0001599489

false

0001599489

2023-10-17

2023-10-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 17, 2023

VERITIV

CORPORATION

(Exact name of registrant as specified in its

charter)

Delaware

(State or other

jurisdiction of incorporation)

| 001-36479 |

|

46-3234977 |

| (Commission File Number) |

|

(I.R.S. Employer Identification No.) |

| 1000 Abernathy

Road NE |

|

|

| Building 400,

Suite 1700 |

|

|

| Atlanta,

Georgia |

|

30328 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (770) 391-8200

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which registered |

| Common

stock, $0.01 par value |

VRTV |

New

York Stock Exchange |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 5.07. | Submission of Matters to a Vote of Security Holders. |

On October 17, 2023, Veritiv Corporation,

a Delaware corporation (“Veritiv” or the “Company”), held a special meeting of stockholders (the “Special

Meeting”) to consider certain proposals related to the Agreement and Plan of Merger, dated as of August 6, 2023 (as it has been

or may be amended, supplemented, waived or otherwise modified in accordance with its terms, the “Merger Agreement”), by and

among Verde Purchaser, LLC, a Delaware limited liability company (“Parent”) that is affiliated with Clayton,

Dubilier & Rice, LLC, Verde Merger Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of Parent (“Merger

Subsidiary”), and Veritiv. Upon the terms and conditions set forth in the Merger Agreement, at the closing of the transactions contemplated

by the Merger Agreement, Merger Subsidiary will be merged with and into Veritiv (the “Merger”) with Veritiv surviving the

Merger as a wholly-owned subsidiary of Parent. Closing of the Merger is subject to customary closing conditions including the receipt

of required regulatory approval.

As of September 13, 2023, the record date

for the Special Meeting, there were 13,551,081 shares of the Company’s common stock, par value $0.01 per share (“Common Stock”),

outstanding, each of which was entitled to one vote on each proposal at the Special Meeting. A total of 12,422,967 shares of the Common

Stock, representing approximately 91.68% of the outstanding shares of Common Stock entitled to vote, were present virtually or represented

by proxy at the Special Meeting, constituting a quorum to conduct business.

At the Special Meeting, the following proposals

were considered:

| 1. | Merger Proposal. To approve and adopt the Merger Agreement, pursuant to which, among other things, Merger Subsidiary will merge

with and into Veritiv, with Veritiv surviving as a wholly-owned subsidiary of Parent (the “Merger Proposal”). |

| 2. | Advisory Compensation Proposal. To approve, on a non-binding, advisory basis, the compensation that may be paid or become payable

to Veritiv’s named executive officers that is based on or otherwise relates to the Merger. |

| 3. | Adjournment Proposal. To approve one or more adjournments of the Special Meeting, if necessary, to solicit additional proxies

if a quorum is not present or there are not sufficient votes cast at the Special Meeting to approve the Merger Proposal. |

Each such proposal is further described in

the Company’s definitive proxy statement on Schedule 14A filed with the U.S. Securities and Exchange Commission (the “SEC”)

on September 18, 2023, as supplemented, and first mailed to the Company’s stockholders on September 18, 2023 (the “Proxy Statement”).

Each of the proposals was approved by the

requisite vote of the Company’s stockholders. The final voting results for each proposal are set forth below.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For |

|

Against |

|

Abstentions |

| 12,374,963 |

|

|

28,307 |

|

|

19,697 |

|

| (2) | Advisory Compensation Proposal: |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For |

|

Against |

|

|

Abstentions |

| 11,942,691 |

|

|

457,655 |

|

|

22,621 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For |

|

Against |

|

Abstentions |

| 11,574,355 |

|

|

826,304 |

|

|

22,308 |

|

Because

the Merger Proposal was approved by the requisite vote of the Company’s stockholders, no adjournment to solicit additional proxies

was necessary.

On October 17, 2023, the Company issued a press release announcing

the voting results of the Special Meeting. A copy of the press release is furnished as Exhibit 99.1 hereto and is incorporated herein

by reference. Additionally, on September 28, 2023, China’s State Administration for Market Regulation approved the Merger.

Cautionary Forward-Looking Statements

This Current Report contains certain forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E

of the Securities Exchange Act of 1934, as amended, which include all statements that do not relate solely to historical or current facts,

such as statements regarding the Company’s expectations, intentions or strategies regarding the future, including strategies or

plans as they relate to the Merger. These forward-looking statements are and will be, subject to many risks, uncertainties and

factors which may cause future events to be materially different from these forward-looking statements or anything implied therein. These

risks and uncertainties include, but are not limited to: uncertainties as to the timing of the Merger; the timing, receipt and terms and

conditions of any required governmental or regulatory approvals of the Merger that could reduce the anticipated benefits of or cause the

parties to abandon the Merger; risks related to the satisfaction of the conditions to closing the Merger in the anticipated timeframe

or at all; the risk that any announcements relating to the Merger could have adverse effects on the market price of the Common Stock;

disruption from the Merger making it more difficult to maintain business and operational relationships, including retaining and hiring

key personnel; the occurrence of any event, change or other circumstances that could give rise to the termination of the Merger Agreement,

including in certain circumstances requiring the Company to pay a termination fee; risks related to disruption of management’s attention

from the Company’s ongoing business operations due to the Merger; significant transaction costs; the risk of litigation and/or regulatory

actions related to the Merger; global economic conditions; adverse industry and market conditions; the ability to retain management and

other personnel; and other economic, business, or competitive factors, including factors described in the Company’s filings with

the SEC. While the list of risks and uncertainties presented here is, and the discussion of risks

and uncertainties presented in the Proxy Statement are considered representative, no such list or discussion should be considered a complete

statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of

forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking

statements could include, among other things, business disruption, operational problems, financial loss, and legal liability to third

parties and similar risks, any of which could have a material adverse effect on the completion of the Merger and/or the Company’s

consolidated financial condition, results of operations, credit rating or liquidity. In light of the significant uncertainties in these

forward-looking statements, the Company cannot assure you that the forward-looking statements in this Current Report will prove to be

accurate, and you should not regard these statements as a representation or warranty by the Company, its directors, officers or employees

or any other person that the Company will achieve its objectives and plans in any specified time frame, or at all. Any forward-looking

statements in this Current Report are based upon information available to the Company on the date of this Current Report. Subject to applicable

law, the Company does not undertake to publicly update or revise its forward-looking statements.

| Item 9.01. | Financial Statements and Exhibits. |

The following exhibits are included with this report:

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

VERITIV CORPORATION |

| |

|

|

|

|

| |

Dated: |

October 17, 2023 |

|

/s/ Susan B. Salyer |

| |

|

|

|

Susan B. Salyer |

| |

|

|

|

Senior Vice President, General Counsel & Corporate Secretary |

Exhibit 99.1

Veritiv

Announces Stockholder Approval of Acquisition By Clayton, Dubilier & Rice

ATLANTA

(October [17], 2023) – Veritiv Corporation (NYSE:

VRTV), a leading full-service provider of business-to-business products, services and solutions, held a special meeting of stockholders

earlier today at which Veritiv stockholders voted in favor of all proposals, including a proposal to approve the Company’s pending

acquisition by an affiliate of Clayton, Dubilier & Rice, (CD&R).

“We are pleased with the results of the special meeting and we

thank our stockholders for their strong support for this transaction,” said Sal Abbate, Chief Executive Officer of Veritiv. “We

look forward to closing the transaction later in the fourth quarter.”

Closing of the transaction is subject to customary closing conditions

including the receipt of required regulatory approval. The voting results of the Veritiv Corporation special meeting will be reported

in a Form 8-K to be filed by Veritiv Corporation with the U.S. Securities and Exchange Commission.

About Veritiv

Veritiv Corporation (NYSE: VRTV), headquartered in Atlanta, is a leading

full-service provider of packaging, JanSan and hygiene products, services and solutions. Additionally, Veritiv provides print and publishing

products. Serving customers in a wide range of industries both in North America and globally, Veritiv has distribution centers throughout

the U.S. and Mexico, and team members around the world helping shape the success of its customers. For more information about Veritiv

and its business segments visit www.veritiv.com.

Safe Harbor Provision

This communication contains certain forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E

of the Securities Exchange Act of 1934, as amended, which include all statements that do not relate solely to historical or current facts,

such as statements regarding Veritiv’s expectations, intentions or strategies regarding the future, including strategies or plans

as they relate to the proposed acquisition of Veritiv by CD&R. These forward-looking statements are and will be, subject to many risks,

uncertainties and factors which may cause future events to be materially different from these forward-looking statements or anything implied

therein. These risks and uncertainties include, but are not limited to: uncertainties as to the timing of the proposed acquisition; the

timing, receipt and terms and conditions of any required governmental or regulatory approvals of the acquisition that could reduce the

anticipated benefits of or cause the parties to abandon the proposed acquisition; risks related to the satisfaction of the conditions

to closing the proposed acquisition in the anticipated timeframe or at all; the risk that any announcements relating to the acquisition

could have adverse effects on the market price of Veritiv’s common stock; disruption from the acquisition making it more difficult

to maintain business and operational relationships, including retaining and hiring key personnel; the occurrence of any event, change

or other circumstances that could give rise to the termination of the definitive merger agreement entered into between Veritiv and affiliates

of CD&R, including in certain circumstances requiring Veritiv to pay a termination fee; risks related to disruption of management’s

attention from Veritiv’s ongoing business operations due to the acquisition; significant transaction costs; the risk of litigation

and/or regulatory actions related to the proposed acquisition; global economic conditions; adverse industry and market conditions; the

ability to retain management and other personnel; and other economic, business, or competitive factors, including factors described in

Veritiv’s filings with the U.S. Securities and Exchange Commission (the “SEC”). While the list of risks and uncertainties

presented here is, and the discussion of risks and uncertainties presented in the proxy statement that Veritiv filed with the SEC in connection

with the proposed acquisition are considered representative, no such list or discussion should be considered a complete statement of all

potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking

statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could

include, among other things, business disruption, operational problems, financial loss, and legal liability to third parties and similar

risks, any of which could have a material adverse effect on the completion of proposed acquisition and/or Veritiv’s consolidated

financial condition, results of operations, credit rating or liquidity. In light of the significant uncertainties in these forward-looking

statements, Veritiv cannot assure you that the forward-looking statements in this communication will prove to be accurate, and you should

not regard these statements as a representation or warranty by Veritiv, its directors, officers or employees or any other person that

Veritiv will achieve its objectives and plans in any specified time frame, or at all. Any forward-looking statements in this communication

are based upon information available Veritiv on the date of this communication. Subject to applicable law, Veritiv does not undertake

to publicly update or revise its forward-looking statements.

Veritiv Contacts:

| Investors: Clark Dwyer, 844-845-2136 |

Media: Kristie Madara, 770-391-8471 |

v3.23.3

Cover

|

Oct. 17, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 17, 2023

|

| Entity File Number |

001-36479

|

| Entity Registrant Name |

VERITIV

CORPORATION

|

| Entity Central Index Key |

0001599489

|

| Entity Tax Identification Number |

46-3234977

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1000 Abernathy

Road NE

|

| Entity Address, Address Line Two |

Building 400

|

| Entity Address, Address Line Three |

Suite 1700

|

| Entity Address, City or Town |

Atlanta

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30328

|

| City Area Code |

770

|

| Local Phone Number |

391-8200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

stock, $0.01 par value

|

| Trading Symbol |

VRTV

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

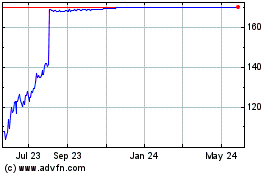

Veritiv (NYSE:VRTV)

Historical Stock Chart

From Apr 2024 to May 2024

Veritiv (NYSE:VRTV)

Historical Stock Chart

From May 2023 to May 2024