0000060086FALSE00000600862024-02-052024-02-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

| | | | | | | | |

| Date of Report (Date of earliest event reported) | | February 5, 2024 |

LOEWS CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-6541 | | 13-2646102 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | |

9 West 57th Street, New York, NY | 10019-2714 |

| (Address of principal executive offices) | (Zip Code) |

| | | | | |

| Registrant’s telephone number, including area code: | (212) 521-2000 |

| | |

| NOT APPLICABLE |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.01 par value | L | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02 Results of Operations and Financial Condition.

On February 5, 2024, Loews Corporation issued a press release and posted on its website (www.loews.com) earnings remarks providing information on its results of operations for the fourth quarter of 2023. The press release is furnished as Exhibit 99.1 and the earnings remarks are furnished as Exhibit 99.2 to this Form 8-K.

The information under Item 2.02 and in Exhibits 99.1 and 99.2 in this Current Report is being furnished and shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information under Item 2.02 and in Exhibits 99.1 and 99.2 in this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits.

(d)Exhibits:

See Exhibit Index.

EXHIBIT INDEX

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | Loews Corporation press release, issued February 5, 2024, providing information on its results of operations for the fourth quarter of 2023. |

| | Loews Corporation earnings remarks, posted on its website February 5, 2024, providing information on its results of operations for the fourth quarter of 2023. |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | LOEWS CORPORATION |

| | (Registrant) |

| | |

| | | |

| | | |

Dated: February 5, 2024 | By: | /s/ Marc A. Alpert |

| | | Marc A. Alpert |

| | | Senior Vice President, |

| | General Counsel |

| | and Secretary |

Exhibit 99.1

NEWS RELEASE

LOEWS CORPORATION REPORTS NET INCOME OF $446 MILLION

FOR THE FOURTH QUARTER OF 2023 AND $1.4 BILLION FOR THE FULL YEAR

14.0 MILLION COMMON SHARES REPURCHASED IN 2023 FOR $852 MILLION

New York, NY, February 5, 2024: Loews Corporation (NYSE: L) today released its fourth quarter 2023 financial results.

Fourth Quarter highlights:

Loews Corporation reported net income of $446 million, or $1.99 per share, in the fourth quarter of 2023, which represents a 26% increase over $355 million, or $1.49 per share, in the fourth quarter of 2022. The following are the highlights for the fourth quarter:

•CNA Financial Corporation’s (NYSE: CNA) net income improved year-over-year due to higher net investment income and higher underwriting income.

•Boardwalk Pipelines’ results improved due to higher revenues from re-contracting, partially offset by higher expenses.

•These increases were partially offset by lower investment returns on equity securities at the parent company compared to the 2022 period.

•Loews Corporation repurchased 2.1 million shares of its common stock for a total cost of $141 million through the end of the quarter.

•Book value per share, excluding AOCI, increased 9% to $81.92 as of December 31, 2023, from $74.88 as of December 31, 2022 due to repurchases of common shares and strong operating results during 2023.

•As of December 31, 2023, the parent company had $2.6 billion of cash and investments and $1.8 billion of debt.

CEO commentary:

“Loews had a spectacular quarter, with each of our subsidiaries producing strong results.”

–James S. Tisch, President and CEO, Loews Corporation

Consolidated highlights:

| | | | | | | | | | | | | | |

| December 31, |

| Three Months | Years Ended |

| (In millions, except per share data) | 2023 | 2022 (a) | 2023 | 2022 (a) |

Net income attributable to Loews Corporation before

net investment gains (losses) | $ | 442 | | $ | 378 | | $ | 1,469 | | $ | 960 | |

| Net investment gains (losses): | | | | |

| CNA | 4 | | (23) | | (71) | | (138) | |

| Loews Hotels & Co | | | 36 | | |

| Total net investment gains (losses) | 4 | | (23) | | (35) | | (138) | |

| Net income attributable to Loews Corporation | $ | 446 | | $ | 355 | | $ | 1,434 | | $ | 822 | |

| | | | |

| Net income per share | $ | 1.99 | | $ | 1.49 | | $ | 6.29 | | $ | 3.38 | |

| | | | | | | | | | | |

| December 31, 2023 | | December 31, 2022 (a) |

|

| |

|

| Book value per share | $ | 70.69 | | | $ | 60.81 | |

| Book value per share excluding AOCI | 81.92 | | | 74.88 | |

| | | | | |

| (a) | As of January 1, 2023, Loews Corporation adopted Accounting Standards Update 2018-12, “Financial Services – Insurance (Topic 944): Targeted Improvements to the Accounting for Long-Duration Contracts (“ASU 2018-12”), which was applied retrospectively effective January 1, 2021. Previously reported amounts have been adjusted to reflect application of the new guidance. See pages 4 and 5 of this release for more information. |

Three months ended December 31, 2023 compared to 2022

CNA:

•Net income attributable to Loews Corporation improved 57% to $336 million from $214 million.

•Core income increased 37% to $362 million from $265 million.

•Results include higher net investment income from limited partnerships and fixed income securities.

•Property and Casualty underwriting results were higher due to improved underlying underwriting income and lower net catastrophe losses, partially offset by lower favorable net prior year loss reserve development.

•Net written premiums grew by 10% driven by strong retention and new business.

•Property and Casualty combined ratio was 92.1% compared to 93.7%. Property and Casualty underlying combined ratio was 91.4% compared to 91.2%.

•Net income was positively impacted by investment gains in 2023 compared to investment losses in 2022 mostly due to the favorable change in fair value of non-redeemable preferred stock.

Boardwalk:

•Net income increased 11% to $92 million compared to $83 million.

•EBITDA increased 5% to $260 million compared to $248 million.

•Net income and EBITDA increased due to higher transportation revenues from re-contracting and recently completed growth projects, increased storage and parking and lending revenues, and the Bayou Ethane acquisition. These increases were partially offset by higher depreciation expenses due to an increased asset base from recently completed growth projects and higher employee-related expenses.

Loews Hotels:

•Net income of $32 million compared to $33 million.

•Adjusted EBITDA of $83 million compared to $85 million.

•Net income slightly decreased due to lower equity income from joint ventures driven by decreased overall occupancy rates and higher operating costs offset by consolidating the results of a property previously accounted for under the equity method.

Corporate & Other:

•Results decreased to a net loss of $14 million compared to net income of $25 million.

•The decrease in results is primarily due to lower investment income from parent company equity securities.

Year ended December 31, 2023 compared to 2022

Loews Corporation reported net income of $1,434 million, or $6.29 per share, compared to $822 million, or $3.38 per share. The 74% year-over-year increase was driven by the following:

•CNA’s results improved due to higher net investment income, higher Property and Casualty underwriting income, lower investment losses, and a significantly lower unfavorable impact from the long-term care annual reserve review performed in the third quarter of each year.

•Investment income at the parent company improved due to higher returns on short-term investments and equity securities.

•Boardwalk Pipelines’ results increased due to higher revenues from re-contracting and recently completed growth projects.

•Loews Hotels & Co’s net income increased due to an after-tax gain of $36 million related to the acquisition of an additional equity interest in, and the consolidation of, a previously unconsolidated joint venture property in the second quarter of 2023.

•These increases were partially offset by an after-tax charge of $37 million related to the termination of a defined benefit plan in the third quarter of 2023 in Corporate & Other.

Share Purchases:

•On December 31, 2023, there were 222.2 million shares of Loews common stock outstanding.

•For the three months and year ended December 31, 2023, Loews repurchased 2.1 million and 14.0 million shares of its common stock at an aggregate cost of $141 million and $852 million, respectively.

•For the year ended December 31, 2023, Loews purchased 4.5 million shares of CNA common stock at an aggregate cost of $178 million.

•Depending on market conditions, Loews may from time to time purchase shares of its and its subsidiaries’ outstanding common stock in the open market, in privately negotiated transactions or otherwise.

Reconciliation of GAAP Measures to Non-GAAP Measures

This news release contains financial measures that are not in accordance with accounting principles generally accepted in the United States of America ("GAAP"). Management believes some investors may find these measures useful to evaluate our and our subsidiaries’ financial performance. CNA utilizes core income, Boardwalk utilizes earnings before interest, income tax expense, depreciation and amortization (“EBITDA”), and Loews Hotels utilizes Adjusted EBITDA. These measures are defined and reconciled to the most comparable GAAP measures on pages 6 and 7 of this release.

Earnings Remarks and Conference Calls

For Loews Corporation

–Today, February 5, 2024, earnings remarks will be available on our website.

–Remarks will include commentary from Loews’s president and chief executive officer and chief financial officer.

For CNA

–Today, February 5, 2024, CNA will host an earnings call at 9:00 a.m. ET.

–A live webcast will be available via the Investor Relations section of CNA’s website at www.cna.com.

–To participate by phone, dial 1-844-481-2830 (USA toll-free) or +1-412-317-1850 (International).

About Loews Corporation

Loews Corporation is a diversified company with businesses in the insurance, energy, hospitality and packaging industries. For more information, please visit www.loews.com.

Forward-Looking Statements

Statements contained in this news release which are not historical facts are “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements are inherently uncertain and subject to a variety of risks that could cause actual results to differ materially from those expected by management of the Company. A discussion of the important risk factors and other considerations that could materially impact these matters, as well as the Company’s overall business and financial performance, can be found in the Company’s reports filed with the Securities and Exchange Commission and readers of this release are urged to review those reports carefully when considering these forward-looking statements. Copies of these reports are available through the Company’s website (www.loews.com). Given these risk factors, investors and analysts should not place undue reliance on forward-looking statements. Any such forward-looking statements speak only as of the date of this news release. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statement to reflect any change in the Company’s expectations with regard thereto or any change in events, conditions or circumstances on which any forward-looking statement is based.

Investor relations and media relations contact:

Chris Nugent

1-212-521-2403

Loews Corporation and Subsidiaries

Selected Financial Information

| | | | | | | | | | | | | | |

| December 31, |

| Three Months | Years Ended |

| (In millions) | 2023 | 2022 | 2023 | 2022 |

| Revenues: | | | | |

| CNA Financial (a) | $ | 3,507 | | $ | 3,111 | | $ | 13,299 | | $ | 11,879 | |

| Boardwalk Pipelines | 511 | | 401 | | 1,636 | | 1,446 | |

| Loews Hotels & Co (b) | 210 | | 189 | | 852 | | 721 | |

| Corporate investment income (loss) and other | 30 | | 92 | | 114 | | (2) | |

| Total | $ | 4,258 | | $ | 3,793 | | $ | 15,901 | | $ | 14,044 | |

| Income (Loss) Before Income Tax: | | | | |

| CNA Financial (a) (c) | $ | 460 | | $ | 283 | | $ | 1,518 | | $ | 814 | |

| Boardwalk Pipelines | 116 | | 109 | | 373 | | 330 | |

| Loews Hotels & Co (b) | 41 | | 41 | | 200 | | 161 | |

| Corporate: | | | | |

| Investment income (loss), net | 30 | | 92 | | 114 | | (8) | |

| Other (d) | (34) | | (60) | | (209) | | (183) | |

| Total (c) | $ | 613 | | $ | 465 | | $ | 1,996 | | $ | 1,114 | |

| Net Income (Loss) Attributable to Loews Corporation: | | | | |

| CNA Financial (a) (c) | $ | 336 | | $ | 214 | | $ | 1,094 | | $ | 612 | |

| Boardwalk Pipelines | 92 | | 83 | | 283 | | 247 | |

| Loews Hotels & Co (b) | 32 | | 33 | | 147 | | 117 | |

| Corporate: | | | | |

| Investment income (loss), net | 24 | | 72 | | 90 | | (6) | |

| Other (d) | (38) | | (47) | | (180) | | (148) | |

| Net income attributable to Loews Corporation (c) | $ | 446 | | $ | 355 | | $ | 1,434 | | $ | 822 | |

(a)The three months ended December 31, 2023 includes net investment gains of $6 million ($4 million after tax and noncontrolling interests). The three months ended December 31, 2022 includes net investment losses of $33 million ($23 million after tax and noncontrolling interests). The years ended December 31, 2023 and 2022 include net investment losses of $99 million and $199 million ($71 million and $138 million after tax and noncontrolling interests).

(b)Includes a gain of $46 million ($36 million after tax) for the year ended December 31, 2023 related to Loews Hotels & Co’s acquisition of an additional equity interest in, and the consolidation of, a previously unconsolidated joint venture property.

(c)The effects of adopting ASU 2018-12 on the Selected Financial Information were as follows:

| | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2022 | As Reported | | Effect of Adoption | | As Adjusted |

| | | | | |

| Income (Loss) Before Income Tax: | | | | | |

| CNA Financial | $ | 294 | | | $ | (11) | | | $ | 283 | |

| Total | 476 | | | (11) | | | 465 | |

| Net Income (Loss) Attributable to Loews Corporation: | | | | | |

| CNA Financial | $ | 223 | | | $ | (9) | | | $ | 214 | |

| Total | 364 | | | (9) | | | 355 | |

| | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2022 | As Reported | | Effect of Adoption | | As Adjusted |

| | | | | |

| Income (Loss) Before Income Tax: | | | | | |

| CNA Financial | $ | 1,081 | | | $ | (267) | | | $ | 814 | |

| Total | 1,381 | | | (267) | | | 1,114 | |

| Net Income (Loss) Attributable to Loews Corporation: | | | | | |

| CNA Financial | $ | 802 | | | $ | (190) | | | $ | 612 | |

| Total | 1,012 | | | (190) | | | 822 | |

(d)Consists of parent company interest expense, corporate expenses and the equity income (loss) of Altium Packaging. The year ended December 31, 2023 includes a charge of $47 million ($37 million after tax) related to the termination of a defined benefit plan.

Loews Corporation and Subsidiaries

Consolidated Financial Review

| | | | | | | | | | | | | | |

| December 31, |

| Three Months | Years Ended |

| (In millions, except per share data) | 2023 | 2022 | 2023 | 2022 |

| Revenues: | | | | |

| Insurance premiums | $ | 2,479 | | $ | 2,232 | | $ | 9,480 | | $ | 8,667 | |

| Net investment income | 643 | | 600 | | 2,395 | | 1,802 | |

| Investment gains (losses) (a) | 6 | | (33) | | (53) | | (199) | |

| Operating revenues and other | 1,130 | | 994 | | 4,079 | | 3,774 | |

| Total | 4,258 | | 3,793 | | 15,901 | | 14,044 | |

| | | | |

| Expenses: | | | | |

| Insurance claims and policyholders’ benefits (b) | 1,810 | | 1,694 | | 7,068 | | 6,653 | |

| Operating expenses and other | 1,835 | | 1,634 | | 6,837 | | 6,277 | |

| Total | 3,645 | | 3,328 | | 13,905 | | 12,930 | |

| | | | |

| Income before income tax (b) | 613 | | 465 | | 1,996 | | 1,114 | |

| Income tax expense (b) | (136) | | (87) | | (451) | | (223) | |

| Net income (b) | 477 | | 378 | | 1,545 | | 891 | |

| Amounts attributable to noncontrolling interests (b) | (31) | | (23) | | (111) | | (69) | |

| Net income attributable to Loews Corporation (b) | $ | 446 | | $ | 355 | | $ | 1,434 | | $ | 822 | |

| | | | |

| Net income per share attributable to Loews Corporation (b) | $ | 1.99 | | $ | 1.49 | | $ | 6.29 | | $ | 3.38 | |

| | | | |

| Weighted average number of shares | 223.80 | | 238.08 | | 227.81 | | 243.28 | |

(a)Includes a gain of $46 million ($36 million after tax) for the year ended December 31, 2023 related to Loews Hotels & Co’s acquisition of an additional equity interest in, and the consolidation of, a previously unconsolidated joint venture property.

(b)The effects of adopting ASU 2018-12 on the Consolidated Financial Review were as follows:

| | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2022 | As Reported | | Effect of Adoption | | As Adjusted |

| | | | | |

| Insurance claims and policyholders’ benefits | $ | 1,683 | | | $ | 11 | | | $ | 1,694 | |

| Income before income tax | 476 | | | (11) | | | 465 | |

| Income tax expense | (88) | | | 1 | | | (87) | |

| Net income | 388 | | | (10) | | | 378 | |

| Amounts attributable to noncontrolling interests | (24) | | | 1 | | | (23) | |

| Net income attributable to Loews Corporation | 364 | | | (9) | | | 355 | |

| Net income per share attributable to Loews Corporation | 1.53 | | | (0.04) | | | 1.49 | |

| | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2022 | As Reported | | Effect of Adoption | | As Adjusted |

| | | | | |

| Insurance claims and policyholders’ benefits | $ | 6,386 | | | $ | 267 | | | $ | 6,653 | |

| Income before income tax | 1,381 | | | (267) | | | 1,114 | |

| Income tax expense | (278) | | | 55 | | | (223) | |

| Net income | 1,103 | | | (212) | | | 891 | |

| Amounts attributable to noncontrolling interests | (91) | | | 22 | | | (69) | |

| Net income attributable to Loews Corporation | 1,012 | | | (190) | | | 822 | |

| Net income per share attributable to Loews Corporation | 4.16 | | | (0.78) | | | 3.38 | |

Definitions of Non-GAAP Measures and Reconciliation of GAAP Measures to Non-GAAP Measures:

CNA Financial Corporation

Core income is calculated by excluding from CNA’s net income attributable to Loews Corporation the after-tax effects of investment gains (losses). In addition, core income excludes the effects of noncontrolling interests. The calculation of core income excludes investment gains (losses) because these are generally driven by economic factors that are not necessarily reflective of CNA’s primary operations. The following table presents a reconciliation of CNA net income attributable to Loews Corporation to core income:

| | | | | | | | | | | | | | |

| December 31, |

| Three Months | Years Ended |

| (In millions) | 2023 | 2022 | 2023 | 2022 |

CNA net income attributable to Loews

Corporation | $ | 336 | | $ | 214 | | $ | 1,094 | | $ | 612 | |

| Investment (gains) losses | (5) | | 26 | | 79 | | 154 | |

| Consolidation adjustments including noncontrolling interests | 31 | | 25 | | 111 | | 70 | |

| Core income | $ | 362 | | $ | 265 | | $ | 1,284 | | $ | 836 | |

Boardwalk Pipelines

EBITDA is defined as earnings before interest, income tax expense, depreciation and amortization. The following table presents a reconciliation of Boardwalk net income attributable to Loews Corporation to EBITDA:

| | | | | | | | | | | | | | |

| December 31, |

| Three Months | Years Ended |

| (In millions) | 2023 | 2022 | 2023 | 2022 |

| Boardwalk net income attributable to Loews Corporation | $ | 92 | | $ | 83 | | $ | 283 | | $ | 247 | |

| Interest, net | 38 | | 40 | | 144 | | 166 | |

| Income tax expense | 24 | | 26 | | 90 | | 83 | |

| Depreciation and amortization | 106 | | 99 | | 412 | | 396 | |

| EBITDA | $ | 260 | | $ | 248 | | $ | 929 | | $ | 892 | |

Loews Hotels & Co

Adjusted EBITDA is calculated by excluding from Loews Hotels & Co’s EBITDA, noncontrolling interest share of EBITDA adjustments, state and local government development grants, gains or losses on asset acquisitions and dispositions, asset impairments, and equity method income, and including Loews Hotels & Co’s pro rata Adjusted EBITDA of equity method investments. Pro rata Adjusted EBITDA of equity method investments is calculated by applying Loews Hotels & Co’s ownership percentage to the underlying equity method investment’s components of EBITDA and excluding distributions in excess of basis.

The following table presents a reconciliation of Loews Hotels & Co net income attributable to Loews Corporation to Adjusted EBITDA:

| | | | | | | | | | | | | | |

| December 31, |

| Three Months | Years Ended |

| (In millions) | 2023 | 2022 | 2023 | 2022 |

| Loews Hotels & Co net income attributable to Loews Corporation | $ | 32 | | $ | 33 | | $ | 147 | | $ | 117 | |

| Interest, net | 4 | | 4 | | 9 | | 11 | |

| Income tax expense | 9 | | 8 | | 53 | | 44 | |

| Depreciation and amortization | 18 | | 17 | | 69 | | 64 | |

| EBITDA | 63 | | 62 | | 278 | | 236 | |

| Noncontrolling interest share of EBITDA adjustments | (2) | | | (5) | | |

| Gain on asset acquisition | | | | (46) | | | |

| Asset impairments | 3 | | 3 | | 12 | | 25 | |

| Equity investment adjustments: | | | | |

| Loews Hotels & Co’s equity method income | (31) | | (33) | | (129) | | (148) | |

| Pro rata Adjusted EBITDA of equity method investments | 50 | | 54 | | 218 | | 234 | |

| Consolidation adjustments | | (1) | | | (2) | |

| Adjusted EBITDA | $ | 83 | | $ | 85 | | $ | 328 | | $ | 345 | |

The following table presents a reconciliation of Loews Hotels & Co’s equity method income to Pro rata Adjusted EBITDA of equity method investments:

| | | | | | | | | | | | | | |

| December 31, |

| Three Months | Years Ended |

| (In millions) | 2023 | 2022 | 2023 | 2022 |

| Loews Hotels & Co’s equity method income | $ | 31 | | $ | 33 | | $ | 129 | | $ | 148 | |

| Pro rata share of equity method investments: | | | | |

| Interest, net | 10 | | 11 | | 43 | | 40 | |

| Income tax expense | | | | |

| Depreciation and amortization | 12 | | 12 | | 49 | | 50 | |

| Distributions in excess of basis | (3) | | (3) | | (3) | | (4) | |

| Consolidation adjustments | | 1 | | | |

| Pro rata Adjusted EBITDA of equity method investments | $ | 50 | | $ | 54 | | $ | 218 | | $ | 234 | |

Exhibit 99.2

Loews Corporation Fourth Quarter 2023 Earnings Remarks

James Tisch, President & CEO:

Good morning and welcome to our fourth quarter report. Loews had a strong quarter to close out the fiscal year, with each of our consolidated subsidiaries delivering stellar results. Loews’s earnings per share increased by more than 80% year-over-year to $6.29 in 2023. All our consolidated companies experienced strong growth during 2023, and all of them performed well.

CNA experienced robust growth during the year and reported record core income of nearly $1.3 billion, a more than 50% increase over 2022’s core income. The company’s net written and net earned premiums increased by 9% and 10% respectively, driven by higher rates, an 11% increase in new business, and strong retention of 85%. Additionally, CNA’s earnings growth was fueled by its investment portfolio, which contributed $459 million more pre-tax income this year, split evenly between CNA’s fixed income portfolio, and LP and common stock returns. While the LP and common stock portfolios are prone to yearly fluctuations (CNA earned 9.4% this year versus a 1.4% loss in 2022), we would expect the boost from CNA’s fixed income portfolio to be a tailwind that remains with us for the foreseeable future.

On the underwriting side, CNA’s growth did not come at the expense of profitability. The company’s yearly combined ratio was 93.5% and the company had record underwriting income of $585 million. We remain impressed by the CNA management team’s strategies for delivering greater profitability. They continue to build productive relationships with key distribution partners, to mitigate the long-tailed risk of their run-off long-term care book, and to pursue a disciplined approach to capital management.

Given the strength of CNA’s business, I continue to find the market’s valuation of CNA perplexing. As I discussed last quarter, the company has grown substantially and has become markedly more profitable. Nonetheless, the company’s share price is almost 20% lower today than it was at the beginning of 2018. Our view is that CNA is a compelling value, and for that reason, we purchased 4.5 million shares of CNA common stock for approximately $178 million in 2023. We continue to be bullish on the outlook for CNA’s business.

Boardwalk Pipelines also had a great year, reporting full year 2023 EBITDA of $929 million. The company benefited from stronger natural gas flows and improved pricing. Natural gas remains an essential part of our nation's energy future because it efficiently fuels the generation of dispatchable electricity. Boardwalk also completed the acquisition of Bayou Ethane for $355 million from Williams Companies in September of 2023. Bayou Ethane is a 380-mile ethane pipeline running from Mont Belvieu, Texas to the Mississippi River Corridor in Louisiana. This pipeline is a good strategic fit for Boardwalk’s existing gas liquids business.

Loews Hotels performed well this year with Adjusted EBITDA of $328 million. This represents a substantial increase from the company’s pre-pandemic Adjusted EBITDA resulting from improved profitability, the addition of new properties, and the divestment of less profitable assets. The hotel company also made substantial investments in its growth during 2023 which are not yet reflected in its earnings. The company’s new, nearly 900-room hotel in Arlington, Texas is slated to open next week on February 13th and rooms and events are already booked into 2030. Loews Hotels has a 50% interest in, and will manage, three properties with a total of 2,000 rooms under construction on the Universal campus in Orlando. Those hotels are expected to be completed next year, at which point Loews Hotels will have a 50% interest in a total of 11 hotels with 11,000 rooms at Universal Orlando.

Share repurchases remained Loews's most significant capital allocation lever in 2023. We repurchased 14 million shares for a total cost of $852 million, which amounts to about 6% of the shares outstanding at the beginning of the year. These repurchases were done at an average price of just over $60 per share.

Although Loews’s stock price has performed well over the past year, we continue to believe that our shares are undervalued. Since the end of 2018, we have repurchased over 91 million shares of Loews common stock at an average price of just over $51 per share and reduced our share count by about 29%. As long as our shares trade below our view of their intrinsic value, we will continue to repurchase them.

In conclusion, let me emphasize that it is no accident that Loews and our subsidiaries have had such a good year, given the talent, hard work, and dedication of our employees throughout the enterprise. I am grateful for their contributions and look forward to another successful year of creating value for all our stakeholders.

Jane Wang, CFO:

Good morning. Loews finished 2023 with an outstanding fourth quarter, reporting net income of $446 million or $1.99 per share, which compares favorably to net income of $355 million or $1.49 per share in the prior year's fourth quarter. The increase of 26% was driven by higher underwriting and investment income from CNA and higher income from Boardwalk, partially offset by lower investment income at Loews parent company.

For the full year, Loews reported net income of $1.434 billion or $6.29 per share compared to $822 million or $3.38 per share in 2022. The 74% increase in net income was driven by strong operating performance at our subsidiaries and higher investment income at the parent company. As a reminder, 2022 results have been adjusted to reflect the application of the LDTI (long duration targeted improvement) accounting standard related to CNA’s run-off long-term care business.

Book value per share increased from $60.81 at the end of 2022 to $70.69 at the end of 2023. Excluding accumulated other comprehensive income, book value per share increased by 9% from $74.88 to $81.92. The increase was driven by strong 2023 earnings and accretive share repurchases.

CNA had a terrific fourth quarter, contributing net income of $336 million to Loews, compared to $214 million in the fourth quarter of 2022. The $122 million year-over-year improvement was driven by higher net investment income as well as higher underwriting income, driven mostly by lower catastrophe losses.

For the full year, CNA’s net income contribution to Loews increased by $482 million to $1.094 billion from $612 million in 2022. That improvement was driven by higher net investment income and continued strong profitable growth within the P&C insurance business, as well as improved results within Life & Group.

For the year, CNA’s after-tax net investment income contribution to Loews increased by $327 million driven by both higher fixed income yields and LP and common stock returns. Pre-tax yields on CNA’s fixed income portfolio increased by almost 30 basis points from 4.4% to 4.7%. During 2023, LPs and common stocks in the CNA portfolio together posted a 9.4% return versus a negative 1.4% return in 2022.

On the underwriting side, CNA’s strong profitable growth resulted in another year of record underwriting results. The company’s underlying combined ratio of 90.9% improved by 30 basis points from 91.2% in 2022. The overall combined ratio was slightly higher at 93.5% driven by less favorable prior year development, which offset lower catastrophe losses.

CNA continued to post strong profitable growth, increasing net written premiums by 9% year over year. This was driven by five points of rate, two points of exposure growth, and an 11% increase in new business. Net earned premium growth was also strong at 10%, which represents an increase of three points year-over-year.

Results in the company’s run-off Life & Group business improved substantially driven by a smaller negative impact from the company’s annual reserve review (completed in the third quarter of each year) and higher net investment income. During 2023, CNA also de-risked its long-term care reserves through policyholder buyouts, spending $193 million to buy out approximately 6,600 policies. These cash buyout offers are based on the policies’ statutory reserves, which are generally higher than GAAP reserves, resulting in a small GAAP charge. As I have said in the past, we believe this is the right strategy because it reduces CNA’s exposure and de-risks the business over the long term.

Please refer to CNA's Investor Relations website for more details on their results.

Turning to our natural gas pipeline business. Boardwalk’s EBITDA increased by $12 million to $260 million in the fourth quarter compared to $248 million in the fourth quarter of 2022. For the full year, EBITDA increased by $37 million to $929 million in 2023 from $892 million in 2022. As a reminder, EBITDA is defined and reconciled on page 7 of this document. Boardwalk’s 2023 fourth quarter and full year net income also increased by $9 million and $36 million year over year to $92 million and $283 million, respectively.

Boardwalk’s strong performance was driven by higher recontracting rates and higher utilization of pipeline and storage assets, as well as contribution from its acquisition of Bayou Ethane in the fourth quarter. This revenue growth was partially offset by higher costs from maintenance projects due to revised pipeline safety requirements.

Loews Hotels reported another year of robust profitability in 2023. Fourth quarter Adjusted EBITDA and net income results were essentially flat year over year, driven by a return to pre-pandemic occupancy levels in Orlando, offset by higher occupancy in city center hotels and other resorts. Full year Adjusted EBITDA was $328 million versus $345 million in 2022. The year-over-year decline was driven by higher pre-opening expenses related to Loews Hotels’ new property in Arlington, Texas, as well as lower management fees due to hotels exiting the portfolio. Full year occupancy remained strong at 80% in 2023 compared to 79% in 2022. As a reminder, Adjusted EBITDA is defined and reconciled on page 8 of these remarks. On a net income basis, the year-over-year increase from $117 million to $147 million was driven by a $36 million after-tax gain related to Loews Hotels’ acquisition of an additional equity interest in a previously unconsolidated joint venture.

Finally, at the parent company, Loews recorded pre-tax investment income of $30 million in the fourth quarter of 2023 compared to $92 million in the prior year’s fourth quarter due to lower returns on our common stock portfolio. However, on a full year basis, investment returns improved to $114 million versus a slight loss in 2022 due to higher returns on our cash and common stock portfolios.

From a cash flow perspective, we received $104 million in dividends from CNA in the fourth quarter of 2023. For the full year 2023, CNA paid Loews $706 million, consisting of four regular quarterly dividends of $0.42 per share and a special dividend of $1.20 per share. We also received a distribution of $300 million from Boardwalk Pipelines in 2023, which was paid in December.

From October 30 through December 31, we repurchased 1.1 million shares of our common stock at a cost of $77 million. That brings our total 2023 share repurchases to 14 million shares at a total cost of $852 million.

Loews ended 2023 with $2.6 billion in cash and short-term investments.

Today, CNA announced that they increased their regular quarterly dividend to $0.44 and declared a special dividend of $2.00, which amounts to $606 million for Loews, which we expect to receive in March.

Investor Q&A

Every quarter, we encourage shareholders to send us questions in advance of earnings that they would like us to answer in our remarks. Please see below for the questions we have received, along with some additional questions we found relevant.

How would potential interest rate cuts impact the subsidiaries, particularly CNA?

Lower interest rates are generally not favorable for the insurance industry as they impact future investment income. That said, interest rates are expected to remain substantially higher than they were during and right before the pandemic, which is a positive for CNA. CNA has also taken advantage of the higher interest rate environment in 2023 to lengthen the duration of its investment portfolio, which reduces reinvestment risk.

Lower rates will also reduce the size of the company’s unrealized loss position on its fixed maturity securities portfolio. For example, at the end of the fourth quarter, the company’s unrealized loss position improved by about $2.5 billion from about $4.5 billion on September 30, 2023 to about $2.0 billion on December 31, 2023. It is important to note that regardless of prevailing interest rates, CNA will still receive the same cash flows from the fixed income securities that are currently in its portfolio, and the company intends to hold most of those securities to maturity. Therefore, we view the company’s unrealized loss position as transitory in nature.

Jim, you mentioned that Loews is trading near an all-time high. How does that impact your share repurchase strategy?

We continue to believe that our shares trade at a discount to their intrinsic value and therefore share repurchases will remain a key component of our capital allocation strategy. Currently Loews has a market capitalization of $16.2 billion. When you subtract our $10.8 billion stake in CNA (which is a paltry ten times earnings) and our $800 million net cash position, the market is valuing our non-publicly traded subsidiaries at about $4.6 billion. That valuation is extraordinarily cheap when you consider that the sum of Boardwalk’s EBITDA and Loews Hotels’ Adjusted EBITDA is nearly $1.3 billion.

How much have you invested in the four new developments at Loews Hotels and when do you expect the earnings potential of those hotels to be fully reflected in the financial results?

Loews Hotels has substantially completed its equity investment of nearly $435 million in these four new developments. The total cost incurred for the four properties (including debt and partner equity) through the end of 2023 was $1 billion. Given the hotel company’s strong internal cash flow generation, Loews Hotels self-funded the vast majority of its investment in these new projects, with the parent company contributing $38 million in 2023.

We typically evaluate the attractiveness of new hotel projects using a cash-on-cash return metric. We compare the all-in stabilized cash flow projections to the amount of equity required and we generally target mid-to-high teens returns based on that metric.

In terms of earnings expectations, it normally takes three to four years after a hotel opens for the property to produce fully stabilized results.

How is the regulatory environment impacting Boardwalk’s growth prospects?

Current regulations and permitting requirements regarding new pipeline construction are extremely onerous, which inhibits development of new pipelines. On the positive side, the lack of new pipeline development generally increases demand for existing pipelines.

While we’re on the subject of natural gas pipelines, I would like to say a few words about the recent Biden administration moratorium on new licenses for LNG export facilities. There are two reasons that limiting the construction of these facilities seems absolutely crazy to me. First, to the extent that the U.S. does not export natural gas, other nations will fill that gap and the U.S. will lose out on jobs and GDP. Secondly, if the production and export of natural gas is limited, coal-fired power plants will be utilized instead to generate electricity. A coal plant emits more than twice as much carbon dioxide as a natural gas-fired power plant, so pausing the construction of LNG export facilities will result in an increase – not decrease – in worldwide carbon dioxide emissions.

What is lost in the discussion about renewables is that we need reliable and dispatchable electricity that can be generated when the sun doesn’t shine and the wind doesn’t blow. For that reason, I firmly believe that natural gas will remain a critical transition fuel for decades to come.

What is your outlook for the U.S. natural gas market and how does that impact Boardwalk?

We believe that natural gas will remain an essential component of the U.S. energy infrastructure due to its ability to fuel dispatchable electricity. As the country adds more renewables to the grid, the increased volatility in natural gas demand may actually create new pipeline storage revenue opportunities. Boardwalk’s assets are also well-located to take advantage of demand growth in the Gulf Coast region. Not only are Boardwalk’s assets located near LNG export terminals, but the company’s pipelines may also be able to take advantage of coal to gas switching in the states it serves. For example, nearly 70% of Kentucky’s electricity is still generated by coal-fired plants.

Are there any updates on the Boardwalk litigation?

As a reminder, in December of 2022 the Delaware Supreme Court reversed the Delaware Court of Chancery’s ruling in favor of the former Boardwalk minority unitholders. As part of that decision, the Delaware Supreme Court remanded the three unresolved issues back to the Chancery Court. The Delaware Court of Chancery will hold a hearing in April of this year on those remaining issues.

Reconciliation of GAAP Measures to Non-GAAP Measures

These earnings remarks contain financial measures that are not in accordance with accounting principles generally accepted in the United States of America ("GAAP"). Management believes some investors may find these measures useful to evaluate our and our subsidiaries’ financial performance. CNA utilizes core income, Boardwalk Pipelines utilizes earnings before interest, income tax expense, depreciation and amortization (“EBITDA”), and Loews Hotels & Co utilizes Adjusted EBITDA. These measures are defined and reconciled to the most comparable GAAP measures on pages 7 and 8 of these remarks.

About Loews Corporation

Loews Corporation is a diversified company with businesses in the insurance, energy, hospitality and packaging industries. For more information, please visit www.loews.com.

Forward-Looking Statements

Statements contained in these earnings remarks which are not historical facts are "forward-looking statements" within the meaning of the federal securities laws. Forward-looking statements are inherently uncertain and subject to a variety of risks that could cause actual results to differ materially from those expected by management of the Company. A discussion of the important risk factors and other considerations that could materially impact these matters as well as the Company's overall business and financial performance can be found in the Company's reports filed with the Securities and Exchange Commission and readers of this release are urged to review those reports carefully when considering these forward-looking statements. Copies of these reports are available through the Company's website (www.loews.com). Given these risk factors, investors and analysts should not place undue reliance on forward-looking statements. Any such forward-looking statements speak only as of the date of these remarks. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statement to reflect any change in the Company's expectations with regard thereto or any change in events, conditions or circumstances on which any forward-looking statement is based.

Definitions of Non-GAAP Measures and Reconciliation of GAAP Measures to Non-GAAP Measures:

CNA Financial Corporation

Core income is calculated by excluding from CNA’s net income attributable to Loews Corporation the after-tax effects of investment gains (losses). In addition, core income excludes the effects of noncontrolling interests. The calculation of core income excludes investment gains (losses) because these are generally driven by economic factors that are not necessarily reflective of CNA’s primary operations. The following table presents a reconciliation of CNA net income attributable to Loews Corporation to core income:

| | | | | | | | | | | | | | |

| December 31, |

| Three Months | Years Ended |

| (In millions) | 2023 | 2022 | 2023 | 2022 |

| CNA net income attributable to Loews Corporation | $ | 336 | | $ | 214 | | $ | 1,094 | | $ | 612 | |

| Investment (gains) losses | (5) | | 26 | | 79 | | 154 | |

| Consolidation adjustments including noncontrolling interests | 31 | | 25 | | 111 | | 70 | |

| Core income | $ | 362 | | $ | 265 | | $ | 1,284 | | $ | 836 | |

Boardwalk Pipelines

EBITDA is defined as earnings before interest, income tax expense, depreciation and amortization. The following table presents a reconciliation of Boardwalk net income attributable to Loews Corporation to EBITDA:

| | | | | | | | | | | | | | |

| December 31, |

| Three Months | Years Ended |

| (In millions) | 2023 | 2022 | 2023 | 2022 |

| Boardwalk net income attributable to Loews Corporation | $ | 92 | | $ | 83 | | $ | 283 | | $ | 247 | |

| Interest, net | 38 | | 40 | | 144 | | 166 | |

| Income tax expense | 24 | | 26 | | 90 | | 83 | |

| Depreciation and amortization | 106 | | 99 | | 412 | | 396 | |

| EBITDA | $ | 260 | | $ | 248 | | $ | 929 | | $ | 892 | |

Loews Hotels & Co

Adjusted EBITDA is calculated by excluding from Loews Hotels & Co’s EBITDA, noncontrolling interest share of EBITDA adjustments, state and local government development grants, gains or losses on asset acquisitions and dispositions, asset impairments, and equity method income, and including Loews Hotels & Co’s pro rata Adjusted EBITDA of equity method investments. Pro rata Adjusted EBITDA of equity method investments is calculated by applying Loews Hotels & Co’s ownership percentage to the underlying equity method investment’s components of EBITDA and excluding distributions in excess of basis.

The following table presents a reconciliation of Loews Hotels & Co net income attributable to Loews Corporation to Adjusted EBITDA:

| | | | | | | | | | | | | | |

| December 31, |

| Three Months | Years Ended |

| (In millions) | 2023 | 2022 | 2023 | 2022 |

| Loews Hotels & Co net income attributable to Loews Corporation | $ | 32 | | $ | 33 | | $ | 147 | | $ | 117 | |

| Interest, net | 4 | | 4 | | 9 | | 11 | |

| Income tax expense | 9 | | 8 | | 53 | | 44 | |

| Depreciation and amortization | 18 | | 17 | | 69 | | 64 | |

| EBITDA | 63 | | 62 | | 278 | | 236 | |

| Noncontrolling interest share of EBITDA adjustments | (2) | | | (5) | | |

| Gain on asset acquisition | | | | (46) | | | |

| Asset impairments | 3 | | 3 | | 12 | | 25 | |

| Equity investment adjustments: | | | | |

| Loews Hotels & Co’s equity method income | (31) | | (33) | | (129) | | (148) | |

| Pro rata Adjusted EBITDA of equity method investments | 50 | | 54 | | 218 | | 234 | |

| Consolidation adjustments | | (1) | | | (2) | |

| Adjusted EBITDA | $ | 83 | | $ | 85 | | $ | 328 | | $ | 345 | |

The following table presents a reconciliation of Loews Hotels & Co’s equity method income to Pro rata Adjusted EBITDA of equity method investments:

| | | | | | | | | | | | | | |

| December 31, |

| Three Months | Years Ended |

| (In millions) | 2023 | 2022 | 2023 | 2022 |

| Loews Hotels & Co’s equity method income | $ | 31 | | $ | 33 | | $ | 129 | | $ | 148 | |

| Pro rata share of equity method investments: | | | | |

| Interest, net | 10 | | 11 | | 43 | | 40 | |

| Income tax expense | | | | |

| Depreciation and amortization | 12 | | 12 | | 49 | | 50 | |

| Distributions in excess of basis | (3) | | (3) | | (3) | | (4) | |

| Consolidation adjustments | | 1 | | | |

| Pro rata Adjusted EBITDA of equity method investments | $ | 50 | | $ | 54 | | $ | 218 | | $ | 234 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

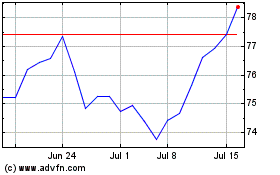

Loews (NYSE:L)

Historical Stock Chart

From Apr 2024 to May 2024

Loews (NYSE:L)

Historical Stock Chart

From May 2023 to May 2024