StarTek Inc. (NYSE: SRT) reported fully diluted earnings per share

from continuing operations decreased for the second quarter ended

June 30, 2005, to $0.18 compared to $0.47 for the second quarter of

2004. Fully diluted earnings per share decreased to $0.18, compared

to $0.44 including discontinued operations for the same period last

year. Discontinued operations consisted of operations in the United

Kingdom which, as previously reported, were sold on September 30,

2004. For the second quarter of 2005, revenue declined 15.9% to

$53.2 million from $63.3 million for the same period in 2004. This

was primarily driven by a downturn in our supply chain management

services representing over 70% of the overall decline. An overall

shift in revenue mix with our second-largest client in our business

process management services also contributed to the reduction of

revenue. Gross margin declined in the second quarter to 21.8% from

26.7% for the same period in 2004. This decline was attributed to a

shift in revenue mix and tiered pricing in our business process

management services, underutilized capacity in three new call

centers launched during 2004, and the foreign exchange impact from

a stronger Canadian dollar. Selling, general and administrative

expenses decreased by 2.3% for the second quarter of 2005 compared

to the same period last year. The decrease is primarily due to

lowered costs associated with reductions in staff, which were

offset by recurring fixed costs of three new call centers opened in

2004, and expenses related to investments in information technology

infrastructure. Other income declined $1.6 million primarily due to

the repositioning of our portfolio investments which is in line

with our current investment policy. In addition, the Board of

Directors declared a quarterly dividend of $0.36 per share, payable

on August 24, 2005, to our stockholders of record as of August 12,

2005. "StarTek continued to make progress in our turnaround process

during the second quarter," said Steve Butler, President and CEO of

StarTek. "The sales opportunities we have nurtured in our pipeline

for the last year are now starting to come to fruition. In

addition, we maintained our commitment to realign costs, while

working to improve our operational processes and efficiencies.

Given the highly competitive marketplace, we are encouraged that

our plans have better positioned the company to close new business.

The changes we have made during the first half of 2005 have

enhanced our ability to deliver value to our clients and

shareholders." StarTek also announced today that it has been

selected by one of the largest telecommunications companies in the

United States to provide national consumer support with its

award-winning outsourced customer care services. The client adds to

StarTek's portfolio of marquee telecommunications clients for

customer care services. "Customer care is a critical business

process for the extremely fast-paced and evolving

telecommunications industry, and particularly for brand-name

companies," said Butler. "For clients with significant brand

equity, putting customer care in the hands of a third party

requires a great level of trust, because those clients demand every

customer-facing operation to perform at a level that goes beyond

merely protecting the brand. We are looking forward to building a

great relationship with this client and earning their continued

trust in StarTek." StarTek's wireless customer care experience was

a major factor in securing this contract. The client also selected

StarTek for its demonstrated ability to quickly ramp-up new

customer care sites with agility and flexibility. The company is

expected to begin using StarTek's business process outsourcing

services as soon as this month. In the near term, StarTek will

deliver the initial support service through existing capacity.

About StarTek StarTek Inc. is a leading provider of business

process outsourced services, which consist of business process

management and supply chain management services. StarTek provides

services from seventeen operating facilities, including four in

Colorado, five in Canada, two in Virginia and one each in Illinois,

Louisiana, Oklahoma, Tennessee, Texas and Wyoming. The Company's

primary clients are in the telecommunications industry, and it also

serves clients in the computer software and hardware, consumer

products, cable TV, entertainment, Internet, and e-commerce

industries. Please visit the Company's website at www.startek.com.

Conference Call President and CEO Steve Butler will host a

conference call on August 2, 2005, to discuss the Company's

financial results. The call will begin at 6:30 a.m. Mountain time

(8:30 a.m. Eastern time) and can be accessed as follows: USA:

866-800-8652 International: 617-614-2705 Passcode: 88168276

Conference Host: Steve Butler A dial-in replay will be available

August 2, 2005, at 8:30 a.m. Mountain time through August 9, 2005,

and can be accessed as follows: USA: 888-286-8010 International:

617-801-6888 Passcode: 89130543 A Web-based replay will be

available on August 5, 2005, and accessible from the Investor

Relations section of the company's website at www.startek.com.

Forward-Looking Statements The matters regarding the future

discussed in this news release include forward-looking statements

as defined in the Private Securities Litigation Reform Act of 1995.

Such statements are subject to a number of risks and uncertainties.

The following are important risks and uncertainties relating to

StarTek's business that could cause StarTek's actual results to

differ materially from those expressed or implied by any such

forward-looking statements. These include, but are not limited to,

loss of its principal clients, concentration of its client base in

a few select industries, highly competitive markets, risks related

to its contracts, decreases in numbers of vendors used by clients

or potential clients, lack of success of StarTek's clients'

products or services, considerable pricing pressure, risks relating

to fluctuations in the value of StarTek's investment securities

portfolio, risks associated with advanced technologies, inability

to grow its business, inability to effectively manage growth,

dependence on qualified employees and key management personnel,

potential future declines in revenue, lack of a significant

international presence, and risks relating to conducting business

in Canada. Readers are encouraged to review Management's Discussion

and Analysis of Financial Condition and Results of Operations -

Risk Factors and all other disclosures appearing in the Company's

Form 10-K for the year ended December 31, 2004, and subsequent

filings with the Securities and Exchange Commission. -0- *T

STARTEK, INC. AND SUBSIDIARIES Condensed Consolidated Statements of

Operations (Dollars in thousands, except per share data)

(Unaudited) Three Months Ended Six Months Ended June 30, June 30,

-------------------- ------------------- 2005 2004 2005 2004

---------- --------- --------- --------- Revenue $53,193 $63,270

$107,511 $126,576 Cost of services 41,617 46,393 84,209 91,601

---------- --------- --------- --------- Gross profit 11,576 16,877

23,302 34,975 Selling, general and administrative expenses 6,717

6,876 14,598 13,789 ---------- --------- --------- ---------

Operating profit 4,859 10,001 8,704 21,186 Net interest income and

other (407) 1,152 37 1,773 ---------- --------- --------- ---------

Income from continuing operations before income taxes 4,452 11,153

8,741 22,959 Income tax expense 1,809 4,278 3,453 8,792 ----------

--------- --------- --------- Income from continuing operations

$2,643 $6,875 $5,288 $14,167 Discontinued operations: Loss from

operations of discontinued operations - (681) - (1,350) Income tax

benefit - 267 - 516 ---------- --------- --------- --------- Loss

on discontinued operations - (414) - (834) ---------- ---------

--------- --------- Net income $2,643 $6,461 $5,288 $13,333

========== ========= ========= ========= Earnings per share from

continuing operations: Basic $0.18 $0.48 $0.36 $0.98 Diluted $0.18

$0.47 $0.36 $0.96 Earnings per share including discontinued

operations: Basic $0.18 $0.45 $0.36 $0.93 Diluted $0.18 $0.44 $0.36

$0.90 *T -0- *T STARTEK, INC. AND SUBSIDIARIES Condensed

Consolidated Balance Sheets (Dollars in thousands) June 30,

December 31, 2005 2004 ----------- ------------ (Unaudited) ASSETS

Current assets: Cash and cash equivalents $6,703 $14,609

Investments 38,678 24,785 Trade accounts receivable, less allowance

for doubtful accounts of $226 and $357, respectively 44,181 51,291

Inventories, net 499 430 Income tax receivable 4,030 12,344

Deferred tax assets 3,608 2,875 Prepaid expenses and other current

assets 2,810 2,180 ----------- ------------ Total current assets

100,509 108,514 Property, plant and equipment, net 57,835 59,760

Long term deferred tax assets 1,784 1,521 Other assets 206 224

----------- ------------ Total assets $160,334 $170,019 ===========

============ LIABILITIES AND STOCKHOLDERS' EQUITY Current

liabilities: Accounts payable $5,220 $7,464 Accrued liabilities :

Accrued payroll 4,986 5,950 Accrued compensated absences 4,245

4,368 Accrued health insurance 445 188 Other accrued liabilities

755 333 Current portion of long-term debt 2,624 2,580 Short-term

borrowings 880 1,250 Income tax payable 3,223 1,626 Other current

liabilities 109 160 ----------- ------------ Total current

liabilities 22,487 23,919 Long-term debt, less current portion

4,281 5,533 Long-term income tax payable 1,363 1,962 Other

liabilities 1,640 1,722 ----------- ------------ Total liabilities

29,771 33,136 Stockholders' equity: Common stock 146 146 Additional

paid-in capital 60,270 59,736 Accumulated other comprehensive

income 1,082 1,815 Retained earnings 69,065 75,186 -----------

------------ Total stockholders' equity 130,563 136,883 -----------

------------ Total liabilities and stockholders' equity $160,334

$170,019 =========== ============ *T -0- *T STARTEK, INC. AND

SUBSIDIARIES Condensed Consolidated Statements of Cash Flows

(Dollars in thousands) Six Months Ended June 30, ------------------

2005 2004 --------- -------- Operating Activities (Unaudited) Net

income $5,288 $13,333 Adjustments to reconcile net income to net

cash provided by operating activities: Depreciation and

amortization 6,460 6,364 Deferred income taxes (539) (215) Realized

loss (gain) on investments 747 (1,072) Loss (gain) on sale of

assets (66) 3 Changes in operating assets and liabilities: Sales of

trading securities, net 2,929 (113) Trade accounts receivable, net

7,110 2,725 Inventories, net (69) (856) Prepaid expenses and other

assets (612) (2,367) Accounts payable (2,244) (537) Income taxes

receivable, net 9,358 (4,400) Accrued and other liabilities (540)

2,708 --------- -------- Net cash provided by operating activities

27,822 15,573 Investing Activities Purchases of investments

available for sale (515,736) (11,479) Proceeds from disposition of

investments available for sale 497,160 15,609 Purchases of

property, plant and equipment (4,882) (6,087) Proceeds from

disposition of property, plant and equipment 57 -- ---------

-------- Net cash used in investing activities (23,401) (1,957)

Financing Activities Proceeds from stock option exercises 488 1,963

Principal payments on borrowings, net (2,458) (778) Dividend

Payments (11,409) (11,083) Proceeds from borrowings 880 10,000

--------- -------- Net cash (used in) provided by financing

activities (12,499) 102 Effect of exchange rate changes on cash 172

117 --------- -------- Net (decrease) increase in cash and cash

equivalents (7,906) 13,835 Cash and cash equivalents at beginning

of period 14,609 5,955 --------- -------- Cash and cash equivalents

at end of period $6,703 $19,790 ========= ======== Supplemental

Disclosure of Cash Flow Information Cash paid for interest $138

$136 Income taxes paid $2,886 $12,886 Property, plant and equipment

financed under long- term debt -- $10,000 Change in unrealized gain

on investments available for sale, net of tax $(618) $(577) *T

StarTek (NYSE:SRT)

Historical Stock Chart

From Sep 2024 to Oct 2024

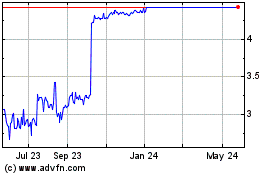

StarTek (NYSE:SRT)

Historical Stock Chart

From Oct 2023 to Oct 2024