false

0001031029

0001031029

2023-11-09

2023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 9, 2023

STARTEK, INC.

(Exact name of Registrant as specified in its charter)

|

Delaware

|

1-12793

|

84-1370538

|

|

(State or other jurisdiction of incorporation or organization)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

4610 South Ulster Street, Suite 150, Denver, Colorado, 80237

(Address of principal executive offices; zip code)

Registrant’s telephone number, including area code: (303) 262-4500

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

SRT

|

New York Stock Exchange, Inc.

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act . ☐

Item 2.02 Results of Operations and Financial Condition.

On November 9, 2023, Startek, Inc. (the “Company”) issued a press release reporting its earnings for its third quarter ended September 30, 2023. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K. This press release shall not be deemed “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, nor shall they be deemed incorporated by reference in any filing under the Securities Act of 1933.

Item 9.01 Financial Statements and Exhibits.

Exhibit Number Exhibit Description

|

99.1

|

|

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

STARTEK, INC.

|

| |

|

|

| |

|

|

| |

|

|

| November 9, 2023 |

By:

|

/s/ Neeraj Jain

|

|

|

|

Neeraj Jain

Chief Financial Officer

|

Exhibit 99.1

Startek Reports Third Quarter 2023 Financial Results

- The Go-Private Transaction with Capital Square Partners Is Expected to Close by End Of 2023 -

DENVER – November 9, 2023 - Startek, Inc. (NYSE:SRT) ("Startek" or the "Company"), a global customer experience (CX) solutions provider, is reporting financial results for the third quarter ended September 30, 2023. As a result of current and planned divestitures, the Company has classified Middle East and Argentina operations as 'Held for Sale and Discontinued Operations'. Accordingly net revenue, gross profit, gross margin, SG&A expenses and adjusted EBITDA are reported for the continuing operations and net income, EPS, adjusted net income/(loss) and adjusted EPS are reported after consolidating continuing and discontinued operations.

Third Quarter 2023 Financial Summary ($ in millions, excl. margin items)

| |

|

Q3 2023

|

|

|

Q3 2022

|

|

|

Change

|

|

|

Revenue

|

|

|

93.63

|

|

|

|

94.88

|

|

|

|

(1.32)%

|

|

|

Gross Profit

|

|

|

12.49

|

|

|

|

14.57

|

|

|

|

(14.28)%

|

|

|

Gross Margin

|

|

|

13.34%

|

|

|

|

15.36%

|

|

|

(202)bps

|

|

|

SG&A Expenses

|

|

|

10.32

|

|

|

|

12.99

|

|

|

|

(20.55)%

|

|

| Adjusted EBITDA [3] |

|

|

8.94 |

|

|

|

9.54 |

|

|

|

(6.29)% |

|

|

Net Income (Loss) [1]

|

|

|

(24.23)

|

|

|

|

0.24

|

|

|

|

(10,195.83)%

|

|

|

EPS[1]

|

|

|

(0.60)

|

|

|

|

0.01

|

|

|

|

(6,100.00)%

|

|

|

Adjusted Net Income [2], [3]

|

|

|

11.83

|

|

|

|

5.67

|

|

|

|

108.64%

|

|

|

Adjusted EPS[2], [3]

|

|

|

0.29

|

|

|

|

0.14

|

|

|

|

107.14%

|

|

[1] Reflects net income (loss) and EPS attributable to Startek shareholders.

[2] Reflects Adjusted net income and adjusted EPS attributable to Startek shareholders.

[3] Refer to the reconciliation of GAAP to Non-GAAP financial measures.

Third Quarter 2023 Financial Summary

Net Revenue in the third quarter was $93.63 million compared to $94.88 million in the year-ago quarter. The slight decrease was primarily due to foreign currency movement of certain currencies relative to the US Dollar. The Company also saw some softness in volume across certain clients within the Company’s international footprint which was largely offset by ramp-up of new clients won in the past few quarters. On a constant currency basis, net revenue increased 2.04% compared to the year-ago quarter.

Gross profit in the third quarter was $12.49 million compared to $14.57 million in the year-ago quarter. Gross margin was 13.34% compared to 15.36% in the year-ago quarter. The decline in gross profit and gross margin was primarily driven by the aforementioned lower volumes which led to a mismatch in staffing levels.

Selling, general and administrative (SG&A) expenses in the third quarter reduced to $10.32 million compared to $12.99 million in the year-ago quarter. The SG&A expense for both the periods include non-recurring costs related to the merger transaction. Adjusting for these costs, as a percentage of revenue, SG&A decreased to 10.70% compared to 12.20% in the year-ago quarter. The improvement was primarily due to operational efficiency across the board.

Adjusted EBITDA* in the third quarter was $8.94 million compared to $9.54 million in the year-ago quarter. The decrease is primarily attributable to the aforementioned decline in net revenue, as well as currency exchange losses during the period.

Net income (loss) attributable to Startek shareholders in the third quarter was $(24.23) million or $(0.60) per share, compared to a net income of $0.24 million or $0.01 per share in the year-ago quarter. The decline was primarily a result of a $19.6 million non-cash impairment charge on goodwill due to change in the forecasts considering the aforementioned decline in revenue. This represents income (loss) attributable to Startek shareholders from continuing operations of $(24.60) million in Q3 2023 and $0.13 million in Q3 2022, along with income (loss) attributable to Startek shareholders from discontinued operations of $0.37 million in Q3 2023 and $0.11 million in Q3 2022.

Adjusted net income* in the third quarter increased by 108.64% to $11.83 million or $0.29 per diluted share, compared to an adjusted net income* of $5.67 million or $0.14 per diluted share in the year-ago quarter. This represents adjusted net income (loss) from continuing operations of $11.34 million in Q3 2023 and $4.60 million in Q3 2022, along with adjusted net income (loss) from discontinued operations of $0.48 million in Q3 2023 and $1.07 million in Q3 2022.

On September 30, 2023, cash and restricted cash was $40.84 million[1] compared to $72.40 million as at December 31, 2022. The decrease in cash balance was driven by the utilization of the proceeds from the strategic transactions to prepay debt. Total debt as at September 30, 2023, was $77.67 million compared to $175.91 million as at December 31, 2022, and net debt as at September 30, 2023, was $36.83 million[2] compared to $103.51 million as at December 31, 2022.

On April 24, 2023, the Board of Directors approved an authorization to repurchase up to $20 million of the Company’s common stock from time to time in accordance with the requirements of the Securities and Exchange Commission. During the three months ended September 30, 2023, the Company repurchased 14,011 shares at an average cost of $2.87 per share.

*A non-GAAP measure defined below.

Subsequent Event and Conference Call

On October 10, 2023, Startek announced that it entered into a definitive agreement to be acquired by funds managed by Capital Square Partners (“CSP”) in an all-cash transaction with a total enterprise value of approximately $217 million and total equity value of approximately $174 million. Under the terms of the agreement, CSP will acquire all shares of Startek common stock not already owned by CSP for $4.30 per share in cash.

The transaction is expected to close before the end of calendar year 2023, subject to the satisfaction of customary closing conditions. The transaction is not subject to any financing contingency. Upon completion of the transaction, Startek will no longer trade on the New York Stock Exchange and will become a private company.

As a result of the definitive agreement and upcoming plans to become a private company, Startek management will not be hosting a conference call to discuss the third quarter results.

[1] Cash balance excluding restricted cash as at September 30, 2023 amounted to $36.72 million as compared to $22.46 million on December 31, 2022.

[2] Net debt excluding restricted cash balance at September 30, 2023 was $40.95 million compared to $153.45 million on December 31, 2022.

About Startek

Startek is a leading global provider of technology-enabled customer experience (CX) solutions. The Company provides omnichannel CX, digital transformation, and technology services to some of the world’s leading brands. Startek is committed to impacting clients’ business outcomes by focusing on enhancing CX and digital enablement across all touch points and channels. Startek has more than 35,000 employees delivering services in 11 countries. The Company services over 145 clients across a range of industries such as banking and financial services, insurance, technology, telecoms, healthcare, travel and hospitality, consumer goods, retail and energy and utilities.

To learn more visit www.startek.com and follow us on LinkedIn @Startek.

Forward-Looking Statements

The matters regarding the future discussed in this news release include forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are intended to be identified in this document by the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “objective,” “outlook,” “plan,” “project,” “possible,” “potential,” “should” and similar expressions. As described below, such statements are subject to a number of risks and uncertainties that could cause Startek's actual results to differ materially from those expressed or implied by any such forward-looking statements. Readers are encouraged to review risk factors and all other disclosures appearing in the Company's Form 10-K for the fiscal year ended December 31, 2022, as filed with the Securities and Exchange Commission (SEC) on March 28, 2023, as well as other filings with the SEC, for further information on risks and uncertainties that could affect Startek's business, financial condition and results of operation. Copies of these filings are available from the SEC, the Company’s website or the Company’s investor relations department. Startek assumes no obligation to update or revise any forward-looking statements as a result of new information, future events or otherwise. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date herein.

Investor Relations

Cody Cree

Gateway Group, Inc.

(949) 574-3860

SRT@gateway-grp.com

Media Relations

Neha Iyer

Startek

neha.iyer@startek.com

STARTEK, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME (LOSS)

(In thousands, except per share amounts)

(Unaudited)

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

|

93,629 |

|

|

|

94,878 |

|

|

|

276,915 |

|

|

|

292,117 |

|

|

Cost of services

|

|

|

(81,141 |

) |

|

|

(80,311 |

) |

|

|

(239,782 |

) |

|

|

(253,182 |

) |

|

Gross profit

|

|

|

12,488 |

|

|

|

14,567 |

|

|

|

37,133 |

|

|

|

38,935 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses

|

|

|

(10,322 |

) |

|

|

(12,990 |

) |

|

|

(31,429 |

) |

|

|

(34,350 |

) |

|

Impairment (losses)/ reversals and restructuring/exit cost

|

|

|

(24,894 |

) |

|

|

(37 |

) |

|

|

(24,769 |

) |

|

|

(110 |

) |

|

Operating income (loss)

|

|

|

(22,728 |

) |

|

|

1,540 |

|

|

|

(19,065 |

) |

|

|

4,475 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share of income (loss) of equity accounted investee

|

|

|

- |

|

|

|

297 |

|

|

|

- |

|

|

|

4,122 |

|

|

Interest expense and other income (expense), net

|

|

|

(1,998 |

) |

|

|

(1,999 |

) |

|

|

(5,657 |

) |

|

|

(5,044 |

) |

|

Foreign exchange gains (losses), net

|

|

|

(308 |

) |

|

|

1,208 |

|

|

|

109 |

|

|

|

1,114 |

|

|

Income (loss) from continuing operations before tax expenses

|

|

|

(25,034 |

) |

|

|

1,046 |

|

|

|

(24,613 |

) |

|

|

4,667 |

|

|

Tax (expenses) / benefits

|

|

|

437 |

|

|

|

(913 |

) |

|

|

(573 |

) |

|

|

(2,854 |

) |

|

Income (loss) from continuing operations, net of tax (A)

|

|

|

(24,597 |

) |

|

|

133 |

|

|

|

(25,186 |

) |

|

|

1,813 |

|

|

Income (loss) before income tax expenses from discontinued operations

|

|

|

367 |

|

|

|

3,056 |

|

|

|

3,118 |

|

|

|

5,865 |

|

|

Pre-tax gain on disposal

|

|

|

- |

|

|

|

- |

|

|

|

11,666 |

|

|

|

- |

|

|

Tax expenses of discontinued operations

|

|

|

- |

|

|

|

(925 |

) |

|

|

(5,374 |

) |

|

|

(2,500 |

) |

|

Income (loss) from discontinued operations, net of tax (B)

|

|

|

367 |

|

|

|

2,131 |

|

|

|

9,410 |

|

|

|

3,365 |

|

|

Net income (loss) (A+B)

|

|

|

(24,230 |

) |

|

|

2,264 |

|

|

|

(15,776 |

) |

|

|

5,178 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from continuing operations (A)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) attributable to noncontrolling interests

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Income (loss) attributable to Startek shareholders

|

|

|

(24,597 |

) |

|

|

133 |

|

|

|

(25,186 |

) |

|

|

1,813 |

|

| |

|

|

(24,597 |

) |

|

|

133 |

|

|

|

(25,186 |

) |

|

|

1,813 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from discontinued operations (B)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) attributable to noncontrolling interests

|

|

|

- |

|

|

|

2,021 |

|

|

|

2,589 |

|

|

|

4,311 |

|

|

Income (loss) attributable to Startek shareholders

|

|

|

367 |

|

|

|

110 |

|

|

|

6,821 |

|

|

|

(946 |

) |

| |

|

|

367 |

|

|

|

2,131 |

|

|

|

9,410 |

|

|

|

3,365 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) (A+B)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to noncontrolling interests

|

|

|

- |

|

|

|

2,021 |

|

|

|

2,589 |

|

|

|

4,311 |

|

|

Net income (loss) attributable to Startek shareholders

|

|

|

(24,230 |

) |

|

|

243 |

|

|

|

(18,365 |

) |

|

|

867 |

|

| |

|

|

(24,230 |

) |

|

|

2,264 |

|

|

|

(15,776 |

) |

|

|

5,178 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per common share from continuing operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net income (loss) attributable to Startek shareholders

|

|

|

(0.61 |

) |

|

|

0.01 |

|

|

|

(0.62 |

) |

|

|

0.04 |

|

|

Diluted net income (loss) attributable to Startek shareholders

|

|

|

(0.61 |

) |

|

|

0.01 |

|

|

|

(0.62 |

) |

|

|

0.04 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per common share from discontinued operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net income (loss) attributable to Startek shareholders

|

|

|

0.01 |

|

|

|

0.00 |

|

|

|

0.17 |

|

|

|

(0.02 |

) |

|

Diluted net income (loss) attributable to Startek shareholders

|

|

|

0.01 |

|

|

|

0.00 |

|

|

|

0.17 |

|

|

|

(0.02 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per common share from continuing and discontinued operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net income (loss) attributable to Startek shareholders

|

|

|

(0.60 |

) |

|

|

0.01 |

|

|

|

(0.45 |

) |

|

|

0.02 |

|

|

Diluted net income (loss) attributable to Startek shareholders

|

|

|

(0.60 |

) |

|

|

0.01 |

|

|

|

(0.45 |

) |

|

|

0.02 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

40,298 |

|

|

|

40,326 |

|

|

|

40,300 |

|

|

|

40,316 |

|

|

Diluted

|

|

|

40,298 |

|

|

|

40,333 |

|

|

|

40,300 |

|

|

|

40,354 |

|

STARTEK, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OTHER COMPREHENSIVE INCOME (LOSS)

(In thousands, except per share amounts)

(Unaudited)

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Net income (loss) (A+B)

|

|

|

(24,230 |

) |

|

|

2,264 |

|

|

|

(15,776 |

) |

|

|

5,178 |

|

|

Net income (loss) attributable to noncontrolling interests

|

|

|

- |

|

|

|

2,021 |

|

|

|

2,589 |

|

|

|

4,311 |

|

|

Net income (loss) attributable to Startek shareholders

|

|

|

(24,230 |

) |

|

|

243 |

|

|

|

(18,365 |

) |

|

|

867 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss), net of taxes from continuing operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments

|

|

|

(1,053 |

) |

|

|

(3,701 |

) |

|

|

(3,578 |

) |

|

|

(7,089 |

) |

|

Pension amortization

|

|

|

- |

|

|

|

184 |

|

|

|

124 |

|

|

|

184 |

|

|

Other comprehensive income (loss) from continuing operations

|

|

|

(1,053 |

) |

|

|

(3,517 |

) |

|

|

(3,454 |

) |

|

|

(6,905 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss), net of taxes from discontinued operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustments

|

|

|

- |

|

|

|

- |

|

|

|

(50 |

) |

|

|

(1 |

) |

|

Pension amortization

|

|

|

- |

|

|

|

(41 |

) |

|

|

4,187 |

|

|

|

(727 |

) |

|

Other comprehensive income (loss) from discontinued operations

|

|

|

- |

|

|

|

(41 |

) |

|

|

4,137 |

|

|

|

(728 |

) |

|

Other comprehensive income (loss) from continuing and discontinued operations

|

|

|

(1,053 |

) |

|

|

(3,558 |

) |

|

|

683 |

|

|

|

(7,633 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss), net of taxes from continuing operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attributable to noncontrolling interest

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Attributable to Startek shareholders

|

|

|

(1,053 |

) |

|

|

(3,517 |

) |

|

|

(3,454 |

) |

|

|

(6,905 |

) |

| |

|

|

(1,053 |

) |

|

|

(3,517 |

) |

|

(3,454

|

) |

|

|

(6,905 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss), net of taxes from discontinued operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attributable to noncontrolling interests

|

|

|

- |

|

|

|

(23 |

) |

|

|

614 |

|

|

|

(397 |

) |

|

Attributable to Startek shareholders

|

|

|

- |

|

|

|

(18 |

) |

|

|

3,523 |

|

|

|

(331 |

) |

| |

|

|

- |

|

|

|

(41 |

) |

|

4,137

|

|

|

|

(728 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income (loss) from continuing and discontinued operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Attributable to noncontrolling interests

|

|

|

- |

|

|

|

1,998 |

|

|

|

3,203 |

|

|

|

3,914 |

|

|

Attributable to Startek shareholders

|

|

|

(25,283 |

) |

|

|

(3,292 |

) |

|

|

(18,296 |

) |

|

|

(6,369 |

) |

| |

|

|

(25,283 |

) |

|

|

(1,294 |

) |

|

(15,093

|

) |

|

|

(2,455 |

) |

STARTEK, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(In thousands, except share data)

(Unaudited)

| |

|

September 30,

|

|

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

|

36,718 |

|

|

|

22,457 |

|

|

Restricted cash

|

|

|

4,122 |

|

|

|

49,946 |

|

|

Trade accounts receivables, net

|

|

|

41,144 |

|

|

|

47,138 |

|

|

Unbilled revenue

|

|

|

27,109 |

|

|

|

24,207 |

|

|

Prepaid expenses and other current assets

|

|

|

14,045 |

|

|

|

9,159 |

|

|

Assets classified as held for sale

|

|

|

7,783 |

|

|

|

202,831 |

|

|

Total current assets

|

|

|

130,921 |

|

|

|

355,738 |

|

| |

|

|

|

|

|

|

|

|

|

Non-current assets

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net

|

|

|

25,932 |

|

|

|

22,945 |

|

|

Operating lease right-of-use assets

|

|

|

27,478 |

|

|

|

36,450 |

|

|

Intangible assets, net

|

|

|

72,023 |

|

|

|

79,745 |

|

|

Goodwill

|

|

|

100,857 |

|

|

|

120,505 |

|

|

Deferred tax assets, net

|

|

|

3,126 |

|

|

|

2,771 |

|

|

Prepaid expenses and other non-current assets

|

|

|

9,148 |

|

|

|

7,889 |

|

|

Total non-current assets

|

|

|

238,564 |

|

|

|

270,305 |

|

|

Total assets

|

|

|

369,485 |

|

|

|

626,043 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Trade accounts payables

|

|

|

8,696 |

|

|

|

2,428 |

|

|

Accrued expenses

|

|

|

31,470 |

|

|

|

29,707 |

|

|

Short term debt

|

|

|

10,643 |

|

|

|

14,267 |

|

|

Current maturity of long term debt

|

|

|

12,269 |

|

|

|

120,466 |

|

|

Current maturity of operating lease liabilities

|

|

|

15,120 |

|

|

|

14,492 |

|

|

Other current liabilities

|

|

|

21,067 |

|

|

|

17,615 |

|

|

Liabilities classified as held for sale

|

|

|

6,365 |

|

|

|

89,486 |

|

|

Total current liabilities

|

|

|

105,630 |

|

|

|

288,461 |

|

| |

|

|

|

|

|

|

|

|

|

Non-current liabilities

|

|

|

|

|

|

|

|

|

|

Long term debt

|

|

|

54,755 |

|

|

|

41,175 |

|

|

Operating lease liabilities

|

|

|

20,111 |

|

|

|

26,651 |

|

|

Other non-current liabilities

|

|

|

3,279 |

|

|

|

2,682 |

|

|

Deferred tax liabilities, net

|

|

|

15,274 |

|

|

|

15,508 |

|

|

Total non-current liabilities

|

|

|

93,419 |

|

|

|

86,016 |

|

|

Total liabilities

|

|

|

199,049 |

|

|

|

374,477 |

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ equity

|

|

|

|

|

|

|

|

|

|

Common stock, 60,000,000 non-convertible shares, $0.01 par value, authorized; 41,209,497 and 41,098,456 shares issued as of September 30, 2023 and December 31, 2022 respectively.

|

|

|

412 |

|

|

|

411 |

|

|

Additional paid-in capital

|

|

|

294,725 |

|

|

|

293,472 |

|

|

Accumulated deficit

|

|

|

(104,768 |

) |

|

|

(86,302 |

) |

|

Treasury stock, 905,204 and 839,214 shares as of September 30, 2023 and December 31, 2022 respectively, at cost

|

|

|

(3,944 |

) |

|

|

(3,749 |

) |

|

Accumulated other comprehensive loss

|

|

|

(15,989 |

) |

|

|

(16,058 |

) |

|

Equity attributable to Startek shareholders

|

|

|

170,436 |

|

|

|

187,774 |

|

|

Non-controlling interest

|

|

|

- |

|

|

|

63,792 |

|

|

Total stockholders’ equity

|

|

|

170,436 |

|

|

|

251,566 |

|

|

Total liabilities and stockholders’ equity

|

|

|

369,485 |

|

|

|

626,043 |

|

STARTEK, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| |

|

Nine Months Ended September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

Operating activities

|

|

|

|

|

|

|

|

|

|

Income from continuing and discontinued operations

|

|

|

(15,776 |

) |

|

|

5,178 |

|

|

less: Income (loss) from discontinued operations, net of tax

|

|

|

9,410 |

|

|

|

3,365 |

|

|

Income (loss) from continuing operations, net of tax

|

|

|

(25,186 |

) |

|

|

1,813 |

|

| |

|

|

|

|

|

|

|

|

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

16,420 |

|

|

|

16,856 |

|

|

Impairment of goodwill

|

|

|

19,648 |

|

|

|

- |

|

|

Impairment of right-of-use assets

|

|

|

4,391 |

|

|

|

- |

|

|

Profit on sale of property, plant and equipment

|

|

|

(41 |

) |

|

|

(166 |

) |

|

Provision/(reversal) for doubtful accounts

|

|

|

(472 |

) |

|

|

(112 |

) |

|

Amortization of debt issuance costs (including loss on extinguishment of debt)

|

|

|

120 |

|

|

|

426 |

|

|

Amortization of call option premium

|

|

|

- |

|

|

|

1,080 |

|

|

Mark to market gain on derivative instrument

|

|

|

(314 |

) |

|

|

- |

|

|

Share-based compensation expense

|

|

|

1,138 |

|

|

|

1,213 |

|

|

Deferred income taxes

|

|

|

(428 |

) |

|

|

(1,101 |

) |

|

Share of income (loss) of equity accounted investee

|

|

|

- |

|

|

|

(4,122 |

) |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Trade accounts receivables (including unbilled revenue)

|

|

|

766 |

|

|

|

(1,119 |

) |

|

Prepaid expenses and other assets

|

|

|

(3,979 |

) |

|

|

(2,289 |

) |

|

Trade accounts payable

|

|

|

6,386 |

|

|

|

2,391 |

|

|

Income taxes, net

|

|

|

(4,351 |

) |

|

|

150 |

|

|

Accrued expenses and other liabilities

|

|

|

(1,181 |

) |

|

|

(4,216 |

) |

|

Net cash generated from/used in by operating activities from continuing operations

|

|

|

12,917 |

|

|

|

10,804 |

|

|

Net cash generated from/used in operating activities from discontinued operations

|

|

|

(7,691 |

) |

|

|

11,464 |

|

|

Net cash generated from/used in operating activities

|

|

|

5,226 |

|

|

|

22,268 |

|

| |

|

|

|

|

|

|

|

|

|

Investing activities

|

|

|

|

|

|

|

|

|

|

Purchase of property, plant and equipment and intangible assets, net

|

|

|

(10,677 |

) |

|

|

(9,645 |

) |

|

Proceeds from sale of discontinued operations, net of cash disposed

|

|

|

35,782 |

|

|

|

- |

|

|

Net cash generated from/used in investing activities from continuing operations

|

|

|

25,105 |

|

|

|

(9,645 |

) |

|

Net cash generated from/used in investing activities from discontinued operations

|

|

|

(3,616 |

) |

|

|

(2,294 |

) |

|

Net cash generated from/used in investing activities

|

|

|

21,489 |

|

|

|

(11,939 |

) |

| |

|

|

|

|

|

|

|

|

|

Financing activities

|

|

|

|

|

|

|

|

|

|

Proceeds from the issuance of common stock

|

|

|

116 |

|

|

|

348 |

|

|

Payments of long term debt

|

|

|

(93,466 |

) |

|

|

- |

|

|

Payment from a line of credit, net

|

|

|

(3,569 |

) |

|

|

1,110 |

|

|

Payments of other borrowings, net

|

|

|

(1,272 |

) |

|

|

(2,319 |

) |

|

Common stock repurchases

|

|

|

(195 |

) |

|

|

(1,636 |

) |

|

Net cash generated from/used in financing activities from continuing operations

|

|

|

(98,386 |

) |

|

|

(2,497 |

) |

|

Net cash generated from/used in financing activities from discontinued operations

|

|

|

(325 |

) |

|

|

534 |

|

|

Net cash generated from/used in financing activities

|

|

|

(98,711 |

) |

|

|

(1,963 |

) |

| |

|

|

|

|

|

|

|

|

|

Net increase (decrease) in cash and cash equivalents

|

|

|

(71,996 |

) |

|

|

8,366 |

|

|

Effect of exchange rate changes on cash and cash equivalents and restricted cash

|

|

|

(1,142 |

) |

|

|

(2,432 |

) |

|

Cash and cash equivalents and restricted cash at beginning of period

|

|

|

115,146 |

|

|

|

55,396 |

|

|

Cash and cash equivalents and restricted cash at end of period

|

|

|

42,008 |

|

|

|

61,330 |

|

|

Less: Cash and cash equivalents from discontinued operations

|

|

|

(1,168 |

) |

|

|

(33,358 |

) |

|

Cash and cash equivalents and restricted cash of continuing operations at end of period

|

|

|

40,840 |

|

|

|

27,972 |

|

| |

|

|

|

|

|

|

|

|

|

Components of cash and cash equivalents and restricted cash

|

|

|

|

|

|

|

|

|

|

Balances with banks

|

|

|

36,718 |

|

|

|

22,267 |

|

|

Restricted cash

|

|

|

4,122 |

|

|

|

5,705 |

|

|

Total cash and cash equivalents and restricted cash

|

|

|

40,840 |

|

|

|

27,972 |

|

| |

|

|

|

|

|

|

|

|

|

Supplemental disclosure of cash flow information

|

|

|

|

|

|

|

|

|

|

Cash paid for interest and other finance cost

|

|

|

8,442 |

|

|

|

7,071 |

|

|

Cash paid for income taxes

|

|

|

5,024 |

|

|

|

3,619 |

|

|

Supplemental disclosure of non-cash activities

|

|

|

|

|

|

|

|

|

|

Non-cash share-based compensation expenses

|

|

|

1,138 |

|

|

|

1,213 |

|

STARTEK, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP MEASURE

(In thousands)

(Unaudited)

This press release contains references to the non-GAAP financial measure of Adjusted EBITDA. Reconciliation of this non-GAAP measure to its comparable GAAP measure is included below. This non-GAAP information should not be construed as an alternative to the reported results determined in accordance with GAAP. It is provided solely to assist in an investor’s understanding of these items on the comparability of the Company’s operations.

Adjusted EBITDA:

The Company defines non-GAAP Adjusted EBITDA as Net income (loss) plus Income tax expense, Share of income (loss) of equity-accounted investees, Interest expense and other income (expense), net, Depreciation and amortization expense, Impairment losses and restructuring cost, Share-based compensation expense, Foreign exchange gains (losses), net, Merger transaction costs, Transaction related costs, CSS option amortization and other non-recurring costs (if applicable). Management uses Adjusted EBITDA as a performance measure to analyze the performance of our business. Management believes that excluding these non-cash and other non-recurring items permits a more meaningful comparison and understanding of our strength and performance of our ongoing operations for our investors and analysts.

Adjusted EPS:

Adjusted EPS is a non-GAAP financial measure presenting the earnings generated by the ongoing operations that we believe are useful to investors in making meaningful comparisons to other companies, although our measure of Adjusted EPS may not be directly comparable to similar measures used by other companies, and period-over-period comparisons. Adjusted EPS is defined as our diluted earnings per common share attributable to Startek shareholders adjusted to exclude the effects of the amortization of acquisition-related intangible assets, and the impact of certain events, gains, losses or other charges that affect period-over-period comparisons. Acquisition-related intangible assets are recognized as a result of the application of Accounting Standards Codification Topic (“ASC”) 805, Business Combinations (such as customer relationships and Brand), and their amortization is significantly affected by the size and timing of our acquisitions.

|

Adjusted EBITDA:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Continuing Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

|

(24,597 |

) |

|

|

133 |

|

|

|

(25,186 |

) |

|

|

1,813 |

|

|

Tax expense

|

|

|

(437 |

) |

|

|

913 |

|

|

|

573 |

|

|

|

2,854 |

|

|

Share of income (loss) of equity accounted investee

|

|

|

- |

|

|

|

(297 |

) |

|

|

- |

|

|

|

(4,122 |

) |

|

Interest expense and other income (expense), net

|

|

|

1,998 |

|

|

|

1,999 |

|

|

|

5,657 |

|

|

|

5,045 |

|

|

Foreign exchange (gains) losses, net

|

|

|

308 |

|

|

|

(1,208 |

) |

|

|

(109 |

) |

|

|

(1,114 |

) |

|

Depreciation and amortization expense

|

|

|

5,885 |

|

|

|

5,812 |

|

|

|

16,420 |

|

|

|

16,855 |

|

|

Merger transaction cost

|

|

|

304 |

|

|

|

1,411 |

|

|

|

304 |

|

|

|

2,603 |

|

|

Impairment losses and restructuring cost

|

|

|

24,894 |

|

|

|

37 |

|

|

|

24,769 |

|

|

|

110 |

|

|

Share-based compensation expense

|

|

|

369 |

|

|

|

380 |

|

|

|

1,138 |

|

|

|

1,213 |

|

|

Other non recurring costs / (Income)

|

|

|

216 |

|

|

|

- |

|

|

|

1,316 |

|

|

|

- |

|

|

CSS option amortisation

|

|

|

- |

|

|

|

360 |

|

|

|

- |

|

|

|

1,080 |

|

|

Adjusted EBITDA

|

|

|

8,940 |

|

|

|

9,540 |

|

|

|

24,882 |

|

|

|

26,337 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a) Argentina

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

|

368 |

|

|

|

(844 |

) |

|

|

(2,052 |

) |

|

|

(3,116 |

) |

|

Interest expense and other income (expense), net

|

|

|

(406 |

) |

|

|

(124 |

) |

|

|

(2,415 |

) |

|

|

(1,399 |

) |

|

Foreign exchange gains (losses), net

|

|

|

350 |

|

|

|

233 |

|

|

|

706 |

|

|

|

445 |

|

|

Depreciation and amortization expense

|

|

|

- |

|

|

|

146 |

|

|

|

- |

|

|

|

439 |

|

|

Impairment losses and restructuring cost

|

|

|

404 |

|

|

|

961 |

|

|

|

3,570 |

|

|

|

3,010 |

|

|

Adjusted EBITDA

|

|

|

716 |

|

|

|

372 |

|

|

|

(191 |

) |

|

|

(621 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b) CCC

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

|

- |

|

|

|

2,972 |

|

|

|

11,462 |

|

|

|

6,480 |

|

|

Tax expense

|

|

|

- |

|

|

|

924 |

|

|

|

5,374 |

|

|

|

2,499 |

|

|

Interest expense and other income (expense), net

|

|

|

- |

|

|

|

890 |

|

|

|

1,174 |

|

|

|

2,198 |

|

|

Foreign exchange gains (losses), net

|

|

|

- |

|

|

|

5 |

|

|

|

10 |

|

|

|

20 |

|

|

Depreciation and amortization expense

|

|

|

- |

|

|

|

1,622 |

|

|

|

- |

|

|

|

4,844 |

|

|

Impairment losses and restructuring cost

|

|

|

- |

|

|

|

- |

|

|

|

4 |

|

|

|

30 |

|

|

Other non recurring costs / (Income)

|

|

|

- |

|

|

|

- |

|

|

|

(11,666 |

) |

|

|

- |

|

|

Adjusted EBITDA

|

|

|

- |

|

|

|

6,413 |

|

|

|

6,358 |

|

|

|

16,071 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA from discontinued operations (a+b)

|

|

|

716 |

|

|

|

6,785 |

|

|

|

6,167 |

|

|

|

15,450 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA from continuing and discontinued operations

|

|

|

9,656 |

|

|

|

16,325 |

|

|

|

31,049 |

|

|

|

41,787 |

|

|

Adjusted EPS:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

|

Continuing Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) attributable to Startek shareholders

|

|

|

(24,597 |

) |

|

|

133 |

|

|

|

(25,186 |

) |

|

|

1,813 |

|

|

Share based compensation expense

|

|

|

186 |

|

|

|

380 |

|

|

|

664 |

|

|

|

1,213 |

|

|

Amortization of intangible assets, net of tax

|

|

|

1,310 |

|

|

|

2,279 |

|

|

|

4,507 |

|

|

|

6,783 |

|

|

Merger transaction cost

|

|

|

177 |

|

|

|

1,411 |

|

|

|

177 |

|

|

|

2,603 |

|

|

Impairment losses and restructuring cost

|

|

|

14,535 |

|

|

|

37 |

|

|

|

14,458 |

|

|

|

110 |

|

|

Other non recurring costs / (Income)

|

|

|

84 |

|

|

|

- |

|

|

|

768 |

|

|

|

- |

|

|

CSS option amortisation

|

|

|

- |

|

|

|

360 |

|

|

|

- |

|

|

|

1,080 |

|

|

Adjusted net income

|

|

|

11,343 |

|

|

|

4,600 |

|

|

|

15,036 |

|

|

|

13,602 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a) Argentina

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) attributable to Startek shareholders

|

|

|

368 |

|

|

|

(844 |

) |

|

|

(2,052 |

) |

|

|

(3,116 |

) |

|

Impairment losses and restructuring cost

|

|

|

116 |

|

|

|

961 |

|

|

|

2,084 |

|

|

|

3,010 |

|

|

Adjusted net income (loss)

|

|

|

484 |

|

|

|

117 |

|

|

|

32 |

|

|

|

(106 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b) CCC

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) attributable to Startek shareholders

|

|

|

- |

|

|

|

951 |

|

|

|

8,872 |

|

|

|

2,168 |

|

|

Impairment losses and restructuring cost

|

|

|

- |

|

|

|

- |

|

|

|

3 |

|

|

|

30 |

|

|

Other non recurring costs / (Income)

|

|

|

- |

|

|

|

- |

|

|

|

(7,477 |

) |

|

|

- |

|

|

Adjusted net income (loss)

|

|

|

- |

|

|

|

951 |

|

|

|

1,398 |

|

|

|

2,198 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Net Income from discontinued operations (a+b)

|

|

|

484 |

|

|

|

1,068 |

|

|

|

1,430 |

|

|

|

2,092 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Net Income from continuing and discontinued operations

|

|

|

11,827 |

|

|

|

5,668 |

|

|

|

16,466 |

|

|

|

15,694 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding - basic

|

|

|

40,298 |

|

|

|

40,326 |

|

|

|

40,300 |

|

|

|

40,316 |

|

|

Weighted average common shares outstanding - diluted

|

|

|

40,298 |

|

|

|

40,333 |

|

|

|

40,300 |

|

|

|

40,354 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EPS from continuing operations - Basic

|

|

|

0.28 |

|

|

|

0.11 |

|

|

|

0.37 |

|

|

|

0.34 |

|

|

Adjusted EPS from continuing operations - Diluted

|

|

|

0.28 |

|

|

|

0.11 |

|

|

|

0.37 |

|

|

|

0.34 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EPS from discontinued operations - Basic

|

|

|

0.01 |

|

|

|

0.03 |

|

|

|

0.04 |

|

|

|

0.05 |

|

|

Adjusted EPS from discontinued operations - Diluted

|

|

|

0.01 |

|

|

|

0.03 |

|

|

|

0.04 |

|

|

|

0.05 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EPS from continuing and discontinued operations - Basic

|

|

|

0.29 |

|

|

|

0.14 |

|

|

|

0.41 |

|

|

|

0.39 |

|

|

Adjusted EPS from continuing and discontinued operations - Diluted

|

|

|

0.29 |

|

|

|

0.14 |

|

|

|

0.41 |

|

|

|

0.39 |

|

v3.23.3

Document And Entity Information

|

Nov. 09, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

STARTEK, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 09, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

1-12793

|

| Entity, Tax Identification Number |

84-1370538

|

| Entity, Address, Address Line One |

4610 South Ulster Street

|

| Entity, Address, Address Line Two |

Suite 150

|

| Entity, Address, City or Town |

Denver

|

| Entity, Address, State or Province |

CO

|

| Entity, Address, Postal Zip Code |

80237

|

| City Area Code |

303

|

| Local Phone Number |

262-4500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

SRT

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001031029

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

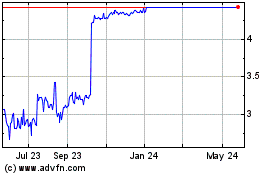

StarTek (NYSE:SRT)

Historical Stock Chart

From Jun 2024 to Jul 2024

StarTek (NYSE:SRT)

Historical Stock Chart

From Jul 2023 to Jul 2024