, suppliers, and other stakeholders, while simultaneously reinvigorating organic growth. These are changes that will endure at any phase of the business cycle and we expect to continue to raise both the floor and ceiling of our earnings profile going forward.”

For the full-year ending December 31, 2023, the Company updated its revenue outlook to a range of $2.6 billion to $2.8 billion with a revenue midpoint of $2.7 billion. The Company increased its EPS guidance to a range of $4.25 to $4.65 with an EPS midpoint of $4.45.

“Our execution during the first half of this year already positions 2023 as our best year in terms of financial achievements and we expect our backlog to support a strong second half," explained Yeagy. "As we continue to track the challenging market conditions affecting our customers, we look forward to improvement in freight rates as capacity and demand align more favorably. We view the return to more normal seasonality during this year's peak season for freight as a potentially significant turning point. Our focus remains on serving our customers with agility and responsiveness, adapting to the evolving market dynamics as we progress toward a brighter long-term future."

Business Segment Highlights

The table below is a summary of select segment operating and financial results prior to the elimination of intersegment sales for the second quarter of 2023 and 2022. A complete disclosure of the results by individual segment is included in the tables following this release.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Wabash National Corporation | | | | | | | | |

| Three Months Ended June 30, | | 2023 | | 2022 | | | | | | | | |

| New Units Shipped | | | | | | | | | | | | |

| Trailers | | 11,825 | | 13,670 | | | | | | | | |

| Truck bodies | | 4,025 | | 3,950 | | | | | | | | |

| | | | | | | | | | | | |

| | | Transportation Solutions | | Parts & Services | | |

| Three Months Ended June 30, | | 2023 | | 2022 | | 2023 | | 2022 | | | | |

| | (Unaudited, dollars in thousands) |

| | | | | | | | | | | | |

| Net sales | | $ | 630,682 | | $ | 595,982 | | $ | 62,066 | | $ | 50,395 | | | | |

| Gross profit | | $ | 133,945 | | $ | 66,055 | | $ | 17,082 | | $ | 11,830 | | | | |

| Gross profit margin | | 21.2% | | 11.1% | | 27.5% | | 23.5% | | | | |

| Income from operations | | $ | 115,806 | | $ | 47,973 | | $ | 12,937 | | $ | 8,138 | | | | |

| Income from operations margin | | 18.4% | | 8.0% | | 20.8% | | 16.1% | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

During the second quarter, Transportation Solutions achieved net sales of $630.7 million, an increase of 5.8% compared to the same quarter of the previous year. Operating income for the quarter amounted to $115.8 million, representing 18.4% of sales.

Parts & Services' net sales for the second quarter reached $62.1 million, an increase of 23.2% compared to the prior year quarter as the segment continued to make notable strides along its path of strategic growth. Operating income for the quarter amounted to $12.9 million, or 20.8% of sales.

Non-GAAP Measures

In addition to disclosing financial results calculated in accordance with United States generally accepted accounting principles (GAAP), the financial information included in this release contains non-GAAP financial measures, including operating EBITDA, free cash flow, adjusted operating income and margin, adjusted net income attributable to common stockholders, adjusted diluted earnings per share, adjusted segment EBITDA, and adjusted segment EBITDA margin. These non-GAAP measures should not be considered a substitute for, or superior to, financial measures and results calculated in accordance with GAAP, including net income, and reconciliations to GAAP financial statements should be carefully evaluated.

Operating EBITDA includes noncontrolling interest and is defined as earnings before interest, taxes, depreciation, amortization, stock-based compensation, impairment and other, net, and other non-operating income and expense (including any loss on debt extinguishment charges). Management believes providing operating EBITDA is useful for investors to understand the Company’s performance and results of operations period to period with the exclusion of the items identified above. Management believes the presentation of operating EBITDA, when combined with the GAAP presentations of operating income and net income, is beneficial to an investor’s understanding of the Company’s operating performance. A reconciliation of operating EBITDA to net income, the most comparable GAAP financial measure, is included in the tables following this release.

Free cash flow is defined as net cash provided by (used in) operating activities minus cash payments for capital expenditures minus expenditures for revenue generating assets. Management believes providing free cash flow is useful for investors to understand the Company’s performance and results of cash generation period to period with the exclusion of the item identified above. Management believes the presentation of free cash flow, when combined with the GAAP presentations of cash provided by operating activities, is beneficial to an investor’s understanding of the Company’s operating performance. A reconciliation of free cash flow to cash used in operating activities, the most comparable GAAP financial measure, is included in the tables following this release.

Adjusted operating income and margin, non-GAAP financial measures, exclude certain costs, expenses, other charges, gains or income that are included in the determination of operating income under U.S. GAAP, but that management would not consider important in evaluating the quality of the Company’s operating results as they are not indicative of the Company’s core operating results or may obscure trends useful in evaluating the Company’s continuing activities. Accordingly, the Company presents adjusted operating income and margin excluding these special items to help investors evaluate our operating performance and trends in our business consistent with how management evaluates such performance and trends. Further, the Company presents adjusted operating income and margin to provide investors with a better understanding of the Company’s view of our results as compared to prior periods. Adjusted operating income margin is calculated by dividing adjusted operating income by total net sales. A reconciliation of adjusted operating income to operating income, the most comparable GAAP financial measure, is included in the tables following this release.

Adjusted net income attributable to common stockholders and adjusted diluted earnings per share reflect no adjustments for any period presented. Management believes providing adjusted measures and excluding certain items facilitates comparisons to the Company’s prior year periods and, when combined with the GAAP presentation of net income and diluted net income per share, is beneficial to an investor’s understanding of the Company’s performance. A reconciliation of adjusted net income attributable to common stockholders and adjusted diluted earnings per share to net income attributable to common stockholders and diluted earnings per share, the most comparable GAAP financial measures, are included in the tables following this release.

Adjusted segment EBITDA, a non-GAAP financial measure, includes noncontrolling interest and is calculated by adding back segment depreciation and amortization expense to segment operating income, and excludes certain costs, expenses, other charges, gains or income that are included in the determination of operating income under GAAP, but that management would not consider important in evaluating the quality of the Company’s segment operating results as they are not indicative of each segment's core operating results or may obscure trends useful in evaluating the segment's continuing activities. Adjusted segment EBITDA Margin is calculated by dividing Adjusted segment EBITDA by segment total net sales. A reconciliation of adjusted segment EBITDA to income from operations, the most comparable GAAP financial measure, is included in the tables following this release.

Information reconciling any forward-looking Operating EBITDA, Operating EBITDA Margin, Adjusted Operating Income, Adjusted Operating Income Margin, Free Cash Flow, Adjusted EBITDA Margin, and Adjusted EPS to GAAP financial measures is unavailable to us without unreasonable effort. We cannot provide reconciliations of the above noted forward looking non-GAAP measures to GAAP financial measures because certain items required for such reconciliations are outside of our control and/or cannot be reasonably predicted. Preparation of such reconciliations would require a forward-looking balance sheet, statement of income and statement of cash flows, prepared in accordance with GAAP, and such forward-looking financial statements are unavailable to us without unreasonable effort.

Second Quarter 2023 Conference Call

Wabash will discuss its results during its quarterly investor conference call on Wednesday, July 26, 2023, beginning at 11:00 a.m. EDT. The call and an accompanying slide presentation will be accessible on the "Investors" section of the Company’s website at www.onewabash.com. The conference call will also be accessible by dialing (888) 440-6928, conference ID 6579482. A replay of the call will be available on the site shortly after the conclusion of the presentation.

About

Wabash (NYSE: WNC) is the visionary leader of connected solutions for the transportation, logistics and distribution industries that is Changing How the World Reaches You®. Headquartered in Lafayette, Indiana, the company enables customers to thrive by providing insight into tomorrow and delivering pragmatic solutions today to move everything from first to final mile. Wabash designs, manufactures, and services a diverse range of products, including: dry freight and refrigerated trailers, flatbed trailers, tank trailers, dry and refrigerated truck bodies,

structural composite panels and products, trailer aerodynamic solutions, and specialty food grade processing equipment. Learn more at www.onewabash.com.

Safe Harbor Statement

This press release contains certain forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements convey the Company’s current expectations or forecasts of future events. All statements contained in this press release other than statements of historical fact are forward-looking statements. These forward-looking statements include, among other things, all statements regarding the Company’s outlook for trailer and truck body shipments, backlog, expectations regarding demand levels for trailers, truck bodies, non-trailer equipment and our other diversified product offerings, pricing, profitability and earnings, cash flow and liquidity, opportunity to capture higher margin sales, new product innovations, our growth and diversification strategies, our expectations for improved financial performance during the course of the year and our expectations with regards to capital allocation. These and the Company’s other forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those implied by the forward-looking statements. Without limitation, these risks and uncertainties include the highly cyclical nature of our business, uncertain economic conditions including the possibility that customer demand may not meet our expectations, our backlog may not reflect future sales of our products, increased competition, reliance on certain customers and corporate partnerships, risks of customer pick-up delays, shortages and costs of raw materials including the impact of tariffs or other international trade developments, risks in implementing and sustaining improvements in the Company’s manufacturing operations and cost containment, dependence on industry trends and timing, supplier constraints, labor costs and availability, customer acceptance of and reactions to pricing changes, costs of indebtedness, and our ability to execute on our long-term strategic plan. Readers should review and consider the various disclosures made by the Company in this press release and in the Company’s reports to its stockholders and periodic reports on Forms 10-K and 10-Q.

# # #

WABASH NATIONAL CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited - dollars in thousands)

| | | | | | | | | | | |

| June 30,

2023 | | December 31,

2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 98,791 | | | $ | 58,245 | |

| Accounts receivable, net | 231,748 | | | 255,577 | |

| Inventories, net | 342,470 | | | 243,870 | |

| Prepaid expenses and other | 55,419 | | | 34,927 | |

| Total current assets | 728,428 | | | 592,619 | |

| Property, plant, and equipment, net | 314,133 | | | 271,116 | |

| Goodwill | 188,411 | | | 188,434 | |

| Intangible assets, net | 92,824 | | | 99,231 | |

| Other assets | 61,245 | | | 52,123 | |

| Total assets | $ | 1,385,041 | | | $ | 1,203,523 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Current portion of long-term debt | $ | — | | | $ | — | |

| | | |

| Accounts payable | 231,036 | | | 189,141 | |

| Other accrued liabilities | 202,374 | | | 158,327 | |

| Total current liabilities | 433,410 | | | 347,468 | |

| Long-term debt | 396,138 | | | 395,818 | |

| | | |

| Deferred income taxes | 33,381 | | | 27,758 | |

| Other non-current liabilities | 40,759 | | | 34,354 | |

| Total liabilities | 903,688 | | | 805,398 | |

| Commitments and contingencies | | | |

| Noncontrolling interest | 329 | | | 512 | |

| Wabash National Corporation stockholders’ equity: | | | |

| Common stock 200,000,000 shares authorized, $0.01 par value, 47,065,370 and 47,675,796 shares outstanding, respectively | 774 | | | 766 | |

| Additional paid-in capital | 671,769 | | | 665,941 | |

| Retained earnings | 305,834 | | | 188,241 | |

| Accumulated other comprehensive loss | (3,004) | | | (882) | |

| Treasury stock at cost, 30,438,260 and 28,972,928 common shares, respectively | (494,349) | | | (456,453) | |

| Total Wabash National Corporation stockholders' equity | 481,024 | | | 397,613 | |

| Total liabilities, noncontrolling interest, and equity | $ | 1,385,041 | | | $ | 1,203,523 | |

WABASH NATIONAL CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited - dollars in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net sales | $ | 686,620 | | | $ | 642,769 | | | $ | 1,307,572 | | | $ | 1,189,530 | |

| Cost of sales | 535,593 | | | 564,735 | | | 1,040,518 | | | 1,053,441 | |

| Gross profit | 151,027 | | | 78,034 | | | 267,054 | | | 136,089 | |

| General and administrative expenses | 37,318 | | | 30,944 | | | 73,358 | | | 57,276 | |

| Selling expenses | 7,194 | | | 7,376 | | | 14,078 | | | 13,585 | |

| Amortization of intangible assets | 3,203 | | | 3,803 | | | 6,406 | | | 8,842 | |

| | | | | | | |

| Impairment and other, net | 2 | | | 3 | | | 2 | | | 343 | |

| Income from operations | 103,310 | | | 35,908 | | | 173,210 | | | 56,043 | |

| Other income (expense): | | | | | | | |

| Interest expense | (4,987) | | | (5,218) | | | (9,981) | | | (10,131) | |

| Other, net | 475 | | | (327) | | | 862 | | | (398) | |

| Other expense, net | (4,512) | | | (5,545) | | | (9,119) | | | (10,529) | |

| Income before income tax expense | 98,798 | | | 30,363 | | | 164,091 | | | 45,514 | |

| Income tax expense | 24,324 | | | 7,624 | | | 38,221 | | | 10,701 | |

| Net income | 74,474 | | | 22,739 | | | 125,870 | | | 34,813 | |

| Net income attributable to noncontrolling interest | 146 | | | 187 | | | 329 | | | 187 | |

| Net income attributable to common stockholders | $ | 74,328 | | | $ | 22,552 | | | $ | 125,541 | | | $ | 34,626 | |

| | | | | | | |

| | | | | | | |

| Net income attributable to common stockholders per share: | | | | | | | |

| Basic | $ | 1.57 | | | $ | 0.46 | | | $ | 2.64 | | | $ | 0.71 | |

| Diluted | $ | 1.54 | | | $ | 0.46 | | | $ | 2.58 | | | $ | 0.70 | |

| Weighted average common shares outstanding (in thousands): | | | | | | | |

| Basic | 47,452 | | | 49,034 | | | 47,610 | | | 49,019 | |

| Diluted | 48,373 | | | 49,535 | | | 48,737 | | | 49,662 | |

| | | | | | | |

| Dividends declared per share | $ | 0.08 | | | $ | 0.08 | | | $ | 0.16 | | | $ | 0.16 | |

| | | | | | | |

| | | | | | | |

WABASH NATIONAL CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited - dollars in thousands)

| | | | | | | | | | | |

| Six Months Ended June 30, |

| 2023 | | 2022 |

| Cash flows from operating activities | | | |

| Net income | $ | 125,870 | | | $ | 34,813 | |

| Adjustments to reconcile net income to net cash provided by operating activities | | | |

| Depreciation | 13,760 | | | 16,482 | |

| Amortization of intangibles | 6,406 | | | 8,842 | |

| Net loss (gain) on sale of property, plant and equipment | 2 | | | (642) | |

| | | |

| Deferred income taxes | 6,653 | | | (139) | |

| Stock-based compensation | 5,681 | | | 4,647 | |

| Impairment | — | | | 986 | |

| Non-cash interest expense | 477 | | | 426 | |

| | | |

| Accounts receivable | 23,829 | | | (55,114) | |

| Inventories | (98,600) | | | (67,717) | |

| Prepaid expenses and other | (9,148) | | | 814 | |

| Accounts payable and accrued liabilities | 69,793 | | | 142,869 | |

| Other, net | 1,608 | | | (3,593) | |

| Net cash provided by operating activities | 146,331 | | | 82,674 | |

| Cash flows from investing activities | | | |

| Cash payments for capital expenditures | (55,820) | | | (22,369) | |

| Expenditures for revenue generating assets | (3,244) | | | — | |

| Proceeds from the sale of assets | — | | | 1,445 | |

| | | |

| Net cash used in investing activities | (59,064) | | | (20,924) | |

| Cash flows from financing activities | | | |

| Proceeds from exercise of stock options | 155 | | | 735 | |

| Dividends paid | (8,366) | | | (8,278) | |

| Borrowings under revolving credit facilities | 103,731 | | | 56,739 | |

| Payments under revolving credit facilities | (103,731) | | | (30,773) | |

| Principal payments under finance lease obligations | — | | | (59) | |

| | | |

| | | |

| | | |

| Debt issuance costs paid | (102) | | | (83) | |

| Stock repurchases | (37,896) | | | (13,325) | |

| Distribution to noncontrolling interest | (512) | | | — | |

| Net cash (used in) provided by financing activities | (46,721) | | | 4,956 | |

| Cash and cash equivalents: | | | |

| Net increase in cash, cash equivalents, and restricted cash | 40,546 | | | 66,706 | |

| Cash, cash equivalents, and restricted cash at beginning of period | 58,245 | | | 71,778 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 98,791 | | | $ | 138,484 | |

| | | |

| | | |

| | | |

WABASH NATIONAL CORPORATION

SEGMENTS AND RELATED INFORMATION

(Unaudited - dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Wabash National Corporation | | | | | | |

| Three Months Ended June 30, | | 2023 | | 2022 | | | | | | |

| Units Shipped | | | | | | | | | | |

| New trailers | | 11,825 | | | 13,670 | | | | | | | |

| New truck bodies | | 4,025 | | | 3,950 | | | | | | | |

| Used trailers | | 15 | | | 40 | | | | | | | |

| | | | | | | | | | |

| Three Months Ended June 30, | | Transportation Solutions | | Parts & Services | | | | Corporate and

Eliminations | | Consolidated |

| 2023 | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| New Trailers | | $ | 523,537 | | | $ | — | | | | | $ | (2,002) | | | $ | 521,535 | |

| Used Trailers | | — | | | 517 | | | | | — | | | 517 | |

| Components, parts and service | | — | | | 39,794 | | | | | — | | | 39,794 | |

| Equipment and other | | 107,145 | | | 21,755 | | | | | (4,126) | | | 124,774 | |

| Total net external sales | | $ | 630,682 | | | $ | 62,066 | | | | | $ | (6,128) | | | $ | 686,620 | |

| Gross profit | | $ | 133,945 | | | $ | 17,082 | | | | | $ | — | | | $ | 151,027 | |

| Income (loss) from operations | | $ | 115,806 | | | $ | 12,937 | | | | | $ | (25,433) | | | $ | 103,310 | |

Adjusted income (loss) from operations1 | | $ | 115,806 | | | $ | 12,937 | | | | | $ | (25,433) | | | $ | 103,310 | |

| | | | | | | | | | |

| 2022 | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| New Trailers | | $ | 508,430 | | | $ | 188 | | | | | $ | (361) | | | $ | 508,257 | |

| Used Trailers | | — | | | 1,120 | | | | | — | | | 1,120 | |

| Components, parts and service | | — | | | 37,473 | | | | | — | | | 37,473 | |

| Equipment and other | | 87,552 | | | 11,614 | | | | | (3,247) | | | 95,919 | |

| Total net external sales | | $ | 595,982 | | | $ | 50,395 | | | | | $ | (3,608) | | | $ | 642,769 | |

| Gross profit | | $ | 66,055 | | | $ | 11,830 | | | | | $ | 149 | | | $ | 78,034 | |

| Income (loss) from operations | | $ | 47,973 | | | $ | 8,138 | | | | | $ | (20,203) | | | $ | 35,908 | |

Adjusted income (loss) from operations1 | | $ | 47,973 | | | $ | 8,138 | | | | | $ | (20,203) | | | $ | 35,908 | |

1 Adjusted operating income (loss), a non-GAAP financial measure, excludes certain costs, expenses, other charges, gains or income that are included in the determination of operating income (loss) under U.S. GAAP, but that management would not consider important in evaluating the quality of the Company’s operating results as they are not indicative of the Company’s core operating results or may obscure trends useful in evaluating the Company’s continuing activities. Accordingly, the Company presents adjusted operating income (loss) excluding these special items to help investors evaluate our operating performance and trends in our business consistent with how management evaluates such performance and trends. Further, the Company presents adjusted operating income (loss) to provide investors with a better understanding of the Company’s view of our results as compared to prior periods.

WABASH NATIONAL CORPORATION

SEGMENTS AND RELATED INFORMATION

(Unaudited - dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Wabash National Corporation | | | | | | |

| Six Months Ended June 30, | | 2023 | | 2022 | | | | | | |

| Units Shipped | | | | | | | | | | |

| New trailers | | 23,610 | | | 25,535 | | | | | | | |

| New truck bodies | | 7,835 | | | 7,435 | | | | | | | |

| Used trailers | | 30 | | | 60 | | | | | | | |

| | | | | | | | | | |

| Six Months Ended June 30, | | Transportation Solutions | | Parts & Services | | | | Corporate and

Eliminations | | Consolidated |

| 2023 | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| New Trailers | | $ | 1,008,785 | | | $ | — | | | | | $ | (2,364) | | | $ | 1,006,421 | |

| Used Trailers | | — | | | 1,056 | | | | | — | | | 1,056 | |

| Components, parts and service | | — | | | 75,476 | | | | | — | | | 75,476 | |

| Equipment and other | | 199,968 | | | 32,674 | | | | | (8,023) | | | 224,619 | |

| Total net external sales | | $ | 1,208,753 | | | $ | 109,206 | | | | | $ | (10,387) | | | $ | 1,307,572 | |

| Gross profit | | $ | 237,549 | | | $ | 29,505 | | | | | $ | — | | | $ | 267,054 | |

| Income (loss) from operations | | $ | 202,922 | | | $ | 22,146 | | | | | $ | (51,858) | | | $ | 173,210 | |

Adjusted income (loss) from operations1 | | $ | 202,922 | | | $ | 22,146 | | | | | $ | (51,858) | | | $ | 173,210 | |

| | | | | | | | | | |

| 2022 | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| New Trailers | | $ | 946,393 | | | $ | 242 | | | | | $ | (672) | | | $ | 945,963 | |

| Used Trailers | | — | | | 1,689 | | | | | — | | | 1,689 | |

| Components, parts and service | | — | | | 71,037 | | | | | — | | | 71,037 | |

| Equipment and other | | 151,654 | | | 24,135 | | | | | (4,948) | | | 170,841 | |

| Total net external sales | | $ | 1,098,047 | | | $ | 97,103 | | | | | $ | (5,620) | | | $ | 1,189,530 | |

| Gross profit | | $ | 113,737 | | | $ | 22,352 | | | | | $ | — | | | $ | 136,089 | |

| Income (loss) from operations | | $ | 79,670 | | | $ | 14,927 | | | | | $ | (38,554) | | | $ | 56,043 | |

Adjusted income (loss) from operations1 | | $ | 79,670 | | | $ | 14,927 | | | | | $ | (38,554) | | | $ | 56,043 | |

1 Adjusted operating income (loss), a non-GAAP financial measure, excludes certain costs, expenses, other charges, gains or income that are included in the determination of operating income (loss) under U.S. GAAP, but that management would not consider important in evaluating the quality of the Company’s operating results as they are not indicative of the Company’s core operating results or may obscure trends useful in evaluating the Company’s continuing activities. Accordingly, the Company presents adjusted operating income (loss) excluding these special items to help investors evaluate our operating performance and trends in our business consistent with how management evaluates such performance and trends. Further, the Company presents adjusted operating income (loss) to provide investors with a better understanding of the Company’s view of our results as compared to prior periods.

WABASH NATIONAL CORPORATION

SEGMENT AND COMPANY FINANCIAL INFORMATION

(Unaudited - dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

Adjusted Operating Income1 | Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Transportation Solutions | | | | | | | |

| Income from operations | $ | 115,806 | | | $ | 47,973 | | | $ | 202,922 | | | $ | 79,670 | |

| Adjustments: | | | | | | | |

| | | | | | | |

| N/A | — | | | — | | | — | | | — | |

| Adjusted operating income | 115,806 | | | 47,973 | | | 202,922 | | | 79,670 | |

| | | | | | | |

| Parts & Services | | | | | | | |

| Income from operations | 12,937 | | | 8,138 | | | 22,146 | | | 14,927 | |

| Adjustments: | | | | | | | |

| | | | | | | |

| N/A | — | | | — | | | — | | | — | |

| Adjusted operating income | 12,937 | | | 8,138 | | | 22,146 | | | 14,927 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Corporate | | | | | | | |

| Loss from operations | (25,433) | | | (20,203) | | | (51,858) | | | (38,554) | |

| Adjustments: | | | | | | | |

| N/A | — | | | — | | | — | | | — | |

| | | | | | | |

| | | | | | | |

| Adjusted operating loss | (25,433) | | | (20,203) | | | (51,858) | | | (38,554) | |

| | | | | | | |

| Consolidated | | | | | | | |

| Income from operations | 103,310 | | | 35,908 | | | 173,210 | | | 56,043 | |

| Adjustments: | | | | | | | |

| | | | | | | |

| N/A | — | | | — | | | — | | | — | |

| | | | | | | |

| | | | | | | |

| Adjusted operating income | $ | 103,310 | | | $ | 35,908 | | | $ | 173,210 | | | $ | 56,043 | |

1 Adjusted operating income (loss), a non-GAAP financial measure, excludes certain costs, expenses, other charges, gains or income that are included in the determination of operating income (loss) under U.S. GAAP, but that management would not consider important in evaluating the quality of the Company’s operating results as they are not indicative of the Company’s core operating results or may obscure trends useful in evaluating the Company’s continuing activities. Accordingly, the Company presents adjusted operating income (loss) excluding these special items to help investors evaluate our operating performance and trends in our business consistent with how management evaluates such performance and trends. Further, the Company presents adjusted operating income (loss) to provide investors with a better understanding of the Company’s view of our results as compared to prior periods.

WABASH NATIONAL CORPORATION

RECONCILIATION OF GAAP FINANCIAL MEASURES TO

NON-GAAP FINANCIAL MEASURES

(Unaudited - dollars in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

Operating EBITDA1: | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Net income | $ | 74,474 | | | $ | 22,739 | | | $ | 125,870 | | | $ | 34,813 | |

| Income tax expense | 24,324 | | | 7,624 | | | 38,221 | | | 10,701 | |

| Interest expense | 4,987 | | | 5,218 | | | 9,981 | | | 10,131 | |

| Depreciation and amortization | 10,470 | | | 12,060 | | | 20,166 | | | 25,324 | |

| Stock-based compensation | 2,915 | | | 2,370 | | | 5,681 | | | 4,647 | |

| | | | | | | |

| Impairment and other, net | 2 | | | 3 | | | 2 | | | 343 | |

| Other, net | (475) | | | 327 | | | (862) | | | 398 | |

| Operating EBITDA | $ | 116,697 | | | $ | 50,341 | | | $ | 199,059 | | | $ | 86,357 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Adjusted Net Income Attributable to Common Stockholders2: | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Net income attributable to common stockholders | $ | 74,328 | | | $ | 22,552 | | | $ | 125,541 | | | $ | 34,626 | |

| Adjustments: | | | | | | | |

| | | | | | | |

| N/A | — | | | — | | | — | | | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Adjusted net income attributable to common stockholders | $ | 74,328 | | | $ | 22,552 | | | $ | 125,541 | | | $ | 34,626 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Adjusted Diluted Earnings Per Share2: | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Diluted earnings per share | $ | 1.54 | | | $ | 0.46 | | | $ | 2.58 | | | $ | 0.70 | |

| Adjustments: | | | | | | | |

| | | | | | | |

| N/A | — | | | — | | | — | | | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Adjusted diluted earnings per share | $ | 1.54 | | | $ | 0.46 | | | $ | 2.58 | | | $ | 0.70 | |

| | | | | | | |

| Weighted average diluted shares outstanding (in thousands) | 48,373 | | | 49,535 | | | 48,737 | | | 49,662 | |

1 Operating EBITDA includes noncontrolling interest and is defined as earnings before interest, taxes, depreciation, amortization, stock-based compensation, impairment and other, net, and other non-operating income and expense (including any loss on debt extinguishment charges). Management believes providing operating EBITDA is useful for investors to understand the Company’s performance and results of operations period to period with the exclusion of the items identified above. Management believes the presentation of operating EBITDA, when combined with the GAAP presentations of operating income and net income, is beneficial to an investor’s understanding of the Company’s operating performance.

2 Adjusted net income attributable to common stockholders and adjusted diluted earnings per share reflect no adjustments for any period presented.

WABASH NATIONAL CORPORATION

RECONCILIATION OF FREE CASH FLOW1

(Unaudited - dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net cash provided by operating activities | $ | 76,847 | | | $ | 117,241 | | | $ | 146,331 | | | $ | 82,674 | |

| Cash payments for capital expenditures | (24,397) | | | (12,420) | | | (55,820) | | | (22,369) | |

| Expenditures for revenue generating assets | (3,244) | | | — | | | (3,244) | | | — | |

Free cash flow1 | $ | 49,206 | | | $ | 104,821 | | | $ | 87,267 | | | $ | 60,305 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

1 Free cash flow is defined as net cash provided by operating activities minus cash payments for capital expenditures minus expenditures for revenue generating assets. Management believes providing free cash flow is useful for investors to understand the Company’s performance and results of cash generation period to period with the exclusion of the item identified above. Management believes the presentation of free cash flow, when combined with the GAAP presentations of cash used in operating activities, is beneficial to an investor’s understanding of the Company’s operating performance.

WABASH NATIONAL CORPORATION

RECONCILIATION OF ADJUSTED SEGMENT EBITDA1

AND ADJUSTED SEGMENT EBITDA MARGIN1

(Unaudited - dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Transportation Solutions | | Parts & Services | | |

| Three Months Ended June 30, | 2023 | | 2022 | | 2023 | | 2022 | | | | |

| Income from operations | $ | 115,806 | | | $ | 47,973 | | | $ | 12,937 | | | $ | 8,138 | | | | | |

| Depreciation and amortization | 9,379 | | | 10,705 | | | 553 | | | 643 | | | | | |

| Impairment and other, net | 2 | | | 2 | | | — | | | — | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Adjusted segment EBITDA | $ | 125,187 | | | $ | 58,680 | | | $ | 13,490 | | | $ | 8,781 | | | | | |

| | | | | | | | | | | |

| Adjusted segment EBITDA margin | 19.8 | % | | 9.8 | % | | 21.7 | % | | 17.4 | % | | | | |

| | | | | | | | | | | |

| Transportation Solutions | | Parts & Services | | | | |

| Six Months Ended June 30, | 2023 | | 2022 | | 2023 | | 2022 | | | | |

| Income from operations | $ | 202,922 | | | $ | 79,670 | | | $ | 22,146 | | | $ | 14,927 | | | | | |

| Depreciation and amortization | 18,007 | | | 22,238 | | | 1,049 | | | 1,678 | | | | | |

| Impairment and other, net | 2 | | | (619) | | | — | | | (10) | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Adjusted segment EBITDA | $ | 220,931 | | | $ | 101,289 | | | $ | 23,195 | | | $ | 16,595 | | | | | |

| | | | | | | | | | | |

| Adjusted segment EBITDA margin | 18.3 | % | | 9.2 | % | | 21.2 | % | | 17.1 | % | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

1 Adjusted segment EBITDA, a non-GAAP financial measure, includes noncontrolling interest and is calculated by adding back segment depreciation and amortization expense to segment operating income, and excludes certain costs, expenses, other charges, gains or income that are included in the determination of operating income under GAAP, but that management would not consider important in evaluating the quality of the Company’s segment operating results as they are not indicative of each segment's core operating results or may obscure trends useful in evaluating the segment's continuing activities. Adjusted segment EBITDA margin is calculated by dividing Adjusted segment EBITDA by segment total net sales.

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

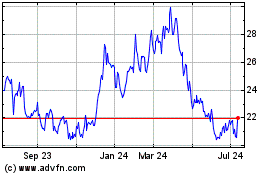

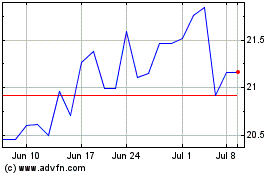

Wabash National (NYSE:WNC)

Historical Stock Chart

From Apr 2024 to May 2024

Wabash National (NYSE:WNC)

Historical Stock Chart

From May 2023 to May 2024