Tenet Healthcare Corp. (THC) dramatically stepped up its defense

against Community Health Systems Inc.'s (CYH) hostile bid by

accusing the rival hospital operator of boosting its financial

performance for years by unnecessarily converting emergency-room

visits into more lucrative inpatient admissions.

Community Health called Tenet's federal lawsuit baseless and

proof of the company's "scorched-earth defense" against the

takeover bid. The company said it remains committed to its offer to

acquire Tenet and that its financial advisers--Credit Suisse and

Goldman Sachs--have reaffirmed their confidence in the

transaction.

Nonetheless, news of the suit damaged the stocks of both

companies and other hospital operators, and it threatened to expose

a potential loophole for the industry. Community Health was hurt

the most, with shares falling as much as 45% to $22.32, its lowest

point in nearly two years.

Ellen Griffith, spokeswoman for the Centers for Medicare &

Medicaid Services, said Medicare had no comment on the lawsuit and

that CMS doesn't confirm or deny the existence or likelihood of

investigations.

Since late last year, Dallas-based Tenet has been fighting

Community Health's unsolicited cash-and-stock offer of $3.3

billion, or $6 a share, calling the bid opportunistic and

inadequate. Monday, Tenet went on the offensive by accusing

Community Health of overbilling Medicare and likely other issuers

for "hundreds of millions--if not billions--of dollars for

unnecessary hospital admissions," the company said in the lawsuit,

filed in U.S. District Court in Dallas.

"We believe this unsustainable strategy has resulted in

Community Health overstating its inpatient admissions, revenues and

profits and has created substantial financial and legal liability,"

the company said.

A Tenet spokesman said it filed the lawsuit because its due

diligence revealed that Community Health had been admitting

patients to its hospitals "when industry practice is to treat them

in outpatient observation status."

Community Health said in a press release, "Tenet's allegations

are completely without merit, and we intend to vigorously defend

ourselves against these unfounded and irresponsible claims."

Community called the "self-serving allegations" an attempt by

Tenet's management and board "to continue their entrenchment

strategy and to distract Tenet shareholders" from the offer.

"Providing high-quality patient care is the company's most

important priority. (Community) conducts its business with the

utmost integrity and adheres to the highest business practice

standards," Community said.

Community Health shares recently fell 34% to $26.57. Tenet

shares also retreated on the news, down 13.6% to $6.52, removing

some of the gains in the stock's price following Community Health's

announcement of the offer in December.

Other hospital operators also slid Monday. HCA Holdings Inc.

(HCA) dropped nearly 4%, while Health Management Associates Inc.

(HMA) lost almost 7%.

Tenet said consultants it hired found Community Health's

observation rate to be "significantly lower than the industry and

its peer companies," or less than half of the national average.

Community expanded admissions by dramatically reducing observation

status at hospitals it acquired, especially in the case of Triad

Hospitals, acquired in 2007, according to the lawsuit.

Tenet wants the court to force Community to disclose "its unique

and non-industry standard patient admissions criteria and billing

practices," Tenet said. Tenet alleged Community Health's admissions

and billing practices have resulted in "materially misleading

financial reports and statements."

Community Health's potential liability, including damages, is

well in excess of $1 billion for the years between 2006 and 2009

for the Medicare fee-for-service portion of its business alone,

Tenet alleged.

"Tenet's shareholders are at risk of being harmed by false and

misleading statements and omissions by CHS, a company whose

financial performance has, for many years, been driven by the

improper and undisclosed practice of systematically admitting into

CHS hospitals despite no clinical need," the lawsuit said.

Community Health disclosed in February that the Texas attorney

general's office had opened a civil probe involving its hospitals

in the state, focusing on emergency-department procedures and

billing. The agency, months earlier, had issued civil investigative

demands saying it was probing "misrepresentations and/or unlawful

acts" related to practices of health-care providers treating

Medicaid recipients.

Analysts took the lawsuit seriously.

"While Tenet clearly has an axe to grind, the allegations are

serious and cannot be dismissed by investors without a more

detailed analysis," Wells Fargo analyst Gary Lieberman said.

CRT Capital Group analyst Sheryl Skolnick said that by doing the

due diligence and filing the lawsuit, Tenet fulfilled its fiduciary

duty to its shareholders. "It could not risk [Community Health]

making a higher bid that would have persuaded [Tenet] shareholders

to vote" for Community's slate, she said.

Skolnick sees Tenet shares being worth $9 in a year even without

the takeover premium and sees Community Health as "untouchable for

the foreseeable future" as the company may become the subject of

investigations by the Justice Department and other federal

agencies.

The lawsuit is the latest move to fend off Community, which is

based in Franklin, Tenn. Tenet previously delayed its 2011

shareholder meeting by some six months and adopted a

shareholder-rights plan, or poison pill, that could dilute the

holdings of a major acquirer of its stock.

Community, meanwhile, announced a full slate of 10 director

nominees to Tenet's board.

-By Dinah Wisenberg Brin, Dow Jones Newswires, 215-982-5582;

dinah.brin@dowjones.com

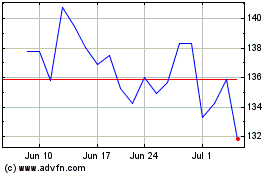

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From May 2024 to Jun 2024

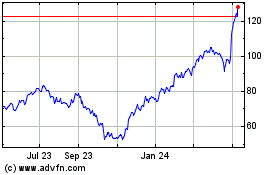

Tenet Healthcare (NYSE:THC)

Historical Stock Chart

From Jun 2023 to Jun 2024