Tenet Rises to Outperform - Analyst Blog

December 02 2011 - 4:45AM

Zacks

We have upgraded our recommendation on Tenet Healthcare

Corp. (THC) to Outperform from Neutral based on its strong

operating performance in the third quarter of 2011, which raises

ample optimism for future growth.

Tenet reported third-quarter 2011 operating earnings of 4 cents

per share, beating the Zacks Consensus Estimate of 1 cent and

operating loss of 1 cent in the prior-year quarter. The improvement

was driven by strong results in all lines of business, especially

the robust growth in outpatient volumes and higher admissions.

Since 2006, the company has been steadily generating operating

revenue growth. The improved results are attributable to

significant contribution from Tenet’s general hospitals, which have

been showing a revenue growth trend due to increase in outpatient

visits, improvement in managed care pricing and a favorable shift

in managed care payer mix.

Additionally, Tenet has been gradually expanding its operating

capacity via acquisitions. In August 2011, the company announced an

agreement to acquire CardioVascular Associates P.C. during fourth

quarter 2011 and subsequently, merge it with subsidiary Brookwood

Medical Center to form CardioVascular Associates of the Southeast,

which will act as a subsidiary of the group company.

Further, during the nine months ended September 30, 2011, Tenet

acquired one diagnostic imaging center each in Florida and South

Carolina, two oncology centers in Texas and Florida and 18

physician practice entities. Additionally, the company also

purchased majority interests in a diagnostic imaging center in

Georgia, three ambulatory surgery centers in Texas and one in South

Carolina.

Going ahead, the company also aspires to acquire hospitals and

other health care assets to increase its outpatient revenues, as

historically, the outpatient business has generated significantly

higher margins than the other business lines.

Moreover, the issue of new 6.5% senior secured notes is likely

to be beneficial for Tenet as the subsequent repayment of 9.0%

senior secured notes from the proceeds will significantly reduce

interest payments. While the total debt of the company has

increased with the issue, the new debt has improved the company’s

debt maturity profile.

Additionally, the health care reform bill signed in March 2010

is expected to impact hospital companies like Tenet positively. It

aims to expand the pool of insured patients by imposing an annual

penalty on uninsured individuals and employers who do not provide

health insurance cover to employees from 2014 onwards, which should

aid the hospitals' bottom lines.

In addition, given the concentration of Tenet’s operations in

California, Florida and Texas, which historically

have higher percentages of uninsured and underinsured patients, the

company enjoys a strong competitive advantage in benefiting from

extended insurance coverage.

However, on

the downside, Tenet is a highly leveraged company with

approximately $3.97 billion of long-term debt and $169 million of

letters of credit outstanding under the senior secured

revolving credit facility as of September 30, 2011.

Additionally, Tenet has been experiencing a high level of

operating expenses during the past few years. The impact of

industry-wide and company-specific challenges have led to the rise

of operating expenses to $8.57 billion in 2010 from $8.48 billion

in 2009, $8.27 billion in 2008 and $7.81 billion in 2007.

Nevertheless, the positives far outweigh the negatives, leading

to increased earnings expectation for the upcoming quarters. The

Zacks Consensus Estimate of fourth-quarter earnings is currently 14

cents per share, up 45% from the year-ago quarter. 12 out of 15

firms covering the stock have revised their estimates upward, while

no downward revisions were witnessed in the past 30 days.

For 2011, Tenet’s earnings are expected to be 43 cents per

share, up 4% from 2010. The company competes with HCA

Inc. (HCA) and Community Health Systems

Inc. (CYH).

On Thursday, the shares of Tenet closed at $4.68, up 0.65%, on

the New York Stock Exchange. The company carries a Zacks #1 Rank,

which implies a short-term Strong Buy rating.

COMMNTY HLTH SY (CYH): Free Stock Analysis Report

HCA HOLDINGS (HCA): Free Stock Analysis Report

TENET HEALTH (THC): Free Stock Analysis Report

Zacks Investment Research

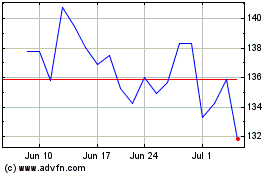

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From May 2024 to Jun 2024

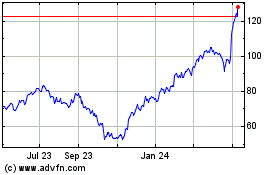

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From Jun 2023 to Jun 2024