Current Report Filing (8-k)

April 09 2020 - 5:12PM

Edgar (US Regulatory)

0001163739

false

0001163739

2020-04-02

2020-04-03

0001163739

us-gaap:CommonStockMember

2020-04-02

2020-04-03

0001163739

us-gaap:SeriesAPreferredStockMember

2020-04-02

2020-04-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): April 3, 2020

NABORS INDUSTRIES LTD.

(Exact name of registrant as specified in

its charter)

|

Bermuda

|

|

001-32657

|

|

98-0363970

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

Crown House

4 Par-la-Ville Road

Second Floor

Hamilton, HM08 Bermuda

|

|

N/A

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(441) 292-1510

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of exchange on which

registered

|

|

Common shares

|

|

NBR

|

|

NYSE

|

|

Preferred

shares – Series A

|

|

NBR.PRA

|

|

NYSE

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

Item 3.01

|

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

|

On April 8, 2020, Nabors Industries Ltd.

(“Nabors”) received notice (the “Delisting Notice”) from the New York Stock Exchange (the “NYSE”)

that it is no longer in compliance with the NYSE continued listing criteria set forth in Section 802.01C of the Listed Company

Manual of the NYSE that requires listed companies to maintain an average closing share price of at least $1.00 over a period of

30 consecutive trading days.

Pursuant to Section 802.01C, Nabors has

a period of six months following the receipt of the Delisting Notice to regain compliance with the minimum share price requirement,

subject to possible extension in the discretion of the NYSE. Nabors has proposed a reverse stock split to raise the per share trading

price of its commons shares and to maintain its listing on the NYSE. Nabors plans to formally notify the NYSE within 10 business

days of its intent to cure the deficiency. Nabors is in compliance with all other NYSE continued listing standard rules.

Nabors can regain compliance with the minimum

share price requirement at any time during the six month cure period if, on the last trading day of any calendar month during the

cure period or on the last day of the cure period, Nabors has a closing share price of at least $1.00, and an average closing share

price of at least $1.00 over the 30 trading-day period ending on such date. If Nabors effectuates a reverse stock split following

shareholder approval to cure the condition, the condition will be deemed cured if the price promptly exceeds $1.00 a share, and

the price remains above that level for at least the following 30 trading days. If Nabors does not notify the NYSE that it intends

to cure the deficiency as described above, then the NYSE could commence delisting procedures.

The Delisting Notice has no immediate impact

on the listing of Nabors’ common shares, which will continue to be listed and traded on the NYSE during the cure period under

the trading symbol “NBR”, subject to Nabors’ continued compliance with the other listing requirements of the

NYSE. However, the trading symbol will have an added designation of “.BC” to indicate that the status of the common

shares is “below compliance” with the NYSE continued listing standards. The “.BC” indicator will be removed

at such time as Nabors regains compliance.

The NYSE notification does not affect Nabors’

business operations or its Securities and Exchange Commission reporting requirements, and does not conflict with or cause an event

of default under any of Nabors’ material debt agreements.

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements

of Certain Officers.

|

On April 3, 2020, Nabors internally announced

certain broad-based reductions in employee compensation, which will also affect the compensation of its executives (the “Compensation

Reductions”). On April 6, 2020, Nabors entered into amendments to the executive employment agreements of each of Anthony

G. Petrello, Nabors’ Chairman, CEO and President (the “Petrello Amendment”), and William Restrepo, Nabors’

CFO (the “Restrepo Amendment” and together with the Petrello Amendment, the “Amendments”), to document and memorialize the Compensation Reductions as well as reductions in compensation

that were previously announced. The Petrello Amendment provides that, for an interim period as

set forth therein the amount of base salary due and payable for purposes of biweekly payroll administration only shall be based

on a salary for Mr. Petrello, determined on an annualized basis, as follows: (i) for the period commencing on the first payroll

period of fiscal 2020 and ending on March 22, 2020, an amount equal to ninety percent (90%) of Mr. Petrello’s base salary,

as set forth in his employment agreement; (ii) for the payroll period commencing on March 23, 2020 and ending on April 5, 2020,

an amount equal to eighty percent (80%) of Mr. Petrello’s base salary, as set forth in his employment agreement; (iii) for

the two (2) payroll periods commencing on April 6, 2020 and ending on May 3, 2020, an amount equal to fifty percent (50%) of the

amount calculated in accordance with clause (ii) above; and (iv) for the payroll period commencing on May 4, 2020 and ending at

the end of the last payroll period of fiscal 2020, an amount equal to ninety percent (90%) of the amount calculated in accordance

with clause (ii) above. Likewise, the Restrepo Amendment provides that, for an interim period as set forth therein the amount of

base salary due and payable for purposes of biweekly payroll administration only shall be based on a salary for Mr. Restrepo, determined

on an annualized basis, as follows: (a) for the payroll period commencing on March 23, 2020 and ending on April 5, 2020, an amount

equal to eighty percent (80%) of Mr. Restrepo’s base salary as set forth in his employment agreement; (b) for the two (2)

payroll periods commencing on April 6, 2020 and ending on May 3, 2020, an amount equal to fifty percent (50%) of the amount calculated

in accordance with clause (a) above; and (c) for the payroll period commencing on May 4, 2020 and ending at the end of the last

payroll period of fiscal 2020, an amount equal to ninety percent (90%) of the amount calculated in accordance with clause (a) above.

As a result of the Amendments, each of Mr. Petrello and Restrepo will receive salary reductions of approximately 31% for the period

from March 23, 2020 through the remainder of the year, and reductions of approximately 26 percent and 24 percent, respectively,

for the entire year.

The descriptions above for the Petrello

Amendment and the Restrepo Amendment are qualified in their entirety by reference to the Petrello Amendment, which are included

as Exhibits 10.1 and 10.2 to this Current Report on Form 8-K and incorporated into this Item 5.02 by reference.

|

|

Item 7.01

|

Regulation FD Disclosure.

|

On April 8, 2020, Nabors issued a press

release announcing the receipt of the Delisting Notice, a copy of which is furnished herewith as Exhibit 99.1 and is incorporated

herein by reference.

The information in this Item 7.01 of this

Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of

1934, or otherwise subject to the liabilities of that section or Sections 11 or 12(a)(2) of the Securities Act of 1933, as amended.

|

|

Item 9.01

|

Financial Statement and Exhibits.

|

(d) Exhibits

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

10.1

|

|

Eighth Amendment to Executive Employment Agreement, dated April 6, 2020, among Nabors Industries Ltd., Nabors Industries, Inc., and Anthony G. Petrello

|

|

10.2

|

|

First Amendment to Amended and Restated Employment Agreement, dated April 6, 2020, among Nabors Industries Ltd., Nabors Industries, Inc., and William Restrepo.

|

|

99.1

|

|

Press Release issued April 8, 2020

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

NABORS

INDUSTRIES LTD.

|

|

|

|

|

Date:

April 9, 2020

|

|

By:

|

/s/Mark

D. Andrews

|

|

|

|

Mark

D. Andrews

|

|

|

|

Corporate

Secretary

|

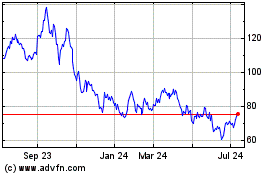

Nabors Industries (NYSE:NBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

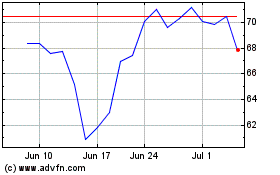

Nabors Industries (NYSE:NBR)

Historical Stock Chart

From Apr 2023 to Apr 2024