0000763744FALSE00007637442023-08-082023-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 8, 2023

| | | | | | | | | | | | | | |

| LCI INDUSTRIES |

| | | | |

| | | | |

| (Exact name of registrant as specified in its charter) |

| | | | |

| Delaware | | 001-13646 | 13-3250533 |

| | | | |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | (I.R.S. Employer

Identification No.) |

| | | | |

| 3501 County Road 6 East, | Elkhart, | Indiana | 46514 |

| | | | |

| (Address of principal executive offices) | (Zip Code) |

| | | | |

| Registrant's telephone number, including area code: | (574) | 535-1125 |

| | | | |

| | | | |

| N/A |

| | | | |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $.01 par value | LCII | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

The following information is furnished pursuant to Item 7.01, "Regulation FD Disclosure." Such information, including the Exhibit attached hereto, shall not be deemed "filed" for purposes of Section 18 of the Securities Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

Transcript of Earnings Conference Call as contained in Exhibit 99.1 and hereby incorporated by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit Index:

99.1 Transcript of Earnings Conference Call

104 Cover Page Interactive Date File (embedded within the Inline XBRL document).

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

LCI INDUSTRIES |

(Registrant) |

|

|

By: /s/ Lillian D. Etzkorn Lillian D. Etzkorn Chief Financial Officer |

|

|

| Dated: | August 9, 2023 |

08-August-2023

LCI Industries (LCII)

Q2 2023 Earnings Call

CORPORATE PARTICIPANTS

Lillian D. Etzkorn – Chief Financial Officer & Executive Vice President, LCI Industries

Jason Douglas Lippert – President, Chief Executive Officer & Director, LCI Industries

Kip A. Emenhiser – Vice President of Finance and Treasurer, LCI Industries

......................................................................................................................................................................................................................................................

OTHER PARTICIPANTS

Kathryn Thompson – Analyst, Thompson Research Group LLC

Fred Wightman – Analyst, Wolfe Research LLC

Daniel Moore – Analyst, CJS Securities, Inc.

Craig R. Kennison – Analyst, Robert W. Baird & Co., Inc.

Bret Jordan – Analyst, Jefferies LLC

Brandon Rollé – Analyst, D.A. Davidson & Co.

Scott Stember - Analyst, ROTH MKM

Mike Swartz - Analyst, Truist Securities, Inc.

......................................................................................................................................................................................................................................................

MANAGEMENT DISCUSSION SECTION

Operator: Good morning or good afternoon all, and welcome to the LCI Industries Q2 2023 Earnings Call. My name is Adam and I’ll be your operator for today. [Operator Instructions]

I would now hand the floor over to Lillian Etzkorn to begin. So, Lillian, please go ahead when you’re ready.

......................................................................................................................................................................................................................................................

Lillian D. Etzkorn

Chief Financial Officer & Executive Vice President, LCI Industries

Good morning, everyone, and welcome to the LCI Industries second quarter 2023 conference call. I am joined on the call today by Jason Lippert, President and CEO; and Kip Emenhiser, VP of Finance and Treasurer. We will discuss the results for the quarter in just a minute.

But first, I would like to inform you that certain statements made in today’s conference call regarding LCI Industries and its operations may be considered forward-looking statements under the security laws and involve a number of risks and uncertainties. As a result, the company cautions you that there are a number of factors, many of which are beyond the company’s control, which could cause actual results and events to differ materially from those described in the forward-looking statements. These factors are discussed in our earnings release and in our Form 10-K and other filings with the SEC. The company disclaims any obligation or undertaking to update forward-looking statements to reflect circumstances or events that occur after the date of the forward-looking statements are made except as required by law.

With that, I would like to turn the call over to Jason.

......................................................................................................................................................................................................................................................

Jason Douglas Lippert

President, Chief Executive Officer & Director, LCI Industries

Thank you, Lillian. Good morning, everyone, and welcome to LCI’s second quarter 2023 earnings call. We delivered solid results in the second quarter, highlighted by continued content growth and sequential margin expansion as we navigate a challenging RV operating environment.

Revenues were $1 billion, down 34% compared to the prior year, but up $41 million sequentially. Net sales from acquisitions completed in 2023 and 2022 contributed approximately $17 million for the quarter. While revenues are down compared to record highs we reached in 2022, our results are still $386 million above the second quarter of 2019. We continue to benefit from strength in our aftermarket, international, marine, transportation and housing businesses, which made up a combined 64% of overall revenue this quarter, partially offsetting the impact from the significant year-over-year drop in RV wholesale unit shipments. With North American RV being only 36% of our revenue this quarter, our diversified revenues are greatly helping make a difference in our results during the challenging RV environment.

Coupled with our steadfast commitment to driving long term operational improvement throughout our business while continuing to move forward with our diversification strategy, we believe we will continue our trajectory of sustained, profitable growth. Pursuing and capitalizing on operational efficiencies remains top priority. With the flexibility we’ve added to our manufacturing footprint, we’re able to quickly adjust capacity to match changes in demand while supporting areas in our business that are running strong. Our executive and plant leadership teams have been hard at work driving new cost savings initiatives, driving new sourcing initiatives and implementing hundreds of continuous improvement projects around the business to diversify and improve our overall cost structure.

We’ve been successful in rightsizing our overall cost structure, reducing general and administrative expenses, while also significantly bringing down inventories to drive enhanced cash generation. We continue to rationalize margins across the business and also divested a few smaller business units, focusing on better margin product lines to improve our mix. These combined actions, along with the tailwinds of lower freight and commodity costs, have strengthened our financial profile, putting us in a solid position with sufficient cash amidst uncertain operating conditions. Needless to say, our company will be in a better position with this reduced cost structure as the industry starts to normalize in the coming quarters.

Moving on to RV OEM, sales decreased 55% during the second quarter of 2023 compared to 2022, largely due to decreased wholesale shipments. We’re beginning to see improvements in dealer inventory levels where we have been most challenged as destocking rates amongst dealers decelerates, as inventories reach appropriate levels. In addition, 2022 and 2023 year vehicles are being moved out of the pipeline as 2024 models begin to enter the market just over a month ago. This changeover also produced a major buying opportunity as dealers cut prices on older models, helping bring in new RVers looking for great deals.

August and September OEM order forecasts have improved slightly over prior months, a sign that they are likely hitting an inflection point in demand. Camping trends this summer are also up with millions more taking trips this Memorial Day and 4th of July versus 2022 against the backdrop of frustrated air travelers. Compared to air travel and other traditional modes of vacation RVing is 35% to 50% more affordable on average according to recent RVIA study, which makes it attractive choice in any economic environment. During the quarter, content per towable RV increased 2% from the prior year to $5,487, while content per motorhome RV for the quarter increased 6% from the prior year to $3,760. The model changeover has also supported content growth in recent months.

As we continue to launch new and innovative products for RVs, we are typically able to capture share in demand from the latest models which normally feature additional leading edge content with each successive year. With the annual RV Open House only a month away in September, we are looking forward to showcasing some of our latest product introductions that have been driving content growth like our new 4000 Series Windows with built-in shade systems, independent suspension and ABS suspensions and air conditioners and much more.

Moving to the Aftermarket, revenues reached a record trailing 12 months of $854 million, decreasing only 2% year-over-year for the quarter, driven by inflationary pressures that have impacted consumer demand, partially offset by improvement in automotive end markets, which weighed positively on Aftermarket results.

Operating profit for the Aftermarket segment expanded significantly year-over-year in the second quarter, driven by market share gains, declining commodity costs and targeted price increases. We believe the RV, automotive and marine aftermarkets will continue to be a major driver for our business as we meet demand for RVers looking to make improvements and repairs to their vehicles.

In addition, we feel with the hundreds of thousands of rental nights added annually to rental platforms like RVshare and Outdoorsy, repairs and upgrades will be turbocharged as many RVs go from being used just a few weeks a year to as many as 20 to 30 weeks a year for some renters. We continue to expand our wide aftermarket product catalog by launching many new product and product programs in the RV aftermarket, helping us capitalize on nearly 0.5 million RVs that are in the repair, replacement and upgrade cycle annually.

As we become a premier source for our targeted aftermarket, we’re continuing to expand our share in a nearly $5 billion addressable market, while strengthening the Lippert brands through our best-in-class customer service. With the support teams in place to directly engage RVers everywhere, we’re able to quickly solve problems and help people spend some more time on the road rather than in the repair shop.

In the month of June alone, our customer care center took a record 180,000 calls, which is up 80% over last year, which we believe is a sign that we will continue to grow as we add content and continue to make the customer experience and service a central focus of our Aftermarket business. We also just announced our third annual Lippert Getaway event, which will be held at Island Park, Idaho, this September. Our teams are always excited for the opportunity to shape the future of RVing by engaging the community and collecting valuable feedback about the products that keep them in the lifestyle.

In July, our customer experience team attended the EAA AirVenture Air Show event in Oshkosh, Wisconsin, that attracted over 50,000 RVers. Events like these, along with other major initiatives like the Campground Project, Lippert Ambassadors, product giveaways and Lippert Scouts have been critical to helping us build trust and lasting relationships with customers, all while helping us create a strong community that is involved with and heavily invested in the Lippert brand.

Turning to North American adjacent markets, second quarter revenues were down 8% compared to prior year, primarily due to softness in marine and manufactured housing end markets. On a positive note, we continued to see stabilization and some growth in other meaningful adjacent markets like transit bus, school bus and utility trailer markets.

We’re very focused on continued innovation in the marine markets on products like our anchor systems, thrusters, windshields and seating and moving the market to our patented electric bimini product lineup that is quickly becoming an industry standard since we launched it a few years ago. In June, we launched a partnership between our Captain’s group and Oasis Marinas, the largest marina management company in the US, to support and donate Lippert marine products to several events in celebration of National Marina Day. Because our brand is one of the largest product supplier brands in boats, we have our customers’ attention and we’ll continue to develop more featured products for the space.

Our international markets had another quarter of solid results due to the easing supply chain constraints that have hindered our OEM partners, along with continued operating improvements as we integrate our acquisitions there, helping to drive a sales increase of 6%. As expected, with chassis shipments increasing, European OEMs are able to deliver higher levels of production to meet a pent-up demand, which we anticipate will be a tailwind through the remainder of the year. We continue to leverage European innovations in our North American RV markets to drive long term content growth with products like window blinds, pop tops and acrylic windows. These types of products have the potential to strengthen our competitive differentiation in the US with easy access to our proven European products designs and production facilities. We look forward to driving further growth internationally as this business continues to contribute to our overall performance.

I’ll now move on to our innovation highlights. In the past months, we’ve announced many new exciting product launches, including our Solera Off-Grid awnings with an industry first solar panel fabric; the OneControl auto setup app, BaseCamp leveling systems, independent suspension axles, windows with integrated blind systems, glass entry doors, ABS braking, Class B pop tops and much more.

Set to launch this fall, the Solera Off-Grid Series Solar awnings will help us tap into a growing off-grid trend. These awnings provide the added benefit of up to 300 watts of solar power without the added expense and weight of installing conventional rigid panels on the roofs of RVs, redefining the possibilities of sustainable energy integration for off-grid enthusiasts.

We believe that our suspension system enhancements pose one of the greatest opportunities for us as we introduce the ABS concept for towable RVs, that has been around an auto suspension for decades. We have developed an ABS product that we think meets price point and performance expectations and quickly [indiscernible] volume that should influence many of the industry leading brands to make a move in this direction, as many already have.

Other innovations, such as the industry’s first glass door and windows with integrated blinds, make for a cleaner and better looking designs inside and outside the RV while allowing all price points to consider these options. We believe that innovation is a significant reason we have grown our business profitably through adding meaningful content to most RVs over the last three decades.

On top of innovation, culture remains a true differentiator for our business. As I’ve long stated the strong culture starts with experienced and caring leaders at the top who work to create trust and meaningful relationships and leadership opportunities for people they have the privilege to lead. Our leadership development programs and in-house leader development staff have made Lippert a place where team members have the opportunity to grow both personally and professionally. Beyond simply creating a better work environment, our cultural focus has had measurable impact on our company helping us achieve an annualized voluntary turnover rate of 25%, an incredible achievement given the environment putting us far ahead of our peers.

The team members are excited and energized to show up every day. And here for the longer term, we believe we are able to more consistently build high quality products with a safer, more productive workplace. Within our culture, in addition to focusing on how we can support our team members, we also focus on how we can improve the communities around us. And it’s important for our stakeholders to know that we actually measure this.

In the first half of 2023, Lippert team members performed 65,000 hours of community service at hundreds of charitable organizations. Over the last year, over 75% of our 15,000 team members participated in at least one serving event. Overall, we could not be more proud of these accomplishments and the efforts from our global teams that give back and serve to the areas where we operate. We look forward to bringing our teams together to make even more of a community impact through the rest of 2023.

Regarding capital allocation, our priority is keeping a strong balance sheet, driving solid cash generation to pay down debt and maintaining sufficient liquidity amidst challenging operating conditions. We remain open to strategic M&A opportunities and have an acquisition pipeline, but our primary focus is on fortifying our balance sheet and making investments in the business to support our growth.

We are taking a diligent approach to CapEx, which we expect to be lower this year than last year by approximately $50 million, targeted on high return investments. In the past 18 months, we’ve invested over $50 million in new automation projects, including significant glass automation dedicated to the towable and motorhome window and windshield markets to drive efficiencies, get a new product to market and improve product quality. We believe that automation projects like these have been transformational for our business and we are already seeing the benefit of these investments in our performance today.

In closing, we want to give a very heartfelt thank you to all of our team members for their very hard work this year and what has been a very challenging operating environment. We are proud to see how our teams continue to grow personally, professionally and contribute to the ongoing success of our business with the guidance of our driven and tenured leadership teams. Moving further into 2023, we believe we are very well-positioned to keep moving forward and deliver long term value for our stakeholders.

I’m now going to turn the call over to Lillian Etzkorn, our CFO, to give more detail on our financial results. Lillian?

......................................................................................................................................................................................................................................................

Lillian D. Etzkorn

Chief Financial Officer & Executive Vice President, LCI Industries

Thank you, Jason. Our consolidated net sales for the quarter decreased 34% to $1 billion compared to the prior year period, primarily impacted by the reduction in North American RV production and decreased selling prices, which are indexed to select commodities partially offset by acquisitions. For the month of July, sales were down 20% to $295 million versus July of 2022, primarily due to the decline in wholesale RV shipments.

As Jason noted, we are continuing to see the benefit from operational improvements that we have made to our business, while also capturing continued tailwinds from our long term diversification strategy. While sales in North American RV OEMs declined 57%, sales in our adjacent markets, Aftermarket and international businesses only declined 4%. This significantly reduced the impact of the year-over-year decline in the RV industry production.

The decline in Q2 2023 sales to North American RV OEMs was again driven by a decrease in wholesale shipments, partially offset by content expansion in towables and motorhomes. Content per towable RV unit increased 2% to $5,487, while content per motorized unit increased 6% to $3,760 compared to the prior year period. Towable content growth can be attributed to organic market share gains of 7%, while acquired revenue contributed 5% of the year-over-year growth, partially offset by the sales price reductions contractually tied to commodity prices.

Sales to the adjacent industries declined 6% versus the prior year. Sales were positively impacted by acquisitions and pricing adjustments to our transportation product and were offset by lower sales in North American marine OEMs and manufactured housing. Marine content per power boat decreased 17% to $1,457, primarily due to price

decreases associated with year-over-year declining input costs and changes in the product mix. Q2 2023 sales to the Aftermarket decreased 2% compared to the prior year period, driven by inflationary pressures impacting consumer demand. International sales increased 6% year-over-year, including an estimated 2% positive impact of exchange rate for the quarter. Supply chain constraints have been easing, which has enabled European OEMs to meet pent-up demand.

Gross margins were 21.5% compared to 26.6% in the prior year period, primarily due to the impact of fixed production costs on lower sales volumes and the timing of sales price reductions contractually tied to commodity prices. Operating margins decreased compared to the prior year period, in line with expectations as we continue to absorb fixed costs on the lower sales base, and also decreased prices indexed to select commodities.

As a bright spot, we had a year-over-year increase in Aftermarket margins driven by decreased material commodity costs, helping to partially offset the impact from lower overall sales. GAAP net income in Q2 of 2023 was $33.4 million or $1.31 per diluted share compared to $154.5 million or $6.06 per diluted share in Q2 of 2022.

EBITDA decreased 65% to $88.2 million for the second quarter compared to the prior year period. Non-cash depreciation and amortization was $65.5 million for the six months ended June 30, 2023, while non-cash stock-based compensation expense was $9.1 million for the same period. We anticipate depreciation and amortization in the range of $130 million to $140 million during the full year of 2023.

For the six months ended June 30, 2023, cash generated from operating activities was $274 million with $34 million used for capital expenditures, $26 million used for business acquisitions and $53 million returned to the shareholders in the form of dividends. Operating cash flows were negatively impacted by lower sales and partially offset by the positive changes in working capital.

The improvements in working capital were led by the initiatives we put in place to decrease inventory, which has resulted in a decrease of $200 million year-to-date. As inventories continue to normalize, we expect further improvements to working capital and positive impact to cash flow. We have made net debt repayments on our long term debt of $179 million year-to-date through June 30. At the end of the second quarter, we had an outstanding net debt position of $921 million, 3.1 times pro forma EBITDA adjusted to include LTM EBITDA of acquired businesses and the impact of our non-cash items.

As we look forward, we are focused on continuing to maintain a strong balance sheet and targeting a long term leverage of 1.5 times net debt to EBITDA. In the near term, we are working to integrate recently completed acquisitions which we expect to positively impact our operating cash flows in the coming quarters. For the full year of 2023, capital expenditures are anticipated in the range of $60 million to $80 million.

We continue to expect that RV production levels will remain volatile in the short term. We estimate our July consolidated sales of down roughly 20% to be indicative of third quarter 2023 results as RV OEM production remains depressed as dealers continue destocking to get inventories to more appropriate levels. We anticipate Q3 of 2023 RV shipments will be between 65,000 and 75,000 units, with a full year estimated range of 290,000 to 310,000 units.

We believe third quarter financial results will be very similar to the second quarter. Looking ahead, we are confident in our ability to keep up our solid performance and are very well-positioned to continue managing through operational challenges to create long-term shareholder value.

With that, this is the end of our prepared remarks and we’re ready to take questions.

......................................................................................................................................................................................................................................................

QUESTION AND ANSWER SECTION

Operator: [Operator Instructions] Our first question today comes from Kathryn Thompson from Thompson Research Group. Kathryn, your line is open. Please go ahead.

<Q – Kathryn Thompson – Thompson Research Group LLC>: Hi. Thanks for taking my question today. This is just really more about the balance of going into the Elkhart Open House and where inventories in field right now. Have you seen – we’ve sort of seen this earlier this year, but are you seeing dealers scratch out orders to a degree before the Open House and are maybe running a little bit leaner in hopes of waiting – placing orders for new units or do you feel that inventory right now really reflects current demand and just really kind of understanding how you think about inventories going into that show?

<A – Jason Lippert – LCI Industries>: Thanks, Kathryn. I think that it’s more the latter of what you just said. I think that obviously dealers can – they get to a point where their inventories are so low where they need to order and need to stay stocked up. Dealer inventories have obviously decelerated the destocking, but they’re still destocked. I mean, the way we’ve looked at it is from Q1 2020 when we felt inventories were fairly normalized, we’re about 85,000 units, almost 100,000 units less today in this quarter than what we were back then.

So, it feels, and again I’m just giving you our feeling, yards are empty here. The shipyards at the OEMs are pretty empty. You go back just 12 months ago, they were chock-full, but the orders have ticked up feels like 10% or so for August and September, like they need units because the last handful of months have obviously been – we’ve been pretty starved for orders. So it feels like they need some of those units to get through Open House, and then we’re anticipating continuing to stock up. As Camping World said in their recent release that they were going to continue to stock through the next six months and gain inventory. So that’s what it feels like.

<Q – Kathryn Thompson – Thompson Research Group LLC>: Okay. And that ties into the cash generation. You previously said that inventory – obviously inventory and cash go hand in hand, especially if you have inventory build-up. But with lower inventory and the debt reduction are key bogies that you’re focused on. From here, what is your outlook on inventory to cash conversion and uses?

<A – Lillian Etzkorn – LCI Industries>: Yeah. Hey, good morning, Kathryn. It’s Lillian. So as you noted, we’ve done some significant reductions in our inventory year-to-date. We’ve reduced it by about $200 million. We are going to look to continue to reduce inventory through the second half of the year, probably not at that type of pace, but we are going to still continue to right-size our inventories as we move forward. We had very strong cash generation in the first half of the year. Expect that we’re going to continue to be generating cash as we move into this next half. So company’s been positioned very solidly and very focused on cash generation, and that’s going to be something that we will continue to be working towards for the balance of the year.

<A – Jason Lippert – LCI Industries>: And it feels like with – if volume stays up as we kind of see the trend for August and September, what we have immediate visibility for, obviously we can reduce inventory at a quicker clip than what we have the last couple of months. But July was obviously a little slow. Again, if August, September, rest of the year pick up, we can move inventory out and generate more cash, so...

<Q – Kathryn Thompson – Thompson Research Group LLC>: Okay. And then final question, can you touch on any of your updated automation efforts, just where you are and...

<A – Jason Lippert – LCI Industries>: Yeah.

<Q – Kathryn Thompson – Thompson Research Group LLC>: ...given lower production rates, [indiscernible] (00:26:13) use this opportunity to speed up some of those initiatives?

<A – Jason Lippert – LCI Industries>: Yeah, we’ve obviously squeezed CapEx this year for obvious reasons, but we had quite a few projects flowing into the year that were carryovers from 2022. Probably most notable is our glass automation that we’re doing for windshields, which will be a new product line for us for towable and motorized RVs. Especially in the towables, the windshields have really ticked up over the last few years. You see probably about 30% of the towables now with windshields on the fronts where they didn’t have anything in prior years. So, we’ve got automation for those two lines. I’d say we’ve probably got 40-or-so-million dollars of automation in one building for glass now. Half of that is online, the other half is coming online over the next six to eight months. So – and we’ve got other projects that we’ve got in the back burner warming up for 2024 as soon as cash improves.

<Q – Kathryn Thompson – Thompson Research Group LLC>: Okay. Perfect. Excellent. Thanks very much.

<A – Jason Lippert – LCI Industries>: Yeah. Thanks, Kathryn.

Operator: The next question comes from Fred Wightman from Wolfe Research. Fred, your line is open. Please go ahead.

<Q – Fred Wightman – Wolfe Research LLC>: Hey, guys. Good morning. I just wanted to follow up on the comment about 3Q being similar to 2Q. I wasn’t sure if that was a comment in terms of total dollar performance, so sales, EBITDA, earnings, was that a comment on year-over-year performance? What exactly did you mean by that?

<A – Lillian Etzkorn – LCI Industries>: Hey. Good morning, Fred. It’s Lillian. Yes, what I was referencing with that really is comparability to the second quarter of this year’s performance, both from the top line perspective and the overall earnings for the business.

<Q – Fred Wightman – Wolfe Research LLC>: Okay. Perfect. And then did you guys – I apologize if I missed it. Did you give an updated retail number for 2023?

<A – Jason Lippert – LCI Industries>: I don’t know if we did or not, but we feel the retail for this year is going to be somewhere in the 375 range. And we feel 375 to 400 for 2024. That’s kind of what we’re throwing out. I think that’s in line with some of the other public companies that have stated their forecast, so...

<Q – Fred Wightman – Wolfe Research LLC>: Okay. Great. And then just lastly, I think last quarter you said from an inventory mix perspective, model year 2022 was like 35%. Do you have an updated number for that sort of where it stands today?

<A – Jason Lippert – LCI Industries>: Can you repeat that again, Fred?

<Q – Fred Wightman – Wolfe Research LLC>: The – just the mix of model year 2022s I think last quarter you said it was around 35%.

<A – Jason Lippert – LCI Industries>: Yeah. Yeah. So it feels and doing all the dealer touches and talking to all the OEMs that it’s around – it’s nearing the 10% mark. Some dealers have 15% that we’ve touched and others are in the 5% – in the 3% to 5% range. So it’s definitely declining pretty good. And with respect to the performance, I just want to be clear that while we’re challenged in the times recently with lower volumes we feel very confident, as we’ve stated in past years that this is a double digit OI business. And we will get back there, but there’s some choppiness in just volume and getting through some of our inventory challenges and things like that over the next couple quarters. Just wanted to be clear about that.

<Q – Fred Wightman – Wolfe Research LLC>: Okay. Great. Thank you.

Operator: The next question comes from Mike Swartz from Truist Securities. Mike, your line is open. Please go ahead.

<Q – Mike Swartz – Truist Securities, Inc.>: Yeah. Hey. Good morning, everyone. Just maybe for Lillian, a question. I think previously you had – said you anticipated mid- to high-single-digit operating margins for the full year. I think you’re implying kind of mid-single digit, again, third quarter. So do you have an update there? It seems like it’d be probably at the lower end of the range, but I don’t want to put words in your mouth.

<A – Lillian Etzkorn – LCI Industries>: Yeah. Now, I think that’s probably fair. So as we’re seeing how the cadence for volume coming through and as we’re seeing the RV business cadencing and what have you through the balance of the year, it probably is more at that that mid-single digit for this year. And as Jason just commented just immediately previously, we do still see this business on a longer term basis being a double digit OI business. It’s just taking a little bit of time as we get into more normalized operating patterns for the industry to get there.

<Q – Mike Swartz – Truist Securities, Inc.>: Got you. Okay. And then just a point of clarification. I think you said your kind of visibility into August and September RV production looks better than past months. I’m guessing you’re talking about maybe June and July. Was that on...

<A – Jason Lippert – LCI Industries>: Yeah.

<Q – Mike Swartz – Truist Securities, Inc.>: ...a year-over-year basis or was that absolute production levels? I just want to clarify that.

<A – Jason Lippert – LCI Industries>: Well, I think one of the things that we want – we want a lot of the investors to understand specifically is the ramp down we’ve seen over the last – you can go back to April of 2022, just over a year ago, we were on a run rate of 725,000 units as an industry. That was what – if you annualize the monthly production in April, that’s what we were kind of shooting toward. And if you look to one year later, in April 2023, we’re running at a 260,000 run rate. So, the deceleration of the business is a lot greater than what it might have looked at from the outside saying, hey, we finished 2022 at a 500,000 unit wholesale and 2023 looking at a 300,000-plus unit wholesale. So the difference is a lot greater. But yeah I think that what we have visibility on today, August and September being up, we should get into better comps, obviously, significantly better comps as we get closer to first quarter. But right now all we have visibility on is August and September, and it feels like 10% over what we saw in May, June and July, which had several weeks of downtime in all three of those months, more than normal for those months. So I hope that answered your question. If not, you can – we can keep trying.

<Q – Mike Swartz – Truist Securities, Inc.>: Okay. No. That’s helpful. Thanks, Jason.

<A – Jason Lippert – LCI Industries>: Okay.

Operator: The next question is from Bret Jordan from Jefferies. Bret, your line is open. Please go ahead.

<Q – Bret Jordan – Jefferies LLC>: Yeah, on the prior topic, I guess, you’d said Q3 similar to Q2, but it sounds like most of Q3 is going to be running better than Q2 or is that just better year-over-year? I’m trying to reconcile the August and September being up versus the second quarter.

<A – Jason Lippert – LCI Industries>: Yeah, I think we’ve got some puts and takes with our diversified businesses. That might be where some of the clarity needs to be. But when you look at August in Europe, they take the entire month down where you look at, Q2, we had a pretty robust quarter for Europe. So you got to look at all the different industries and segments independently. But for the RV segment, I think is what we’re speaking to, is we see orders at least for August and September, not knowing what October is going to be yet, and still there’s – we can’t be certain that they don’t come back after Open House or even in the next few weeks and say, hey, we need to take a week down in September. So just telling you what we see today.

<A – Lillian Etzkorn – LCI Industries>: Yeah. And maybe, Bret, building on that a little...

<Q – Bret Jordan – Jefferies LLC>: Okay. And then what’s your outlook – it’s okay.

<A – Lillian Etzkorn – LCI Industries>: Bret, just to expand a little bit on that from a sequential perspective, as we look at some of the other industries, I think it is important to note that Europe, generally speaking, is lighter from a seasonality perspective for Q3 because of the shutdowns that we have in the various countries. The other area that we’re seeing softness as expected is in the marine side of the business that that was down a little bit sequentially in the second quarter. And as we progress through into the third quarter, that’s also going to be down again sequentially. So again to the point that everything kind of the puts and takes, we are seeing strength in certain areas. Clearly, some of these adjacent markets are being puts and takes with the RV.

<Q – Bret Jordan – Jefferies LLC>: Okay. And what’s the second half impact from commodities? I mean, what you can see in price deals that you have now?

<A – Jason Lippert – LCI Industries>: Yeah, we’ve got, I mean, again, lots of positives and negatives there. We have some commodity pricing going down. We have some that are going up. We have commodity indexes where some of our pricing to customers is going up, some of it’s going down. So, again, overall, I think that it’s a pretty net neutral result. We’ll know more about Q4 next quarter, but that’s kind of where we’re at.

<Q – Bret Jordan – Jefferies LLC>: Okay. And then one last question. The outlook on sort of content as the OEs, the manufacturers are rolling out the 2024, is there a bias to sort of try to get consumer prices lower by – on average moving content down or is it sort of try to make them more appealing by moving content up? Is there any shift there?

<A – Jason Lippert – LCI Industries>: Yeah, I mean, definitely the shift is to as you’ve heard maybe from some of the other public calls, there’s a real push to get pricing down as pricing crept up over the last couple years. And some of that’s coming through de-contenting, some of that’s coming through just pure discounting. When I look at our products and I’ve said this in the past, but I think it’s helpful to repeat it, that when a unit’s taken a slide out or axles or a chassis, there’s not really much that changes from a content standpoint on that because they need those products, windows, awnings and you can’t really build units without those. They’re de-contenting largely on product – a lot of products that we don’t sell.

So when I look – when I think about our products and de-contenting, the only time we get a little pinched is when the market tends to go from high-end units to entry level units or bigger travel trailers to smaller travel trailers. And the market shifts that way, which we’re seeing a little bit of especially when you look at big Class A motorhomes and diesel motorhomes. Those are certainly taking the biggest hit, but again, it’s a small overall part of the entire market. So I hope that’s helpful.

<Q – Bret Jordan – Jefferies LLC>: Great. Yeah. Great. Thank you.

<A – Jason Lippert – LCI Industries>: Yeah.

Operator: The next question comes from Scott Stember from ROTH MKM. Scott, your line is open. Please go ahead.

<Q – Scott Stember – ROTH MKM>: Good morning, guys, and thanks for taking my questions.

<A – Jason Lippert – LCI Industries>: Morning.

<Q – Scott Stember – ROTH MKM>: Can we get – go back to the content conversation? Sounds like you won’t be as impacted by de-contenting. So looking out to 2024 factoring everything in, where do you see organic content growing? I know you’ve been in the 3% to 5% range as a goal, right? But do we still stay there?

<A – Jason Lippert – LCI Industries>: Yeah, I think if you peel out inflation and those pressures, certainly we – our goal is to continue to add bells and whistles and features to existing products and then continue to come out with new product lineups. And we’ve been doing that for the better part of 20 years and been pretty successful. I’d also add that we haven’t lost market share during this time. So, it’s another strength we’ve got as we tend to continue to keep our market share pretty level or grow it over time. So, given all that, I think that that’s still a fairly safe assumption, again netting out any kind of inflationary issues and things like that.

<Q – Scott Stember – ROTH MKM>: All right. And then looking at the marine side, getting a little bit softer than the previous quarters, but could you maybe just flesh that out pontoon versus more expensive types of boats?

<A – Jason Lippert – LCI Industries>: Yeah, I think the – obviously, pontoon – we sell lot of – a lot into the pontoons, but we sell a lot of windshields to all the bigger boats as well. So we have some decent content there. But I think because over the last couple years, they just – as you all know, they haven’t ramped – the marine business hasn’t ramped up as high and as fast and to the levels that RV did compared to where they were, we feel that this cycle is going to be relatively short-lived. Most of the OEM customers we talk to are talking first quarter to get some of the inventory fleshed out. But I don’t feel that the dealers have the same type of problem or the size of the problem with marine inventory that the RV dealers had with the RV inventory and especially on the towable side.

<Q – Scott Stember – ROTH MKM>: All right. And then last question on the aftermarket. You talked about your customer call centers having a tremendous increases of inbound calls. Can you maybe talk about where is that coming from? Is that related to repair work, break/fix or – and what are you hearing from dealers as far as warranty and things like that?

<A – Jason Lippert – LCI Industries>: Yeah. Yeah. Sure. That’s a great question. Yeah, 180,000 calls and communications in each of the last two months, so, we – if you look at over the last 10 or so years that we’ve really had our call center running and running full tilt and we really rarely had a quarter that had less service impact and calls in the prior quarter. So we put more RVs out there, we’re going to get more calls. We put more content out there, we’re going to get more calls.

I think the other thing that leads to more calls and opportunities is the fact that I think we’re servicing better than anybody else in the industry. So we tend to get calls when maybe other people’s lines are busy. We’re monitoring every single call, how quickly we answer, how much we’re putting toward sales on each of those calls, their sales efforts obviously in each of those calls, even if it comes in for repair. But to answer your question on repairs, it’s – my guess would be 65%, 70% of the calls come in for service, repairs, warranty, things like that. The rest are, hey, I’m thinking about getting this or that product from my RV, where do I get it, how do I get it, how do I get it installed? And then we’ve got service to handle all of those things. So, our – in our best estimation of the calls into our service center are going to continue to grow over time, especially as we put more RVs and more content out there, which is good for our aftermarket and one of the reasons why it’s growing like it has.

<Q – Scott Stember – ROTH MKM>: Got it. That’s all I have. Thank you.

<A – Jason Lippert – LCI Industries>: Thanks, Scott.

Operator: [Operator Instructions] The next question is from Daniel Moore from CJS Securities. Daniel, your line is open. Please go ahead.

<Q – Dan Moore – CJS Securities, Inc.>: Thank you. Good morning, Jason. Morning, Lillian. Covered a lot of ground already...

<A – Jason Lippert – LCI Industries>: Morning.

<Q – Dan Moore – CJS Securities, Inc.>: ...but maybe just one or two quick ones. The de-contenting discussion, maybe if we take that over to marine, content was down, I think I heard 17%. What was the split between

price and mix, and do you anticipate mix being maybe a little bit more of a headwind, at least near term if customers are looking for kind of lower price point, lower amenity models?

<A – Jason Lippert – LCI Industries>: Well, they’re looking for some of those exact numbers. I’ll say a couple things. One is we just started measuring marine content within the last year. So some of those numbers might just be fuzzy because we’re starting to measure it. Certainly some of that’s inflationary because we have given some decreases. But I would tell you that just when we look at the pontoon market and Forest River had their dealer show just the other day. I mean, the pontoon boats feel like they’re as expensive as they’ve ever been in terms of what dealers are looking to buy. You don’t see very many of the entry level $30,000 pontoons anymore like you used to. I mean, there’s a lot of pontoons that are in the $70,000 to $100,000 range, with lots of bells and whistles and feature. And you look at electric biminis, you look at some of the power arches, obviously they’re putting more windshields on pontoons today, which they didn’t do in the past. And seating packages that we do a lot of are getting more expensive. So I’d say that that’s probably the best color we can give you there. And maybe the color will become more clearer on future quarters as we get more time under our belt reporting the content.

<Q – Dan Moore – CJS Securities, Inc.>: Fair enough and that’s helpful. And maybe 1A and 1B on capital allocation. CapEx, as you mentioned tightening the belt a little bit. Are there projects that you deem as less necessary or maybe just sort of pushing things out to fiscal 2024 when things get a little bit clearer?

<A – Jason Lippert – LCI Industries>: Yeah, I’d say that we’re just pushing them out. I mean, all the projects that we’ve got on the block right now are – we feel are important. We wouldn’t put them on, we de-prioritize them. Some of those projects are automation projects. So those usually take priority because we’re improving our labor and quality and safety all while putting these CapEx in place. So, when we look at last year at $130-ish million in CapEx and this year at $65 million, we’re just trying to put the most important projects. $65-ish million in CapEx this year is what we look to be at. We’re just trying to prioritize the most important ones we can do in that range.

<Q – Dan Moore – CJS Securities, Inc.>: Makes sense. And lastly, appreciate the color, Lillian. You mentioned your leverage target 1.5 times. Again, would you want to get back down 90% to 100% of the way there or all the way there before you kind of start looking at M&A again or if you made meaningful progress, would you start to consider smaller tuck-ins along the way? Thank you.

<A – Lillian Etzkorn – LCI Industries>: Yeah, no, I think it’s – I think what I would want to see is that we’re making meaningful progress. We’re always going to be looking for opportunities from an M&A perspective to the extent that it makes sense for the business and it’s strategically aligned with our objectives. So if the right opportunity came forward and we were making meaningful progress, then I’d be comfortable doing that. I’d say for right now, as we’ve stated, really focused on making sure that the balance sheet is very strong and it’s fortress, basically, but always willing to entertain opportunities as long as we’re making that progress.

<Q – Dan Moore – CJS Securities, Inc.>: Makes sense. Thank you again.

<A – Lillian Etzkorn – LCI Industries>: Thank you.

Operator: The next question comes from Craig Kennison from Baird. Craig, your line is open. Please go ahead.

<Q – Craig Kennison – Robert W. Baird & Co., Inc.>: Hey. Good morning. Thanks for taking my question as well. It’s been a good call. Had a – I think I have a decent handle on stocking trends in the RV channel and then in the marine channel. Wondering if there’s any color you can shed or any light you can shed on any stocking trends in your aftermarket channel.

<A – Jason Lippert – LCI Industries>: Yeah, it’s real difficult, Craig, to answer that question in a way that’s going to provide you any kind of better color than maybe what we already – what you already have. But – and I would say that the trends typically follow the retail unit trend. So, when the dealers are challenged a little bit, they’re typically holding back on those inventories, but there’s also the factor that you have with when retail slows down and people are moving more used product, they’re tending to use a little bit more of aftermarket parts to upgrade and

things like that. And obviously we sell a lot of those. So, all I can tell you is that our – you look at our quarter, we’re 2% down, which is a lot better than obviously what the market’s doing, but I think a lot of that as we continue to just put more content into the channels, the aftermarket channels. Our automotive side is a factor that’s been bumping up a little bit recently. It was a little bit challenged in past quarters. And then you’ve got the marine channel as well. So you’ve kind of got three channels and aftermarket when you look at that number versus just our RV OEM, which is strictly RV. That helpful?

<Q – Craig Kennison – Robert W. Baird & Co., Inc.>: It is. Thank you, Jason. And then just an unrelated question. Hopped on a little late, but did you offer any commentary on your appetite for acquisitions in this environment?

<A – Jason Lippert – LCI Industries>: Yeah, I think, we’re obviously staying super diligent on the capital expenditure side and we’re just – we’re looking at companies, we’ve got a pipeline, we’re pushing some of those out right now for obvious reasons, but I don’t anticipate when we get back to 2024, I mean, M&A is still an important part of our growth strategy and we’re still going to continue to look at acquisitions as actively as we have in the past. That might look a little bit different as we look more to marine and aftermarket and a little bit less in RV, but it just depends on what presents itself, but we’re going to stay active.

<Q – Craig Kennison – Robert W. Baird & Co., Inc.>: Great. Thank you.

<A – Jason Lippert – LCI Industries>: More tuck-ins likely that are smaller like we’ve announced this year. We announced two smaller deals. So if those types of things come along, obviously those would be easier to consider.

<Q – Craig Kennison – Robert W. Baird & Co., Inc.>: That’s helpful. Thank you, Jason.

<A – Jason Lippert – LCI Industries>: Yeah. See you Craig.

Operator: The next question is from Brandon Rollé from D.A. Davidson. Brandon, your line is open. Please go ahead.

<Q – Brandon Rollé – D.A. Davidson & Co.>: Good morning. Thank you for taking my question. I just had a quick one on the labor situation in Elkhart. Could you comment on the availability and maybe competition for labor as the industry starts to ramp up production?

<A – Jason Lippert – LCI Industries>: Yeah, sure. And I’ll start by saying it’s a little bit of a mystery to me. We are having obviously one of the biggest downturns in RV, the industry has ever seen. This community is pretty heavily reliant on that industry and different than 2008/2009, I mean – and I’ve talked to a lot of people recently, I haven’t heard a lot of people screaming and complaining that they can’t find work. So, there’s a lot of people obviously that have done really well. The RV workforce probably are comfortable staying for a period at this kind of four-day workweek level. But unlike the last big dip we had, I just – we’re just not hearing about a lot of people having trouble finding jobs. I think the other industries in the area are finally getting some of the labor that they need. And a lot of those businesses are doing okay. As you know this industry or the economy in general is still growing a little bit. There is – the RV industry is struggling right now and has for the last 12 months. But it’s good to know that people seem to be sticking around. So long answer to the question, but hopefully that’s helpful.

<Q – Brandon Rollé – D.A. Davidson & Co.>: Yeah. Thank you.

Operator: We have no further questions. So I’ll turn the call back to Jason for concluding remarks.

......................................................................................................................................................................................................................................................

Jason Douglas Lippert

President, Chief Executive Officer & Director, LCI Industries

Yeah, I just want to thank everybody for joining the call. Obviously, it’s been a year of dealing with some of the RV challenges, but it feels like we’re starting to see some of the light at the end of the tunnel. And we look forward to updating you on that over the next couple quarters. So thanks for joining the call.

Disclaimer

The information herein is based on sources we believe to be reliable but is not guaranteed by us and does not purport to be a complete or error-free statement or summary of the available data. As such, we do not warrant, endorse or guarantee the completeness, accuracy, integrity, or timeliness of the information. You must evaluate, and bear all risks associated with, the use of any information provided hereunder, including any reliance on the accuracy, completeness, safety or usefulness of such information. This information is not intended to be used as the primary basis of investment decisions. It should not be construed as advice designed to meet the particular investment needs of any investor. This report is published solely for information purposes, and is not to be construed as financial or other advice or as an offer to sell or the solicitation of an offer to buy any security in any state where such an offer or solicitation would be illegal. Any information expressed herein on this date is subject to change without notice. Any opinions or assertions contained in this information do not represent the opinions or beliefs of FactSet CallStreet, LLC. FactSet CallStreet, LLC, or one or more of its employees, including the writer of this report, may have a position in any of the securities discussed herein.

THE INFORMATION PROVIDED TO YOU HEREUNDER IS PROVIDED "AS IS," AND TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, FactSet CallStreet, LLC AND ITS LICENSORS, BUSINESS ASSOCIATES AND SUPPLIERS DISCLAIM ALL WARRANTIES WITH RESPECT TO THE SAME, EXPRESS, IMPLIED AND STATUTORY, INCLUDING WITHOUT LIMITATION ANY IMPLIED WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, ACCURACY, COMPLETENESS, AND NON-INFRINGEMENT. TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLE LAW, NEITHER FACTSET CALLSTREET, LLC NOR ITS OFFICERS, MEMBERS, DIRECTORS, PARTNERS, AFFILIATES, BUSINESS ASSOCIATES, LICENSORS OR SUPPLIERS WILL BE LIABLE FOR ANY INDIRECT, INCIDENTAL, SPECIAL, CONSEQUENTIAL OR PUNITIVE DAMAGES, INCLUDING WITHOUT LIMITATION DAMAGES FOR LOST PROFITS OR REVENUES, GOODWILL, WORK STOPPAGE, SECURITY BREACHES, VIRUSES, COMPUTER FAILURE OR MALFUNCTION, USE, DATA OR OTHER INTANGIBLE LOSSES OR COMMERCIAL DAMAGES, EVEN IF ANY OF SUCH PARTIES IS ADVISED OF THE POSSIBILITY OF SUCH LOSSES, ARISING UNDER OR IN CONNECTION WITH THE INFORMATION PROVIDED HEREIN OR ANY OTHER SUBJECT MATTER HEREOF.

The contents and appearance of this report are Copyrighted FactSet CallStreet, LLC 2023. CallStreet and FactSet CallStreet, LLC are trademarks and service marks of FactSet CallStreet, LLC. All other trademarks mentioned are trademarks of their respective companies. All rights reserved.

Editor

Company disclaimer

Forward-Looking Statements

This audio event contains certain "forward-looking statements" with respect to the Company's financial condition, results of operations, profitability, margin growth, business strategies, operating efficiencies or synergies, competitive position, growth opportunities, acquisitions, plans and objectives of management, markets for the Company's common stock, the impact of legal proceedings, and other matters. Statements in this audio event that are not historical facts are "forward-looking statements" for the purpose of the safe harbor provided by Section 21E of the Securities Exchange Act of 1934, as amended, and Section 27A of the Securities Act of 1933, as amended, and involve a number of risks and uncertainties.

Forward-looking statements, including, without limitation, those relating to our future business prospects, net sales, expenses and income (loss), capital expenditures, tax rate, cash flow, financial condition, liquidity, covenant compliance, retail and wholesale demand, integration of acquisitions, R&D investments, and industry trends, whenever they occur in this audio event are necessarily estimates reflecting the best judgment of the Company's senior management at the time such statements were made. There are a number of factors, many of which are beyond the Company's control, which could cause actual results and events to differ materially from those described in the forward-looking statements. These factors include, in addition to other matters described in this audio event, the impacts of COVID-19, or other future pandemics, the Russia-Ukraine war, and heightened tensions between China and Taiwan on the global economy and on the Company's customers, suppliers, employees, business and cash flows, pricing pressures due to domestic and foreign competition, costs and availability of, and tariffs on, raw materials (particularly steel and aluminum) and other components, seasonality and cyclicality in the industries to which we sell our products, availability of credit for financing the retail and wholesale purchase of products for which we sell our components, inventory levels of retail dealers and manufacturers, availability of transportation for products for which we sell our components, the financial condition of our customers, the financial condition of retail dealers of products for which we sell our components, retention and concentration of significant customers, the costs, pace of and successful integration of acquisitions and other growth initiatives, availability and costs of production facilities and labor, team member benefits, team member retention, realization and impact of expansion plans, efficiency improvements and cost reductions, the disruption of business resulting from natural disasters or other unforeseen events, the successful entry into new markets, the costs of compliance with environmental laws, laws of foreign jurisdictions in which we operate, other operational and financial risks related to conducting business internationally, and increased governmental regulation and oversight, information technology performance and security, the ability to protect intellectual property, warranty and product liability claims or product recalls, interest rates, oil and gasoline prices, and availability, the impact of international, national and regional economic conditions and consumer confidence on the retail sale of products for which we sell our components, and other risks and uncertainties discussed more fully under the caption "Risk Factors" in the Company's Annual Report on Form 10-K for the year ended December 31, 2022, and in the Company's subsequent filings with the Securities and Exchange Commission. Readers of this audio event are cautioned not to place undue reliance on these forward-looking statements, since there can be no assurance that these forward-looking statements will prove to be accurate. The Company disclaims any obligation or undertaking to update forward-looking statements to reflect circumstances or events that occur after the date the forward-looking statements are made, except as required by law.

v3.23.2

Cover

|

Aug. 08, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 08, 2023

|

| Entity Registrant Name |

LCI INDUSTRIES

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-13646

|

| Entity Tax Identification Number |

13-3250533

|

| Entity Address, Address Line One |

3501 County Road 6 East,

|

| Entity Address, City or Town |

Elkhart,

|

| Entity Address, State or Province |

IN

|

| Entity Address, Postal Zip Code |

46514

|

| City Area Code |

(574)

|

| Local Phone Number |

535-1125

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock, $.01 par value

|

| Trading Symbol |

LCII

|

| Security Exchange Name |

NYSE

|

| Entity Central Index Key |

0000763744

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

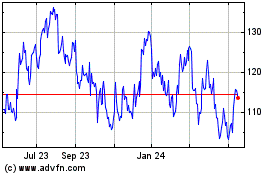

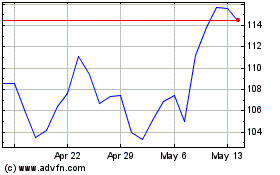

LCI Industries (NYSE:LCII)

Historical Stock Chart

From Jun 2024 to Jul 2024

LCI Industries (NYSE:LCII)

Historical Stock Chart

From Jul 2023 to Jul 2024