United Rentals Announces Redemption at Par of the Remaining 6 ½% Senior Notes

January 13 2010 - 5:50PM

Business Wire

United Rentals, Inc. (NYSE: URI) today announced that its

principal subsidiary, United Rentals (North America), Inc., will

redeem its remaining $435.2 million aggregate principal amount of

outstanding 6 ½% Senior Notes due 2012. The 6 ½% Senior Notes will

be redeemed on February 16, 2010 at par, plus accrued interest. The

redemption of the 6 ½% Senior Notes follows on the company’s recent

redemption of $270.6 million aggregate principal amount of its 14%

Senior Notes due 2014 and the upsizing of its asset-based revolving

credit facility in December 2009.

William Plummer, Chief Financial Officer, said, “The redemption

of the 6 ½% Senior Notes substantially improves our debt maturity

profile. The company’s next significant debt maturity comes due in

2013. This move highlights our company’s commitment to proactively

refine our capital structure to reduce financial risk and supports

our focus on long-term profitable growth.”

About United Rentals

United Rentals, Inc. is the largest equipment rental company in

the world, with an integrated network of 568 rental locations in 48

states, 10 Canadian provinces and Mexico. The company’s

approximately 8,000 employees serve construction and industrial

customers, utilities, municipalities, homeowners and others. The

company offers for rent approximately 3,000 classes of equipment

with a total original cost of $3.8 billion. United Rentals is a

member of the Standard & Poor’s MidCap 400 Index and the

Russell 2000 Index® and is headquartered in Greenwich, Conn.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Such statements can be identified by

the use of forward-looking terminology such as “believe,” “expect,”

“may,” “will,” “should,” “seek,” “on-track,” “plan,” “project,”

“forecast,” “intend” or “anticipate,” or the negative thereof or

comparable terminology, or by discussions of strategy or outlook.

You are cautioned that our business and operations are subject to a

variety of risks and uncertainties, many of which are beyond our

control, and, consequently, our actual results may differ

materially from those projected. Factors that could cause actual

results to differ materially from those projected include, but are

not limited to, the following: (1) on-going decreases in North

American construction and industrial activities, which have

significantly affected revenues and, because many of our costs are

fixed, our profitability, and which may further reduce demand and

prices for our products and services; (2) our highly leveraged

capital structure, which requires us to use a substantial portion

of our cash flow for debt service and can constrain our flexibility

in responding to unanticipated or adverse business conditions; (3)

noncompliance with financial or other covenants in our debt

agreements, which could result in our lenders terminating our

credit facilities and requiring us to repay outstanding borrowings;

(4) inability to access the capital that our businesses or growth

plans may require; and (5) rates we can charge and time utilization

we can achieve being less than anticipated. For a more complete

description of these and other possible uncertainties, please refer

to our Annual Report on Form 10-K for the year ended December 31,

2008, as well as to our subsequent filings with the SEC. Our

forward-looking statements contained herein speak only as of the

date hereof, and we make no commitment to update or publicly

release any revisions to forward-looking statements in order to

reflect new information or subsequent events, circumstances or

changes in expectations.

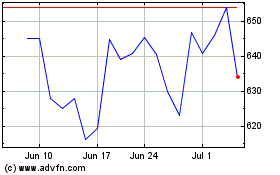

United Rentals (NYSE:URI)

Historical Stock Chart

From Jun 2024 to Jul 2024

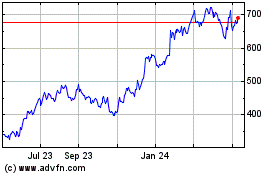

United Rentals (NYSE:URI)

Historical Stock Chart

From Jul 2023 to Jul 2024