0001392972false00013929722023-07-252023-07-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 25, 2023

PROS Holdings, Inc.

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

Delaware |

(State or Other Jurisdiction of Incorporation) |

| | | | |

001-33554 | | | | 76-0168604 |

(Commission File Number) | | | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

3200 Kirby Drive, Suite 600 | Houston | TX | | | | | 77098 | |

(Address of Principal Executive Offices) | | | | | (Zip Code) | |

| | | | | | |

Registrant’s telephone number, including area code | (713) | 335-5151 | |

| | | | | | | | |

| | | | | | | | |

(Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

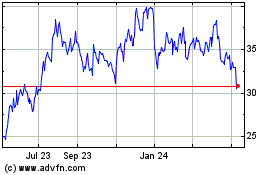

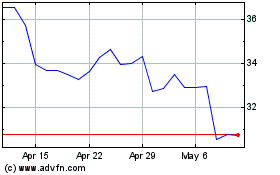

| Common stock $0.001 par value per share | | PRO | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

| | | | | |

| Item 2.02. | Results of Operations and Financial Condition. |

On July 25, 2023, PROS Holdings, Inc. (the "Company") issued a press release announcing financial results for its quarter ended June 30, 2023. A copy of the press release, dated as of July 25, 2023, is furnished as Exhibit 99.1 to this Current Report on Form 8-K. The press release contains forward looking statements regarding the Company and includes cautionary statements identifying important factors that could cause actual results to differ materially from those anticipated.

The information in this Current Report, including Exhibit 99.1 attached hereto, shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section. The information contained herein and in the accompanying exhibit shall not be incorporated by reference into any registration statement or other document filed with the Securities and Exchange Commission ("SEC") by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

| | | | | |

| Item 7.01. | Regulation FD Disclosure. |

On July 25, 2023, the Company published the Q2 2023 Investor Presentation ("Investor Presentation") on the Investor Relations section of the Company’s website located at https://ir.pros.com/. From time to time, the Company may also present and/or distribute the Investor Presentation to the investment community to provide updates and summaries of its business. Copy of the Q2 2023 Investor Presentation is furnished herewith as Exhibits 99.2. Investors should note that the Company uses the Investor Relations section of its corporate website to announce material information to investors and the marketplace. While not all of the information that the Company posts on its corporate website is of a material nature, some information could be deemed to be material. Accordingly, the Company encourages investors, the media, and others interested in the Company to review the information that it shares on the Investor Relations section of our website.

The information contained in the Investor Presentation is summary information that is intended to be considered in the context of the Company's SEC filings and other public announcements that the Company may make, by press release or otherwise, from time to time. The Company undertakes no duty or obligation to publicly update or revise the information contained in this report, although it may do so from time to time as its management believes is warranted. Any such updating may be made through the filing of other reports or documents with the SEC, through press releases or through other public disclosure.

The information in this Current Report, including Exhibits 99.2 attached hereto, shall not be deemed "filed" for the purpose of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section. The information contained herein and in the accompanying exhibits shall not be incorporated by reference into any registration statement or other document filed with the SEC by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | | | | |

| | |

| Exhibit No. | | Exhibit Description |

| | |

| 99.1 | | |

| | |

| 99.2 | | |

| | |

| 104 | | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL (included as Exhibit 101). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | |

| PROS HOLDINGS, INC. |

| | |

| July 25, 2023 | | /s/ Stefan Schulz |

| | Stefan Schulz |

| | Executive Vice President and Chief Financial Officer |

EXHIBIT 99.1

PROS HOLDINGS, INC. REPORTS SECOND QUARTER 2023 FINANCIAL RESULTS

•Total revenue of $75.8 million, up 11% year-over-year.

•Subscription revenue of $57.3 million, up 14% year-over-year.

•Subscription gross margin of 75% and non-GAAP subscription gross margin of 78%, up 150 basis points year-over-year.

HOUSTON – July 25, 2023 — PROS Holdings, Inc. (NYSE: PRO), a leading provider of AI-powered SaaS pricing, CPQ, revenue management, and digital offer marketing solutions, today announced financial results for the second quarter ended June 30, 2023.

“We delivered an outstanding second quarter, exceeding our guidance ranges across all metrics, driving 14% subscription revenue growth, and delivering a more than 100% improvement to adjusted EBITDA year-over-year,” stated CEO Andres Reiner. “Our performance in the first half of 2023 is a testament to the critical need for the PROS Platform in the market as businesses look to embrace digitization, automation, and AI to fuel profitable growth. Our passion for continuous AI innovation and delivering exceptional customer value is why we continue to welcome many new customers to PROS across the industries we serve.”

Second Quarter 2023 Financial Highlights

Key financial results for the second quarter 2023 are shown below. Throughout this press release all dollar figures are in millions, except net (loss) earnings per share. Unless otherwise noted, all results are on a reported basis and are compared with the prior-year period.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| GAAP | | Non-GAAP |

| Q2 2023 | | Q2 2022 | | Change | | Q2 2023 | | Q2 2022 | | Change |

| Revenue: | | | | | | | | | | | |

| Total Revenue | $75.8 | | $68.4 | | 11% | | n/a | | n/a | | n/a |

| Subscription Revenue | $57.3 | | $50.4 | | 14% | | n/a | | n/a | | n/a |

| Subscription and Maintenance Revenue | $62.4 | | $57.6 | | 8% | | n/a | | n/a | | n/a |

| Profitability: | | | | | | | | | | | |

| Gross Profit | $47.2 | | $40.7 | | 16% | | $49.4 | | $43.4 | | 14% |

| Operating (Loss) Income | $(13.4) | | $(20.5) | | $7.2 | | $(1.0) | | $(7.2) | | $6.2 |

| Net (Loss) Income | $(13.3) | | $(22.4) | | $9.1 | | $(0.3) | | $(6.5) | | $6.2 |

| Net (Loss) Earnings Per Share | $(0.29) | | $(0.50) | | $0.21 | | $(0.01) | | $(0.14) | | $0.13 |

| Adjusted EBITDA | n/a | | n/a | | n/a | | $0.1 | | $(6.0) | | $6.1 |

| Cash: | | | | | | | | | | | |

| Net Cash Used in Operating Activities | $(6.5) | | $(1.9) | | $(4.6) | | n/a | | n/a | | n/a |

| Free Cash Flow | n/a | | n/a | | n/a | | $(6.2) | | $(2.2) | | $(4.0) |

The attached table provides a summary of PROS results for the period, including a reconciliation of GAAP to non-GAAP metrics.

Recent Business Highlights

•Welcomed many new customers who are adopting the PROS Platform such as Condor, JSX, Novolex, Pipeline Supply & Services, PODS, Singapore Airlines Cargo, and XMA Limited, among others.

•Named a Leader in the Forrester WaveTM: Configure, Price, Quote Solutions Q2 2023 evaluation; PROS is now the only independent software solution to be named a Leader in CPQ by both Gartner and Forrester.

•Launched a new partnership with Adobe that combines Adobe’s Commerce offering with PROS market leading CPQ product configuration capabilities, enabling Adobe Commerce customers to power personalized products and offers through their eCommerce channels.

•Delivered the 2023 Outperform with PROS Conference which had PROS largest, in-person user conference turnout ever; the event featured over 50 customer speakers and attracted business leaders from around the globe eager to learn how to use digitization, automation, and AI to thrive in ever-changing markets.

•Hosted PROS 2023 Analyst Day on May 23, 2023 at the 2023 Outperform with PROS Conference where PROS executive management team presented PROS vision, strategy, and three-year financial projections.

•Named as one of three Global Independent Software Vendor finalists for Business Transformation in the 2023 Microsoft US Partner of the Year Award for the second year in a row, placing PROS in the top 1% of Microsoft partners globally; PROS was recognized for our seamlessly integrated Smart CPQ offering which enhances and extends Microsoft Dynamics 365 Sales to help businesses fuel profitable growth through AI-powered, digital sales experiences.

Financial Outlook

PROS currently anticipates the following based on an estimated 46.7 million diluted weighted average shares outstanding for the third quarter of 2023 and a 22% non-GAAP estimated tax rate for the third quarter and full year 2023.

| | | | | | | | | | | | | | | | | | | | | | | |

| Q3 2023 Guidance | | v. Q3 2022 at Mid-Point | | Full Year 2023 Guidance | | v. Prior Year at Mid-Point |

| Total Revenue | $75.0 to $76.0 | | 7% | | $300.0 to $302.0 | | 9% |

| Subscription Revenue | $58.6 to $59.1 | | 14% | | $231.7 to $233.7 | | 14% |

| | | | | | | |

| Subscription ARR | n/a | | n/a | | $251.0 to $254.0 | | 11% |

| Non-GAAP Earnings Per Share | $0.03 to $0.04 | | $0.10 | | n/a | | n/a |

| Adjusted EBITDA | $2.5 to $3.5 | | $5.2 | | $5.5 to $7.5 | | $21.4 |

| Free Cash Flow | n/a | | n/a | | $2.5 to $6.5 | | $26.2 |

Conference Call

In conjunction with this announcement, PROS Holdings, Inc. will host a conference call on Tuesday, July 25, 2023, at 4:45 p.m. ET to discuss the Company’s financial results and business outlook. To access this call, dial 1-877-407-9039 (toll-free) or 1-201-689-8470. The live and archived webcasts of this call can be accessed under the “Investor Relations” section of the Company’s website at www.pros.com.

A telephone replay will be available until Tuesday, August 1, 2023, 11:59 PM ET at 1-844-512-2921 (toll-free) or 1-412-317-6671 using the pass code 13739818.

About PROS

PROS Holdings, Inc. (NYSE: PRO) is a leading provider of AI-powered SaaS pricing, CPQ, revenue management, and digital offer marketing solutions. Our vision is to optimize every shopping and selling experience. With over 30 years of industry expertise and a proven track record of success, PROS helps B2B and B2C companies across the globe, in a variety of industries, including airlines, manufacturing, distribution, and services, drive profitable growth. The PROS Platform leverages AI to provide real-time predictive insights that enable businesses to drive revenue and margin improvements. To learn more about PROS and our innovative SaaS solutions, please visit our website at www.pros.com.

Forward-looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements about our financial outlook; expectations; ability to achieve future growth and profitability; management's confidence and optimism; positioning; customer successes; demand for our software solutions; pipeline; business

expansion; revenue; subscription revenue; ARR; non-GAAP earnings (loss) per share; adjusted EBITDA; free cash flow; shares outstanding and effective tax rate. The forward-looking statements contained in this press release are based upon our historical performance and our current plans, estimates and expectations and are not a representation that such plans, estimates or expectations will be achieved. Factors that could cause actual results to differ materially from those described herein include, among others, risks related to: (a) the macroeconomic environment, (b) the effects of inflation, (c) the impact of the COVID-19 pandemic, (d) cyberattacks, data breaches and breaches of security measures within our products, systems and infrastructure or products, systems and infrastructure of third parties upon whom we rely, (e) increasing business from customers and maintaining subscription renewal rates, (f) managing our growth and profit objectives effectively, (g) disruptions from our third party data center, software, data, and other unrelated service providers, (h) implementing our solutions, (i) cloud operations, (j) intellectual property and third-party software, (k) acquiring and integrating businesses and/or technologies, (l) catastrophic events, (m) operating globally, including economic and commercial disruptions, (n) potential downturns in sales and lengthy sales cycles, (o) software innovation, (p) competition, (q) market acceptance of our software innovations, (r) maintaining our corporate culture, (s) personnel risks including loss of any key employees and competition for talent, (t) expanding and training our direct and indirect sales force, (u) evolving data privacy, cyber security and data localization laws, (v) our debt repayment obligations, (w) the timing of revenue recognition and cash flow from operations, (x) migrating customers to our latest cloud solutions, and (y) returning to profitability. Additional information relating to the risks and uncertainties affecting our business is contained in our filings with the SEC. These forward-looking statements represent our expectations as of the date hereof. Subsequent events may cause these expectations to change, and PROS disclaims any obligations to update or alter these forward-looking statements in the future, whether as a result of new information, future events or otherwise.

Non-GAAP Financial Measures

PROS has provided in this release certain non-GAAP financial measures, including non-GAAP gross profit and margin, non-GAAP income (loss) from operations or non-GAAP operating income (loss), annual recurring revenue, adjusted EBITDA, free cash flow, non-GAAP tax rate, non-GAAP net income (loss), and non-GAAP earnings (loss) per share. PROS uses these non-GAAP financial measures internally in analyzing its financial results and believes they are useful to investors, as a supplement to GAAP measures, in evaluating PROS’ ongoing operational performance and cloud transition. Non-GAAP gross margin can be compared to gross margin which can be calculated from the condensed consolidated statements of loss by dividing gross profit by total revenue. Non-GAAP gross margin is similarly calculated but first adds back to gross profit the portion of certain of the non-GAAP adjustments described below attributable to cost of revenue. Non-GAAP subscription margin can be compared to subscription margin which can be calculated from the condensed consolidated statements of loss by dividing subscription gross profit (subscription revenue minus subscription cost) by subscription revenue. Non-GAAP subscription margin is similarly calculated but first subtracts out from subscription cost the portion of certain of the non-GAAP adjustments described below attributable to cost of subscription. These items and amounts are presented in the Supplemental Schedule of Non-GAAP Financial Measures.

Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Investors are encouraged to review the reconciliation of these non-GAAP measures to their most directly comparable GAAP financial measure as detailed above. A reconciliation of GAAP to the non-GAAP financial measures has been provided in the tables included as part of this press release, and can be found, along with other financial information, in the investor relations portion of our website. PROS' use of non-GAAP financial measures may not be consistent with the presentations by similar companies in PROS' industry. PROS has also provided in this release certain forward-looking non-GAAP financial measures, including non-GAAP income (loss) from operations, annual recurring revenue, non-GAAP earnings (loss) per share, adjusted EBITDA, free cash flow, non-GAAP tax rates, and calculated billings (collectively the "non-GAAP financial measures") as follows:

Non-GAAP income (loss) from operations: Non-GAAP income (loss) from operations excludes the impact of share-based compensation, amortization of acquisition-related intangibles and severance. Non-GAAP income (loss) from operations excludes the following items from non-GAAP estimates:

•Share-Based Compensation: Although share-based compensation is an important aspect of compensation for our employees and executives, our share-based compensation expense can vary because of changes in our stock price and market conditions at the time of grant, varying valuation methodologies, and the variety of award types. Since share-based compensation expense can vary for reasons that are generally unrelated to our performance during any particular period, we believe this could make it difficult for investors to compare our current financial results to previous and future periods. Therefore, we believe it is useful to exclude share-based compensation in order to better understand our business performance and allow investors to compare our operating results with peer companies.

•Amortization of Acquisition-Related Intangibles: We view amortization of acquisition-related intangible assets, such as the amortization of the cost associated with an acquired company's research and development efforts, trade names, customer lists and customer relationships, as items arising from pre-acquisition activities determined at the time of an acquisition. While these intangible assets are continually evaluated for impairment, amortization of the cost of purchased intangibles is a static expense, one that is not typically affected by operations during any particular period.

•Severance: Severance costs relate to the separation of our Chief Operations Officer in Q1 2022 and costs related to other internal role consolidations as well as severance cost incurred in Q4 2022 and Q1 2023 as the Company reprioritized its investments to focus on supporting key growth areas of its business. As a result of this reprioritization, the Company incurred severance, employee benefits, outplacement and related costs. These amounts are unrelated to our core performance during any particular period, and therefore, we believe it is useful to exclude these amounts in order to better understand our business performance and allow investors to compare our results with peer companies.

Non-GAAP earnings (loss) per share: Non-GAAP net income (loss) excludes the items listed above as excluded from non-GAAP income (loss) from operations and also excludes amortization of debt issuance costs and the taxes related to these items and the items excluded from non-GAAP income (loss) from operations. Estimates of non-GAAP earnings (loss) per share are calculated by dividing estimates for non-GAAP net income (loss) by our estimate of weighted average shares outstanding for the future period. In addition to the items listed above as excluded from non-GAAP income (loss) from operations, non-GAAP net income (loss) excludes the following items from non-GAAP estimates:

•Amortization of Debt Issuance Costs: Amortization of debt issuance costs are related to our convertible notes. These amounts are unrelated to our core performance during any particular period, and therefore, we believe it is useful to exclude these amounts in order to better understand our business performance and allow investors to compare our results with peer companies.

•Taxes: We exclude the tax consequences associated with non-GAAP items to provide investors with a useful comparison of our operating results to prior periods and to our peer companies because such amounts can vary significantly. In the fourth quarter of 2014, we concluded that it is more likely than not that we will be unable to fully realize our deferred tax assets and accordingly, established a valuation allowance against those assets. The ongoing impact of the valuation allowance on our non-GAAP effective tax rate has been eliminated to allow investors to better understand our business performance and compare our operating results with peer companies.

Annual Recurring Revenue: Annual Recurring Revenue ("ARR") is used to assess the trajectory of our cloud business. ARR means, as of a specified date, the contracted recurring revenue, including contracts with a future start date, together with annualized overage fees incurred above contracted minimum transactions, and excluding perpetual and term license agreements. ARR should be viewed independently of revenue and any other GAAP measure. Subscription ARR is calculated in the same manner, but excludes maintenance and support ARR.

Non-GAAP Tax Rate: The estimated non-GAAP effective tax rate adjusts the tax effect to quantify the impact of the excluded non-GAAP items.

Adjusted EBITDA: Adjusted EBITDA is defined as GAAP net income (loss) before interest expense, provision for income taxes, depreciation and amortization, as adjusted to eliminate the effect of stock-based compensation cost, severance, amortization of acquisition-related intangibles, and depreciation and amortization. Adjusted EBITDA should not be considered as an alternative to net income (loss) as an indicator of our operating performance.

Free Cash Flow: Free cash flow is a non-GAAP financial measure which is defined as net cash provided by (used in) operating activities, excluding severance payments, less capital expenditures, purchases of other (non-acquisition-related) intangible assets and capitalized internal-use software development costs.

Calculated Billings: Calculated billings is defined as total subscription, maintenance and support revenue plus the change in recurring deferred revenue in a given period.

These non-GAAP estimates are not measurements of financial performance prepared in accordance with GAAP, and we are unable to reconcile these forward-looking non-GAAP financial measures to their directly comparable GAAP financial measures because the information described above which is needed to complete a reconciliation is unavailable at this time without unreasonable effort.

Investor Contact:

PROS Investor Relations

Belinda Overdeput

713-335-5879

ir@pros.com

PROS Holdings, Inc.

Condensed Consolidated Balance Sheets

(In thousands, except share and per share amounts)

(Unaudited)

| | | | | | | | | | | | | | |

| | June 30, 2023 | | December 31, 2022 |

Assets: | | | | |

Current assets: | | | | |

Cash and cash equivalents | | $ | 184,567 | | | $ | 203,627 | |

| | | | |

| Trade and other receivables, net of allowance of $679 and $609, respectively | | 54,163 | | | 48,178 | |

Deferred costs, current | | 6,221 | | | 6,032 | |

Prepaid and other current assets | | 11,413 | | | 9,441 | |

| | | | |

Total current assets | | 256,364 | | | 267,278 | |

| | | | |

Property and equipment, net | | 24,659 | | | 25,012 | |

Operating lease right-of-use assets | | 14,050 | | | 17,474 | |

Deferred costs, noncurrent | | 8,234 | | | 8,764 | |

Intangibles, net | | 14,425 | | | 17,851 | |

Goodwill | | 107,724 | | | 107,561 | |

| | | | |

Other assets, noncurrent | | 8,508 | | | 9,012 | |

Total assets | | $ | 433,964 | | | $ | 452,952 | |

Liabilities and Stockholders’ (Deficit) Equity: | | | | |

Current liabilities: | | | | |

Accounts payable and other liabilities | | $ | 6,874 | | | $ | 7,964 | |

Accrued liabilities | | 13,784 | | | 12,854 | |

Accrued payroll and other employee benefits | | 20,109 | | | 23,797 | |

Operating lease liabilities, current | | 4,863 | | | 7,662 | |

Deferred revenue, current | | 116,365 | | | 108,659 | |

Current portion of convertible debt, net | | 143,003 | | | — | |

Total current liabilities | | 304,998 | | | 160,936 | |

Deferred revenue, noncurrent | | 5,218 | | | 8,298 | |

Convertible debt, net, noncurrent | | 147,522 | | | 289,779 | |

Operating lease liabilities, noncurrent | | 26,456 | | | 28,184 | |

Other liabilities, noncurrent | | 1,224 | | | 1,228 | |

Total liabilities | | 485,418 | | | 488,425 | |

Stockholders' (deficit) equity: | | | | |

Preferred stock, $0.001 par value, 5,000,000 shares authorized; none issued | | — | | | — | |

Common stock, $0.001 par value, 75,000,000 shares authorized; 50,821,459

and 50,318,726 shares issued, respectively; 46,140,736 and 45,638,003 shares outstanding, respectively | | 51 | | | 50 | |

Additional paid-in capital | | 606,599 | | | 590,475 | |

| Treasury stock, 4,680,723 common shares, at cost | | (29,847) | | | (29,847) | |

Accumulated deficit | | (623,189) | | | (590,898) | |

Accumulated other comprehensive loss | | (5,068) | | | (5,253) | |

| | | | |

Total stockholders’ (deficit) equity | | (51,454) | | | (35,473) | |

Total liabilities and stockholders’ (deficit) equity | | $ | 433,964 | | | $ | 452,952 | |

PROS Holdings, Inc.

Condensed Consolidated Statements of Loss

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

Revenue: | | | | | | | | |

| Subscription | | $ | 57,304 | | | $ | 50,386 | | | $ | 113,273 | | | $ | 99,151 | |

| Maintenance and support | | 5,093 | | | 7,249 | | | 10,805 | | | 15,104 | |

| Total subscription, maintenance and support | | 62,397 | | | 57,635 | | | 124,078 | | | 114,255 | |

| Services | | 13,395 | | | 10,727 | | | 24,896 | | | 20,599 | |

| Total revenue | | 75,792 | | | 68,362 | | | 148,974 | | | 134,854 | |

| Cost of revenue: | | | | | | | | |

| Subscription | | 14,059 | | | 13,746 | | | 28,152 | | | 27,525 | |

| Maintenance and support | | 1,876 | | | 1,988 | | | 4,158 | | | 4,155 | |

| Total cost of subscription, maintenance and support | | 15,935 | | | 15,734 | | | 32,310 | | | 31,680 | |

| Services | | 12,636 | | | 11,907 | | | 25,803 | | | 23,322 | |

| Total cost of revenue | | 28,571 | | | 27,641 | | | 58,113 | | | 55,002 | |

| Gross profit | | 47,221 | | | 40,721 | | | 90,861 | | | 79,852 | |

| Operating expenses: | | | | | | | | |

| Selling and marketing | | 24,880 | | | 24,020 | | | 50,890 | | | 49,307 | |

| Research and development | | 21,847 | | | 23,401 | | | 44,138 | | | 47,868 | |

| General and administrative | | 13,849 | | | 13,837 | | | 27,984 | | | 28,166 | |

| | | | | | | | |

| Impairment of fixed assets | | — | | | — | | | — | | | 1,551 | |

| Loss from operations | | (13,355) | | | (20,537) | | | (32,151) | | | (47,040) | |

| Convertible debt interest and amortization | | (1,576) | | | (1,576) | | | (3,152) | | | (3,152) | |

| Other income (expense), net | | 1,791 | | | (2) | | | 3,242 | | | (420) | |

| Loss before income tax provision | | (13,140) | | | (22,115) | | | (32,061) | | | (50,612) | |

| Income tax provision | | 149 | | | 291 | | | 230 | | | 434 | |

| Net loss | | $ | (13,289) | | | $ | (22,406) | | | $ | (32,291) | | | $ | (51,046) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net loss per share: | | | | | | | | |

| Basic and diluted | | $ | (0.29) | | | $ | (0.50) | | | $ | (0.70) | | | $ | (1.13) | |

| | | | | | | | |

| Weighted average number of shares: | | | | | | | | |

| Basic and diluted | | 46,101 | | | 45,222 | | | 46,013 | | | 45,154 | |

| | | | | | | | |

PROS Holdings, Inc.

Condensed Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

Operating activities: | | | | | | | | |

Net loss | | $ | (13,289) | | | $ | (22,406) | | | $ | (32,291) | | | $ | (51,046) | |

Adjustments to reconcile net loss to net cash used in operating activities: | | | | | | | | |

Depreciation and amortization | | 2,751 | | | 3,801 | | | 5,752 | | | 8,448 | |

| Amortization of debt issuance costs | | 373 | | | 373 | | | 746 | | | 746 | |

Share-based compensation | | 10,752 | | | 10,766 | | | 20,656 | | | 21,991 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Provision for credit losses | | (20) | | | (209) | | | 88 | | | (300) | |

Loss on disposal of assets | | — | | | — | | | 35 | | | — | |

Impairment of fixed assets | | — | | | — | | | — | | | 1,551 | |

| | | | | | | | |

| | | | | | | | |

Changes in operating assets and liabilities: | | | | | | | | |

Accounts and unbilled receivables | | (8,309) | | | 18,571 | | | (6,070) | | | 6,441 | |

Deferred costs | | (84) | | | 180 | | | 341 | | | 132 | |

Prepaid expenses and other assets | | 1,056 | | | (1,133) | | | (1,449) | | | (1,395) | |

| Operating lease right-of-use assets and liabilities | | (646) | | | (378) | | | (1,237) | | | (1,117) | |

Accounts payable and other liabilities | | 2,541 | | | (2,274) | | | (1,252) | | | 1,629 | |

Accrued liabilities | | 573 | | | 41 | | | 1,077 | | | (68) | |

Accrued payroll and other employee benefits | | 4,486 | | | 4,102 | | | (3,688) | | | (9,144) | |

Deferred revenue | | (6,726) | | | (13,365) | | | 4,607 | | | 9,187 | |

| Net cash used in operating activities | | (6,542) | | | (1,931) | | | (12,685) | | | (12,945) | |

Investing activities: | | | | | | | | |

Purchases of property and equipment | | (277) | | | (308) | | | (1,823) | | | (769) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Purchase of equity securities | | — | | | (169) | | | — | | | (169) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net cash used in investing activities | | (277) | | | (477) | | | (1,823) | | | (938) | |

Financing activities: | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Proceeds from employee stock plans | | — | | | — | | | 1,137 | | | 1,443 | |

Tax withholding related to net share settlement of stock awards | | (958) | | | — | | | (5,668) | | | (212) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net cash (used in) provided by financing activities | | (958) | | | — | | | (4,531) | | | 1,231 | |

| Effect of foreign currency rates on cash | | (32) | | | 193 | | | (21) | | | 277 | |

| Net change in cash and cash equivalents | | (7,809) | | | (2,215) | | | (19,060) | | | (12,375) | |

Cash and cash equivalents: | | | | | | | | |

Beginning of period | | 192,376 | | | 217,393 | | | 203,627 | | | 227,553 | |

End of period | | $ | 184,567 | | | $ | 215,178 | | | $ | 184,567 | | | $ | 215,178 | |

PROS Holdings, Inc.

Reconciliation of GAAP to Non-GAAP Financial Measures

(In thousands, except per share data)

(Unaudited)

We use these non-GAAP financial measures to assist in the management of the Company because we believe that this information provides a more consistent and complete understanding of the underlying results and trends of the ongoing business due to the uniqueness of these charges.

See breakdown of the reconciling line items on page 10.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, | | Quarter over Quarter | | Six Months Ended June 30, | | Year over Year |

| | | 2023 | | 2022 | | % change | | 2023 | | 2022 | | % change |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

GAAP gross profit | | $ | 47,221 | | | $ | 40,721 | | | 16 | % | | $ | 90,861 | | | $ | 79,852 | | | 14 | % |

| Non-GAAP adjustments: | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Amortization of acquisition-related intangibles | | 1,243 | | | 1,685 | | | | | 2,580 | | | 3,668 | | | |

| Severance | | — | | | — | | | | | 749 | | | — | | | |

| Share-based compensation | | 985 | | | 1,006 | | | | | 1,817 | | | 1,831 | | | |

Non-GAAP gross profit | | $ | 49,449 | | | $ | 43,412 | | | 14 | % | | $ | 96,007 | | | $ | 85,351 | | | 12 | % |

| | | | | | | | | | | | | |

Non-GAAP gross margin | | 65.2 | % | | 63.5 | % | | | | 64.4 | % | | 63.3 | % | | |

| | | | | | | | | | | | | |

GAAP loss from operations | | $ | (13,355) | | | $ | (20,537) | | | (35) | % | | $ | (32,151) | | | $ | (47,040) | | | (32) | % |

| Non-GAAP adjustments: | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Amortization of acquisition-related intangibles | | 1,620 | | | 2,597 | | | | | 3,426 | | | 5,572 | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Severance | | — | | | — | | | | | 3,586 | | | 1,508 | | | |

| Share-based compensation | | 10,752 | | | 10,766 | | | | | 20,656 | | | 21,991 | | | |

| Total Non-GAAP adjustments | | 12,372 | | | 13,363 | | | | | 27,668 | | | 29,071 | | | |

Non-GAAP loss from operations | | $ | (983) | | | $ | (7,174) | | | (86) | % | | $ | (4,483) | | | $ | (17,969) | | | (75) | % |

| | | | | | | | | | | | | |

Non-GAAP loss from operations % of total revenue | | (1.3) | % | | (10.5) | % | | | | (3.0) | % | | (13.3) | % | | |

| | | | | | | | | | | | | |

GAAP net loss | | $ | (13,289) | | | $ | (22,406) | | | (41) | % | | $ | (32,291) | | | $ | (51,046) | | | (37) | % |

| Non-GAAP adjustments: | | | | | | | | | | | | |

| Total Non-GAAP adjustments affecting loss from operations | | 12,372 | | | 13,363 | | | | | 27,668 | | | 29,071 | | | |

| Amortization of debt issuance costs | | 373 | | | 373 | | | | | 746 | | | 746 | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Tax impact related to non-GAAP adjustments | | 235 | | | 2,132 | | | | | 1,032 | | | 5,012 | | | |

Non-GAAP net loss | | $ | (309) | | | $ | (6,538) | | | (95) | % | | $ | (2,845) | | | $ | (16,217) | | | (82) | % |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | | |

Non-GAAP loss per share | | $ | (0.01) | | | $ | (0.14) | | | | | $ | (0.06) | | | $ | (0.36) | | | |

| | | | | | | | | | | | |

Shares used in computing non-GAAP loss per share | | 46,101 | | | 45,222 | | | | | 46,013 | | | 45,154 | | | |

PROS Holdings, Inc.

Supplemental Schedule of Non-GAAP Financial Measures

Increase (Decrease) in GAAP Amounts Reported

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Cost of Subscription Items | | | | | | | | |

| | | | | | | | |

Amortization of acquisition-related intangibles | | 1,243 | | | 1,685 | | | 2,580 | | | 3,668 | |

| Severance | | — | | | — | | | 125 | | | — | |

Share-based compensation | | 169 | | | 185 | | | 294 | | | 336 | |

Total cost of subscription items | | $ | 1,412 | | | $ | 1,870 | | | $ | 2,999 | | | $ | 4,004 | |

| | | | | | | | |

Cost of Maintenance Items | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Severance | | — | | | — | | | 307 | | | — | |

Share-based compensation | | 98 | | | 98 | | | 178 | | | 189 | |

Total cost of maintenance items | | $ | 98 | | | $ | 98 | | | $ | 485 | | | $ | 189 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Cost of Services Items | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Severance | | — | | | — | | | 317 | | | — | |

Share-based compensation | | 718 | | | 723 | | | 1,345 | | | 1,306 | |

Total cost of services items | | $ | 718 | | | $ | 723 | | | $ | 1,662 | | | $ | 1,306 | |

| | | | | | | | |

Sales and Marketing Items | | | | | | | | |

| | | | | | | | |

Amortization of acquisition-related intangibles | | 377 | | | 912 | | | 846 | | | 1,904 | |

Severance | | — | | | — | | | 1,595 | | | 1,444 | |

Share-based compensation | | 3,103 | | | 3,276 | | | 6,031 | | | 6,516 | |

Total sales and marketing items | | $ | 3,480 | | | $ | 4,188 | | | $ | 8,472 | | | $ | 9,864 | |

| | | | | | | | |

Research and Development Items | | | | | | | | |

| | | | | | | | |

| Severance | | — | | | — | | | 1,008 | | | — | |

Share-based compensation | | 2,673 | | | 2,899 | | | 5,023 | | | 6,612 | |

Total research and development items | | $ | 2,673 | | | $ | 2,899 | | | $ | 6,031 | | | $ | 6,612 | |

| | | | | | | | |

General and Administrative Items | | | | | | | | |

| | | | | | | | |

Severance | | — | | | — | | | 234 | | | 64 | |

| | | | | | | | |

| | | | | | | | |

Share-based compensation | | 3,991 | | | 3,585 | | | 7,785 | | | 7,032 | |

Total general and administrative items | | $ | 3,991 | | | $ | 3,585 | | | $ | 8,019 | | | $ | 7,096 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | |

PROS Holdings, Inc.

Supplemental Reconciliation of GAAP to Non-GAAP Financial Measures

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Adjusted EBITDA | | | | | | | | |

GAAP Loss from Operations | | $ | (13,355) | | | $ | (20,537) | | | $ | (32,151) | | | $ | (47,040) | |

| | | | | | | | |

| | | | | | | | |

Amortization of acquisition-related intangibles | | 1,620 | | | 2,597 | | | 3,426 | | | 5,572 | |

| | | | | | | | |

| | | | | | | | |

Severance | | — | | | — | | | 3,586 | | | 1,508 | |

| | | | | | | | |

Share-based compensation | | 10,752 | | | 10,766 | | | 20,656 | | | 21,991 | |

Depreciation and other amortization | | 1,131 | | | 1,204 | | | 2,326 | | | 2,876 | |

| | | | | | | | |

Adjusted EBITDA | | $ | 148 | | | $ | (5,970) | | | $ | (2,157) | | | $ | (15,093) | |

| | | | | | | | |

| | | | | | | | |

| Net cash used in operating activities | | $ | (6,542) | | | $ | (1,931) | | | $ | (12,685) | | | $ | (12,945) | |

| Severance | | 579 | | | — | | | 3,749 | | | — | |

Purchase of property and equipment | | (277) | | | (308) | | | (1,823) | | | (769) | |

| | | | | | | | |

| | | | | | | | |

Free Cash Flow | | $ | (6,240) | | | $ | (2,239) | | | $ | (10,759) | | | $ | (13,714) | |

| | | | | | | | |

| Guidance | | | | | | | | |

| | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | Q3 2023 Guidance | | Full Year 2023 Guidance |

| | Low | | High | | Low | | High |

| Adjusted EBITDA | | | | | | | | |

GAAP Loss from Operations | | $ | (11,400) | | | $ | (10,400) | | | $ | (51,900) | | | $ | (49,900) | |

Amortization of acquisition-related intangibles | | 1,400 | | | 1,400 | | | 6,100 | | | 6,100 | |

Severance | | — | | | — | | | 3,600 | | | 3,600 | |

Share-based compensation | | 11,300 | | | 11,300 | | | 43,000 | | | 43,000 | |

Depreciation and other amortization | | 1,200 | | | 1,200 | | | 4,700 | | | 4,700 | |

| | | | | | | | |

Adjusted EBITDA | | $ | 2,500 | | | $ | 3,500 | | | $ | 5,500 | | | $ | 7,500 | |

PROS Holdings, Inc. Second Quarter 2023 Investor Presentation Updated July 25, 2023 ir@pros.com

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 2 Disclaimer / Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements about our financial outlook; expectations; ability to achieve future growth and profitability; management's confidence and optimism; positioning; customer successes; demand for our software solutions; pipeline; business expansion; revenue; subscription revenue; ARR; non-GAAP earnings (loss) per share; adjusted EBITDA; free cash flow; shares outstanding and effective tax rate. The forward-looking statements contained in this presentation are based upon our historical performance and our current plans, estimates and expectations and are not a representation that such plans, estimates or expectations will be achieved. Factors that could cause actual results to differ materially from those described herein include, among others, risks related to: (a) the macroeconomic environment, (b) the effects of inflation, (c) the impact of the COVID-19 pandemic, (d) cyberattacks, data breaches and breaches of security measures within our products, systems and infrastructure or products, systems and infrastructure of third parties upon whom we rely, (e) increasing business from customers and maintaining subscription renewal rates, (f) managing our growth and profit objectives effectively, (g) disruptions from our third party data center, software, data, and other unrelated service providers, (h) implementing our solutions, (i) cloud operations, (j) intellectual property and third-party software, (k) acquiring and integrating businesses and/or technologies, (l) catastrophic events, (m) operating globally, including economic and commercial disruptions, (n) potential downturns in sales and lengthy sales cycles, (o) software innovation, (p) competition, (q) market acceptance of our software innovations, (r) maintaining our corporate culture, (s) personnel risks including loss of any key employees and competition for talent, (t) expanding and training our direct and indirect sales force, (u) evolving data privacy, cyber security and data localization laws, (v) our debt repayment obligations, (w) the timing of revenue recognition and cash flow from operations, (x) migrating customers to our latest cloud solutions, and (y) returning to profitability. Additional information relating to the risks and uncertainties affecting our business is contained in our filings with the SEC. These forward-looking statements represent our expectations as of the date hereof. Subsequent events may cause these expectations to change, and PROS disclaims any obligations to update or alter these forward-looking statements in the future, whether as a result of new information, future events or otherwise. This presentation includes certain supplemental non-GAAP financial measures, that we believe are useful to investors as tools for assessing the comparability between periods as well as company by company. Our computation of these measures may not be comparable to other similarly titled measures computed by other companies. These non-GAAP financial measures should be considered in addition to, but not as a substitute for, our financial information and results prepared in accordance with U.S. GAAP included in our periodic filings made with the SEC. Investors are encouraged to review the reconciliation of our historical non-GAAP financial measures to the comparable GAAP results, which can be found, along with other financial information, on the investor relations’ page of our website at PROS.com. We are unable to reconcile forward-looking non-GAAP financial measures to their directly comparable GAAP financial measures because the information needed to complete a reconciliation is unavailable at this time without unreasonable effort.

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 3 PROS at a Glance $290 mm+ Total Revenue TTM Q2 2023 84% Recurring Revenue as a % of TTM Q2 2023 Total Revenue $38B+ Underpenetrated, Addressable Market Subscription Revenue Growth YoY Q2 2023 60+ Countries with Customers 14 % 93%+ Customer Gross Revenue Retention Rate TTM Q2 2023 2.8T Transactions Processed TTM Q2 2023 78% Non-GAAP Subscription Gross Margin Q2 2023; 635+ bps Improvement in 8 Quarters

Business Overview

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 5 To optimize every shopping and selling experience. Our vision…

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 6 Businesses Face Many Challenges Today The way we work is evolving. Manual business processes and disconnected digital tools cause more time to be spent on process than on driving business forward. Digitization, automation, and AI are critical for keeping up and driving a better employee experience. Business uncertainty is here to stay. Everything is in a constant state of rapid change – costs, currencies, supply chains, prices, demand patterns – and in response, businesses must constantly change what they sell, how they sell, and how they price. Customers have increasingly higher expectations. Buyers expect every buying experience to be as magical as the best one they have ever had (“the Amazon effect”). Self-serve, personalization, transparency, and accuracy driven by convenience, value, and confidence across all touchpoints.

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 7 Siloed Applications Make It Difficult to Digitize, Automate and Apply AI to Deliver a Superior Shopping and Selling Experience Procurement Revenue Management Contract Lifecycle Management Product Information Management Back Office Systems ERP PSS Excel / Flat Files / Home Grown API + Many More Partner Sales / Distributors Direct Sales Independent Agents Marketers Business Intelligence / Analytics eCommerce / Marketplaces / OTA & MSE Partner Portals Agency Portals / GDS Marketing Systems + Many More API CRM Front Office Systems Product Configuration / Bundling Substitute Product Recommendations Product Availability Control Demand Forecasting Offer Optimization List Price Optimization Cost Optimization Negotiated Discount Recommendations Churn Detection Upsells Cross Sells Competitor Price Forecasting Artificial Intelligence Needs + Many More Trade Promotion Management Rebate Management List Price Management CPQ Digital Offer Marketing Internet Booking Engines Special Price Agreements / Renewals / Amendments Deal Desk Multi-modal, Omnichannel Catalog BillingPayments Buyer

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 8 PROS Real-Time AI Platform Maximizes Value for B2B Commerce Back Office Systems ERP + Many More Partner Sales / Distributors Direct Sales Marketers eCommerce / Marketplaces Partner Portals Marketing Systems + Many More API CRM Front Office Systems AI Real-Time Secure Scalable High Availability Extensible Superior UX Insights Powered by an Industry-Leading Real-Time, AI Platform Real-Time Omnichannel Digital Marketing Smart Configure, Price, QuoteSmart Price Optimization & Management Partner Ecosystem Omnichannel Price Management Automatic UoM & Currency Conversion List Price / Negotiated Price Tiered Prices / Discounts AI-driven Price Optimization 700ms Real-Time Price Delivery Margin Driver Analysis Price Waterfalls & Advanced Analytics Omnichannel Quoting Guided Selling Rich Media Catalog 10K+ Line Quotes Constraints-based Configuration Price Agreements Document Generation Collaboration Portal Rebates Billing CLM Product/Supply Mix Optimization Subscription Rate Plans Mass Price Update Workflow Subscription Quoting Sales Incentive Comp Data Warehouse Homegrown Systems API Data Providers Buyer

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 9 PROS Real-Time AI Platform Maximizes Value for Travel Commerce Partner Sales / Distributors Direct Sales Marketers Airline.com Marketing Systems + Many More API Front Office Systems AI Real-Time Secure Scalable High Availability Extensible Superior UX Real-Time Omnichannel Digital Marketing Partner Ecosystem Agency Portals / GDS OTA MSE Revenue Management Shopping/Distribution Groups Demand Forecasting Class-based or Continuous Pricing Holiday, Special Events, & Influences Network / O&D / Segment Optimization Willingness-To-Pay Model Dynamic Pricing of Ancillaries Quote, Negotiate, Save, and Book Manage PNR Modifications Ticket & Payments Reporting & Analytics Ancillaries EMD Handling Full NDC Offer Management Direct Distribution to MSE Direct Connect Pricing and Availability ATPCO Pricing & Repricing Inspiration / Calendar Search Merchandising Promotional Rebooking Payments Advertising Back Office Systems ERP + Many More Data Warehouse Homegrown Systems API Data Providers Buyer Insights Powered by an Industry-Leading Real-Time, AI Platform

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 10 Real-Time AI is at the Core of PROS Self- Learning, Trainable Predictive, Prescriptive, Generative Explainable, Trustworthy, Ethical 89 Data Scientists and ~460 Engineers 20+ Patents 2.8 Trillion Transactions Processed1 99.98% Uptime1 Sub-700ms Response Time ~5.3MM Transactions Per Minute1 Extensible Real- Time Secure ScalableHigh Availability Superior UX Extensible AI 1) Trailing twelve-month measurement as of Q2 2023

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 11 Our Library of AI Models and Techniques Can Be Ensembled to Solve High-Value Business Problems PROS AI Business AI (Decision) Internet AI Perceptual AI L e a rn in g P a ra d ig m s , M o d e ls & T o o ls Prescriptive Algorithms • Linear programming • Non-linear programming • Dynamic programming • Integer programming • Reinforcement learning Data Science Techniques • Constraint satisfaction programming • Shapley value (SHAP) • kNN clustering • Extensible AI Recommender System Collaborative Filtering Human-Computer Interaction ChatGPT (Azure OpenAI) Predictive Algorithms • Neural networks • FF Wide & Deep • NN Matrix Factorization • Online Learning (Bayesian & Variational Inference) • Decision Trees • Semi-parametric Estimation • Parametric estimation B u s in e s s P ro b le m s Revenue / Margin • Negotiated Price Optimization • Ecommerce Price Optimization • EMSR (Expected Marginal Seat Revenue) • O&D, Leg & Segment-based Optimization Cost • Inventory Control + Optimization • Capacity Aware Optimization • Forecasting • Cost Optimization Profit Optimization Sales Guidance • Offer Optimization • Dynamic Pricing of Ancillaries • Cross-Sell / Upsell Recommendation • Churn Prediction • Production Planning • Fleet Acquisition & Disposition • Fleet Distribution • Production Mix Optimization • Procurement Optimization Supply Chain Optimization

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 12 Highly Extensible Across Industries and Use Cases Solving problems across 40+ industries and 60 countries Travel Technology Chemicals & Energy Healthcare Food & Consumables Services Automotive & Industrial

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 13 The Power of AI Driving Measurable Business Outcomes 400% ROI in 3 years Payback in 9 months & Source: Forrester Total Economic Impact Report, 2023 +8% Revenue Uplift +200 bp Margin Improvement +67% Efficiency Gain Source: PROS study of 131 customers’ self-reported results, 2022 Our customers have said… Industry experts have said…

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 14 The TAM PROS Addresses is Massive, Global, and Growing $38B+ Underpenetrated, Addressable Market(1) $14B+ Strategic Industries & Geographies $3.3B Travel $3.2B Automotive & Industrial $2.1B Healthcare $1.9B Technology $1.8B Food & Consumables $1.1B Business Services $800mm Chemicals & Energy (1) TAM represents our estimated global total revenue and market opportunity but does not represent the actual market opportunity that we may target or ultimately service or otherwise derive revenue from. Our estimate of TAM may be revised in the future depending on a variety of factors, including competitive dynamics, our sales efforts, customer needs, industry shifts and other economic factors.

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 15 Strategic Focus Areas Land the Platform, Realize Value, and Expand with Many Paths Leverage Partnerships to Accelerate deal Velocity Decrease Time to Value and Improve Customer Advocacy

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 16 Proven Land and Expand Motion in Our Business $38k $282k Q2'21 Q1'23 7.5x $639k $3.1M Q1'18 Q1'23 Passenger Airline 3 4.8x $262k $1.6M Q1'18 Q1'23 6.3x $1.3M $5.1M Q1'18 Q1'23 Passenger Airline 4 4x $425k $3.3M Q1'18 Q1'23 7.7x $136k $928k Q1'18 Q1'23 Industrial Equipment Distributor 6.8x $527k $4.1M Q1'18 Q1'23 7.7x $229k $1.4M Q1'18 Q1'23 Leading B2B Distributor 6.2x TravelB2B Passenger Airline 1 Passenger Airline 2 Multinational Oil & Gas Company Industrial Manufacturing Conglomerate

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 17 An Ecosystem of Partners Help Position Us to Win System Integrators GTM Partners

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 18 Extensive Platform Integrations and Technology Partners API integration into any ecosystem CRMs ERP / Platform eCommerce Platforms SalesTech Online Travel Agencies Reservations & Bookings Data Providers Billing, Payments & Tax Payment Gateway Commerce Cloud MarTech

Financial Overview

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 20 PROS Has Delivered Long-Term Sustainable Growth $29 $38 $61 $99 $145 $170 $178 $204 $71 $97 $118 $145 $186 $168 $153 $169 $197 $250 $252 $251 $276 CY10A CY11A CY12A CY13A CY14A CY15A CY16A CY17A CY18A CY19A CY20A CY21A CY22A Total Revenue ($MM) Subscription Transition CY15 – CY19 GTM Transformation CY22 - Ongoing 49% CY15 – CY19 Subscription CAGR COVID CY20 – CY21 27% CY10 – CY14 Revenue CAGR Subscription Revenue

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 21 Subscription Revenue Growth Trajectory ($mm, % YoY Growth) • 27% 5-Year CAGR (2017 through 2022) • Continued growth through the COVID-19 pandemic 1) 2023 dollar value and growth rate based on the mid-point of the Subscription Revenue 2023 Guidance. 2023 expectations are forward-looking statements. Given the risks, uncertainties and assumptions related to PROS’ business and operations, PROS’ actual future results may differ materially from these expectations. Investors should review the Company’s cautionary statements and risk factors referred to in this presentation. 60.5 98.7 145.3 170.5 178.0 204.0 232.7 2017 2018 2019 2020 2021 2022 2023E 49% 17% 47% 4% 15% 1 14%

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 22 Driving Consistent Margin1 Expansion 1) For definitions of non-GAAP measures or reconciliation of non-GAAP to GAAP measures, please refer to the appendix of this presentation. 635+ basis point improvement in 8 quarters 465+ basis point improvement in 8 quarters 72% 75% 76% 76% 77% 77% 78% 78% 61% 63% 63% 64% 64% 65% 64% 65% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% Q3 '21 Q4 '21 Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '23 Non-GAAP Subscription Gross Margin Non-GAAP Gross Margin

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 23 Second Quarter 2023 Earnings Recap $mm (Except Per Share) Q2 2023 Q2 2022 Delta TTM 6/30/2023 TTM 6/30/2022 Delta Total Revenue $75.8 $68.4 11% $290.3 $262.5 11% Subscription Revenue $57.3 $50.4 14% $218.2 $190.3 15% Adjusted EBITDA $0.1 $(6.0) $6.1 $(1.9) $(25.9) $24.0 Free Cash Flow $(6.2) $(2.2) $(4.0) $(18.8) $(23.6) $4.8 Non-GAAP (Loss) Earnings Per Share $(0.01) $(0.14) $0.13 $(0.11) $(0.64) $0.53

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 24 Guidance Summary $mm (Except Per Share) Q3 2023 Guidance v. Q3 2022 at Mid-Point Full Year 2023 Guidance (7/25/2023) v. Prior Year at Mid-Point Prior Full Year 2023 Range (5/2/2023) Total Revenue $75.0 to $76.0 7% $300.0 to $302.0 9% $295.0 to $297.0 Subscription Revenue $58.6 to $59.1 14% $231.7 to $233.7 14% $231.7 to $233.7 Subscription ARR n/a n/a $251.0 to $254.0 11% $251.0 to $254.0 Non-GAAP Earnings Per Share $0.03 to $0.04 $0.10 n/a n/a n/a Adjusted EBITDA $2.5 to $3.5 $5.2 $5.5 to $7.5 $21.4 $3.5 to $6.5 Free Cash Flow n/a n/a $2.5 to $6.5 $26.2 $2.5 to $6.5 Notes: • The 2023 Guidance shown here are forward-looking statements. Given the risks, uncertainties and assumptions related to PROS’ business and operations, PROS’ actual future results may differ materially from these expectations. Investors should review the Company’s cautionary statements and risk factors referred to in this presentation. • Based on an estimated 46.7 million diluted weighted average shares outstanding for the third quarter of 2023 and a 22% non-GAAP estimated tax rate for the third quarter and full year 2023. • Please see appendix for a reconciliation of these non-GAAP metrics to GAAP metrics.

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 25 Targeting “Rule of 40” in Three Years (by 2026) 16-21% 19-24% Total Revenue Growth Free Cash Flow Margin Financial targets assume macroeconomic conditions remain consistent with conditions as of the time of this presentation.

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 26 Supplemental Business Metrics Revenue Q3 '21 Q4 '21 Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '23 Subscription $ 44,119 $ 47,015 $ 48,765 $ 50,386 $ 51,763 $ 53,127 $ 55,969 $ 57,304 Maintenance and Support $ 8,477 $ 8,390 $ 7,855 $ 7,249 $ 7,071 $ 6,417 $ 5,712 $ 5,093 Recurring Revenue $ 52,596 $ 55,405 $ 56,620 $ 57,635 $ 58,834 $ 59,544 $ 61,681 $ 62,397 Services $ 10,075 $ 9,568 $ 9,872 $ 10,727 $ 11,514 $ 11,391 $ 11,501 $ 13,395 Total Revenue $ 62,671 $ 64,973 $ 66,492 $ 68,362 $ 70,348 $ 70,935 $ 73,182 $ 75,792 Recurring Revenue % 84% 85% 85% 84% 84% 84% 84% 82% Revenue by Geography Q3 '21 Q4 '21 Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '23 United States $ 23,275 $ 22,866 $ 23,194 $ 23,908 $ 24,952 $ 26,307 $ 26,232 $ 27,224 Europe $ 18,571 $ 20,659 $ 20,823 $ 20,865 $ 20,816 $ 20,981 $ 22,949 $ 24,748 Rest of World $ 20,825 $ 21,448 $ 22,475 $ 23,589 $ 24,580 $ 23,647 $ 24,001 $ 23,820 $ in 000s

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 27 Supplemental Business Metrics Financial & Operating Metrics Q3 '21 Q4 '21 Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 Q2 '23 Non-GAAP Gross Margin1 61% 63% 63% 64% 64% 65% 64% 65% Non-GAAP Subscription Gross Margin1 72% 75% 76% 76% 77% 77% 78% 78% Non-GAAP Recurring Revenue Gross Margin1 72% 75% 76% 76% 76% 77% 77% 77% Adjusted EBITDA1 $ (4,438) $ (6,356) $ (9,123) $ (5,970) $ (2,160) $ 2,382 $ (2,305) $ 148 Cash and Cash Equivalents $ 308,642 $ 227,553 $ 217,393 $ 215,178 $ 206,824 $ 203,627 $ 192,376 $ 184,567 Recurring Deferred Revenue $ 95,774 $ 96,133 $ 116,948 $ 103,510 $ 105,650 $ 105,468 $ 117,837 $ 111,688 Total Deferred Revenue $ 105,764 $ 106,266 $ 128,802 $ 115,485 $ 116,191 $ 116,957 $ 128,353 $ 121,583 TTM Recurring Calculated Billings1 $ 200,748 $ 213,699 $ 224,858 $ 228,255 $ 238,370 $ 241,968 $ 238,584 $ 250,634 Remaining Performance Obligations2 $ 373,000 $ 360,500 $ 433,100 $ 434,900 $ 442,300 $ 441,500 $ 430,600 $ 407,600 Remaining Performance Obligations - Current $ 180,500 $ 184,600 $ 201,100 $ 197,400 $ 199,300 $ 206,300 $ 210,000 $ 204,200 Free Cash Flow1 $ (8,518) $ (1,334) $ (11,475) $ (2,239) $ (9,067) $ 1,072 $ (4,519) $ (6,240) Total Headcount (including contractors) 1,401 1,545 1,541 1,597 1,626 1,528 1,436 1,471 1) For definitions of non-GAAP measures or reconciliation of non-GAAP to GAAP measures, please refer to the appendix of this presentation. 2) Remaining performance obligations represent contractually committed revenue that has not yet been recognized, which includes deferred revenue and unbilled amounts that will be recognized as revenue in future periods. $ in 000s

Our Values

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 29 Our Mission: To Help People and Companies Outperform We are INNOVATORS Thinking creatively to find new paths to success for our people, our customers, and our business. We CARE Putting people first - our customers, employees, partners, and community - it’s how our company was started, and how we’ll always run it. Looking for every opportunity to create a better PROS and a better experience for our customers, and we hold ourselves accountable. We are OWNERS Learn more about our incredible culture

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 30 Governance, Security, & Environmental Sustainability Governance • LEED Silver certified global HQ • Sustainable data centers worldwide through our partnership with Microsoft • Recycling program in all offices Security PROS Board of Directors and Executive team are committed to adhering to the highest ethical values and promoting transparency. For more detail and a complete list of governance documents and charters, visit the governance page of our website. For further disclosures, read our ESG report. At PROS, security is the responsibility of everyone. We take data security and privacy seriously. ✓ ISO 27001 Certified ✓ ISO 27018 Certified ✓ SOC1 Type 2 Certified ✓ SOC2 Type 2 Certified ✓ Cloud Security Alliance Compliant ✓ GDPR Compliant For more detail on security and compliance, including detail on all certifications we hold, visit the trust and security page of our website. Environmental Sustainability

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 31 25% 25% 27% 26% 26% 29% 17% 21% 23% 24% 25% 33% 2017 2018 2019 2020 2021 2022 27% 30% 30% 29% 33% 37% 32% 35% 35% 36% 36% 2017 2018 2019 2020 2021 2022 Diversity & Inclusion PROS Employee Resource Groups (ERGs) Our ERGs are formed and led by employees, with company support, and any interested employee may join any group. Organized around common life experiences and backgrounds, they serve to champion our diversity initiatives and facilitate a workplace culture of equity and inclusion. Committed to a Diverse & Inclusive Environment We welcome and celebrate diverse perspectives, cultures and experiences. We are truly a ‘people first’ culture where every person is encouraged to bring their authentic selves to work and feel they belong and are valued. Our diversity in thought and action is what makes PROS a special place. Learn more Overall Representation % of All Employees Globally Management % of All Managers Globally Overall Representation % of All Employees U.S. Management % of All Managers U.S. Women at PROS Underrepresented Minorities in the U.S. 2022 figures based on 1,357 global employees as of 12/31/22 2022 figures based on 845 employees in the U.S. as of 12/31/22 Note: Underrepresented Minorities include AA, Hispanic and Multicultural For further disclosures on D&I at PROS, read our ESG report.

Appendix

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 33 Supplemental Information – Explanation of Non-GAAP Measures PROS has provided certain financial information that has not been prepared in accordance with GAAP. This information includes non-GAAP gross profit, non-GAAP gross margin, non-GAAP subscription gross margin, non-GAAP recurring revenue gross margin, adjusted EBITDA and free cash flow. PROS uses these non-GAAP financial measures internally in analyzing its financial results and believes they are useful to investors, as a supplement to GAAP measures, in evaluating PROS’ ongoing operational performance and cloud transition. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with GAAP. Investors are encouraged to review the reconciliation of these non-GAAP measures to their most directly comparable GAAP financial measure. A reconciliation of GAAP to the non-GAAP financial measures has been provided in these tables and in the earnings press release. PROS' use of non-GAAP financial measures may not be consistent with the presentations by similar companies in PROS' industry. Non-GAAP gross profit: Non-GAAP gross profit is defined as GAAP gross profit less amortization of acquisition-related intangibles, severance and share-based compensation costs allocated to cost of subscription, maintenance and support, and services. Non-GAAP gross margin is calculated as the percentage of non-GAAP gross profit divided by total revenue. Non-GAAP subscription gross margin and recurring revenue gross margin are similarly calculated to compare the non-GAAP gross profit of subscritpion revenue and recurring revenue (subscription, maintenance and support revenue), respectively, to total subscription and recurring revenue, respectively. In calculating the non-GAAP gross profit of subscription revenue, the total costs of subscription are adjusted to reduce such costs by the portion of amortization of acquisition-related intangibles, severance and share-based compensation costs allocated to cost of subscription. In calculating the non-GAAP gross profit of recurring revenue, the total costs of subscription, maintenance and support are adjusted to reduce such costs by the portion of amortization of acquisition-related intangibles, severance and share-based compensation costs allocated to cost of subscription and cost of maintenance and support. Adjusted EBITDA: Adjusted EBITDA is defined as GAAP net income (loss) before interest expense, provision for income taxes, depreciation and amortization, as adjusted to eliminate the effect of stock-based compensation cost, severance, acquisition-related expenses, amortization of acquisition-related intangibles, and depreciation and amortization. Adjusted EBITDA should not be considered as an alternative to net loss as an indicator of our operating performance. Free Cash Flow: Free cash flow is a non-GAAP financial measure which is defined as net cash provided by (used in) operating activities, excluding severance payments, less capital expenditures (excluding expenditures for PROS new headquarters), purchases of other (non-acquisition-related) intangible assets and capitalized internal-use software development costs. Calculated Billings: Calculated billings is defined as total subscription, maintenance and support revenue plus the change in recurring deferred revenue in a given period.

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 34 Supplemental Reconciliation of GAAP to Non-GAAP Financial Measures – Guidance (In thousands, Unaudited) Low High Adjusted EBITDA GAAP Loss from Operations $ (11,400) $ (10,400) Amortization of acquisition-related intangibles 1,400 1,400 Share-based compensation 11,300 11,300 Depreciation and other amortization 1,200 1,200 Adjusted EBITDA $ 2,500 $ 3,500 Q3 2023 Guidance Low High Adjusted EBITDA GAAP Loss from Operations $ (51,900) $ (49,900) Amortization of acquisition-related intangibles 6,100 6,100 Severance 3,600 3,600 Share-based compensation 43,000 43,000 Depreciation and other amortization 4,700 4,700 Adjusted EBITDA $ 5,500 $ 7,500 Full Year 2023 Guidance

©2023 PROS, Inc. All rights reserved. Confidential and Proprietary page 35 Supplemental Information - GAAP to Non-GAAP Reconciliations (In thousands, Unaudited) Gross Profit Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 GAAP Gross Profit $ 36,619 $ 38,996 $ 39,131 $ 40,721 $ 42,738 $ 43,467 $ 43,640 $ 47,221 Amortization of acquisition-related intangibles 384 752 1,983 1,685 1,555 1,441 1,337 1,243 Severance - - - - - 245 749 - Share-based compensation 951 926 825 1,006 1,050 1,017 832 985 Non-GAAP Gross Profit $ 37,954 $ 40,674 $ 41,939 $ 43,412 $ 45,343 $ 46,170 $ 46,558 $ 49,449 Non-GAAP Gross Margin 61% 63% 63% 64% 64% 65% 64% 65% Subscription Gross Profit Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 GAAP Subscription Gross Profit $ 30,997 $ 34,109 $ 34,986 $ 36,640 $ 37,934 $ 39,442 $ 41,876 $ 43,245 Amortization of acquisition-related intangibles 384 752 1,983 1,685 1,555 1,441 1,337 1,243 Severance - - - - - 8 125 - Share-based compensation 182 207 151 185 174 148 125 169 Non-GAAP Subscription Gross Profit $ 31,563 $ 35,068 $ 37,120 $ 38,510 $ 39,663 $ 41,039 $ 43,463 $ 44,657 Non-GAAP Subscription Gross Margin 72% 75% 76% 76% 77% 77% 78% 78% Recurring Revenue Gross Profit Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 GAAP Recurring Revenue Gross Profit $ 37,430 $ 40,446 $ 40,674 $ 41,901 $ 43,053 $ 43,962 $ 45,306 $ 46,462 Amortization of acquisition-related intangibles 384 752 1,983 1,685 1,555 1,441 1,337 1,243 Severance - - - - - 8 432 - Share-based compensation 313 343 242 283 283 266 205 267 Non-GAAP Recurring Revenue Gross Profit $ 38,127 $ 41,541 $ 42,899 $ 43,869 $ 44,891 $ 45,677 $ 47,280 $ 47,972 Non-GAAP Recurring Revenue Gross Margin 72% 75% 76% 76% 76% 77% 77% 77% Adjusted EBITDA Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 GAAP Loss From Operations $ (15,808) $ (21,639) $ (26,503) $ (20,537) $ (16,181) $ (14,873) $ (18,796) $ (13,355) Acquisition-related expenses - 2,386 - - - - - - Amortization of acquisition-related intangibles 845 1,420 2,975 2,597 2,221 1,973 1,806 1,620 Severance - - 1,508 - - 4,034 3,586 - Share-based compensation 8,634 9,665 11,225 10,766 10,626 10,097 9,904 10,752 Depreciation and other amortization 1,891 1,812 1,672 1,204 1,174 1,151 1,195 1,131 Adjusted EBITDA $ (4,438) $ (6,356) $ (9,123) $ (5,970) $ (2,160) $ 2,382 $ (2,305) $ 148 Free Cash Flow Q3'21 Q4'21 Q1'22 Q2'22 Q3'22 Q4'22 Q1'23 Q2'23 Cash Flow From Operations $ (8,171) $ (970) $ (11,014) $ (1,931) $ (8,991) $ (1,970) $ (6,413) $ (6,542) Severance - - - - - 3,058 3,170 579 Purchase of property and equipment (excluding new headquarters) (347) (364) (461) (308) (76) (16) (1,546) (277) Free Cash Flow $ (8,518) $ (1,334) $ (11,475) $ (2,239) $ (9,067) $ 1,072 $ (4,519) $ (6,240)

Thank You pros.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |