Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

March 01 2024 - 7:09AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the

month of March 2024

PEARSON plc

(Exact

name of registrant as specified in its charter)

N/A

(Translation

of registrant's name into English)

80 Strand

London, England WC2R 0RL

44-20-7010-2000

(Address

of principal executive office)

Indicate

by check mark whether the Registrant files or will file annual

reports

under

cover of Form 20-F or Form 40-F:

Form

20-F

X

Form 40-F

Indicate

by check mark whether the Registrant by furnishing the

information

contained

in this Form is also thereby furnishing the information to

the

Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of

1934

Yes

No X

1 March 2024

Pearson plc

Announcement of share repurchase programme

Further to its announcement on 1 March 2024 of its

Preliminary Results, Pearson plc (the Company) announces that it has entered into an engagement

with Citigroup Global Markets Limited (the Bank) to execute its £200 million share buyback

programme (the Programme).

The Programme will commence the next business day following

completion of the current £300 million share buyback programme

announced on 20 September 2023, and is anticipated to end on or

before 8 August 2024 (the Engagement

Period). As per the 20

September 2023 announcement, it is anticipated that the current

£300 million share buyback programme will end on or before 7

March 2024. Purchases may continue during any closed periods of the

Company during the Engagement Period.

The Company has entered into an engagement with the Bank under

which it has issued a non-discretionary irrevocable instruction to

the Bank to manage the Programme. The Bank will carry out the

instruction through the acquisition of ordinary shares in the

Company for subsequent repurchase by the Company. The Bank will

make trading decisions in relation to the Company's ordinary shares

repurchased under the Programme independently of, and uninfluenced

by, the Company.

Any acquisitions of its ordinary shares by the Company will be

effected within certain pre-set parameters set out in the Bank's

engagement letter, and in accordance with the Company's AGM

authority to repurchase ordinary shares as in force from time to

time (at the AGM on 28 April 2023, shareholders gave the Company

authority to purchase a maximum of 71,612,324 ordinary shares),

Chapter 12 of the Financial Conduct Authority's Listing Rules and

the provisions of the Market Abuse Regulation 596/2014/EU (as it

forms part of UK law pursuant to the European Union (Withdrawal)

Act 2018, as amended) and will be discontinued in the event that

the Company ceases to have the necessary general authority to

repurchase ordinary shares.

The sole purpose of the Programme is to reduce the capital of the

Company. As such, the Company will cancel any ordinary shares

purchased.

For the avoidance of doubt, no repurchases will be made in respect

of the Company's American Depositary Receipts.

The Bank may undertake transactions in the Company's ordinary

shares during the Engagement Period in order to manage its market

exposure under the Programme.

CONTACTS

|

Investor Relations

|

Jo Russell

|

+44 (0)

7785 451 266

|

|

|

Gemma

Terry

|

+44 (0)

7841 363 216

|

|

|

Brennan

Matthews

|

+1

(332) 238-8785

|

|

Teneo

|

Charles Armitstead

|

+44 (0)

7703 330 269

|

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

PEARSON

plc

|

|

|

|

|

Date:

01 March 2024

|

|

|

|

By: /s/

NATALIE WHITE

|

|

|

|

|

|

------------------------------------

|

|

|

Natalie

White

|

|

|

Deputy

Company Secretary

|

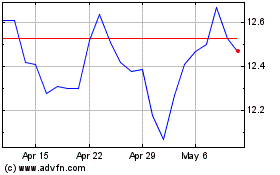

Pearson (NYSE:PSO)

Historical Stock Chart

From Apr 2024 to May 2024

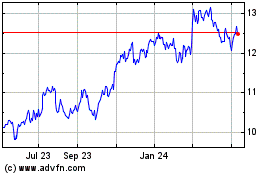

Pearson (NYSE:PSO)

Historical Stock Chart

From May 2023 to May 2024