JBG SMITH Declares a Quarterly Common Dividend of $0.225 Per Share

May 04 2023 - 4:15PM

Business Wire

JBG SMITH (NYSE: JBGS), a leading owner and developer of

high-quality, mixed-use properties in the Washington, DC market,

today announced that its Board of Trustees has declared a quarterly

dividend of $0.225 per common share. The dividend will be paid on

June 30, 2023 to common shareholders of record as of June 23,

2023.

About JBG SMITH

JBG SMITH owns, operates, invests in, and develops mixed-use

properties in high growth and high barrier-to-entry submarkets in

and around Washington, DC. Through an intense focus on placemaking,

JBG SMITH cultivates vibrant, amenity-rich, walkable neighborhoods

throughout the Washington, DC metropolitan area. Approximately

two-thirds of JBG SMITH's holdings are in the National Landing

submarket in Northern Virginia, which is anchored by four key

demand drivers: Amazon's new headquarters; Virginia Tech's

under-construction $1 billion Innovation Campus; the submarket’s

proximity to the Pentagon; and JBG SMITH’s deployment of

next-generation public and private 5G digital infrastructure. JBG

SMITH's dynamic portfolio currently comprises 15.3 million square

feet of high-growth office, multifamily, and retail assets at

share, 98% of which are metro-served. It also maintains a

development pipeline encompassing 9.7 million square feet of

mixed-use development opportunities. JBG SMITH’s capital allocation

strategy is to shift the majority of its portfolio to multifamily

and concentrate its office assets in National Landing. JBG SMITH is

committed to the operation and development of green, smart, and

healthy buildings and plans to maintain carbon neutral operations

annually. For more information on JBG SMITH please visit

www.jbgsmith.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230504005762/en/

Barbat Rodgers JBG SMITH Senior Vice President, Investor

Relations (240) 333-3805 brodgers@jbgsmith.com

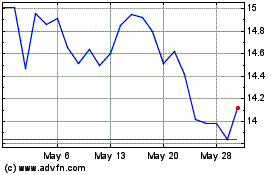

JBG SMITH Properties (NYSE:JBGS)

Historical Stock Chart

From Apr 2024 to May 2024

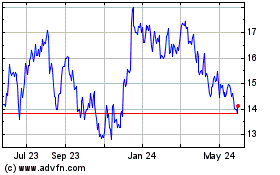

JBG SMITH Properties (NYSE:JBGS)

Historical Stock Chart

From May 2023 to May 2024