Form 8-K - Current report

December 15 2023 - 7:00AM

Edgar (US Regulatory)

false

0001822993

0001822993

2023-12-14

2023-12-14

0001822993

us-gaap:CommonStockMember

2023-12-14

2023-12-14

0001822993

JXN:DepositaryShareseachrepresentinga11000thInterestinashareofFixedRateResetNoncumulativePerpetualPreferredStockSeriesAMember

2023-12-14

2023-12-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported): December 14, 2023

Jackson

Financial Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-40274 |

|

98-0486152 |

(State or other jurisdiction of incorporation or

organization) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer Identification No.) |

1 Corporate Way,

Lansing,

Michigan |

|

48951 |

| (Address of principal executive

offices) |

|

(Zip Code) |

(517) 381-5500

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Exchange on Which Registered |

| Common Stock, Par Value $0.01 Per Share |

|

JXN |

|

New

York Stock Exchange |

| |

|

|

|

|

| Depositary Shares, each representing a 1/1,000th Interest in a share of Fixed-Rate Reset Noncumulative Perpetual Preferred Stock, Series A

|

|

JXN PRA |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Jackson Financial Inc. (the “Company,” “we,”

or “our”) has actively pursued methods to moderate the impact of the cash surrender value floor on the statutory capital and

risk-based capital ratio of our primary life insurance subsidiary, Jackson National Life Insurance Company (“Jackson”). On

December 14, 2023, Jackson received initial approval from the Michigan Department of Insurance and Financial Services (“Michigan

DIFS”) to form an affiliated Michigan captive insurer, Brooke Life Reinsurance

Company (“Brooke Re”). Under Michigan DIFS guidelines, the initial approval permits funding of Brooke Re in January 2024 with

permanent approval that enables operations expected promptly after funding occurs.

Jackson

will then enter into a reinsurance transaction with Brooke Re, which is expected to close in the first quarter of 2024, and all

economics of the transaction will be effective as of January 1, 2024. The transaction will provide for the cession from Jackson to

Brooke Re of liabilities associated with certain guaranteed benefit riders under our variable annuity contracts and similar

products of Jackson (“market risk benefits”), both in-force on the effective date of the reinsurance agreement and

written in the future (i.e., on a “flow” basis). Brooke Re will utilize a modified GAAP approach primarily

related to market risk benefits, with the intent to increase alignment between assets and liabilities in response to changes

in economic factors. The transaction is anticipated to mitigate the impact of the cash surrender value floor on Jackson’s

total adjusted capital, statutory required capital, and risk-based capital ratio, as well as to allow for more efficient economic

hedging of the underlying risks of Jackson’s business. This outcome will serve the interests of policyholders by protecting

statutory capital through avoidance of non-economic hedging costs.

The transaction

will be structured as a 100% coinsurance with funds withheld cession, with Jackson ceding the guaranteed benefit liabilities and related

future fees, claims and other benefits, and maintenance expenses to Brooke Re in exchange for a ceding commission for the in-force business.

Jackson will retain the variable annuity base contract, which will continue to be subject to the cash surrender value minimum reserve,

and will accrue the related base contract cash flows, which should result in less volatile effects on capital requirements. Jackson will

retain responsibility for investment management of the assets in the funds withheld account supporting the ceded liabilities. Jackson

will also execute a hedging program on behalf of Brooke Re, which we expect will

involve higher levels of interest rate hedging, while Jackson continues to maintain its own hedging programs for its retained liabilities,

such as registered index-linked annuities. Jackson will retain the annuity contract administration of the ceded business.

Based upon current market conditions and estimates of funding, which

estimates will be updated as of the effective date of the transaction, Brooke Re is expected to be funded through a return of capital

distribution from Jackson to Brooke Life Insurance Company (“Brooke Life”). Brooke Life is Jackson’s direct parent and

will be the direct parent of Brooke Re. The return of capital distribution is subject to the approval of Michigan DIFS. Based on these

same conditions and estimates, no impact is expected on the Company’s holding company cash and highly liquid securities and Jackson’s

risk-based capital ratio is expected to be within or above our 425% to 500% targeted range. Additional details on Brooke Re, as well as

our 2024 financial targets, are expected to be provided in connection with the Company’s earnings announcement in late February

2024 for the quarter and year ending December 31, 2023.

SAFE HARBOR

The

information in this report contains forward-looking statements about future events and circumstances and their effects upon revenues,

expenses and business opportunities. Generally speaking, any statement not based upon historical fact is a forward-looking statement.

Forward-looking statements can also be identified by the use of forward-looking or conditional words, such as “could,” “should,”

“can,” “continue,” “estimate,” “forecast,” “intend,” “look,” “may,”

“will,” “expect,” “believe,” “anticipate,” “plan,” “remain,” “confident”

and “commit” or similar expressions. In particular, statements regarding plans, strategies, prospects, targets and expectations

regarding the business and industry are forward-looking statements. They reflect expectations, are not guarantees of performance and speak

only as of the dates the statements are made. We caution investors that these forward-looking statements are subject to known and unknown

risks and uncertainties that may cause actual results to differ materially from those projected, expressed or implied. Factors that could

cause actual results to differ materially from those in the forward-looking statements include those reflected in Part I, Item

1A. Risk Factors and Part II, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations in our Annual

Report on Form 10-K for the year ended December 31, 2022, as filed with the SEC on March 1, 2023, as Part II, Item 7 was recast to reflect

the adoption of the Long Duration Targeted Improvements accounting principle in our Current Report on Form 8-K filed May 10, 2023, and

elsewhere in the Company’s reports filed with the U.S. Securities and Exchange Commission. Except as required by law, Jackson Financial

Inc. does not undertake to update such forward-looking statements. You should not rely unduly on forward-looking statements.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

| Exhibit No. |

|

Description |

| |

|

|

| 104 |

|

Cover Page Interactive Data File (the coverage page XBRL tags are embedded within the Inline XBRL Document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

JACKSON

FINANCIAL INC. |

| |

|

| |

By: |

/s/

Marcia Wadsten |

| |

|

Marcia

Wadsten |

| |

|

Executive Vice President and Chief Financial

Officer |

| |

|

(Principal

Financial Officer) |

| Date:

December 15, 2023 |

|

|

v3.23.3

Cover

|

Dec. 14, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 14, 2023

|

| Entity File Number |

001-40274

|

| Entity Registrant Name |

Jackson

Financial Inc.

|

| Entity Central Index Key |

0001822993

|

| Entity Tax Identification Number |

98-0486152

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1 Corporate Way

|

| Entity Address, City or Town |

Lansing

|

| Entity Address, State or Province |

MI

|

| Entity Address, Postal Zip Code |

48951

|

| City Area Code |

517

|

| Local Phone Number |

381-5500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, Par Value $0.01 Per Share

|

| Trading Symbol |

JXN

|

| Security Exchange Name |

NYSE

|

| Depositary Shares, each representing a 1/1,000th Interest in a share of Fixed-Rate Reset Noncumulative Perpetual Preferred Stock, Series A [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares, each representing a 1/1,000th Interest in a share of Fixed-Rate Reset Noncumulative Perpetual Preferred Stock, Series A

|

| Trading Symbol |

JXN PRA

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=JXN_DepositaryShareseachrepresentinga11000thInterestinashareofFixedRateResetNoncumulativePerpetualPreferredStockSeriesAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

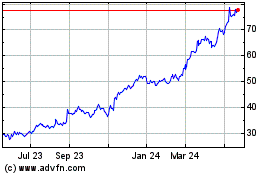

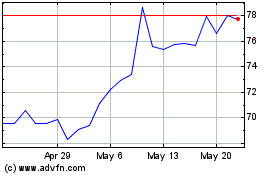

Jackson Financial (NYSE:JXN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Jackson Financial (NYSE:JXN)

Historical Stock Chart

From Apr 2023 to Apr 2024