Current Report Filing (8-k)

February 10 2020 - 4:03PM

Edgar (US Regulatory)

false

0000719413

0000719413

2020-02-07

2020-02-07

0000719413

hl:CommonStockCustomMember

2020-02-07

2020-02-07

0000719413

hl:SeriesBCumulativeConvertiblePreferredStockCustomMember

2020-02-07

2020-02-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

Current Report

PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 7, 2020

HECLA MINING COMPANY

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

1-8491

|

|

77-0664171

|

|

(State or other jurisdiction

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

of incorporation)

|

|

|

|

|

6500 North Mineral Drive, Suite 200

Coeur d'Alene, Idaho 83815-9408

(Address of principal executive offices) (Zip Code)

(208) 769-4100

Registrant's telephone number, including area code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading

Symbol(s)

|

Name of each exchange on

which registered

|

|

Common Stock, par value $0.25 per share

|

HL

|

New York Stock Exchange

|

|

Series B Cumulative Convertible Preferred Stock, par value $0.25 per share

|

HL-PB

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On February 7, 2020, we entered into an amendment (the “Fourth Amendment”) to our revolving credit agreement (the “Credit Agreement”) dated July 16, 2018 with the various financial institutions and other persons from time to time parties thereto as lender (the “Lenders”) and The Bank of Nova Scotia, as administrative agent for the Lenders and as letter of credit issuer. The Credit Agreement was previously amended by agreements dated May 8, 2019 (the “First Amendment”), July 15, 2019 (the “Second Amendment”), and August 23, 2019 (the “Third Amendment”). Among the changes to the Credit Agreement contained in the Fourth Amendment are:

|

|

●

|

In addition to restoring the amount available to be borrowed to $250 million pursuant to the terms of the Third Amendment, we can also restore the amount available to be borrowed to $250 million if by August 7, 2020, we refinance our existing senior notes currently outstanding.

|

|

|

●

|

Until August 7, 2020, we can use up to $100 million of the revolving credit facility to refinance our existing senior notes so long as we issue at least $400 million of new senior unsecured notes and all of our existing senior notes currently outstanding are refinanced after giving effect to such borrowings. If we raise more than $600 million in new senior notes, the credit facility will be reduced dollar for dollar by the amounts in excess of $600 million.

|

Our leverage ratio was changed to not more than (a) 4.25:1.00 for the fiscal quarters ending on March 31, 2020 and June 30, 2020 and (b) 4.00:1.00 for each fiscal quarter ending on and after September 30, 2020. A copy of the Credit Agreement was previously filed with the SEC as Exhibit 101 to our Current Report on Form 8-K filed with the SEC on July 17, 2018, and the First, Second and Third Amendments are included as an exhibit to this report, and each are incorporated herein by reference. The Credit Agreement, as amended, contains representations and warranties we made. The assertions embodied in those representations and warranties are qualified by information in confidential disclosure schedules that we have exchanged in connection with signing the Credit Agreement. While we do not believe that they contain information securities laws require us to publicly disclose other than information that has already been so disclosed, the disclosure schedules do contain information that modifies, qualifies and creates exceptions t the representations and warranties set forth in the Credit Agreement. Accordingly, you should not rely on the representations and warranties as characterizations of the actual state of facts, since they are modified in important part by the underlying disclosure schedules. The Credit Agreement has been incorporated by reference herein to provide you with information regarding its terms. It is not intended to provide any other factual information about us. Such information about us can be found elsewhere in other public filings we have made with the SEC, which are available without charge at www.sec.gov.

The disclosure schedules contain information that has been included in our general prior public disclosures, as well as potential additional non-public information. Moreover, information concerning the subject matter of the representations and warranties may have changed since the date of the Credit Agreement, which subsequent information may or may not be fully reflected in public disclosures.

From time to time we enter into forward contracts to buy Canadian dollars (“CAD”) and Mexican pesos (“MXN”) to manage our exposure to fluctuations in the exchange rates between those currencies and the U.S. dollar and the impact on our future operating costs denominated in CAD and MXN. We also enter into financially settled forward contracts to manage exposures to our metals contained in our concentrate shipments, both between the time of shipment and final settlement as well as forecasted future concentrate shipments (only lead and zinc), as well as commodity put option contracts to manage our exposure to fluctuations in the prices of certain metals we produce. These currently, metal sales contracts and options are with The Bank of Nova Scotia, ING Capital, Canadian Imperial Bank of Commerce and JPMorgan Chase Bank, each of which is a Lender under the Credit Agreement.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit

Number

|

|

Description

|

|

|

|

|

|

10.1

|

|

Fifth Amended and Restated Credit Agreement dated as of July 16, 2018, by and among Hecla Mining Company, Hecla Limited, Hecla Alaska LLC, Hecla Greens Creek Mining Company, and Hecla Juneau Mining Company, as the Borrowers, The Bank of Nova Scotia, as the Administrative Agent for the Lenders, and various Lenders. Filed as exhibit 10.1 to Registrant’s Current Report on Form 8-K filed on July 17, 2018 (File No. 1-8491) and incorporated herein by reference.

|

|

|

|

|

|

10.2

|

|

First Amendment to Fifth Amended and Restated Credit Agreement dated as of May 8, 2019, by and among Hecla Mining Company, certain subsidiaries of Hecla Mining Company, The Bank of Nova Scotia, as the Administrative Agent for the Lenders, and various Lenders. Filed as exhibit 10.2 to Registrant’s Current Report on Form 8-K filed on July 18, 2019 (File No. 1-8491) and incorporated herein by reference.

|

|

|

|

|

|

10.3

|

|

Second Amendment to Fifth Amended and Restated Credit Agreement dated as of July 15, 2019, by and among Hecla Mining Company, certain subsidiaries of Hecla Mining Company, The Bank of Nova Scotia, as the Administrative Agent for the Lenders, and various Lenders. Filed as exhibit 10.3 to Registrant’s Current Report on Form 8-K filed on July 18, 2019 (File No. 1-8491) and incorporated herein by reference.

|

|

|

|

|

|

10.4

|

|

Third Amendment to Fifth Amended and Restated Credit Agreement dated as of August 23, 2019, by and among Hecla Mining Company, certain subsidiaries of Hecla Mining Company, The Bank of Nova Scotia, as the Administrative Agent for the Lenders, and various Lenders. Filed as exhibit 10.2 to Registrant’s Form 10-Q for the period ended September 30, 2019 (File No. 1-8491) and incorporated herein by reference.

|

|

|

|

|

|

10.5

|

|

Fourth Amendment to Fifth Amended and Restated Credit Agreement dated as of February 7, 2020, by and among Hecla Mining Company, certain subsidiaries of Hecla Mining Company, The Bank of Nova Scotia, as the Administrative Agent for the Lenders, and various Lenders. *

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101).

|

|

|

|

* Filed herewith

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

HECLA MINING COMPANY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ David C. Sienko

|

|

|

|

|

David C. Sienko

Vice President and General Counsel

|

|

Dated: February 10, 2020

4

Hecla Mining (NYSE:HL)

Historical Stock Chart

From Mar 2024 to Apr 2024

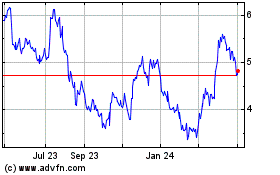

Hecla Mining (NYSE:HL)

Historical Stock Chart

From Apr 2023 to Apr 2024