Novo Nordisk Shares Dive on Lower Forecast

October 28 2016 - 5:00AM

Dow Jones News

Shares in Novo Nordisk A/S plummeted Friday as the Danish

pharmaceutical company slashed its long-term growth target, despite

reporting a forecast-beating 17% rise in third-quarter net

profit.

The company reduced its long-term guidance and narrowed its

sales and operating profit outlook for 2016 due to a difficult U.S.

market.

Its shares were trading 15% lower Friday morning.

It now expects 2016 sales growth of 5% to 6% from earlier

guidance of 5% to 7%, and operating profit growth of 5% to 7% from

5% to 8%, both measured in local currencies.

The preliminary outlook for 2017 indicates low single-digit

growth in sales and flat to low single-digit growth in operating

profit, in local currencies, it said.

"In terms of long-term financial targets, Novo Nordisk no longer

deems it achievable to reach the operating profit growth target of

10% set in February 2016," it said. "As a result, the target has

been revised and Novo Nordisk is now aiming for an average

operating profit growth of 5%."

In a further move to become more competitive, the pharmaceutical

firm said it has revised its R&D strategy and priorities, and

won't progress its current development projects within oral insulin

and related combinations.

Net profit for the three months ended Sept. 30 rose to 9.8

billion Danish kroner ($1.44 billion) from 8.38 billion kroner in

the same period last year. Analysts polled by FactSet had expected

net profit of 9.46 billion kroner.

Sales rose to 27.54 billion kroner from 26.79 billion kroner in

the year-earlier period, missing analysts' expectations of 28.01

billion kroner.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

October 28, 2016 04:45 ET (08:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

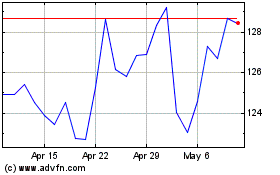

Novo Nordisk (NYSE:NVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

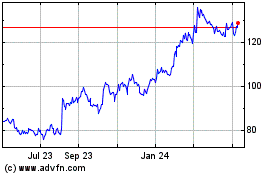

Novo Nordisk (NYSE:NVO)

Historical Stock Chart

From Apr 2023 to Apr 2024