UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-40692

Riskified Ltd.

(Translation of the registrant's name into English)

Riskified Ltd.

Europe House

Sderot Sha’ul HaMelech 37

Tel Aviv-Yafo, Israel

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

EXPLANATORY NOTE

Riskified Ltd. (the “Company”) previously announced on August 15, 2023, that its Board of Directors had authorized a program to repurchase up to $75 million of the Company’s ordinary shares (the "Repurchase Program"), subject to the receipt of approval from the Tel Aviv District Court Economic Department (the "Israeli Court"), as required by law.

On November 20, 2023, the Company issued a press release announcing that it had received approval from the Israeli Court for the implementation of the Repurchase Program. The Israeli Court Approval is valid through May 19, 2024. The Company may file extension requests with the Israeli Court on an ongoing basis as required. A copy of the press release is furnished as Exhibit 99.1 hereto.

The information in this Report on Form 6-K (including in Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act.

EXHIBIT INDEX

The following exhibit is furnished as part of this Report on Form 6-K:

| | | | | | | | |

| Exhibit No. | | Description |

| |

| 99.1 | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| | Riskified Ltd. | |

| | (Registrant) | |

| | | |

| | By: | /s/ Eido Gal | |

| Date: November 20, 2023 | Name: | Eido Gal | |

| Title: | Chief Executive Officer | |

Exhibit 99.1

Riskified Receives Israeli Court Approval for $75M Share Repurchase Program

NEW YORK, NY / November 20, 2023 / Businesswire / Riskified Ltd. (NYSE: RSKD), a leader in eCommerce fraud and risk intelligence, today announced that it has received approval from the Tel Aviv District Court Economic Department (“Israeli Court”) to implement its previously announced share repurchase program (the “Repurchase Program”), pursuant to which the Company may repurchase up to $75 million of its ordinary shares. The Israeli Court approval is valid through May 19, 2024. The Company may file extension requests with the Israeli Court on an ongoing basis as required.

Eido Gal, Chief Executive Officer, stated: “We are pleased to announce that the Israeli Court has approved our Repurchase Program. We expect to leverage this program to take advantage of attractive repurchasing opportunities and to manage share dilution. Our strong balance sheet enables us to continue investing in the growth of the business, while simultaneously driving shareholder value by executing this Repurchase Program.”

The Repurchase Program, approved by the Company's Board of Directors (the "Board") on August 8, 2023, authorizes the Company to repurchase ordinary shares, from time to time in the open market, including through trading plans intended to qualify under Rule 10b5-1 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), in privately negotiated transactions or by other means in accordance with U.S. federal securities laws. The Company may repurchase all or a portion of the authorized amount. The timing, as well as the number and value of any shares repurchased under the program, will be determined by the Company at its discretion under the Board authorized program and will depend on a variety of factors, including management's assessment of the intrinsic value of the Company's ordinary shares, the market price of the Company's ordinary shares, general market and economic conditions, available liquidity, alternative investment opportunities, and applicable legal requirements. The Repurchase Program does not obligate the Company to repurchase any specific number of ordinary shares and may be suspended, modified or discontinued at any time without prior notice. The share repurchases will be funded from existing cash and cash equivalents.

About Riskified

Riskified (NYSE:RSKD) empowers businesses to grow eCommerce revenues and profit by mitigating risk. An unrivaled network of merchant brands partner with Riskified for guaranteed protection against chargebacks, to fight fraud and policy abuse at scale, and to improve customer retention. Developed and managed by the largest team of eCommerce risk analysts, data scientists and researchers, Riskified’s AI-powered fraud and risk intelligence platform analyzes the individual behind each interaction to provide real-time decisions and robust identity-based insights. Learn more at riskified.com.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. We intend such forward-looking statements to be covered by the safe harbor provisions for forward looking statements contained in Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements contained in this press release other than statements of historical fact, including, without limitation, statements regarding the implementation and anticipated benefits of the Share Repurchase Program are forward looking statements, which reflect our current views with respect to future events and are not a guarantee of future performance. The words “believe,” “may,” “will,” “estimate,” “potential,” “continue,” “anticipate,” “intend,” “expect,” “could,” “would,” “project,” “forecasts,” “aims,” “plan,” “target,” and similar expressions are intended to identify forward-looking statements, though not all forward-looking statements use these words or expressions. The forward-looking statements contained in this press release are subject to various risks and uncertainties, including those discussed under the heading “Risk Factors” in our annual report on Form 20-F filed with the Securities and Exchange Commission (“SEC”) on February 24, 2023, and in any subsequent filings with the SEC. Except as otherwise required by law, the Company undertakes no obligation to publicly release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof.

Investor Relations:

Chett Mandel

Head of Investor Relations

ir@riskified.com

Corporate Communications:

Cristina Dinozo

Senior Director of Communications

press@riskified.com

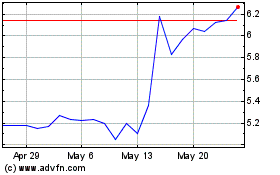

Riskified (NYSE:RSKD)

Historical Stock Chart

From Apr 2024 to May 2024

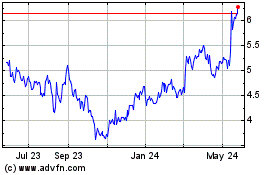

Riskified (NYSE:RSKD)

Historical Stock Chart

From May 2023 to May 2024