Rogers Accelerates De-Leveraging Plans With Private Sale of Cogeco Shares

December 11 2023 - 4:35PM

Rogers Communications announced today the sale of all of its shares

of Cogeco to Caisse de dépôt et placement du Québec in a

private transaction for $829 million.

“This sale further demonstrates our commitment to

strengthen our investment grade balance sheet and aggressively

reduce our debt leverage ratio,” said Tony Staffieri, President and

Chief Executive Officer, Rogers. “We’re tracking six months ahead

on our deleveraging priorities and we’re committed to reducing our

debt leverage ratio even further.”

Accelerates Deleveraging PlansWith the sale of

these Cogeco shares, the Company expects to achieve a debt leverage

ratio of 4.7x by year end, compared to the expected 4.8x at

year end announced on the release of its third quarter

results. The Company’s debt leverage ratio was 4.9x at the end of

Q3. Today’s sale proceeds are in addition to the

previously announced divestiture of $1 billion in non-core

assets, predominantly real estate, that is expected to be

completed in 2024.[1]

About Rogers Communications Inc.Rogers is

Canada’s leading wireless, cable and media company that provides

connectivity and entertainment to Canadian consumers and businesses

across the country. RCI’s shares are publicly traded on the Toronto

Stock Exchange (TSX: RCI.A and RCI.B) and the New York Stock

Exchange (NYSE: RCI).

For more information:

Rogers Communications media contactSarah

Schmidt647.643.6397media@rci.rogers.com

Rogers Communications investment community

contactPaul

Carpino647.435.6470paul.carpino@rci.rogers.com

________________________[1] The debt leverage ratio

presented in this press release is a non-GAAP ratio calculated to

include the trailing 12-month adjusted EBITDA of a combined Rogers

and Shaw Communications. For more information about our debt

leverage ratio and associated financial measures, see "Financial

Condition" and "Non-GAAP and Other Financial Measures" in our Third

Quarter 2023 Management Discussion and Analysis dated November 8,

2023 (Q3 2023 MD&A), which is

available at www.sedarplus.ca and sec.gov. This

release contains "forward-looking information" within the

meaning of applicable securities laws; see “About Forward-Looking

Information” in our 2022 Annual MD&A and Q3 2023 MD&A.

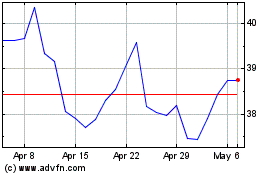

Rogers Communications (NYSE:RCI)

Historical Stock Chart

From Apr 2024 to May 2024

Rogers Communications (NYSE:RCI)

Historical Stock Chart

From May 2023 to May 2024