0000844965FALSEOctober 30, 202300008449652023-10-302023-10-300000844965us-gaap:CommonClassAMember2023-10-302023-10-300000844965us-gaap:CommonStockMember2023-10-302023-10-300000844965us-gaap:SeriesAPreferredStockMember2023-10-302023-10-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 30, 2023

TETRA Technologies, Inc.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | |

| Delaware | 1-13455 | 74-2148293 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

24955 Interstate 45 North

The Woodlands, Texas 77380

(Address of Principal Executive Offices, and Zip Code)

(281) 367-1983

Registrant’s Telephone Number, Including Area Code

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| | ☐ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| | ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| | ☐ | Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| | ☐ | Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | TTI | New York Stock Exchange |

| Preferred Share Purchase Right | N/A | New York Stock Exchange |

| | | | | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 2.02. Results of Operations and Financial Condition.

On October 30, 2023, TETRA Technologies, Inc., a Delaware corporation (the “Company”), issued a news release announcing its financial results for the third quarter 2023. The news release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

The information furnished in this Item 2.02 and in Exhibit 99.1 to this Current Report shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| TETRA Technologies, Inc. |

| |

| By: | /s/Brady M. Murphy |

| Brady M. Murphy |

| President and Chief Executive Officer |

Exhibit 99.1

TETRA TECHNOLOGIES, INC. ANNOUNCES THIRD QUARTER

2023 FINANCIAL RESULTS AND PROVIDES UPDATE ON

ARKANSAS BROMINE AND LITHIUM BRINE UNIT

•Third quarter revenue of $151.5 million increased 12% year-over-year.

•Net income before discontinued operations was $5.5 million and net income per share attributable to TETRA stockholders was $0.04, each improved from break-even in the same quarter a year ago.

•Net cash provided by operating activities was $14.0 million while adjusted free cash flow was $7.1 million.

•Adjusted EBITDA of $26.1 million increased 40% year-over-year.

THE WOODLANDS, Texas, October 30, 2023 / PR Newswire / - TETRA Technologies, Inc. (“TETRA” or the “Company”) (NYSE:TTI) today announced third quarter 2023 financial results. Brady Murphy, TETRA President and Chief Executive Officer, stated, “In addition to another strong financial performance, in the third quarter we achieved an important milestone in our Company’s history with unanimous approval by the Arkansas Oil & Gas Commission (“AOGC”) of the 6,138 acre joint brine unit application, giving TETRA and our partner the rights to develop and produce the brine for bromine production and future lithium production once the lithium royalty is established by the AOGC. In addition, we completed the data gathering and sampling operations for the second test well with results yielding lithium measurements in the upper Smackover as high as 646 mg/l, 35% higher than the first test well which was on the southern end of the unit that we reported in September 2022, and bromine values of 5,890 mg/l, in line with the first test well. These results are being used to update the lithium and bromine resource report which we plan to complete and release shortly.

On August 8, Standard Lithium Ltd. (“Standard Lithium”) released a Preliminary Feasibility Study (“PFS”) on its South West Arkansas Project, which is part of the roughly 35,000 gross acres held by TETRA and where Standard Lithium has the option to acquire lithium mineral rights. The Standard Lithium PFS indicates a base case production of 30,000 tonnes per annum of battery-quality lithium hydroxide monohydrate (“LHM”). The PFS also assumes a long-term selling price of battery-quality LHM of $30,000 per metric ton. Based on these assumptions, TETRA’s illustrative royalties would be $22.5 million per year based on a 2.5% royalty on gross lithium revenues, without any investments required by TETRA. The PFS study stated that Standard Lithium is targeting construction in 2025 and commencing production in 2027. In October we received notice from Standard Lithium exercising the option in accordance with the 2017 option agreement.

Financial results for the third quarter are highlighted by year-on-year revenue growth of 12%, net income before discontinued operations growth of $5.5 million, and adjusted EBITDA growth of 40%. Net income was

$5.4 million, inclusive of $3.7 million of non-recurring charges, net of credits, and compares to net income of $0.3 million in the third quarter of 2022, inclusive of $2.7 million of non-recurring charges, and to net income of $18.2 million in the second quarter of 2023, inclusive of $0.9 million of non-recurring credits, net of charges. Third quarter results included unrealized losses on investments of $0.6 million. Excluding these unrealized losses on investments, Adjusted EBITDA for the third quarter of 2023 was $26.6 million, or 18% of revenue. Completion Fluids & Products led the way with year-on-year revenue growth of 24%, net income before taxes and discontinued operations growth of 37% and Adjusted EBITDA growth of 52%, when adjusted for unrealized gains or losses on investments. Due to the strong Northern European industrial chemicals seasonality impact each year on the second quarter results, the third quarter performance can be compared to the first quarter performance. Compared to the first quarter, total Company revenues were up 4%, net income before discontinued operations was down 10%, and Adjusted EBITDA was up 27%. Both segments contributed to the Adjusted EBITDA growth as both segments achieved fall through of 100% or greater versus the first quarter, when excluding gains or losses from investments.

“Third quarter cash flow from operating activities was $14.0 million and compares to $2.1 million in the third quarter of 2022 and to $28.4 million in the second quarter of 2023. Adjusted free cash flow was $7.1 million in the third quarter of 2023 and compares to a use of cash of $9.8 million in the third quarter of 2022 and to cash flow of $17.7 million in the second quarter of 2023. Working capital at the end of the third quarter was $110 million and represents a slight increase from the prior quarter due to a temporary build in inventory which is expected to be monetized as products are shipped for future projects. Working capital is defined as current assets, excluding cash and restricted cash, less current liabilities.

“Completion Fluids & Products revenue of $73 million increased 24% year-on-year driven by another robust performance in our industrial calcium chloride business where utilization and production volumes remained strong. Higher offshore activity year-on-year also drove higher demand for our high value completion fluids products. Sequentially, revenue decreased 25% reflecting the seasonal decrease in our Northern Europe industrial calcium chloride business. Net income before taxes for the quarter was $16.9 million (23.1% of revenue) and compares to $12.4 million (20.9% of revenue) in the third quarter of 2022 and to $32.0 million (32.5% of revenue) in the second quarter of 2023. Adjusted EBITDA was $20.9 million (28.6% of revenue) and compares to $14.7 million (24.9% of revenue in the third quarter of 2022 and to $31.8 million (32.4% of revenue) in the second quarter of 2023. The third quarter included $1.2 million in net unrealized losses from investments. Excluding unrealized losses from investments. Adjusted EBITDA margins were 30.2% and above the 30% mark for two consecutive quarters.

“In the third quarter, we were awarded a multi-year, multi-well contract extension with one of the most active deepwater supermajors in the Gulf of Mexico, further validating our market position in the region. Kimberlite International Oilfield Research published an updated 2023 Completion Fluids Offshore Supplier Analysis where TETRA remained ranked as the top supplier in the Gulf of Mexico for product quality and overall performance. Kimberlite is an international oil & gas market research and consulting company that uses data collected from one-on-one interviews with operators to assess market trends and establish performance benchmarks for oilfield equipment and service suppliers. The report indicated that TETRA continues to receive the highest customer loyalty ratings as measured by the net promoter score.

“Water & Flowback Services revenue of $78 million improved modestly by 3% year-on-year while remaining flat sequentially. The increase in revenue was driven by international operations. U.S. revenue was relatively flat, even though the U.S. onshore average rig count was down nearly 15% and active frac fleets were down nearly 5% from the third quarter of last year. Net income before taxes for the quarter was $8.5 million (10.8% of revenue) and compares to $6.5 million (9% of revenue) in the third quarter of 2022 and to $8.0 million (10.4% of revenue) in the second quarter of 2023. Adjusted EBITDA of $14.8 million improved by $1.7 million (13%) year-on-year and by $0.6 million (4%) quarter-over-quarter. Water & Flowback Services Adjusted EBITDA margins continued to improve (up 60 basis points from 18.4% in the second quarter of 2023 to 19.0% in the third quarter of 2023) despite the pullback in fracking activity and achieved the Company’s target set earlier this year. The 19.0% margins are the highest margins achieved since the fourth quarter of 2018 and the fourth consecutive quarter of margin improvement, reflecting our focus on technology and automation. We have been successful in maintaining stable pricing for our differentiated products and services meanwhile continuing to drive cost-reduction efforts in our US land business, which helped us achieve sequential Adjusted EBITDA margin fall-through greater than 60%.

“In October, we sold one of the three early production facilities (“EPF”) in Argentina to the operator for an amount in excess of $5 million, with all the cash proceeds received in October. TETRA will continue to operate and maintain the EPF on behalf of the operator for a fixed monthly fee. We are currently in the process of expanding the EPF to process greater volumes of oil and are in discussions with this same operator to potentially construct 1 to 3 additional facilities in the future.

“Our target to have the engineering completed for our first produced water desalination plant for beneficial re-use applications is on track for year end or early part of 2024. In parallel to the engineering design work, we are in commercial discussions with one of the largest North America shale producers for their beneficial re-use projects in multiple unconventional basins and expect to have our first project awarded shortly.

“Finally, we anticipate strong cash from operating activities and Adjusted Free Cash Flow in the fourth quarter, driven by the cash proceeds from the EPF sale and working capital improvements. Total year 2023 cash from operating activities is expected to be between $70 million and $79 million while Adjusted Free Cash Flow is expected to be between $35 million and $40 million. Cash generation from our existing businesses positions us to continue investing in the evaluation and development of our Arkansas bromine and lithium assets.”

This press release includes the following financial measures that are not presented in accordance with generally accepted accounting principles in the United States (“GAAP”): Adjusted net income per share, Adjusted EBITDA, and Adjusted EBITDA Margin (Adjusted EBITDA as a percent of revenue) on consolidated and segment basis, adjusted net income, adjusted free cash flow, net debt, net leverage ratio and return on capital employed. Please see Schedules E through K for reconciliations of these non-GAAP financial measures to the most directly comparable GAAP measures.

Third Quarter Results and Highlights

A summary of key financial metrics for the third quarter are as follows:

Third Quarter 2023 Results

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| September 30,

2023 | | June 30, 2023 | | September 30,

2022 |

| (in thousands, except per share amounts) |

| Revenue | $ | 151,464 | | | $ | 175,463 | | | $ | 135,012 | |

| Income before discontinued operations | 5,468 | | | 18,205 | | | (63) | |

| | | | | |

| Adjusted EBITDA | 26,059 | | | 36,046 | | | 18,595 | |

| Net income attributable to TETRA stockholders | 0.04 | | | 0.14 | | | 0.00 | |

| Adjusted net income per share | 0.07 | | | 0.13 | | | 0.00 | |

| Net cash provided by operating activities | 13,974 | | | 28,372 | | | 2,145 | |

| Adjusted free cash flow | $ | 7,073 | | | $ | 17,711 | | | $ | (9,774) | |

Free Cash Flow, Balance Sheet and Income Taxes

Cash from operating activities was $14.0 million in the third quarter and adjusted free cash flow from continuing operations was $7.1 million. Liquidity at the end of the third quarter was $107 million, an improvement over the second quarter. Liquidity is defined as unrestricted cash plus availability under our revolving credit facilities. At the end of the third quarter, unrestricted cash was $34 million and availability under our credit agreements was $73 million. Long-term debt, primarily with a September 2025 maturity, was $159 million, while net debt was $125 million. TETRA’s net leverage ratio improved to 1.4X at the end of the third quarter of 2023, down from 1.5X as of June 30, 2023 and down from almost 2.0X at the end of the fourth quarter of 2022. As of September 30, 2023, TETRA held $9.5 million in total marketable securities between its holdings in CSI Compressco and Standard Lithium. TETRA’s return on net capital employed improved to 20.7% at the end of the third quarter of 2023, up from 18.2% as of June 30, 2023.

Non-recurring Charges and Expenses

Non-recurring credits, charges and expenses are reflected on Schedule E and include the following:

•$1.8 million of costs associated with our Arkansas bromine and lithium project including evaluating the second test well as well as ongoing engineering and design work net of the amounts recovered from Saltwerx consistent with the recently completed Memorandum of Understanding (“MOU”).

•$1.1 million of non-cash stock appreciation right expense and $0.5 million of adjustments to long-term incentives.

Unrealized losses on investments totaling $0.6 million are included in both reported and adjusted earnings.

Conference Call

TETRA will host a conference call to discuss these results tomorrow, October 31, at 10:30 a.m. Eastern Time. The phone number for the call is 1-888-347-5303. The conference call will also be available by live audio webcast. A replay of the conference call will be available at 1-877-344-7529 conference number 4719291, for one week following the conference call and the archived webcast will be available through the Company's website for thirty days following the conference call.

Investor Contact

For further information, please contact Elijio Serrano, CFO, TETRA Technologies, Inc. at (281) 367-1983 or via email at eserrano@tetratec.com or Rigo Gonzalez, Manager of Corporate Finance and Investor Relations, at (281) 364-2213 or via email at rgonzalez@tetratec.com.

Financial Statements, Schedules and Non-GAAP Reconciliation Schedules (Unaudited)

Schedule A: Consolidated Income Statement

Schedule B: Condensed Consolidated Balance Sheet

Schedule C: Consolidated Statements of Cash Flows

Schedule D: Statement Regarding Use of Non-GAAP Financial Measures

Schedule E: Non-GAAP Reconciliation of Adjusted Net Income

Schedule F: Non-GAAP Reconciliation of Adjusted EBITDA

Schedule G: Non-GAAP Reconciliation of Net Debt

Schedule H: Non-GAAP Reconciliation to Adjusted Free Cash Flow

Schedule I: Non-GAAP Reconciliation to Net Leverage Ratio

Schedule J: Non-GAAP Reconciliation to Return on Capital Employed

Schedule K: Non-GAAP Reconciliation to Adjusted Free Cash Flow – Full Year Guidance

Company Overview

TETRA Technologies, Inc. is an energy services and solutions company operating on six continents with a focus on bromine-based completion fluids, calcium chloride, water management solutions, frac flowback, and production well testing services. Calcium chloride is used in the oil and gas, industrial, agricultural, road, food, and beverage markets. TETRA is evolving its business model by expanding into the low carbon energy markets with its chemistry expertise, key mineral acreage, and global infrastructure. Low carbon energy initiatives include commercialization of TETRA PureFlow®, an ultra-pure zinc bromide clear brine fluid for stationary batteries and energy storage; advancing an innovative carbon capture utilization and storage technology with CarbonFree to capture CO2 and mineralize emissions to make commercial, carbon-negative chemicals; and development of TETRA's lithium and bromine mineral acreage to meet the growing demand for oil and gas products and energy storage. Visit the Company's website at www.tetratec.com for more information.

Cautionary Statement Regarding Forward Looking Statements

This news release includes certain statements that are deemed to be forward-looking statements. Generally, the use of words such as “may,” “see,” “expectation,” “expect,” “intend,” “estimate,” “projects,” “anticipate,” “believe,” “assume,” “could,” “should,” “plans,” “targets” or similar expressions that convey the uncertainty of future events, activities, expectations or outcomes identify forward-looking statements that the Company intends to be included within the safe harbor protections provided by the federal securities laws. These forward-looking statements include statements concerning economic and operating conditions that are outside of our control, including statements concerning recovery of the oil and gas industry; customer delays for international completion fluids related to global shipping and logistics issues; potential revenue associated with prospective energy storage projects or our pending carbon capture partnership; inferred mineral resources of lithium and bromine, the potential extraction of lithium and bromine from the leased acreage, including the acreage subject to Standard Lithium’s option, the economic viability thereof, the demand for such resources, the timing and costs of such activities, and the expected revenues and profits from such activities, including the illustrative royalty revenue associated with the Standard Lithium option; the ability to obtain an indicated or measured resources report and initial economic assessment regarding our lithium and bromine acreage; projections or forecasts concerning the Company's business activities, financial guidance, profitability, estimated earnings, earnings per share, and statements regarding the Company's beliefs, expectations, plans, goals, future events and performance, and other statements that are not purely historical. With respect to the Company’s disclosures of inferred mineral resources, including bromine and lithium carbonate equivalent concentrations, it is uncertain if further exploration will ever result in the estimation of a higher category of mineral resource or a mineral reserve. Inferred mineral resources are considered to have the lowest level of geological confidence of all mineral resources. Investors are cautioned that mineral resources do not have demonstrated economic value. Inferred mineral resources have a high degree of uncertainty as to their existence and to whether they can be economically or legally commercialized. A significant amount of exploration must be completed in order to determine whether an inferred mineral resource may be upgraded to a higher category. Therefore, you are cautioned not to assume that all or any part of an inferred mineral resource exists, that it can be economically or legally commercialized, or that it will ever be upgraded to a higher category. These forward-looking statements are based on certain assumptions and analyses made by the Company in light of its experience and its perception of historical trends, current conditions, expected future developments and other factors it believes are appropriate in the circumstances. Such statements are subject to a number of risks and uncertainties, many of which are beyond the control of the Company. With respect to the Company’s disclosures of the MOU with Saltwerx, it is uncertain about the ability of the parties to successfully negotiate one or more definitive agreements, the future relationship between the parties, and the ability to successfully and economically produce lithium and bromine from the brine unit. Investors are cautioned that any such statements are not guarantees of future performances or results and that actual results or developments may differ materially from those projected in the forward-looking statements. Some of the factors that could affect actual results are described in the section titled “Risk Factors” contained in the Company's Annual Reports on Form 10-K, as well as other risks identified from time to time in its reports on Form 10-Q and Form 8-K filed with the Securities and Exchange Commission. Investors should not place undue reliance on forward-looking statements. Each forward-looking statement speaks only as of the date of the particular statement, and the Company undertakes no obligation to update or revise any forward-looking statements, except as may be required by law.

Schedule A: Consolidated Income Statement (Unaudited)

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| September 30,

2023 | | June 30, 2023 | | September 30,

2022 |

| (in thousands, except per share amounts) |

| Revenues | $ | 151,464 | | | $ | 175,463 | | | $ | 135,012 | |

| | | | | |

| Cost of sales, services, and rentals | 104,962 | | | 117,074 | | | 96,905 | |

| Depreciation, amortization, and accretion | 8,578 | | | 8,457 | | | 8,634 | |

| Impairments and other charges | — | | | 777 | | | — | |

| | | | | |

| Total cost of revenues | 113,540 | | | 126,308 | | | 105,539 | |

| Gross profit | 37,924 | | | 49,155 | | | 29,473 | |

| Exploration and appraisal costs | 3,775 | | | 2,341 | | | 936 | |

| General and administrative expense | 23,838 | | | 26,225 | | | 23,833 | |

| | | | | |

| Interest expense, net | 5,636 | | | 5,944 | | | 3,999 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Other (income) expense, net | (2,041) | | | (6,435) | | | (1,410) | |

| Income before taxes and discontinued operations | 6,716 | | | 21,080 | | | 2,115 | |

Provision (benefit) for income taxes | 1,248 | | | 2,875 | | | 2,178 | |

Income (loss) before discontinued operations | 5,468 | | | 18,205 | | | (63) | |

| Discontinued operations: | | | | | |

| Income (loss) from discontinued operations, net of taxes | (48) | | | (8) | | | 319 | |

| Net income | 5,420 | | | 18,197 | | | 256 | |

Loss attributable to noncontrolling interest | — | | | 18 | | | 22 | |

| Net income attributable to TETRA stockholders | $ | 5,420 | | | $ | 18,215 | | | $ | 278 | |

| | | | | |

| Basic per share information: | | | | | |

| Income from continuing operations | $ | 0.04 | | | $ | 0.14 | | | $ | 0.00 | |

| | | | | |

| Net income attributable to TETRA stockholders | $ | 0.04 | | | $ | 0.14 | | | $ | 0.00 | |

| Weighted average shares outstanding | 129,777 | | 129,460 | | | 128,407 |

| | | | | |

| Diluted per share information: | | | | | |

| Income from continuing operations | $ | 0.04 | | | $ | 0.14 | | | $ | 0.00 | |

| | | | | |

| Net income attributable to TETRA stockholders | $ | 0.04 | | | $ | 0.14 | | | $ | 0.00 | |

| Weighted average shares outstanding | 132,089 | | | 129,925 | | | 128,407 |

Schedule B: Condensed Consolidated Balance Sheet (Unaudited)

| | | | | | | | | | | |

| | September 30,

2023 | | December 31,

2022 |

| (in thousands) |

| | (unaudited) | | |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 33,826 | | $ | 13,592 |

| | | |

| Trade accounts receivable | 122,900 | | 129,631 |

Inventories | 92,128 | | 72,113 |

| | | |

| | | |

Prepaid expenses and other current assets | 21,575 | | 23,112 |

Total current assets | 270,429 | | 238,448 |

| Property, plant, and equipment, net | 106,079 | | 101,580 |

| Other intangible assets, net | 30,132 | | 32,955 |

| | | |

| Operating lease right-of-use assets | 34,227 | | 33,818 |

| Investments | 16,405 | | 14,286 |

| Other assets | 15,147 | | 13,279 |

| Total long-term assets | 201,990 | | 195,918 |

| Total assets | $ | 472,419 | | $ | 434,366 |

| | | | | | | | | | | |

| LIABILITIES AND EQUITY | | | |

| Current liabilities: | | | |

Trade accounts payable | $ | 50,322 | | $ | 49,121 |

| Current portion of long-term debt | 1,911 | | 3 |

| Compensation and employee benefits | 31,090 | | 30,958 |

| Operating lease liabilities, current portion | 8,745 | | 7,795 |

| Accrued taxes | 10,777 | | 9,913 |

| Accrued liabilities and other | 23,281 | | 25,557 |

| Current liabilities associated with discontinued operations | 414 | | 920 |

Total current liabilities | 126,540 | | 124,267 |

| Long-term debt, net | 156,748 | | 156,455 |

| Operating lease liabilities | 28,013 | | 28,108 |

| Asset retirement obligations | 14,132 | | 13,671 |

| Deferred income taxes | 1,890 | | 2,038 |

| | | |

| Other liabilities | 3,959 | | 3,430 |

| Total long-term liabilities | 204,742 | | 203,702 |

| Commitments and contingencies | | | |

| TETRA stockholders’ equity | 142,393 | | 107,625 |

| Noncontrolling interests | (1,256) | | (1,228) |

| Total equity | 141,137 | | 106,397 |

| Total liabilities and equity | $ | 472,419 | | $ | 434,366 |

Schedule C: Consolidated Statements of Cash Flows (Unaudited)

| | | | | | | | | | | | | | | | | |

| | Three Months Ended |

| | September 30, 2023 | | June 30, 2023 | | September 30, 2022 |

| (in thousands) |

| Operating activities: | | | | | |

| Net income | $ | 5,420 | | | $ | 18,197 | | | $ | 256 | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | | | |

Depreciation, amortization, and accretion | 8,578 | | | 8,457 | | | 8,634 | |

| | | | | |

| Impairments and other charges | — | | | 777 | | | — | |

| (Gain) loss on investments | 560 | | | (908) | | | 549 | |

Equity-based compensation expense | 1,431 | | | 1,492 | | | 1,098 | |

| Provision for (recovery of) credit losses | (530) | | | 741 | | | (213) | |

| | | | | |

| Amortization and expense of financing costs | 926 | | | 897 | | | 805 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Gain on sale of assets | (151) | | | (111) | | | (261) | |

Provision (benefit) for deferred taxes | (780) | | | (23) | | | (10) |

| Other non-cash credits | (204) | | | (614) | | | (102) |

Changes in operating assets and liabilities: | | | | | |

Accounts receivable | 8,114 | | | (13,140) | | | (2,080) | |

Inventories | (11,441) | | | 2,764 | | | (10,226) | |

Prepaid expenses and other current assets | (929) | | | (2,254) | | | (1,500) | |

Trade accounts payable and accrued expenses | 2,450 | | | 11,622 | | | 5,884 | |

Other | 530 | | | 475 | | | (689) | |

| Net cash provided by operating activities | 13,974 | | | 28,372 | | | 2,145 | |

| Investing activities: | | | | | |

Purchases of property, plant, and equipment, net | (6,966) | | | (10,490) | | | (12,266) | |

| | | | | |

| | | | | |

| Proceeds from sale of property, plant, and equipment | 161 | | | 208 | | | 295 | |

| | | | | |

Purchase of investments | (100) | | | (250) | | | — | |

Other investing activities | (9) | | | (275) | | | (390) | |

| Net cash used in investing activities | (6,914) | | | (10,807) | | | (12,361) | |

| Financing activities: | | | | | |

| Proceeds from credit agreements and long-term debt | 215 | | | 44,413 | | | 28 | |

| Principal payments on credit agreements and long-term debt | (204) | | | (50,875) | | | (25) | |

| Payments on financing lease obligations | (148) | | | (431) | | | — | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Net cash (used in) provided by financing activities | (137) | | | (6,893) | | | 3 | |

| Effect of exchange rate changes on cash | (772) | | | 320 | | | (872) | |

Increase (decrease) in cash and cash equivalents | 6,151 | | | 10,992 | | | (11,085) | |

| Cash and cash equivalents at beginning of period | 27,675 | | | 16,683 | | | 36,332 | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Cash and cash equivalents at end of period | $ | 33,826 | | | $ | 27,675 | | | $ | 25,247 | |

| | | | | |

| Supplemental cash flow information: | | | | | |

Interest paid | $ | 4,870 | | | $ | 4,899 | | | $ | 3,522 | |

| Income taxes paid | 1,906 | | | 654 | | | 1,055 | |

| Increase (decrease) in accrued capital expenditures | (1,871) | | | 652 | | | (2,389) | |

Schedule D: Statement Regarding Use of Non-GAAP Financial Measures

In addition to financial results determined in accordance with U.S. GAAP, this press release may include the following non-GAAP financial measures for the Company: adjusted net income per share; consolidated and segment Adjusted EBITDA; segment Adjusted EBITDA as a percent of revenue (“Adjusted EBITDA margin”); adjusted net income, adjusted free cash flow; net debt, net leverage ratio, and return on capital employed. The following schedules provide reconciliations of these non-GAAP financial measures to their most directly comparable U.S. GAAP measures. The non-GAAP financial measures should be considered in addition to, not as a substitute for, financial measures prepared in accordance with U.S. GAAP, as more fully discussed in the Company’s financial statements and filings with the Securities and Exchange Commission.

Management believes that the exclusion of the special charges and credits from the historical results of operations enables management to evaluate more effectively the Company’s operations over the prior periods and to identify operating trends that could be obscured by the excluded items.

Adjusted net income is defined as the Company’s income before noncontrolling interests and discontinued operations, excluding certain special or other charges (or credits), and including noncontrolling interest attributable to continued operations. Adjusted net income is used by management as a supplemental financial measure to assess financial performance, without regard to charges or credits that are considered by management to be outside of its normal operations.

Adjusted net income per share is defined as the Company’s diluted net income per share attributable to TETRA stockholders excluding certain special or other charges (or credits). Adjusted net income per share is used by management as a supplemental financial measure to assess financial performance, without regard to charges or credits that are considered by management to be outside of its normal operations.

Adjusted EBITDA is defined as net income before taxes and discontinued operations, excluding impairments, exploration and pre-development costs, income from collaborative arrangement, certain special, non-recurring or other charges (or credits), interest, depreciation and amortization and certain non-cash items such as equity-based compensation expense. The most directly comparable GAAP financial measure is net income (loss) before taxes and discontinued operations. Exploration and pre-development costs represent expenditures incurred to evaluate potential future development of TETRA’s lithium and bromine properties in Arkansas. Such costs include exploratory drilling and associated engineering studies. Income from collaborative arrangement represents the portion of exploration and pre-development costs that are reimbursable by our strategic partner. Exploration and pre-development costs and the associated income from collaborative arrangement are excluded from Adjusted EBITDA because they do not relate to the Company’s current business operations. Adjustments to long-term incentives represent cumulative adjustments to valuation of long-term cash incentive compensation awards that are related to prior years. These costs are excluded from Adjusted EBITDA because they do not relate to the current year and are considered to be outside of normal operations. Long-term incentives are earned over a three-year period and the costs are recorded over the three-year period they are earned. The amounts accrued or incurred are based on a cumulative of the three-year period. Equity-based compensation expense represents compensation that

has been or will be paid in equity and is excluded from Adjusted EBITDA because it is a non-cash item. Adjusted EBITDA is used by management as a supplemental financial measure to assess financial performance, without regard to charges or credits that are considered by management to be outside of its normal operations and without regard to financing methods, capital structure or historical cost basis, and to assess the Company’s ability to incur and service debt and fund capital expenditures.

Adjusted free cash flow is defined as cash from operations less capital expenditures net of sales proceeds and cost of equipment sold, less payments on financing lease obligations and including cash distributions to TETRA from CSI Compressco and cash from other investments. Management uses this supplemental financial measure to:

•assess the Company’s ability to retire debt;

•evaluate the capacity of the Company to further invest and grow; and

•to measure the performance of the Company as compared to its peer group.

Adjusted free cash flow does not necessarily imply residual cash flow available for discretionary expenditures, as they exclude cash requirements for debt service or other non-discretionary expenditures that are not deducted.

Net debt is defined as the sum of the carrying value of long-term and short-term debt on its consolidated balance sheet, less cash, excluding restricted cash on the balance sheet. Management views net debt as a measure of TETRA’s ability to reduce debt, add to cash balances, pay dividends, repurchase stock, and fund investing and financing activities.

Net leverage ratio is defined as debt excluding financing fees & discount on term loan and including letters of credit and guarantees, less cash divided by trailing twelve months adjusted EBITDA for credit facilities. Adjusted EBITDA for credit facilities consists of adjusted EBITDA described above, less non-cash (gain) loss on sale of investments, (gain) loss on sales of assets and excluding certain special or other charges (or credits). Management primarily uses this metric to assess TETRA’s ability to borrow, reduce debt, add to cash balances, pay distributions, and fund investing and financing activities.

Return on capital employed is defined as Adjusted EBIT divided by average net capital employed. Adjusted EBIT is defined as net income (loss) before taxes and discontinued operations, interest, and certain non-cash charges, and non-recurring adjustments. Net capital employed is defined as assets, excluding assets associated with discontinued operations, plus impaired assets, less cash and cash equivalents and restricted cash, and less current liabilities, excluding current liabilities associated with discontinued operations. Average net capital employed is calculated as the average of the beginning and ending net capital employed for the respective periods. Return on capital employed is used by management as a supplemental financial measure to assess the financial performance of the Company relative to assets, without regard to financing methods or capital structure.

Schedule E: Non-GAAP Reconciliation of Adjusted Net Income (Unaudited)

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| September 30, 2023 | | June 30, 2023 | | September 30, 2022 |

| (in thousands, except per share amounts) |

| | | | | |

| Income before taxes and discontinued operations | $ | 6,716 | | | $ | 21,080 | | | $ | 2,115 | |

Provision (benefit) for income taxes | 1,248 | | | 2,875 | | | 2,178 | |

| Noncontrolling interest attributed to continuing operations | — | | | 18 | | | 22 | |

Income (loss) from continuing operations | 5,468 | | | 18,187 | | | (85) | |

| Insurance recoveries | 174 | | | (5) | | | — | |

| Impairments and other charges | — | | | 777 | | | — | |

| Exploration and pre-development costs | 3,775 | | | 2,341 | | | 936 | |

| Adjustment to long-term incentives | 500 | | | 322 | | | 1,731 | |

| Former CEO stock appreciation right expense | 1,074 | | | 329 | | | — | |

| Transaction, legal, and other expenses | 108 | | | 57 | | | 82 | |

| Income from collaborative arrangement | (1,933) | | | (4,749) | | | — | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Adjusted net income | $ | 9,166 | | | $ | 17,259 | | | $ | 2,664 | |

| | | | | |

| Diluted per share information | | | | | |

| Net income attributable to TETRA stockholders | $ | 0.04 | | 0 | $ | 0.14 | | | $ | 0.00 | |

| Adjusted net income | $ | 0.07 | | | $ | 0.13 | | | $ | 0.02 | |

| Diluted weighted average shares outstanding | 132,089 | | | 129,925 | | | 128,407 | |

Schedule F: Non-GAAP Reconciliation of Adjusted EBITDA (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2023 |

| Completion Fluids & Products | | Water & Flowback Services | | Corporate SG&A | | Other and Eliminations | | Total |

| (in thousands, except percents) |

| Revenues | $ | 73,210 | | | $ | 78,254 | | | $ | — | | | $ | — | | | $ | 151,464 | |

Net income (loss) before taxes and

discontinued operations | 16,932 | | | 8,475 | | | (13,552) | | | (5,139) | | | 6,716 | |

| Insurance recoveries | 174 | | | — | | | — | | | — | | | 174 | |

| | | | | | | | | |

| Exploration and pre-development costs | 3,775 | | | — | | | — | | | — | | | 3,775 | |

| Adjustment to long-term incentives | — | | | — | | | 500 | | | — | | | 500 | |

| Former CEO stock appreciation right expense | — | | | — | | | 1,074 | | | — | | | 1,074 | |

| Transaction and other expenses | — | | | — | | | 108 | | | — | | | 108 | |

| Income from collaborative arrangement | (1,933) | | | — | | | — | | | — | | | (1,933) | |

| | | | | | | | | |

| | | | | | | | | |

Interest expense, net | (309) | | | 190 | | | — | | | 5,755 | | | 5,636 | |

| Depreciation, amortization and accretion | 2,301 | | | 6,176 | | | — | | | 101 | | | 8,578 | |

| Equity-based compensation expense | — | | | — | | | 1,431 | | | — | | | 1,431 | |

| Adjusted EBITDA | $ | 20,940 | | | $ | 14,841 | | | $ | (10,439) | | | $ | 717 | | | $ | 26,059 | |

| | | | | | | | | |

| Adjusted EBITDA as a % of revenue | 28.6 | % | | 19.0 | % | | | | | | 17.2 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2023 |

| Completion Fluids & Products | | Water & Flowback Services | | Corporate SG&A | | Other and Eliminations | | Total |

| (in thousands, except percents) |

| Revenues | $ | 98,222 | | | $ | 77,241 | | | $ | — | | | $ | — | | | $ | 175,463 | |

Net income (loss) before taxes and

discontinued operations | 31,956 | | | 8,014 | | | (12,595) | | | (6,295) | | | 21,080 | |

| Insurance recoveries | (5) | | | — | | | — | | | — | | | (5) | |

| Impairments and other charges | — | | | — | | | 777 | | | — | | | 777 | |

| Exploration and pre-development costs | 2,341 | | | — | | | — | | | — | | | 2,341 | |

| Adjustment to long-term incentives | — | | | — | | | 322 | | | — | | | 322 | |

| Former CEO stock appreciation right expense | — | | | — | | | 329 | | | — | | | 329 | |

| Transaction and other expenses | — | | | — | | | 57 | | | — | | | 57 | |

| Income from collaborative arrangements | (4,749) | | | — | | | — | | | — | | | (4,749) | |

Interest (income) expense, net | 104 | | | 27 | | | — | | | 5,813 | | | 5,944 | |

| Depreciation, amortization and accretion | 2,193 | | | 6,172 | | | — | | | 93 | | | 8,458 | |

| Equity-based compensation expense | — | | | — | | | 1,492 | | | — | | | 1,492 | |

| Adjusted EBITDA | $ | 31,840 | | | $ | 14,213 | | | $ | (9,618) | | | $ | (389) | | | $ | 36,046 | |

| | | | | | | | | |

| Adjusted EBITDA as a % of revenue | 32.4 | % | | 18.4 | % | | | | | | 20.5 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2022 |

| Completion Fluids & Products | | Water & Flowback Services | | Corporate SG&A | | Other and Eliminations | | Total |

| (in thousands, except percents) |

| Revenues | $ | 59,163 | | | $ | 75,849 | | | $ | — | | | $ | — | | | $ | 135,012 | |

Net income (loss) before taxes and

discontinued operations | 12,357 | | | 6,482 | | | (11,968) | | | (4,756) | | | 2,115 | |

| | | | | | | | | |

| Exploration and pre-development costs | 936 | | | — | | | — | | | — | | | 936 | |

| Adjustment to long-term incentives | — | | | — | | | 1,731 | | | — | | | 1,731 | |

| Transaction and other expenses | — | | | 82 | | | — | | | — | | | 82 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Interest (income) expense, net | (436) | | | (2) | | | — | | | 4,437 | | | 3,999 | |

| Depreciation, amortization and accretion | 1,846 | | | 6,626 | | | — | | | 162 | | | 8,634 | |

| Equity-based compensation expense | — | | | — | | | 1,098 | | | — | | | 1,098 | |

| Adjusted EBITDA | $ | 14,703 | | | $ | 13,188 | | | $ | (9,139) | | | $ | (157) | | | $ | 18,595 | |

| | | | | | | | | |

| Adjusted EBITDA as a % of revenue | 24.9 | % | | 17.4 | % | | | | | | 13.8 | % |

Schedule G: Non-GAAP Reconciliation of Net Debt (Unaudited)

The following reconciliation of net debt is presented as a supplement to financial results prepared in accordance with GAAP.

| | | | | | | | | | | |

| September 30,

2023 | | December 31,

2022 |

| (in thousands) |

| Unrestricted Cash | $ | 33,826 | | $ | 13,592 | |

| | | |

| Term Credit Agreement | $ | 156,748 | | | $ | 154,570 | |

| Asset-Based Credit Agreement | — | | | 1,885 | |

| Argentina Credit Agreement | 1,900 | | | — | |

| Swedish Credit Facility | 11 | | | 3 | |

| Net debt | $ | 124,833 | | | $ | 142,866 | |

Schedule H: Non-GAAP Reconciliation to Adjusted Free Cash Flow (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, 2023 | | June 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 |

| (in thousands) |

Cash from operating activities | $ | 13,974 | | | $ | 28,372 | | | 2,145 | | | $ | 51,331 | | | $ | 25,948 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Capital expenditures, net of proceeds from asset sales | (6,805) | | | (10,282) | | | (11,971) | | | (29,582) | | | (31,189) | |

| Payments on financing lease obligations | (148) | | | (431) | | | — | | | (837) | | | (1,174) | |

| | | | | | | | | |

| | | | | | | | | |

Distributions from CSI Compressco LP (1) | 52 | | | 52 | | | 52 | | | — | | | 157 | |

| | | | | | | | | |

| Adjusted Free Cash Flow | $ | 7,073 | | | $ | 17,711 | | | $ | (9,774) | | | $ | 20,912 | | | $ | (6,258) | |

(1) Following the GP Sale on January 29, 2021, TETRA retained an investment CSI Compressco representing a 3.7% limited partner interest as of September 30, 2023.

Schedule I: Non-GAAP Reconciliation to Net Leverage Ratio (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 | | September 30, 2023 |

| (in thousands) |

Net income (loss) before taxes and

discontinued operations | $ | 6,716 | | | $ | 21,080 | | | $ | 7,534 | | | $ | (1,163) | | | $ | 34,167 | |

| Insurance recoveries | 174 | | | (5) | | | (2,850) | | | — | | | (2,681) | |

| Impairments and other charges | — | | | 777 | | | — | | | 542 | | | 1,319 | |

| Exploration and pre-development costs | 3,775 | | | 2,341 | | | 720 | | | 3,135 | | | 9,971 | |

| Adjustment to long-term incentives | 500 | | | 322 | | | 353 | | | 131 | | | 1,306 | |

| Former CEO stock appreciation right expense (credit) | 1,074 | | | 329 | | | (307) | | | (57) | | | 1,039 | |

| Transaction, restructuring and other expenses | 108 | | | 57 | | | 82 | | | 576 | | | 823 | |

| Income from collaborative arrangement | (1,933) | | | (4,749) | | | — | | | — | | | (6,682) | |

| | | | | | | | | |

| | | | | | | | | |

| Adjusted interest expense, net | 5,636 | | | 5,944 | | | 5,092 | | | 4,900 | | | 21,572 | |

| Adjusted depreciation and amortization | 8,578 | | | 8,458 | | | 8,670 | | | 8,758 | | | 34,464 | |

| Equity compensation expense | 1,431 | | | 1,492 | | | 1,293 | | | 3,519 | | | 7,735 | |

| | | | | | | | | |

| Acquisition trailing EBITDA | — | | | — | | | — | | | 503 | | | 503 | |

| Non-cash (gain) loss on investments | 560 | | | (907) | | | 504 | | | (286) | | | (129) | |

| Gain on sale of assets | (151) | | | (112) | | | (170) | | | (190) | | | (623) | |

| Other debt covenant adjustments | 426 | | | — | | | — | | | 249 | | | 675 | |

| Debt covenant adjusted EBITDA | $ | 26,894 | | | $ | 35,027 | | | $ | 20,921 | | | $ | 20,617 | | | $ | 103,459 | |

| | | | | | | | | |

| | | | | | | | | September 30, 2023 |

| | | | | | | | | (in thousands, except ratio) |

| Term credit agreement | | | | | | | | | $ | 163,071 | |

| ABL credit agreement | | | | | | | | | — | |

| Argentina credit agreement | | | | | | | | | 1,900 | |

| Swedish credit agreement | | | | | | | | | 11 | |

| ABL letters of credit and guarantees | | | | | | | | | 11,457 | |

| Total debt and commitments | | | | | | | | | 176,439 | |

| Unrestricted cash | | | | | | | | | 33,826 | |

| Debt covenant net debt and commitments | | | | | | | | $ | 142,613 | |

| Net leverage ratio | | | | | | | | | 1.4 | |

Schedule J: Non-GAAP Reconciliation to Return on Net Capital Employed

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 | | September 30, 2023 |

| (in thousands) |

Net income (loss) before taxes and

discontinued operations | $ | 6,716 | | | $ | 21,080 | | | $ | 7,534 | | | $ | (1,163) | | | $ | 34,167 | |

| Insurance recoveries | 174 | | | (5) | | | (2,850) | | | — | | | (2,681) | |

| Impairments and other charges | — | | | 777 | | | — | | | 542 | | | 1,319 | |

| Exploration and pre-development costs | 3,775 | | | 2,341 | | | 720 | | | 3,135 | | | 9,971 | |

| Adjustment to long-term incentives | 500 | | | 322 | | | 353 | | | 131 | | | 1,306 | |

| Former CEO stock appreciation right expense (credit) | 1,074 | | | 329 | | | (307) | | | (57) | | | 1,039 | |

| Transaction, restructuring and other expenses | 108 | | | 57 | | | 82 | | | 576 | | | 823 | |

| Income from collaborative arrangement | (1,933) | | | (4,749) | | | — | | | — | | | (6,682) | |

| | | | | | | | | |

| | | | | | | | | |

| Adjusted interest expense, net | 5,636 | | | 5,944 | | | 5,092 | | | 4,900 | | | 21,572 | |

| Other adjustments | 426 | | | — | | | — | | | 249 | | | 675 | |

| Adjusted EBIT | $ | 16,476 | | | $ | 26,096 | | | $ | 10,624 | | | $ | 8,313 | | | $ | 61,509 | |

| | | | | | | | | |

| | | | | | | September 30, 2023 | | September 30,

2022 |

| | | | | | | (in thousands, except ratio) |

| Consolidated total assets | | | | | | | $ | 472,419 | | | $ | 413,486 | |

| Plus: assets impaired in last twelve months | | | | 1,319 | | | 2,394 | |

| Less: cash, cash equivalents and restricted cash | | | | 33,826 | | | 25,247 | |

| | | | | | |

| Adjusted assets employed | | | | | | | $ | 439,912 | | | $ | 390,633 | |

| | | | | | | | | |

| Consolidated current liabilities | | | | | | | $ | 126,540 | | | $ | 111,504 | |

| Less: current liabilities associated with discontinued operations | | | | 414 | | | 919 | |

| Adjusted current liabilities | | | | | | | $ | 126,126 | | | $ | 110,585 | |

| | | | | | | | | |

| Net capital employed | | | | | | | $ | 313,786 | | | $ | 280,048 | |

| Average net capital employed | | | | | | $ | 296,917 | | | |

Return on net capital employed for the twelve months ended September 30, 2023 | | | | 20.7 | % | | |

Schedule K: Non-GAAP Reconciliation of Adjusted Free Cash Flow (Unaudited) – Full Year Guidance

| | | | | | | | |

| | |

| |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | Twelve Months Ending December 31, 2023 |

| (in millions) |

Cash from operating activities | | $70 - $79 |

Capital expenditures, net of proceeds from asset sales | | (38) - (42) |

Cash received from other investments | | 4 |

Payments on financing lease obligations | | (1) |

| | |

Adjusted Free Cash Flow | | $35 - $40 |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesAPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

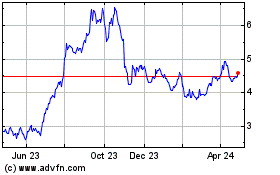

TETRA Technologies (NYSE:TTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

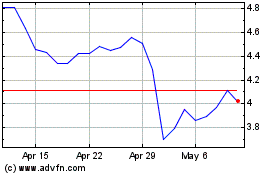

TETRA Technologies (NYSE:TTI)

Historical Stock Chart

From Apr 2023 to Apr 2024