false000009089600000908962023-08-252023-08-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 25, 2023 |

SKYLINE CHAMPION CORPORATION

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Indiana |

001-04714 |

35-1038277 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

755 West Big Beaver Road, Suite 1000 |

|

Troy, Michigan |

|

48084 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (248) 614-8211 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock |

|

SKY |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Purchase Agreement

On August 25, 2023, Skyline Champion Corporation, an Indiana corporation (“Skyline Champion”), entered into a definitive Securities Purchase Agreement (the “Purchase Agreement”) with Champion Home Builders, Inc., a Delaware corporation and subsidiary of Skyline Champion (“CHB”), Champion Retail Housing, Inc., a Delaware corporation and subsidiary of Skyline Champion (together with CHB, “Buyers”), Regional Holdings Corporation, a Mississippi corporation (“Regional”), Regional Underwriters, Inc., a Saint Kitts and Nevis corporation (“Regional Underwriters”), Heath Jenkins, as beneficial owner of the outstanding equity interests of Regional (collectively, with Regional and the Regional Underwriters, the “Sellers”), Dana Jenkins, as beneficial owner of the outstanding equity interests of Helicon Insurance, LLC, and party thereto solely with respect to the sale of Helicon Insurance, LLC (“Dana Jenkins”), and Heath Jenkins, solely in his capacity as the representative of the Sellers (the “Sellers’ Representative”), pursuant to which Buyers have agreed to acquire all of the outstanding equity interests in Regional Enterprises, LLC and related companies (collectively, “Regional Homes,” each being a “Regional Home Company”). Regional Homes is the fourth largest builder of manufactured homes in the United States and operates three manufacturing facilities in Alabama and 43 retail sales centers across the south and southeast.

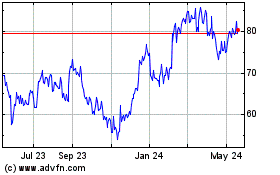

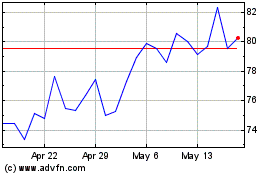

Pursuant to the terms and conditions of the Purchase Agreement, the aggregate consideration to be paid to the Sellers and Dana Jenkins upon the Closing (as defined below) of the transaction contemplated therein (the “Transaction”), subject to customary closing adjustments, will consist of: (i) cash equal to approximately $428,000,000 (the “Base Purchase Price”), less assumed indebtedness (not to exceed $130,000,000); (ii) an “earnout” payment, whereby the Sellers are entitled to receive up to $25,000,000, an amount equal to 50 percent of Regional Homes’ EBITDA (attributable solely to certain government contracts) for each fiscal year during the post-closing period ending December 31, 2026; and (iii) an aggregate number of shares of common stock in Skyline Champion, par value $0.0277 per share (“Parent Common Stock”), equal to $25,000,000 (in the case of the Sellers) and $5,000,000 (in the case of Dana Jenkins), in each case divided by the volume weighted average price per share of the common stock on the New York Stock Exchange for the 30 consecutive trading days immediately preceding the closing of the Transaction (the “Closing”). The Parent Common Stock will be issued to the Sellers and Dana Jenkins in a private placement exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Section 4(a)(2) of the Securities Act (the “Private Placement”).

In addition, at the Closing, the Sellers (but not Dana Jenkins) will deposit with U.S. Bank, N.A. (the “Escrow Agent”) the Parent Common Stock issued to them upon Closing, and Buyers will deposit with the Escrow Agent, for and on behalf of the Sellers, a portion of the Base Purchase Price equal to $603,750 (collectively, the “Escrow Funds”). The Escrow Funds will be subject to offset for indemnification claims and closing purchase price adjustments and will be disbursed as set forth in the Purchase Agreement and an escrow agreement among the Sellers, Buyers and Escrow Agent to be executed and delivered at Closing.

The Purchase Agreement contains customary representations, warranties, indemnification provisions and covenants. The Purchase Agreement also provides for certain termination rights for the Sellers and Buyers, including (and subject to certain exceptions in each case) (i) by mutual written consent of the Sellers’ Representative and Buyers, (ii) by either the Sellers’ Representative or Buyers, if the Transaction has not closed by December 31, 2023 (the “End Date”), provided that the End Date will automatically be extended until March 31, 2024 if the parties are diligently pursuing approval with respect to the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (“HSR Act”), (iii) by either the Sellers’ Representative or Buyers, if any governmental authority or arbitrator has issued a final and non-appealable order, decree, injunction or judgment restraining, enjoining or otherwise prohibiting the Closing, (iv) by Buyers, if the Sellers have breached or failed to perform their covenants and obligations under the Purchase Agreement in any material respect (and such breach cannot be, or has not been, cured within the earlier of ten days after written notice by the Sellers thereof or by the End Date), and (v) by the Sellers’ Representative, if Buyers or Skyline Champion have breached or failed to perform their covenants and obligations under the Purchase Agreement in any material respect (and such breach cannot be, or has not been, cured within the earlier of ten days after written notice by Buyers or Skyline Champion thereof or by the End Date). The Purchase Agreement requires a termination fee in the amount of $9,660,000 to be paid by (a) Buyers, if the Purchase Agreement is terminated under the foregoing clauses (ii), (iii) or (v), or (b) the Sellers, if the Purchase Agreement is terminated under clause (iv).

The foregoing summary of the Purchase Agreement does not purport to be complete and is subject to, and qualified in its entirety by reference to, the full text of the Purchase Agreement, a copy of which is filed as Exhibit 2.1 to this Current Report on Form 8-K (this “Current Report”) and is incorporated herein by reference.

The representations, warranties and covenants contained in the Purchase Agreement have been made solely for the benefit of the parties thereto. In addition, such representations, warranties and covenants (i) have been made only for purposes of the Purchase Agreement, (ii) are subject to materiality qualifications contained in the Purchase Agreement which may differ from what may be viewed as material by investors, (iii) were made only as of the date of the Purchase Agreement or such other date as is specified in the Purchase Agreement, and (iv) have been included in the Purchase Agreement for the purpose of allocating risk between the contracting parties rather than establishing matters as fact. Accordingly, the Purchase Agreement is included with this filing only to provide investors with information regarding the terms of the Purchase Agreement, not to provide investors with any other factual information regarding the parties thereto or their respective businesses. Investors should not rely on the representations, warranties and covenants or any descriptions thereof as statements of fact about the parties to the Purchase Agreement or any of their respective subsidiaries or affiliates. Moreover, information concerning the subject matter of the representations and warranties may change after

the date of the Purchase Agreement, which subsequent information may or may not be fully reflected in Skyline Champion’s public disclosures. The Purchase Agreement should not be read alone, but should instead be read in conjunction with the other information regarding Skyline Champion that is or will be contained in Skyline Champion’s most recent Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q and other documents that Skyline Champion files with the Securities and Exchange Commission (“SEC”).

The Closing is expected to occur in the fourth quarter of 2023, subject to satisfaction or waiver of a number of conditions set forth in the Purchase Agreement, including the expiration of the waiting period under the HSR Act and other customary closing conditions.

Restrictive Covenant Agreement

Concurrently and in connection with the Closing, Skyline Champion and Buyers will enter into a Restrictive Covenant Agreement with certain of Sellers’ affiliates (the “Restricted Parties”), pursuant to which the Restricted Parties will agree to refrain from competing with, and soliciting service providers and customers from, Regional Homes for the five years immediately following the Closing in order to protect Regional Homes’ business interests and goodwill.

Release Agreement

Concurrently and in connection with the Closing, the Sellers and Dana Jenkins will enter into a Release Agreement, pursuant to which the Sellers and Dana Jenkins will release any and all claims arising prior to the Closing against Skyline Champion, Buyers and Regional Homes, including, but not limited to, claims arising out of or relating to the Purchase Agreement.

Assignment and Assumption Agreements

Concurrently and in connection with the Closing, the Sellers (through certain affiliates) will transfer to Buyers (through certain Regional Homes Companies) such affiliates’ right, title and interest (or the equivalent of such right, title and interest, if a replacement agreement is used) with respect to certain software and payroll matters related to the operation and conduct of the business of Regional Homes.

Restricted Stock Agreement

Concurrently and in connection with the Closing, Skyline Champion will enter into a Restricted Stock Agreement with the Sellers and Dana Jenkins (the “Recipients”), pursuant to which the parties will agree to be bound by the terms and conditions set forth therein in connection with any transfer of the Parent Common Stock issued to them in the Private Placement (collectively with any new, substituted or additional securities that may be received in replacement of the Parent Common Stock, the “Shares”). The Restricted Stock Agreement will contain customary representations and warranties from each of Skyline Champion and the Recipients, including, among others, that the Recipients are “accredited investors” within the meaning of Regulation D adopted under the Securities Act.

Pursuant to the terms and conditions of the Restricted Stock Agreement, the Recipients will be entitled to all rights of a stockholder with respect to the Shares, including, but not limited to, all rights to vote the Shares while the Sellers’ Shares are held in escrow. The Shares will be “restricted securities” within the meaning of Regulation D and Rule 144 under the Securities Act and will be subject to certain restrictions, including, but not limited to, (i) a six-month holding period after issuance of the Shares, (ii) compliance with the requirements of Rule 144 applicable to an affiliate of Skyline Champion that impose limitations on the amount of securities sold in any three-month period, (iii) limitations on the encumbrances or liens that may be placed on the Shares within six months following the issuance of the Shares, (iv) compliance with any stock ownership or holding guidelines that may be adopted by Skyline Champion and may be in effect with respect to directors, officers or employees of Skyline Champion, and (v) in the case of Heath Jenkins, compliance with the terms and conditions set forth in Skyline Champion’s Insider Trading Policy. In addition, the Restricted Stock Agreement provides for certain vesting periods, subject to certain exceptions, such that (a) no Recipient may transfer any Shares until the first anniversary of the Closing, (b) from the first anniversary of the Closing to the second anniversary, a Recipient may transfer one-third of the Shares that such Recipient owned beneficially on the first anniversary, (c) from the second anniversary of the Closing to the third anniversary, a Recipient may transfer all but one-third of the Shares that such Recipient owned beneficially on the first anniversary, and (d) from and after the third anniversary, a Recipient may transfer any and all other Shares.

The Restricted Stock Agreement will not obligate Skyline Champion to register the Shares under the Securities Act. That said, Skyline Champion will agree in the Restricted Stock Agreement to make all information publicly available as required by Rule 144 of the Securities Act and other applicable regulations such that the Recipients may resell the Shares to the public without registration.

The Private Placement is expected to close concurrently with the Closing.

Item 3.02. Unregistered Sales of Equity Securities.

The information set forth in Item 1.01 of this Current Report concerning the Private Placement is hereby incorporated by reference into this Item 3.02. The offers and sales that constitute the Private Placement have been and will be undertaken in reliance upon Section 4(a)(2) of the Securities Act.

Item 9.01 Financial Statements and Exhibits.

|

|

2.1* |

Securities Purchase Agreement, dated August 25, 2023, by and among Skyline Champion Corporation, Champion Retail Housing, Inc., Champion Home Builders, Inc., Regional Holdings Corporation, Heath Jenkins, Regional Underwriters, Inc., Dana Jenkins (for the limited purposes set forth herein), and Heath Jenkins as the Sellers’ Representative |

104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

* Certain exhibits and schedules to this exhibit have been omitted pursuant to Item 601(a)(5) and/or Item 601(b)(2) of Regulation S-K. The registrant hereby undertakes to furnish copies of any of the omitted schedules and exhibits upon request by the U.S. Securities and Exchange Commission.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Skyline Champion Corporation |

|

|

|

|

Date: |

August 31, 2023 |

By: |

/s/ Robert Spence |

|

|

|

Robert Spence

Senior Vice President,

General Counsel and Secretary |

Exhibit 2.1

SECURITIES Purchase AGREEMENT

BY AND AMONG

SKYLINE CHAMPION CORPORATION,

CHAMPION RETAIL HOUSING, INC.,

Champion home builders, INC.,

regional holdings corpORATION,

HEATH JENKINS,

REGIONAL UNDERWRITERS, INC.,

DANA JENKINS (FOR THE LIMITED PURPOSES SET FORTH HEREIN),

AND

HEATH JENKINS AS THE SELLERS’ REPRESENTATIVE

DATED AS OF AUGUST 25, 2023

STRICTLY PRIVATE AND CONFIDENTIAL DRAFT FOR DISCUSSION PURPOSES ONLY. CIRCULATION OF THIS DRAFT SHALL NOT GIVE RISE TO ANY DUTY TO NEGOTIATE OR CREATE OR IMPLY ANY OTHER LEGAL OBLIGATION. NO LEGAL OBLIGATION OF ANY KIND WILL ARISE UNLESS AND UNTIL A DEFINITIVE WRITTEN AGREEMENT IS EXECUTED AND DELIVERED BY ALL PARTIES.

TABLE OF CONTENTS

|

|

|

Article I. DEFINITIONS |

1 |

1.1 |

Certain Definitions |

1 |

1.2 |

Table of Defined Terms |

12 |

Article II. SALE AND PURCHASE |

12 |

2.1 |

Sale and Purchase of Securities |

12 |

2.2 |

Purchase Price |

10 |

2.3 |

Payments at Closing for Selling Expenses |

10 |

2.4 |

Payment at Closing for Company Closing Indebtedness |

10 |

2.5 |

Payment at Closing of Escrow Amounts |

10 |

2.6 |

Payment at Closing of Closing Cash Amount |

10 |

2.7 |

Issuance at Closing of the Stock Consideration |

10 |

2.8 |

Closing Calculation |

11 |

2.9 |

Funds Flow Memorandum |

11 |

2.10 |

Closing |

11 |

2.11 |

Deliveries by Sellers |

12 |

2.12 |

Deliveries by Buyers and Parent |

14 |

2.13 |

Earnout Payment |

14 |

2.14 |

Purchase Price Adjustments |

14 |

2.15 |

Withholding Taxes |

16 |

Article III. REPRESENTATIONS AND WARRANTIES OF THE SELLERS AND COMPANY GROUP |

17 |

3.1 |

Organization and Qualification |

17 |

3.2 |

Organizational Documents |

17 |

3.3 |

Capitalization |

17 |

3.4 |

Authority; Enforceability |

18 |

3.5 |

No Conflict; Required Filings and Consents |

18 |

3.6 |

Material Contracts |

18 |

3.7 |

Compliance with Laws; Permits |

20 |

3.8 |

Financial Statements |

20 |

3.9 |

Absence of Certain Changes or Events |

21 |

3.10 |

Absence of Litigation, Claims and Orders |

22 |

3.11 |

Employee Benefit Plans. |

22 |

3.12 |

Employee and Labor Matters |

24 |

3.13 |

Assets. |

26 |

3.14 |

Taxes |

27 |

3.15 |

Intellectual Property |

31 |

3.16 |

Privacy and Data Security |

32 |

3.17 |

Insurance |

33 |

3.18 |

Environmental Matters |

34 |

3.19 |

Suppliers; Customers |

35 |

3.20 |

Questionable Payments |

36 |

3.21 |

Warranties |

36 |

3.22 |

Government Contracts |

36 |

3.23 |

Inventory |

37 |

3.24 |

Accounts Receivable |

37 |

3.25 |

Accounts Payable |

38 |

3.26 |

Bank Accounts |

38 |

3.27 |

Brokers |

38 |

3.28 |

Affiliated Transactions |

38 |

i

|

|

|

3.29 |

Disclaimer of Other Representations and Warranties. |

38 |

Article IV. REPRESENTATIONS AND WARRANTIES OF BUYERS |

39 |

4.1 |

Organization |

39 |

4.2 |

Authority; Enforceability |

39 |

4.3 |

No Conflict; Required Filings and Consents |

39 |

4.4 |

Absence of Litigation, Claims and Orders |

39 |

4.5 |

Availability of Funds |

40 |

4.6 |

Capitalization; Stock Exchange Compliance; Continuous Disclosure |

40 |

4.7 |

Solvency |

40 |

4.8 |

Investment Intent |

40 |

4.9 |

R&W Insurance Policy |

41 |

4.10 |

Brokers |

41 |

4.11 |

WARN Act Matters |

41 |

4.12 |

Investigation and Acknowledgement of Non-Reliance |

41 |

Article V. PRE-CLOSING COVENANTS |

42 |

5.1 |

Conduct of Business Pending Closing. |

42 |

5.2 |

Access to Information; Confidentiality. |

43 |

5.3 |

Reasonable Efforts; HSR Act Filings; Further Assurances. |

44 |

5.4 |

R&W Insurance Policy |

46 |

5.5 |

Exclusive Dealing |

47 |

5.6 |

Public Announcements |

47 |

5.7 |

Regional Enterprises, LLC |

47 |

5.8 |

Landlord Estoppel |

47 |

Article VI. ADDITIONAL AGREEMENTS |

47 |

6.1 |

Directors and Officers Indemnification. |

47 |

6.2 |

Preservation of Records |

48 |

6.3 |

Maintain Stock Exchange Listing |

49 |

6.4 |

Interim Breaches |

49 |

Article VII. CONDITIONS TO CLOSING |

49 |

7.1 |

Conditions to Obligations of the Company Group and Sellers |

49 |

7.2 |

Conditions to Obligations of Buyers |

50 |

7.3 |

Frustration of Closing Conditions |

50 |

7.4 |

Waiver of Conditions |

50 |

Article VIII. TERMINATION; FEES AND EXPENSES |

51 |

8.1 |

Termination |

51 |

8.2 |

Effect of Termination |

51 |

8.3 |

Reverse Termination Fee |

52 |

8.4 |

Fees and Expenses |

53 |

Article IX. TAX MATTERS |

53 |

9.1 |

Straddle Periods |

53 |

9.2 |

Tax Return Preparation. |

54 |

9.3 |

Contests Related to Taxes |

54 |

9.4 |

Cooperation on Tax Matters |

55 |

9.5 |

Transfer Taxes |

55 |

9.6 |

Tax Treatment and Tax Reporting. |

55 |

9.7 |

Purchase Price Allocation |

56 |

ii

|

|

|

Article X. INDEMNIFICATION |

56 |

10.1 |

Survival |

56 |

10.2 |

Indemnification by Sellers |

56 |

10.3 |

Indemnification by Buyer |

56 |

10.4 |

Indemnification Procedures |

57 |

10.5 |

Sources of Indemnification |

57 |

10.6 |

Payment Mechanics |

59 |

10.7 |

Tax Treatment of Indemnification Payments |

59 |

10.8 |

Mitigation |

59 |

10.9 |

Exclusive Remedies |

60 |

Article XI. THE SELLERS’ REPRESENTATIVE |

60 |

11.1 |

Appointment |

60 |

11.2 |

Authorization |

60 |

11.3 |

Access to Information |

61 |

11.4 |

Reasonable Reliance |

61 |

11.5 |

Attorney-in-Fact |

61 |

11.6 |

Liability |

61 |

11.7 |

Removal of Sellers’ Representative; Authority of Successor Sellers’ Representative |

62 |

11.8 |

The Sellers’ Representative Expense Fund |

62 |

11.9 |

Actions of the Sellers’ Representative |

62 |

11.10 |

Binding Appointment |

62 |

Article XII. MISCELLANEOUS |

63 |

12.1 |

Amendment |

63 |

12.2 |

Waiver |

63 |

12.3 |

Notices |

63 |

12.4 |

Specific Performance. |

63 |

12.5 |

Consents |

63 |

12.6 |

Interpretation |

64 |

12.7 |

Severability |

64 |

12.8 |

Entire Agreement |

64 |

12.9 |

Assignment |

65 |

12.10 |

Third Party Beneficiaries |

65 |

12.11 |

Non-Assertion of Attorney-Client Privilege; Access to Communications; and Waiver of Conflicts |

65 |

12.12 |

Failure or Indulgence Not Waiver; Remedies Cumulative |

66 |

12.13 |

Non-Recourse |

66 |

12.14 |

Governing Law |

66 |

12.15 |

Waiver of Jury Trial |

66 |

12.16 |

Conflict Between Transaction Documents |

67 |

12.17 |

Time of the Essence |

67 |

12.18 |

Company Disclosure Schedule |

67 |

12.19 |

Counterparts |

67 |

12.20 |

Parent Guarantee |

67 |

iii

EXHIBITS

Exhibit A — R&W Insurance Policy and Binder Agreement

Exhibit B — Form of Restrictive Covenant Agreement

Exhibit C — Form of Release

Exhibit D — Form of Restricted Stock Agreement

Exhibit E — Form of Assignment and Assumption Agreement

Exhibit F — Special Indemnities

ANNEXES

Annex A — Example Calculation

Annex B — Earnout

Annex C — Required Consents

iv

SECURITIES Purchase Agreement

This securities Purchase AGREEMENT, dated as of August 25, 2023 (this “Agreement”), is by and among Skyline Champion Corporation, an Indiana corporation (“Parent”), Champion Home Builders, Inc., a Delaware corporation and subsidiary of Parent (“CHB”), Champion Retail Housing, Inc., a Delaware corporation and subsidiary of Parent (“CHR” and together with CHB, “Buyers”, and each individually, a “Buyer”), Regional Holdings Corporation, a Mississippi corporation (“Regional”), Regional Underwriters, Inc., a Saint Kitts and Nevis corporation (“Regional Underwriters”), Heath Jenkins, a resident of Mississippi (“Heath Jenkins” and together with Regional and Regional Underwriters, “Sellers”, and each individually, “Seller”), Dana Jenkins, a resident of Mississippi (“Dana Jenkins”) solely with respect to the sale of Helicon Insurance, LLC, and Heath Jenkins, as the Sellers’ Representative (the “Sellers’ Representative”). Capitalized terms used but not defined in the context of the Section in which such terms first appear have the respective meanings set forth in Section 1.1.

WHEREAS, Sellers are the owners of all of the issued and outstanding Equity Interests of the Company Group (collectively, the “Securities”);

WHEREAS, Sellers desire to sell to Buyers, and Buyers desire to purchase from Sellers, all of the Securities held by Sellers upon the terms and conditions set forth in this Agreement, such that upon the Closing, Buyers shall own all of the Securities of the Company Group;

WHEREAS, Dana Jenkins shall exchange the Equity Interests of Helicon Insurance, LLC (“Helicon Insurance”) for that portion of the Stock Consideration as set forth in the Allocation Schedule (the “Exchange”);

WHEREAS, the parties intend for the Exchange to qualify as a reorganization under section 368(a)(1)(B) of the Code and will file all applicable Tax Returns consistent therewith;

WHEREAS, the Sellers shall sell their respective interests in Liberty to Buyers for that portion of the Purchase Price as set forth in the Allocation Schedule;

WHEREAS, concurrently with the execution and delivery of this Agreement, and as a condition and inducement to Sellers’ willingness to enter into this Agreement, Buyer has delivered to Sellers the executed binder evidencing the R&W Insurance Policy (the “Binder Agreement”) and the R&W Insurance Policy issued and bound as of the date hereof and attached hereto as Exhibit A; and

WHEREAS, concurrently with the execution and delivery of this Agreement, and as a condition and inducement to Sellers’ willingness to enter into this Agreement, Buyer shall cause Parent to issue to the Sellers the Stock Consideration (as defined below) pursuant to and in accordance with the terms and conditions of this Agreement and the Restricted Stock Agreement (as defined below).

NOW, THEREFORE, in consideration of the foregoing and the mutual representations, warranties, covenants and agreements herein contained, and intending to be legally bound hereby, the parties hereto hereby agree as follows:

Article I.

DEFINITIONS

1.1 Certain Definitions. For purposes of this Agreement, the following terms shall have the following meanings:

(a) “Accounting Principles” means GAAP (except as set forth on Section 3.8(a)(ii) of the Company Disclosure Schedule), and, to the extent consistent therewith, as applied in a manner consistent with the Company Group’s past practices.

(b) “Acquisition Transaction” means any transaction or proposed transaction or series of related transactions involving (i) any direct or indirect acquisition or purchase by any person or “group” (as defined

1

under Section 13(d) of the Exchange Act) of a twenty percent (20%) interest or more in the total outstanding Equity Interests of the Company Group, (ii) any sale or disposition of consolidated assets of the Company Group to any person or “group” for consideration equal to twenty percent (20%) or more of the aggregate fair market value of all of the outstanding Securities, or (iii) any consolidation, merger, business combination, recapitalization, liquidation, dissolution or similar transaction with respect to the Company Group.

(c) “Affiliate” means, with respect to a Person, any other Person that directly or indirectly, through one or more intermediaries, controls, is controlled by or is under common control with such Person. The term “control” (including the terms “controlled by” and “under common control with”) means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by Contract or otherwise, and the terms “controlled” and “controlling” have meanings correlative thereto.

(d) “Business Day” means any day, other than a Saturday or Sunday, on which commercial banks in the State of Delaware are open for the general transaction of business.

(e) “Buyer Disclosure Schedule” means the Buyer Disclosure Schedule delivered by Buyer to Sellers concurrently with the execution of this Agreement.

(f) “Cash on Hand” means, with respect to the Company Group, without duplication, (i) the aggregate amount of all cash and cash equivalents (excluding restricted cash (which shall exclude any Customer Deposits Amount) and third party deposits), plus (ii) all deposits in transit or amounts held for deposit that have not yet cleared, other wire transfers and drafts deposited or received and available for deposit, minus (iii) issued but uncleared checks (to the extent not otherwise an accrued liability in the Closing Date Net Working Capital) of the Company Group, in each case, calculated in accordance with the Accounting Principles.

(g) “Claim” means any claim, action, lawsuit, arbitration, cause of action, complaint, criminal prosecution, audit, notice of violation, litigation, citation, summons, subpoena, demand letter or Proceeding of any nature, civil, criminal, administrative, regulatory or otherwise, whether at Law or at equity.

(h) “Closing Date Cash on Hand” means the Cash on Hand as of the Reference Time.

(i) “Closing Date Net Working Capital” means the Net Working Capital as of the Reference Time.

(j) “Code” means the U.S. Internal Revenue Code of 1986, as amended.

(k) “Company Closing Assumed Indebtedness” means that certain Indebtedness of the Company Group as of immediately prior to Closing that is to be assumed by Buyer at Closing in an amount not to exceed $130,000,000, all of which is specifically identified on Section 1.1(k) of the Company Disclosure Schedule.

(l) “Company Closing Indebtedness” means all Indebtedness of the Company Group as of immediately prior to Closing (other than the Company Closing Assumed Indebtedness), which includes the Indebtedness listed on Section 1.1(l) of the Company Disclosure Schedule. The Company Closing Indebtedness shall be repaid at Closing.

(m) “Company Disclosure Schedule” means the Company Disclosure Schedule delivered by Sellers and the Company Group to Buyer concurrently with the execution of this Agreement and as updated prior to Closing.

(n) “Company Group” means Regional Enterprises, LLC, Helicon Capital, LLC, Helicon Transport, LLC, Regional Land Company, LLC (including its Subsidiaries Regional Land Company BM, LLC and Regional Land Company LH, LLC), Rogers-Jenkins Properties, LLC, Platinum Homes, LLC, Hamilton Home Builders, LLC (“Hamilton”), Hamilton Property Group, LLC, Winston Housing Group, LLC, Marion Property

2

Group, LLC, Regional Enterprises of AL, LLC, Regional Realty, LLC, Helicon Insurance, LLC and Liberty NMTC, LLC (“Liberty”).

(o) “Company Group Material Adverse Effect” means any result, event, occurrence, condition or change that is, or would reasonably be expected to become, individually or in the aggregate materially adverse to (a) the business, condition (financial or otherwise) or results of operations or assets of the Company Group, taken as a whole, or (b) the ability of Sellers to consummate the transactions contemplated hereby on a timely basis; provided, however, that any adverse effect arising out of, resulting from or attributable to (i) an event or circumstance or series of events or circumstances affecting (A) the United States or the global economy generally or such capital, credit or financial markets generally, including (1) changes in interest or exchange rates and (2) any suspension of trading in securities, (B) political conditions of the United States, or (C) any of the industries in which the Company Group operates; (ii) the announcement or consummation of the transactions contemplated by, or the performance of obligations under, this Agreement or the other Transaction Documents, including effects related to the identity of Buyers or their Affiliates, compliance with the covenants contained herein or therein or the failure to take any action as a result of any restrictions or prohibitions set forth herein or therein; (iii) any actual or proposed changes in applicable Law or GAAP or the enforcement or interpretation thereof; (iv) actions specifically permitted to be taken or omitted pursuant to this Agreement or taken with Buyers’ written consent; (v) any acts of God, including tornados, earthquakes, hurricanes, flooding, disease outbreaks, pandemics, epidemics, public health crises or other similar events, including the COVID-19 pandemic, or the continuation or any worsening of such events or circumstances; (vi) any hostilities, acts of war, sabotage, terrorism or military actions, or any escalation or worsening of any such hostilities, act of war, sabotage, terrorism or military actions; (vii) any adverse change in or effect on the business of the Company Group that is caused by any delay in consummating the Closing as a result of (A) any violation or breach by Buyers of any covenant, agreement, representation or warranty contained in this Agreement, (B) the institution of any action or Proceeding challenging the validity or legality, or seeking to restrain the consummation of, or rescind, the transactions contemplated by this Agreement by any Governmental Authority or third party, or (C) the failure to satisfy the condition to Closing set forth in Section 7.2(e) (including as a result of the request for submission of additional information or documents regarding the transactions contemplated by this Agreement from the Company Group or Buyers after review of the initial notification submitted pursuant to the HSR Act or any other applicable antitrust or competition Law by the Federal Trade Commission or any other Governmental Authority); or (viii) any failure to meet Projections, estimates or forecasts of revenues, earnings, or other measures of financial or operating performance for any period (provided that the underlying causes of such failures (subject to the other provisions of this definition) shall not be excluded), shall, in each such case, not be taken into account in determining whether a Company Group Material Adverse Effect has occurred or would be reasonably likely to occur.

(p) “Company-Owned Intellectual Property” means any Intellectual Property owned by the Company Group and used in the operation of the business of the Company Group as currently conducted that is material to the Company Group, taken as a whole.

(q) “Company Group Software” means Software owned or purported to be owned by the Company Group.

(r) “Contracts” means all contracts, leases, subleases, deeds, mortgages, instruments, indentures, joint ventures, licenses, notes, undertakings, and all other similar agreements, commitments and arrangements, whether written or oral.

(s) “Court” means any court or arbitration tribunal of the United States, any domestic state, any foreign country and any political subdivision or agency thereof.

(t) “COVID-19” means the infectious disease known as coronavirus disease 2019, or COVID-19, caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2), and any evolutions thereof or related or associated epidemics, pandemics or disease outbreaks.

3

(u) “COVID-19 Measures” means any quarantine, “shelter in place,” “stay at home,” workforce reduction, shut down, closure, or any other Law, order, directive, guideline or recommendation by any Governmental Authority in connection with or in response to COVID-19, including the CARES Act.

(v) “Customer Deposits Amount” means the amount of deposits from customers of the Company Group as of the Reference Time for the construction and/or purchase of homes and related products.

(w) “D. Jenkins Stock Consideration Amount” means Five Million Dollars ($5,000,000).

(x) “Disregarded Entities” means Helicon Transport, LLC, Helicon Capital LLC, Regional Enterprises, LLC, Regional Transport, LLC, Regional Realty, LLC, and Regional Land Company, LLC; provided, however, that Regional Enterprises, LLC shall only be included as a “Disregarded Entity” as of the effective date of the Disregarded Entity Election. For the avoidance of doubt, inclusion of an entity as a “Disregarded Entity” shall not preclude or in any way limit such entity from being included in the “Company Group”.

(y) “Earnout Payment” is defined in Annex B.

(z) “Employee Plan” means any pension, benefit, retirement, compensation, employment, consulting, profit-sharing, deferred compensation, incentive, bonus, performance award, phantom equity, stock or stock-based, change in control, retention, severance, vacation, paid time off (PTO), medical, vision, dental, disability, Code Section 125 cafeteria, welfare, fringe-benefit and any other similar agreement, plan, policy, program or arrangement (and any amendments thereto), in each case whether or not reduced to writing and whether funded or unfunded, including each “employee benefit plan” within the meaning of Section 3(3) of ERISA, whether or not tax-qualified and whether or not subject to ERISA, which is or has been maintained, sponsored, contributed to, or required to be contributed to by any member of the Company Group for the benefit of any current or former employee, officer, director, retiree, independent contractor or consultant of the Company Group or any spouse or dependent of such individual, or under which the Company Group or any ERISA Affiliate of any member of the Company Group has or may have any Liability, or with respect to which Buyers or any of their Subsidiaries or Affiliates would reasonably be expected to have any Liability, contingent or otherwise, including by reason of being treated as a single employer under Section 414 of the Code.

(aa) “Equity Interests” means, with respect to any Person, any share, unit, capital stock, limited liability company interest, membership interest, partnership interest or similar interest or other indicia of equity or equity-like ownership (including any option, warrant or similar right or security convertible, exchangeable or exercisable therefor or other instrument or right the value of which is based on any of the foregoing) in such Person.

(bb) “ERISA” means the Employee Retirement Income Security Act of 1974, as amended.

(cc) “ERISA Affiliate” means all employers (whether or not incorporated) that would be treated together with any Person as a “single employer” within the meaning of Section 414 of the Code or Section 4001 of ERISA.

(dd) “Escrow Agent” means U.S. Bank National Association.

(ee) “Escrow Agreement” means that certain agreement among the Escrow Agent, Buyers and Sellers’ Representative, in form and substance reasonably acceptable to Buyers and Sellers’ Representative.

(ff) “Estimated Closing Date Cash on Hand” means Sellers’ estimate of Closing Date Cash on Hand, as set forth in the Estimated Closing Date Balance Sheet and Closing Calculation Statement to be delivered pursuant to Section 2.8.

(gg) “Estimated Closing Date Net Working Capital” means Sellers’ estimate of the Closing Date Net Working Capital, as set forth in the Estimated Closing Date Balance Sheet and Closing Calculation Statement to be delivered pursuant to Section 2.8.

4

(hh) “Estimated Company Closing Assumed Indebtedness” means Sellers’ estimate of Company Closing Assumed Indebtedness, as set forth in the Closing Calculation Statement to be delivered pursuant to Section 2.8.

(ii) “Estimated Company Closing Indebtedness” means Sellers’ estimate of Company Closing Indebtedness, as set forth in the Closing Calculation Statement to be delivered pursuant to Section 2.8.

(jj) “Estimated Customer Deposits Amount” means Sellers’ estimate of the Customer Deposits Amount, as set forth in the Closing Calculation Statement to be delivered pursuant to Section 2.8.

(kk) “Estimated Selling Expenses” means Sellers’ estimate of Selling Expenses as of immediately prior to Closing, as set forth in the Closing Calculation Statement to be delivered pursuant to Section 2.8.

(ll) “Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended.

(mm) “Filing” means any registration, petition, statement, application, schedule, form, declaration, notice, notification, report, submission or other filing.

(nn) “Fraud” means the actual, knowing and intentional fraud (and not negligent misrepresentation or omission, or any form of fraud based on recklessness or negligence) by a party to this Agreement with respect to the making of a representation or warranty by such party set forth in this Agreement (as qualified by the Company Disclosure Schedule) with the intent to induce another party to enter into this Agreement that was material to the claiming party’s decision to enter into this Agreement and upon which the claiming party justifiably relied, in each case, as determined in a non-appealable final determination by a Court of competent jurisdiction.

(oo) “GAAP” means generally accepted accounting principles in the United States as in effect from time to time.

(pp) “Governmental Approval” means any consent, approval, Order or authorization of, or registration, declaration or Filing with, any Governmental Authority.

(qq) “Governmental Authority” means any federal, state, local or foreign government or political subdivision thereof, or any agency, instrumentality or authority of such government or political subdivision, or any self-regulated organization or other non-governmental regulatory authority or quasi-governmental authority (to the extent that the rules, regulations or orders of such organization or authority have the force of Law, including any administrative agency or commission), or any arbitrator, court or tribunal of competent jurisdiction.

(rr) “Government Contract” means any Contract, including any prime contract, subcontract, facility contract, teaming agreement or arrangement, joint venture agreement, basic ordering agreement, pricing agreement, letter contract, purchase order, delivery order, task order, release, or other contractual agreement of any kind, as modified by binding modification or change orders, whether currently active or subject to an open audit period, between a member of the Company Group and, (a) any Governmental Authority (acting on its own behalf or on behalf of another country or international organization), (b) any prime contractor or higher-tier contractor of any Governmental Authority, or (c) any lower-tier subcontractor to a member of the Company Group with respect to any contract of a type described in clauses (a) or (b) above. For purposes of clarity, a task order, purchase order, delivery order, or release issued pursuant to a Government Contract shall be considered a part of the Government Contract to which it relates.

(ss) “HSR Act” means the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended.

5

(tt) “Income Tax” means any U.S. federal, state, local, or foreign Tax based upon or measured by, in whole or in part, net income and any similar Taxes.

(uu) “Income Tax Return” means any Tax Return with respect to Income Taxes.

(vv) “Indebtedness” means, without duplication, (i) the Company Group’s indebtedness for borrowed money and all obligations represented by bonds, notes, debentures or similar instruments, (ii) the Company Group’s obligations under finance leases required in accordance with GAAP to be capitalized on the balance sheet of a member of the Company Group (excluding leases for real property or such equipment leases for the leasing of forklifts set forth in Section 1.1(vv) of the Company Disclosure Schedule), (iii) obligations under letters of credit solely to the extent drawn upon, (iv) obligations for deferred purchase price of assets, (v) obligations under any existing interest rate, currency, commodity or other swap, hedge or financial derivative agreement, (vi) unpaid portions of installment purchases, (vii) equity appreciation rights, vested capital appreciation rights, phantom options and/or installment purchases incurred by the Company Group prior to the Closing, or required to be paid in order to discharge fully all such amounts as of the Closing, (viii) any unpaid Taxes deferred under Section 2302 of the CARES Act or deferred pursuant to the CARES Act, IRS Notice 2021-11 or IRS Notice 2020-65), (ix) commissions or bonuses earned and/or payable by the Company Group to any of its Representatives, (x) any guaranty of indebtedness of another Person of the type described in clauses (i) through (ix), and (xi) any unpaid interest, prepayment penalties, premiums, costs and fees that would arise or become due as a result of the repayment, prepayment or satisfaction of any of the obligations referred to in the foregoing clauses (including without limitation, any of the foregoing arising on or prior to the Closing Date with respect to (y) the assumption of the obligations under or relating to the New Market Tax Agreements or (z) the restructuring of the agreements or arrangements related thereto as a result of the consummation of the transactions contemplated by this Agreement). Notwithstanding the foregoing, Indebtedness does not include (A) operating lease obligations, (B) any undrawn letters of credit, performance bonds, bankers’ acceptances or similar obligations, (C) any Selling Expenses, (D) any amount included in the calculation of Net Working Capital (other than such amounts specifically referenced in this definition of Indebtedness), or (E) any Customer Deposits Amount.

(ww) “Indemnification Escrow Amount” means an amount equal to Six Hundred Three Thousand Seven Hundred Fifty Dollars and 00/100 ($603,750).

(xx) “Indemnification Escrow Fund” means (i) the Indemnification Escrow Amount, and all interest and earnings thereon, and (ii) the Stock Consideration, in each case, as may be reduced from time to time as a result of disbursements thereof pursuant to the Escrow Agreement.

(yy) “Indemnified Taxes” means any liability for: (i) Taxes of any Seller; and (ii) Taxes of the Company Group for any Pre-Closing Taxes Period, in each of clauses (i) and (ii), other than any such Taxes included in the calculation of the Purchase Price.

(zz) “Information Privacy and Security Laws” means all applicable Laws governing the privacy, security, anti-spam, call or electronic monitoring or recording or any outbound communications (including outbound calling and text messaging, telemarketing and email marketing), and Laws applicable to the Processing of Personal Information (including Laws of jurisdictions where Personal Information was collected), and all regulations promulgated and guidance issued by an applicable Governmental Authority thereunder, including but not limited to state social security number protection laws, state data breach notification laws, state consumer protection laws, and analogous foreign Laws.

(aaa) “Intellectual Property” means trademarks, trade names, service marks, service names, logos, assumed names, domain names, copyrights, software, patents, trade secrets, or other intellectual property, and any registrations or applications to register any of the foregoing.

(bbb) “IT Systems” means all of the following used by or on behalf of the Company Group (whether owned or third party) in the ordinary course of business: electronic data processing and storage, information, record keeping, communications, telecommunications, hardware, software, networks, peripherals,

6

portfolio trading and computer systems, including any outsourced systems and processes, and all documentation associated with any of the foregoing.

(ccc) “Knowledge” means, with respect to the Company Group, the actual knowledge of Heath Jenkins, Neil Godfrey, Andrew Houser (only with respect to the Company Group’s manufacturing operations) and Harini Vedala (only with respect to Section 3.15 and Section 3.16), after due inquiry of the appropriate direct reports with respect to any particular subject and, with respect to Buyer, the actual knowledge of Mark Yost and Laurie Hough after due inquiry of the appropriate direct reports with respect to any particular subject; provided, however, that it is understood and agreed that the individuals listed above shall have no personal liability in any manner whatsoever hereunder or otherwise related to the transactions contemplated hereby by virtue of being named in this definition.

(ddd) “Law” means all laws, statutes, ordinances, directives, codes, common laws, rules of law, Regulations and similar mandates of any Governmental Authority, including all Orders having the effect of law in any jurisdiction.

(eee) “Liability” means any debt, liability, commitment or obligation (whether known or unknown direct or indirect, absolute or contingent, accrued or unaccrued, matured or unmatured, or liquidated or unliquidated).

(fff) “Lien” means any lien, charge, pledge, claim, encumbrance, mortgage, deed of trust, hypothecation or security interest of any kind, in each case, other than Permitted Liens.

(ggg) “Loss” or “Losses” means any and all Liabilities, Claims, losses, deficiencies, damages, penalties, fines, judgments, awards, interest, settlements, costs, fees (including reasonable investigation fees, Court costs and fees of expert witnesses), expenses (including reasonable attorneys’ fees) and disbursements, together with all amounts paid in defense or settlement and all amounts incurred in connection with enforcing any rights.

(hhh) “Net Working Capital” means (i) the sum of the current assets of the Company Group, (excluding Cash on Hand but including the actual amount of capital expenditures made by or on behalf of the Company Group in an amount not to exceed $400,000 related to the plant molding line), minus (ii) the sum of the current liabilities of the Company Group (excluding (A) Selling Expenses (to the extent included in the calculation of the Closing Cash Amount); and (B) Indebtedness (other than any Company Closing Indebtedness that was not paid in connection with Closing, unless the failure to so pay such Company Closing Indebtedness is related to a breach by Buyer of Section 2.4). In no event will the determination of the Net Working Capital include any Liability related to Selling Expenses to the extent included as a reduction to the Purchase Price in accordance with Section 2.14. An example of the calculation of the Net Working Capital based on the Reference Balance Sheet and applying the Accounting Principles is set forth on Annex A hereto (the “Example Calculation”). The Estimated Closing Date Net Working Capital and the Final Closing Date Net Working Capital shall be calculated in good faith in accordance with the Accounting Principles. Such calculations shall exclude the impact of any action taken by, or operations of, Buyer or the Company Group’s business on or after the Closing. The parties hereto agree that the purpose of preparing and calculating the Net Working Capital hereunder is solely to measure changes in the Net Working Capital without the introduction of new or different accounting methods, policies, practices, procedures, reserves, accruals, classifications, judgments or estimation methodologies of GAAP and taking into account only those components (i.e., line items) used in calculating the Example Calculation.

(iii) “New Market Tax Credit Agreements” means Items 9 through 13 of Section 1.1(k) and Item 21 of Section 3.6(a)(viii) of the Company Disclosure Schedules.

(jjj) “Open Source License” means any “free software” license, “software libre” license, “public” license, or open-source software license, including the GNU General Public License, the GNU Lesser General Public License, the Mozilla Public License, the Apache license, the MIT license, the BSD, and any BSD-like license, and any other license that meets the “Open Source Definition” promulgated by the Open Source Initiative.

7

(kkk) “Open Source Software” means any software code that is subject to the terms and conditions of an Open Source License.

(lll) “Order” means any binding judgment, order, writ, injunction, ruling or decree of, or any settlement under the jurisdiction of, any Court or Governmental Authority.

(mmm) “Parent Common Stock” means Parent’s common stock, par value $0.0277 per share, subject to the terms of the Restricted Stock Agreement.

(nnn) “Parent Trading Price” means the volume weighted average price per share of Parent Common Stock as reported on the New York Stock Exchange (“NYSE”) for the thirty (30) consecutive trading days ending on the trading day immediately preceding the Closing Date (as adjusted as appropriate to reflect any stock splits, stock dividends, combinations, reorganizations, reclassifications, or similar events).

(ooo) “Partnership Entities” means Platinum Homes, LLC, Wilkins Mobile Builders, LLC, Hamilton Home Builders, LLC, Hamilton Property Group, LLC, Winston Housing Group, LLC and Marion Property Group, LLC. For the avoidance of doubt, inclusion of an entity as a “Partnership Entity” shall not preclude or in any way limit such entity from being included in the “Company Group”.

(ppp) “Permits” means all franchises, authorizations, consents, approvals, licenses, registrations, certificates, orders, permits or other rights and privileges issued by any Governmental Authority.

(qqq) “Permitted Lien” means (i) Liens for Taxes not yet due and payable or that are being contested in good faith, (ii) covenants, restrictions, conditions, easements, easement agreements, rights of way, restrictions, title defects, zoning ordinances and other similar Liens affecting Company-Owned Real Property or Company Leased Real Property and, except for zoning ordinances, appearing in the official records of the jurisdiction in which such properties are located, (iii) purchase money or similar vendor Liens and Liens in favor of carriers, warehousemen, mechanics and materialmen, or other similar liens incurred in the ordinary course of business (and not as a result of a default under the applicable Contract) securing amounts that are not yet due and payable, (iv) Liens imposed by applicable state, federal and foreign securities Laws, (v) encroachments and other matters that would be shown in an accurate survey or physical inspection of each parcel of Company-Owned Real Property or Company Leased Real Property, (vi) zoning, building and other land use laws imposed by any Governmental Authority having jurisdiction over any Company-Owned Real Property or Company Leased Real Property, (vii) Liens to secure landlords, lessors or renters under leases or rental agreements confined to the premises rented, or (viii) any other non-monetary Liens that have been incurred or suffered in the ordinary course of business and that would not reasonably be expected to be, individually or in the aggregate, material and adverse to the business of the Company Group at the applicable Company-Owned Real Property or Company Leased Real Property.

(rrr) “Person” means an individual, corporation, partnership, association, trust, unincorporated organization, limited liability company or other entity or group (as defined in Section 13(d)(3) of the Exchange Act).

(sss) “Personal Information” means all information that identifies or can be used to identify an individual consumer or a device as that of an individual consumer, including: (a) name, physical address, telephone number, email address, financial account number, government-issued identifier (including social security number and driver’s license number), medical, health or insurance information, gender, date of birth, educational or employment information, religious or political views or affiliations, marital or other status, photograph, face geometry, or biometric information, and any other data used or intended to be used to identify, contact or precisely locate an individual; (b) any data regarding an individual’s activities online or on a mobile or other application (e.g., searches conducted, web pages or content visited or viewed) that is identifiable to an individual or unique device; (c) internet protocol addresses or other persistent identifiers; (d) individually identifiable health information; and (e) any information that is covered by the PCI DSS. Personal Information may relate to any individual, including a

8

current, prospective or former employee, customer, supplier, distributor or vendor of any Person. Personal Information includes information in any form, including paper, electronic and other forms.

(ttt) “Post-Closing Tax Period” means any taxable period (or portion of a Straddle Period) beginning after the Closing Date.

(uuu) “Pre-Closing Tax Period” means any taxable period (or portion of a Straddle Period) ending on or before the Closing Date.

(vvv) “Principal” means an officer, director, owner, partner, or a Person having primary management or supervisory responsibilities within a business entity (e.g., general manager; plant manager; head of a division or business segment; and similar positions).

(www) “Proceeding” means any legal, administrative, arbitral or other proceeding, suit, action or governmental or regulatory investigation before or by any Governmental Authority.

(xxx) “Processing” means any operation performed on Personal Information, including the collection, creation, receipt, access, use, handling, compilation, analysis, monitoring, maintenance, storage, transmission, transfer, protection, disclosure, destruction, or disposal of Personal Information.

(yyy) “Projections” means, collectively, any projections, business plan information, estimates, forecasts, budgets, pro-forma financial information or other statements communicated (orally or in writing) to or made available to Buyer or its Representatives of or regarding future revenues, profitability, expenses or expenditures, future results of operations (or any component thereof), future cash flows or future financial components (or any component thereof) of or regarding the Company Group.

(zzz) “Public Disclosure Record” means, as of any date, collectively, all of the documents which have been filed by or on behalf of Parent prior to such date with the relevant securities regulators pursuant to the requirements of applicable securities Laws, including all documents filed by Parent on EDGAR at www.sec.gov/edgar.

(aaaa) “Purchase Price Adjustment Escrow Amount” means an amount equal to Twenty-Five Million Dollars ($25,000,000).

(bbbb) “Purchase Price Adjustment Escrow Fund” means the Purchase Price Adjustment Escrow Amount, and all interest and earnings thereon, as may be reduced from time to time as a result of disbursements thereof pursuant to the Escrow Agreement.

(cccc) “R&W Insurance Policy” means the buyer’s representations and warranty insurance policy obtained by Buyers as of the date hereof, at Buyers’ and Sellers’ equal expense, and attached hereto as Exhibit A.

(dddd) “R&W Retention Amount” means cash in an amount equal to $1,207,500.00.

(eeee) “Reference Time” means 11:59 p.m., Central Standard Time, on the day immediately prior to the Closing Date.

(ffff) “Regulation” means any rule, regulation, policy or binding interpretation (regarding such rule, regulation or policy) of any Governmental Authority.

(gggg) “SALT Election” means any election under applicable state or local Income Tax Law made by or with respect to any entity in the Company Group or the income of such entity pursuant to which the entity will incur or otherwise be liable for any state or local Income Tax Liability under applicable state or local

9

Law that would have been borne (in whole or in part) by the direct or indirect equity owners of the entity had no such election been made (including any “Specified Income Tax Payment” as defined by IRS Notice 2020-75).

(hhhh) “Securities Act” means the U.S. Securities Act of 1933, as amended.

(iiii) “Sellers’ Representative Expense Amount” means cash in an amount equal to $100,000.

(jjjj) “Selling Expenses” means, in each case, solely to the extent incurred but not paid immediately prior to the Closing, (i) the fees and expenses payable by Sellers and/or the Company Group to Bass, Berry & Sims and any other attorneys engaged by the Company Group in connection with this Agreement and the transactions and other agreements contemplated by this Agreement, (ii) the fees and expenses payable by Sellers and/or the Company Group to other advisors engaged by the Company Group and incurred in connection with this Agreement and the transactions and other agreements contemplated by this Agreement, (iii) any severance, bonus, change of control, transaction bonus, “stay-around,” retention or similar bonuses or payment obligations, and other similar compensatory payments, in each case, only if triggered without the requirement of any further action following the Closing by Buyers, any member of the Company Group or any of their Affiliates (including any termination of employment or severance agreements following the Closing, including, for the avoidance of doubt, the employer-paid portion of any employment or payroll taxes, (iv) fees and expenses payable by Sellers in connection with the procurement of the Title Policies and Surveys, but expressly excluding any cost or expense of any endorsements requested by Buyers (which shall be at the sole cost and expense of Buyers), (v) 50% of the premiums for the Tail Policies, (vi) 50% of any Transfer Taxes, (vii) 50% of any fees or expenses payable to the Escrow Agent, (viii) 50% of any premiums or insurance costs for the R&W Insurance Policy, and (ix) 50% of any Filing fees (including HSR Act fees) with any Governmental Authority relating to the transactions contemplated hereby. Notwithstanding the foregoing, Selling Expenses does not include (A) any Company Closing Indebtedness, or (B) any amount included in the calculation of the Net Working Capital.

(kkkk) “Software” means any computer program, operating system, applications system, firmware, or software code of any nature, whether operational, under development or inactive, including all object code, source code, data files, rules or definitions and any derivations, updates, enhancements, and customization of any of the foregoing, and all Intellectual Property embodied with the foregoing, technical manuals, user manuals, and other documentation thereof, whether in machine-readable form, programming language, or any other language or symbols and whether stored, encoded, recorded, or written on disk, tape, film, memory device, paper, or other media of any nature.

(llll) “Straddle Period” means any taxable period beginning before and ending after the Closing Date.

(mmmm) “Stock Consideration Amount” means Twenty-Five Million Dollars ($25,000,000) of Parent Common Stock.

(nnnn) “Subsidiary” means, with respect to any Person, any corporation, partnership, joint venture, limited liability company or other legal entity of which such Person owns, directly or indirectly, greater than fifty percent (50%) of the Equity Interests that are generally entitled to vote for the election of the board of directors or other governing body of such corporation, partnership, joint venture, limited liability company or other legal entity or to vote as a general partner thereof.

(oooo) “Target Closing Date Net Working Capital” means $170,000,000.00.

(pppp) “Tax” or “Taxes” means any federal, state, local, foreign, and other income, excise, capital stock, profits, social security (or similar), disability, registration, value added, estimated, gross receipts, sales, use, production, ad valorem, transfer, franchise, license, lease, service, service use, withholding, payroll, employment, unemployment, excise, severance, stamp, occupation, premium, property (real or personal), real property gains, windfall profits, capital stock alternative or add-on minimum taxes, customs duties, escheat, unclaimed property, customs, duties, environmental, and other similar taxes, fees, assessments, or charges of any

10

kind, together with all interest, additions to tax, and penalties imposed by any Tax Authority (domestic or foreign) with respect thereto, whether disputed or not, and including any obligations to indemnify or otherwise assume or succeed to the Tax Liability of any other Person as a result of being a transferee, successor or member of a combined, consolidated, unitary or affiliated group, a contractual obligation to indemnify any Person or other entity, or otherwise.

(qqqq) “Tax Authority” means any Governmental Authority responsible for the imposition, assessment, reassessment or collection of any Taxes.

(rrrr) “Tax Returns” means all returns, declarations, reports, claims for refund and information statements and returns required or permitted to be filed with a Governmental Authority relating to Taxes, including any schedules attached to any of the foregoing.

(ssss) “Tax Sharing Agreement” means any Tax sharing, Tax allocation or Tax indemnification agreement (other than any agreement entered into in the ordinary course of business the principal purpose of which is not Taxes, including any customary Tax allocation, sharing or indemnification provisions in credit agreements, loans, leases and similar agreements entered into in the ordinary course of business).

(tttt) “Trade Secrets” means non-public information that derives commercial value from being confidential as defined under applicable Law, including ideas (whether or not patentable), know-how, inventions, processes, formulae, models, and methodologies.

(uuuu) “Transaction Documents” means this Agreement, the Release, the Restrictive Covenant Agreement, any Restricted Stock Agreement, any Assignment and Assumption Agreement, and Bringdown Certificate and the Escrow Agreement.

11

1.2 Table of Defined Terms. Terms that are not defined in Section 1.1 have the meanings set forth in the following Sections:

12

Adjustment Statement 2.11(a)

Agreement Preamble

Allocation Schedule 2.11(w)

Annual Financial Statements 3.8(a)

Arbitrating Accountant 2.11(c)

Balance Sheet Date 3.8(a)

Bass, Berry & Sims 2.11(e)

Binder Agreement Recitals

Buyer Preamble

Buyer Material Adverse Effect 4.4

Buyer Tax Return 9.1(b)

CARES Act 12.6

Closing 2.7

Closing Calculation 2.8

Closing Cash Amount 2.6

Closing Date 2.10

Company Group Privacy Policies 3.16(a)

Company Leased Real Property 3.13(b)

Company-Owned Real Property 3.13(b)

Confidentiality Agreement 5.2(b)

D&O Indemnified Person 6.1(d)

Deal Communications 12.11(a)

Employee Plan 3.11(a)

End Date 8.1(b)

Environmental Laws 3.18(f)(i)

ERISA 3.11(a)

Estimated Adjustment Amount 2.11(d)(i)

Final Adjustment Amount 2.11(d)(i)

Final Closing Date Cash on Hand 2.11(a)

Final Closing Date Net Working Capital 2.11(a)

Final Company Closing Assumed Indebtedness 2.11(a)

Final Company Closing Indebtedness 2.11(a)

Final Selling Expenses 2.11(a)

Financial Statements 3.8(a)

Flow-Through Tax Return 9.1(a)

Form Assignment and Assumption Agreement 2.11(p)

Hazardous Substances 3.18(f)(i)

Helicon Insurance Recitals

Indemnified Persons 6.1(a)

Interim Financial Statements 3.8(a)

Interim Breach 6.4

Interim Period 6.4

IP License 3.15(b)

Jenkins Preamble

Leases 3.15(b)

Malicious Code 3.15(f)

Material Contracts 3.19(b)

Material Customer 3.19(a)

Material Supplier 3.6(a)

Qualified Benefit Plan 3.11(b)

Parent Preamble

Post-Closing Representation 12.11(b)

Prior Company Counsel 12.11(b)

8

Prohibitive Order 7.1(d)

Protected Communications 12.11(a)

Protest Notice 2.11(b)

Purchase Price 2.2

Real Property 3.13(b)

Reference Balance Sheets 3.8(a)

Registered Intellectual Property 3.18(f)(iii)

Release 3.18(f)(iii)

Representatives 5.5

Restrictive Covenant Agreement 2.11(f)

Securities Recitals

Security Incident 3.16(e)

Seller(s) Preamble

Sellers’ Representative Preamble

Sellers’ Representative Expense Fund 2.3

Seller Tax Claim 9.3(b)

Specified Termination 8.3(a)

Stock Consideration 0

Tail Policies 6.1(d)

Tax Allocation 9.7

Tax Claim 9.3(a)

Transfer Taxes 9.5

WARN Act 3.12(b)

9

Article II.

SALE AND PURCHASE

2.1 Sale and Purchase of Securities. At the Closing, subject to the terms and conditions of this Agreement, (a) Sellers (and, with respect to Helicon Insurance, Dana Jenkins) shall sell, assign, transfer and convey to Buyers, and Buyers shall purchase from Sellers and Dana Jenkins, free and clear of all Liens (other than restrictions imposed by securities Laws), all of the Securities in the allocations set forth on the Allocation Schedule; and (b) in exchange for the sale, assignment, transfer and conveyance of the Securities to Buyers, Buyers shall pay to Sellers and to Dana Jenkins the Purchase Price in the allocations set forth on the Allocation Schedule.

2.2 Purchase Price. Subject to the adjustments set forth in this Agreement, the aggregate purchase price for the Securities (the “Purchase Price”) shall be an amount equal to the sum of: (a) $428,000,000 (the “Base Purchase Price”), plus (b) the Earnout Payment, if any, plus (c) the Stock Consideration Amount, plus (d) the D. Jenkins Stock Consideration Amount, minus (e) the Final Company Closing Assumed Indebtedness, minus (f) the unpaid Final Company Closing Indebtedness, minus (g) the unpaid Final Selling Expenses, plus (h) the Final Closing Date Cash on Hand (if a positive number), minus (i) the Final Closing Date Cash on Hand (if a negative number), plus (j) the amount by which the Final Closing Date Net Working Capital is greater than the Target Closing Date Net Working Capital, if any, minus (k) the amount by which the Final Closing Date Net Working Capital is less than the Target Closing Date Net Working Capital, if any, minus (l) the Customer Deposits Amount.

2.3 Payments at Closing for Selling Expenses. At least three (3) Business Days prior to the Closing Date, the Sellers’ Representative shall deliver to Buyers one or more statements or invoices, in customary form, from each obligee for each Selling Expense outstanding as of Closing as set forth on the Closing Calculation Statement (each, an “Expense Invoice”). Buyer shall pay by wire transfer of immediately available funds at the Closing to the applicable obliges any outstanding Selling Expenses, for and on behalf of Sellers as set forth on the Closing Calculation Statement. Buyer shall pay by wire transfer of immediately available funds at the Closing the Sellers’ Representative Expense Amount to an account (the “Sellers’ Representative Expense Fund”) to be held by the Sellers’ Representative, for and on behalf of the Sellers, in accordance with the terms of this Agreement.

2.4 Payment at Closing for Company Closing Indebtedness. At least three (3) Business Days prior to the Closing Date, the Sellers’ Representative shall deliver to Buyer one or more payoff letters, in customary form and substance, from each obligee for each item of Company Closing Indebtedness as set forth on the Closing Calculation Statement (each, a “Payoff Letter”) and shall provide reasonable assurance that promptly following payment to the Person that has issued the Payoff Letter of the amount stated or described in the Payoff Letter, all Liens of such Person on any tangible and intangible assets of the Company Group shall be released and discharged. Buyer shall pay by wire transfer of immediately available funds at the Closing any outstanding Company Closing Indebtedness, for and on behalf of Sellers, as set forth on the Closing Calculation Statement.

2.5 Payment at Closing of Escrow Amounts. Buyer shall pay by wire transfer of immediately available funds at the Closing the Purchase Price Adjustment Escrow Amount and the Indemnification Escrow Amount to the Escrow Agent, for and on behalf of Sellers, for deposit into one or more escrow accounts to be held by the Escrow Agent in accordance with the terms of this Agreement and the Escrow Agreement.

2.6 Payment at Closing of Closing Cash Amount. At the Closing, Buyers shall pay or cause to be paid by wire transfer of immediately available funds to Sellers at the Closing, in the allocations set forth on Annex A, an aggregate amount equal to the sum of: (a) the Base Purchase Price, minus (b) the Estimated Company Closing Assumed Indebtedness, minus (c) the unpaid Estimated Company Closing Indebtedness, minus (d) the unpaid Estimated Selling Expenses, plus (e) the Estimated Closing Date Cash on Hand (if a positive number), minus (f) the Estimated Closing Date Cash on Hand (if a negative number), plus (g) the amount by which the Estimated Closing Date Net Working Capital is greater than the Target Closing Date Net Working Capital, if any, minus (h) the amount by which the Estimated Closing Date Net Working Capital is less than the Target Closing Date Net Working Capital, if any, minus (i) the Purchase Price Adjustment Escrow Amount, minus (j) the Indemnification

9

Escrow Amount, minus (k) the Sellers’ Representative Expense Amount, minus (l) the Estimated Customer Deposits Amount (such net amount being, the “Closing Cash Amount”).

2.7 Issuance at Closing of the Stock Consideration. At the Closing, Buyer shall cause Parent to issue to the Sellers, in the allocations set forth on Annex A, and pursuant to the terms of the Restricted Stock Agreement, an aggregate number of shares of Parent Common Stock equal to the quotient obtained by dividing (a) the Stock Consideration Amount by (b) the Parent Trading Price (the “Stock Consideration”) free and clear of all Liens (other than restrictions imposed by securities Laws and the Restricted Stock Agreement). The Stock Consideration shall be issued in non-certificated book-entry form. Buyer shall also cause Parent to issue to Dana Jenkins, in the allocations set forth on Annex A and pursuant to the terms of the Restricted Stock Agreement, an aggregate number of shares of Parent Common Stock equal to the quotient obtained by dividing (a) D. Jenkins Stock Consideration Amount by (b) the Parent Trading Price (the “D. Jenkins Stock Consideration”), with such shares to be issued in free and clear of all Liens (other than restrictions imposed by securities laws and the Restricted Stock Agreement) and in non-certificated book-entry form.

(a) Immediately following the Closing, the Sellers receiving the Stock Consideration shall place and deposit the Stock Consideration with the Escrow Agent by directing the transfer agent for Parent to deposit the Stock Consideration with the Escrow Agent in the Indemnification Escrow Fund to be held and released pursuant to the terms of this Section 2.7 and the Escrow Agreement.

(b) The Stock Consideration shall be held in escrow to satisfy claims made by the Buyer Indemnitees for satisfaction of indemnification claims in accordance with the terms and conditions set forth in this Section 2.7 and Article X. The Escrow Agent will hold the Stock Consideration in accordance with the terms of the Escrow Agreement. If Sellers become obligated (whether through mutual agreement between Buyers and the Sellers’ Representative, as a result of a non-appealable, final determination by a Court of competent jurisdiction or otherwise determined in accordance with the terms of this Agreement) to make a payment to a Buyer Indemnitee from the Indemnification Escrow Fund (such dollar amount, as determined from time to time pursuant to this Agreement, an “Indemnification Escrow Claim Dollar Amount”), then, unless the Sellers’ Representative otherwise elects (at its sole discretion) upon written notice to Buyer of Sellers’ Representative’s election to satisfy such amount in cash, Buyers and the Sellers’ Representative shall promptly execute and deliver joint written instructions to the Escrow Agent to disburse to Buyers or another Buyer Indemnitee a number of shares of Parent Common Stock from the Indemnification Escrow Fund equal to the applicable Indemnification Escrow Claim Dollar Amount divided by (y) the Parent Trading Price. Notwithstanding the foregoing, the Sellers’ Representative can elect, in his sole discretion, to settle any such claim in cash.