UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2024

Commission File Number: 001-40210

Tuya Inc.

10/F, Building A, Huace

Center

Xihu District, Hangzhou

City

Zhejiang, 310012

People’s Republic

of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Tuya Inc. |

| |

|

| |

By |

: |

/s/ Yao (Jessie) Liu |

| |

Name |

: |

Yao (Jessie) Liu |

| |

Title |

: |

Chief Financial Officer |

Date: February 27, 2024

Exhibit 99.1

SCHEDULE I

Tuya Reports Fourth Quarter 2023 Unaudited Financial

Results

SANTA

CLARA, Calif., February, 27, 2024/PRNewswire/– Tuya Inc. (“Tuya” or the “Company”)

(NYSE: TUYA; HKEX: 2391), a global leading IoT cloud development platform, today announced its unaudited financial results for the fourth

quarter ended December 31, 2023.

Fourth Quarter 2023 Financial Highlights

| · | Total revenue was US$64.4 million,

up approximately 42.2% year over year (4Q2022: US$45.3 million). |

| · | IoT platform-as-a-service (“PaaS”)

revenue was US$47.2 million, up approximately 44.6% year over year (4Q2022: US$32.6 million). |

| · | Software-as-a-service (“SaaS”)

and others revenue was US$9.5 million, up approximately 19.3% year over year (4Q2022: US$7.9 million). |

| · | Overall gross margin increased to 47.3%,

up 2.7 percentage points year over year (4Q2022: 44.6%). Gross margin of IoT PaaS increased to 44.8%, up 3.3 percentage points year over

year (4Q2022: 41.5%). |

| · | Operating

margin was negative 36.7%, improved by 35.8 percentage points year over year (4Q2022: negative 72.5%). Non-GAAP operating

margin was negative 0.4%, improved by 33.4 percentage points year over year

(4Q2022: negative 33.8%). |

| · | Net margin was negative 16.8%,

improved by 33.4 percentage points year over year (4Q2022: negative 50.2%). Non-GAAP net margin was 19.5%, improved by 31.0 percentage

points year over year (4Q2022: negative 11.5%). |

| · | Net cash generated from operating activities

was US$31.8 million (4Q2022: net cash used in operating activities was US$0.1 million). |

| · | Total cash and cash equivalents,

time deposits and U.S. treasury securities recorded as short-term and long-term investments were US$984.3 million as of December 31,

2023, compared to US$952.0 million as of December 31, 2022. |

For

further information on the non-GAAP financial measures presented above, see the section headed “Use of Non-GAAP Financial

Measures.”

Fourth Quarter 2023 Operating Highlights

| · | IoT PaaS customers1 for the

fourth quarter of 2023 were approximately 2,200 (4Q2022: approximately 2,400). Total customers for the fourth quarter of 2023 were

approximately 3,200 (4Q2022: approximately 3,400). The Company’s implementation of key-account strategy has enabled it to be more

focused on serving strategic customers. |

| · | Premium IoT PaaS customers2

for the trailing 12 months ended December 31, 2023 were 265 (4Q2022: 263). In the fourth quarter of 2023, the Company’s

premium IoT PaaS customers contributed approximately 82.7% of its IoT PaaS revenue (4Q2022: approximately 77.0%). |

| · | Dollar-based net expansion rate

(“DBNER”)3 of IoT PaaS for the trailing 12 months ended December 31, 2023 was 103% (4Q2022: 51%). |

| · | Registered IoT device and software developers

were approximately 993,000 as of December 31, 2023, up 40.3% from approximately 708,000 developers as of December 31,

2022. |

| 1. | The Company defines an IoT PaaS customer for a given period as a customer who has directly placed orders

for IoT PaaS with the Company during that period. |

| 2. | The Company defines a premium IoT PaaS customer as a customer as of a given date that contributed more

than US$100,000 of IoT PaaS revenue during the immediately preceding 12-month period. |

| 3. | The Company calculates DBNER of IoT PaaS for a trailing 12-month period by first identifying all customers

in the prior 12-month period (i.e., those have placed at least one order for IoT PaaS during that period), and then calculating the quotient

from dividing the IoT PaaS revenue generated from such customers in the current trailing 12-month period by the IoT PaaS revenue generated

from the same Company of customers in the prior 12-month period. The Company’s DBNER may change from period to period, due to a

combination of various factors, including changes in the customers’ purchase cycles and amounts and the Company’s customer

mix, among other things. DBNER indicates the Company’s ability to expand customer use of the Tuya platform over time and generate

revenue growth from existing customers. |

Mr. Xueji

(Jerry) Wang, Founder and Chief Executive Officer of Tuya, commented, “In the fourth quarter of 2023, we continued to execute

our proven development strategies of focusing on key account customers and enhancing our product capabilities to boost our value proposition,

while also essentially completing our organization adjustment. These combined efforts enabled us to conclude the year with strong sequential

growth momentum. Notably, we achieved a 42.2% year-over-year revenue increase, reaching approximately $64.4 million in the quarter, alongside

a record-high blended gross margin of 47.3%. These results reflect the substantial value of our platform, products, and services offer

to our customers, affirming our confidence in Tuya’s resilience and its capability to navigate industry cycles with improved operational

leverage and financial performance.”

Ms. Yao

(Jessie) Liu, Director and Chief Financial Officer of Tuya, added, “The fourth quarter marked our transition from recovery

to growth, efficiency enhancements, and margin expansion. During the quarter, all three business sectors recorded robust revenue growth,

and their margins either improved or remained steady, a testament to the effectiveness of our product focus and enrichment strategy. Our

strategic commitment to cost management and operational efficiency, coupled with the steady growth of gross profits, resulted in continued

record-high non-GAAP net profits and positive net operating cashflow. As we advance into 2024, we are confident that Tuya’s solid

financial position and momentum will sustain our business expansion and product profitability.”

Fourth Quarter 2023 Unaudited Financial Results

REVENUE

Total

revenue in the fourth quarter of 2023 increased by 42.2% to US$64.4 million from US$45.3 million in the same period of 2022, mainly

due to the increase in IoT PaaS revenue, SaaS and others revenue and smart device distribution revenue.

| · | IoT PaaS revenue in the fourth quarter of 2023

increased by 44.6% to US$47.2 million from US$32.6 million in the same period of 2022, primarily due to the relief of downstream

inventory backlog and a global economic improvement compared with the same period of 2022, along with the effective customer-focus and

product-enhancement strategies the Company adopted to navigate through the macroeconomic headwinds. Correspondingly, the Company’s

DBNER of IoT PaaS for the trailing 12 months ended December 31, 2023 increased to 103% from 51% for the trailing 12 months ended

December 31, 2022. |

| · | SaaS and others revenue in the fourth quarter

of 2023 increased by 19.3% to US$9.5 million from US$7.9 million in the same period of 2022, primarily due to an increase in revenue

from cloud software products. The Company remained committed to offering value-added services and a diverse range of software products

with compelling value propositions to its customers. |

| · | Smart device distribution revenue in the fourth

quarter of 2023 increased by 64.6% to US$7.8 million from US$4.7 million in the same period of 2022, primarily due to an increase

in revenue from smart device solutions and the variations in the timing and volume of customer demands and purchases. |

COST OF REVENUE

Cost

of revenue in the fourth quarter of 2023 increased by 35.3% to US$33.9 million from US$25.1 million in the same period of 2022,

generally in line with the increase in the Company’s total revenue.

GROSS PROFIT AND GROSS MARGIN

Total gross profit in the fourth quarter of 2023

increased by 50.9% to US$30.5 million from US$20.2 million in the same period of 2022 and gross margin increased to 47.3% in the fourth

quarter of 2023 from 44.6% in the same period of 2022.

| · | IoT PaaS gross margin in the fourth quarter of

2023 was 44.8%, compared to 41.5% in the same period of 2022, primarily due to the changes in product mix, enhancement in product

value, and the decrease in provision recorded for certain slow-moving IoT chips and raw materials compared to the fourth quarter of last

year. |

| · | SaaS and others gross margin in the fourth quarter

of 2023 was 74.2%, which remained relatively stable, compared to 75.2% in the same period of 2022. |

| · | Smart device distribution gross margin in the

fourth quarter of 2023 was 29.7%, compared to 14.6% in the same period of 2022, primarily due to higher-value product solutions

we provided to our customers during the fourth quarter of 2023. |

OPERATING EXPENSES

Operating expenses increased by 2.0% to US$54.1

million in the fourth quarter of 2023 from US$53.0 million in the same period of 2022.

Non-GAAP

operating expenses, defined as operating expenses excluding share-based compensation expenses and credit loss of long-term investments,

decreased by 13.5% to US$30.7 million in the fourth quarter of 2023 from US$35.5 million in the same period of 2022. Share-based compensation

expenses in the fourth quarter of 2023 were US$15.9 million, compared to US$17.5 million in the same period of 2022. Credit loss of long-term

investments was US$7.4 million in the fourth quarter of 2023, compared to nil in the same period of 2022.

| · | Research and development expenses in the fourth

quarter of 2023 were US$22.8 million, down 17.9% from US$27.8 million in the same period of 2022, primarily because of the strategic

streamlining of the Company’s research and development team and operations. During this quarter, average salaried employee headcount

of the Company’s research and development team was down approximately 21.9% year over year, compared to the same quarter in last

year. Non-GAAP adjusted research and development expenses in the fourth quarter of 2023 were US$19.4 million, compared to US$23.8 million

in the same period of 2022. |

| · | Sales and marketing expenses in the fourth quarter

of 2023 were US$10.9 million, down 2.4% from US$11.2 million in the same period of 2022, primarily due to the strategic streamlining

of the Company’s sales and marketing team, partially offset by increased spending in marketing events as the revenue returned to

a year-over-year growth trajectory since the third quarter of 2023. Non-GAAP adjusted sales and marketing expenses in the fourth quarter

of 2023 were US$9.5 million, compared to US$9.6 million in the same period of 2022. |

| · | General and administrative expenses in the fourth

quarter of 2023 were US$23.8 million, up 46.8% compared to US$16.2 million in the same period of 2022, primarily due to the credit

loss of US$7.4 million of long-term investments. Non-GAAP adjusted general and administrative expenses in the fourth quarter of 2023 were

US$5.3 million, compared to US$4.3 million in the same period of 2022. |

| · | Other operating income, net in the fourth

quarter of 2023 was US$3.4 million, primarily due to the receipt of software value-added tax refunds and various general subsidies for

enterprises. |

LOSS FROM OPERATIONS AND OPERATING MARGIN

Loss

from operations in the fourth quarter of 2023 narrowed by 28.0% to US$23.6 million from US$32.8 million in the same period of 2022. Non-GAAP

loss from operations in the fourth quarter of 2023 narrowed by 98.3% to US$0.3 million from US$15.3 million in the same period of 2022.

Operating

margin in the fourth quarter of 2023 was negative 36.7%, improved by 35.8 percentage points from negative 72.5% in the same period

of 2022. Non-GAAP operating margin in the fourth quarter of 2023 was negative 0.4%, improved by 33.4 percentage points from negative 33.8%

in the same period of 2022.

NET LOSS/PROFIT AND NET MARGIN

Net

loss in the fourth quarter of 2023 narrowed by 52.4% to US$10.8 million from US$22.7 million in the same period of 2022. The difference

between loss from operations and net loss in the fourth quarter of 2023 was primarily because of a US$13.1 million interest income achieved

mainly due to well implemented treasury strategies on the Company’s cash and bank time deposits recorded as short-term and

long-term investments.

The

Company had a non-GAAP net profit of US$12.6 million in the fourth quarter of 2023, compared to a non-GAAP net loss of US$5.2 million

in the same period of 2022, demonstrating the Company’s ability to sustain profitability on a non-GAAP basis.

Net

margin in the fourth quarter of 2023 was negative 16.8%, improving by 33.4 percentage points from negative 50.2% in the same period

of 2022. Non-GAAP net margin in the fourth quarter of 2023 was 19.5%, improving by 31.0 percentage points from negative 11.5% in the same

period of 2022.

BASIC AND DILUTED NET LOSS/PROFIT PER ADS

Basic

and diluted net loss per ADS was US$0.02 in the fourth quarter of 2023, compared to US$0.04 in the same period of 2022. Each ADS

represents one Class A ordinary share.

Non-GAAP

basic and diluted net profit per ADS was US$0.02 in the fourth quarter of 2023, compared to non-GAAP basic and diluted net loss of US$0.01

in the same period of 2022.

CASH

AND CASH EQUIVALENTS, TIME DEPOSITS AND U.S. TREASURY SECURITIES RECORDED AS SHORT-TERM AND LONG-TERM INVESTMENTS

Cash

and cash equivalents, time deposits and U.S. treasury securities recorded as short-term and long-term investments were US$984.3

million as of December 31, 2023, compared to US$952.0 million as of December 31, 2022, which the Company believes is sufficient

to meet its current liquidity and working capital needs.

NET CASH GENERATED FROM OPERATING ACTIVITIES

Net

cash generated from operating activities in the fourth quarter of 2023 was US$31.8 million, compared to net cash used in operating

activities US$0.1 million in the same period of 2022. The net cash generated from operating activities for the fourth quarter of 2023

improved mainly due to the increase in the Company’s revenue, and the decrease in operating expenses, particularly employee-related

costs, and working capital changes in the ordinary course of business.

For

further information on non-GAAP financial measures presented above, see the section headed “Use of Non-GAAP Financial Measures.”

Business Outlook

In

the fourth quarter of 2023, we continued to observe a moderately declining yet persisting overall inflation, which is expected

to continually influence the discretionary consumer electronics spending. On the supply chain front, we expect downstream inventory levels

to be normalizing ongoingly, providing downstream smart device manufacturers, brands, and retail channels with greater flexibility and

resilience to adapt their operational and procurement plans as necessary. This, in turn, will revitalize their investment in smart business.

Overall, discretionary consumer electronic spending alongside enterprise procurement are expected to prioritize cost-effectiveness, reflecting

a balanced approach widely adopted in the current economic climate.

In

response to this evolving market environment, the Company will remain committed to continuously iterating and improving its products

and services, further enhancing software and hardware capabilities, expanding key customer base, investing in innovations and new opportunities,

diversifying revenue streams, and further optimizing operating efficiency. At the same time, the Company understands that future trajectories

may encounter challenges, including shifting consumer spending patterns, regional economic disparities, inventory management, foreign

exchange rate volatility, and broader geopolitical uncertainties.

Conference Call Information

The

Company’s management will hold a conference call at 07:30 P.M. Eastern Time on Tuesday, February 27, 2024 (08:30

A.M. Beijing Time on Wednesday, February 28, 2024) to discuss the financial results. In advance of the conference call, all

participants must use the following link to complete the online registration process. Upon registering, each participant will receive

access details for this conference including a conference access code, a PIN number (personal access code), the dial-in number, and an

e-mail with detailed instructions to join the conference call.

Online

registration: https://www.netroadshow.com/events/login?show=a98d0a81&confId=60968

The

replay will be accessible through March 5, 2024 by dialing the following numbers:

| International: |

+1-929-458-6194 |

| United States: |

+1-866-813-9403 |

| Access Code: |

925036 |

A live and archived webcast of the conference

call will also be available at the Company’s investor relations website at https://ir.tuya.com.

About Tuya Inc.

Tuya

Inc. (NYSE: TUYA; HKEX: 2391) is a global leading IoT cloud development platform with a mission to build an IoT developer ecosystem

and enable everything to be smart. Tuya has pioneered a purpose-built IoT cloud development platform that delivers a full suite of offerings,

including Platform-as-a-Service, or PaaS, and Software-as-a-Service, or SaaS, to businesses and developers. Through its IoT cloud development

platform, Tuya has enabled developers to activate a vibrant IoT ecosystem of brands, OEMs, partners and end users to engage and communicate

through a broad range of smart devices.

Use

of Non-GAAP Financial Measures

In

evaluating the business, the Company considers and uses non-GAAP measures, such as non-GAAP operating expenses, non-GAAP loss from

operations (including non-GAAP operating margin), non-GAAP net (loss)/profit (including non-GAAP net margin), and non-GAAP basic and diluted

net (loss)/profit per ADS, as supplemental measures to review and assess its operating performance. The presentation of non-GAAP financial

measures is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance

with generally accepted accounting principles in the United States of America (“U.S. GAAP”). The Company defines non-GAAP

measures by excluding the impact of share-based compensation expenses and credit-related impairment of long-term investments from the

respective GAAP measures. The Company presents the non-GAAP financial measures because they are used by the management to evaluate its

operating performance and formulate business plans. The Company also believes that the use of the non-GAAP measures facilitates investors’

assessment of its operating performance.

Non-GAAP

financial measures are not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP. Non-GAAP financial measures have

limitations as analytical tools. One of the key limitations of using the aforementioned non-GAAP financial measures is that they do not

reflect all items of expenses that affect the Company’s operations. Share-based compensation expenses and credit-related impairment

of long-term investments have been and may continue to be incurred in the business and are not reflected in the presentation of non-GAAP

financial measures. Further, the non-GAAP financial measures may differ from the non-GAAP information used by other companies, including

peer companies, and therefore their comparability may be limited. The Company compensates for these limitations by reconciling the non-GAAP

financial measures to the nearest U.S. GAAP performance measures, all of which should be considered when evaluating the Company’s

performance. The Company encourages you to review its financial information in its entirety and not rely on a single financial measure.

Reconciliations

of Tuya’s non-GAAP financial measures to the most comparable U.S. GAAP measures are included at the end of this press release.

Safe Harbor Statement

This

press release contains forward-looking statements. These statements are made under the “safe harbor” provisions of

the U.S. Private Securities Litigation Reform Act of 1995. Statements that are not historical facts, including statements about the Company’s

beliefs, and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties, and a

number of factors could cause actual results to differ materially from those contained in any forward-looking statement. In some cases,

forward-looking statements can be identified by words or phrases such as “may”, “will”, “expect”,

“anticipate”, “target”, “aim”, “estimate”, “intend”, “plan”, “believe”,

“potential”, “continue”, “is/are likely to” or other similar expressions. Further information regarding

these and other risks, uncertainties or factors is included in the Company’s filings with the SEC. The forward-looking statements

included in this press release are only made as of the date hereof, and the Company disclaims any obligation to publicly update any forward-looking

statement to reflect subsequent events or circumstances, except as required by law. All forward-looking statements should be evaluated

with the understanding of their inherent uncertainty.

Investor Relations Contact

Tuya Inc.

Investor Relations

Email:

ir@tuya.com

The Blueshirt Group

Gary

Dvorchak, CFA

Phone:

+1 (323) 240-5796

Email:

gary@blueshirtgroup.com

TUYA

INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

AS

OF DECEMBER 31, 2022 AND 2023

(All

amounts in US$ thousands (“US$”),

except

for share and per share data, unless otherwise noted)

| | |

As of

December 31, | | |

As of

December 31, | |

| | |

2022 | | |

2023 | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

| 133,161 | | |

| 498,688 | |

| Short-term investments | |

| 821,134 | | |

| 291,023 | |

| Accounts receivable, net | |

| 12,172 | | |

| 9,214 | |

| Notes receivable, net | |

| 2,767 | | |

| 4,955 | |

| Inventories, net | |

| 45,380 | | |

| 32,865 | |

| Prepayments and other current assets, net | |

| 8,752 | | |

| 11,053 | |

| | |

| | | |

| | |

| Total current assets | |

| 1,023,366 | | |

| 847,798 | |

| | |

| | | |

| | |

| Non-current assets: | |

| | | |

| | |

| Property, equipment and software, net | |

| 3,827 | | |

| 2,589 | |

| Operating lease right-of-use assets, net | |

| 9,736 | | |

| 7,647 | |

| Long-term investments | |

| 18,031 | | |

| 207,489 | |

| Other non-current assets, net | |

| 1,179 | | |

| 877 | |

| | |

| | | |

| | |

| Total non-current assets | |

| 32,773 | | |

| 218,602 | |

| | |

| | | |

| | |

| Total assets | |

| 1,056,139 | | |

| 1,066,400 | |

| | |

| | | |

| | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

| 9,595 | | |

| 11,577 | |

| Advances from customers | |

| 27,633 | | |

| 31,776 | |

| Deferred revenue, current | |

| 6,821 | | |

| 6,802 | |

| Accruals and other current liabilities | |

| 33,383 | | |

| 32,807 | |

| Incomes tax payables | |

| – | | |

| 689 | |

| Lease liabilities, current | |

| 3,850 | | |

| 3,883 | |

| | |

| | | |

| | |

| Total current liabilities | |

| 81,282 | | |

| 87,534 | |

| | |

| | | |

| | |

| Non-current liabilities: | |

| | | |

| | |

| Lease liabilities, non-current | |

| 5,292 | | |

| 3,904 | |

| Deferred revenue, non-current | |

| 394 | | |

| 506 | |

| Other non-current liabilities | |

| 7,004 | | |

| 3,891 | |

| | |

| | | |

| | |

| Total non-current liabilities | |

| 12,690 | | |

| 8,301 | |

| | |

| | | |

| | |

| Total liabilities | |

| 93,972 | | |

| 95,835 | |

TUYA INC.

UNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS (CONTINUED)

AS

OF DECEMBER 31, 2022 AND 2023

(All

amounts in US$ thousands (“US$”),

except

for share and per share data, unless otherwise noted)

| | |

As of

December 31, | | |

As of

December 31, | |

| | |

2022 | | |

2023 | |

| Shareholders’ equity: | |

| | | |

| | |

| Ordinary shares | |

| – | | |

| – | |

| Class A ordinary shares | |

| 25 | | |

| 25 | |

| Class B ordinary shares | |

| 4 | | |

| 4 | |

| Treasury stock | |

| (86,438 | ) | |

| (53,630 | ) |

| Additional paid-in capital | |

| 1,584,764 | | |

| 1,616,105 | |

| Accumulated other comprehensive loss | |

| (22,115 | ) | |

| (17,091 | ) |

| Accumulated deficit | |

| (514,073 | ) | |

| (574,848 | ) |

| | |

| | | |

| | |

| Total shareholders’ equity | |

| 962,167 | | |

| 970,565 | |

| | |

| | | |

| | |

| Total liabilities and shareholders’ equity | |

| 1,056,139 | | |

| 1,066,400 | |

TUYA INC.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF COMPREHENSIVE LOSS

(All

amounts in US$ thousands (“US$”),

except

for share and per share data, unless otherwise noted)

| | |

For the Three Months Ended | |

| | |

December 31,

2022 | | |

December 31,

2023 | |

| Revenue | |

| 45,286 | | |

| 64,411 | |

| Cost of revenue | |

| (25,100 | ) | |

| (33,948 | ) |

| | |

| | | |

| | |

| Gross profit | |

| 20,186 | | |

| 30,463 | |

| | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | |

| Research and development expenses | |

| (27,792 | ) | |

| (22,806 | ) |

| Sales and marketing expenses | |

| (11,203 | ) | |

| (10,937 | ) |

| General and administrative expenses | |

| (16,181 | ) | |

| (23,754 | ) |

| Other operating incomes, net | |

| 2,160 | | |

| 3,410 | |

| | |

| | | |

| | |

| Total operating expenses | |

| (53,016 | ) | |

| (54,087 | ) |

| | |

| | | |

| | |

| Loss from operations | |

| (32,830 | ) | |

| (23,624 | ) |

| | |

| | | |

| | |

| Other income/(loss) | |

| | | |

| | |

| Other non-operating income, net | |

| 779 | | |

| 778 | |

| Financial income, net | |

| 10,234 | | |

| 13,135 | |

| Foreign exchange (loss)/gain, net | |

| (102 | ) | |

| 17 | |

| | |

| | | |

| | |

| Loss before income tax expense | |

| (21,919 | ) | |

| (9,694 | ) |

| Income tax expense | |

| (811 | ) | |

| (1,122 | ) |

| | |

| | | |

| | |

| Net loss | |

| (22,730 | ) | |

| (10,816 | ) |

| | |

| | | |

| | |

| Net loss attributable to Tuya Inc. | |

| (22,730 | ) | |

| (10,816 | ) |

| | |

| | | |

| | |

| Net loss attribute to ordinary shareholders | |

| (22,730 | ) | |

| (10,816 | ) |

| | |

| | | |

| | |

| Net loss | |

| (22,730 | ) | |

| (10,816 | ) |

| Other comprehensive (loss)/income | |

| | | |

| | |

| Changes in fair value of long-term investments | |

| (8,347 | ) | |

| (5,321 | ) |

| Transfer out of fair value changes of long-term investments | |

| – | | |

| 7,487 | |

| Foreign currency translation | |

| 2,090 | | |

| 1,772 | |

| | |

| | | |

| | |

| Total comprehensive loss attributable to Tuya Inc. | |

| (28,987 | ) | |

| (6,878 | ) |

TUYA INC.

UNAUDITED CONDENSED CONSOLIDATED

STATEMENTS OF COMPREHENSIVE LOSS (CONTINUED)

(All

amounts in US$ thousands (“US$”),

except

for share and per share data, unless otherwise noted)

| | |

For the Three Months Ended | |

| | |

December 31,

2022 | | |

December 31,

2023 | |

| Net loss attributable to Tuya Inc. | |

| (22,730 | ) | |

| (10,816 | ) |

| | |

| | | |

| | |

| Net loss attributable to ordinary shareholders | |

| (22,730 | ) | |

| (10,816 | ) |

| | |

| | | |

| | |

| Weighted average number of ordinary shares used in computing net loss per share, basic and diluted | |

| 554,121,595 | | |

| 557,103,923 | |

| | |

| | | |

| | |

| Net loss per share attributable to ordinary shareholders, basic and diluted | |

| (0.04 | ) | |

| (0.02 | ) |

| | |

| | | |

| | |

| Share-based compensation expenses were included in: | |

| | | |

| | |

| Research and development expenses | |

| 4,032 | | |

| 3,446 | |

| Sales and marketing expenses | |

| 1,611 | | |

| 1,462 | |

| General and administrative expenses | |

| 11,867 | | |

| 11,028 | |

TUYA INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS

OF CASH FLOWS

(All

amounts in US$ thousands (“US$”),

except

for share and per share data, unless otherwise noted)

| | |

For the Three Months Ended | |

| | |

December 31,

2022 | | |

December 31,

2023 | |

| Net cash (used in)/generated from operating activities | |

| (138 | ) | |

| 31,760 | |

| Net cash (used in)/generated from investing activities | |

| (165,305 | ) | |

| 299,763 | |

| Net cash (used in)/generated from financing activities | |

| (3,432 | ) | |

| 162 | |

| Effect of exchange rate changes on cash and cash equivalents, restricted cash | |

| 2,138 | | |

| 729 | |

| | |

| | | |

| | |

| Net (decrease)/increase in cash and cash equivalents, restricted cash | |

| (166,737 | ) | |

| 332,414 | |

| | |

| | | |

| | |

| Cash and cash equivalents, restricted cash at the beginning of period | |

| 299,898 | | |

| 166,274 | |

| | |

| | | |

| | |

| Cash and cash equivalents, restricted cash at the end of period | |

| 133,161 | | |

| 498,688 | |

TUYA INC.

UNAUDITED

RECONCILIATION OF NON-GAAP MEASURES TO THE MOST DIRECTLY COMPARABLE FINANCIAL MEASURES

(All

amounts in US$ thousands (“US$”),

except

for share and per share data, unless otherwise noted)

| | |

For the Three Months Ended | |

| | |

December 31,

2022 | | |

December 31,

2023 | |

| Reconciliation of operating expenses to non-GAAP operating expenses | |

| | | |

| | |

| Research and development expenses | |

| (27,792 | ) | |

| (22,806 | ) |

| Add: Share-based compensation expenses | |

| 4,032 | | |

| 3,446 | |

| Adjusted Research and development expenses | |

| (23,760 | ) | |

| (19,360 | ) |

| | |

| | | |

| | |

| Sales and marketing expenses | |

| (11,203 | ) | |

| (10,937 | ) |

| Add: Share-based compensation expenses | |

| 1,611 | | |

| 1,462 | |

| Adjusted Sales and marketing expenses | |

| (9,592 | ) | |

| (9,475 | ) |

| | |

| | | |

| | |

| General and administrative expenses | |

| (16,181 | ) | |

| (23,754 | ) |

| Add: Share-based compensation expenses | |

| 11,867 | | |

| 11,028 | |

| Add: Credit-related impairment of long-term investments | |

| – | | |

| 7,435 | |

| Adjusted General and administrative expenses | |

| (4,314 | ) | |

| (5,291 | ) |

| | |

| | | |

| | |

| Reconciliation of loss from operations to non-GAAP loss from operations | |

| | | |

| | |

| Loss from operations | |

| (32,830 | ) | |

| (23,624 | ) |

| Operating margin | |

| (72.5 | )% | |

| (36.7 | )% |

| Add: Share-based compensation expenses | |

| 17,510 | | |

| 15,936 | |

| Add: Credit-related impairment of long-term investments | |

| – | | |

| 7,435 | |

| Non-GAAP Loss from operations | |

| (15,320 | ) | |

| (253 | ) |

| | |

| | | |

| | |

| Non-GAAP Operating margin | |

| (33.8 | )% | |

| (0.4 | )% |

| | |

| | | |

| | |

| Reconciliation of net loss to non-GAAP net (loss)/profit | |

| | | |

| | |

| Net loss | |

| (22,730 | ) | |

| (10,816 | ) |

| Net margin | |

| (50.2 | )% | |

| (16.8 | )% |

| Add: Share-based compensation expenses | |

| 17,510 | | |

| 15,936 | |

| Add: Credit-related impairment of long-term investments | |

| – | | |

| 7,435 | |

| Non-GAAP Net (loss)/profit | |

| (5,220 | ) | |

| 12,555 | |

| | |

| | | |

| | |

| Non-GAAP Net margin | |

| (11.5 | )% | |

| 19.5 | % |

| | |

| | | |

| | |

| Weighted average number of ordinary shares used in computing non-GAAP net loss per share | |

| | | |

| | |

| – Basic | |

| 554,121,595 | | |

| 557,103,923 | |

| | |

| | | |

| | |

| – Diluted | |

| 554,121,595 | | |

| 589,438,606 | |

| | |

| | | |

| | |

| Non-GAAP net (loss)/profit per share attributable to ordinary shareholders | |

| | | |

| | |

| – Basic | |

| (0.01 | ) | |

| 0.02 | |

| | |

| | | |

| | |

| – Diluted | |

| (0.01 | ) | |

| 0.02 | |

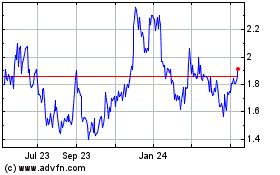

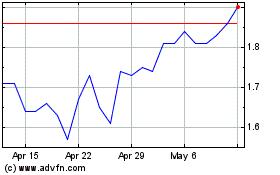

Tuya (NYSE:TUYA)

Historical Stock Chart

From Apr 2024 to May 2024

Tuya (NYSE:TUYA)

Historical Stock Chart

From May 2023 to May 2024