By Erica E. Phillips

Sign up: With one click, get this newsletter delivered to your

inbox.

Crude oil is back on the rails in a big way. North America's oil

drillers are turning to trains amid tight pipeline capacity, the

WSJ's Rebecca Elliot and Paul Ziobro write, triggering a rebound in

crude-by-rail business that all but collapsed in the wake of

high-profile accidents. North American railroads handled an average

of 718,000 barrels of crude a day in October, up 88% from a year

earlier and near the peak average of about 1.1 million barrels in

October 2014. Rail is more expensive than pipelines, but pipeline

projects typically lag behind growth in oil and gas production and

have gotten tougher under protests against construction. North

American oil production topped 15.6 million barrels daily in

August, a 17% annual increase. The traffic is up nearly 25% for

U.S. railroads in the first weeks of this year and Canadian

transports are growing as stalled pipeline projects lead to more

bottlenecks.

New digital tools are allowing truck drivers to be pickier about

where they go for cargo.Uber Technologies Inc. has added a ratings

feature to its freight-booking app that gives details on wait times

and amenities at distribution siste, the WSJ Logistics Report's

Jennifer Smith writes, with sites rated on a 1-to-5 scale and an

option for written feedback. It';s the latest example of how

tech-driven features in consumer business are being incorporated

into industrial transportation. Surging cargo volumes last year had

shippers scrambling for trucks competing to make their warehouses

and factories more driver-friendly as operators got more picky

about loads. Several freight brokers, from startups to established

logistics firms like C.H. Robinson Worldwide Inc. and XPO Logistics

Inc., collect driver feedback on conditions at loading docks, and

use that information to set rates or pinpoint delays in supply

chains.

The Midwest's deep freeze is putting supply chains on ice. An

explosion and fire at a natural-gas facility in Michigan forced the

shutdown of several auto plants, the WSJ's Douglas Belkin and Erin

Ailworth report, as well as calls for businesses and consumers to

cut back gas usage. General Motors Co. halted production at 13

plants while Fiat Chrysler Automobiles NV and Ford Motor Co. cut

back on some work to ease the burden on power grids. Transportation

companies including Union Pacific Corp., BNSF Railway, United

Parcel Service Inc. and FedEx Corp. were alerting customers of

potential multi-day delays in deliveries. Airlines canceled

thousands of flights. And the U.S. Postal Service said it was

suspending delivery service in certain locations including parts of

Michigan, Indiana, Illinois, Ohio and Pennsylvania.

TRANSPORTATION

Investments in modernizing parcel networks are paying off as

carriers align more operations for e-commerce. UPS posted

higher-than-expected revenue during the busy fourth quarter even as

the costs of adding sorting centers and upgrading facilities cut

into profits, the WSJ's Paul Ziobro reports, and the company said

it expects margins to grow this year. UPS spent billions of dollars

to handle the increase in online orders rushing into its network,

and the company held up well during its latest holiday season.

Extra capacity and new technology to reroute packages around

problem spots created fewer backlogs than prior years. UPS

delivered 21 million packages a day in the U.S. during the fourth

quarter and said it set a record for on-time deliveries. Even amid

trade disruptions and weak growth overseas, UPS CEO David Abney

said, "E-commerce is providing all kinds of opportunities."

The first big bankruptcy in several years in the freight-payment

business is getting messy. Tool company Stanley Black & Decker

Inc. claims in court papers that IPS Worldwide LLC

"misappropriated" millions of dollars before filing for chapter 11

protection, the WSJ's Becky Yerak writes, launching sharp

allegations in a case in which several major shippers are owed tens

of millions of dollars. With big sums and big company names, the

case has roiled a normally quiet corner of shipping. Creditors

include metals manufacturers Alcoa Corp., $28.8 million, Arconic

Inc., $16.9 million, retailer True Value Co., $6 million, and

trucker YRC Freight, which is owed $4.7 million. Stanley is on the

hook for about about $41 million the company says was supposed to

go toward its freight bills. Freight companies weren't paid,

however, and Stanley says IPS never answered its increasingly

urgent questions on what happened to the money.

QUOTABLE

IN OTHER NEWS

Strong holiday sales and heavier reliance on third-party sellers

boosted Amazon to another record quarterly profit. (WSJ)

The U.S. and China moved closer to settling their trade dispute

as Beijing agreed to significant soybean purchases. (WSJ)

The number of Americans filing for new unemployment benefits

rose to its highest level in 16 months. (WSJ)

Compensation growth for American workers slowed in the fourth

quarter. (WSJ)

Sales in the U.S. of newly built homes rose 16.9% from October

to November. (WSJ)

South Korea's exports fell 5.% in January in the second straight

monthly decline. (WSJ)

The eurozone's annual rate of inflation fell for the third

straight month in January

The Canadian economy contracted slightly in November. (WSJ)

China's slowing economy appears to be taking a toll on its

trading partners around the world. (WSJ)

The European Union is exploring ways to address security

concerns about Huawei Technologies Co. and other Chinese

telecom-equipment suppliers. (WSJ)

Mexico has stopped buying U.S. light crude oil under its new

president. (WSJ)

Meal-kit company Blue Apron Holdings Inc. lost customers in the

latest quarter. (WSJ)

Computer-chip shortages are hurting Microsoft Corp. sales.

(WSJ)

General Electric Co. reported weak profits in its core power

business and legacy problems at GE Capital. (WSJ)

Hershey Co. is rolling out new candy and packaging to lift sales

as it faces higher shipping costs. (WSJ)

Marlboro maker Altria Group Inc. said U.S. cigarette sales are

falling more than it had expected. (WSJ)

Ford Motor Co. is boosting production of its Ranger midsize

pickup truck at a Michigan factory. (Industry Week)

Amazon pulled many products from its India website to comply

with new regulations. (Nikkei Asian Review)

China expects freight rail volume to grow 30% over the next two

years. (RailFreight)

Waterways operator Kirby Corp. bought 99 barges and other

vessels from Cenac Marine Services for $244 million. (Lloyd's

List)

Cargo through Mexico's Pacific ports rose faster than at its

Gulf Coast's ports for first time in five years. (Journal of

Commerce)

Dockworkers in Sweden are extending their strikes at ports.

(Lloyd's Loading List)

Canada introduced technology to allow trucks to bypass

inspection stations. (Commercial Carrier Journal)

C.R. England Inc. increased pay for its truck drivers for the

second in eight months. (American Journal of Transportation)

Adani Group and Welspun India Ltd. are developing logistics

parks in Hyderabad, India. (Economic Times)

Michaels Cos. Inc. is closing 36 of its Pat Catan's stores.

(Dallas Morning News)

Dozens of retail properties are being converted to logistics

facilities. (CNBC)

Goya Foods Inc. plans a 330,000-square-foot distribution center

in central Florida. (Business Journals)

Dollar General Inc. expects to open a nearly 1

million-square-foot distribution center in Longview, Texas, this

spring. (Longview News-Journal)

ABOUT US

Paul Page is deputy editor of WSJ Logistics Report. Follow him

at @PaulPage, and follow the entire WSJ Logistics Report team:

@brianjbaskin , @jensmithWSJ and @EEPhillips_WSJ. Follow the WSJ

Logistics Report on Twitter at @WSJLogistics.

Write to Erica E. Phillips at erica.phillips@wsj.com

(END) Dow Jones Newswires

February 01, 2019 11:19 ET (16:19 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

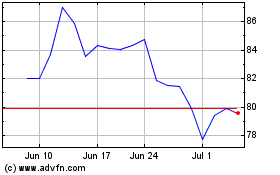

Stanley Black and Decker (NYSE:SWK)

Historical Stock Chart

From Mar 2024 to Apr 2024

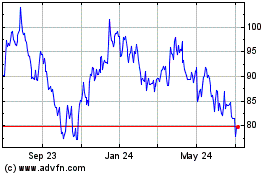

Stanley Black and Decker (NYSE:SWK)

Historical Stock Chart

From Apr 2023 to Apr 2024