Current Report Filing (8-k)

September 26 2019 - 4:16PM

Edgar (US Regulatory)

false0000043920

0000043920

2019-09-26

2019-09-26

0000043920

us-gaap:CommonClassAMember

2019-09-26

2019-09-26

0000043920

us-gaap:CommonClassBMember

2019-09-26

2019-09-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

|

|

|

|

|

|

September 26, 2019

|

(September 24, 2019)

|

Date of Report (Date of earliest event reported)

GREIF INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

Delaware

|

|

001-00566

|

31-4388903

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

|

|

|

|

|

425 Winter Road

|

Delaware

|

Ohio

|

43015

|

|

(Address of principal executive offices)

|

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (740) 549-6000

Not Applicable

(Former name or former address, if changed since last report.)

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of Each Class

|

Trading Symbol(s)

|

Name of Each Exchange on Which Registered

|

|

Class A Common Stock

|

GEF

|

New York Stock Exchange

|

|

Class B Common Stock

|

GEF-B

|

New York Stock Exchange

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Section 1 – Registrant’s Business and Operations

|

|

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

Amended and Restated Transfer and Administration Agreement

On September 24, 2019, certain U.S. subsidiaries of Greif, Inc. (the “Company”) amended and restated the existing receivables financing facility (the “Receivables Facility”). Greif Receivables Funding LLC (“Greif Funding”), Greif Packaging LLC (“Greif Packaging”), for itself and as servicer, and certain other U.S. subsidiaries of the Company entered into a Third Amended and Restated Transfer and Administration Agreement, dated as of September 24, 2019 (the “Third Amended TAA”), with Bank of America, N.A. (“BANA”), as the agent, managing agent, administrator and committed investor, and various investor groups, managing agents, and administrators, from time to time parties thereto. The Third Amended TAA, as of September 24, 2019, replaced in its entirety the Existing TAA (as defined below in Item 1.02 to this Current Report on Form 8-K), which provided for a $150 million Receivables Facility. The Third Amended TAA will provide for a $275 million Receivables Facility.

Greif Funding is a direct subsidiary of Greif Packaging and is included in the Company’s consolidated financial statements. However, because Greif Funding is a separate and distinct legal entity from the Company, the assets of Greif Funding are not available to satisfy the liabilities and obligations of the Company, Greif Packaging or other subsidiaries of the Company, and the liabilities of Greif Funding are not the liabilities or obligations of the Company or its other subsidiaries.

The Third Amended TAA provides for the ongoing purchase by BANA of receivables from Greif Funding, which Greif Funding will have purchased from Greif Packaging and certain other U.S. subsidiaries of the Company as the originators under the Third Amended and Restated Sale Agreement, dated as of September 24, 2019 (the “Third Amended Sale Agreement”). Greif Packaging will service and collect on behalf of Greif Funding those receivables sold to Greif Funding under the Third Amended Sale Agreement. The commitment termination date of the Receivables Facility is September 24, 2020, subject to earlier termination as provided in the Third Amended TAA (including acceleration upon an event of default as provided therein), or such later date to which the purchase commitment may be extended by agreement of the parties. In addition, Greif Funding may terminate the Receivables Facility at any time upon five days’ prior written notice. The Company has guaranteed the performance by Greif Funding, Greif Packaging and its other participating subsidiaries of their respective obligations under the Third Amended TAA, the Third Amended Sale Agreement and related agreements thereto, but has not guaranteed the collectability of the receivables thereunder. A significant portion of the proceeds from the Receivables Facility was used to pay the obligations under the Existing TAA, as described below in Item 1.02 to this Current Report on Form 8-K. The remaining proceeds will be used to pay certain fees, costs and expenses incurred in connection with the Receivables Facility and for working capital and general corporate purposes of the Company and its subsidiaries.

The Receivables Facility is secured by certain trade accounts receivables related to the Rigid Industrial Packaging & Services and the Paper Packaging & Services businesses of Greif Packaging and other subsidiaries of the Company in the United States and bears interest at a variable rate based on the London InterBank Offered Rate or an applicable base rate, plus a margin, or a commercial paper rate, all as provided in the Third Amended TAA. Interest is payable on a monthly basis and the principal balance is payable upon termination of the Receivables Facility.

|

|

|

|

Item 1.02.

|

Termination of a Material Definitive Agreement.

|

Greif Funding, Greif Packaging and certain other U.S. subsidiaries of the Company entered into an Amended and Restated Transfer and Administration Agreement dated as of September 28, 2016 (the “Existing TAA”), with Cooperatieve Rabobank U.A., New York Branch, providing for the $150 million Receivables Facility. On September 24, 2019, proceeds from the $275 million Receivables Facility were used to repay the obligations outstanding under the Existing TAA, and the Existing TAA was terminated as of that date. See Item 1.01 to this current report on form 8-K above, for a discussion of the Receivables Facility and the Third Amended TAA.

The Existing TAA provided for a $150 million receivables financing facility for the Company and certain of its U.S. subsidiaries. The Existing TAA had a maturity date of September 26, 2019, but the parties terminated the Existing TAA by mutual consent, on September 24, 2019, with certain subsidiaries of the Company making a payment of $78,703.65 to discharge all of their outstanding obligations then due and owing. No material early termination penalty was incurred by the Company or any of its subsidiaries in connection with the repayment and termination of the Existing TAA.

Section 2 – Financial Information

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

(A) Creation of a Direct Financial Obligation

Information concerning the Company’s Third Amended TAA is set forth in Item 1.01, which information is incorporated herein by reference.

Item 2.04. Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off- Balance Sheet Arrangement.

(A) Repayment of a Direct Financial Obligation

Information concerning the repayment of the Company’s Existing TAA is set forth in Items 1.01 and 1.02, which information is incorporated herein by reference.

Section 9 – Financial Statements and Exhibits

|

|

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

|

Third Amended and Restated Sale Agreement

|

|

|

Third Amended and Restated Transfer and Administration Agreement

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

GREIF, INC.

|

|

Date: September 26, 2019

|

By

|

/s/ David C. Lloyd

|

|

|

|

David C. Lloyd,

Vice President, Corporate Financial Controller and Treasurer

|

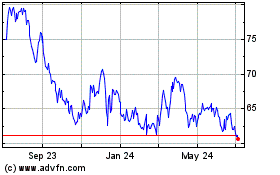

Greif (NYSE:GEF.B)

Historical Stock Chart

From Jun 2024 to Jul 2024

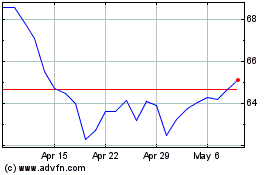

Greif (NYSE:GEF.B)

Historical Stock Chart

From Jul 2023 to Jul 2024