Price Hikes Help Ralph Lauren Boost Profits -- Update

November 07 2019 - 1:27PM

Dow Jones News

By Suzanne Kapner

Ralph Lauren Corp. posted higher quarterly profit as the luxury

apparel maker pushes through price increases, helping offset some

of the rising costs due to tariffs on products imported from

China.

The Polo maker has been pulling back on promotions and

increasing prices in Asia and Europe. On a conference call

Thursday, Chief Executive Patrice Louvet said the company began

raising prices slightly at its North American outlet stores in late

September, and plans targeted price increases with its wholesale

partners and at its own full-line stores starting with its spring

2020 assortments.

Ralph Lauren's shares jumped more than 13% in Thursday trading

after the company reported higher-than-expected profit for its

fiscal second quarter. Net income was $182.1 million in the three

months to Sept. 28, up from $170.3 million a year earlier. The

profit growth was driven by higher gross margin and expense

control.

Total revenue was $1.71 billion, compared with $1.69 billion a

year earlier. North American sales fell 1%, dragged down by a 6%

decline in sales to third parties such as department stores.

The company lowered its full-year fiscal guidance slightly, in

part due to the protests in Hong Kong. Ralph Lauren stores in the

territory were closed for 48 days in the most recent period because

of the unrest.

Ralph Lauren executives said they have also mitigated the impact

of tariffs by reducing the amount of Chinese goods they import to

the U.S. The company's U.S. exposure to China will fall to 22% by

the end of this fiscal year, from over 40% two years ago, they

said.

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com

(END) Dow Jones Newswires

November 07, 2019 13:12 ET (18:12 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

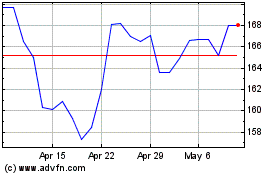

Ralph Lauren (NYSE:RL)

Historical Stock Chart

From Mar 2024 to Apr 2024

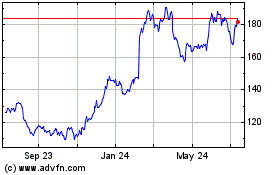

Ralph Lauren (NYSE:RL)

Historical Stock Chart

From Apr 2023 to Apr 2024