Filed by CopperSteel HoldCo, Inc. pursuant to Rule 425 under the Securities

Act of 1933 Subject Company: Six Flags Entertainment Corporation Commission File No. 1-13703 Date: November 2, 2023 Investor Presentation

Disclaimer (1/2) Forward Looking Statements This presentation contains

certain “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements,

other than statements of historic fact, included in this presentation that address activities, events or developments that Cedar Fair or Six Flags expects, believes or anticipates will or may occur in the future are forward-looking statements. Words

such as “anticipate,” “believe,” “create,” “expect,” “future,” “guidance,” “intend,” “plan,” “potential,” “seek,”

“target,” “synergies,” “will,” “would,” similar expressions, and variations or negatives of these words identify forward-looking statements. However, the absence of these words does not mean that the

statements are not forward-looking. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed transaction and the anticipated benefits thereof. All

such forward-looking statements are based upon current plans, estimates, expectations and ambitions that are subject to risks, uncertainties and assumptions, many of which are beyond the control of Cedar Fair and Six Flags, and that could cause

actual results to differ materially from those expressed in such forward-looking statements. Important risk factors that may cause such a difference include, but are not limited to: the expected timing and likelihood of completion of the proposed

transaction, including the timing, receipt and terms and conditions of any required governmental and regulatory approvals of the proposed transaction and Six Flags stockholder approval; anticipated tax treatment, unforeseen liabilities, future

capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the combined

company’s operations and other conditions to the completion of the proposed transaction, including the possibility that any of the anticipated benefits of the proposed transaction will not be realized or will not be realized within the

expected time period; the occurrence of any event, change or other circumstances that could give rise to the termination of the merger agreement; the outcome of any legal proceedings that may be instituted against Cedar Fair, Six Flags or their

respective directors and others following announcement of the merger agreement and proposed transaction; the inability to consummate the transaction due to the failure to satisfy other conditions to complete the transaction; risks that the proposed

transaction disrupts and/or harms current plans and operations of Cedar Fair or Six Flags, including that management’s time and attention will be diverted on transaction-related issues; the amount of the costs, fees, expenses and charges

related to the transaction, including the possibility that the transaction may be more expensive to complete than anticipated; the ability of Cedar Fair and Six Flags to successfully integrate their businesses and to achieve anticipated synergies

and value creation; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the proposed transaction; legislative, regulatory and economic developments and changes in laws, regulations, and

policies affecting Cedar Fair and Six Flags; potential business uncertainty, including the outcome of commercial negotiations and changes to existing business relationships during the pendency of the proposed transaction that could affect Cedar

Fair’s and/or Six Flags’ financial performance and operating results; acts of terrorism or outbreak of war, hostilities, civil unrest, and other political or security disturbances; the impacts of pandemics or other public health crises,

including the effects of government responses on people and economies; risks related to the potential impact of general economic, political and market factors on the companies or the proposed transaction; those risks described in Item 1A of Cedar

Fair’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on February 17, 2023, and subsequent reports on Forms 10-Q and 8-K; those risks described in Item 1A of Six Flags’ Annual Report

on Form 10-K, filed with the SEC on March 7, 2023, and subsequent reports on Forms 10-Q and 8-K; and those risks that will be described in the registration statement on Form S-4 and accompanying proxy statement/prospectus available from the sources

indicated below. These risks, as well as other risks associated with the proposed transaction, will be more fully discussed in the registration statement on Form S-4 that will be filed by CopperSteel HoldCo, Inc. (“HoldCo”) with the SEC

in connection with the proposed transaction, which will contain a prospectus relating to the issuance of HoldCo securities in the proposed transaction and a proxy statement relating to the special meeting of the stockholders of Six Flags. While the

list of factors presented here is, and the list of factors to be presented in the registration statement on Form S-4 will be, considered representative, no such list should be considered to be a complete statement of all potential risks and

uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. The ability of Cedar Fair or Six Flags to achieve the goals for the proposed transaction may also be affected by our

ability to manage the factors identified above. We caution you not to place undue reliance on any of these forward-looking statements as they are not guarantees of future performance or outcomes and actual performance and outcomes may differ

materially from those made in or suggested by the forward-looking statements contained in this presentation. Neither Cedar Fair nor Six Flags assumes any obligation to publicly provide revisions or updates to any forward-looking statements, whether

as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws. 2

Disclaimer (2/2) Important Information about the Transaction and Where to

Find It In connection with the proposed transaction, Cedar Fair and Six Flags will cause HoldCo to file with the SEC a registration statement on Form S-4 that will include a proxy statement of Six Flags and a prospectus of HoldCo. A definitive proxy

statement/prospectus will be mailed to stockholders of Six Flags. Cedar Fair, Six Flags and HoldCo may also file other documents with the SEC regarding the proposed transaction. This presentation is not a substitute for the registration statement,

proxy statement/prospectus or any other document that Cedar Fair, Six Flags or HoldCo (as applicable) may file with the SEC in connection with the proposed transaction. BEFORE MAKING ANY VOTING AND/OR INVESTMENT DECISION, INVESTORS AND SECURITY

HOLDERS OF CEDAR FAIR AND SIX FLAGS ARE URGED TO READ THE REGISTRATION STATEMENT, THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE

DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the

registration statement and the proxy statement/prospectus (when they become available), as well as other filings containing important information about Cedar Fair or Six Flags, without charge at the SEC’s Internet website (http://www.sec.gov).

Investors and security holders may obtain free copies of the registration statement and the proxy statement/prospectus (when available) and other documents filed with the SEC by Cedar Fair, Six Flags and HoldCo through the web site maintained by the

SEC at www.sec.gov or by contacting the investor relations department of Cedar Fair or Six Flags at the following: Cedar Fair Six Flags Investor Contact: Michael Russell, 419.627.2233 Evan Bertrand VP, Investor Relations and Treasurer Media Contact:

Gary Rhodes, 704.249.6119 +1-972-595-5180 investorrelations@sftp.com The information included on, or accessible through, Cedar Fair’s or Six Flags’ website is not incorporated by reference into this presentation. Participants in the

Solicitation Cedar Fair, Six Flags, HoldCo and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from Six Flags stockholders in respect of the proposed transaction. Information

regarding Cedar Fair’s directors and executive officers, including a description of their direct interests, by security holdings or otherwise, is contained in Cedar Fair’s Form 10-K for the year ended December 31, 2022 filed with the SEC

on February 17, 2023 and its proxy statement filed with the SEC on April 13, 2023, and subsequent statements of changes in beneficial ownership on file with the SEC. Information regarding Six Flags’ directors and executive officers, including

a description of their direct interests, by security holdings or otherwise, is contained in Six Flags’ Form 10-K for the year ended January 1, 2023 filed with the SEC on March 7, 2023 and its proxy statement filed with the SEC on March 28,

2023, and subsequent statements of changes in beneficial ownership on file with the SEC. Additional information regarding the participants in the proxy solicitations and a description of their direct or indirect interests, by security holdings or

otherwise, will be contained in the proxy statement/prospectus and other relevant materials filed with the SEC when they become available. No Offer or Solicitation This presentation is for informational purposes and is not intended to, and shall

not, constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of

1933, as amended. 3

Creating a Well-Diversified Leading Amusement Park Operator ▪

Bringing together two iconic businesses to create an expanded portfolio of 42 parks and 9 resort properties across North America Enhanced Footprint and Increased Diversification ▪ Complementary geographic footprints enhance diversification and

reduce dependency on any single park or geography, of Portfolio mitigating weather risk ▪ Combine complementary operating capabilities to create a more robust operating platform for improved park offerings and more efficient systemwide

performance Enhanced Guest Value ▪ Leverage Cedar Fair’s recent park investments experience to accelerate the transformation underway across Six Flags’ portfolio Proposition ▪ Bring together technology platforms and data

analytics capabilities to create a more engaging and immersive guest experience ▪ Combined loyalty program will provide guests with increased access and additional perks ▪ HoldCo expects to capture potential $200 million in annual

synergies Identified and Highly- — $120mm of identified cost savings realized within 2 years of transaction close Achievable Synergies — $80mm of incremental EBITDA uplift from improved guest experience expected to be realized within 3

years of transaction close ▪ Synergies drive meaningful deleveraging, with combined company expected to have ~3.0x Net Debt / Adj. EBITDA within 2 years of Optimized Balance Sheet transaction close Significant Free Cash Flow Generation and

▪ Cash flow profile and strong balance sheet create flexibility to increase in-park investments to grow attendance, increase per capita spending, and improve profitability, all while enhancing the guest experience across the park portfolio

Enhanced Financial Flexibility 4

Transaction Overview ▪ Combined company to be named Six Flags, and

trade as FUN on NYSE Combined Company ▪ Headquartered in Charlotte, North Carolina Overview Former Former ▪ Cedar Fair unitholders receive HoldCo C Corp shares at 1.000x exchange ratio ▪ Six Flags shareholders receive HoldCo C Corp

shares at 0.5800x exchange ratio, (the “Six Flags Exchange Ratio”) and a special dividend composed of: Unitholders Shareholders i. $1.00 per outstanding Six Flags share, totaling approximately $85 million in the aggregate, plus, 51.2%

48.8% ii. An amount per outstanding Six Flags share equal to (a) the aggregate per unit distributions declared or paid by Cedar Fair to unitholders with a record date Transaction Details after today and prior to the close of the transaction

multiplied by (b) the Six CopperSteel Flags Exchange Ratio HoldCo, Inc. (“HoldCo”) ▪ Implied fully diluted pro forma ownership at close: Cedar Fair unitholders ~51.2%, Six (C Corp to be listed on NYSE; Flags shareholders ~48.8%

Ticker Symbol: FUN) ▪ Cedar Fair MLP structure will be dissolved upon transaction close ▪ Transaction structure does not trigger change of control provisions for either Six Flags’ or Cedar Fair’s notes, minimizing refinancing

needs for both companies ▪ Executive Chairman: Selim Bassoul ▪ CEO: Richard Zimmerman Assets Assets ▪ CFO: Brian Witherow ▪ Chief Integration Officer: Gary Mick Leadership & ▪ Board will consist of 12 directors; 6

nominated by Six Flags and 6 nominated by Governance Cedar Fair ▪ Integration Committee comprised of Richard Zimmerman, Selim Bassoul, Ben Baldanza, and Daniel Hanrahan focused on synergy realization and integration 5

Transaction Overview (Continued) ▪ Transaction expected to be

accretive to adjusted EPS for both Six Flags Former Former shareholders and Cedar Fair unitholders within 12 months of transaction close ▪ $120mm of identified cost savings realized within 2 years of transaction close Financial Impact ▪

$80mm of incremental EBITDA uplift from improved guest experience expected to Unitholders Shareholders be realized within 3 years of transaction close 51.2% 48.8% ▪ Pro forma net leverage of ~3.7x assuming $120mm of run-rate cost savings and 1

revenue uplift resulting in $80mm of incremental EBITDA CopperSteel ▪ Path to delever to ~3.0x Net Leverage within 2 years of transaction close HoldCo, Inc. (“HoldCo”) ▪ Key capital allocation priorities: (C Corp to be listed

on NYSE; Capital Structure — Investments in guest experience and new rides and attractions Ticker Symbol: FUN) — Reduce leverage — Return capital to shareholders; committed to capital returns after delevering to ~3.0x Net Leverage

▪ Transaction unanimously approved by the Board of Directors of Six Flags and Assets Assets Cedar Fair ▪ Expected completion in first half of 2024 following Six Flags shareholder approval Timing and receipt of regulatory clearance

▪ No unitholder vote will be required from Cedar Fair’s unitholders, as Cedar Fair will own greater than 51% of the combined company 1 Based on Q3’23 LTM combined Net Debt of $4,390 million and combined Q3’23 LTM Adjusted

EBITDA (incl. RR synergies) of $1.2 billion. 6

Enhancing the Guest Experience More diversified guest experience across

various live entertainment formats including amusement parks, water parks, resorts, safaris and campgrounds Partnerships with leading entertainment businesses and a portfolio of beloved IP such as Looney Tunes, DC Comics and PEANUTS to develop

engaging new attractions More robust operating platform for improved park offerings and more efficient systemwide performance Leverage Cedar Fair’s recent park investments experience to accelerate Six Flags’ portfolio transformation

Combined technology platforms and data analytics capabilities to help create a more engaging and immersive guest experience Greater flexibility to invest in new rides and attractions, broader food and beverage selections, additional in-park

offerings, and cross-park initiatives Expanded park access offerings to season pass holders and combined loyalty program featuring additional perks 77

Expanded IP Portfolio to Develop Engaging New Attractions and In-Park

Offerings 8

42 Parks to Maximize the Guest Experience Q3 2023 LTM Financial Metrics

Parks 15 27 42 26 million 22 million 48 million Attendance 2 Revenue $1.8 billion $1.4 billion $3.4 billion (Incl. Uplift) 1 2 Adjusted EBITDA $527 million $462 million $1.2 billion (Incl. Synergies) Adjusted | Modified 2 36 % 29 % 36 % 3 EBITDA

Margin (Incl. Synergies) 4 2,5 $312 million $314 million $826 million Free Cash Flow (Incl. Synergies) 7 3.7 x 6 Net Leverage 4.1 x 4.8 x (Incl. Synergies) 1 2 Adjusted EBITDA for Six Flags excludes the net income attributable to non-controlling

interests in the Adjusted EBITDA of partnership parks. Reflects combined company run rate cost savings of $120mm and revenue uplift 3 resulting in $80mm of incremental EBITDA. Represents Adjusted EBITDA margin for Cedar Fair, and Modified EBITDA

margin, including third party EBITDA interests in partnership parks, for both Six Flags and the combined company. 4 5 Free Cash Flow (FCF) defined as Adjusted EBITDA less CapEx. Excludes $65mm of one-time implementation costs and $90mm of

incremental CapEx at the combined company, which do not represent run-rate view of FCF post- 6 7 synergies. Net leverage multiples computed as Net Debt divided by Adjusted EBITDA. Combined company Net Debt based on Q3’23 LTM combined Net Debt

of $4,390 million and combined Q3’23 LTM Adjusted EBITDA (incl. 9 RR synergies) of $1.2 billion.

Combined Portfolio Delivers Well-rounded Guest Experience Across Various

Entertainment and Travel Formats Amusement Parks 11 16 27 Water Parks 4 11 15 Hotels / Resort Properties 7 2 9 Campgrounds 5 2 7 Safaris / Animal Experiences - 2 2 Sports Facilities 2 - 2 Marinas 3 - 3 10

Complementary Portfolio Delivers Greater Value to Customer Through

Expanded Season Pass and Operational Efficiencies Select Benefits of Combined Footprint Midwest ✓ Enhances guest experience ✓ Parks: 10 by increasing access to a ✓ Aggregate wider variety of iconic parks Attendance: and other

formats of live 12.5mm entertainment Northeast ✓ Creates operational efficiencies at regional level✓ Parks: 10 ✓ Mitigates seasonality and ✓ Aggregate earnings volatility Attendance: 11.4mm West ✓ Parks: 8

Southeast South ✓ Aggregate ✓ Parks: 4 ✓ Parks: 10 Attendance: 10.9mm ✓ Aggregate ✓ Aggregate Attendance: 5.2mm Attendance: 8.1mm Parks Parks Note: Attendance figures represent Q3’23 LTM 11

Compelling Financial Benefits to Combination 1 Combined Q3’23 LTM

Adj. EBITDA of $1.2 billion, including synergies Highly realizable cost saving plus additional revenue uplift opportunities resulting 1 in $200 million estimated annual run rate synergies Diversification of park portfolio across regions and various

entertainment and travel formats to mitigate weather-related and season earnings volatility Opportunity to accelerate growth driven by enhanced value proposition for guests and season pass holders across the portfolio Transaction expected to be

accretive to adjusted EPS for both Six Flags shareholders and Cedar Fair unitholders within 12 months of transaction close Transaction structure does not trigger change of control provisions for either Six Flags’ or Cedar Fair’s notes,

minimizing refinancing needs for both companies Strong combined balance sheet with attractive cash flow profile allowing for increased investments in guest experience and amusement parks Free cash flow from run-rate synergies with limited

incremental capex to support investments in guest experience and drive meaningful deleveraging 1 Reflects combined company run rate cost savings of $120mm and revenue uplift resulting in $80mm of incremental EBITDA. 12

Diversified Geographic Footprint Mitigates Weather-Related and Seasonal

Earnings Volatility and Increases Visibility Northeast Midwest Northeast 13% 14% 17% Midwest 29% South South Midwest 39% 16% 42% Northeast 22% South 27% West West West 29% 27% 25% No single geography expected to contribute greater than 30% of

Park-level EBITDA; No single park expected to contribute greater than 17% of Park-level EBITDA Note: Geographic breakdowns based on Q3’23 LTM; West: Arizona, California; Northeast: Canada, Massachusetts, Maryland, New Jersey, New York,

Pennsylvania; South: Georgia, Mexico, North Carolina, Oklahoma, 13 Texas, Virginia; Midwest: Illinois, Michigan, Minnesota, Missouri, Ohio

Identified and Highly Achievable Cost Savings of $120mm Within 2 Years of

Transaction Close Sources of $120mm Identified Cost Savings % of Cost Savings Realized ~ 100 % Procurement, Advertising & IT / Technology ~20% ~ 65 % Corporate Costs ~55% Operating Efficiencies ~25% Within 1 Year Within 2 Years Cost savings

expected to be realized within 2 years of transaction close 14

Combined Footprint, IP Portfolio and Management Knowhow Will Deliver

Improved Guest Experience and Unlock $80mm of Incremental EBITDA from Revenue Uplift Enhanced Season Optimized Flash Pass / Improved Food & Expanded IP Portfolio Pass Program Fast Lane Program Merchandise Offerings ~$40M EBITDA benefit ~$40M

EBITDA benefit P Season Pass holders represent ~55% of 2023E attendance for both Six Flags and Cedar Fair but most only visit 1-2 parks P Shared best practices across Food & Merchandise guest experience to be applied across combined

portfolio P Rollout of combined season pass program providing access to all parks of combined company enhances customer value while P IP universe to include Six Flags’ licenses to Warner Bros and DC increasing potential utilization and

in-park spend versus Out-of-Home Comics and Cedar Fair’s license to Peanuts’ Snoopy and Charlie Entertainment alternatives Brown P Fully optimized Flash Pass / Fast Lane Program EBITDA uplift expected to be realized within 3 years of

transaction close 15

Enhanced Cash Flow and Optimized Balance Sheet — Run-rate cost

savings and incremental growth opportunities drive meaningful deleveraging — Incremental free cash flow generation enables investments that enhance the guest experience and create shareholder value 1 Net Leverage over Time Free Cash Flow (Adj.

EBITDA – CapEx) 5 % Conversion ~ 68 % ~ 59 % ~70 % $ 826 4.8 x 4.1 x 3.7 x ~3.0 x $ 314 $ 312 SIX FUN Combined Company Combined Company SIX FUN Combined Standalone Standalone (Incl. RR Synergies) (Incl. RR Synergies) Standalone Standalone

Company 2 3 4 (Q3'23 LTM) (Q3'23 LTM) (Q3'23 LTM) (Within 2 Years) (Q3'23 LTM) (Q3'23 LTM) (Incl. Synergies) 6,7 (Q3'23 LTM) 1 2 3 Net leverage multiples computed as Net Debt divided by Adjusted EBITDA. Adjusted EBITDA for Six Flags excludes the net

income attributable to non-controlling interests in the Adjusted EBITDA of partnership parks. Combined 4 company Net Debt based on Q3’23 LTM combined Net Debt of $4,390 million and combined Q3’23 LTM Adjusted EBITDA (incl. RR synergies)

of $1.2 billion. Combined company path to ~3.0x Net Leverage within 2 years of 5 6 transaction close. Conversion defined as FCF (Adjusted EBITDA less CapEx) divided by Adjusted EBITDA. Combined company FCF reflects combined company run rate cost

savings of $120mm and revenue uplift resulting in 7 $80mm of incremental EBITDA. Combined company FCF excludes $65mm of one-time implementation costs and $90mm of incremental CapEx at the combined company, which do not represent a run-rate view of

FCF post- 16 synergies.

Path to Completion Merger expected to close in the first half of 2024,

following receipt of Six Flags shareholder approval, regulatory approvals, and satisfaction of other customary closing conditions. Complete Pre-Merger Integration Refinance Six Q4 2023 1H 2024 Commitments Preparation Flags Term Loan TRANSACTION

TARGET for Revolver and ANNOUNCED Cedar Fair Bonds TRANSACTION Six Flags Consent Solicitation CLOSE Shareholder Vote 17

Creating a Well-Diversified Leading Amusement Park Operator ▪

Bringing together two iconic businesses to create an expanded portfolio of 42 parks and 9 resort properties across North America Enhanced Footprint and Increased Diversification ▪ Complementary geographic footprints enhance diversification and

reduce dependency on any single park or geography, of Portfolio mitigating weather risk ▪ Combine complementary operating capabilities to create a more robust operating platform for improved park offerings and more efficient systemwide

performance Enhanced Guest Value ▪ Leverage Cedar Fair’s recent park investments experience to accelerate the transformation underway across Six Flags’ portfolio Proposition ▪ Bring together technology platforms and data

analytics capabilities to create a more engaging and immersive guest experience ▪ Combined loyalty program will provide guests with increased access and additional perks ▪ HoldCo expects to capture potential $200 million in annual

synergies Identified and Highly- — $120mm of identified cost savings realized within 2 years of transaction close Achievable Synergies — $80mm of incremental EBITDA uplift from improved guest experience expected to be realized within 3

years of transaction close ▪ Synergies drive meaningful deleveraging, with combined company expected to have ~3.0x Net Debt / Adj. EBITDA within 2 years of Optimized Balance Sheet transaction close Significant Free Cash Flow Generation and

▪ Cash flow profile and strong balance sheet create flexibility to increase in-park investments to grow attendance, increase per capita spending, and improve profitability, all while enhancing the guest experience across the park portfolio

Enhanced Financial Flexibility 18

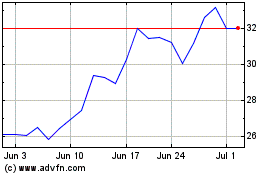

Six Flags Entertainment (NYSE:SIX)

Historical Stock Chart

From Apr 2024 to May 2024

Six Flags Entertainment (NYSE:SIX)

Historical Stock Chart

From May 2023 to May 2024