0000063330

false

--12-31

2023

Q2

10

10

3

0

0

1

0

0

0

0

00000633302023-01-012023-06-30

iso4217:USD

0000063330us-gaap:OperatingSegmentsMember2022-01-012022-06-30

0000063330us-gaap:OperatingSegmentsMember2023-01-012023-06-30

0000063330us-gaap:OperatingSegmentsMember2022-04-012022-06-30

0000063330us-gaap:OperatingSegmentsMember2023-04-012023-06-30

0000063330us-gaap:OperatingSegmentsMembermlp:ResortAmenitiesSegmentMember2022-01-012022-06-30

0000063330us-gaap:OperatingSegmentsMembermlp:ResortAmenitiesSegmentMember2023-01-012023-06-30

0000063330us-gaap:OperatingSegmentsMembermlp:ResortAmenitiesSegmentMember2022-04-012022-06-30

0000063330us-gaap:OperatingSegmentsMembermlp:ResortAmenitiesSegmentMember2023-04-012023-06-30

0000063330us-gaap:OperatingSegmentsMembermlp:LeasingSegmentMember2022-01-012022-06-30

0000063330us-gaap:OperatingSegmentsMembermlp:LeasingSegmentMember2023-01-012023-06-30

0000063330us-gaap:OperatingSegmentsMembermlp:LeasingSegmentMember2022-04-012022-06-30

0000063330us-gaap:OperatingSegmentsMembermlp:LeasingSegmentMember2023-04-012023-06-30

0000063330us-gaap:OperatingSegmentsMembermlp:RealEstateSegmentMember2022-01-012022-06-30

0000063330us-gaap:OperatingSegmentsMembermlp:RealEstateSegmentMember2023-01-012023-06-30

0000063330us-gaap:OperatingSegmentsMembermlp:RealEstateSegmentMember2022-04-012022-06-30

0000063330us-gaap:OperatingSegmentsMembermlp:RealEstateSegmentMember2023-04-012023-06-30

xbrli:shares

00000633302022-01-012022-06-30

00000633302022-04-012022-06-30

00000633302023-04-012023-06-30

0000063330us-gaap:RestrictedStockMember2022-01-012022-06-30

0000063330us-gaap:RestrictedStockMember2023-01-012023-06-30

0000063330us-gaap:RestrictedStockMember2022-04-012022-06-30

0000063330us-gaap:RestrictedStockMember2023-04-012023-06-30

xbrli:pure

0000063330mlp:ContinuedServiceOfTheChairmanOfTheBoardMember2023-04-012023-06-30

utr:Y

iso4217:USDxbrli:shares

0000063330mlp:ContinuedServiceOfTheChairmanOfTheBoardMember2023-06-30

0000063330mlp:ContinuedServiceOfTheChairmanOfTheBoardMembermlp:ShareBasedPaymentArrangementTrancheFourMember2023-04-012023-06-30

0000063330mlp:ContinuedServiceOfTheChairmanOfTheBoardMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2023-04-012023-06-30

0000063330mlp:ContinuedServiceOfTheChairmanOfTheBoardMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2023-04-012023-06-30

0000063330mlp:BoardCommitteeServiceMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2023-04-012023-06-30

0000063330mlp:BoardCommitteeServiceMember2023-04-012023-06-30

0000063330mlp:BoardCommitteeServiceMember2023-06-30

0000063330mlp:AnnualBoardServiceMember2023-04-012023-06-30

0000063330mlp:OperatingLeaseIncomeIncludingWaterSystemSalesMember2022-01-012022-06-30

0000063330mlp:OperatingLeaseIncomeIncludingWaterSystemSalesMember2023-01-012023-06-30

0000063330mlp:OperatingLeaseIncomeIncludingWaterSystemSalesMember2022-04-012022-06-30

0000063330mlp:OperatingLeaseIncomeIncludingWaterSystemSalesMember2023-04-012023-06-30

0000063330mlp:NoticeAndFindingOfViolationAndOrderMember2018-12-312018-12-31

00000633302022-12-31

00000633302023-06-30

0000063330us-gaap:NonqualifiedPlanMemberus-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2022-12-31

0000063330us-gaap:NonqualifiedPlanMemberus-gaap:SupplementalEmployeeRetirementPlanDefinedBenefitMember2023-06-30

0000063330us-gaap:QualifiedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2022-12-31

0000063330us-gaap:QualifiedPlanMemberus-gaap:PensionPlansDefinedBenefitMember2023-06-30

0000063330us-gaap:RevolvingCreditFacilityMembermlp:FirstHawaiianBankRevolvingLineOfCreditMember2022-12-31

0000063330us-gaap:RevolvingCreditFacilityMembermlp:FirstHawaiianBankRevolvingLineOfCreditMember2023-06-30

0000063330us-gaap:RevolvingCreditFacilityMembermlp:FirstHawaiianBankRevolvingLineOfCreditMember2023-01-012023-06-30

0000063330us-gaap:RevolvingCreditFacilityMembermlp:FirstHawaiianBankRevolvingLineOfCreditMembermlp:KapaluaResortMember2023-06-30

0000063330us-gaap:RevolvingCreditFacilityMembermlp:FirstHawaiianBankRevolvingLineOfCreditMemberus-gaap:BaseRateMember2023-01-012023-06-30

0000063330us-gaap:LicenseMember2022-01-012022-06-30

0000063330us-gaap:LicenseMember2023-01-012023-06-30

0000063330us-gaap:LicenseMember2020-04-012023-06-30

0000063330us-gaap:LicenseMember2020-03-31

0000063330mlp:ClubMembershipMember2022-01-012022-06-30

0000063330mlp:ClubMembershipMember2023-01-012023-06-30

0000063330mlp:ClubMembershipMember2023-04-012023-06-30

0000063330mlp:KapaluaCentralResortProjectMember2023-06-30

utr:acre

0000063330us-gaap:LandMembermlp:UpcountryMauiMember2023-06-30

0000063330us-gaap:LandMembermlp:KapaluaResortMembermlp:WestMauiMember2023-01-012023-06-30

0000063330us-gaap:LandMembermlp:WestMauiMember2023-01-012023-06-30

0000063330us-gaap:LandMembermlp:WestMauiMember2023-06-30

0000063330us-gaap:LandMember2023-06-30

0000063330us-gaap:ConstructionInProgressMember2022-12-31

0000063330us-gaap:ConstructionInProgressMember2023-06-30

0000063330us-gaap:MachineryAndEquipmentMember2022-12-31

0000063330us-gaap:MachineryAndEquipmentMember2023-06-30

0000063330us-gaap:BuildingMember2022-12-31

0000063330us-gaap:BuildingMember2023-06-30

0000063330us-gaap:LandImprovementsMember2022-12-31

0000063330us-gaap:LandImprovementsMember2023-06-30

0000063330us-gaap:LandMember2022-12-31

0000063330mlp:DepositsHeldInEscrowForPropertiesHeldForSaleMember2022-12-31

00000633302022-06-29

00000633302022-06-30

00000633302021-12-31

0000063330us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-30

0000063330us-gaap:RetainedEarningsMember2022-06-30

0000063330us-gaap:AdditionalPaidInCapitalMember2022-06-30

0000063330us-gaap:CommonStockMember2022-06-30

0000063330us-gaap:RetainedEarningsMember2022-04-012022-06-30

0000063330us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-06-30

0000063330us-gaap:CommonStockMember2022-04-012022-06-30

0000063330us-gaap:AdditionalPaidInCapitalMember2022-04-012022-06-30

00000633302022-03-31

0000063330us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-31

0000063330us-gaap:RetainedEarningsMember2022-03-31

0000063330us-gaap:AdditionalPaidInCapitalMember2022-03-31

0000063330us-gaap:CommonStockMember2022-03-31

00000633302022-01-012022-03-31

0000063330us-gaap:RetainedEarningsMember2022-01-012022-03-31

0000063330us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-31

0000063330us-gaap:CommonStockMember2022-01-012022-03-31

0000063330us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-31

0000063330us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-31

0000063330us-gaap:RetainedEarningsMember2021-12-31

0000063330us-gaap:AdditionalPaidInCapitalMember2021-12-31

0000063330us-gaap:CommonStockMember2021-12-31

0000063330us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-30

0000063330us-gaap:RetainedEarningsMember2023-06-30

0000063330us-gaap:AdditionalPaidInCapitalMember2023-06-30

0000063330us-gaap:CommonStockMember2023-06-30

0000063330us-gaap:RetainedEarningsMember2023-04-012023-06-30

0000063330us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-30

0000063330us-gaap:CommonStockMember2023-04-012023-06-30

0000063330us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-30

00000633302023-03-31

0000063330us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-31

0000063330us-gaap:RetainedEarningsMember2023-03-31

0000063330us-gaap:AdditionalPaidInCapitalMember2023-03-31

0000063330us-gaap:CommonStockMember2023-03-31

00000633302023-01-012023-03-31

0000063330us-gaap:RetainedEarningsMember2023-01-012023-03-31

0000063330us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-31

0000063330us-gaap:CommonStockMember2023-01-012023-03-31

0000063330us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-31

0000063330us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-31

0000063330us-gaap:RetainedEarningsMember2022-12-31

0000063330us-gaap:AdditionalPaidInCapitalMember2022-12-31

0000063330us-gaap:CommonStockMember2022-12-31

0000063330mlp:ResortAmenitiesAndOtherMember2022-01-012022-06-30

0000063330mlp:ResortAmenitiesAndOtherMember2023-01-012023-06-30

0000063330us-gaap:RealEstateMember2022-01-012022-06-30

0000063330us-gaap:RealEstateMember2023-01-012023-06-30

0000063330mlp:ResortAmenitiesAndOtherMember2022-04-012022-06-30

0000063330mlp:ResortAmenitiesAndOtherMember2023-04-012023-06-30

0000063330us-gaap:RealEstateMember2022-04-012022-06-30

0000063330us-gaap:RealEstateMember2023-04-012023-06-30

0000063330mlp:MemberDepositsMember2022-12-31

0000063330mlp:MemberDepositsMember2023-06-30

0000063330us-gaap:LicenseMember2022-12-31

0000063330us-gaap:LicenseMember2023-06-30

00000633302023-07-31

thunderdome:item

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| |

☒

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended June 30, 2023

OR

| |

☐

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission file number 001-06510

MAUI LAND & PINEAPPLE COMPANY, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

99-0107542

|

|

(State or other jurisdiction

|

|

(IRS Employer

|

|

of incorporation or organization)

|

|

Identification No.)

|

200 Village Road, Lahaina, Maui, Hawaii 96761

(Address of principal executive offices) (Zip Code)

(808) 877-3351

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.0001 par value

|

|

MLP

|

|

NYSE

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐

|

|

Accelerated filer ☐

|

|

Non-accelerated filer ☒

|

|

Smaller reporting company ☒

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

|

Class

|

|

Outstanding at July 31, 2023

|

|

Common Stock, $0.0001 par value

|

|

19,624,963 shares

|

MAUI LAND & PINEAPPLE COMPANY, INC.

AND SUBSIDIARIES

TABLE OF CONTENTS

|

Cautionary Note Regarding Forward-Looking Statements

|

3

|

| |

|

|

PART I. FINANCIAL INFORMATION

|

4

|

| |

|

|

Item 1. Condensed Consolidated Interim Financial Statements (unaudited)

|

4

|

| |

|

|

Condensed Consolidated Balance Sheets, June 30, 2023 and December 31, 2022 (audited)

|

4

|

| |

|

|

Condensed Consolidated Statements of Operations and Comprehensive Income (Loss), Three Months Ended June 30, 2023 and 2022

|

5

|

| |

|

|

Condensed Consolidated Statements of Operations and Comprehensive Income (Loss), Six Months Ended June 30, 2023 and 2022

|

5

|

| |

|

|

Condensed Consolidated Statements of Changes in Stockholders’ Equity, Three and Six Months Ended June 30, 2023 and 2022

|

7

|

| |

|

|

Condensed Consolidated Statements of Cash Flows, Six Months Ended June 30, 2023 and 2022

|

8

|

| |

|

|

Notes to Condensed Consolidated Interim Financial Statements

|

9

|

| |

|

|

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

16

|

| |

|

|

Item 3. Quantitative and Qualitative Disclosures About Market Risk

|

19

|

| |

|

|

Item 4. Controls and Procedures

|

20

|

| |

|

|

PART II. OTHER INFORMATION

|

20

|

| |

|

|

Item 1. Legal Proceedings

|

20

|

| |

|

|

Item 1A. Risk Factors

|

20

|

| |

|

|

Item 6. Exhibits

|

20

|

| |

|

|

Signature

|

22

|

| |

|

|

EXHIBIT INDEX

|

|

| |

|

| Exhibit 10.1 |

|

| Exhibit 10.2 |

|

|

Exhibit 31.1

|

|

|

Exhibit 31.2

|

|

|

Exhibit 32.1

|

|

|

Exhibit 32.2

|

|

|

Exhibit 101

|

|

| Exhibit 104 |

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This quarterly report on Form 10-Q (this “Quarterly Report”) and other reports filed by us with the U.S. Securities and Exchange Commission (the “SEC”) contain “forward-looking statements” intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. These statements relate to future events or our future financial performance and are subject to known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. These statements include all statements included in or incorporated by reference to this Quarterly Report that are not statements of historical facts, which can generally be identified by words such as “anticipate,” “believe,” “continue” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “project,” “pursue,” “will,” “would,” or the negative or other variations thereof or comparable terminology. We caution you that the foregoing list may not include all of the forward-looking statements made in this Quarterly Report. Actual results could differ materially from those projected in forward-looking statements as a result of the following factors, among others:

| |

•

|

concentration of credit risk on deposits held at banks in excess of the Federal Deposit Insurance Corporation (the “FDIC”) insured limits and in receivables due from our commercial leasing portfolio; |

| |

•

|

unstable macroeconomic market conditions, including, but not limited to, energy costs, credit markets, interest rates, inflationary pressures, and changes in income and asset values; |

| |

•

|

risks associated with real estate investments, including demand for real estate and tourism in Hawaii;

|

| |

•

|

security incidents through cyber-attacks or intrusions on our information systems;

|

| |

•

|

our ability to complete land development projects within forecasted time and budget expectations;

|

| |

•

|

our ability to obtain required land use entitlements at reasonable costs;

|

| |

•

|

our ability to compete with other developers of real estate on Maui;

|

| |

•

|

potential liabilities and obligations under various federal, state and local environmental regulations;

|

| |

•

|

changes in weather conditions, the occurrence of natural disasters, or threats of the spread of contagious diseases;

|

| |

•

|

our ability to cover catastrophic losses in excess of insurance coverages;

|

| |

•

|

unauthorized use of our trademarks could negatively impact our business;

|

| |

•

|

our ability to maintain the listing of our common stock on the New York Stock Exchange;

|

| |

•

|

our ability to comply with funding requirements of our retirement plans;

|

| |

•

|

our ability to comply with the terms of our indebtedness, including financial covenants, and to extend maturity dates, or refinance such indebtedness, prior to its maturity date;

|

| |

•

|

availability of capital on terms favorable to us, and our ability to raise capital through the sale of certain real estate assets, or at all; and

|

| |

•

|

changes in U.S. accounting standards adversely impacting us.

|

Such risks and uncertainties also include those risks and uncertainties discussed in the sections entitled “Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended December 31, 2022 (the “Annual Report”) and the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Quarterly Report, as well as other factors described from time to time in our reports filed with the SEC. Although we believe that our opinions and expectations reflected in the forward-looking statements are reasonable as of the date of this Quarterly Report, we cannot guarantee future results, levels of activity, performance or achievements, and our actual results may differ substantially from the views and expectations set forth in this Quarterly Report. Thus, you should not place undue reliance on any forward-looking statements. New factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Further, any forward-looking statements speak only as of the date made and, except as required by law, we undertake no obligation to publicly revise our forward-looking statements to reflect events or circumstances that arise after the date of this Quarterly Report. We qualify all of our forward-looking statements by these cautionary statements.

PART I FINANCIAL INFORMATION

Item 1. Condensed Consolidated Interim Financial Statements (unaudited)

MAUI LAND & PINEAPPLE COMPANY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| |

|

June 30, 2023

|

|

|

December 31, 2022

|

|

| |

|

(unaudited)

|

|

|

(audited)

|

|

| |

|

(in thousands except share data)

|

|

| ASSETS |

|

|

|

|

|

|

|

|

| CURRENT ASSETS |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

7,246 |

|

|

$ |

8,499 |

|

|

Restricted cash

|

|

|

- |

|

|

|

10 |

|

|

Accounts receivable, net

|

|

|

1,248 |

|

|

|

892 |

|

|

Investments, current portion

|

|

|

2,785 |

|

|

|

2,432 |

|

|

Prepaid expenses and other assets

|

|

|

497 |

|

|

|

368 |

|

|

Assets held for sale

|

|

|

3,056 |

|

|

|

3,019 |

|

|

Total current assets

|

|

|

14,832 |

|

|

|

15,220 |

|

| |

|

|

|

|

|

|

|

|

|

PROPERTY & EQUIPMENT, NET

|

|

|

15,566 |

|

|

|

15,878 |

|

| |

|

|

|

|

|

|

|

|

| OTHER ASSETS |

|

|

|

|

|

|

|

|

|

Investments, net of current portion

|

|

|

274 |

|

|

|

551 |

|

|

Deferred development costs

|

|

|

9,585 |

|

|

|

9,566 |

|

|

Other noncurrent assets

|

|

|

1,198 |

|

|

|

1,191 |

|

|

Total other assets

|

|

|

11,057 |

|

|

|

11,308 |

|

|

TOTAL ASSETS

|

|

$ |

41,455 |

|

|

$ |

42,406 |

|

| |

|

|

|

|

|

|

|

|

| LIABILITIES & STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

|

|

|

| CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

459 |

|

|

$ |

589 |

|

|

Payroll and employee benefits

|

|

|

736 |

|

|

|

869 |

|

|

Accrued retirement benefits, current portion

|

|

|

142 |

|

|

|

142 |

|

|

Deferred revenue, current portion

|

|

|

447 |

|

|

|

227 |

|

|

Other current liabilities

|

|

|

488 |

|

|

|

480 |

|

|

Total current liabilities

|

|

|

2,272 |

|

|

|

2,307 |

|

| |

|

|

|

|

|

|

|

|

| LONG-TERM LIABILITIES |

|

|

|

|

|

|

|

|

|

Accrued retirement benefits, net of current portion

|

|

|

2,626 |

|

|

|

2,612 |

|

|

Deferred revenue, net of current portion

|

|

|

1,433 |

|

|

|

1,500 |

|

|

Deposits

|

|

|

2,148 |

|

|

|

2,185 |

|

|

Other noncurrent liabilities

|

|

|

19 |

|

|

|

30 |

|

|

Total long-term liabilities

|

|

|

6,226 |

|

|

|

6,327 |

|

|

TOTAL LIABILITIES

|

|

|

8,498 |

|

|

|

8,634 |

|

| |

|

|

|

|

|

|

|

|

|

COMMITMENTS AND CONTINGENCIES

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

Preferred stock--$0.0001 par value; 5,000,000 shares authorized; no shares issued and outstanding

|

|

|

- |

|

|

|

- |

|

|

Common stock--$0.0001 par value; 43,000,000 shares authorized; 19,589,504 and 19,476,671 shares issued and outstanding at June 30, 2023 and December 31, 2022, respectively

|

|

|

84,421 |

|

|

|

83,392 |

|

|

Additional paid-in-capital

|

|

|

9,657 |

|

|

|

9,184 |

|

|

Accumulated deficit

|

|

|

(53,018 |

) |

|

|

(50,537 |

) |

|

Accumulated other comprehensive loss

|

|

|

(8,103 |

) |

|

|

(8,267 |

) |

|

Total stockholders' equity

|

|

|

32,957 |

|

|

|

33,772 |

|

|

TOTAL LIABILITIES & STOCKHOLDERS' EQUITY

|

|

$ |

41,455 |

|

|

$ |

42,406 |

|

See Notes to Condensed Consolidated Interim Financial Statements

MAUI LAND & PINEAPPLE COMPANY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(UNAUDITED)

| |

|

Three Months Ended

June 30,

|

|

| |

|

2023

|

|

|

2022

|

|

| |

|

(in thousands except per share amounts)

|

|

| OPERATING REVENUES |

|

|

|

|

|

|

|

|

|

Real estate

|

|

$ |

19 |

|

|

$ |

11,600 |

|

|

Leasing

|

|

|

2,241 |

|

|

|

2,198 |

|

|

Resort amenities and other

|

|

|

213 |

|

|

|

189 |

|

|

Total operating revenues

|

|

|

2,473 |

|

|

|

13,987 |

|

| |

|

|

|

|

|

|

|

|

| OPERATING COSTS AND EXPENSES |

|

|

|

|

|

|

|

|

|

Real estate

|

|

|

336 |

|

|

|

707 |

|

|

Leasing

|

|

|

1,039 |

|

|

|

997 |

|

|

Resort amenities and other

|

|

|

363 |

|

|

|

330 |

|

|

General and administrative

|

|

|

1,035 |

|

|

|

759 |

|

|

Share-based compensation

|

|

|

806 |

|

|

|

276 |

|

|

Depreciation

|

|

|

238 |

|

|

|

277 |

|

|

Total operating costs and expenses

|

|

|

3,817 |

|

|

|

3,346 |

|

| |

|

|

|

|

|

|

|

|

|

OPERATING INCOME (LOSS)

|

|

|

(1,344 |

) |

|

|

10,641 |

|

|

Other income

|

|

|

350 |

|

|

|

- |

|

|

Pension and other post-retirement expenses

|

|

|

(121 |

) |

|

|

(114 |

) |

|

Interest expense

|

|

|

(2 |

) |

|

|

(2 |

) |

|

NET INCOME (LOSS)

|

|

$ |

(1,117 |

) |

|

$ |

10,525 |

|

|

Other comprehensive income - pension, net

|

|

|

82 |

|

|

|

156 |

|

|

TOTAL COMPREHENSIVE INCOME (LOSS)

|

|

$ |

(1,035 |

) |

|

$ |

10,681 |

|

| |

|

|

|

|

|

|

|

|

|

NET INCOME (LOSS) PER COMMON SHARE-BASIC AND DILUTED

|

|

$ |

(0.06 |

) |

|

$ |

0.54 |

|

See Notes to Condensed Consolidated Interim Financial Statements

MAUI LAND & PINEAPPLE COMPANY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(UNAUDITED)

| |

|

Six Months Ended

June 30,

|

|

| |

|

2023

|

|

|

2022

|

|

| |

|

(in thousands except per share amounts)

|

|

| OPERATING REVENUES |

|

|

|

|

|

|

|

|

|

Real estate

|

|

$ |

19 |

|

|

$ |

11,600 |

|

|

Leasing

|

|

|

4,318 |

|

|

|

4,228 |

|

|

Resort amenities and other

|

|

|

433 |

|

|

|

406 |

|

|

Total operating revenues

|

|

|

4,770 |

|

|

|

16,234 |

|

| |

|

|

|

|

|

|

|

|

| OPERATING COSTS AND EXPENSES |

|

|

|

|

|

|

|

|

|

Real estate

|

|

|

418 |

|

|

|

796 |

|

|

Leasing

|

|

|

1,833 |

|

|

|

1,739 |

|

|

Resort amenities and other

|

|

|

911 |

|

|

|

840 |

|

|

General and administrative

|

|

|

2,059 |

|

|

|

1,516 |

|

|

Share-based compensation

|

|

|

1,772 |

|

|

|

654 |

|

|

Depreciation

|

|

|

491 |

|

|

|

550 |

|

|

Total operating costs and expenses

|

|

|

7,484 |

|

|

|

6,095 |

|

| |

|

|

|

|

|

|

|

|

|

OPERATING INCOME (LOSS)

|

|

|

(2,714 |

) |

|

|

10,139 |

|

| |

|

|

|

|

|

|

|

|

|

Other income

|

|

|

479 |

|

|

|

- |

|

|

Pension and other post-retirement expenses

|

|

|

(243 |

) |

|

|

(229 |

) |

|

Interest expense

|

|

|

(3 |

) |

|

|

(3 |

) |

|

NET INCOME (LOSS)

|

|

$ |

(2,481 |

) |

|

$ |

9,907 |

|

|

Other comprehensive income - pension, net

|

|

|

164 |

|

|

|

312 |

|

|

TOTAL COMPREHENSIVE INCOME (LOSS)

|

|

$ |

(2,317 |

) |

|

$ |

10,219 |

|

| |

|

|

|

|

|

|

|

|

|

NET INCOME (LOSS) PER COMMON SHARE-BASIC AND DILUTED

|

|

$ |

(0.13 |

) |

|

$ |

0.51 |

|

See Notes to Condensed Consolidated Interim Financial Statements.

MAUI LAND & PINEAPPLE COMPANY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

For the Three and Six Months Ended June 30, 2023 and 2022

(UNAUDITED)

(in thousands)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accumulated

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Additional

|

|

|

|

|

|

|

Other

|

|

|

|

|

|

| |

|

Common Stock

|

|

|

Paid in

|

|

|

Accumulated

|

|

|

Comprehensive

|

|

|

|

|

|

| |

|

Shares

|

|

|

Amount

|

|

|

Capital

|

|

|

Deficit

|

|

|

Loss

|

|

|

Total

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, January 1, 2023

|

|

|

19,477 |

|

|

$ |

83,392 |

|

|

$ |

9,184 |

|

|

$ |

(50,537 |

) |

|

$ |

(8,267 |

) |

|

$ |

33,772 |

|

|

Share-based compensation

|

|

|

67 |

|

|

|

620 |

|

|

|

821 |

|

|

|

|

|

|

|

|

|

|

|

1,441 |

|

|

Vested restricted stock issued

|

|

|

82 |

|

|

|

821 |

|

|

|

(821 |

) |

|

|

|

|

|

|

|

|

|

|

- |

|

|

Shares cancelled to pay tax liability

|

|

|

(50 |

) |

|

|

(544 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(544 |

) |

|

Other comprehensive income - pension

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

82 |

|

|

|

82 |

|

|

Net loss

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1,364 |

) |

|

|

|

|

|

|

(1,364 |

) |

|

Balance, March 31, 2023

|

|

|

19,576 |

|

|

$ |

84,289 |

|

|

$ |

9,184 |

|

|

$ |

(51,901 |

) |

|

$ |

(8,185 |

) |

|

$ |

33,387 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation

|

|

|

|

|

|

|

|

|

|

|

608 |

|

|

|

|

|

|

|

|

|

|

|

608 |

|

|

Vested restricted stock issued

|

|

|

14 |

|

|

|

135 |

|

|

|

(135 |

) |

|

|

|

|

|

|

|

|

|

|

- |

|

|

Shares cancelled to pay tax liability

|

|

|

- |

|

|

|

(3 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3 |

) |

|

Other comprehensive income - pension

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

82 |

|

|

|

82 |

|

|

Net loss

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1,117 |

) |

|

|

|

|

|

|

(1,117 |

) |

|

Balance, June 30, 2023

|

|

|

19,590 |

|

|

$ |

84,421 |

|

|

$ |

9,657 |

|

|

$ |

(53,018 |

) |

|

$ |

(8,103 |

) |

|

$ |

32,957 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, January 1, 2022

|

|

|

19,383 |

|

|

$ |

82,378 |

|

|

$ |

9,184 |

|

|

$ |

(52,324 |

) |

|

$ |

(15,648 |

) |

|

$ |

23,590 |

|

|

Share-based compensation

|

|

|

49 |

|

|

|

494 |

|

|

|

273 |

|

|

|

|

|

|

|

|

|

|

|

767 |

|

|

Vested restricted stock issued

|

|

|

24 |

|

|

|

273 |

|

|

|

(273 |

) |

|

|

|

|

|

|

|

|

|

|

- |

|

|

Shares cancelled to pay tax liability

|

|

|

(26 |

) |

|

|

(269 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(269 |

) |

|

Other comprehensive income - pension

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

156 |

|

|

|

156 |

|

|

Net loss

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(618 |

) |

|

|

|

|

|

|

(618 |

) |

|

Balance, March 31, 2022

|

|

|

19,430 |

|

|

$ |

82,876 |

|

|

$ |

9,184 |

|

|

$ |

(52,942 |

) |

|

$ |

(15,492 |

) |

|

$ |

23,626 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation

|

|

|

|

|

|

|

|

|

|

|

170 |

|

|

|

|

|

|

|

|

|

|

|

170 |

|

|

Vested restricted stock issued

|

|

|

16 |

|

|

|

170 |

|

|

|

(170 |

) |

|

|

|

|

|

|

|

|

|

|

- |

|

|

Shares cancelled to pay tax liability

|

|

|

(2 |

) |

|

|

(21 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(21 |

) |

|

Other comprehensive income - pension

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

156 |

|

|

|

156 |

|

|

Net loss

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10,525 |

|

|

|

|

|

|

|

10,525 |

|

|

Balance, June30, 2022

|

|

|

19,444 |

|

|

$ |

83,025 |

|

|

$ |

9,184 |

|

|

$ |

(42,417 |

) |

|

$ |

(15,336 |

) |

|

$ |

34,456 |

|

See Notes to Condensed Consolidated Interim Financial Statements.

MAUI LAND & PINEAPPLE COMPANY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| |

|

Six Months Ended

June 30,

|

|

| |

|

2023

|

|

|

2022

|

|

| |

|

(in thousands) |

|

| |

|

|

|

|

|

|

|

|

|

NET CASH (USED IN) PROVIDED BY OPERATING ACTIVITIES

|

|

$ |

(444 |

) |

|

$ |

11,948 |

|

| |

|

|

|

|

|

|

|

|

| CASH FLOWS FROM INVESTING ACTIVITIES |

|

|

|

|

|

|

|

|

|

Payments for property and deferred development costs

|

|

|

(198 |

) |

|

|

(31 |

) |

|

Purchases of bond investments

|

|

|

(1,742 |

) |

|

|

- |

|

|

Maturities of bond investments

|

|

|

1,668 |

|

|

|

- |

|

|

NET CASH USED IN INVESTING ACTIVITIES

|

|

|

(272 |

) |

|

|

(31 |

) |

| |

|

|

|

|

|

|

|

|

| CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

|

Debt and common stock issuance costs and other

|

|

|

(547 |

) |

|

|

(291 |

) |

|

NET CASH USED IN FINANCING ACTIVITIES

|

|

|

(547 |

) |

|

|

(291 |

) |

| |

|

|

|

|

|

|

|

|

|

NET (DECREASE) INCREASE IN CASH

|

|

|

(1,263 |

) |

|

|

11,626 |

|

|

CASH AND RESTRICTED CASH AT BEGINNING OF PERIOD

|

|

|

8,509 |

|

|

|

5,596 |

|

|

CASH AND RESTRICTED CASH AT END OF PERIOD

|

|

$ |

7,246 |

|

|

$ |

17,222 |

|

SUPPLEMENTAL SCHEDULE OF NON-CASH INVESTING AND FINANCING ACTIVITIES:

| |

●

|

Common stock issued under the Company’s 2017 Equity and Incentive Award Plan was $1.0 million and $0.6 million for the six months ended June 30, 2023 and 2022, respectively.

|

See Notes to Condensed Consolidated Interim Financial Statements.

MAUI LAND & PINEAPPLE COMPANY, INC. AND SUBSIDIARIES

NOTES TO CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

For the Three and Six Months Ended June 30, 2023 and 2022

(UNAUDITED)

The accompanying unaudited condensed consolidated interim financial statements have been prepared by Maui Land & Pineapple Company, Inc. (together with its subsidiaries, the “Company”) in conformity with generally accepted accounting principles in the United States of America (“GAAP”) for interim financial information that are consistent in all material respects with those applied in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, and pursuant to the instructions to Form 10-Q and Article 8 of Regulation S-X of the U.S. Securities and Exchange Commission (“SEC”). Accordingly, they do not include all of the information and notes to the annual audited consolidated financial statements required by GAAP for complete financial statements. In the opinion of management, the accompanying unaudited condensed consolidated interim financial statements contain all normal and recurring adjustments necessary to fairly present the Company’s consolidated financial position, results of operations and cash flows for the interim periods ended June 30, 2023 and 2022. The unaudited condensed consolidated interim financial statements and notes should be read in conjunction with the annual audited consolidated financial statements and notes thereto included in the Company’s Form 10-K for the year ended December 31, 2022.

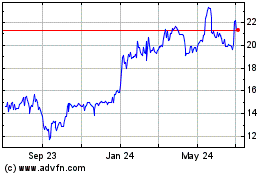

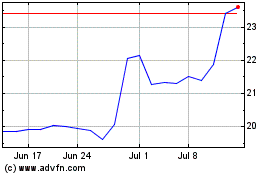

On June 29, 2022, the Company’s shareholders voted to approve a proposal to change the state of incorporation of the Company from Hawaii to Delaware. The reincorporation was effected through a plan of conversion completed on July 18, 2022. Total authorized capital stock provided by the Delaware certificate of incorporation includes 48,000,000 shares, consisting of 43,000,000 shares of common stock, par value $0.0001 per share, and 5,000,000 shares of preferred stock, par value $0.0001 per share. No change in ownership resulted from the reincorporation as each outstanding share of common stock was automatically converted into one share of the newly established Company. The name of the Company after reincorporation remains Maui Land & Pineapple Company, Inc. and shares of common stock continue to be listed on the New York Stock Exchange under the ticker symbol “MLP.”

|

2.

|

CASH AND CASH EQUIVALENTS

|

Cash and cash equivalents include cash on hand, deposits in banks, and money market funds.

Restricted cash of $10,000 at December 31, 2022 (audited) consisted of deposits held in escrow from the prospective buyer of a property held for sale. The funds held in escrow were returned to the Company due to the termination of the sale agreement in April 2023.

Held-to-maturity debt securities are stated at amortized cost. Investments are reviewed for impairment by management on a periodic basis. If any impairment is considered other-than-temporary, the security is written down to its fair value and a corresponding loss recorded as a component of other income (expense).

Amortized cost and fair value of corporate debt securities at June 30, 2023 and December 31, 2022 consisted of the following:

| |

|

June 30,

|

|

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

| |

|

(unaudited)

|

|

|

(audited)

|

|

| |

|

(in thousands)

|

|

|

Amortized cost

|

|

$ |

3,059 |

|

|

$ |

2,983 |

|

|

Unrealized gains

|

|

|

- |

|

|

|

9 |

|

|

Unrealized losses

|

|

|

(8 |

) |

|

|

- |

|

|

Fair value

|

|

$ |

3,051 |

|

|

$ |

2,992 |

|

Maturities of debt securities at June 30, 2023 and December 31, 2022 were as follows:

| |

|

June 30, 2023

(unaudited)

|

|

|

December 31, 2022

(audited)

|

|

| |

|

Amortized

Cost

|

|

|

Fair Value

|

|

|

Amortized

Cost

|

|

|

Fair Value |

|

| |

|

(in thousands)

|

|

|

One year or less

|

|

$ |

2,785 |

|

|

$ |

2,778 |

|

|

$ |

2,432 |

|

|

$ |

2,440 |

|

|

Greater than one year through five years

|

|

|

274 |

|

|

|

273 |

|

|

|

551 |

|

|

|

552 |

|

| |

|

$ |

3,059 |

|

|

$ |

3,051 |

|

|

$ |

2,983 |

|

|

$ |

2,992 |

|

The fair value of debt securities were measured using Level 1 inputs which are based on quotes for trades occurring in active markets for identical assets.

Property and equipment at June 30, 2023 and December 31, 2022 consisted of the following:

| |

|

June 30,

|

|

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

| |

|

(unaudited)

|

|

|

(audited)

|

|

| |

|

(in thousands)

|

|

|

Land

|

|

$ |

5,052 |

|

|

$ |

5,052 |

|

|

Land improvements

|

|

|

12,943 |

|

|

|

12,943 |

|

|

Buildings

|

|

|

22,869 |

|

|

|

22,869 |

|

|

Machinery and equipment

|

|

|

10,398 |

|

|

|

10,360 |

|

|

Construction in progress

|

|

|

140 |

|

|

|

- |

|

|

Total property and equipment

|

|

|

51,402 |

|

|

|

51,224 |

|

|

Less accumulated depreciation

|

|

|

35,836 |

|

|

|

35,346 |

|

|

Property and equipment, net

|

|

$ |

15,566 |

|

|

$ |

15,878 |

|

Land

The Company holds approximately 22,000 acres of land. Most of this land was acquired between 1911 and 1932 and is carried in its condensed consolidated balance sheets at cost. More than 20,400 acres are located in West Maui and is comprised of a largely contiguous collection of parcels which extend from the ocean to an elevation of approximately 5,700 feet. The West Maui landholdings include approximately 900 acres within Kapalua Resort, a master-planned, destination resort and residential community. Approximately 1,500 acres are located in Upcountry Maui in an area commonly known as Hali’imaile and is mainly comprised of leased agricultural fields, commercial and light industrial properties.

Land Improvements

Land improvements are comprised primarily of roads, utilities, and landscaping infrastructure improvements at the Kapalua Resort. Also included is the Company’s potable and non-potable water systems in West Maui. The majority of the Company’s land improvements were constructed and placed in service in the mid-to-late 1970’s or conveyed in 2017. Depreciation expense would be considerably higher if these assets were stated at current replacement cost.

Buildings

Buildings are comprised of restaurant, retail and light industrial spaces located at the Kapalua Resort and Hali’imaile which are used in the Company’s leasing operations. The majority of the Company’s buildings were constructed and placed in service in the mid-to-late 1970’s. Depreciation expense would be considerably higher if these assets were stated at current replacement cost.

Machinery and Equipment

Machinery and equipment are mainly comprised of zipline course equipment installed in 2008 at the Kapalua Resort and used in the Company’s leasing operations.

Assets held for sale consisted of the 46-acre Central Resort project located in Kapalua. In December 2021, the Company entered into an agreement to sell the Kapalua Central Resort project for $40.0 million. Terms of the agreement were subsequently amended to include a closing condition requiring the Maui Planning Commission to approve a five-year extension of a Special Management Area (“SMA”) permit issued by the County of Maui. The Company allowed the agreement with the buyer to expire on April 11, 2023. The application for the extension of the SMA permit is being managed by the Company while the project continues to be marketed for sale and joint venture.

The above assets held for sale have not been pledged as collateral under the Company’s credit facility.

|

7.

|

CONTRACT ASSETS AND LIABILITIES

|

Receivables from contracts with customers were $0.4 million and $0.3 million at June 30, 2023 and December 31, 2022, respectively.

Deferred club membership revenue

The Company manages the operations of the Kapalua Club, a private, non-equity club program providing members special programs, access and other privileges at certain of the amenities within the Kapalua Resort. Deferred revenues from dues received from the private club membership program are recognized on a straight-line basis over one year. Revenue recognized for each of the six months ended June 30, 2023 and 2022 was $0.4 million.

Deferred license fee revenue

The Company entered into a trademark license agreement with the owner of the Kapalua Plantation and Bay golf courses, effective April 1, 2020. Under the terms and conditions set forth in the agreement, the licensee is granted a perpetual, terminable on default, transferable, non-exclusive license to use the Company’s trademarks and service marks to promote its golf courses and to sell its licensed products. The Company received a single royalty payment of $2.0 million in March 2020. Revenue recognized on a straight-line basis over its estimated economic useful life of 15 years was $0.1 million for each of the six months ended June 30, 2023 and 2022.

Long-term debt is comprised of amounts outstanding under the Company’s $15.0 million revolving line of credit facility (“Credit Facility”) with First Hawaiian Bank (“Bank”) maturing on December 31, 2025. The Credit Facility provides options for revolving or term loan borrowing. Interest on loan borrowing is based on the Bank’s prime rate minus 1.125 percentage points. Interest on term loan borrowing may be fixed at the Bank’s commercial loan rates using an interest rate swap option. The Company has pledged approximately 30,000 square feet of commercial leased space in the Kapalua Resort as security for the Credit Facility. Net proceeds from the sale of any collateral are required to be repaid toward outstanding borrowings and will permanently reduce the Credit Facility’s revolving commitment amount. There are no commitment fees on the unused portion of the Credit Facility.

The terms of the Credit Facility include various representations, warranties, affirmative, negative and financial covenants and events of default customary for financings of this type. Financial covenants include a minimum liquidity (as defined) of $2.0 million, a maximum of $45.0 million in total liabilities, and a limitation of new indebtedness on collateralized properties without the prior written consent of the Bank.

The outstanding balance of the Credit Facility was zero at June 30, 2023 and December 31, 2022. The Company was in compliance with the covenants under the Credit Facility at June 30, 2023.

|

9.

|

ACCRUED RETIREMENT BENEFITS

|

Accrued retirement benefits at June 30, 2023 and December 31, 2022 consisted of the following:

| |

|

June 30,

|

|

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

| |

|

(unaudited)

|

|

|

(audited)

|

|

| |

|

(in thousands)

|

|

| |

|

|

|

|

|

|

|

|

|

Defined benefit pension plan

|

|

$ |

1,059 |

|

|

$ |

1,023 |

|

|

Non-qualified retirement plans

|

|

|

1,709 |

|

|

|

1,731 |

|

|

Total

|

|

|

2,768 |

|

|

|

2,754 |

|

|

Less current portion

|

|

|

142 |

|

|

|

142 |

|

|

Non-current portion of accrued retirement benefits

|

|

$ |

2,626 |

|

|

$ |

2,612 |

|

The Company has a defined benefit pension plan which covers substantially all of its former bargaining and non-bargaining full-time, part-time and intermittent employees. In 2011, pension benefits under the plan were frozen. The Company also has an unfunded non-qualified retirement plan covering nine of its former executives. The non-qualified retirement plan was frozen in 2009 and future vesting of additional benefits discontinued.

The net periodic benefit costs for pension and post-retirement benefits for the three and six months ended June 30, 2023 and 2022 were as follows:

| |

|

Three Months Ended

|

|

|

Six Months Ended

|

|

| |

|

June 30,

|

|

|

June 30,

|

|

| |

|

(unaudited)

|

|

|

(unaudited)

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

(in thousands)

|

|

|

(in thousands) |

|

|

Interest cost

|

|

$ |

203 |

|

|

$ |

264 |

|

|

$ |

406 |

|

|

$ |

529 |

|

|

Expected return on plan assets

|

|

|

(164 |

) |

|

|

(306 |

) |

|

|

(328 |

) |

|

|

(612 |

) |

|

Amortization of net loss

|

|

|

82 |

|

|

|

156 |

|

|

|

165 |

|

|

|

312 |

|

|

Pension and other postretirement expenses

|

|

$ |

121 |

|

|

$ |

114 |

|

|

$ |

243 |

|

|

$ |

229 |

|

No contributions are required to be made to the defined benefit pension plan in 2023.

|

10.

|

COMMITMENTS AND CONTINGENCIES

|

On December 31, 2018, the State of Hawaii Department of Health (“DOH”) issued a Notice and Finding of Violation and Order (“Order”) for alleged wastewater effluent violations related to the Company’s Upcountry Maui wastewater treatment facility. The facility was built in the 1960s to serve approximately 200 single-family homes developed for workers in the Company’s former agricultural operations. The facility is comprised of two 1.5-acre wastewater stabilization ponds and surrounding disposal leach fields. The Order includes, among other requirements, payment of a $230,000 administrative penalty and development of a new wastewater treatment plant, which become final and binding – unless a hearing is requested to contest the alleged violations and penalties.

An administrative hearing date previously scheduled for July 2023 was postponed due to continuing favorable negotiations with the State and the Company making progress towards the determination of a technical solution to resolve the Order. As a condition of the deferral of the administrative hearing, the Company will submit a progress update at the end of August 2023. The Company is engaged with a third party specialist to provide recommendations for a technical solution that would meet the requirements of the Order and the Company has committed to the State that a formal selection of a technical solution will be presented to the State on or before December 31, 2023. .

There are various other claims and legal actions pending against the Company. The resolution of these other matters is not expected to have a material adverse effect on the Company’s condensed consolidated interim financial position or results of operations after consultation with legal counsel.

The Company leases land primarily to agriculture operators and space in commercial buildings primarily to restaurant and retail tenants through 2048. These operating leases generally provide for minimum rents and, in some cases, licensing fees, percentage rentals based on tenant revenues, and reimbursement of common area maintenance and other expenses. Certain leases allow the lessee an option to extend or terminate the agreement. There are no leases allowing a lessee an option to purchase the underlying asset. Leasing income subject to ASC Topic 842 for the three and six months ended June 30, 2023 and 2022 were as follows:

| |

|

Three Months Ended

|

|

|

Six Months Ended

|

|

| |

|

June 30,

|

|

|

June 30,

|

|

| |

|

(unaudited)

|

|

|

(unaudited)

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

(in thousands)

|

|

|

(in thousands)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Minimum rentals

|

|

$ |

837 |

|

|

$ |

818 |

|

|

$ |

1,644 |

|

|

$ |

1,640 |

|

|

Percentage rentals

|

|

|

536 |

|

|

|

578 |

|

|

|

1,031 |

|

|

|

971 |

|

|

Licensing fees

|

|

|

295 |

|

|

|

275 |

|

|

|

518 |

|

|

|

498 |

|

|

Other

|

|

|

238 |

|

|

|

264 |

|

|

|

443 |

|

|

|

603 |

|

|

Total

|

|

$ |

1,906 |

|

|

$ |

1,935 |

|

|

$ |

3,636 |

|

|

$ |

3,712 |

|

|

12.

|

SHARE-BASED COMPENSATION

|

The Company’s directors and certain members of management receive a portion of their compensation in shares of the Company’s common stock granted under the Company’s 2017 Equity and Incentive Award Plan (“Equity Plan”).

Share-based compensation is awarded annually to certain members of the Company’s management based on their achievement of predefined performance goals and objectives under the Equity Plan. Such share-based compensation is comprised of an annual incentive paid in shares of common stock and a long-term incentive paid in restricted shares of common stock vesting quarterly over a period of three years. Share-based compensation is valued based on the average of the high and low share price on the date of grant. Shares are issued upon execution of agreements reflecting the grantee’s acceptance of the respective shares subject to the terms and conditions of the Equity Plan. Restricted shares issued under the Equity Plan have voting and regular dividend rights but cannot be disposed of until such time as they are vested. All unvested restricted shares are forfeited upon the grantee’s termination of directorship or employment from the Company.

Directors receive both cash and equity compensation under the Equity Plan. Share-based compensation is comprised of restricted shares of common stock vesting quarterly over the directors’ annual period of service and valued based on the average of the high and low share price on the date of grant. Shares are issued upon execution of agreements reflecting the grantee’s acceptance of the respective shares subject to the terms and conditions of the Equity Plan. Restricted shares issued under the Equity Plan have voting and regular dividend rights but cannot be disposed of until such time as they are vested. All unvested restricted shares are forfeited upon the grantee’s termination of directorship or employment from the Company.

During the quarter ended June 30, 2023, options to purchase shares of the Company’s common stock under the Equity Plan were granted to directors. The number of common shares granted which are subject to option for annual board service, board committee service, and continued service of the Chairman of the Board is 0.3 million shares, 0.1 million shares, and 0.4 million shares, respectively. Share-based compensation of stock option grants is valued at the commitment date, based on the fair value of the equity instruments, and is recognized as expense on a straight-line basis over the directors’ service period. For annual board service and board committee service, stock option grants have a contractual period of ten years and vest quarterly over 12 months. The exercise price per share is based on the average of the high and low share price on the date of grant, or $12.11 per share. The fair value of these grants using the Black-Scholes option-pricing model was $3.88 per share based on an expected term of 5.25 years, expected volatility of 28%, and a risk-free rate of 4.16%. During the three months ended June 30, 2023, 0.1 million share options vested to directors for annual board and committee service. For continued board service of the Chairman, the stock option grant has a contractual period of ten years which vests as follows: 0.1 million shares on June 1, 2024, 0.1 million shares on June 1, 2025, and 0.1 million shares on June 1, 2026. The exercise price per share is based on the average of the high and low share price on the date of grant, or $9.08 per share. The fair value of these grants using the Black-Scholes option-pricing model was $3.94 per share based on an expected term of 6.12 years, expected volatility of 37%, and a risk-free rate of 3.53%.

The simplified method described in Staff Accounting Bulletin No. 107 was used by management due to the lack of historical option exercise behavior, The Company does not currently issue dividends. There were no forfeitures of stock option grants as of June 30, 2023. Management does not anticipate future forfeitures to be material.

Share-based compensation expense totaled $0.8 million and $0.3 million for the three months ended June 30, 2023 and 2022, respectively, and $1.8 million and $0.7 million for the six months ended June 30, 2023 and 2022, respectively. Included in these amounts were $0.1 million and $0.2 million of restricted common stock vested during the three months ended June 30, 2023 and 2022, respectively, and $1.0 million and $0.4 million of restricted common stock vested during the six months ended June 30, 2023 and 2022 respectively.

The Company uses a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. The Company’s provision for income taxes is calculated using the liability method. Deferred income taxes are provided for all temporary differences between the financial statement and income tax bases of assets and liabilities using tax rates enacted by law or regulation. A full valuation allowance was established for deferred income tax assets at June 30, 2023 and December 31, 2022, respectively.

|

14.

|

EARNINGS (LOSS) PER SHARE

|

Basic net income per common share is computed by dividing net income by the weighted-average number of common shares outstanding. Diluted net income per common share is computed similar to basic net income per common share except that the denominator is increased to include the number of additional common shares that would have been outstanding if the dilutive potential common shares had been issued. Potentially dilutive shares arise from non-vested restricted stock and non-qualified stock options granted under the Company’s Equity Plan. The treasury stock method is applied to determine the number of potentially dilutive shares.

Basic and diluted weighted-average shares outstanding for the three months ended June 30, 2023 and 2022 were 19.6 million and 19.4 million, respectively. Basic and diluted weighted-average shares outstanding for the six months ended June 30, 2023 and 2022 were also 19.6 million and 19.4 million, respectively.

|

15.

|

REPORTABLE OPERATING SEGMENTS

|

The Company’s reportable operating segments are comprised of the discrete business units whose operating results are regularly reviewed by the Company’s Chief Executive Officer – its chief decision maker – in assessing performance and determining the allocation of resources and by the Board of Directors. Reportable operating segments are as follows:

| |

•

|

Real Estate includes the planning, entitlement, development, and sale of real estate inventory.

|

| |

•

|

Leasing includes revenues and expenses from real property leasing activities, license fees and royalties for the use of certain of the Company’s trademarks and brand names by third parties, and the cost of maintaining the Company’s real estate assets, including watershed conservation activities. The operating segment also includes the revenues and expenses from the management of ditch, reservoir and well systems that provide non-potable irrigation water to West and Upcountry Maui areas.

|

| |

•

|

Resort Amenities include a membership program that provides certain benefits and privileges within the Kapalua Resort for its members.

|

The Company’s reportable operating segment results are measured based on operating income (loss), exclusive of interest, depreciation, general and administrative, and share-based compensation.

Reportable operating segment revenues and income for the three and six months ended June 30, 2023 and 2022 were as follows:

| |

|

Three Months Ended

|

|

|

Six Months Ended

|

|

| |

|

June 30,

|

|

|

June 30,

|

|

| |

|

(unaudited)

|

|

|

(unaudited)

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

(in thousands)

|

|

|

(in thousands)

|

|

| Operating Segment Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real estate

|

|

$ |

19 |

|

|

$ |

11,600 |

|

|

$ |

19 |

|

|

$ |

11,600 |

|

|

Leasing

|

|

|

2,241 |

|

|

|

2,198 |

|

|

|

4,318 |

|

|

|

4,228 |

|

|

Resort amenities and other

|

|

|

213 |

|

|

|

189 |

|

|

|

433 |

|

|

|

406 |

|

|

Total Operating Segment Revenues

|

|

$ |

2,473 |

|

|

$ |

13,987 |

|

|

$ |

4,770 |

|

|

$ |

16,234 |

|

| Operating Segment Income (Loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Real estate

|

|

$ |

(317 |

) |

|

$ |

10,893 |

|

|

$ |

(399 |

) |

|

$ |

10,804 |

|

|

Leasing

|

|

|

1,202 |

|

|

|

1,201 |

|

|

|

2,485 |

|

|

|

2,489 |

|

|

Resort amenities and other

|

|

|

(150 |

) |

|

|

(141 |

) |

|

|

(478 |

) |

|

|

(434 |

) |

|

Total Operating Segment Income

|

|

$ |

735 |

|

|

$ |

11,953 |

|

|

$ |

1,608 |

|

|

$ |

12,859 |

|

|

16.

|

FAIR VALUE MEASUREMENTS

|

GAAP establishes a framework for measuring fair value and requires certain disclosures about fair value measurements to enable the reader of the unaudited condensed consolidated interim financial statements to assess the inputs used to develop those measurements by establishing a hierarchy for ranking the quality and reliability of the information used to determine fair values. GAAP requires that financial assets and liabilities be classified and disclosed in one of the following three categories:

Level 1: Quoted market prices in active markets for identical assets or liabilities.

Level 2: Observable market based inputs or unobservable inputs that are corroborated by market data.

Level 3: Unobservable inputs that are not corroborated by market data.

The Company considers all cash on hand to be unrestricted cash for the purposes of the unaudited condensed consolidated balance sheets and unaudited condensed consolidated statements of cash flows. The fair value of receivables and payables approximate their carrying value due to the short-term nature of the instruments. The method to determine the valuation of stock options granted to directors during the three months ended June 30, 2023 is described in Note 12.

|

17.

|

NEW ACCOUNTING STANDARD ADOPTED

|

In June 2016, the FASB issued ASU 2016-13 to update the methodology used to measure current expected credit losses. The ASU applies to financial assets measured at amortized cost, including loans, held-to-maturity debt securities, net investments in leases, and trade accounts receivable as well as certain off-balance sheet exposures, such as loan commitments. The guidance requires consideration of a broader range of reasonable and supportable information to explain credit loss estimates. ASU 2019-10 was subsequently issued delaying the effective date to the first quarter of 2023. The ASU did not have a material effect on the Company’s condensed consolidated interim financial statements.

18. SUBSEQUENT EVENT