“Strong Start to the Year and Targets

Raised”

Turkcell Iletisim Hizmetleri (NYSE:TKC)

(BIST:TCELL):

- Please note that all financial data is

consolidated and comprises that of Turkcell Iletisim Hizmetleri

A.S. (the “Company”, or “Turkcell”) and its subsidiaries and

associates (together referred to as the “Group”), unless otherwise

stated.

- We have three reporting segments:

- "Turkcell Turkey" which comprises all

of our telecom related businesses in Turkey (as used in our

previous releases in periods prior to Q115, this term covered only

the mobile businesses). All non-financial data presented in this

press release is unconsolidated and comprises Turkcell Turkey only

figures, unless otherwise stated. The terms "we", "us", and "our"

in this press release refer only to Turkcell Turkey, except in

discussions of financial data, where such terms refer to the Group,

and except where context otherwise requires.

- “Turkcell International” which

comprises all of our telecom related businesses outside of

Turkey.

- “Other subsidiaries” which is mainly

comprised of our information and entertainment services, call

center business revenues, financial services revenues and

inter-business eliminations. Turkcell Ödeme ve Elektronik Para

Hizmetleri A.Ş., our subsidiary responsible for payment services,

was previously reported under Turkcell Turkey but with effect from

the first quarter of 2019 is now included in “Other Subsidiaries”.

We made this change due to the fact that its non-group revenues,

which are not telco related, and consumer finance business related

revenues now comprise the majority of its total revenues. All

figures presented in this document for prior periods have been

restated to reflect this change.

- In this press release, a year-on-year

comparison of our key indicators is provided, and figures in

parentheses following the operational and financial results for

March 31, 2019 refer to the same item as at March 31, 2018. For

further details, please refer to our consolidated financial

statements and notes as at and for March 31, 2019, which can be

accessed via our website in the investor relations section

(www.turkcell.com.tr).

- Selected financial information

presented in this press release for the first and fourth quarters

of 2018 and the first quarter of 2019 is based on IFRS figures in

TRY terms unless otherwise stated.

- In accordance with our strategic

approach and IFRS requirements, Fintur is classified as ‘held for

sale’ and reported as discontinued operations as of October 2016.

Certain operating data that we previously presented with Fintur

included has been restated without Fintur.

- In the tables used in this press

release totals may not foot due to rounding differences. The same

applies to the calculations in the text.

- Year-on-year and quarter-on-quarter

percentage comparisons appearing in this press release reflect

mathematical calculation.

FINANCIAL HIGHLIGHTS

TRY million Q118 Q418

Q119 y/y % q/q % Revenue

4,762 5,626 5,675 19.2% 0.9% EBITDA1

2,022 2,239 2,281 12.8% 1.9% EBITDA Margin (%) 42.5% 39.8% 40.2%

(2.3pp) 0.4pp Net Income 501 864 1,224

144.5% 41.7%

FIRST QUARTER HIGHLIGHTS

- Strong set of financials:

- Group revenues of TRY5,675 million, up

19.2% year-on-year

- Group EBITDA of TRY2,281 million, with

an EBITDA margin of 40.2%

- Positive quarterly trend in EBITDA

margin, up 0.4pp for the Group and up 2.2pp for Turkcell

Turkey

- Group net income of TRY1,224 million on

strong operating performance, disciplined financial risk management

and contribution of Fintur sale

- Solid operational performance:

- Mobile ARPU2 growth of 13.4%

year-on-year, like-for-like ARPU3 growth of 19.6%

- Residential fiber ARPU

growth of 12.3% year-on-year

- Digital services downloads reached 178

million

- Mobile multiplay subscriber ratio4

reached 68.6%, up 9.9pp year-on-year; multiplay with TV

subscribers5 reached 49.5%, up 3.8pp year-on-year

- Data usage of 4.5G users at 7.8GB in

March

- The transfer of our stake in Fintur to

Sonera Holding B.V. was completed. The final transaction value was

EUR352.9 million. TRY772.4 million profit was generated from the

transaction.

- Restructuring of the sales organization

enables us to closely focus on customer needs and respond with more

effective services and solutions.

- We revise our guidance6 for 2019.

Accordingly, we now target revenue growth of 17%-19% up from

16%-18% and an EBITDA margin of 38%-40% compared to 37%-40%

previously. We maintain our target operational capex over sales

ratio7 of 16%-18%.

(1) EBITDA is a non-GAAP financial measure. See page 13 for the

explanation of how we calculate Adjusted EBITDA and its

reconciliation to net income.(2) Excluding M2M(3) The ARPU of

customers who have stayed with Turkcell for at least 14 months(4)

Share of mobile voice line users which excludes subscribers who

have not used their line in the last 3 months. Multiplay refers to

mobile customers who use voice, data and one of core digital

services.(5) Multiplay subscribers with TV: Fiber internet + IPTV

users & fiber internet + IPTV + fixed voice users(6) Please

note that this paragraph contains forward looking statements based

on our current estimates and expectations regarding market

conditions for each of our different businesses. No assurance can

be given that actual results will be consistent with such estimates

and expectations. For a discussion of factors that may affect our

results, see our Annual Report on Form 20-F for 2018 filed with

U.S. Securities and Exchange Commission, and in particular, the

risk factor section therein(7) Excluding license feeFor further

details, please refer to our consolidated financial statements and

notes as at and for March 31, 2019 which can be accessed via our

website in the investor relations section

(www.turkcell.com.tr).

COMMENTS BY MURAT ERKAN, CEO

Economic fragility has prevailed in the emerging markets in the

first quarter of 2019. Regardless, as Turkcell Group, we have

delivered robust results on the back of our solid business model

built on strong pillars. Our consolidated revenues grew yearly by

19.2% to TRY5.7 billion with an EBITDA1 of TRY2.3 billion,

resulting in an EBITDA margin of 40.2%. Including the TRY772

million profit generated from the Fintur transaction, we reported

TRY1.2 billion net income, 1.4 times higher than for the same

period of last year. Accordingly, we revise our full-year guidance2

for 2019 upwards to 17% - 19% for revenue growth and 38% - 40% for

the EBITDA margin. In addition to our solid financial performance,

our leverage ratio has declined to 1.3x with the contribution of

the Fintur transaction, and we expect it to further decline over

the coming periods.

Demand for mobile data has remained strong this quarter with the

contribution of our digital services. Monthly average data

consumption of customers on our 4.5G network has increased 28%

yearly to 7.4GB. Total downloads of our digital services reached

178 million, while we have continued efforts to increase the time

spent on these services. In the fixed segment, Superbox, our Fixed

Wireless Access (FWA) product providing fiber-like speeds at

locations not covered by our fiber network, has earned customer

appreciation, reaching 56 thousand subscribers. Our capability to

provide the Superbox service for the first time in Turkey through

our wide frequency and strong infrastructure has also proven our

readiness for 5G.

As Turkcell, with our “customer first” motto we continue to

contribute to our people and our country.

We marked our twenty-fifth anniversary in February. Over the

past 25 years, Turkcell has transformed from a conventional telco

into the world’s first digital operator. We have developed digital

services; and what’s more, we export technology. Following the one

signed with Moldcell, we have also signed cooperation agreements

with ALBtelecom of Albania, CG Corp Global of Nepal and Digicel

Group of the Caribbean to allow the use of our digital services.

Our customer-focused approach, which we have always pursued in

achieving this success, will only gain strength in the upcoming

periods as we contribute to their lives with new smart

technologies. In this new era, we aim to strengthen our emotional

ties with our customers and have redesigned our sales organization

accordingly. We now have a structure enabling us to focus on

customer needs more closely, and design more effective services and

solutions.

We have three strategic focus areas.

We believe we can sustain profitable growth with a strategic

focus on three key areas: Our digital services, digital business

solutions and our techfin platform. While continuing to work on

increasing the usage of our locally-developed digital services, we

plan to establish new commercial partnerships for digital exports,

the destinations of which today number 38 countries. We will serve

the digital transformation of both private and public sectors

through Digital Business Solutions, our new subsidiary. The

digitization of financial services, which in our view offers great

potential, as well as other new opportunities in this field form

the third focus area.

We continue our efforts towards a shared

infrastructure.

As we offer our services through a strong mobile and fixed

infrastructure, we continue to work towards accomplishing a shared

infrastructure; one that best serves the interests primarily of our

country, but also of all parties involved. In this context, we

already provide fixed broadband to additional households through

bilateral agreements with Türksat and Vodafone Turkey. Regarding

the next phase, we believe in the necessity of joint investments

into infrastructure to position Turkey’s communication

infrastructure among the best in the world. We particularly

perceive the importance of joint infrastructure in the era of 5G,

which will serve as the platform for Industry 4.0.

We are determined to pioneer Turkey’s technological

advancement.

In April, we hosted the technology summit, which coinciding with

our 25th anniversary, was particularly significant. The latest

advances, particularly of locally manufactured technologies formed

the agenda of the summit in its 10th year. The summit hosted over

70 opinion and business leaders in around 30 sessions where 5G,

artificial intelligence, Industry 4.0, smart technologies,

entrepreneurship, cyber security, robotics and cloud technologies

were the key topics of discussion. Over 10,000 attendees in person

witnessed the introduction of our locally-developed AI-powered

personal assistant “Yaani Assistant”.

We will continue to serve our country and people through our

investments.

Turkcell has accomplished its pioneering role in the

technological transformation of Turkey with its well-established

infrastructure. We have been the fastest growing telco globally on

the back of our services and solutions developed for our customers

over the past three years. We own a strong mobile network operating

over the widest frequency in Turkey. We have laid 43 thousand km of

fiber and built eight data centers, enabling us to provide

high-quality services. For this, we have already invested TRY50

billion in our technological infrastructure over the past 25 years,

and going forward we will continue our investments.

We will announce our 3-year targets in New York.

We have seen a strong start to 2019 and have revised our

full-year targets upwards. Accordingly, we are scheduled to

announce our 3-year targets on October 31, 2019 in New York at the

Turkcell Capital Markets Day.

We thank all our colleagues for the part they have played in our

success, along with our Board of Directors for their unyielding

trust and support. We also express our gratitude to our customers

and business partners, who have remained with us throughout our

success story.

(1) EBITDA is a non-GAAP financial measure. See page 13 for the

explanation of how we calculate Adjusted EBITDA and its

reconciliation to net income.(2) Please note that this paragraph

contains forward looking statements based on our current estimates

and expectations regarding market conditions for each of our

different businesses. No assurance can be given that actual results

will be consistent with such estimates and expectations. For a

discussion of factors that may affect our results, see our Annual

Report on Form 20-F for 2018 filed with U.S. Securities and

Exchange Commission, and in particular, the risk factor section

therein

FINANCIAL AND OPERATIONAL REVIEW

Financial Review of Turkcell Group

Profit & Loss Statement (million TRY) Q118

Q418 Q119 y/y %

q/q % Revenue 4,761.6

5,626.3 5,675.3 19.2%

0.9% Cost of revenue1 (2,134.9) (2,607.3) (2,730.2) 27.9%

4.7%

Cost of revenue1/Revenue (44.8%)

(46.3%) (48.1%) (3.3pp) (1.8pp)

Gross Margin1 55.2% 53.7% 51.9%

(3.3pp) (1.8pp) Administrative expenses (154.3)

(198.2) (190.6) 23.5% (3.8%)

Administrative expenses/Revenue

(3.2%) (3.5%) (3.4%) (0.2pp)

0.1pp Selling and marketing expenses (356.6) (500.8) (403.1)

13.0% (19.5%)

Selling and marketing expenses/Revenue

(7.5%) (8.9%) (7.1%) 0.4pp 1.8pp

Net impairment loses on financial and contract assets (93.8) (81.0)

(70.3) (25.1%) (13.2%)

EBITDA2 2,022.0

2,239.0 2,281.1 12.8% 1.9% EBITDA

Margin 42.5% 39.8% 40.2% (2.3pp)

0.4pp Depreciation and amortization (979.8) (1,287.0)

(1,178.1) 20.2% (8.5%)

EBIT3 1,042.1

952.0 1,103.0 5.8% 15.9% Net finance

income / (costs) (313.5) (18.5) (420.4) 34.1% n.m. Finance income

355.6 (1,225.9) 583.0 63.9% (147.6%) Finance costs4 (669.1) 1,207.4

(1,003.4) 50.0% (183.1%) Other income / (expense) (33.5) 46.5

(51.8) 54.6% (211.4%) Non-controlling interests (24.2) (77.7)

(19.8) (18.2%) (74.5%) Share of profit of equity accounted

investees - 0.3 0.8 n.a. 166.7% Income tax expense (170.2) (38.7)

(159.8) (6.1%) 312.9% Discontinued operations - - 772.4 n.a. n.a.

Net Income 500.8 863.9

1,224.5 144.5% 41.7%

(1) Excluding depreciation and amortization expenses.(2) EBITDA

is a non-GAAP financial measure. See page 13 for the explanation of

how we calculate Adjusted EBITDA and its reconciliation to net

income.(3) EBIT is a non-GAAP financial measure and is equal to

EBITDA minus depreciation and amortization expenses.(4) Fair value

loss and interest expense in relation to derivative instruments

reported under finance cost were netted off from respective fair

value gain and interest income in relation to derivative

instruments reported under finance income. Historical periods were

restated to reflect this change.

Revenue of the Group rose 19.2% year-on-year in Q119.

This was driven mainly by growth in Turkcell Turkey revenues on the

back of successful execution of digital services focused strategy

and upsell performance.

Turkcell Turkey revenues, at 85% of Group revenues, increased

18.7% to TRY4,833 million (TRY4,072 million).

- Data and digital services revenues rose

by 18.1% to TRY3,215 million (TRY2,722 million).

- Higher number of data users, increased

data consumption per user, rise in 4.5G smartphone penetration as

well as the rise in penetration of digital services were the main

drivers of growth on the mobile front.

- Larger fiber subscriber base, price

adjustments and upsell efforts, as well as the increased ratio of

multiplay subscribers with TV, were the main drivers of growth on

the fixed front.

- Wholesale revenues rose by 38.9% to

TRY232 million (TRY167 million) due to increased carrier traffic

and the positive impact of currency movements.

Turkcell International revenues, comprising 7% of Group

revenues, grew by 52.0% to TRY425 million (TRY279 million),

resulting mainly from the rise in lifecell and BeST revenues.

Other subsidiaries' revenues, at 7% of Group revenues, and which

includes information and entertainment services, call center

revenues and revenues from financial services were at TRY417

million (TRY410 million).

- Please note that we completed the sale

of our shares in Azerinteltek, our sports betting business in

Azerbaijan, as of January 11, 2019. As we received the transfer of

proceeds on December 27, 2018 and transferred the control of the

subsidiary, we did not report any revenues in Q119 in relation to

Azerinteltek operations.

- Our consumer finance company’s revenues

grew by 14.1% to TRY242 million (TRY212 million). Revenue growth

was impacted by the decline in consumer loan portfolio from TRY4.4

billion as of Q118 to TRY3.6 billion as of Q119 due to the

installment limitation on consumer loans for telecom devices.

- Turkcell Ödeme ve Elektronik Para

Hizmetleri A.Ş., our subsidiary responsible for payment services,

was previously reported under Turkcell Turkey but with effect from

the first quarter of 2019 is now included in “Other Subsidiaries”.

We made this change due to the fact that its non-group revenues,

which are not telco related, and consumer finance business related

revenues now comprise the majority of its total revenues. All

figures presented in this document for prior periods have been

restated to reflect this change.

Cost of revenue (excluding depreciation and amortization)

increased to 48.1% (44.8%) as a percentage of revenues in Q119.

This was mainly due to the rise in cost of goods sold (4.6pp),

despite the decline in other cost items (1.3pp) as a percentage of

revenues.

Administrative expenses were at 3.4% (3.2%) as a

percentage of revenues in Q119.

Selling and marketing expenses declined to 7.1% (7.5%) as

a percentage of revenues in Q119. This was mainly due to the

decline in selling expenses (0.7pp), despite the rise in other cost

items (0.3pp) as a percentage of revenues.

Net impairment loses on financial and contract assets

were at TRY70 million (TRY 94 million) in Q119.

EBITDA1 rose by 12.8% year-on-year in Q119,

leading to an EBITDA margin of 40.2% (42.5%).

- Turkcell Turkey’s EBITDA grew by 9.7%

to TRY1,910 million (TRY1,741 million) resulting in an EBITDA

margin of 39.5% (42.8%). Turkcell Turkey’s EBITDA margin improved

by 2.2pp compared to Q418 (37.3%).

- Turkcell International EBITDA2

increased to TRY194 million (TRY93 million) with an EBITDA margin

of 45.6% (33.2%).

- The EBITDA of other subsidiaries was at

TRY178 million (TRY188 million).

(1) EBITDA is a non-GAAP financial measure. See page 13 for the

explanation of how we calculate adjusted EBITDA and its

reconciliation to net income.

(2) We started to capitalize the frequency usage fees of

lifecell in Q418 in accordance with IFRS16 which led to a positive

impact on Turkcell International EBITDA. The change was implemented

retrospectively; impact regarding previous quarters of 2018 was

booked in Q418.

Depreciation and amortization expenses increased by 20.2%

in Q119.

Net finance expense increased to TRY420 million (TRY313

million) in Q119, mainly due to the higher interest expense of

loans. Please note that the Group started to apply hedge accounting

as of July 1, 2018 for existing participating cross currency swap

and cross currency swap transactions, in accordance with the IFRS 9

hedge accounting requirement. Please see the IFRS report for

details.

See Appendix A for details of net foreign exchange gain and

loss.

Income tax expense declined 6.1% year-on-year in Q119.

Please see Appendix A for details.

Net income of the Group rose to TRY1,224 million (TRY501

million) in Q119, mainly driven by strong operating performance,

disciplined financial risk management and contribution of the

Fintur sale, which had a positive impact of TRY772 million.

Total cash & debt: Consolidated cash as of March 31,

2019 increased to TRY8,888 million from TRY7,419 million as of

December 31, 2018. Excluding the FX swap transactions for TRY

borrowing, 79% of our cash is in US$ and 21% is in EUR.

Consolidated debt as of March 31, 2019 increased to TRY22,867

million from TRY20,156 million as of December 31, 2018. Please note

that TRY1,410 million of our consolidated debt is comprised of

lease obligations resulting from the implementation of IFRS 16.

- Consolidated debt breakdown excluding

lease obligations resulting from the implementation of IFRS 16:

- Turkcell Turkey’s debt balance was

TRY16,771 million, of which TRY9,727 million (US$1,728 million) was

denominated in US$, TRY6,299 million (EUR997 million) in EUR,

TRY214 million (CNY257 million) in CNY and the remaining TRY531

million in TRY.

- The debt balance of lifecell was

TRY1,071 million all denominated in UAH.

- Our consumer finance company had a debt

balance of TRY3,610 million, of which TRY1,759 million (US$312

million) was denominated in US$, and TRY1,077 million (EUR170

million) in EUR with the remaining TRY774 million in TRY.

- TRY705 million of IFRS 16 lease

obligations is denominated in TRY, TRY39 million (US$7 million) in

US$, TRY178 million (EUR28 million) in EUR and the remaining

balance in other local currencies (please note that the figures in

parentheses refer to US$ or EUR equivalents).

TRY13,342 million of our consolidated debt is set at a floating

rate. Excluding the consumer finance business borrowings, TRY5,048

million of consolidated debt will mature within less than a

year.

Net debt as of March 31, 2019 was at TRY13,979 million.

Including the proceeds of the Fintur deal of EUR352.9 million

(equivalent of TRY2,230 million as of March 31, 2019), which is

booked under due from related parties, net debt was TRY11,749 with

a net debt to EBITDA ratio of 1.3 times. Excluding consumer finance

company consumer loans, our telco only net debt was at TRY8,108

million with a leverage of 0.9 times.

Turkcell Group has a long FX position of US$216 million as at

the end of Q119. (Please note that this figure takes into account

advance payments and hedging but excludes FX swap transactions for

TL borrowing. Derivatives (VIOP) and forward transactions are

included).

Capital expenditures: Capital expenditures, including

non-operational items, amounted to TRY1,352.6 million in Q119. In

Q119, operational capital expenditures (excluding license fees) at

the Group level were at 15.6% of total revenues.

Capital expenditures (million TRY) Q118

Q418 Q119 Operational Capex (526.3)

(1,448.6) (883.6) License and Related Costs (188.0)

(1.7) (0.7) Non-operational Capex (Including IFRS15 & IFRS16)

(1,845.9) (784.3) (468.4)

Total

Capex1 (2,560.1) (2,234.6)

(1,352.6)

(1) Breakdown of capex for Q118 has been restated.

Operational Review of Turkcell Turkey

Summary of Operational Data Q118

Q418 Q119 y/y % q/q

% Number of subscribers (million) 37.3

36.7 36.6 (1.9%)

(0.3%) Mobile Postpaid (million) 18.6 18.8 18.7 0.5% (0.5%)

Mobile M2M (million) 2.4 2.4 2.4 - - Mobile Prepaid (million) 16.0

14.9 15.0 (6.3%) 0.7% Fiber (thousand) 1,248.7 1,385.6 1,411.1

13.0% 1.8% ADSL (thousand) 916.6 905.6 861.7 (6.0%) (4.8%) Superbox

(thousand)1 3.5 33.5 56.4 n.m 68.4% Cable (thousand) - - 9.7 n.a.

n.a. IPTV (thousand) 535.0 613.4 632.0 18.1% 3.0%

Churn

(%)2 Mobile Churn (%)3 1.4% 2.9% 1.9% 0.5pp (1.0pp)

Fixed Churn (%) 1.8% 2.2% 2.0% 0.2pp (0.2pp)

ARPU (Average

Monthly Revenue per User) (TRY) Mobile ARPU, blended 31.5 35.0

35.7 13.3% 2.0% Mobile ARPU, blended (excluding M2M) 33.6 37.4 38.1

13.4% 1.9% Postpaid 45.4 49.5 50.6 11.5% 2.2% Postpaid (excluding

M2M) 51.5 56.4 57.4 11.5% 1.8% Prepaid 15.3 17.4 17.2 12.4% (1.1%)

Fixed Residential ARPU, blended 55.3 56.6 59.8 8.1% 5.7%

Residential Fiber ARPU 55.9 58.2 62.8 12.3% 7.9%

Average mobile

data usage per user (GB/user) 4.4 5.9 5.9

34.1% - Mobile MoU (Avg. Monthly Minutes of usage

per subs) blended 344.8 356.4

393.1 14.0% 10.3%

(1) Superbox subscribers are included in mobile subscribers.(2)

Presentation of churn figures has been changed to demonstrate

average monthly churn figures for the respective quarters.(3) In

Q117, our churn policy was revised to extend from 9 months to 12

months (the period at the end of which we disconnect prepaid

subscribers who have not topped up above TRY10). Additionally,

under our revised policy, prepaid customers who last topped up

before March will be disconnected at the latest by year-end.

Our mobile subscriber base stood at 33.7 million by the end of

Q119. While we registered 73 thousand quarterly prepaid subscriber

net additions, our postpaid subscribers declined by 155 thousand

during the quarter. The share of postpaid subscribers was at 55.4%

(53.8%) of our mobile subscriber base.

Our fixed subscriber base was at 2.3 million by the end of Q119.

Our fiber customer base exceeded 1.4 million on 25 thousand

quarterly and 162 thousand annual net additions. Superbox, our

fixed wireless access product, exceeded 56 thousand subscribers in

Q119. IPTV subscribers reached 632 thousand on 19 thousand

quarterly and 97 thousand annual net additions. Total TV

subscribers, including OTT only users, reached 4.1 million4. As of

April, the Turkcell TV+ mobile application has been downloaded 12.6

million times.

In Q119, our average monthly mobile churn rate was at 1.9% and

our average monthly fixed churn rate was at 2.0%.

Mobile ARPU (excluding M2M) rose by 13.4% year-on-year in Q119,

mainly driven by the rise in penetration of digital services,

increased data consumption per user and price adjustments as well

as our upsell efforts. The increased share of multiplay customers,

who use voice, data and digital services combined, to 68.6%5,

contributed to the ARPU rise as well.

Our residential fiber ARPU grew by 12.3% in Q119 year-on-year.

This was driven by upsell efforts and price adjustments, as well as

by the rise in multiplay subscribers with TV6 to 49.5% of total

residential fiber subscribers.

Average mobile data usage per user rose by 34.1% in Q119

year-on-year, on the back of rising number and data consumption of

4.5G users and rising digital services usage. Average mobile data

usage of 4.5G users was at 7.8 GB in March.

4.5G compatible smartphones increased to 18.5 million in Q119 on

0.5 million quarterly additions, comprising 82% of total

smartphones on our network by the end of Q119.

(4) IPTV users and OTT only cumulative active users(5) Share

among mobile voice users excluding subscribers who have not used

their lines in the last 3 months. Multiplay refers to mobile

customers who use voice, data and one of core digital services(6)

Multiplay subscribers with TV: Fiber internet + IPTV users &

fiber internet + IPTV + voice users

TURKCELL INTERNATIONAL

lifecell1 Financial Data Q118

Q418 Q119 y/y%

q/q% Revenue (million UAH) 1,207.9

1,417.0 1,415.5 17.2%

(0.1%) EBITDA (million UAH) 504.9 1,083.5 815.5 61.5%

(24.7%)

EBITDA margin (%) 41.8% 76.5%

57.6% 15.8pp (18.9pp) Net income / (loss)

(million UAH) (178.2) (730.1) (267.2) 49.9% (63.4%)

Capex

(million UAH) 2,588.7 2,694.9

357.8 (86.2%) (86.7%)

Revenue (million TRY) 167.9 273.3 275.8 64.3% 0.9%

EBITDA

(million TRY) 69.8 205.9 159.0

127.8% (22.8%) EBITDA margin (%) 41.6% 75.3% 57.7%

16.1pp (17.6pp)

Net income / (loss) (million TRY)

(24.9) (126.3) (52.1)

109.2% (58.7%)

(1) Since July 10, 2015, we hold a 100% stake in lifecell.

lifecell (Ukraine) revenues rose by 17.2% year-on-year in

Q119 in local currency terms mainly on the back of increased mobile

data revenues with rising penetration of 4.5G users and higher data

consumption. EBITDA in local currency terms increased 61.5%

year-on-year to UAH816 million, which led to an EBITDA margin of

57.6%. Please also note that starting from Q418, lifecell started

to capitalize its radio frequency usage costs in accordance with

IFRS16. The overall impact, including the retrospective adjustments

for previous quarters of 2018, was booked in Q418.

lifecell revenues in TRY terms increased 64.3% year-on-year,

while its EBITDA rose to TRY159 million in Q119.

lifecell Operational Data Q118

Q418 Q119 y/y%

q/q% Number of subscribers (million)2

10.3 9.9 9.4

(8.7%) (5.1%) Active (3 months)3 7.7 7.3 6.9

(10.4%) (5.5%)

MOU (minutes) (12 months) 138.5

148.6 141.4 2.1% (4.8%) ARPU

(Average Monthly Revenue per User), blended (UAH) 37.7

47.2 49.0 30.0% 3.8% Active (3 months)

(UAH) 51.4 63.1 66.7 29.8% 5.7%

(2) We may occasionally offer campaigns and tariff schemes that

have an active subscriber life differing from the one that we

normally use to deactivate subscribers and calculate churn.(3)

Active subscribers are those who in the past three months made a

revenue generating activity.

lifecell’s three-month active subscriber base declined to 6.9

million in Q119, mainly due to the declining multiple SIM card

usage trend in the country. lifecell continued its strong ARPU

performance with 29.8% growth in Q119, mainly on increased mobile

data consumption and upsell efforts. Leveraging the quality of its

4.5G and 3G networks and attractive digital services, lifecell

continued to attract high ARPU generating subscribers, which

supported the solid ARPU performance.

The 4.5G subscriber base of lifecell continued to expand in

Q119. 4.5G users reached 36% of total mobile data users. The

penetration of 4.5G services continued to rise as reflected by the

increased number of 3-month active 4.5G users, which exceeded 1.6

million. Average data consumption per user rose by 117%

year-on-year, mainly driven by the higher data consumption of 4.5G

users. lifecell continued its leadership of the Ukrainian market in

smartphone penetration, which reached 77% as at the end of

Q119.

In accordance with Turkcell’s global digital services strategy,

lifecell continued to increase the penetration of its digital

services within its customer base. Accordingly, the number of

three-month active digital services users exceeded 1 million in

Q119. Furthermore, lifecell continued to enrich its digital

services portfolio launching new offerings during the quarter in

order to meet the digital needs of both retail and corporate

customers.

BeST1 Q118 Q418

Q119 y/y% q/q% Number of

subscribers (million) 1.6 1.6

1.6 - - Active (3 months)

1.2 1.2 1.2 - -

Revenue

(million BYN) 29.2 32.9 31.9 9.2%

(3.0%) EBITDA (million BYN) 5.3 12.7 7.4 39.6% (41.7%)

EBITDA margin (%) 18.2% 38.6% 23.2%

5.0pp (15.4pp) Net loss (million BYN) (10.0) (8.3)

(8.8) (12.0%) 6.0%

Capex (million BYN) 29.5

18.3 10.8 (63.4%)

(41.0%) Revenue (million TRY) 56.6 83.8 79.5 40.5% (5.1%)

EBITDA (million TRY) 10.3 31.3 18.4

78.6% (41.2%) EBITDA margin (%) 18.2% 37.4% 23.1%

4.9pp (14.3pp)

Net loss (million TRY) (19.4)

(21.3) (21.9) 12.9%

2.8%

(1) BeST, in which we hold an 80% stake, has operated in Belarus

since July 2008.

BeST revenues grew by 9.2% year-on-year in Q119 in local

currency terms, mainly driven by growth in mobile data revenues.

Digital services revenue growth also contributed to the revenue

increase. BeST’s EBITDA rose by 39.6% year-over-year to BYN7.4

million, which led to an EBITDA margin of 23.2%.

BeST’s revenues in TRY terms grew by 40.5% year-on-year in Q119,

with an EBITDA margin of 23.1%.

BeST continued to increase the penetration of its 4G services as

reflected by the number of 4G users, which reached 40% of its

3-month active subscriber base, resulting in increased data

consumption and digital services usage. Average monthly data

consumption of subscribers rose by 76% year-over-year to 6.3GB in

Q119. Digital services penetration continued to increase within its

customer base. Accordingly, subscribers who use at least one

digital service comprise 21% of the 3-month active subscriber base.

Meanwhile, BeST launched its new digital offering PLAY, which

includes 7 digital services.

Kuzey Kıbrıs Turkcell2 (million TRY)

Q118 Q418 Q119

y/y% q/q% Number of subscribers

(million) 0.5 0.5 0.6

20.0% 20.0% Revenue 43.5 45.8 47.9

10.1% 4.6%

EBITDA 14.1 11.6 16.7

18.4% 44.0% EBITDA margin (%) 32.4% 25.3% 34.9% 2.5pp

9.6pp

Net income 5.2 8.9 7.6

46.2% (14.6%) Capex 15.2 23.3

10.6 (30.3%) (54.5%)

(2) Kuzey Kıbrıs Turkcell, in which we hold a 100% stake, has

operated in Northern Cyprus since 1999.

Kuzey Kıbrıs Turkcell revenues grew by 10.1% year-on-year

in Q119, mainly driven by mobile data revenue growth. EBITDA

increased by 18.4% resulting in an EBITDA margin of 34.9%.

Fintur: In accordance with our strategic approach and

IFRS requirements, Fintur is classified as ‘held for sale’ and

reported as discontinued operations as of October 2016.

On December 12, 2018, Turkcell signed a binding agreement and on

April 2, 2019 completed the transfer of its shares in Fintur to

Sonera Holding B.V., the majority shareholder of Fintur. The final

value of the transaction was EUR352.9 million. As the conditions

precedent required for the share transfer were completed within

Q119, TRY772 million profit generated from the transaction is

reflected in Q119 financial statements.

Turkcell Group Subscribers

Turkcell Group subscribers amounted to approximately 48.4

million as of March 31, 2019. This figure is calculated by taking

the number of subscribers of Turkcell Turkey and each of our

subsidiaries. It includes the total number of mobile, fiber, ADSL,

cable and IPTV subscribers of Turkcell Turkey, and the mobile

subscribers of lifecell and BeST, as well as those of Kuzey Kıbrıs

Turkcell and lifecell Europe.

Turkcell Group Subscribers Q118

Q418 Q119 y/y%

q/q% Mobile Postpaid (million) 18.6 18.8

18.7 0.5% (0.5%) Mobile Prepaid (million) 16.0

14.9 15.0 (6.3%) 0.7% Fiber (thousand) 1,248.7 1,385.6 1,411.1

13.0% 1.8% ADSL (thousand) 916.6 905.8 861.7 (6.0%) (4.9%) Superbox

(thousand)1 3.5 33.5 56.4 n.m 68.4% Cable (thousand) - - 9.7 n.a.

n.a. IPTV (thousand) 535.0 613.4 632.0 18.1% 3.0%

Turkcell

Turkey subscribers (million)2 37.3 36.7

36.6 (1.9%) (0.3%) lifecell (Ukraine) 10.3 9.9

9.4 (8.7%) (5.1%) BeST (Belarus) 1.6 1.6 1.6 - - Kuzey Kıbrıs

Turkcell 0.5 0.5 0.6 20.0% 20.0% lifecell Europe3 0.3 0.2 0.2

(33.3%) -

Turkcell Group Subscribers (million)

50.1 48.9 48.4

(3.4%) (1.0%)

(1) Superbox subscribers are included in mobile subscribers.(2)

Subscribers to more than one service are counted separately for

each service.(3) The “wholesale traffic purchase” agreement, signed

between Turkcell Europe GmbH operating in Germany and Deutsche

Telekom for five years in 2010, had been modified to reflect the

shift in business model to a “marketing partnership”. The new

agreement between Turkcell and a subsidiary of Deutsche Telekom was

signed on August 27, 2014. The transfer of Turkcell Europe

operations to Deutsche Telekom’s subsidiary was completed on

January 15, 2015. Subscribers are still included in the Turkcell

Group Subscriber figure. Turkcell Europe was rebranded as lifecell

Europe on January 15, 2018.

OVERVIEW OF THE MACROECONOMIC ENVIRONMENT

The foreign exchange rates used in our financial reporting,

along with certain macroeconomic indicators, are set out below.

Q118 Q418 Q119

y/y% q/q% GDP Growth (Turkey)

7.4% (3.0%) n.a.

n.a. n.a. Consumer Price Index (Turkey)

(yoy) 10.2% 20.3% 19.7% 9.5pp

(0.6pp) US$ / TRY rate Closing Rate 3.9489 5.2609

5.6284 42.5% 7.0% Average Rate 3.8077 5.4369 5.3378 40.2% (1.8%)

EUR / TRY rate Closing Rate 4.8673 6.0280 6.3188 29.8% 4.8%

Average Rate 4.6795 6.2121 6.0777 29.9% (2.2%)

US$ / UAH

rate Closing Rate 26.54 27.69 27.25 2.7% (1.6%) Average Rate

27.42 28.18 27.41 - (2.7%)

US$ / BYN rate Closing Rate

1.9501 2.1598 2.1285 9.1% (1.4%) Average Rate 1.9663

2.1307 2.1470 9.2% 0.8%

RECONCILIATION OF NON-GAAP FINANCIAL MEASUREMENTS: We

believe Adjusted EBITDA, among other measures, facilitates

performance comparisons from period to period and management

decision making. It also facilitates performance comparisons from

company to company. Adjusted EBITDA as a performance measure

eliminates potential differences caused by variations in capital

structures (affecting interest expense), tax positions (such as the

impact of changes in effective tax rates on periods or companies)

and the age and book depreciation of tangible assets (affecting

relative depreciation expense). We also present Adjusted EBITDA

because we believe it is frequently used by securities analysts,

investors and other interested parties in evaluating the

performance of other mobile operators in the telecommunications

industry in Europe, many of which present Adjusted EBITDA when

reporting their results.

Our Adjusted EBITDA definition includes Revenue, Cost of Revenue

excluding depreciation and amortization, Selling and Marketing

expenses and Administrative expenses, but excludes translation

gain/(loss), finance income, finance expense, share of profit of

equity accounted investees, gain on sale of investments, minority

interest and other income/(expense).

Nevertheless, Adjusted EBITDA has limitations as an analytical

tool, and you should not consider it in isolation from, or as a

substitute for analysis of, our results of operations, as reported

under IFRS. The following table provides a reconciliation of

Adjusted EBITDA, as calculated using financial data prepared in

accordance with IFRS as issued by the IASB, to net profit, which we

believe is the most directly comparable financial measure

calculated and presented in accordance with IFRS as issued by the

IASB.

Turkcell Group (million TRY) Q118

Q418 Q119 y/y%

q/q% Adjusted EBITDA 2,022.0

2,239.0 2,281.1 12.8%

1.9% Depreciation and amortization (979.8) (1,287.0)

(1,178.1) 20.2% (8.5%) Finance income 355.6 (1,225.9) 583.0 63.9%

(147.6%) Finance costs (669.1) 1,207.4 (1,003.4) 50.0% (183.1%)

Other income / (expense) (33.5) 46.5 (51.8) 54.6% (211.4%) Share of

profit of equity accounted investees - 0.3 0.8 n.a. 166.7%

Consolidated profit from continued operations before income tax

& minority interest 695.2 980.4 631.6

(9.1%) (35.6%) Income tax expense (170.2) (38.7)

(159.8) (6.1%) 312.9%

Consolidated profit from continued

operations before minority interest 525.0 941.7

471.8 (10.1%) (49.9%) Discontinued operations

- - 772.4 n.a. n.a.

Consolidated profit before minority

interest 525.0 941.7

1,244.3 137.0% 32.1%

NOTICE: This release includes forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933,

Section 21E of the Securities Exchange Act of 1934 and the Safe

Harbor provisions of the US Private Securities Litigation Reform

Act of 1995. This includes, in particular, our targets for revenue,

EBITDA and capex for 2019. More generally, all statements other

than statements of historical facts included in this press release,

including, without limitation, certain statements regarding the

launch of new businesses, our operations, financial position and

business strategy may constitute forward-looking statements. In

addition, forward-looking statements generally can be identified by

the use of forward-looking terminology such as, among others,

"will," "expect," "intend," "estimate," "believe", "continue" and

“guidance”.

Although Turkcell believes that the expectations reflected in

such forward-looking statements are reasonable at this time, it can

give no assurance that such expectations will prove to be correct.

All subsequent written and oral forward-looking statements

attributable to us are expressly qualified in their entirety by

reference to these cautionary statements. For a discussion of

certain factors that may affect the outcome of such forward looking

statements, see our Annual Report on Form 20-F for 2018 filed with

the U.S. Securities and Exchange Commission, and in particular the

risk factor section therein. We undertake no duty to update or

revise any forward looking statements, whether as a result of new

information, future events or otherwise.

The Company makes no representation as to the accuracy or

completeness of the information contained in this press release,

which remains subject to verification, completion and change. No

responsibility or liability is or will be accepted by the Company

or any of its subsidiaries, board members, officers, employees or

agents as to or in relation to the accuracy or completeness of the

information contained in this press release or any other written or

oral information made available to any interested party or its

advisers.

ABOUT TURKCELL: Turkcell is a digital operator

headquartered in Turkey, serving its customers with its unique

portfolio of digital services along with voice, messaging, data and

IPTV services on its mobile and fixed networks. Turkcell Group

companies operate in 5 countries – Turkey, Ukraine, Belarus,

Northern Cyprus, Germany. Turkcell launched LTE services in its

home country on April 1st, 2016, employing LTE-Advanced and 3

carrier aggregation technologies in 81 cities. Turkcell offers up

to 10 Gbps fiber internet speed with its FTTH services. Turkcell

Group reported TRY5.7 billion revenue in Q119 with total assets of

TRY46.1 billion as of March 31, 2019. It has been listed on the

NYSE and the BIST since July 2000, and is the only NYSE-listed

company in Turkey. Read more at www.turkcell.com.tr

This press release can also be viewed using the Turkcell

Investor Relation app, which can be downloaded

here for iOS,

and here for Android mobile

devices.

Appendix A – Tables

Table: Net foreign exchange gain and loss details

Million TRY Q118 Q418

Q119 y/y% q/q% Turkcell Turkey

(367.5) 1,030.1 (558.5) 52.0%

(154.2%) Turkcell International (9.4) 5.7 (25.8) 174.5% (552.6%)

Other Subsidiaries (117.1) 434.3 (128.1) 9.4% (129.5%)

Net FX

loss before hedging (494.0) 1,470.1

(712.5) 44.2% (148.5%) Fair value gain on

derivative financial instruments1 213.7 (1,551.9) 452.3 111.7%

(129.1%)

Net FX gain / (loss) after hedging

(280.3) (81.8) (260.2)

(7.2%) 218.1%

(1) Definition of fair value gain on derivative financial

instruments has been extended to include the impact of interest

income and expense in relation to derivative instruments and fair

value of FX swaps, option contracts engaged in during the period to

manage operational cash flow balance.

Table: Income tax expense details

Million TRY Q118 Q418

Q119 y/y% q/q% Current Tax

expense (180.2) (114.9) (153.8) (14.7%)

33.9% Deferred Tax income / (expense) 10.0 76.2 (6.0)

(160.0%) (107.9%)

Income Tax expense (170.2)

(38.7) (159.8) (6.1%)

312.9% TURKCELL ILETISIM HIZMETLERI

A.S.

IFRS SELECTED FINANCIALS (TRY

Million)

Quarter

Ended Quarter Ended Year Ended

Quarter Ended Mar 31, Dec 31, Dec

31, Mar 31, 2018

2018 2018

2019 Consolidated Statement of

Operations Data Turkcell Turkey 4,072.0 4,747.5 18,092.6

4,833.3 Turkcell International 279.4 421.9 1,457.0 424.8 Other

410.2 457.0 1,742.9 417.3 Total revenues 4,761.6 5,626.4 21,292.5

5,675.4 Direct cost of revenues (3,114.8) (3,894.5)

(14,146.0) (3,908.3) Gross profit 1,646.8 1,731.9 7,146.5

1,767.1 Administrative expenses (154.3) (198.2) (673.4) (190.6)

Selling & marketing expenses (356.6) (500.8) (1,626.7) (403.2)

Other Operating Income / (Expense) (33.4) 46.5 (140.1) (51.8) Net

impairment loses on financial and contract assets (93.8)

(80.9) (346.4) (70.3) Operating profit before

financing costs 1,008.7 998.5 4,359.9 1,051.2 Finance costs (669.1)

1,207.4 (3,619.1) (1,003.4) Finance income 355.6 (1,225.9) 1,932.1

583.0 Share of profit of equity accounted investees - 0.3

(0.1) 0.8 Income before tax and non-controlling

interest 695.2 980.3 2,672.8 631.6 Income tax expense (170.2)

(38.8) (495.5) (159.8) Income from continuing

operations before non-controlling interest 525.0 941.5 2,177.3

471.8 Discontinued operations - - - 772.4 Non-controlling interests

(24.2) (77.8) (156.3) (19.8) Net income 500.8

863.7 2,021.0 1,224.4 Net income per

share 0.23 0.40 0.93 0.21

Other Financial Data

Gross margin 34.6% 30.8% 33.6% 31.1% EBITDA(*) 2,022.0 2,239.0

8,788.0 2,281.1 Total Capex 2,560.1 2,234.6 7,644.1 1,352.6

Operational Capex 526.3 1,448.6 3,943.1 883.6 Licence and related

costs 188.0 1.7 414.1 0.7 Non-operational Capex 1,845.9 784.3

3,286.9 468.4

Consolidated Balance Sheet Data (at

period end) Cash and cash equivalents 4,589.7 7,419.2 7,419.2

8,888.3 Total assets 37,073.1 42,765.3 42,765.3 46,078.6 Long term

debt 9,414.2 13,119.6 13,119.6 15,407.7 Total debt 15,130.5

20,155.5 20,155.5 22,866.9 Total liabilities 22,825.5 26,711.7

26,711.7 28,976.3 Total shareholders’ equity / Net Assets 14,247.6

16,053.6 16,053.6 17,102.3 (*) Please refer to the notes on

reconciliation of Non-GAAP Financial measures on page 13 For

further details, please refer to our consolidated financial

statements and notes as at 31 March 2019 on our web site

TURKCELL ILETISIM HIZMETLERI A.S.

TURKISH ACCOUNTING STANDARDS SELECTED

FINANCIALS (TRY Million)

Quarter

Ended Quarter Ended Year Ended

Quarter Ended Mar 31, Dec 31, Dec

31, Mar 31, 2018

2018 2018

2019 Consolidated Statement of

Operations Data Turkcell Turkey 4,072.0 4,747.5 18,092.6

4,833.3 Turkcell International 279.4 421.9 1,457.0 424.8 Other

410.2 457.0 1,742.9 417.3 Total revenues

4,761.6 5,626.4 21,292.5 5,675.4 Direct cost of revenues (3,114.8)

(3,894.5) (14,146.0) (3,908.3) Gross profit

1,646.8 1,731.9 7,146.5 1,767.1 Administrative expenses (154.3)

(198.2) (673.4) (190.6) Selling & marketing expenses (356.6)

(500.8) (1,626.7) (403.2) Other Operating Income / (Expense) 100.5

(500.8) 1,392.4 248.7 Operating profit before

financing and investing costs 1,236.4 532.1 6,238.8 1,422.0 Net

impairment loses on financial and contract assets (93.8) (80.9)

(346.4) (70.3) Income from investing activities 8.7 212.9 238.8

12.7 Expense from investing activities (14.2) 58.1 (118.9) (50.1)

Share of profit of equity accounted investees - 0.3

(0.1) 0.8 Income before financing costs 1,137.1 722.5

6,012.2 1,315.1 Finance income 288.9 (1,533.0) 1,280.3 461.5

Finance expense (730.8) 1,790.8 (4,619.7)

(1,145.0) Income from continuing operations before tax and

non-controlling interest 695.2 980.3 2,672.8 631.6 Income tax

expense from continuing operations (170.2) (38.8)

(495.5) (159.8) Income from continuing operations before

non-controlling interest 525.0 941.5 2,177.3 471.8 Discontinued

operations - - - 772.4 Income before

non-controlling interest 525.0 941.5 2,177.3 1,244.2

Non-controlling interest (24.2) (77.8) (156.3)

(19.8) Net income 500.8 863.7 2,021.0 1,224.4 Net income per

share 0.23 0.40 0.93 0.21

Other Financial Data

Gross margin 34.6% 30.8% 33.6% 31.1% EBITDA 2,022.0 2,239.0 8,788.0

2,281.1 Total Capex 2,560.1 2,234.6 7,644.1 1,352.6 Operational

Capex 526.3 1,448.6 3,943.1 883.6 Licence and related costs 188.0

1.7 414.1 0.7 Non-operational Capex 1,845.9 784.3 3,286.9 468.4

Consolidated Balance Sheet Data (at period

end) Cash and cash equivalents 4,589.7 7,419.2 7,419.2 8,888.3

Total assets 37,073.1 42,765.3 42,765.3 46,078.6 Long term debt

9,414.2 13,119.6 13,119.6 15,407.7 Total debt 15,130.5 20,155.5

20,155.5 22,866.9 Total liabilities 22,825.5 26,711.7 26,711.7

28,976.3 Total shareholders’ equity / Net Assets 14,247.6 16,053.6

16,053.6 17,102.3

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190430005822/en/

TurkcellInvestor RelationsKorhan Bilek, Tel: + 90 212 313

1888investor.relations@turkcell.com.tr

Corporate Communications:Tel: + 90 212 313

2321Turkcell-Kurumsal-Iletisim@turkcell.com.tr

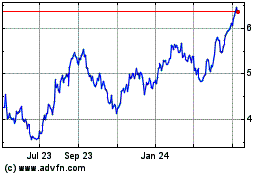

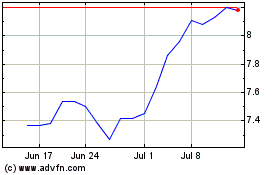

Turkcell lletism Hizmetl... (NYSE:TKC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Turkcell lletism Hizmetl... (NYSE:TKC)

Historical Stock Chart

From Apr 2023 to Apr 2024