Current Report Filing (8-k)

October 06 2020 - 4:40PM

Edgar (US Regulatory)

0001509991

false

0001509991

2020-09-30

2020-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

September 30, 2020

KOSMOS ENERGY LTD.

(Exact Name of Registrant as Specified in

its Charter)

|

Delaware

|

|

001-35167

|

|

98-0686001

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

8176 Park Lane

Dallas, Texas

|

|

|

|

75231

|

|

(Address of Principal Executive Offices)

|

|

|

|

(Zip Code)

|

Registrant’s telephone number, including

area code: 214-445-9600

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

|

|

☐

|

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

|

|

|

|

Title of each class

|

|

Trading symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 Par Value

|

|

KOS

|

|

New York Stock Exchange

London Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange

Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised

financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material

Definitive Agreement

On

September 30, 2020, Kosmos Energy Gulf of Mexico Operations, LLC (“GOM Operations”) and Kosmos Energy GOM Holdings,

LLC (“GOM Holdings” and, together with GOM Operations, the “Borrowers”), along with Kosmos

Energy Gulf of Mexico, LLC (“Holdings”), Kosmos Energy Gulf of Mexico Management, LLC (“GOM Management”),

Kosmos Energy Ltd. (“Kosmos Energy”), and certain other subsidiary guarantors (the “Guarantors”)

entered into a Senior Secured Term Loan Credit Agreement (the “Credit Agreement”) with Trafigura Trading LLC

(“Trafigura”) and an affiliate of Beal Bank (together, the “Lenders”) and CLMG Corp., as

administrative agent and term loan collateral agent.

The

following is a summary of the key terms of the Credit Agreement and related agreements:

|

|

·

|

Amounts: The Lenders

have agreed to make terms loans to the Borrowers pursuant to two separate facilities each with a 5 year term: (i) a Term Loan A

Facility in an aggregate principal amount of $150,000,000 and (ii) a Term Loan B Facility in an aggregate principal amount of

$50,000,000 (the “Term Loan Facilities”). The Credit Agreement also includes an accordion feature providing

for incremental term loan commitments of up to $100,000,000, subject to certain conditions.

|

|

|

·

|

Use

of Proceeds: $50,000,000 of the proceeds of the Term Loan A Facility will be loaned

to Holdings to repay intercompany debt owing to Kosmos Energy. The balance of the proceeds

of the Term Loan A Facility will be used to fund working capital and general operating

expenses of the Borrowers and their subsidiaries, and to pay fees and expenses incurred

in connection with the entry into the Term Loan Facilities. The proceeds of the Term

Loan B Facility will constitute the deemed repayment in full of GOM Operations’

obligations under the previously Prepayment Agreement dated as of June 26, 2020 between

GOM Operations, as seller and Trafigura, as buyer (the “Prepayment Agreement”).

|

|

|

·

|

Interest:

Interest on outstanding loans under the Term Loan Facilities is payable quarterly in

arrears and accrues at a benchmark rate (subject to certain minimums) plus an effective

margin of approximately 6% per annum.

|

|

|

·

|

Guarantee:

Each Borrower’s obligations under the Term Loan Facilities are guaranteed by Kosmos

Energy, each other Borrower and certain of their subsidiaries (collectively, the “Loan

Parties”). Pursuant to a Parent Guarantee Agreement dated as of September 30,

2020 (the “Parent Guarantee Agreement”), Kosmos Energy Delaware Holdings,

LLC, Kosmos Energy Holdings and any other intermediate entity in the direct chain of

ownership between Kosmos Energy and GOM Holdings from time to time shall be subject to

providing a springing guarantee that becomes effective upon such entities becoming liable

for an aggregate amount of indebtedness in excess of $10,000,000.

|

|

|

·

|

Security:

In accordance with the Term Loan Collateral and Guarantee Agreement dated as of September

30, 2020 (the “Term Loan Security Agreement”), the obligations of

the Loan Parties under the Term Loan Facilities are secured by liens on certain assets

of the Loan Parties, including (i) all the oil and gas properties owned by any Borrower

or certain of its subsidiaries, (ii) all equity interests issued by Holdings, GOM Management,

GOM Operations and its

|

subsidiaries,

and (iii) all other property of any Borrower or its subsidiaries (other than certain excluded property).

|

|

·

|

Covenants:

The Credit Agreement contains customary affirmative and negative covenants, including

covenants that affect the ability of the Borrowers and their subsidiaries to incur additional

indebtedness, create liens, merge, dispose of assets, and make distributions, dividends,

investments or capital expenditures, among other things.

|

|

|

·

|

Events

of Default: The Term Loan Facility includes certain representations and warranties,

indemnities and events of default that, subject to certain materiality thresholds and

grace periods, arise as a result of a payment default, failure to comply with covenants,

material inaccuracy of representation or warranty, and certain bankruptcy or insolvency

proceedings. If there is an event of default, the Lenders may declare all or any portion

of the outstanding indebtedness to be immediately due and payable and exercise any rights

they might have (including against the collateral).

|

The

foregoing description of the Credit Agreement, Parent Guarantee Agreement and Term Loan Security Agreement is not complete and

is qualified in its entirety by reference to the text of the Credit Agreement, Parent Guarantee Agreement and Term Loan Security

Agreement. Copies of the Credit Agreement and Parent Guarantee Agreement will be filed as an exhibit to Kosmos Energy’s

Quarterly Report on Form 10-Q for the quarter ended September 30, 2020.

Item 1.02. Termination of

a Material Definitive Agreement.

The

information set forth in Item 1.01 of this Report is hereby incorporated by reference into this Item 1.02 in its entirety.

As

previously disclosed, on June 26, 2020, GOM Operations and Trafigura entered into the Prepayment Agreement for up to $200 million

of crude oil sales related primarily to a portion of GOM Operations 2022 and 2023 production, with $150 million committed by Trafigura.

On September 30, 2020, GOM Operations and Trafigura agreed to terminate the Prepayment Agreement pursuant to, and subject to the

terms of, the Credit Agreement.

Item 2.03. Creation of a Direct

Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information

set forth in Item 1.01 of this Form 8-K is incorporated by reference to this Item 2.03.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

Date: October 6, 2020

|

|

KOSMOS ENERGY LTD.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Neal D. Shah

|

|

|

|

Neal D. Shah

|

|

|

|

Senior Vice President, Chief Financial Officer

|

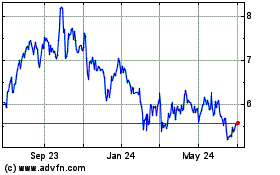

Kosmos Energy (NYSE:KOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

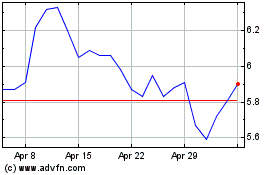

Kosmos Energy (NYSE:KOS)

Historical Stock Chart

From Apr 2023 to Apr 2024