Form SC TO-I/A - Tender offer statement by Issuer: [Amend]

November 07 2023 - 10:40AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER SECTION 14(D)(1) OR 13(E)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. 2)

MFS Investment Grade Municipal Trust

(Name of Subject Company (Issuer))

MFS Investment Grade Municipal Trust

(Name of Filing Person (Issuer))

Common Shares, Without Par

(Title of Class of Securities)

59318B108

(CUSIP Number of Class of Securities)

Christopher R. Bohane

Massachusetts Financial Services Company

111 Huntington Avenue

Boston, MA 02199

Telephone: (617) 954-5000

(Name, address and telephone number of person authorized to receive notices and communications on behalf of filing persons)

With a Copy to:

David C. Sullivan

Ropes & Gray LLP

Prudential Tower

800 Boylston Street

Boston, MA 02199-3600

Telephone: (617) 951-7000

| ☐ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

|

Check the appropriate boxes below to designate any transactions to which the statement relates:

|

☐ third party tender offer subject

to Rule 14d-1.

☒ issuer tender offer subject to

Rule 13e-4.

☐ going-private transaction

subject to Rule 13e-3.

☐ amendment to Schedule 13D under

Rule 13d-2.

Check the following box if the filing is a final amendment reporting the results of the tender offer. ☐

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

☐ Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

☐ Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

-2-

EXPLANATORY NOTE

This Amendment No. 2 (“Amendment No. 2”) amends and supplements the Schedule TO filed with the Securities and Exchange Commission (the “SEC”) on August 25, 2023, as first amended October 6,

2023, regarding the communications made for the commencement of a tender offer (the “Offer”) on October 6, 2023 by MFS Investment Grade Municipal Trust, a closed-end management investment company (the “Fund”), to purchase for cash up to 10%

or 911,024 shares of the Fund’s outstanding common shares (the “Shares”) upon the terms and subject to the conditions of the Offer.

This Amendment No. 2 to Schedule TO is intended to satisfy the requirements pursuant to Rule 13e-4(c)(3) of the Exchange Act.

Forward-Looking Statements

This document contains statements regarding plans and expectations for the future that constitute forward-looking statements within The Private Securities Litigation Reform Act of 1995. All

statements other than statements of historical fact are forward-looking and can be identified by the use of words such as “may,” “will,” “expect,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. Such

forward-looking statements are based on the Fund’s current plans and expectations, are not guarantees of future results or performance, and are subject to risks and uncertainties that could cause actual results to differ materially from

those described in the forward-looking statements. All forward-looking statements are as of the date of this release only; the Fund undertakes no obligation to update or review any forward-looking statements. You are urged to carefully

consider all such factors.

Items 1 through 11 and Item 13

The information set forth in the Offer to Purchase and the related Letter of Transmittal is incorporated herein by reference into this Amendment No. 2 in answer to Item 1 through Item 11

and Item 13 of Schedule TO.

Items 12. EXHIBITS

Item 12 of the Schedule TO is hereby amended and supplemented to add the following exhibits:

Exhibit No. Document

|

(a)(1)(i)

|

|

Offer to Purchase dated October 6, 2023.1

|

| |

|

|

(a)(1)(ii)

|

|

Letter of Transmittal.1

|

| |

|

|

(a)(1)(iii)

|

|

Letter to Brokers, Dealers, Commercial Banks, Trust Companies and Other Nominees.1

|

| |

|

|

(a)(1)(iv)

|

|

Letter to Clients.1

|

-3-

|

(a)(3)

|

|

Not Applicable.

|

| |

|

|

(a)(4)

|

|

Not Applicable.

|

| |

|

|

(a)(5)(iii)

|

|

Press Release issued on October 6, 20231

|

|

(a)(5)(iv)

|

|

|

| |

|

|

(d)

|

|

Tender Offer and Standstill Agreement dated August 23, 2023.1

|

| |

|

(g)

|

|

None.

|

1 Previously Filed on October 6, 2023, as an exhibit to the Schedule TO.

2 Filed herewith.

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

MFS Investment Grade Municipal Trust

|

| |

|

|

|

|

By: /s/ William B. Wilson

|

|

|

|

Name: William B. Wilson

|

|

|

Title: Assistant Secretary and Assistant Clerk

|

Exhibit (a)(5)(iv)

For Immediate

Release Media contacts: Dan Flaherty, +1 617.954.4256

For shareholders/advisors: Jeffrey Schwarz, +1 617.954.5872

MFS INVESTMENT GRADE MUNICIPAL TRUST ANNOUNCES PRELIMINARY RESULTS OF TENDER OFFER

BOSTON (November 7, 2023) – MFS® Investment Grade Municipal Trust (the “Fund”) (NYSE: CXH) announced today that its tender offer for 911,024 shares of the Fund’s outstanding common shares (the “Shares”),

representing approximately 10% of the Fund’s outstanding shares, expired at 5:00 P.M., Eastern Standard Time, on November 6, 2023.

Based on current information, approximately 3,875,017.30 Shares were properly tendered and not withdrawn. Based on this preliminary information, the proration for a tendering shareholder is estimated to be approximately 23.51 percent of the

shares properly tendered and not withdrawn. These numbers, including the estimated proration for a tendering shareholder, are subject to adjustment and should not be regarded as final. The actual number of shares to be purchased is anticipated to be

announced on or about November 10, 2023, and payment for such shares will be made on or about November 10, 2023. The purchase price of properly tendered Shares is 98% of the Fund’s net asset value (“NAV”) per Share calculated as of the close of

regular trading on the New York Stock Exchange (“NYSE”) on November 6, 2023, which is equal to $7.79 per Share.

The Fund’s information agent for the tender offer is Georgeson LLC and the depositary agent for the tender offer is Computershare Trust Company, N.A. Any questions with regard to the tender offer may be directed to the information agent toll-free

at 1-866-316-3922.

About the Fund

The Fund is a closed-end investment company product advised by MFS Investment Management. Closed-end funds, unlike open-end funds, are not continuously offered. Except pursuant to a tender offer, common shares of the Fund are only available for

purchase/sale on the NYSE at the current market price. Shares may trade at a discount to NAV. Shares of the Fund are not FDIC-insured and are not deposits or other obligations of, or guaranteed by, any bank. Shares of the Fund involve investment

risk, including possible loss of principal. For more complete information about the Fund, including risks, charges, and expenses, please see the Fund's annual and semi-annual shareholder reports or contact your financial adviser.

About MFS Investment Management

In 1924, MFS launched the first U.S. open-end mutual fund, opening the door to the markets for millions of everyday investors. Today, as a full-service global investment manager serving financial advisors, intermediaries, and institutional

clients, MFS still serves a single purpose: to create long-term value for clients by allocating capital responsibly. That takes our powerful investment approach combining collective expertise, thoughtful risk management and long-term discipline.

Supported by our culture of shared values and collaboration, our teams of diverse thinkers actively debate ideas and assess material risks to uncover what we believe are the best investment opportunities in the market. As of October 31, 2023, MFS

manages $538.9 billion in assets on behalf of individual and institutional investors worldwide. Please visit mfs.com for more information.

MFS Investment Management 111 Huntington Ave., Boston, MA 02199

# # #

CALCULATION OF FILING FEE TABLES

Schedule TO

(Form Type)

MFS Investment Grade Municipal Trust

(Exact Name of Registrant as Specified in its Charter)

Table 1: Transaction Valuation

|

|

Transaction

Valuation (a)

|

Fee

rate

|

Amount of

Filing Fee (b)

|

|

Fees to Be Paid

|

—

|

0.0001476%

|

—

|

|

Fees Previously Paid

|

$6,865,480.63 (c)

|

|

$1,013.34

|

|

Total Transaction Valuation

|

$6,865,480.63 (c)

|

|

|

|

Total Fees Due for Filing

|

|

|

$1,013.34

|

|

Total Fees Previously Paid

|

|

|

$1,013.34

|

|

Total Fee Offsets

|

|

|

—

|

|

Net Fee Due

|

|

|

$0.00

|

(a) Estimated for purposes of calculating the amount of the filing fee only. Pursuant to Rule 0-11(b)(1) under the Securities Exchange

Act of 1934, as amended, the Transactional Valuation was calculated by multiplying 911,024.50 shares of shares in the offer (10% of the total number of common shares outstanding) by $7.536 (98% of the net asset value per share of $7.69 as of the

close of regular trading on the New York Stock Exchange on October 3, 2023).

(b) Calculated at $147.60 per $1,000,000 of the Transaction Valuation.

(c) Calculated as of the close of business on October 3, 2023.

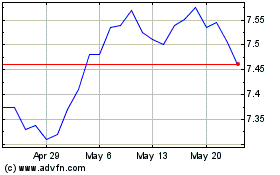

MFS Investment Grade Mun... (NYSE:CXH)

Historical Stock Chart

From Apr 2024 to May 2024

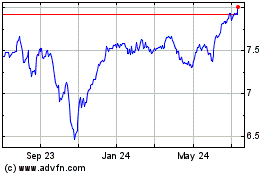

MFS Investment Grade Mun... (NYSE:CXH)

Historical Stock Chart

From May 2023 to May 2024