0000075208

false

0000075208

2023-08-28

2023-08-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of the

Securities

Exchange Act of 1934

August

28, 2023

Date

of Report (Date of earliest event reported)

Overseas

Shipholding Group, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-06479 |

|

13-2637623 |

(State

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

Two

Harbor Place

302

Knights Run Avenue, Suite 1200

Tampa,

Florida 33602

(Address

of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code: (813) 209-0600

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Class

A Common Stock (par value $0.01 per share) |

|

OSG

|

|

NYSE |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

8.01 Other Events

On

August 28, 2023, Overseas Shipholding Group, Inc. announced that it had agreed to purchase 3,788,639 shares of the Company’s common

stock from entities managed by Cyrus Capital Partners, L.P. at a price of $4.05 per share, or a total of $15,343,987.95.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, OSG has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

OVERSEAS

SHIPHOLDING GROUP, INC. |

| |

(Registrant) |

| |

|

|

| Date:

August 29, 2023 |

By: |

/s/

Richard Trueblood |

| |

|

Richard

Trueblood |

| |

|

Vice

President, Chief Financial Officer |

EXHIBIT

INDEX

Exhibit

99.1

Overseas

Shipholding Group

Announces

Off-Market Share Repurchase

Tampa,

FL –August 28, 2023 – Overseas Shipholding Group, Inc. (NYSE: OSG) (the “Company” or “OSG”) today

announced that it has agreed to purchase 3,788,639 shares of the Company’s common stock from entities managed by Cyrus Capital

Partners, L.P. at a price of $4.05 per share for a total consideration of $15,343,987.95 in a privately negotiated transaction. The purchase

is expected to be completed today and will be paid out of OSG’s available cash. The closing price of OSG common stock in composite

trading on August 25, 2023 was $4.01. The purchase is not part of the previously announced program to purchase up to $20 million of OSG

common stock.

Sam

Norton, OSG’s President and CEO, stated, “The opportunity offered to us by Cyrus Capital to acquire a meaningful block of

OSG shares presented an attractive means for continuing our commitment to increasing shareholder value through our share repurchase strategy.

The price paid in this share purchase equates to an enterprise value of roughly four times expected 2023 adjusted EBITDA, an implied

valuation that we believe represents a compelling value. Through both open market purchases and opportunistic off-market transactions

such as the one to be concluded today with Cyrus Capital, OSG has repurchased 16.76 million shares over the past fifteen months at an

average price of $3.33 per share.”

Mr.

Norton added, “The recent success of our operations and the duration of our current book of charter contracts has given OSG the

appropriate level of visibility to reasonably expect a steady stream of cash flows from both our specialized and conventional trading

businesses for the foreseeable future. The repurchase of shares at attractive prices is but one of several options for utilizing excess

cash that our Board of Directors continuously reviews, and we look forward to reporting on future cash deployment opportunities in the

quarters ahead.”

About

Overseas Shipholding Group, Inc

Overseas

Shipholding Group, Inc. (NYSE: OSG) is a publicly traded company providing liquid bulk transportation services in the energy industry

for crude oil and petroleum products in the U.S. Flag markets. OSG is a major operator in the Jones Act industry and in the Tanker Security

Program. OSG’s U.S. Flag fleet consists of Suezmax crude oil tankers doing business in Alaska, conventional and lightering ATBs,

shuttle and conventional MR tankers, and non-Jones Act MR tankers that participate in the U.S. Tanker Security Program and for the Military

Sealift Command.

OSG

is committed to setting high standards of excellence for its quality, safety, and environmental programs. OSG is recognized as one of

the world’s most customer-focused marine transportation companies and is headquartered in Tampa, FL. More

information is available at www.osg.com

Forward-Looking

Statements

This

press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements

other than statements of historical facts should be considered forward-looking statements, including but not limited to words such as

“may”, “will”, “intends”, “plans”, “expects” and similar expressions. Such

forward-looking statements represent the Company’s reasonable expectations with respect to future events or circumstances based

on various factors and are subject to various risks, uncertainties, and assumptions relating to the Company’s operations, financial

results, financial condition, business, prospects, growth strategy and liquidity. Undue reliance should not be placed on any forward-looking

statements and, when reviewing any forward-looking statements, investors should carefully consider factors including, but not limited

to, those risk factors discussed in the Company’s Annual Report on Form 10-K and in the Company’s subsequently filed Quarterly

Reports on Form 10-Q filed with the SEC. The Company assumes no obligation to update or revise any forward-looking statements except

as may be required by law. Forward-looking statements in this press release and written and oral forward-looking statements attributable

to the Company or its representatives after the date of this press release are qualified in their entirety by the cautionary statement

contained in this paragraph and in other reports hereafter filed by the Company with the SEC.

Investor

Relations & Media Contact:

Susan

Allan, Overseas Shipholding Group, Inc.

(813)

209-0620

sallan@osg.com

Source:

Overseas Shipholding Group, Inc.

v3.23.2

Cover

|

Aug. 28, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 28, 2023

|

| Entity File Number |

001-06479

|

| Entity Registrant Name |

Overseas

Shipholding Group, Inc

|

| Entity Central Index Key |

0000075208

|

| Entity Tax Identification Number |

13-2637623

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

Two

Harbor Place

|

| Entity Address, Address Line Two |

302

Knights Run Avenue

|

| Entity Address, Address Line Three |

Suite 1200

|

| Entity Address, City or Town |

Tampa

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33602

|

| City Area Code |

(813)

|

| Local Phone Number |

209-0600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class

A Common Stock (par value $0.01 per share)

|

| Trading Symbol |

OSG

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

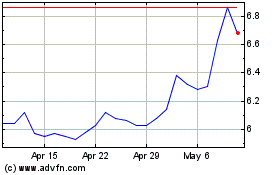

Overseas Shipholding (NYSE:OSG)

Historical Stock Chart

From Apr 2024 to May 2024

Overseas Shipholding (NYSE:OSG)

Historical Stock Chart

From May 2023 to May 2024