|

|

|

|

|

|

|

|

|

|

Harbor Real Return Fund

Summary Prospectus – March 1, 2014

|

|

Institutional Class

HARRX

Administrative Class

HRRRX

|

|

|

Before you invest, you may want to review the Fund’s prospectus, which contains more information about the Fund and its risks. You can find the Fund’s

prospectus and other information about the Fund online at

harborfunds.com/prospectus

. You can also get this information at no cost by calling 800-422-1050 or by sending an e-mail request to funddocuments@harborfunds.com. If you purchase

shares of the Fund through a financial intermediary, the prospectus and other information will also be available from your financial intermediary. The current prospectus and statement of additional information, dated March 1, 2014, are incorporated

by referenced into this summary prospectus and may be obtained, free of charge, at the website, phone number or e-mail address noted above.

Investment Objective

The Fund seeks maximum real return, consistent with preservation of real capital.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy and hold shares of the Fund.

Annual Fund Operating Expenses

(expenses that you pay each year as a percentage of the value of your investment)

|

|

|

|

|

|

|

|

|

Institutional

Class

|

|

Administrative

Class

|

|

Management Fees

|

|

0.48%

|

|

0.48%

|

Distribution and/or

Service (12b-1) Fees

|

|

None

|

|

0.25%

|

|

Other Expenses

|

|

0.13%

|

|

0.13%

|

|

Interest Expense from Sale-Buyback Transactions

|

|

0.02%

|

|

0.02%

|

|

Other Operating Expenses

|

|

0.11%

|

|

0.11%

|

|

Total Annual Fund Operating Expenses

|

|

0.61%

|

|

0.86%

|

Expense Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time

periods indicated. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, under these assumptions, your costs would be:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year

|

|

|

Three

Years

|

|

|

Five

Years

|

|

|

Ten

Years

|

|

|

Institutional

|

|

$

|

62

|

|

|

$

|

195

|

|

|

$

|

340

|

|

|

$

|

762

|

|

|

Administrative

|

|

$

|

88

|

|

|

$

|

274

|

|

|

$

|

477

|

|

|

$

|

1,061

|

|

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover may indicate higher transaction costs and may

result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. The Fund’s portfolio turnover rate in the most

recent fiscal year was 285%.

Principal Investment Strategy

Principal Style Characteristics:

Inflation-indexed fixed income securities

The Fund is

non-diversified, which means that it may concentrate its assets in a smaller number of issuers than a diversified fund.

Inflation-indexed

bonds are fixed income securities that are structured to provide protection against inflation. The value of the bond’s principal or the interest income paid on the bond is adjusted to track changes in an official inflation measure. The U.S.

Treasury uses the Consumer Price Index for Urban Consumers as the inflation measure for U.S. Treasury Inflation-Protected Securities (“TIPS”). Inflation-indexed bonds issued by foreign governments are generally adjusted to reflect a

comparable inflation index, calculated by that government. “Real return” equals total return less the estimated cost of inflation, which is typically measured by the change in an official inflation measure.

The Fund may invest up to 30% of its total assets in securities denominated in foreign currencies, and may invest beyond this limit in U.S. dollar

denominated securities of foreign issuers. Foreign currency exposure (from non-U.S. dollar denominated securities or currencies) normally will be limited to 20% of the Fund’s total assets. The Fund also may invest up to 10% of its total assets

in securities of issuers based in countries with developing (or “emerging market”) economies.

Under normal market conditions, the

Fund expects to invest at least 80% of its net assets, plus borrowings for investment purposes, in inflation-indexed bonds of varying maturities issued by the U.S. government, non-U.S. governments, their agencies or instrumentalities, and

corporations, which may represented by forwards or derivatives such as options, futures contracts or swap agreements. Assets not invested in inflation-indexed bonds may be invested in other types of fixed income securities.

The Fund may invest, without limitation, in derivative instruments, such as options, futures contracts or swap agreements (including currency swaps,

interest rate swaps, total return swaps, credit default swaps and others, in which the Fund may be either the buyer or the seller), or in mortgage- or asset-backed securities. The Fund may, without limitation, seek to obtain market exposure to the

securities in which it invests by entering into a series of purchase and sale contracts or by using other investment techniques (such as buy-backs or dollar rolls). The Fund may engage in short selling, which is the sale by the Fund of a borrowed

security. Because the Fund is obligated to replace the borrowed security, the Fund would benefit from the short sale if the price of the security declines before it is replaced. The Fund may also invest up to 10% of its total assets in preferred

stocks.

1

Summary Prospectus

HARBOR REAL RETURN FUND

Credit Quality.

The Fund invests primarily in investment-grade debt

securities, but may invest up to 10% of its total assets in below investment-grade securities, commonly referred to as “high-yield” or “junk” bonds. For all securities other than mortgage-related securities, the Fund may invest

in below investment-grade securities only if they are rated B or higher by Moody’s, S&P or Fitch, or, if unrated, determined to be of comparable quality. For mortgage-related securities, the Fund may invest in securities of any credit

quality, including those rated below B.

Duration.

The average portfolio duration of this Fund, as calculated by the Subadviser,

normally varies within three years (plus or minus) of the duration of the Barclays Capital U.S. TIPS Index, which as of December 31, 2013 was 6.83 years. Average duration is a weighted average of all fixed income security durations in the

Fund’s portfolio, and is an approximate measure of the sensitivity of the market value of the Fund’s holdings to changes in interest rates. If the Fund’s duration is longer than the market’s duration, the Fund would experience a

greater change in the value of its assets when interest rates are rising or falling than would the market as a whole. The average duration of the Fund’s portfolio was 6.93 years as of December 31, 2013.

Principal Risks

There is no

guarantee that the investment objective of the Fund will be achieved. Fixed income securities fluctuate in price in response to various factors, including changes in interest rates, changes in market conditions and issuer-specific events, and the

value of your investment in the Fund may go down. This means that you could lose money on your investment in the Fund or the Fund may not perform as well as other possible investments. Principal risks include:

Interest rate risk:

As nominal interest rates rise, the value of fixed income securities held by the Fund are likely to decrease and reduce the

value of the Fund’s portfolio. Securities with longer durations tend to be more sensitive to changes in interest rates, and are usually more volatile than securities with shorter durations. For example, a 5 year average duration generally means

the fixed income security will decrease in value by 5% if interest rates rise by 1%. Additionally, rising interest rates may lead to increased redemptions and decreased liquidity in the fixed income markets, making it more difficult for the Fund to

sell its fixed income holdings when the Subadviser may wish to sell or must sell to meet redemptions.

A nominal interest rate can be described

as the sum of a real interest rate and an expected inflation rate. Inflation-indexed securities, including U.S. Treasury inflation protected securities (“TIPS”), decline in value when real interest rates rise. In certain interest rate

environments, such as when real interest rates are rising faster than nominal interest rates, inflation-indexed securities may experience greater losses than other fixed income securities with similar durations. Interest rates in the U.S. are at, or

near, historic lows, which may increase the Fund’s exposure to risks associated with rising rates.

Credit risk:

The issuer of a

security owned by the Fund could default on its obligation to pay principal or interest or its credit rating could be downgraded. Likewise, a counterparty to a derivative or other contractual instrument owned by the Fund could default on its

obligation. This risk may be higher for below investment-grade securities.

Prepayment risk:

When interest rates are declining, the

issuer of a pass-through security, such as a mortgage-backed or an asset-backed security, may exercise its option to prepay principal earlier than scheduled, forcing the Fund to reinvest in lower yielding securities.

Selection risk:

The Subadviser’s judgment about the attractiveness, value and potential appreciation of a particular security may be

incorrect.

Derivatives risk:

The value of derivative instruments held by the Fund may not change in the manner expected by the

Subadviser, which could result in disproportionately large losses to the Fund.

Leveraging risk:

The Fund’s use of certain

investments, such as derivative instruments or reverse repurchase agreements, and certain transactions, such as securities purchased on a when-issued, delayed delivery or forward commitment basis, can give rise to leverage within the Fund’s

portfolio, which could cause the Fund’s returns to be more volatile than if leverage had not been used.

Market and Issuer risk:

Securities markets are volatile and can decline significantly in response to adverse market, economic, political or regulatory developments, which may lower the value of securities held by the Fund, sometimes rapidly or unpredictably.

Additionally, an adverse event or adverse economic conditions may depress the value of a particular issuer’s securities or may increase the risk that issuers will not generate sufficient cash flow to service their debt obligations.

Foreign securities risk:

Because the Fund may invest in securities of foreign issuers, an investment in the Fund is subject to special risks in

addition to those of U.S. securities. These risks include heightened political and economic risks, greater volatility, currency fluctuations, higher transaction costs, delayed settlement, possible foreign controls on investment, and less stringent

investor protection and disclosure standards of foreign markets. Foreign securities are sometimes less liquid and harder to value than securities of U.S. issuers. These risks are more significant for issuers in emerging market countries. Global

economies and financial markets are becoming increasingly interconnected, and conditions and events in one country, region or financial market may adversely impact issuers in a different country, region or financial market.

Non-diversification risk:

Because the Fund is non-diversified, which means it may invest a greater percentage of its assets in securities of a

single issuer or in a relatively small number of issuers, it is more susceptible to risks associated with a single economic, political or regulatory occurrence than a more diversified portfolio. Some of those issuers may also present substantial

credit or other risks.

Short sales risk:

If the price of securities sold short increases, the Fund would be required to pay more to

replace the borrowed securities than the Fund received on the sale of the securities. Because there is theoretically no limit to the amount of the increase in price of the borrowed securities, the Fund’s risk of loss on a short sale is

potentially unlimited.

Mortgage risk:

Mortgage derivatives in the Fund’s portfolio may have especially volatile prices because the

embedded leverage can magnify the impact of the extension or contraction event on the underlying cash flow. There may be a greater risk that the Fund could lose money due to prepayment and extension risks because the Fund invests heavily at times in

mortgage-related securities.

2

Summary Prospectus

HARBOR REAL RETURN FUND

Performance

The following bar chart and table show two aspects of the Fund: volatility and performance. The bar chart shows the volatility — or variability

— of the Fund’s annual total returns over time, and shows that Fund performance can change from year to year. The table shows the Fund’s average annual total returns for certain time periods compared to the returns of a broad-based

securities index. The bar chart and table provide some indication of the risks and potential rewards of investing in the Fund. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in

the future. To obtain updated performance information please visit the Fund’s website at

harborfunds.com

or call 800-422-1050.

Calendar Year Total Returns for Institutional Class Shares

The Fund’s best and worst calendar quarters during this time period were:

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Return

|

|

|

Quarter/Year

|

|

|

Best Quarter

|

|

|

7.84%

|

|

|

|

1st/2009

|

|

|

Worst Quarter

|

|

|

-8.10%

|

|

|

|

2nd/2013

|

|

Average Annual Total Returns — As of December 31, 2013

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One

Year

|

|

|

Five

Years

|

|

|

Ten

Years

|

|

Life of

Fund

|

|

|

Institutional Class (inception date 12-01-2005)

|

|

|

Before Taxes

|

|

|

-9.20%

|

|

|

|

6.25%

|

|

|

N/A

|

|

|

4.75%

|

|

|

After Taxes on Distributions

|

|

|

-10.70%

|

|

|

|

4.62%

|

|

|

N/A

|

|

|

3.02%

|

|

|

After Taxes on Distributions and Sale of Fund Shares

|

|

|

-5.06%

|

|

|

|

4.39%

|

|

|

N/A

|

|

|

3.12%

|

|

|

Administrative Class (inception date 12-01-2005)

|

|

|

Before Taxes

|

|

|

-9.38%

|

|

|

|

5.97%

|

|

|

N/A

|

|

|

4.49%

|

|

Comparative Index

(reflects no deduction for fees, expenses or taxes)

|

|

|

Barclays U.S. TIPS

|

|

|

-8.60%

|

|

|

|

5.63%

|

|

|

N/A

|

|

|

4.77%

|

|

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not

reflect the impact of state and local taxes. Actual after-tax returns depend on a shareholder’s tax situation and may differ from those shown. The after-tax returns shown are not relevant to tax exempt shareholders or shareholders who hold

their Fund shares through tax-deferred arrangements such as 401(k) plans or individual retirement accounts. In some cases, average annual total return “After Taxes on Distributions and Sale of Fund Shares” may exceed the return

“Before Taxes” and/or “After Taxes on Distributions” due to an assumed tax benefit for any losses on a sale of Fund shares at the end of the measurement period. After-tax returns are shown for Institutional Class shares only.

After-tax returns for the Administrative Class shares will vary.

Portfolio Management

Investment Adviser

Harbor Capital Advisors, Inc.

Subadviser

Pacific Investment

Management Company LLC (PIMCO) has subadvised the Fund since its inception in 2005.

Portfolio Manager

|

|

|

|

|

|

|

|

|

Mihir Worah

PIMCO

|

|

|

|

Mr. Worah is a Managing Director for PIMCO. Mr. Worah is a Portfolio Manager and he has managed the Fund since 2007.

|

Buying and Selling Fund Shares

Shareholders may purchase or sell (redeem) Fund shares on any business day (normally any day the New York Stock Exchange is open). You may conduct transactions by mail, by telephone or through our

website.

|

|

|

|

|

By Mail

|

|

Harbor Funds

P.O. Box 804660

Chicago, IL 60680-4108

|

|

By Telephone

|

|

800-422-1050

|

|

By Visiting Our Website

|

|

Harborfunds.com

|

Investors who

wish to purchase, exchange or redeem shares held through a financial intermediary should contact the financial intermediary directly.

The

minimum initial investment amounts are shown below. The minimums may be reduced or waived in some cases. There are no minimums for subsequent investments.

|

|

|

|

|

|

|

|

|

|

|

Type of Account

|

|

Institutional

Class

|

|

|

Administrative

Class*

|

|

|

Regular

|

|

$

|

1,000

|

|

|

$

|

50,000

|

|

|

Individual Retirement Account (IRA)

|

|

$

|

1,000

|

|

|

|

N/A

|

|

Custodial

(UGMA/UTMA)

|

|

$

|

1,000

|

|

|

|

N/A

|

|

|

*

|

|

Limited only to eligible retirement plans and financial intermediaries. There is no minimum investment for qualified retirement plans and Section 457 plans.

|

3

Summary Prospectus

HARBOR REAL RETURN FUND

Tax Information

Distributions you receive from the fund are subject to federal income tax and may also be subject to state and local taxes. These distributions will

generally be taxed as ordinary income or capital gains, unless you are investing through a tax-deferred retirement account, such as a 401(k) plan or individual retirement account. Investments in tax-deferred accounts may be subject to tax when they

are withdrawn.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary, the Fund and/or its related companies may pay the intermediary for the

sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your sales representative to recommend the Fund over another investment. Ask your sales

representative or visit your financial intermediary’s website for more information.

4

[INTENTIONALLY LEFT BLANK]

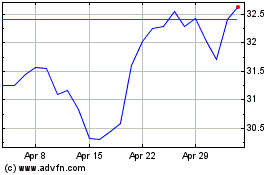

Tortoise Pipeline and En... (NYSE:TTP)

Historical Stock Chart

From May 2024 to Jun 2024

Tortoise Pipeline and En... (NYSE:TTP)

Historical Stock Chart

From Jun 2023 to Jun 2024