UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number811-00266

Tri-Continental Corporation

(Exact name of registrant as specified in charter)

225 Franklin Street, Boston, Massachusetts 02110

(Address of principal executive offices) (Zip code)

Christopher O. Petersen

c/o Columbia Management Investment Advisers, LLC

225 Franklin Street

Boston, Massachusetts 02110

Ryan C. Larrenaga, Esq.

c/o Columbia Management Investment Advisers, LLC

225 Franklin Street

Boston, MA 02110

(Name and address of agent for service)

Registrant's telephone number, including area code: (800) 345-6611

Date of fiscal year end: December 31

Date of reporting period: December 31, 2019

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

Annual Report

December 31, 2019

Tri-Continental

Corporation

Beginning on January 1, 2021, as

permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semiannual stockholder reports will no longer be sent by mail, unless you specifically request

paper copies of the reports. Instead, the reports will be made available on the Fund’s website (columbiathreadneedleus.com/investor/), and each time a report is posted you will be notified by mail and provided

with a website address to access the report.

If you have already elected to

receive stockholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive stockholder reports and other communications from the Fund electronically

at any time by contacting your financial intermediary (such as a broker-dealer or bank) or, for Fund shares held directly with the Fund, by calling 800.345.6611, option 3, or by enrolling in “eDelivery” by

logging into your account at columbiathreadneedleus.com/investor/.

You may elect to receive all future

reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue receiving paper copies of your stockholder reports. If you

invest directly with the Fund, you can call 800.345.6611, option 3, to let the Fund know you wish to continue receiving paper copies of your stockholder reports. Your election to receive paper reports will apply to

the Fund and all other Columbia Funds held in your account if you invest through a financial intermediary or to the Fund and all other Columbia Funds held with the fund complex if you invest directly with the Fund.

Not FDIC Insured • No bank

guarantee • May lose value

Letter to the Stockholders

Dear Stockholders,

We are pleased to present the

annual stockholder report for Tri-Continental Corporation (the Fund). The report includes the Fund’s investment results, a discussion with the Fund’s portfolio managers, the portfolio of investments and

financial statements as of December 31, 2019.

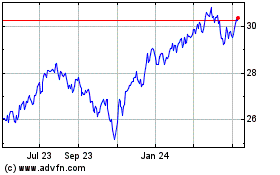

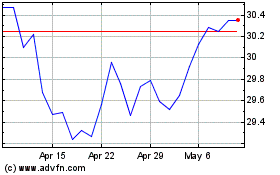

The Fund’s common shares

(Common Stock) returned 25.20%, based on net asset value, and 28.59%, based on market price, for the 12 months ended December 31, 2019. During the same 12-month period, the S&P 500 Index returned 31.49% and the

Fund’s Blended Benchmark returned 26.42%.

During 2019, the Fund paid four

distributions in accordance with its distribution policy that aggregated to $1.0164 per share of Common Stock of the Fund. These distributions were based upon amounts distributed by underlying portfolio companies

owned by the Fund. In addition, the Fund paid two capital gain distributions that totalled $0.9180 per share of Common Stock. The Fund has paid dividends on its Common Stock for 75 consecutive years.

On December 12, 2019, the

Fund’s Board of Directors (the Board) unanimously appointed Brian J. Gallagher to the Fund’s Board. His service with the Board commenced on January 1, 2020, for a term expiring at the 2023 annual meeting

of stockholders. Mr. Gallagher currently serves on the board of trustees of certain of the mutual funds and exchange-traded funds (ETFs) within the Columbia Funds Complex and on the board of another closed-end fund

within the Columbia Funds Complex. Effective December 31, 2019, Mr. Edward J. Boudreau, Jr. retired from the Fund’s Board. We thank Mr. Boudreau for his service to the Fund.

Information about the Fund,

including daily pricing, current performance, Fund holdings, stockholder reports, the current prospectus for the Fund, distributions and other information can be found at columbiathreadneedleus.com/investor/ under the

Closed-End Funds tab.

On behalf of the Board, I would

like to thank you for your continued support of Tri-Continental Corporation.

Regards,

Catherine James Paglia

Chair of the Board

Tri-Continental Corporation | Annual

Report 2019

|

2

|

|

4

|

|

6

|

|

16

|

|

17

|

|

18

|

|

19

|

|

20

|

|

31

|

|

32

|

|

32

|

Tri-Continental Corporation (the

Fund) mails one stockholder report to each stockholder address. If you would like more than one report, please call shareholder services at 800.345.6611, option 3 and additional reports will be sent to you.

Proxy voting policies and

procedures

The policy of the Board of

Directors is to vote the proxies of the companies in which the Fund holds investments consistent with the procedures as stated in the SAI. You may obtain a copy of the SAI without charge by calling 800.345.6611,

option 3; contacting your financial intermediary; visiting columbiathreadneedleus.com/investor/; or searching the website of the SEC at sec.gov. Information regarding how the Fund voted proxies relating to portfolio

securities is filed with the SEC by August 31st for the most recent 12-month period ending June 30th of that year, and is available without charge by visiting columbiathreadneedleus.com/investor/, or searching the

website of the SEC at sec.gov.

Quarterly schedule of

investments

The Fund files a complete schedule

of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT, and for reporting periods ended prior to March 31, 2019, on Form N-Q. The Fund’s Form N-Q and Form N-PORT

filings are available on the SEC’s website at sec.gov. The Fund’s complete schedule of portfolio holdings, as filed on Form N-Q or Form N-PORT, can also be obtained without charge, upon request, by calling

800.345.6611, option 3.

Additional Fund information

For more information about the

Fund, please visit columbiathreadneedleus.com/investor/ or call 800.345.6611, option 3. Customer Service Representatives are available to answer your questions Monday through Friday from 8 a.m. to 7 p.m. Eastern

time.

Fund investment manager

Columbia Management Investment Advisers, LLC (the

Investment Manager)

225 Franklin Street

Boston, MA 02110

Fund servicing agent

Columbia Management Investment Services Corp.

P.O. Box 219371

Kansas City, MO 64121-9371

Tri-Continental Corporation | Annual

Report 2019

Investment objective

The Fund

seeks future growth of both capital and income while providing reasonable current income.

Portfolio management

Brian Condon, CFA, CAIA

Co-Portfolio Manager

Managed Fund since 2010

David King, CFA

Co-Portfolio Manager

Managed Fund since 2011

Yan Jin

Co-Portfolio Manager

Managed Fund since 2012

Peter Albanese

Co-Portfolio Manager

Managed Fund since 2014

|

Average annual total returns (%) (for the period ended December 31, 2019)

|

|

|

|

Inception

|

1 Year

|

5 Years

|

10 Years

|

|

Market Price

|

01/05/29

|

28.59

|

11.63

|

14.11

|

|

Net Asset Value

|

01/05/29

|

25.20

|

10.52

|

13.21

|

|

S&P 500 Index

|

|

31.49

|

11.70

|

13.56

|

|

Blended Benchmark

|

|

26.42

|

9.61

|

11.55

|

The performance information shown

represents past performance and is not a guarantee of future results. The investment return and principal value of your investment will fluctuate so that your shares, when sold, may be worth more or less than their

original cost. Current performance may be lower or higher than the performance information shown. You may obtain performance information current to the most recent month-end by visiting

columbiathreadneedleus.com/investor/.

Returns reflect changes in market

price or net asset value, as applicable, and assume reinvestment of distributions. Returns do not reflect the deduction of taxes that investors may pay on distributions or the sale of shares.

The S&P 500 Index, an unmanaged

index, measures the performance of 500 widely held, large-capitalization U.S. stocks and is frequently used as a general measure of market performance.

The Blended Benchmark, a weighted

custom composite established by the Investment Manager, consists of a 50% weighting in the S&P 500 Index, a 16.68% weighting in the Russell 1000 Value Index, a 16.66% weighting in the Bloomberg Barclays U.S.

Corporate Investment Grade & High Yield Index and a 16.66% weighting in the Bloomberg Barclays U.S. Convertible Composite Index.

Indices are not available for

investment, are not professionally managed and do not reflect sales charges, fees, brokerage commissions, taxes or other expenses of investing. Securities in the Fund may not match those in an index.

|

Price Per Share

|

|

|

December 31, 2019

|

September 30, 2019

|

June 30, 2019

|

March 31, 2019

|

|

Market Price ($)

|

28.20

|

27.25

|

26.97

|

26.30

|

|

Net Asset Value ($)

|

31.03

|

30.03

|

30.03

|

29.60

|

|

Distributions Paid Per Common Share(a)

|

|

Payable Date

|

Per Share Amount ($)

|

|

March 28, 2019

|

0.2400

|

|

June 27, 2019

|

0.3715(b)

|

|

September 26, 2019

|

0.2602

|

|

December 26, 2019

|

1.0627(c)

|

(a) Preferred Stockholders were

paid dividends totaling $2.50 per share.

(b) Includes a distribution of

$0.2650 from ordinary income and a capital gain distribution of $0.1065 per share.

(c) Includes a distribution of

$0.2512 from ordinary income and a capital gain distribution of $0.8115 per share.

The net asset value of the

Fund’s shares may not always correspond to the market price of such shares. Common stock of many closed-end funds frequently trade at a discount from their net asset value. The Fund is subject to stock market

risk, which is the risk that stock prices overall will decline over short or long periods, adversely affecting the value of an investment in the Fund.

|

2

|

Tri-Continental Corporation | Annual Report 2019

|

Fund at a Glance (continued)

|

Portfolio breakdown (%) (at December 31, 2019)

|

|

Common Stocks

|

69.2

|

|

Convertible Bonds

|

6.1

|

|

Convertible Preferred Stocks

|

8.1

|

|

Corporate Bonds & Notes

|

12.7

|

|

Limited Partnerships

|

0.6

|

|

Money Market Funds

|

2.4

|

|

Preferred Debt

|

0.5

|

|

Senior Loans

|

0.4

|

|

Warrants

|

0.0(a)

|

|

Total

|

100.0

|

Percentages indicated are based upon

total investments excluding investments in derivatives, if any. The Fund’s portfolio composition is subject to change.

|

Equity sector breakdown (%) (at December 31, 2019)

|

|

Communication Services

|

8.4

|

|

Consumer Discretionary

|

8.5

|

|

Consumer Staples

|

7.1

|

|

Energy

|

5.3

|

|

Financials

|

15.9

|

|

Health Care

|

14.3

|

|

Industrials

|

8.0

|

|

Information Technology

|

20.6

|

|

Materials

|

1.9

|

|

Real Estate

|

4.0

|

|

Utilities

|

6.0

|

|

Total

|

100.0

|

Percentages indicated are based

upon total long equity investments. The Fund’s portfolio composition is subject to change.

Tri-Continental Corporation | Annual Report 2019

|

3

|

Manager Discussion of Fund Performance

For the 12-month period that

ended December 31, 2019, the Fund’s common stock returned 25.20% at net asset value and 28.59% at market price. The Fund performed in line with its Blended Benchmark, which returned 26.42% for the same time

period. The S&P 500 Index returned 31.49%.

The Fund is divided into two

approximately equal segments, each of which is managed with its own approach. The equity segment uses quantitative models to select individual stocks. The flexible capital income segment invests across a

company’s investable capital structure, including stocks, bonds and convertible securities. The Fund’s equity portfolio underperformed its Blended Benchmark while the Fund’s flexible capital income

segment outperformed.

Declining interest rates helped

drive financial markets to new highs

Optimism prevailed early in 2019,

buoyed by solid economic growth and a recovery from meaningful stock market losses in the fourth quarter of 2018. The labor markets added 184,000 jobs per month, on average. Unemployment fell to 3.5%, annualized.

As the year wore on, U.S. growth

slowed from 3.1% in the first quarter to an estimated 2.1%, annualized, for the year overall, as manufacturing activity edged lower. European economies transitioned to a slower pace of growth, struggling with rising

interest rates, trade tensions and uncertainty surrounding the U.K.’s departure from the European Union (Brexit). At the same time, China’s economic conditions weakened and emerging markets came under

pressure, driven by trade and tariff concerns.

Despite these global uncertainties,

the U.S. stock market rose strongly in 2019, as the Fed reduced short-term interest rates three times during the second half of the year, then announced at its December meeting that it would hold the federal funds

target rate at 1.50%-1.75%, judging its current monetary policy appropriate to support economic expansion, a strong labor market and inflation approximating its 2.0% target. In the second half of the year, central

banks in major foreign economies followed the Fed’s lead with stimulus efforts.

Stocks outperformed bonds for the

12-month period. The S&P 500 Index, a broad measure of U.S. stock returns, gained 31.49% while the Bloomberg Barclays U.S. Aggregate Bond Index, a broad measure of investment-grade bonds, returned 8.72%.

Significant performance

factors

The team’s quantitative

models detracted from performance relative to the Blended Benchmark. We divide the metrics for our stock selection model into three broad categories: valuation (fundamental measures such as earnings and cash flow

relative to market values), catalyst (price momentum and business momentum) and quality (quality of earnings and financial strength). We then rank the securities within a sector/industry from 1 (most attractive) to 5

(least attractive) based upon the metrics within these categories. For the year, the models generally delivered disappointing results. Stocks rated 1 by the models underperformed while those rated 5 outperformed on a

relative basis. All three themes — value, quality and catalyst — underperformed. The portfolio uses index futures for cash equitization purposes, which allows the Fund to stay fully invested and to

maintain its relative risk profile in line with the benchmark.

The calendar year 2019 generated

double-digit returns for equities. Yet, below the relatively calm surface of the market, factor volatility limited the ability of the Fund’s multifactor framework to capture market inefficiencies and generate

excess returns, especially when considering measures of momentum and value. For example, in the two worst months of the year for the Fund, momentum factors outperformed strongly in August while value factors

struggled. Conversely, the risk-on nature of September caused value stocks to rally while trending growth stocks struggled. For the year overall, stock selection in the financials and energy sectors aided relative

performance for the year, while stock selection in the information technology and consumer discretionary sectors resulted in underperformance.

Within the flexible capital income

segment of the Fund, equities in all major industry groups were positive performers and equities made the strongest contribution to portfolio gains. The Fund’s positions in yield-oriented financials, especially

banks, and information technology were top equity gainers within the portfolio. Within financials, JPMorgan Chase & Co. and Truist Financial Corp. generated strong returns. JPMorgan demonstrated continued growth

potential with rising loan demand, branch expansion efforts and an emphasis on strength in its credit card business. Shares of Truist Financial, formed by the

|

4

|

Tri-Continental Corporation | Annual Report 2019

|

Manager Discussion of Fund Performance (continued)

merger of former BB&T and SunTrust Banks to

become the sixth largest bank in the United States, got off to a slow start but rose strongly in the second half. In the real estate sector, medical research REIT (real estate investment trust) Alexandria Real Estate

Equities, Inc. and Starwood Property Trust, Inc., a commercial mortgage REIT, delivered significant gains. Alexandria buys up land, rehabs old properties and outfits them for use by biotechnology companies. Both

companies did poorly at the end of 2018 and their rebounds were solid. In the technology sector, Lam Research Corp., Western Digital Corp. and Microchip Technology, Inc. convertibles all rose more than 45%.

In the consumer staples sector,

security selection was strong. Positions in ConAgra Foods, Inc. and General Mills, Inc. were top performers for the portfolio. In the health care sector, Medicines Co. convertibles delivered a significant gain as the

company’s announced takeover at a significant premium by Swiss pharmaceutical giant Novartis International AG boosted its shares.

In a period of few disappointments,

energy sector holdings remained a challenge. The portfolio lost ground on Bristow Group, Inc. convertibles. The company helicopters people to oil platforms. Bristow experienced declining demand for its flights amid

turmoil in the oil and gas industry. Accounting issues also figured into the company’s default. We sold the small position at a loss. Williams Companies, Inc., a natural gas pipeline company, was an additional

detractor in the energy sector. Weak energy prices weighed on Williams. Chesapeake Energy Corp. convertibles also lost ground.

At period’s end

Our equity portfolio quantitative

strategy is based on individual quantitative stock selection models. As a result, we do not try to predict when equities (as an asset class) will perform well or when they will perform poorly. Instead, we keep our

portion of the Fund substantially invested at all times, with security selection driven by quantitative models, which we work to improve and enhance over time.

Within the flexible capital income

portfolio, we continued to find attractive income opportunities in an environment of solid dividend growth. At the end of the year, we believed the portfolio was well-positioned for a market environment in which

investors are more cautious and lean less toward growth. 2019 was the best year for convertible securities since the 2009 recovery from the Great Recession. New issuance reduced the sector’s equity sensitivity

and contributed to the sector’s diversity. We continue to believe that flexibility is an important competitive tool for this portion of the Fund.

Market risk may affect a single

issuer, sector of the economy, industry or the market as a whole. Foreign investments subject the Fund to risks, including political, economic, market, social and others within a particular country, as well as to

currency instabilities and less stringent financial and accounting standards generally applicable to U.S. issuers. Risks are enhanced for emerging market issuers. The Fund’s use of leverage allows for investment

exposure in excess of net assets, thereby magnifying volatility of returns and risk of loss. Non-investment-grade (high-yield or junk) securities present greater price volatility and more risk to principal and income

than higher rated securities. Convertible securities are subject to issuer default risk. A rise in interest rates may result in a price decline of convertible securities held by the Fund. Falling rates may result in

the Fund investing in lower yielding securities, lowering the Fund’s income and yield. The Fund may also be forced to convert a convertible security at an inopportune time, which may decrease the Fund’s

return. Investing in derivatives is a specialized activity that involves special risks, which may result in significant losses. See the Fund’s prospectus for more information on these and other risks.

The views expressed in this report

reflect the current views of the respective parties. These views are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict, so actual outcomes and

results may differ significantly from the views expressed. These views are subject to change at any time based upon economic, market or other conditions and the respective parties disclaim any responsibility to update

such views. These views may not be relied on as investment advice and, because investment decisions for a Columbia fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf

of any particular Columbia fund. References to specific securities should not be construed as a recommendation or investment advice.

Tri-Continental Corporation | Annual Report 2019

|

5

|

Portfolio of Investments

December 31, 2019

(Percentages represent value of

investments compared to net assets)

Investments in securities

|

Common Stocks 68.9%

|

|

Issuer

|

Shares

|

Value ($)

|

|

Communication Services 6.5%

|

|

Diversified Telecommunication Services 2.5%

|

|

AT&T, Inc.

|

225,000

|

8,793,000

|

|

BCE, Inc.

|

87,500

|

4,055,625

|

|

Verizon Communications, Inc.

|

487,900

|

29,957,060

|

|

Total

|

|

42,805,685

|

|

Interactive Media & Services 4.0%

|

|

Alphabet, Inc., Class A(a)

|

29,100

|

38,976,249

|

|

Facebook, Inc., Class A(a)

|

138,300

|

28,386,075

|

|

Total

|

|

67,362,324

|

|

Total Communication Services

|

110,168,009

|

|

Consumer Discretionary 6.6%

|

|

Automobiles 0.4%

|

|

General Motors Co.

|

170,000

|

6,222,000

|

|

Hotels, Restaurants & Leisure 1.6%

|

|

Extended Stay America, Inc.

|

425,000

|

6,315,500

|

|

Las Vegas Sands Corp.

|

65,000

|

4,487,600

|

|

Six Flags Entertainment Corp.

|

95,000

|

4,285,450

|

|

Starbucks Corp.

|

132,200

|

11,623,024

|

|

Total

|

|

26,711,574

|

|

Household Durables 0.4%

|

|

Garmin Ltd.

|

16,000

|

1,560,960

|

|

Newell Brands, Inc.

|

225,000

|

4,324,500

|

|

PulteGroup, Inc.

|

41,400

|

1,606,320

|

|

Total

|

|

7,491,780

|

|

Internet & Direct Marketing Retail 1.6%

|

|

Amazon.com, Inc.(a)

|

7,275

|

13,443,036

|

|

eBay, Inc.

|

306,700

|

11,074,937

|

|

Expedia Group, Inc.

|

27,400

|

2,963,036

|

|

Total

|

|

27,481,009

|

|

Multiline Retail 0.7%

|

|

Target Corp.

|

95,200

|

12,205,592

|

|

Common Stocks (continued)

|

|

Issuer

|

Shares

|

Value ($)

|

|

Specialty Retail 1.3%

|

|

AutoZone, Inc.(a)

|

9,300

|

11,079,183

|

|

Best Buy Co., Inc.

|

74,600

|

6,549,880

|

|

Home Depot, Inc. (The)

|

19,000

|

4,149,220

|

|

Total

|

|

21,778,283

|

|

Textiles, Apparel & Luxury Goods 0.6%

|

|

Kontoor Brands, Inc.

|

105,000

|

4,408,950

|

|

Nike, Inc., Class B

|

24,600

|

2,492,226

|

|

Under Armour, Inc., Class A(a)

|

179,900

|

3,885,840

|

|

Total

|

|

10,787,016

|

|

Total Consumer Discretionary

|

112,677,254

|

|

Consumer Staples 5.1%

|

|

Food & Staples Retailing 0.9%

|

|

Walgreens Boots Alliance, Inc.

|

104,150

|

6,140,684

|

|

Walmart, Inc.

|

83,100

|

9,875,604

|

|

Total

|

|

16,016,288

|

|

Food Products 1.4%

|

|

ConAgra Foods, Inc.

|

200,000

|

6,848,000

|

|

General Mills, Inc.

|

242,400

|

12,982,944

|

|

Tyson Foods, Inc., Class A

|

43,800

|

3,987,552

|

|

Total

|

|

23,818,496

|

|

Household Products 1.2%

|

|

Kimberly-Clark Corp.

|

96,050

|

13,211,677

|

|

Procter & Gamble Co. (The)

|

64,200

|

8,018,580

|

|

Total

|

|

21,230,257

|

|

Tobacco 1.6%

|

|

Altria Group, Inc.

|

203,200

|

10,141,712

|

|

Philip Morris International, Inc.

|

190,900

|

16,243,681

|

|

Total

|

|

26,385,393

|

|

Total Consumer Staples

|

87,450,434

|

|

Energy 3.5%

|

|

Oil, Gas & Consumable Fuels 3.5%

|

|

BP PLC, ADR

|

230,000

|

8,680,200

|

|

Chevron Corp.(b)

|

77,600

|

9,351,576

|

|

ConocoPhillips Co.

|

200,000

|

13,006,000

|

|

Devon Energy Corp.

|

66,800

|

1,734,796

|

The accompanying Notes to Portfolio of

Investments are an integral part of this statement.

|

6

|

Tri-Continental Corporation | Annual Report 2019

|

Portfolio of Investments

(continued)

December 31, 2019

|

Common Stocks (continued)

|

|

Issuer

|

Shares

|

Value ($)

|

|

HollyFrontier Corp.

|

68,700

|

3,483,777

|

|

Suncor Energy, Inc.

|

200,000

|

6,560,000

|

|

Valero Energy Corp.

|

133,300

|

12,483,545

|

|

Williams Companies, Inc. (The)

|

185,000

|

4,388,200

|

|

Total

|

|

59,688,094

|

|

Total Energy

|

59,688,094

|

|

Financials 11.0%

|

|

Banks 3.9%

|

|

Bank of America Corp.

|

60,700

|

2,137,854

|

|

Citigroup, Inc.

|

383,100

|

30,605,859

|

|

Citizens Financial Group, Inc.

|

21,600

|

877,176

|

|

JPMorgan Chase & Co.

|

80,000

|

11,152,000

|

|

KeyCorp

|

325,000

|

6,578,000

|

|

Truist Financial Corp.

|

115,000

|

6,476,800

|

|

Wells Fargo & Co.

|

160,000

|

8,608,000

|

|

Total

|

|

66,435,689

|

|

Capital Markets 2.9%

|

|

Ares Capital Corp.

|

450,000

|

8,392,500

|

|

Bank of New York Mellon Corp. (The)

|

43,200

|

2,174,256

|

|

Franklin Resources, Inc.

|

211,900

|

5,505,162

|

|

Intercontinental Exchange, Inc.

|

169,200

|

15,659,460

|

|

Morgan Stanley

|

135,000

|

6,901,200

|

|

S&P Global, Inc.

|

27,300

|

7,454,265

|

|

T. Rowe Price Group, Inc.

|

6,000

|

731,040

|

|

TCG BDC, Inc.

|

250,000

|

3,345,000

|

|

Total

|

|

50,162,883

|

|

Consumer Finance 1.2%

|

|

Capital One Financial Corp.

|

144,300

|

14,849,913

|

|

Discover Financial Services

|

14,300

|

1,212,926

|

|

Synchrony Financial

|

137,000

|

4,933,370

|

|

Total

|

|

20,996,209

|

|

Diversified Financial Services 0.5%

|

|

Voya Financial, Inc.

|

129,600

|

7,903,008

|

|

Common Stocks (continued)

|

|

Issuer

|

Shares

|

Value ($)

|

|

Insurance 1.7%

|

|

Allstate Corp. (The)

|

95,400

|

10,727,730

|

|

MetLife, Inc.

|

195,200

|

9,949,344

|

|

Prudential Financial, Inc.

|

56,500

|

5,296,310

|

|

Willis Towers Watson PLC

|

13,000

|

2,625,220

|

|

Total

|

|

28,598,604

|

|

Mortgage Real Estate Investment Trusts (REITS) 0.8%

|

|

Blackstone Mortgage Trust, Inc.

|

110,000

|

4,094,200

|

|

Starwood Property Trust, Inc.

|

350,000

|

8,701,000

|

|

Total

|

|

12,795,200

|

|

Total Financials

|

186,891,593

|

|

Health Care 9.2%

|

|

Biotechnology 1.9%

|

|

AbbVie, Inc.

|

166,120

|

14,708,265

|

|

Alexion Pharmaceuticals, Inc.(a)

|

40,970

|

4,430,906

|

|

BioMarin Pharmaceutical, Inc.(a)

|

34,800

|

2,942,340

|

|

Gilead Sciences, Inc.

|

65,000

|

4,223,700

|

|

Vertex Pharmaceuticals, Inc.(a)

|

25,050

|

5,484,697

|

|

Total

|

|

31,789,908

|

|

Health Care Equipment & Supplies 1.4%

|

|

Baxter International, Inc.

|

57,000

|

4,766,340

|

|

Dentsply Sirona, Inc.

|

28,860

|

1,633,188

|

|

Hologic, Inc.(a)

|

26,000

|

1,357,460

|

|

Medtronic PLC

|

147,900

|

16,779,255

|

|

Total

|

|

24,536,243

|

|

Health Care Providers & Services 1.1%

|

|

Cardinal Health, Inc.

|

158,940

|

8,039,185

|

|

HCA Healthcare, Inc.

|

13,300

|

1,965,873

|

|

McKesson Corp.

|

65,900

|

9,115,288

|

|

Total

|

|

19,120,346

|

|

Pharmaceuticals 4.8%

|

|

Amryt Pharma PLC, ADR(a)

|

307,275

|

2,442,836

|

|

Bristol-Myers Squibb Co.

|

378,900

|

24,321,591

|

|

Eli Lilly & Co.

|

35,000

|

4,600,050

|

|

Johnson & Johnson

|

103,300

|

15,068,371

|

|

Merck & Co., Inc.

|

281,300

|

25,584,235

|

|

Mylan NV(a)

|

104,300

|

2,096,430

|

The accompanying Notes to Portfolio of

Investments are an integral part of this statement.

Tri-Continental Corporation | Annual Report 2019

|

7

|

Portfolio of Investments (continued)

December 31, 2019

|

Common Stocks (continued)

|

|

Issuer

|

Shares

|

Value ($)

|

|

Perrigo Co. PLC

|

63,700

|

3,290,742

|

|

Pfizer, Inc.

|

115,000

|

4,505,700

|

|

Total

|

|

81,909,955

|

|

Total Health Care

|

157,356,452

|

|

Industrials 6.0%

|

|

Aerospace & Defense 1.4%

|

|

Lockheed Martin Corp.

|

62,200

|

24,219,436

|

|

Air Freight & Logistics 0.4%

|

|

United Parcel Service, Inc., Class B

|

60,000

|

7,023,600

|

|

Airlines 0.8%

|

|

Southwest Airlines Co.

|

254,200

|

13,721,716

|

|

Electrical Equipment 0.8%

|

|

Eaton Corp. PLC

|

137,500

|

13,024,000

|

|

Industrial Conglomerates 0.6%

|

|

3M Co.

|

25,000

|

4,410,500

|

|

Honeywell International, Inc.

|

30,000

|

5,310,000

|

|

Total

|

|

9,720,500

|

|

Machinery 1.4%

|

|

Caterpillar, Inc.

|

30,000

|

4,430,400

|

|

Cummins, Inc.

|

79,000

|

14,137,840

|

|

Illinois Tool Works, Inc.

|

32,300

|

5,802,049

|

|

Total

|

|

24,370,289

|

|

Professional Services 0.1%

|

|

Robert Half International, Inc.

|

37,600

|

2,374,440

|

|

Road & Rail 0.2%

|

|

CSX Corp.

|

32,900

|

2,380,644

|

|

Transportation Infrastructure 0.3%

|

|

Macquarie Infrastructure Corp.

|

105,000

|

4,498,200

|

|

Total Industrials

|

101,332,825

|

|

Information Technology 15.1%

|

|

Communications Equipment 1.7%

|

|

Cisco Systems, Inc.

|

582,700

|

27,946,292

|

|

F5 Networks, Inc.(a)

|

12,000

|

1,675,800

|

|

Total

|

|

29,622,092

|

|

Electronic Equipment, Instruments & Components 0.4%

|

|

Corning, Inc.

|

215,000

|

6,258,650

|

|

Common Stocks (continued)

|

|

Issuer

|

Shares

|

Value ($)

|

|

IT Services 3.1%

|

|

International Business Machines Corp.

|

65,000

|

8,712,600

|

|

MasterCard, Inc., Class A

|

78,700

|

23,499,033

|

|

VeriSign, Inc.(a)

|

72,100

|

13,892,228

|

|

Visa, Inc., Class A

|

34,300

|

6,444,970

|

|

Total

|

|

52,548,831

|

|

Semiconductors & Semiconductor Equipment 3.5%

|

|

Broadcom, Inc.

|

53,500

|

16,907,070

|

|

Lam Research Corp.

|

69,600

|

20,351,040

|

|

Maxim Integrated Products, Inc.

|

110,000

|

6,766,100

|

|

Qorvo, Inc.(a)

|

44,700

|

5,195,481

|

|

QUALCOMM, Inc.

|

14,100

|

1,244,043

|

|

Texas Instruments, Inc.

|

70,000

|

8,980,300

|

|

Total

|

|

59,444,034

|

|

Software 3.5%

|

|

Adobe, Inc.(a)

|

29,000

|

9,564,490

|

|

Autodesk, Inc.(a)

|

7,200

|

1,320,912

|

|

Cadence Design Systems, Inc.(a)

|

17,900

|

1,241,544

|

|

Fortinet, Inc.(a)

|

118,200

|

12,619,032

|

|

Microsoft Corp.

|

155,200

|

24,475,040

|

|

Symantec Corp.

|

165,000

|

4,210,800

|

|

VMware, Inc., Class A

|

41,700

|

6,329,643

|

|

Total

|

|

59,761,461

|

|

Technology Hardware, Storage & Peripherals 2.9%

|

|

Apple, Inc.

|

77,550

|

22,772,557

|

|

HP, Inc.

|

583,100

|

11,982,705

|

|

Seagate Technology PLC

|

120,000

|

7,140,000

|

|

Western Digital Corp.

|

105,000

|

6,664,350

|

|

Total

|

|

48,559,612

|

|

Total Information Technology

|

256,194,680

|

|

Materials 1.5%

|

|

Chemicals 0.9%

|

|

Dow, Inc.

|

110,000

|

6,020,300

|

|

LyondellBasell Industries NV, Class A

|

106,300

|

10,043,224

|

|

Total

|

|

16,063,524

|

|

Metals & Mining 0.6%

|

|

Nucor Corp.

|

167,600

|

9,432,528

|

|

Total Materials

|

25,496,052

|

The accompanying Notes to Portfolio of

Investments are an integral part of this statement.

|

8

|

Tri-Continental Corporation | Annual Report 2019

|

Portfolio of Investments (continued)

December 31, 2019

|

Common Stocks (continued)

|

|

Issuer

|

Shares

|

Value ($)

|

|

Real Estate 2.3%

|

|

Equity Real Estate Investment Trusts (REITS) 2.3%

|

|

Alexandria Real Estate Equities, Inc.

|

40,000

|

6,463,200

|

|

American Tower Corp.

|

76,090

|

17,487,004

|

|

Duke Realty Corp.

|

125,000

|

4,333,750

|

|

Medical Properties Trust, Inc.

|

300,000

|

6,333,000

|

|

ProLogis, Inc.

|

28,500

|

2,540,490

|

|

SBA Communications Corp.

|

11,900

|

2,867,781

|

|

Total

|

|

40,025,225

|

|

Total Real Estate

|

40,025,225

|

|

Utilities 2.1%

|

|

Electric Utilities 1.6%

|

|

American Electric Power Co., Inc.

|

53,900

|

5,094,089

|

|

Edison International

|

90,000

|

6,786,900

|

|

Entergy Corp.

|

20,300

|

2,431,940

|

|

Exelon Corp.

|

288,000

|

13,129,920

|

|

Total

|

|

27,442,849

|

|

Independent Power and Renewable Electricity Producers 0.5%

|

|

AES Corp. (The)

|

425,000

|

8,457,500

|

|

Total Utilities

|

35,900,349

|

Total Common Stocks

(Cost $989,294,319)

|

1,173,180,967

|

|

Convertible Bonds 6.1%

|

|

Issuer

|

Coupon

Rate

|

|

Principal

Amount ($)

|

Value ($)

|

|

Cable and Satellite 0.5%

|

|

DISH Network Corp.

|

|

08/15/2026

|

3.375%

|

|

9,000,000

|

8,657,100

|

|

Health Care 0.4%

|

|

Invacare Corp.

|

|

11/15/2024

|

5.000%

|

|

4,000,000

|

3,676,000

|

|

Novavax, Inc.

|

|

02/01/2023

|

3.750%

|

|

6,800,000

|

2,783,430

|

|

Total

|

6,459,430

|

|

Home Construction 0.3%

|

|

SunPower Corp.

|

|

01/15/2023

|

4.000%

|

|

7,500,000

|

6,125,250

|

|

Independent Energy 0.2%

|

|

Chesapeake Energy Corp.

|

|

09/15/2026

|

5.500%

|

|

9,000,000

|

4,287,456

|

|

Convertible Bonds (continued)

|

|

Issuer

|

Coupon

Rate

|

|

Principal

Amount ($)

|

Value ($)

|

|

Life Insurance 0.4%

|

|

AXA SA(c)

|

|

05/15/2021

|

7.250%

|

|

5,500,000

|

6,348,595

|

|

Metals and Mining 0.3%

|

|

Endeavour Mining Corp.(c)

|

|

02/15/2023

|

3.000%

|

|

4,300,000

|

4,509,840

|

|

Other Financial Institutions 0.4%

|

|

RWT Holdings, Inc.(c)

|

|

10/01/2025

|

5.750%

|

|

6,750,000

|

6,893,019

|

|

Other Industry 0.2%

|

|

Green Plains, Inc.

|

|

09/01/2022

|

4.125%

|

|

4,600,000

|

4,289,295

|

|

Other REIT 0.3%

|

|

Blackstone Mortgage Trust, Inc.

|

|

05/05/2022

|

4.375%

|

|

4,200,000

|

4,458,472

|

|

Pharmaceuticals 1.6%

|

|

Aegerion Pharmaceuticals, Inc.(d),(e)

|

|

04/01/2025

|

2.000%

|

|

5,000,000

|

0

|

|

Aegerion Pharmaceuticals, Inc.(c)

|

|

04/01/2025

|

5.000%

|

|

1,662,963

|

1,579,815

|

|

Clovis Oncology, Inc.

|

|

05/01/2025

|

1.250%

|

|

8,000,000

|

5,020,000

|

|

Dermira, Inc.

|

|

05/15/2022

|

3.000%

|

|

4,700,000

|

4,327,981

|

|

Insmed, Inc.

|

|

01/15/2025

|

1.750%

|

|

5,300,000

|

5,105,546

|

|

Intercept Pharmaceuticals, Inc.

|

|

07/01/2023

|

3.250%

|

|

4,300,000

|

4,335,829

|

|

Radius Health, Inc.

|

|

09/01/2024

|

3.000%

|

|

4,500,000

|

3,811,050

|

|

Tilray, Inc.

|

|

10/01/2023

|

5.000%

|

|

5,250,000

|

2,730,000

|

|

Total

|

26,910,221

|

|

Property & Casualty 0.6%

|

|

Heritage Insurance Holdings, Inc.

|

|

08/01/2037

|

5.875%

|

|

3,500,000

|

3,916,713

|

|

MGIC Investment Corp.(c),(f)

|

|

Junior Subordinated

|

|

04/01/2063

|

9.000%

|

|

4,711,000

|

6,316,620

|

|

Total

|

10,233,333

|

The accompanying Notes to Portfolio of

Investments are an integral part of this statement.

Tri-Continental Corporation | Annual Report 2019

|

9

|

Portfolio of Investments (continued)

December 31, 2019

|

Convertible Bonds (continued)

|

|

Issuer

|

Coupon

Rate

|

|

Principal

Amount ($)

|

Value ($)

|

|

Technology 0.9%

|

|

Avaya Holdings Corp.

|

|

06/15/2023

|

2.250%

|

|

4,500,000

|

3,994,164

|

|

Infinera Corp.

|

|

09/01/2024

|

2.125%

|

|

4,427,000

|

4,673,227

|

|

Microchip Technology, Inc.

|

|

Junior Subordinated

|

|

02/15/2037

|

2.250%

|

|

4,300,000

|

6,246,152

|

|

Total

|

14,913,543

|

Total Convertible Bonds

(Cost $112,645,558)

|

104,085,554

|

|

Convertible Preferred Stocks 8.1%

|

|

Issuer

|

|

Shares

|

Value ($)

|

|

Consumer Staples 0.4%

|

|

Household Products 0.4%

|

|

Energizer Holdings, Inc.

|

7.500%

|

60,000

|

6,359,051

|

|

Total Consumer Staples

|

6,359,051

|

|

Financials 1.4%

|

|

Banks 0.5%

|

|

Bank of America Corp.

|

7.250%

|

5,700

|

8,257,761

|

|

Capital Markets 0.6%

|

|

AMG Capital Trust II

|

5.150%

|

130,000

|

6,272,500

|

|

Cowen, Inc.

|

5.625%

|

5,200

|

4,595,503

|

|

Total

|

|

|

10,868,003

|

|

Insurance 0.3%

|

|

Assurant, Inc.

|

6.500%

|

32,500

|

4,171,141

|

|

Total Financials

|

23,296,905

|

|

Health Care 1.8%

|

|

Health Care Equipment & Supplies 1.0%

|

|

Becton Dickinson and Co.

|

6.125%

|

135,000

|

8,833,470

|

|

Danaher Corp.

|

4.750%

|

7,500

|

8,819,175

|

|

Total

|

|

|

17,652,645

|

|

Health Care Technology 0.3%

|

|

Change Healthcare, Inc.

|

6.000%

|

75,000

|

4,500,000

|

|

Life Sciences Tools & Services 0.5%

|

|

Avantor, Inc.

|

6.250%

|

144,000

|

9,143,438

|

|

Total Health Care

|

31,296,083

|

|

Convertible Preferred Stocks (continued)

|

|

Issuer

|

|

Shares

|

Value ($)

|

|

Industrials 0.3%

|

|

Machinery 0.3%

|

|

Stanley Black & Decker, Inc.

|

5.250%

|

43,000

|

4,673,498

|

|

Total Industrials

|

4,673,498

|

|

Information Technology 0.9%

|

|

Semiconductors & Semiconductor Equipment 0.9%

|

|

Broadcom, Inc.

|

8.000%

|

13,000

|

15,188,680

|

|

Total Information Technology

|

15,188,680

|

|

Real Estate 0.8%

|

|

Equity Real Estate Investment Trusts (REITS) 0.8%

|

|

Crown Castle International Corp.

|

6.875%

|

6,800

|

8,715,194

|

|

QTS Realty Trust, Inc.

|

6.500%

|

35,000

|

4,489,392

|

|

Total

|

|

|

13,204,586

|

|

Total Real Estate

|

13,204,586

|

|

Utilities 2.5%

|

|

Electric Utilities 1.1%

|

|

American Electric Power Co., Inc.

|

6.125%

|

195,000

|

10,525,515

|

|

Southern Co. (The)

|

6.750%

|

162,500

|

8,749,000

|

|

Total

|

|

|

19,274,515

|

|

Multi-Utilities 1.2%

|

|

Dominion Energy, Inc.

|

7.250%

|

82,500

|

8,811,825

|

|

DTE Energy Co.

|

6.250%

|

210,000

|

10,737,720

|

|

Total

|

|

|

19,549,545

|

|

Water Utilities 0.2%

|

|

Aqua America, Inc.

|

6.000%

|

67,500

|

4,207,181

|

|

Total Utilities

|

43,031,241

|

Total Convertible Preferred Stocks

(Cost $124,406,695)

|

137,050,044

|

|

Corporate Bonds & Notes 12.7%

|

|

Issuer

|

Coupon

Rate

|

|

Principal

Amount ($)

|

Value ($)

|

|

Brokerage/Asset Managers/Exchanges 0.5%

|

|

LPL Holdings, Inc.(c)

|

|

09/15/2025

|

5.750%

|

|

7,850,000

|

8,224,610

|

|

Cable and Satellite 0.9%

|

|

Charter Communications Operating LLC/Capital

|

|

10/23/2045

|

6.484%

|

|

6,500,000

|

8,093,921

|

|

Gogo Intermediate Holdings LLC/Finance Co., Inc.(c)

|

|

05/01/2024

|

9.875%

|

|

4,200,000

|

4,451,583

|

The accompanying Notes to Portfolio of

Investments are an integral part of this statement.

|

10

|

Tri-Continental Corporation | Annual Report 2019

|

Portfolio of Investments (continued)

December 31, 2019

|

Corporate Bonds & Notes (continued)

|

|

Issuer

|

Coupon

Rate

|

|

Principal

Amount ($)

|

Value

($)

|

|

Telesat Canada/LLC(c)

|

|

10/15/2027

|

6.500%

|

|

2,286,000

|

2,379,423

|

|

Total

|

14,924,927

|

|

Chemicals 0.5%

|

|

Starfruit Finco BV/US Holdco LLC(c)

|

|

10/01/2026

|

8.000%

|

|

8,400,000

|

8,910,706

|

|

Consumer Products 0.6%

|

|

Mattel, Inc.(c)

|

|

12/31/2025

|

6.750%

|

|

8,042,000

|

8,637,187

|

|

12/15/2027

|

5.875%

|

|

1,079,000

|

1,137,930

|

|

Total

|

9,775,117

|

|

Electric 0.2%

|

|

Enviva Partners LP/Finance Corp.(c)

|

|

01/15/2026

|

6.500%

|

|

3,725,000

|

3,989,166

|

|

Environmental 0.5%

|

|

Covanta Holding Corp.

|

|

07/01/2025

|

5.875%

|

|

4,834,000

|

5,101,229

|

|

01/01/2027

|

6.000%

|

|

3,000,000

|

3,173,393

|

|

Total

|

8,274,622

|

|

Finance Companies 0.9%

|

|

Fortress Transportation & Infrastructure Investors LLC(c)

|

|

10/01/2025

|

6.500%

|

|

6,000,000

|

6,334,096

|

|

Springleaf Finance Corp.

|

|

03/15/2025

|

6.875%

|

|

7,500,000

|

8,536,877

|

|

Total

|

14,870,973

|

|

Food and Beverage 0.5%

|

|

Chobani LLC/Finance Corp., Inc.(c)

|

|

04/15/2025

|

7.500%

|

|

4,597,000

|

4,610,335

|

|

Lamb Weston Holdings, Inc.(c)

|

|

11/01/2026

|

4.875%

|

|

3,900,000

|

4,145,052

|

|

Total

|

8,755,387

|

|

Health Care 0.6%

|

|

Quotient Ltd.(c),(d),(e)

|

|

04/15/2024

|

12.000%

|

|

2,170,000

|

2,170,000

|

|

04/15/2024

|

12.000%

|

|

930,000

|

930,000

|

|

Surgery Center Holdings, Inc.(c)

|

|

07/01/2025

|

6.750%

|

|

7,000,000

|

6,997,935

|

|

Total

|

10,097,935

|

|

Healthcare Insurance 0.3%

|

|

Centene Corp.(c)

|

|

12/15/2027

|

4.250%

|

|

5,027,000

|

5,176,915

|

|

Corporate Bonds & Notes (continued)

|

|

Issuer

|

Coupon

Rate

|

|

Principal

Amount ($)

|

Value ($)

|

|

Independent Energy 0.8%

|

|

Indigo Natural Resources LLC(c)

|

|

02/15/2026

|

6.875%

|

|

8,200,000

|

7,757,507

|

|

Talos Production LLC/Finance, Inc.

|

|

04/03/2022

|

11.000%

|

|

6,136,177

|

6,274,241

|

|

Total

|

14,031,748

|

|

Media and Entertainment 0.7%

|

|

Lions Gate Capital Holdings LLC(c)

|

|

11/01/2024

|

5.875%

|

|

7,950,000

|

7,991,218

|

|

Meredith Corp.

|

|

02/01/2026

|

6.875%

|

|

3,700,000

|

3,847,559

|

|

Total

|

11,838,777

|

|

Metals and Mining 0.9%

|

|

CONSOL Energy, Inc.(c)

|

|

11/15/2025

|

11.000%

|

|

4,200,000

|

3,569,226

|

|

Constellium NV(c)

|

|

03/01/2025

|

6.625%

|

|

7,900,000

|

8,216,425

|

|

Warrior Met Coal, Inc.(c)

|

|

11/01/2024

|

8.000%

|

|

3,832,000

|

3,903,778

|

|

Total

|

15,689,429

|

|

Midstream 0.5%

|

|

Rockpoint Gas Storage Canada Ltd.(c)

|

|

03/31/2023

|

7.000%

|

|

4,216,000

|

4,128,454

|

|

Summit Midstream Partners LP(f)

|

|

Junior Subordinated

|

|

12/31/2049

|

9.500%

|

|

8,400,000

|

4,207,262

|

|

Total

|

8,335,716

|

|

Other Industry 0.4%

|

|

WeWork Companies, Inc.(c)

|

|

05/01/2025

|

7.875%

|

|

7,700,000

|

6,322,970

|

|

Packaging 1.4%

|

|

ARD Finance SA(c),(g)

|

|

06/30/2027

|

6.500%

|

|

8,000,000

|

8,270,447

|

|

BWAY Holding Co.(c)

|

|

04/15/2025

|

7.250%

|

|

8,500,000

|

8,419,769

|

|

Novolex(c)

|

|

01/15/2025

|

6.875%

|

|

6,490,000

|

6,543,306

|

|

Total

|

23,233,522

|

The accompanying Notes to Portfolio of

Investments are an integral part of this statement.

Tri-Continental Corporation | Annual Report 2019

|

11

|

Portfolio of Investments (continued)

December 31, 2019

|

Corporate Bonds & Notes (continued)

|

|

Issuer

|

Coupon

Rate

|

|

Principal

Amount ($)

|

Value ($)

|

|

Pharmaceuticals 0.4%

|

|

Bausch Health Companies, Inc.(c)

|

|

01/31/2027

|

8.500%

|

|

3,700,000

|

4,218,923

|

|

01/30/2028

|

5.000%

|

|

1,228,000

|

1,259,888

|

|

01/30/2030

|

5.250%

|

|

1,228,000

|

1,272,028

|

|

Total

|

6,750,839

|

|

Restaurants 0.2%

|

|

IRB Holding Corp.(c)

|

|

02/15/2026

|

6.750%

|

|

4,300,000

|

4,501,903

|

|

Supermarkets 0.5%

|

|

Albertsons Companies LLC/Safeway, Inc./New Albertsons LP(c)

|

|

02/15/2028

|

5.875%

|

|

500,000

|

531,850

|

|

Safeway, Inc.

|

|

02/01/2031

|

7.250%

|

|

7,512,000

|

7,935,640

|

|

Total

|

8,467,490

|

|

Technology 0.9%

|

|

Diebold, Inc.

|

|

04/15/2024

|

8.500%

|

|

8,100,000

|

7,831,091

|

|

Genesys Telecommunications Laboratories, Inc./Greeneden Lux 3 Sarl/U.S. Holdings I LLC(c)

|

|

11/30/2024

|

10.000%

|

|

3,750,000

|

4,052,167

|

|

Informatica LLC(c)

|

|

07/15/2023

|

7.125%

|

|

3,838,000

|

3,902,128

|

|

Total

|

15,785,386

|

|

Transportation Services 0.5%

|

|

Hertz Corp. (The)(c)

|

|

10/15/2024

|

5.500%

|

|

3,500,000

|

3,596,807

|

|

08/01/2026

|

7.125%

|

|

4,500,000

|

4,872,005

|

|

Total

|

8,468,812

|

Total Corporate Bonds & Notes

(Cost $214,459,370)

|

216,426,950

|

|

Limited Partnerships 0.6%

|

|

Issuer

|

Shares

|

Value ($)

|

|

Energy 0.6%

|

|

Oil, Gas & Consumable Fuels 0.6%

|

|

Enviva Partners LP

|

120,000

|

4,477,200

|

|

Rattler Midstream LP

|

290,000

|

5,159,100

|

|

Total

|

|

9,636,300

|

|

Total Energy

|

9,636,300

|

Total Limited Partnerships

(Cost $8,159,059)

|

9,636,300

|

|

Preferred Debt 0.5%

|

|

Issuer

|

Coupon

Rate

|

|

Shares

|

Value ($)

|

|

Banking 0.3%

|

|

Citigroup Capital XIII(f)

|

|

10/30/2040

|

8.953%

|

|

150,000

|

4,170,000

|

|

Finance Companies 0.2%

|

|

GMAC Capital Trust I(f)

|

|

02/15/2040

|

8.303%

|

|

157,500

|

4,102,875

|

Total Preferred Debt

(Cost $7,915,166)

|

8,272,875

|

|

Senior Loans 0.4%

|

|

Borrower

|

Coupon

Rate

|

|

Principal

Amount ($)

|

Value ($)

|

|

Oil Field Services 0.4%

|

|

BCP Raptor LLC/EagleClaw Midstream Ventures(h),(i)

|

|

Term Loan

|

3-month USD LIBOR + 4.250%

Floor 1.000%

06/24/2024

|

6.049%

|

|

7,803,900

|

7,179,588

|

Total Senior Loans

(Cost $7,742,061)

|

7,179,588

|

|

Warrants —%

|

|

Issuer

|

Shares

|

Value ($)

|

|

Energy —%

|

|

Oil, Gas & Consumable Fuels —%

|

|

Goodrich Petroleum Corp.(a),(d),(e)

|

16,334

|

0

|

|

Total Energy

|

0

|

Total Warrants

(Cost $—)

|

0

|

|

|

|

Money Market Funds 2.4%

|

|

|

Shares

|

Value ($)

|

|

Columbia Short-Term Cash Fund, 1.699%(j),(k)

|

14,273,946

|

14,272,519

|

|

JPMorgan US Government Money Market Fund, Agency Shares, 1.405%(j)

|

26,191,146

|

26,191,146

|

Total Money Market Funds

(Cost $40,463,665)

|

40,463,665

|

Total Investments in Securities

(Cost: $1,505,085,893)

|

1,696,295,943

|

|

Other Assets & Liabilities, Net

|

|

5,741,672

|

|

Net Assets

|

1,702,037,615

|

The accompanying Notes to Portfolio of

Investments are an integral part of this statement.

|

12

|

Tri-Continental Corporation | Annual Report 2019

|

Portfolio of Investments (continued)

December 31, 2019

At December 31, 2019, securities

and/or cash totaling $1,217,151 were pledged as collateral.

Investments in derivatives

|

Long futures contracts

|

|

Description

|

Number of

contracts

|

Expiration

date

|

Trading

currency

|

Notional

amount

|

Value/Unrealized

appreciation ($)

|

Value/Unrealized

depreciation ($)

|

|

S&P 500 Index E-mini

|

100

|

03/2020

|

USD

|

16,155,500

|

205,841

|

—

|

Notes to Portfolio of

Investments

|

(a)

|

Non-income producing investment.

|

|

(b)

|

This security or a portion of this security has been pledged as collateral in connection with derivative contracts.

|

|

(c)

|

Represents privately placed and other securities and instruments exempt from Securities and Exchange Commission registration (collectively, private placements), such as Section

4(a)(2) and Rule 144A eligible securities, which are often sold only to qualified institutional buyers. The Fund may invest in private placements determined to be liquid as well as those determined to be illiquid.

Private placements may be determined to be liquid under guidelines established by the Fund’s Board of Directors. At December 31, 2019, the total value of these securities amounted to $187,073,626, which

represents 10.99% of total net assets.

|

|

(d)

|

Represents fair value as determined in good faith under procedures approved by the Board of Directors. At December 31, 2019, the total value of these securities amounted to

$3,100,000, which represents 0.18% of total net assets.

|

|

(e)

|

Valuation based on significant unobservable inputs.

|

|

(f)

|

Represents a variable rate security with a step coupon where the rate adjusts according to a schedule for a series of periods, typically lower for an initial period and then

increasing to a higher coupon rate thereafter. The interest rate shown was the current rate as of December 31, 2019.

|

|

(g)

|

Payment-in-kind security. Interest can be paid by issuing additional par of the security or in cash.

|

|

(h)

|

The stated interest rate represents the weighted average interest rate at December 31, 2019 of contracts within the senior loan facility. Interest rates on contracts are primarily

determined either weekly, monthly or quarterly by reference to the indicated base lending rate and spread and the reset period. These base lending rates are primarily the London Interbank Offered Rate

(“LIBOR”) and other short-term rates. Base lending rates may be subject to a floor or minimum rate. The interest rate for senior loans purchased on a when-issued or delayed delivery basis will be

determined upon settlement, therefore no interest rate is disclosed. Senior loans often require prepayments from excess cash flows or permit the borrowers to repay at their election. The degree to which borrowers

repay, cannot be predicted with accuracy. As a result, remaining maturities of senior loans may be less than the stated maturities.

|

|

(i)

|

Variable rate security. The interest rate shown was the current rate as of December 31, 2019.

|

|

(j)

|

The rate shown is the seven-day current annualized yield at December 31, 2019.

|

|

(k)

|

As defined in the Investment Company Act of 1940, an affiliated company is one in which the Fund owns 5% or more of the company’s outstanding voting securities, or a company

which is under common ownership or control with the Fund. Holdings and transactions in these affiliated companies during the year ended December 31, 2019 are as follows:

|

|

Issuer

|

Beginning

shares

|

Shares

purchased

|

Shares

sold

|

Ending

shares

|

Realized gain

(loss) —

affiliated

issuers ($)

|

Net change in

unrealized

appreciation

(depreciation) —

affiliated

issuers ($)

|

Dividends —

affiliated

issuers ($)

|

Value —

affiliated

issuers

at end of

period ($)

|

|

Columbia Short-Term Cash Fund, 1.699%

|

|

|

25,992,417

|

100,489,603

|

(112,208,074)

|

14,273,946

|

175

|

—

|

182,130

|

14,272,519

|

Abbreviation Legend

|

ADR

|

American Depositary Receipt

|

Currency Legend

Fair value measurements

The Fund categorizes its fair

value measurements according to a three-level hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs by prioritizing that the most observable input be used when available.

Observable inputs are those that market participants would use in pricing an investment based on market data obtained from sources independent of the reporting entity. Unobservable inputs are those that reflect the

Fund’s assumptions about the information market participants would use in pricing an investment. An investment’s level within the fair value hierarchy is based on the lowest level of any input that is

deemed significant to the asset’s or liability’s fair value measurement. The input levels are not necessarily an indication of the risk or liquidity associated with investments at that level. For example,

certain U.S. government securities are generally high quality and liquid, however, they are reflected as Level 2 because the inputs used to determine fair value may not always be quoted prices in an active market.

The accompanying Notes to Portfolio of Investments

are an integral part of this statement.

Tri-Continental Corporation | Annual Report 2019

|

13

|

Portfolio of Investments (continued)

December 31, 2019

Fair value measurements (continued)

Fair value inputs are summarized in the three broad levels listed below:

|

■

|

Level 1 — Valuations based on quoted prices for investments in active markets that the Fund has the ability to access at the measurement date. Valuation adjustments are not applied to Level 1 investments.

|

|

■

|

Level 2 — Valuations based on other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.).

|

|

■

|

Level 3 — Valuations based on significant unobservable inputs (including the Fund’s own assumptions and judgment in determining the fair value of investments).

|

Inputs that are used in determining

fair value of an investment may include price information, credit data, volatility statistics, and other factors. These inputs can be either observable or unobservable. The availability of observable inputs can vary

between investments, and is affected by various factors such as the type of investment, and the volume and level of activity for that investment or similar investments in the marketplace. The inputs will be considered

by the Investment Manager, along with any other relevant factors in the calculation of an investment’s fair value. The Fund uses prices and inputs that are current as of the measurement date, which may include

periods of market dislocations. During these periods, the availability of prices and inputs may be reduced for many investments. This condition could cause an investment to be reclassified between the various levels

within the hierarchy.

Foreign equity securities actively

traded in markets where there is a significant delay in the local close relative to the New York Stock Exchange are classified as Level 2. The values of these securities may include an adjustment to reflect the impact

of significant market movements following the close of local trading, as described in Note 2 to the financial statements – Security valuation.

Investments falling into the Level 3

category are primarily supported by quoted prices from brokers and dealers participating in the market for those investments. However, these may be classified as Level 3 investments due to lack of market transparency

and corroboration to support these quoted prices. Additionally, valuation models may be used as the pricing source for any remaining investments classified as Level 3. These models may rely on one or more significant

unobservable inputs and/or significant assumptions by the Investment Manager. Inputs used in valuations may include, but are not limited to, financial statement analysis, capital account balances, discount rates and

estimated cash flows, and comparable company data.

Under the direction of the

Fund’s Board of Directors (the Board), the Investment Manager’s Valuation Committee (the Committee) is responsible for overseeing the valuation procedures approved by the Board. The Committee consists of

voting and non-voting members from various groups within the Investment Manager’s organization, including operations and accounting, trading and investments, compliance, risk management and legal.

The Committee meets at least monthly

to review and approve valuation matters, which may include a description of specific valuation determinations, data regarding pricing information received from approved pricing vendors and brokers and the results of

Board-approved valuation control policies and procedures (the Policies). The Policies address, among other things, instances when market quotations are or are not readily available, including recommendations of third

party pricing vendors and a determination of appropriate pricing methodologies; events that require specific valuation determinations and assessment of fair value techniques; securities with a potential for stale

pricing, including those that are illiquid, restricted, or in default; and the effectiveness of third party pricing vendors, including periodic reviews of vendors. The Committee meets more frequently, as needed, to