United Rentals, Inc. (URI) - Zacks #1 Rank Top Performers

January 17 2012 - 7:00PM

Zacks

The economy is improving, but doing so at its own sluggish pace. So

renting is still preferable for many consumers and businesses.

United Rentals, Inc. (URI) has surely been a beneficiary of

this, and today it rode a solid session to the apex of the Zacks #1

Rank Top Performers List.

Shares of the company surged 9.2% Wednesday, far outpacing all

other top performers. Volume surpassed 6.5 million, compared to the

daily average of 1.7 million.

The company’s third quarter report was the first time since the

third quarter of the previous year that URI surpassed profit

expectations. The company reported 92 cents per share, which was

approximately 21% better than the Zacks Consensus Estimate of 76

cents.

Rental revenue jumped 19.1% in the quarter. URI also updated its

full-year financial targets.

Since that report, earnings estimates for 2011 have been on the

rise. The Zacks Consensus Estimate for last year is up 7.2% in the

past three months to $1.64 per share from $1.53. In fact, just the

past 30 days have seen three upward revisions out of eight total

estimates.

As for 2012, the Zacks Consensus Estimate is currently $2.43 per

share, which suggests year-over-year profit growth of nearly

50%.

URI is scheduled to report again next week on January 25th. We

are expecting fourth-quarter earnings at 58 cents, which is up

11.5% in three months and 5.4% in 30 days.

Mid December saw United Rentals announce a $4.2 billion deal to

buy RSC Holdings, Inc., a holding company for the operating entity

RSC Equipment Rental, Inc. According to the press release, the

transaction is ” expected to accelerate United Rentals’ growth with

industrial customers as well as provide a lower cost base and a

less volatile revenue profile to better position the company

through all phases of the business cycle.”

Wall Street liked the move, though there is some concern about

the $2.3 billion in net debt that URI will assume as part of the

deal.

United Rentals, Inc. is the largest equipment rental company in

the world, with an integrated network of 541 rental locations in 48

states and 10 Canadian provinces. It serves construction and

industrial customers, utilities, municipalities, homeowners and

others.

UTD RENTALS INC (URI): Free Stock Analysis Report

To read this article on Zacks.com click here.

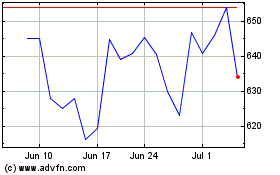

United Rentals (NYSE:URI)

Historical Stock Chart

From Jun 2024 to Jul 2024

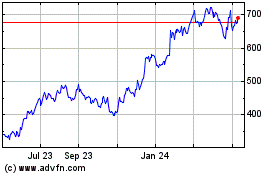

United Rentals (NYSE:URI)

Historical Stock Chart

From Jul 2023 to Jul 2024